Ethereum: The Money-Game Landscape

Level up your open finance game three times a week. Subscribe to the Bankless program below.

Dear Crypto Natives,

Are all money protocols just economic games competing to capture more ETH? That’s what David Hoffman explores in today’s thought-piece.

David’s written some of the best posts on Ethereum and crypto money. And guess what—he’ll be posting something new every month for Bankless subscribers only starting today. 🔥(Bankless keeps delivering the goods)

New models, new paradigms, and new ways of thinking about these novel crypto money systems. Stick close cause we’re leveling up at warp speed now.

- RSA

P.S. David hangs out in the Inner Circle with the rest of the Bankless community—join in the discussion there

THURSDAY THOUGHT

Ethereum: The Money-Game Landscape

By Bankless contributor: David Hoffman COO RealT & POV Crypto host

Game theory is a fascinating subject. Like cryptocurrency, its highly inter-disciplinary and tangential to basically everything in the world.

Learning more about game theory, one discovers its parallels to the living of life itself. We are all rational agents, interested in bettering our lives. We all must make decisions about which direction to take, at the cost of all other possible directions. This makes every decision that we make a sort of game.

- “If I buy Apple instead of Google, will my portfolio go up?”

- “Do I throw a fastball, or a curveball?

- “If I date Alice, instead of Sarah, will that make me happier?”

- “What do I want more: pizza, or hamburgers?”

- “Do I become friends with this individual, or is it not worth it?”

- “Do I drink that extra beer, when I have work at 6:00am?”

This are all single match games that we play inside the big game of life.

Life is the cumulative set of many individual games.

Life is about maximizing value. Game theory (or specifically, decision theory) is about the choices that rational agents make in order to achieve that purpose. As you progress through life, you make decisions that are either conscious choices, or unconscious ones, about how to best find value in the world. “If I buy Apple, will it grow in value?” is a choice that is very obviously about how to maximize value. “If I date Sarah, will that work out?” is still about how to maximize value, but in different terms. “Is this too much jam on my PB+J” is also about maximizing value, but less obviously so.

A ‘rational agent’ doesn’t necessarily mean a conscious individual. Yuval Noah Harari in his masterpiece book Sapiens illustrates how all organisms are “survival and reproduction maximizing algorithms”. We are all algorithms that make choices to best optimize for survival and reproduction. When we haven’t eaten enough, our algorithm makes us hungry; if we haven’t drank enough, we become thirsty. If we are lonely, we seek others.

Yuval uses the example of a hungry monkey, hanging from the trees in a jungle. He sees a banana, and wants to eat it, but it’s next to a lion. The monkey must make a choice… a calculation about what decision to make. Is the risk of being eaten by the lion too great? Can he find bananas elsewhere? Maybe the lion just ate, and isn’t interested in more food. How fast can the monkey grab the banana? These decisions are reflected in the emotions of the monkey, and will ultimately determine what choice the monkey chooses. Evolution will determine if they made the right choice or not.

The Game of Life

The Game of Life is played in a three-dimensional space that we call “the universe”. The rules of the game are the laws of physics, and the players of the game are every individual life-form.

The goal of the Game of Life is to capture value. There is only so much value, to go around, so this effort ultimately converges in competition. Animals compete for mates, food, shelter. Humans do the same thing; the dating market, real estate market, stock market… (we don’t compete for food anymore, but we’re also systemically obese). Humans have evolved to compete inside of markets, rather than the Serengeti.

Establishing New Rules for Life

Sometimes people use a strategy for gaining value that comes at the costs of others. Theft, violence, murder are all strategies that one can use to gain an upper-hand in life, at the cost of another. It’s easy to have more value if you just steal it from people who worked had to create it.

But that makes people upset, and so humans have banded together to create these institutions called ‘governments’ that have the power to add new rules, called ‘laws’, to the game of life. Now, in addition to having to follow the laws of physics, you also have to follow the laws of government.

This is the role of Government, distilled: Generate and enforce a new set of rules that allow for fair competition of value.

Life, Liberty and the pursuit of Happiness

Analogue Value

The value that humans are currently competing for is analogue value. Real estate, dollars, gold, shares of companies, lovers, etc are all found with physical forms in the real world.

Since the beginning of time, humans have only played games that are analogue games. Competition for food and mates being the most analogue. Things begin to transition away from ‘analogue’ in the modern world. Companies aren’t digital, but they’re not exactly a tangible either. Tangible fiat money only has value because of this intangible belief-layer on-top of it.

Shared beliefs are the precursors to digital value.

Bitcoin: The First Digital Game

Bitcoin is one big game. Bitcoin is an interlocking set of stakeholders (players) and protocol-established incentives (rules). The scarcity of BTC drives demand, which creates value, which creates hashpower, which creates security, which creates the value-prop, which creates more demand…

It’s also an accumulation game. Who can accumulate more BTC? I wrote about this in an old article: Bitcoin: Prosecutor of the Prisoners Dilemma. In summary, Bitcoin is one big game of reverse Chicken. The last person to buy it loses; the first person to buy it wins.

Bitcoin is the universe’s first digital value. All previous forms of value were analog, real world, tangible forms of value. However, it was a digital form of value with just one game: the Bitcoin game.

Bitcoin = A digital game of accumulation. Bitcoin the most simple version of digital games. Bitcoin says to the world: “There are these digitally scarce things! Go find them!”. Bitcoin’s game started as a proof-of-concept, and turns out a decent number of players want to play Bitcoin’s game.

Are there more digital games that we can build and play?

What if we get bored of “find the Bitcoins!”? Are there more interesting, complex games out there?

Developing Ethereum: The Landscape for Infinite Games

Ethereum is two things:

- A landscape for playing games (Ethereum)

- A native system for scoring points (Ether)

Ethereum is referred to as ‘turing-complete’. What this means is that any game that can be imagined can be built. This maps onto the real-world: every single decision you ever make is a small little game inside the Big Game of Life. The combination of the molecular components of matter, and the laws of physics, makes the universe itself ‘turing-complete’. The universe is the playing field for all possible games.

This is why Ethereum is so important. It is the digital universe for digital games. The entire possible set of all digital games are able to be built on Ethereum.

Ether: The Point System

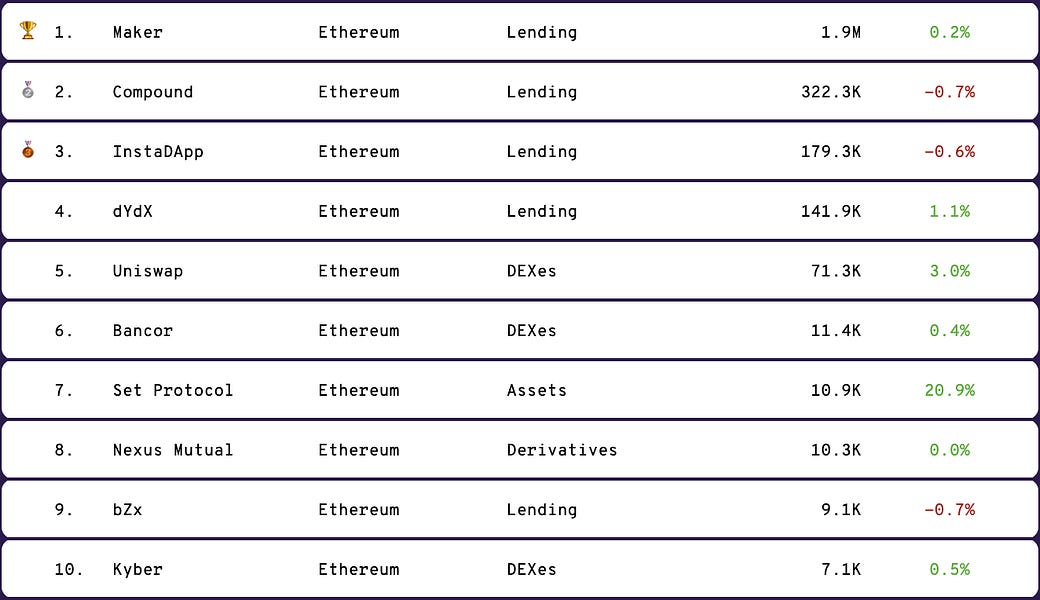

All games, especially economic ones, need ways to measure outcomes. Ether is the point system for measuring and scoring games. If your game captures more ETH than others, you’re winning! If you go to DeFiPulse.com you will quite literally see a 1st place trophy, 2nd place silver medal, and 3rd place bronze for the applications that have captured the most ETH.

This is the Ethereum leaderboard.

In David Graeber’s excellent book “Debt: The first 5,000 years”, he illustrates how modern monies and economic systems unfolded.

- Governments issue money to the public

- Governments announce that they going to charge taxes, denominated in that money

- People need to find ways to make money to pay taxes

- People build businesses that generate revenue in order to pay taxes

In this new digital economic system:

- Ethereum is the government

- Ether is the money

- Transaction fees are the taxes.

Enforcing the Rules

The rules of Ethereum are enforced by the EVM. The EVM is the thing that dictates whether actions executed on Ethereum are valid, or invalid. In the physical world, the EVM is equal to the laws of physics. Nothing can happen EVER on Ethereum, unless approved by the EVM.

Laws of Physics : Laws of Government :: The EVM : Smart-Contracts

But there is a second set of rules also being developed. Standardized tools like ERC20, ZK-Snarks, state-channels, Plasma, Rollups, Meta-Tx, or any other piece of infrastructure built on Ethereum represent rules for how value is managed. These tools are not built into the protocol, in the same way that government laws are not laws of physics. But following them where appropriate will generally make your life easier and more successful. These rules are able to be combined, ordered, stacked to generate operating structures inside Ethereum.

We call these structures “applications”

Applications Capture Value

Before the explosion of DeFi / Open Finance on Ethereum, Ethereum was searching for a narrative. The ‘global super computer’ should have been ‘global economic computer’, which is just another way of saying ‘a global internet landscape that governs value’, but our understanding of ‘What Ethereum is” was lacking at the time.

DeFi on Ethereum has found product/market fit because it leverages the two components of Ethereum, the landscape (the EVM) and the value (Ether), to produce some product or service that is relevant to the users of Ethereum.

Lets go through the list of Ethereum Games that are currently succeeding in capturing ETH.

Application: MakerDAO

ETH Capture Mechanism: Put in ETH, pull out DAI

Captured ETH: 1.9M ETH

MakerDAO is also Ethereum’s most interesting application, because it generates an entirely new dimension inside of Ethereum. Where Ethereum is the landscape for ETH-Lockup Games, MakerDAO generates a whole new landscape: DAI-Lockup Games. A whole second plane of value to exist in.

When applications capture DAI, MakerDAO captures the ETH needed to satisfy DAI demand.

Application: Compound

ETH capture mechanism: Access liquidity from assets; returns from supplying assets

Captured ETH: 435k ETH

If you have 10 ETH, and you need some cash, but don’t want to sell, you can put your ETH inside of Compound

Application: dYdX

ETH capture mechanism: Leveraged ETH price exposure

Captured ETH: 137k ETH

If you have 10 ETH, but you want it’s price to behave like 40 ETH, then give dYdX your ETH.

Application: Uniswap

ETH capture mechanism: 0.3% fees to ETH/Token suppliers

Captured ETH: 63k ETH

Uniswap V2 is coming, and I’m willing to bet that the second largest token by market-cap inside of Uniswap V2 will be Dai. (Take the other side of this bet by DMing me. You won’t).

Application: PoolTogether

PoolTogether is a Dai-Lockup application. This means that MakerDAO is able to capture ETH, in order to supply DAI to PoolTogether.

DAI capture mechanism: Subsidizing Compound lending rates by gamifying the system

DAI captured: 300k in the app; 53k Dai permanently removed from supply

Money Games

‘Money Games’ are a relatively unknown side of Ethereum that I am trying to push exposure to.

Applications like MakerDAO, Compound, Uniswap are Single-Player Games. You are playing by yourself; any winnings or losses you get is because of your actions, and your actions only.

Money Games are Multi-Player Games. A ‘Money Game’ is an application that enables winners and losers, in regards to earning more money. In playing a money-game, you are trying to win other peoples money, and they are trying to win yours too.

Money Games are Games in the traditional sense of the word. It is a competitive, player-vs-player game, with a set of rules, possible moves, and clearly defined winners and losers (defined by how much Wei you won!).

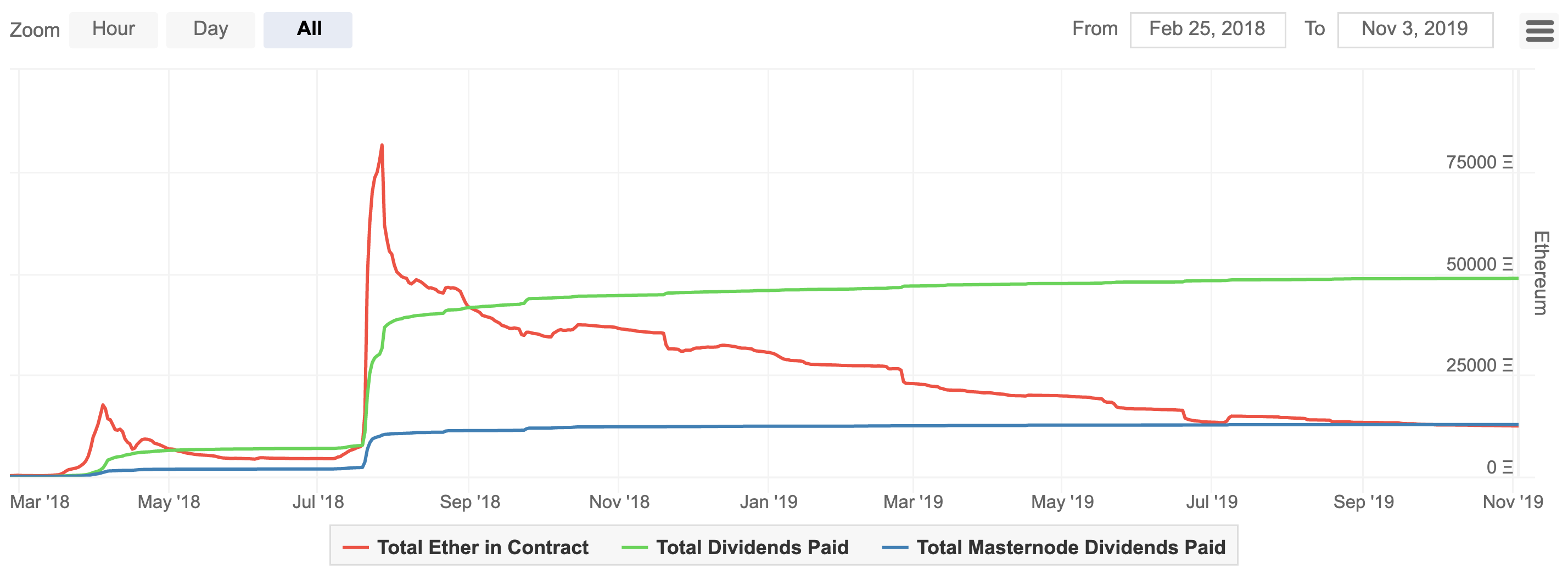

Game: Proof of Weak Hands, PoWH3D

powh.io

The Proof of Weak Hands game is centered around a bonding-curve that issues a token, P3D, for a certain price, as determined by the bonding-curve. When you buy P3D from the bonding-curve, you are changed a 10% exchange-tax. Buying 10 ETH of P3D tokens is taxed 1 ETH. This 10% of ETH is then distributed to all P3D token holders. In fact, all transactions (buy/sell/transfer) of P3D token incurs a 10% fee, with the fee being paid to all other P3D holders.

When enter the game, you enter at a 10% loss. If you exit the game, you are hit with another 10% loss. If you buy 10 ETH of P3D token, you receive 9 ETH of P3D token. If you then immediately sell all your P3D tokens, you’ll receive 8.1 ETH. If you do this, you suck at this game.

If, however, you enter the game with 10 ETH, and receive 9 ETH of P3D tokens, and you hold onto the P3D tokens, and never sell them, then you will receive constant dividends from all other players who buy/sell/transfer their P3D tokens.

This is why it’s called Proof-of-Weak-Hands. P3D token rewards people who buy early, and never ever sell. (Bitcoin?). You are win the game if you exit PoWH3D with more ETH than you started. You lose the game if you don’t.

The team behind PoWH3D also have layered on additional buying incentives, to further add to the power behind the P3D token. The first is a “Masternode” system, in which if you have 100 P3D tokens, you can receive a referral link that gives you a larger share of all new buyers first 10% buying fee.

So that’s a small incentive to buy lots of P3D tokens. Even if you don’t want to participate in sharing a referral link, if you think others will, you still benefit by buying P3D tokens before everyone else, and from holding on to your P3D tokens longer than everyone else who gets referred.

… but the PoWH3D game doesn’t end there. The P3D token has a whole entire separate game built on-top of it!

Game: FOMO3D

FOMO3D is in development from the same team as PoWH3D. It is an entirely new game, that adds further ETH capture and transaction fees to the P3D token. Think of the P3D token as “the company” and FOMO3D as “the product”.

- FOMO3D is centered around a timer. When the timer runs out, the game is over, and it resets and begins again.

- Every time someone purchases a “key” (token) from the game (contract), 30 seconds is added to the timer (24 hour hardcap). The game continues forever until the timer runs out.

- When the timer runs out, the pot of ETH that has been growing from all key-purchases is split equally between all key-purchasers.

- Key prices go up for each sale (another bonding curve).

- Owning Keys grant instant dividends on all ETH from further Key purchases, meaning you will constantly receive a stream of passive income from the game as keys are bought. Buying Keys early = good. Buying keys late = bad.

- BUT buying the LAST key is AWESOME. The last player to have purchased at least 1 full key when the exit-scam timer completes its countdown, immediately drains half of the Ethereum seen in the pot and ends the round.

There’s always incentive to be a late buyer; you might be the last person and win 50% of the pot! There’s incentive to be an early buyer, because you get dividends from all later purchases. There’s ALWAYS incentive to buy. The game basically guarantees ETH lockup in the game.

Additionally, between 0–10% of the pot is paid to P3D token holders, which adds more incentive to play the Proof-of-Weak Hands game, and to buy the P3D token.

Game: Liqui3D - Game of DEXes

Playing Field: A Decentralized Exchange

Rules:

- Every trading pair in a DEX takes a transaction fee on every trade

- The transaction fee goes to a reserve; the ‘POT’ (think ETH lockup)

- POT runs on a timer. Every trade adds time to the timer, with a 1-hour cap.

- If/when the timer runs out, the 50% of the POT is distributed to the last person who made a trade. 25% of the POT is distributed back to traders, pro-rata their contribution. 25% of the POT is retained for the next cycle.

Magic:

This money-game is a way to drive liquidity to DEXs, which are notorious for being illiquid. The possibility of winning a lot of money rewards traders to come trade on the DEX, providing more liquidity, and therefore attracting more traders who want to use the exchange, simply because its a liquid exchange. The game makes the product better.

Ethereum: The Landscape for Value-Capture Games

Ethereum is a virtual landscape. It is an open-source sandbox environment for building and playing games.

One of Placeholder VC’s best articles is DeFi Liquidity Models. The TL;DR: Peer-2-Peer applications don’t do as well as Peer-2-Contract applications when it comes to volume and liquidity.

Peer-2-Peer Apps

- Dharma

- 0x Exchange

Peer-2-Contract Apps

- MakerDAO

- Uniswap

- dYdX

- Compound

- PoolTogether

The difference between P2P apps and P2C apps is that, with P2C apps, you don’t need to find a counter-party to use the application. In MakerDAO, you can just submit ETH into a vault. In Uniswap, you can just swap ETH for a token. In Compound, you just put up ETH, and borrow any other token. It’s the contracts that makes things liquid.

However, this means that all contracts must have plenty of reserves. The way that DeFi is trustless is through over-collateralization. Excess value must be available, so that there can never be a “run on the application”.

As a result, applications must lock-up ETH.

Each application has the incentive it creates to place ETH inside of it. Good applications create good incentives to place ETH inside. Great applications create better incentives, and lockup more ETH.

The Future of Ethereum is a Landscape of P2C Apps

We are seeing them emerge today. Most are in Beta, most have backdoors, and some unknown percentage have bugs. However, everyone in Ethereum knows that a backdoor-free, secure, and fully-autonomous applications is the gold-standard of contracts on Ethereum.

The bull-case for Ethereum is an endless landscape of autonomous protocols that are freely accessible to anyone. These autonomous protocols provide services and products to the users of Ethereum.

Because Ethereum is first-and-foremost a trustless financial system, all of these autonomous protocols must have a native supply of ETH in order to provide their services. Trustlessness is achieved by collateral, and ETH is the only native asset on Ethereum. All protocols on Ethereum need ETH to provide their service.

Ethereum: The House

Ethereum has its own native application: Staking

Staking is Ethereum’s own native application. Place your ETH inside of the staking contract, receive ETH denominated returns.

When an individual submits ETH to a DeFi app, they are saying “The ETH that I place inside Maker/Compound/Uniswap will provide greater yield/utility/returns for me, than if I were to Stake it to Ethereum.”

All Applications compete with Staking.

Finance is inherently tied to risk. Finance is all about making a bet on the future, and positioning yourself today on your belief as to how the future will unfold. Putting your ETH in DeFi is taking risk. Alternatively, staking your ETH is taking the risk-free rate. It’s saying that the risk/reward ratio is in Staking’s favor, and no DeFi app is currently able to provide you a better return (or so you think).

Bitcoin’s Game vs Ethereum’s Game

Bitcoin

The Bitcoin game is revolutionary and simple. The 21M Bitcoins are the first scarce assets on the internet, and its generated a global race to find and capture all of them. However, the only players of Bitcoin’s game are human players; there’s no capacity for non-humans to play Bitcoins game. Additionally, playing Bitcoin’s game ultimately comes to a dead-end. Once you have a sufficient number of Bitcoins, what next? Once your finished playing the game, there’s nothing left to do.

Ethereum

Ethereum has some key advantages that make its game much more fun. First off, it’s a mix of both human players, and computer players. The applications on Ethereum are non-human, but still are ‘in the game’.

The computer players on Ethereum (apps) are trying to collect as much ETH as possible, just like how many humans are. In fact, the applications on Ethereum collect ETH by making useful products and services that convince other humans or computers to part with their ETH.

The game never ends. The is no end-game scenario on Ethereum. It’s a constant, bottomless dungeon-crawler. There’s always new Ether to be captured. There’s always new applications that can be built. There’s always new people able to play Ethereum’s game.

There’s always a reason to play Ethereum’s game.

Conclusion

Value capture is an inherent part of life. The meaning of life is tied to how much value you can capture and experience as you progress through it. Evolution selects for organisms that are good at achieving value. In the real world, however, value is perceived and subjective; we all achieve fulfillment differently.

Ethereum is a new plane of existence, with a new value system, and new players. Value on Ethereum is denominated in ETH, and is totally objective. Organisms on Ethereum are open-source applications, and each compete to capture ETH.

Ethereum has its own value-capture mechanism. It is “the house” of a casino, and has an unfair advantage over all other applications; Ether issuance to stakers. Ether issuance makes application competition for ETH more difficult, in a similar way that higher interest rates from a central bank makes access to capital more difficult.

The Universe : Ethereum :: Value : Ether

Actions

- Consider: is Ethereum a big game to capture more ETH?

- Consider: how are applications on Ethereum competing to capture ETH today?

Subscribe to the Bankless program. $12 per mo. Includes Inner Circle & Deal Sheet.

Author Blub

David Hoffman is the Chief of Operations at RealT and host at POV Crypto. He writes on open finance and Ethereum topics. Check out his recent talk on how ETH accrues value and this accompanying post. (RSA note: this video one of two 4 x 🔥I’ve ever given—highly recommended)

👉Send Bankless a DAI tip for today’s issue

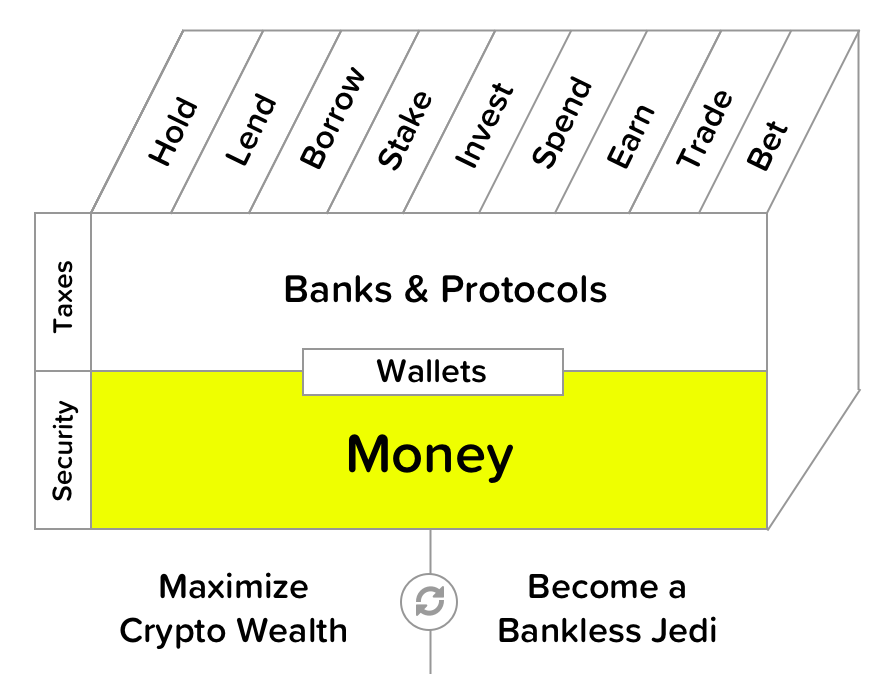

Filling out the skill cube

Ethereum as a landscape for playing economic games that capture Ether—you’re leveling up of Money layer of the skill cube. Everything in crypto is based on this.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.