Dear Bankless Nation,

Yesterday, we told you to not sleep on The Merge.

This will be one of the biggest events in Ethereum crypto history.

Ethereum will shift its entire network from Proof of Work to Proof of Stake, driving energy consumption to zero and fully becoming a Triple Point Asset.

None of this is priced in. There are not enough people inside of crypto—let alone outside of it—who understand the significance of this. Some people still doubt the merge will happen…yet here it is on testnet just this morning.

“Start stacking” is how we ended yesterday’s note.

Before the merge is priced in.

But what are the best ways to stack ETH if you already have ETH?

That’s what we’re diving into today.

Here are the 5 best yields on ETH, in ETH.

- RSA

No one has enough ETH. And chances are, you want more. So what are the best ways to stack ETH?

This Bankless tactic will highlight 5 straightforward ways you can earn ETH yields on your ETH holdings right now.

- Goal: Scope out ways to stack more ETH with ETH

- Skill: Beginner

- Effort: Less than 30 minutes (per project)

- ROI: Up to 21.77% APY (at the time of this post)

🚨 Disclaimer: The lowest risk way to get yield on your ETH is to stake it directly on Eth2, but even that has risks. The other options in this post further increase your risk. In general, as ETH yield goes up so does risk. Proceed at your own risk and please DYOR. 🚨

How to earn more ETH with your ETH

ETH is the world’s first triple-point asset. It’s a capital asset (staking offers bond-like yields), a digital commodity (gas for transactions), and a non-sovereign store-of-value (like bitcoin) all wrapped into one cryptocurrency.

Additionally, the majority of DeFi and NFT activity still takes place on Ethereum. Therefore, having some ETH allows you to interact with the largest ecosystem of decentralized apps in existence. It’s one of the main forms of money for the crypto economy.

ETH is extremely useful, and a growing number of people are HODLing ETH because they perceive the asset’s usefulness is only just beginning.

However, many contemporary crypto opportunities entail parting with your ETH, either temporarily or — if things go poorly — permanently.

For example, in joining a new DeFi project’s Pool 2 (an incentivized trading pair consisting of a base asset, often ETH, and a project’s native governance token), you’ll likely face impermanent loss at some point and thus the prospect of losing some ETH if you back out while you’re down.

Or perhaps you use sweep the floor on a new NFT collection, after which the project’s floor prices only crater over time. It happens! But buying high and selling lower will cost you in ETH.

So let’s say your thesis is “long ETH,” you want to accumulate, and you’re interested in putting your holdings to work to earn more ETH but you want to avoid more complicated and higher-risk strategies.

Where should you look?

To get some ideas, check out these 5 straightforward ETH-on-ETH yield opportunities from DeFi.

1. Vesper’s ETH Grow Pools (up to 2.31% APY)

💰 Estimated APY: 2.31%

What you need to know

- Vesper is a platform that offers user-friendly DeFi products, the first of which are called Grow Pools.

- Vesper’s Grow Pools collect users’ deposits and then puts them to work in yield strategies that “buy back more of the pool’s deposit assets and translate the accumulation into passive returns for pool participants.” Both conservative and aggressive strategies are available.

- The idea is that one can deposit ETH into a Vesper ETH Grow Pool and steadily earn more ETH over time. Depositors receive a vToken like vETH that tracks your stake in the Grow Pool, and this stake grows and represents more ETH as buybacks proceed.

How to join ETH Grow Pools

- Go to app.vesper.finance/eth/pools and connect your wallet.

- Scroll down and press “Deposit” on either the conservative or aggressive ETH Grow Pool. Note: The latter is the higher-yielding 2.31% APY opportunity.

- Input the amount of ETH you want to supply and press “Deposit” again.

- Confirm the transaction with your wallet.

- That’s it! You can track your earnings on the Portfolio page and eventually withdraw your ETH via vETH in the Grow Pools dashboard. Note: some of your APY will come in the form of Vesper’s VSP token, which you can claim through the same dashboard.

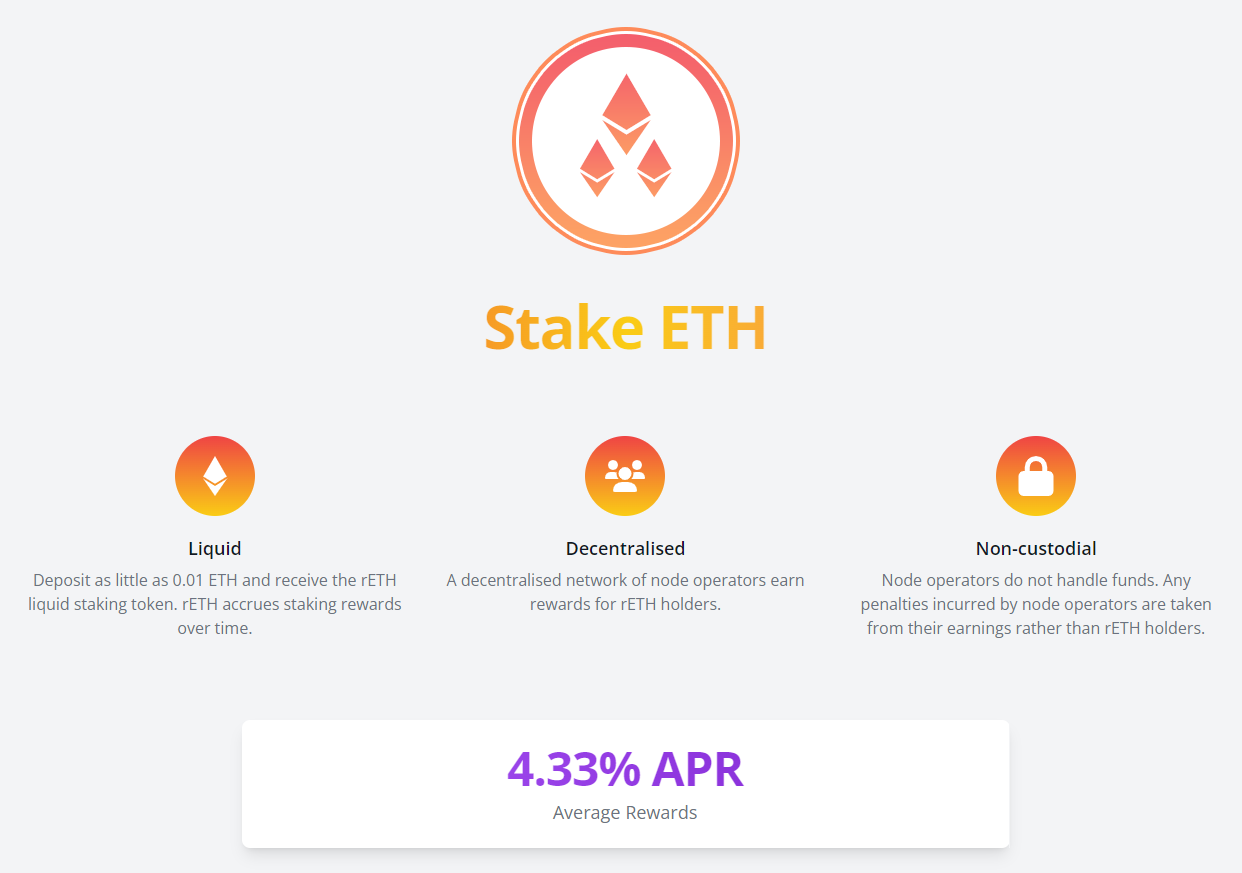

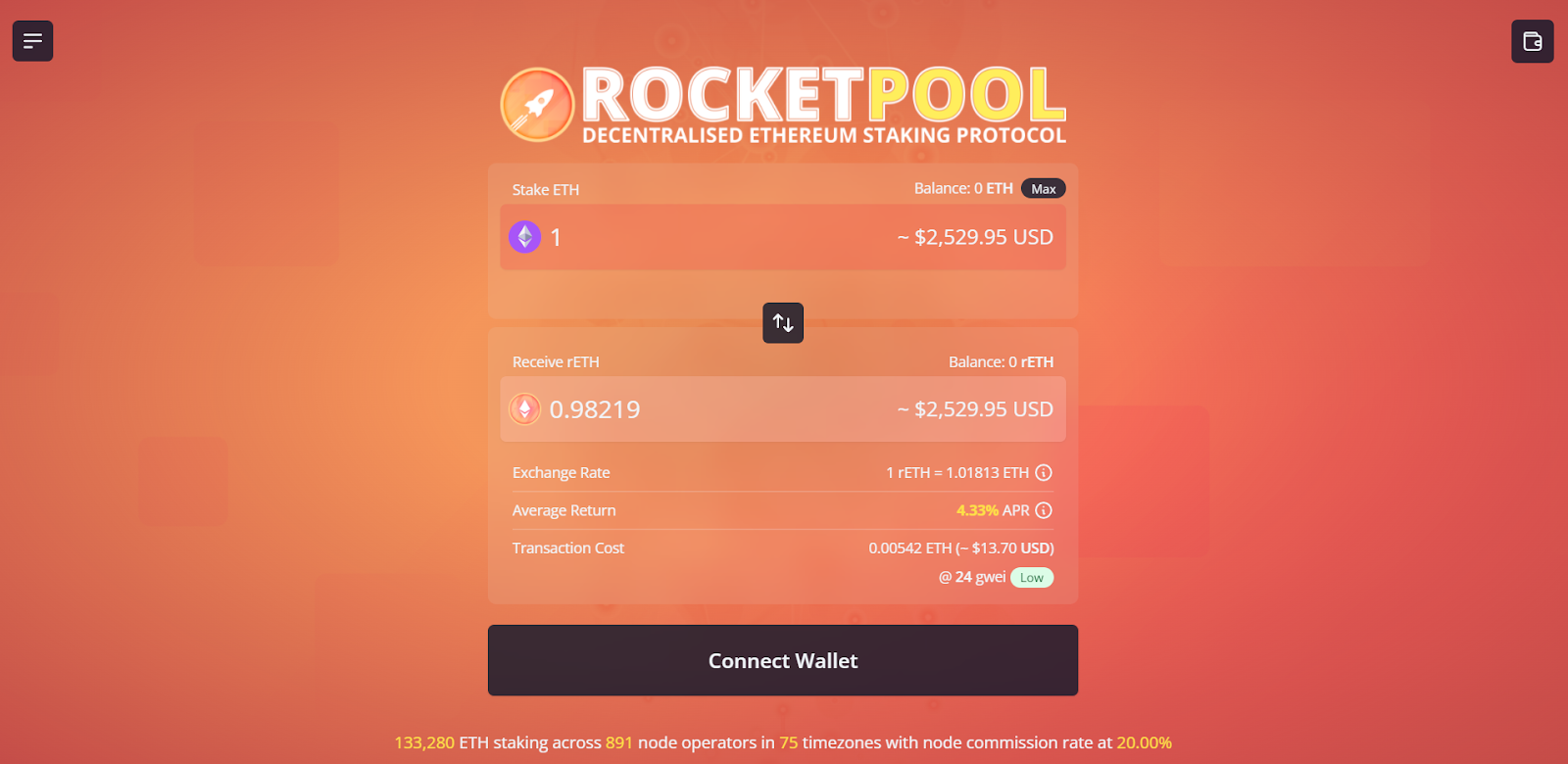

2. Tokenized Staking with Rocket Pool (rETH)

💰 Estimated APY: 4.3%

What you need to know

- Rocket Pool is a decentralized staking-as-a-service (DSaaS) protocol for Ethereum stakers.

- The project lets node operators stake with a minimum of 16 ETH, while users of its tokenized staking service can stake with a minimum of 0.01 ETH.

- People who opt for tokenized staking receive rETH, Rocket Pool’s liquid staking token, upon depositing ETH. Accordingly, rETH represents one’s staking position, and the value of rETH is meant to grow against ETH over time.

How to stake ETH with Rocket Pool

- Go to stake.rocketpool.net and connect your wallet.

- Input how much ETH you want to stake.

- Press “Stake” and finish the deposit transaction with your wallet.

- Once your transaction confirms you’ll receive rETH, which is designed to grow in value over time. You can later unstake rETH and convert back to ETH whenever you want using the double-arrow button in the middle of Rocket Pool’s staking UI.

- ✋ Read our full tactic on Rocket Pool!

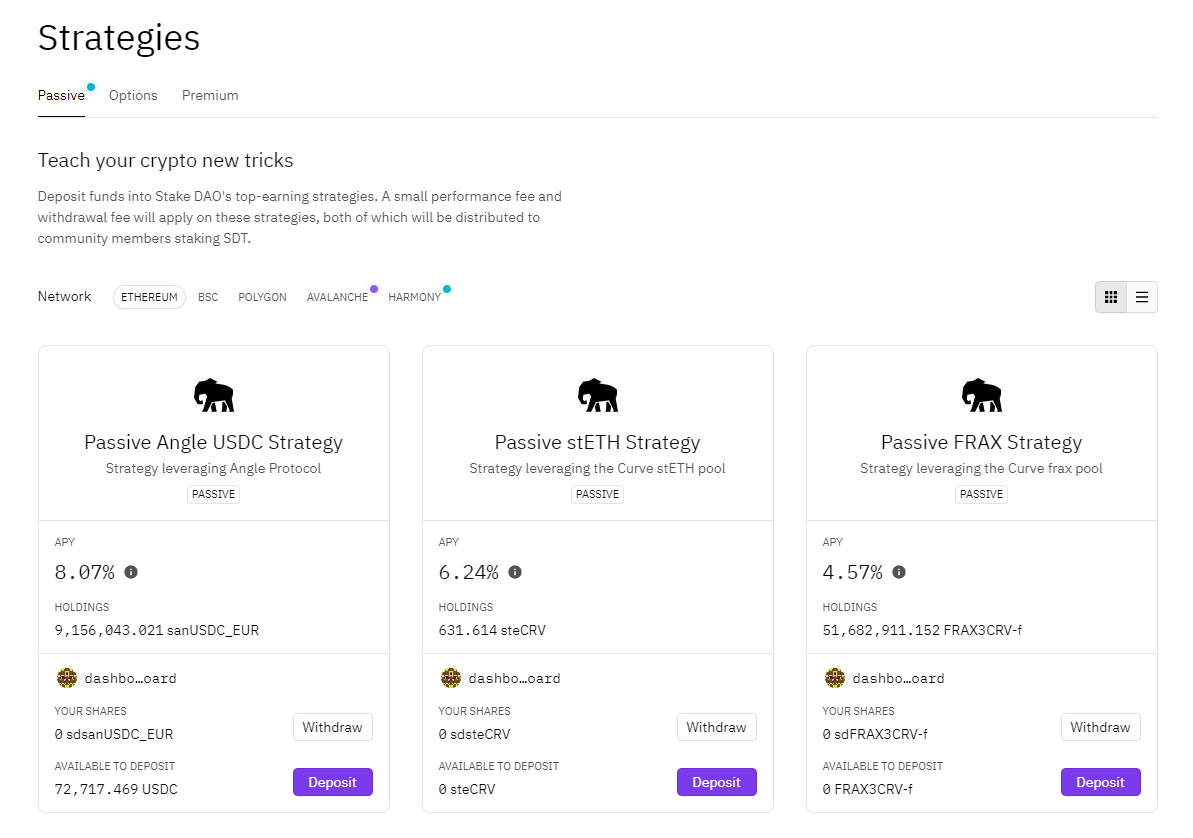

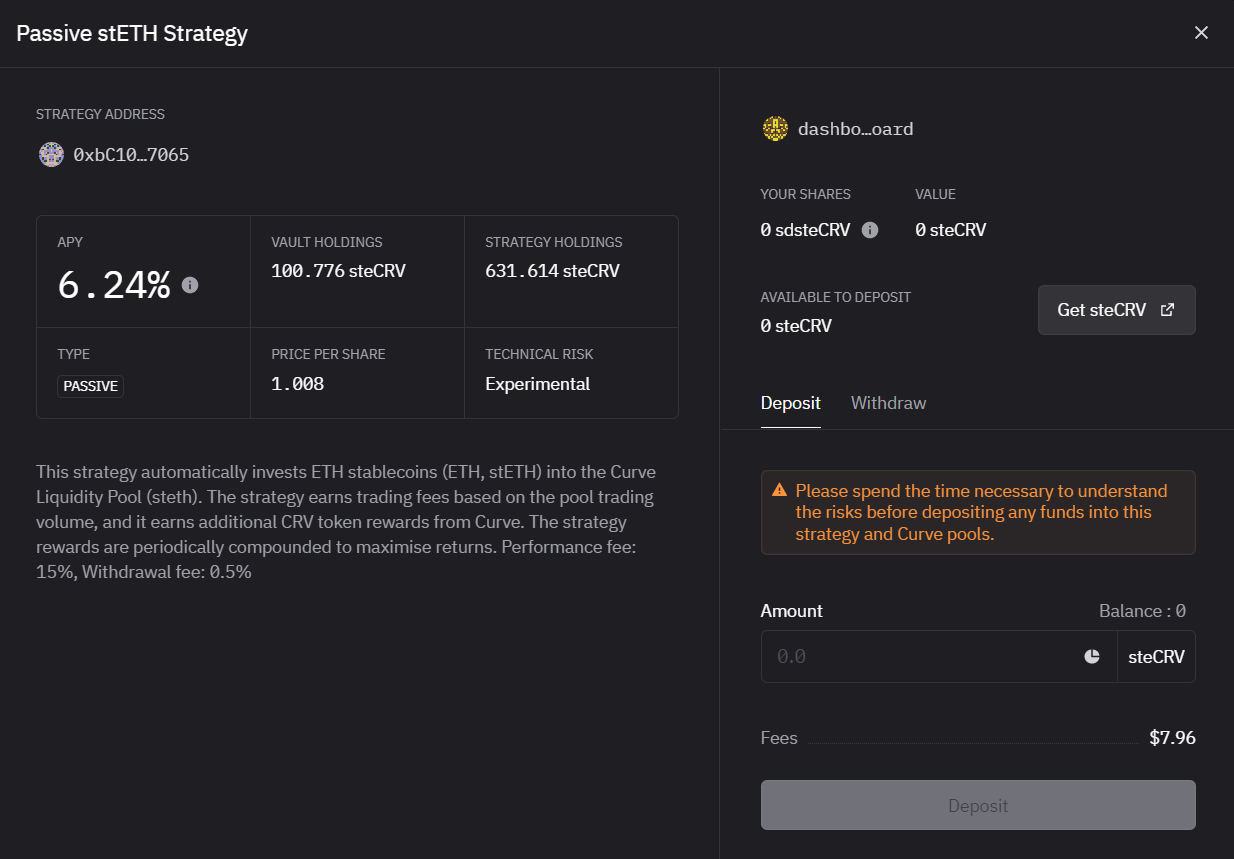

3. Stake DAO’s Passive stETH strategy

💰 Estimated APY: 6.2%

What you need to know

- Stake DAO is a non-custodial platform that offers curated DeFi yield strategies.

- The platform’s Passive Strategies revolve around collecting Curve liquidity provider (LP) tokens and putting them to work in DeFi, e.g. Convex Finance, to earn depositors automated yields.

- One of Stake DAO’s more popular strategies is its Passive stETH strategy, which earns users’ yield on LP tokens from Curve’s stETH pool (a “similarly-priced” assets pool composed of ETH and stETH, or Lido Staked ETH).

How to enter the Passive stETH Strategy

- Head to the Curve stETH pool, connect your wallet, and deposit your desired amount of ETH to receive steCRV LP tokens.

- Then go to stakedao.org/dashboard/strategies and connect your wallet.

- Click on the “Passive stETH Strategy” icon and in the ensuing UI input how many steCRV you want to deposit.

- Fire off an approval transaction and then a final deposit transaction, and you’ll be done.

- When you’re ready to exit the position you can unwind by using the strategy’s “Withdraw” button for all of the sdsteCRV tokens in your wallet. You’ll receive steCRV, which you can withdraw into ETH back on Curve.

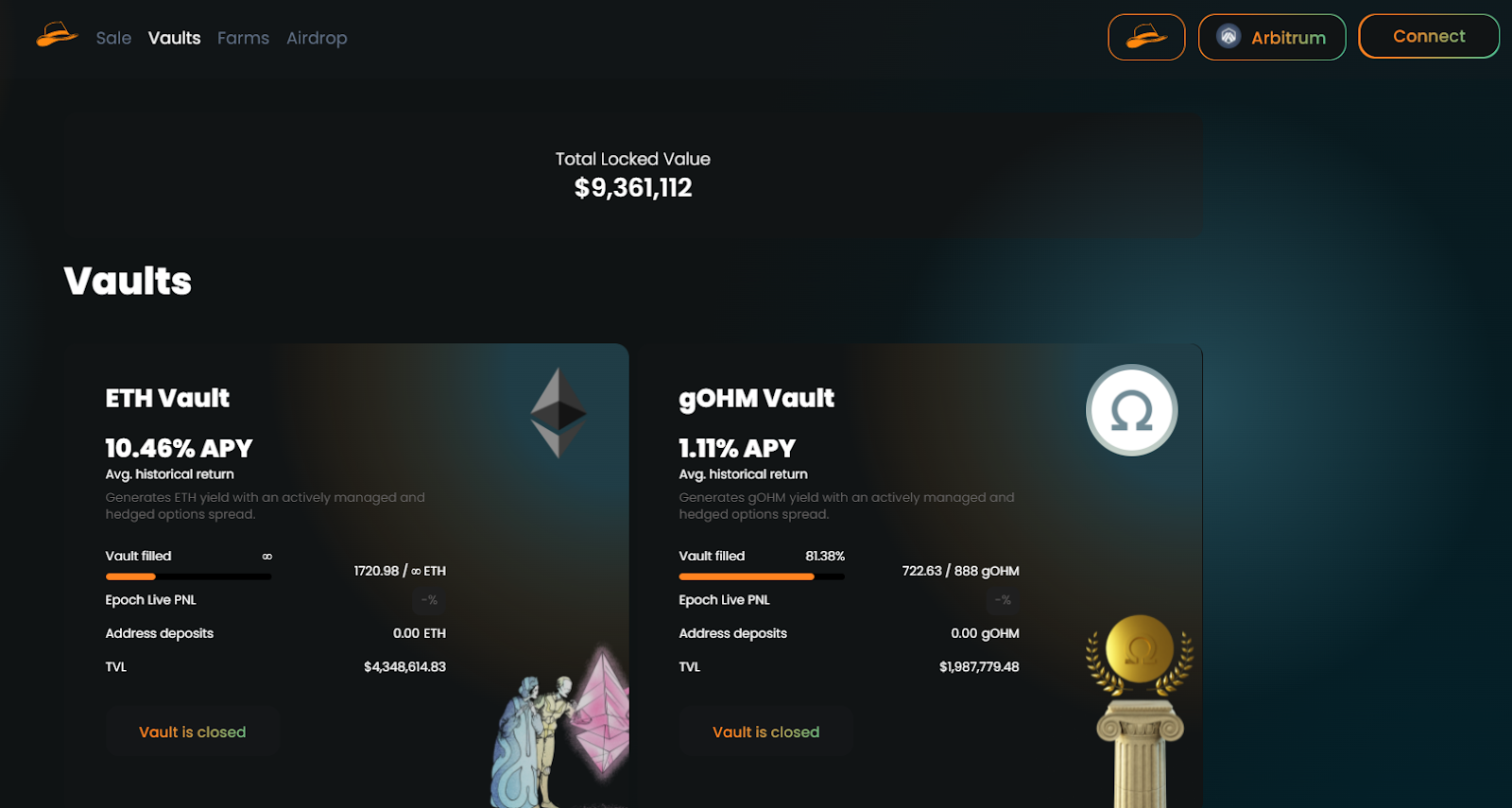

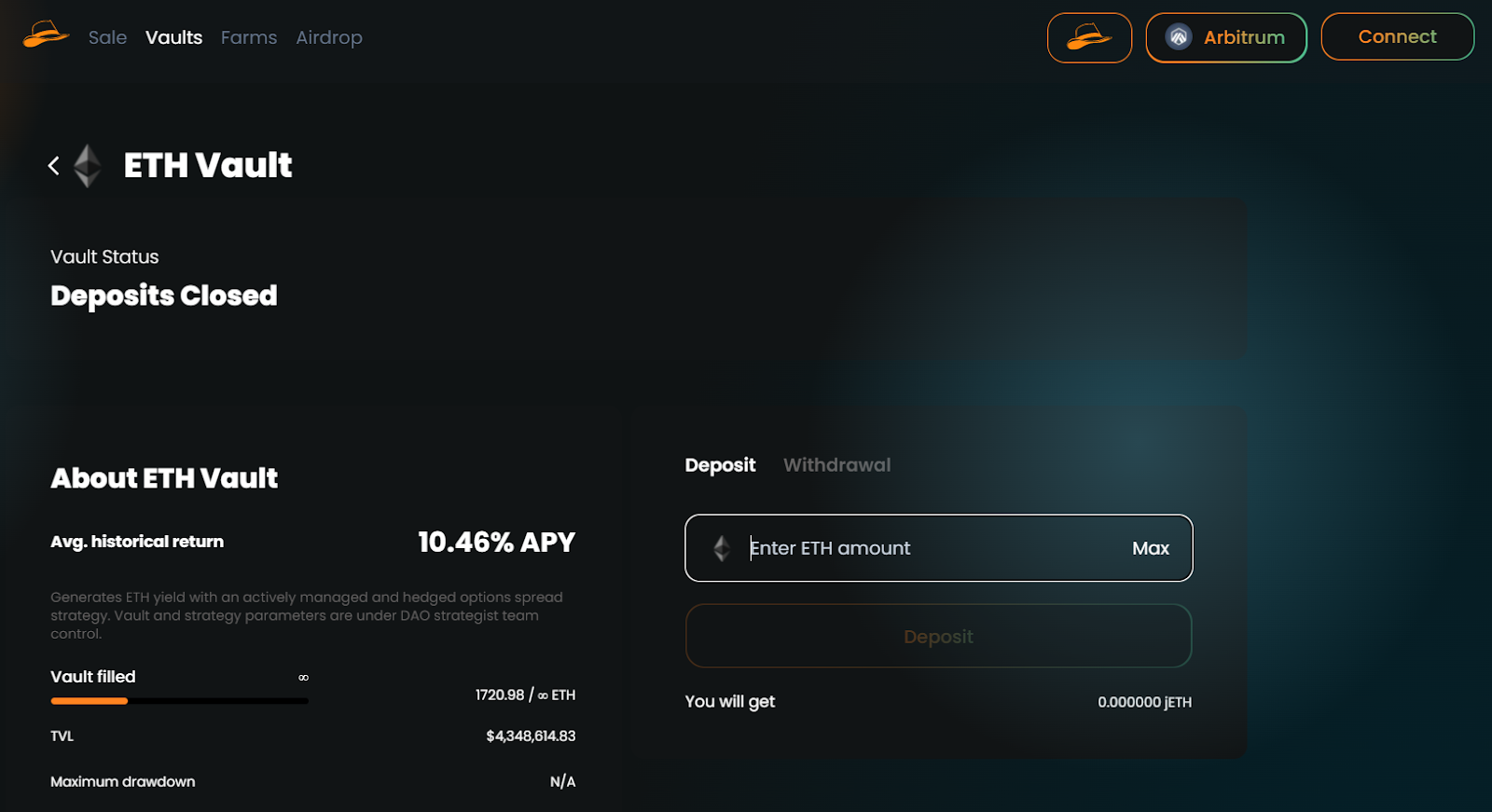

4. Jones DAO ETH Vault

💰 Estimated APY: 10.6%

What you need to know

- Centered around options trading, Jones DAO is a yield and liquidity protocol live on Arbitrum.

- The protocol simplifies the process of investing into the offerings of Dopex, an options exchange built on Arbitrum. The project does this through its Jones Vaults, which are actively managed by the Jones DAO team and are aimed at generating yields via options strategies.

- These vaults operate on a month-to-month epoch schedule, and deposits and withdrawals are only allowed during the period between epochs. Deposits are currently closed to Jones DAO’s inaugural ETH Vault, though they will reopen around March 25th, 2022, when the present epoch ends.

How to join the ETH Vault

(When deposits are open…)

- Transfer ETH to Arbitrum by using a bridge.

- Go to jonesdao.io/vaults/ETH and connect your wallet.

- Input the amount of ETH you want to deposit.

- Carry out the deposit transaction, after which you will receive jETH that represents your holdings in the vault.

- Between epochs you can use the vault’s “Withdrawal” button to convert your jETH back to ETH.

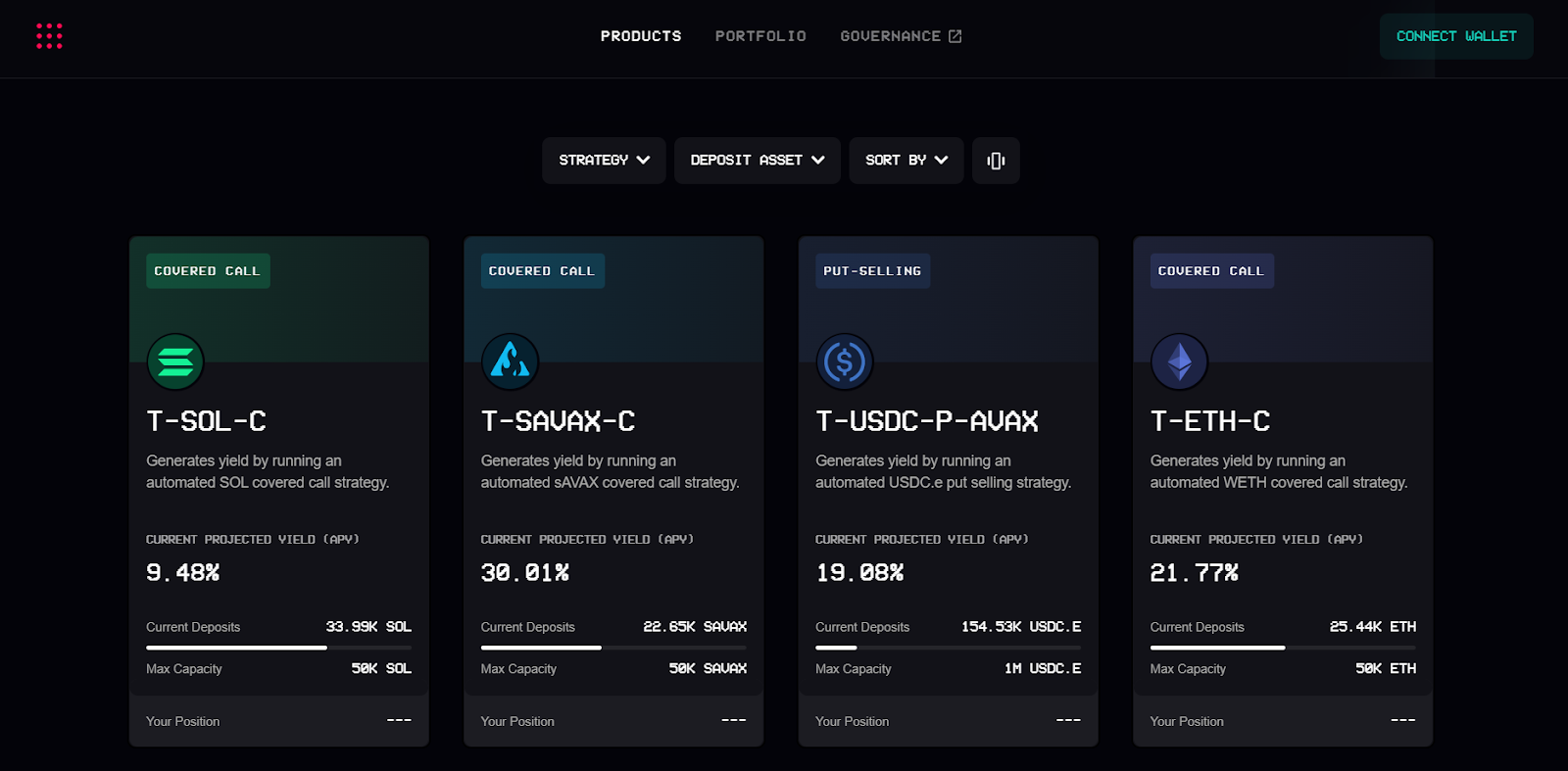

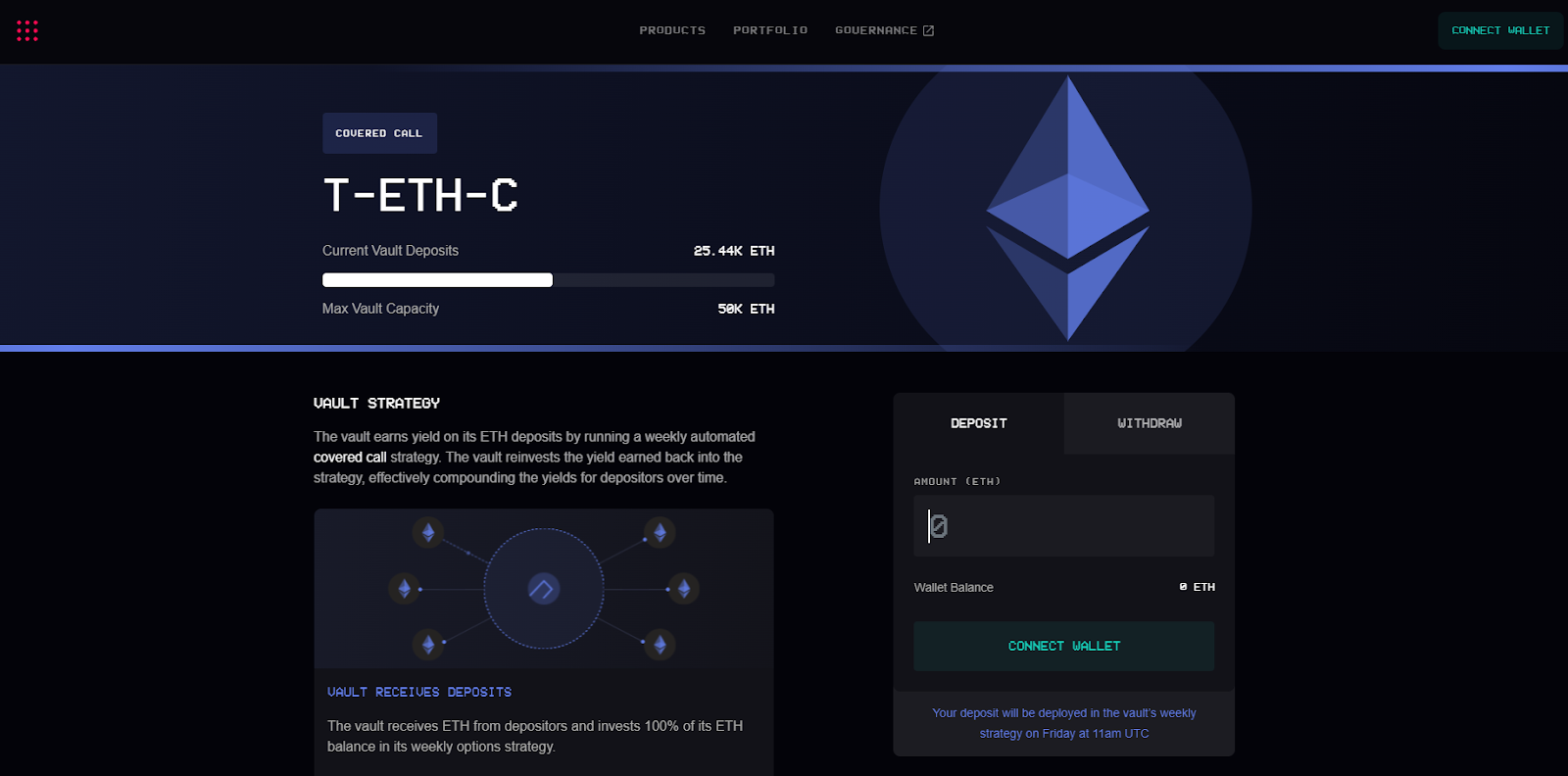

5. Ribbon’s ETH Covered Call Vault

💰 Estimated APY: 21.7%

What you need to know

- Ribbon Finance is a decentralized protocol for creating crypto-structured products, e.g. Theta Vaults that perform automated options selling strategies.

- Ribbon’s ETH Covered Call Vault automates a weekly cover call strategy that entails creating ETH call options on Opyn and then selling the ensuing oTokens to market makers via Gnosis Auctions, which generates yield.

- “The vault reinvests the yield earned back into the strategy, effectively compounding the yields for depositors over time,” the Ribbon team has explained.

How to join the ETH Covered Call Vault

- Go to app.ribbon.finance/v2/theta-vault/T-ETH-C and connect your wallet.

- Input the amount of ETH you want to supply and then press “Preview Deposit.” Review the key info one last time and then press “Deposit Now.”

- Complete the transaction with your wallet.

- Upon your deposit you will receive r-ETH-THETA tokens that represent your underlying holdings in the vault. These are what you’ll use to withdraw back into ETH when you’re ready to close your position.

- ✋ Read our full tactic on Ribbon Finance!

Conclusion

ETH is arguably the most useful money in the crypto economy.

Its prospects going forward seem extremely promising, so it’s nice to have ways that you can maintain direct exposure to ETH while earning more ETH all the while.

The ETH-on-ETH yield opportunities described above are not risk-free, though their risk-adjusted returns are compelling, especially if you think the world will increasingly embrace ETH and you want to rack up as much yield in ETH terms as possible!

Action steps

- 💸 Try earning ETH-on-ETH yields through Vesper, Rocket Pool, Stake DAO, Jones DAO, and/or Ribbon Finance

- 📈 Read our previous tactic 5 analytics tools to make you a better investor if you missed it!