An Intro to xDai: Ethereum's Sister Chain

Fund Bankless on Gitcoin! Your $1 in funding is matched with $36 right now. Let’s do this!

Dear Bankless Nation,

We celebrated the launch of Ethereum 2.0 this week, but we know it’ll still take a while until we can start using it for DeFi. (See the latest Ethereum roadmap)

Even so, DeFi apps need transaction scalability fast! Optimistic rollups are showing promise, but those still need a few more months in the oven.

So what do we have that works today?

We have xDAI—Ethereum’s less decentralized little sister. And xDAI does a damn good job at picking up where Ethereum left off. Anything on Ethereum can be ported to xDAI, so financial applications, DAOs, and non-fungible tokens—anything with lower security needs become a perfect fit. (We use xDAI for our Bankless Badges!)

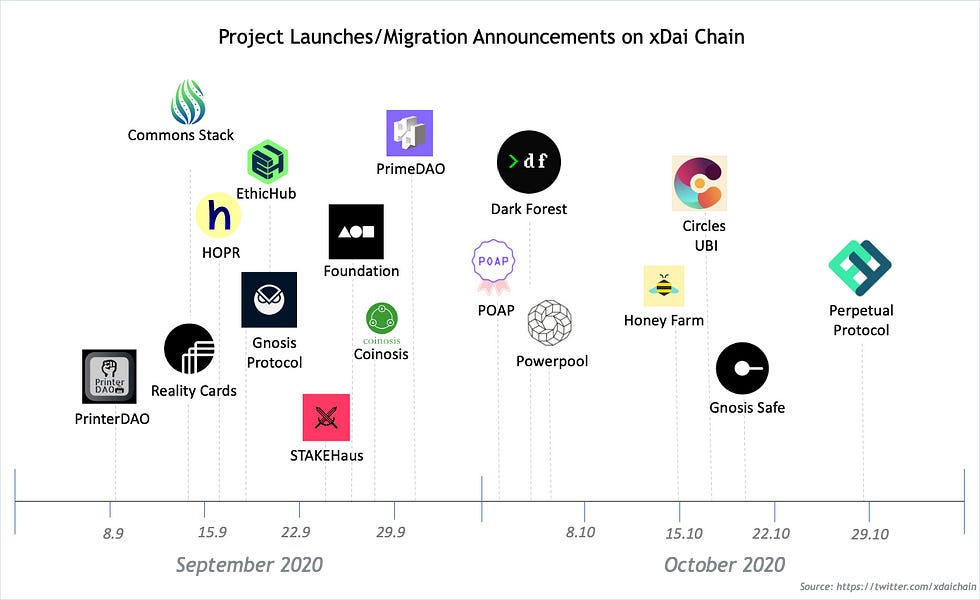

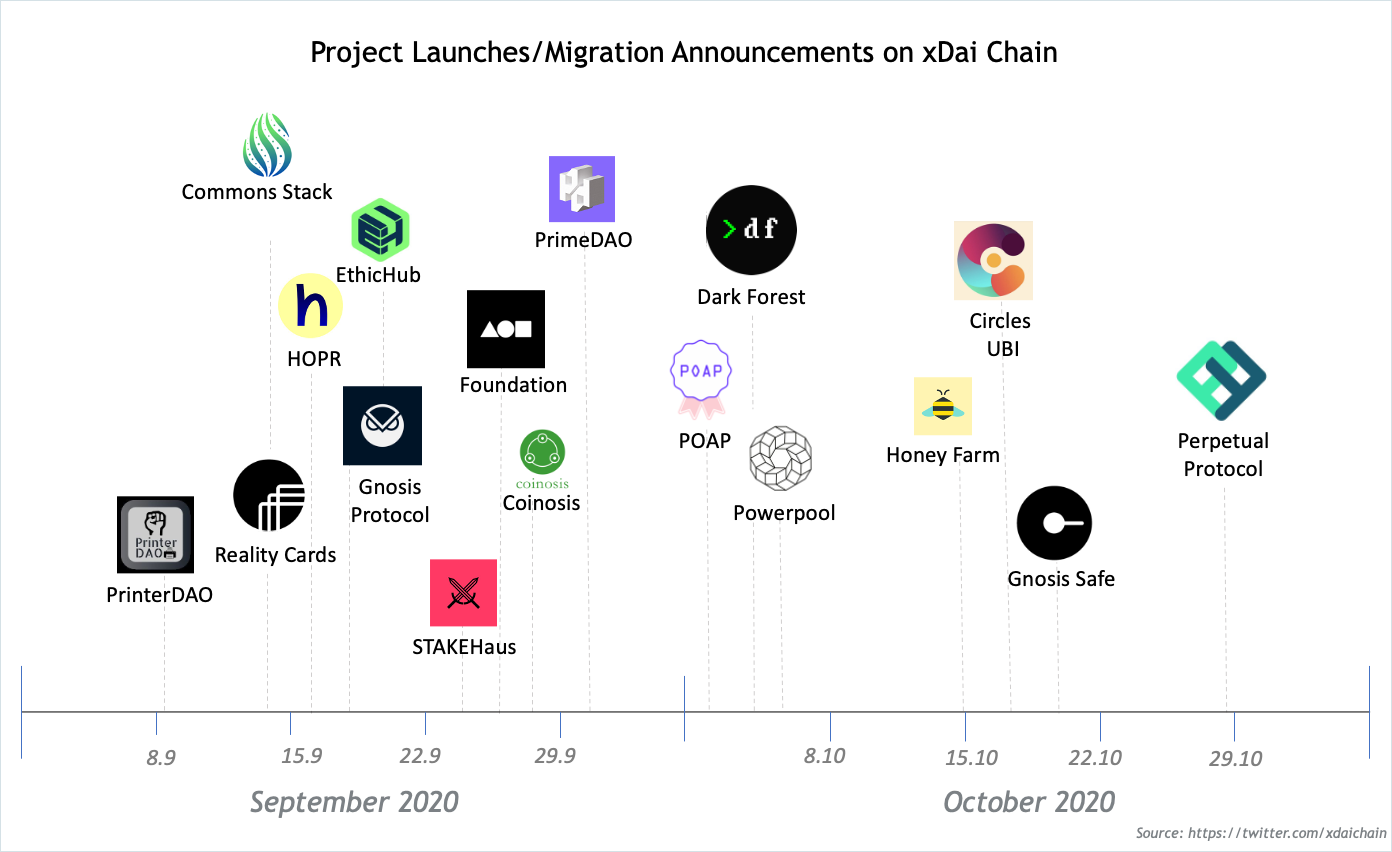

In the past few months, we’ve seen NFT projects like POAP, DeFi protocols like Perpetual Protocol, blockchain games like Dark Forest, and DAOs like PrimeDAO all exploring xDAI as an alternative scaling solution. There’s even a strong bid for xDAI to scale Reddit community points.

So we brought in Andrew to help us learn about xDAI.

Let’s meet Ethereum’s little sidechain sister.

- RSA

P.S. Sign up for the Gitcoin’s Public Good Chess Tournament. $50 entry and all funding goes towards the matching pool!

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

THURSDAY THOUGHT

Guest Post: Andrew Gross, Technical Communicator for xDAI

An Intro to xDAI - A Sidechain of Ethereum

In our blockchain family, Ethereum is the well regarded and respected big sister. She’s quirky and cool but responsible, gets good grades, student council…you get the idea.

Most of you know (and love) Ethereum. But let’s take today to meet xDai, Ethereum’s younger sister chain. She looks up to Eth and very much depends on her, but also thinks Eth can be a bit stodgy sometimes. xDai is more rebellious and fun, an artist, a free spirit so to speak.

Despite their surface differences, they get along well together and compliment each other when achieving common family goals—stuff like building a decentralized settlement network, open finance, non-fungible assets, etc.

They are family, and in the end have the same long-term vision and destination towards a decentralized, blockchain-centric future.

How xDai and Ethereum are Similar

Without Ethereum, there is no xDai.

xDai is an EVM (Ethereum Virtual Machine) sidechain. It functions independently from Ethereum yet relies on Ethereum for the creation of its native token XDAI (converted DAI from Ethereum) as well as its multi-use governance token (STAKE). The network follows the same protocol updates, block size limits and EVM parameters as the Ethereum mainnet. This compatibility makes it easy for developers, projects and users to move seamlessly between chains.

And with the TokenBridge architecture, tokens and messages are also transferable between Ethereum and xDai, as well as other blockchains. Through interoperability, xDai extends the available Ethereum operating space, providing a network with less congestion along with familiar tools and applications for developers.

How xDai and Eth are different

xDai is a chain with a stable reserve currency. Transactions and fees are conducted with XDAI, which is created when DAI on Ethereum is locked in the xDai bridge. The value of XDAI remains stable to the US Dollar, meaning transaction costs are predictable and not subject to market fluctuations.

The real cost of a transaction on Ethereum can vary wildly based on congestion and the price of ETH. Looking at recent prices, a simple ETH transaction will cost ~$5.50 USD. On xDai, the same transaction costs ~1 cent (.01 USD).

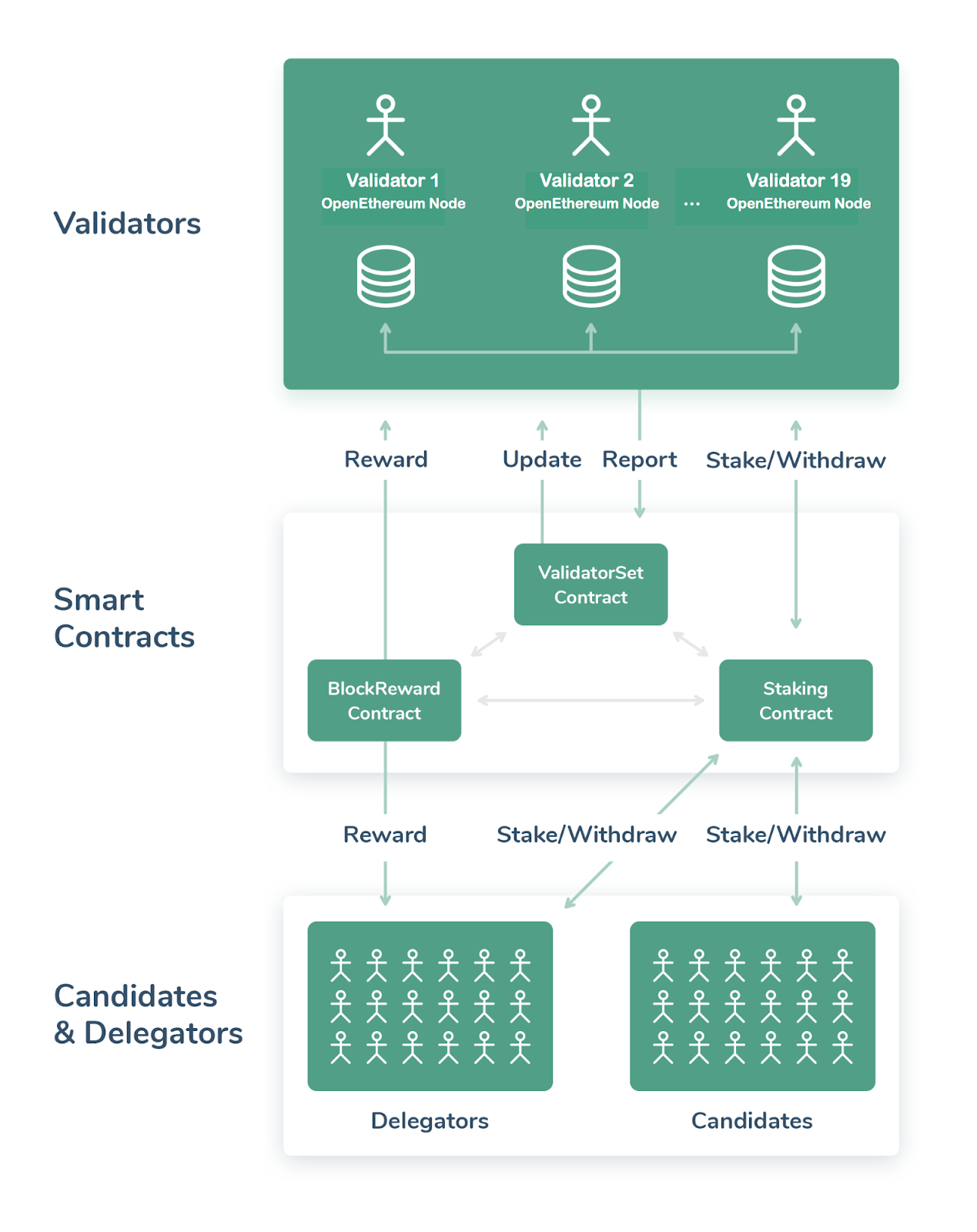

xDai also uses a different consensus mechanism than Ethereum called POSDAO, and uses a Proof-of-Stake incentivization model to achieve 5 second block times with low transaction costs. Validators are incentivized with STAKE rather than the native XDAI token. This decouples incentivization from the transactional currency, so transactions can be processed with minimal costs.

Currently, nominated validators from esteemed Ethereum organizations (Gnosis, MakerDAO, Shapeshift, etc - full list here) are signing blocks, but operations are transitioning to a more permissionless delegated model where community members can participate as validators and delegators.

How they work together

xDai offers additional scaling capacity for Ethereum. It can support primary transaction-heavy operations, complement existing Ethereum applications, and act as an overflow when things become too congested on the mainnet.

Many projects have chosen to migrate to xDai in order to take advantage of the low cost and stable payments model. Others use xDai because their application simply cannot function properly within the limitations of Ethereum 1.0.

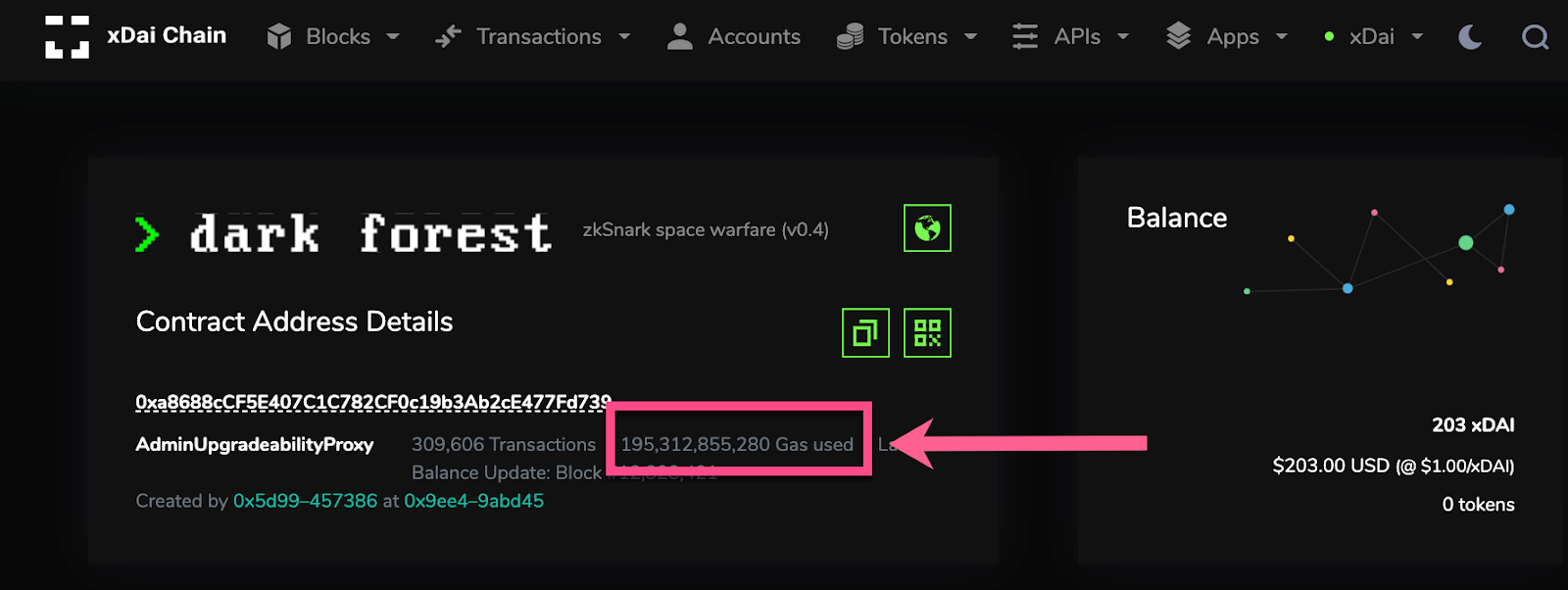

A case in point is dark forest, a multi-player blockchain game using zkSNARK technology to populate planets hidden within a very large universe. Each time a player moves, a non-trivial transaction is processed on the chain, and each player can initiate many moves per minute.

During a recent testing round, Nearly 600 players participated in the round, spending almost 100 billion gas on 250k+ transactions! On Ethereum, players would have spent exorbitant amounts in order to play, and a congested network would have made gameplay impossible.

Other projects are taking a hybrid approach with xDai, moving some operations to xDai while keeping others on Ethereum. PrimeDAO, a DeFi oriented Decentralized Autonomous Organization, moved member voting to xDai, removing a cost-based obstacle that might prevent members from voting or initiating proposals. When a vote costs fractions of a cent vs. dollars, members feel more free to express opinions and actively participate in governance.

In addition, low costs on xDai enable NFT-based projects like Foundation and POAP, new financial protocols like Perpetual Protocol, ecosystem infrastructure like Clr.fund and 1Hive, and other bleeding-edge projects like Circles to deploy on a chain with real economic value.

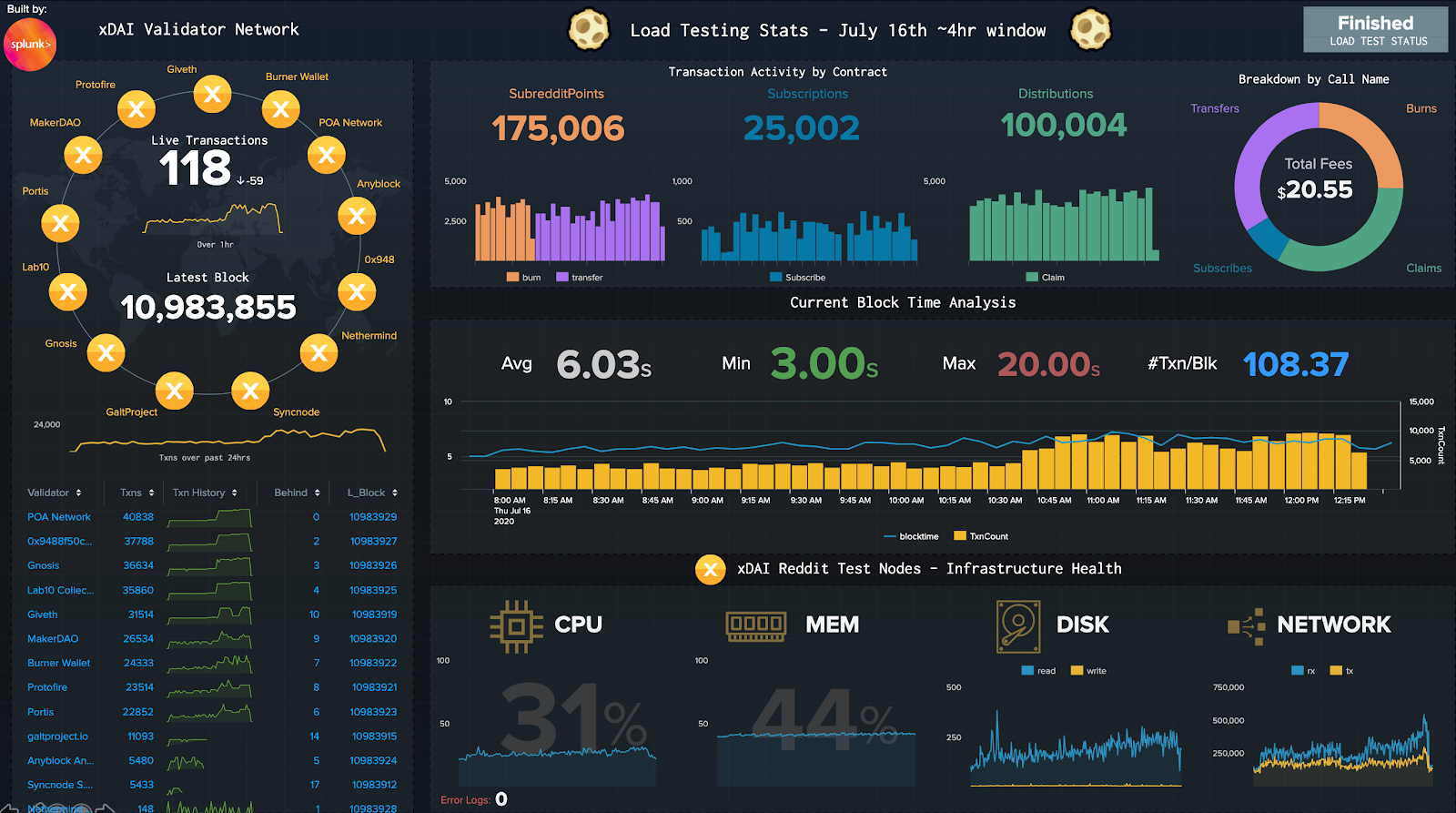

Tools like brightID, Burner Wallets, WalletConnect and others enable projects to use xDai without imposing additional demands on users. Chain data is transparent and available for exploration using BlockScout, and collaboration with companies like Splunk have brought additional visibility and monitoring capabilities to xDai transactional data.

Example Splunk Dashboard for monitoring load test data for the Reddit Bakeoff

There are still a few processes to be improved (notably users must add a custom network when transacting with MetaMask, which can be cumbersome), but overall the experience can accommodate naive as well as experienced users, and has even been considered magical for users accustomed to waiting minutes to settle transactions on Ethereum.

A growing list of projects using xDai is available here. Gnosis infrastructure and oracles from Chainlink are helping flesh out a full-featured ecosystem for developers and users.

The future of xDai and Ethereum

Eth 2.0 is full of promise, and xDai is excited to help scale Ethereum during this multi-year transition period. xDai will continue to support projects and applications that need low-cost, predictable transactions for users or have contracts that must process many transactions in short time frames. xDai is also actively working to enhance network and bridge security and increase protocol decentralization.

During the transition period, xDai will be secured by the STAKE token, which provides proof-of-stake incentives for honest validators. STAKE will also be used for governance, giving holders a chance to update network parameters for optimal performance.

Once Eth 2.0 is fully realized, xDai will be well positioned to join Eth 2.0 either as a shard or in a rollup-type capacity. At this point, xDai security guarantees can shift to the overarching Ethereum architecture, making xDai more decentralized and secure.

For STAKE, this also means transitioning from a network security token to a mechanism for overall xDai governance as well as chain-based micro governance. Holders will use STAKE to determine things like transaction sequencing and priority on a per-block basis, giving a true community voice to the transactions written directly to the chain. Value capture related to this concept, known as Miner Extractable Value, will give STAKE an intrinsic and important purpose when Eth 2.0 is ready for production.

To bring this full circle, xDai plans to reunite with her sister and live in harmony.

Until that time, xDai will be helping where she can, spurring new innovations, enabling unique projects that are otherwise impossible on Ethereum, and attending a few virtual family functions here and there.

Hope to see you there!

Action steps

Understand the role of xDAI in the broader vision for Ethereum

Check out these xDAI resources:

Author Bio

Andrew Gross is a technical communicator with the xDai Network, a stable, layer 2 sidechain built for scalability and compatibility with Ethereum.

Subscribe to Bankless. $12 per mo. Includes archive access, Inner Circle & Badge.

🙏Thanks to our sponsor

Aave

Aave is an open source and non-custodial protocol for money market creation. Originally launched with the Aave Market, it now supports Uniswap and TokenSet markets and enables users and developers to earn interest and leverage their assets. Aave also pioneered Flash Loans, an innovative DeFi building block for developers to build self-liquidations, collateral swaps, and more. Check it out here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.