How to stake any amount of ETH with Rocketpool

Dear Bankless Nation,

Decentralized staking services are incredibly important for Ethereum.

Right now it takes 32 ETH to become a validator—that’s $150,000. If you want to service the network as a validating citizen of Ethereum it takes a lot of capital.

But Ethereum staking should be accessible for everyone.

Some of the most popular staking solutions today include centralized exchanges. These allow you to deposit any amount of ETH but there’s a tradeoff. Centralized exchanges run the validators and take custody of your private keys.

One entity with your private key running the validators?

We can create more decentralized alternatives! We’ve seen moves toward this with Lido which has seen a fair amount of success over the past year by providing a more decentralized staking protocol.

But the holy grail is maximally decentralized staking.

Rocket Pool is a staking services network that’s as close to the decentralization side of the spectrum as we’ve gotten so far. And now they’re in the spotlight with yesterday’s mainnet launch.

Rocket Pool allows anyone to stake any amount of ETH with their tokenized derivative called rETH. Holders of the token and automatically earning passive income from Eth2 staking.

⚠️ Note: Given its freshly launched RocketPool is scaling capacity over the next few weeks so staking capacity is currently full. We’re only in Phase 0, but they’re on track to open up the protocol to more users in the coming days and weeks. Stay up to date on it in their Discord.

Here’s how you can stake any amount of ETH with Rocket Pool.

- RSA

P.S. Bankless DAO is in the running for a TokeMak C.o.R.E Reactor! If you’re holding TOKE, vote for Bankless and help us explore the web3 frontier. Starts later today.

Rocket Pool is a highly anticipated decentralized Ethereum staking as a service protocol. The protocol allows anyone to help secure the Ethereum PoS chain by participating in staking with virtually any amount of ETH.

Accordingly, this Bankless tactic demonstrates how to stake (and unstake) your ETH through the project’s flagship tokenized liquidity service.

- Goal: Learn how to stake ETH through Rocket Pool

- Skill: Intermediate

- Effort: 1 hour of research

- ROI: ~5%+ APR for pool staking currently

What is ETH staking?

Ethereum’s bootstrapping era is coming to an end. During this period, the network relied on the proof-of-work (PoW) consensus mechanism. This empowered miners using specialized hardware to secure Ethereum for a chance at earning ETH block rewards and transaction fees.

But you’re probably aware that PoW mining is extremely energy-intensive due to its massive computational demands while facing certain security pitfalls. These issues aim to be addressed with Proof-of-Stake (PoS), a new consensus algorithm that eliminates the reliance on computer energy, which Ethereum is transitioning to.

In Ethereum’s PoS system, the blockchain is managed by validators rather than miners. For Ethereum, a validator is a user who locks up (stakes) 32 ETH in order to run a node and secure the Ethereum blockchain.

To put it simply, rather than relying on energy for security, the network relies on capital instead. So whereas mining requires significant hardware operations, staking takes the process of securing the blockchain virtual and thus exponentially reduces Ethereum’s energy demands.

Additionally (and as Ethereum creator Vitalik Buterin has previously noted), PoS offers better security guarantees than PoW. Some of these guarantees include:

- More security than PoW for the same cost (i.e. PoS is more expensive to attack)

- Better recoverability than PoW from attacks (i.e. slashing destroys attacker’s staked ETH and attack costs quickly rise)

- Better decentralization prospects than PoW (i.e. some services let users stake with any amount of ETH by pooling funds)

- Better censorship-resistance than PoW (i.e. with a VPN staking can be performed privately)

Why stake ETH?

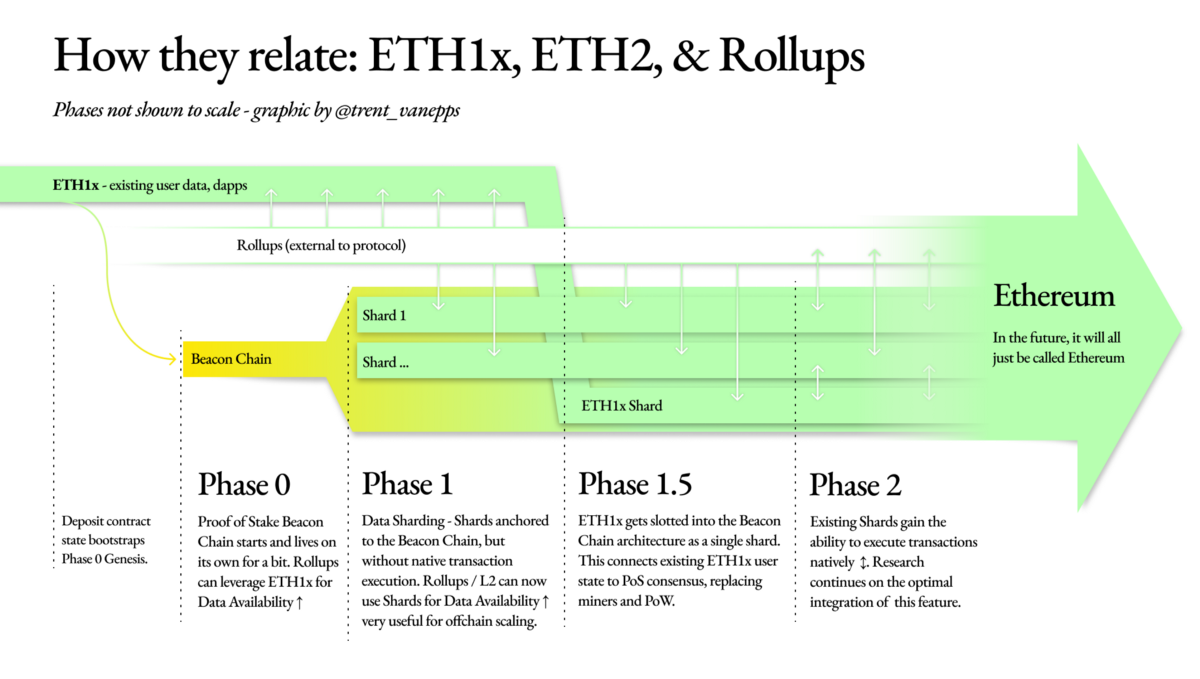

Ethereum hasn’t completely transitioned from PoW yet, but the PoS migration formally began when the community launched the Beacon Chain — the beating heart of the Ethereum 2.0 blockchain — in December 2020.

This is where ETH stakers “lock” their ETH.

Sometime next year or in early 2023, “The Merge” will completely shift Ethereum’s operations over to the 2.0 PoS chain. Until this shift occurs, all ETH will remain locked up on the Beacon Chain.

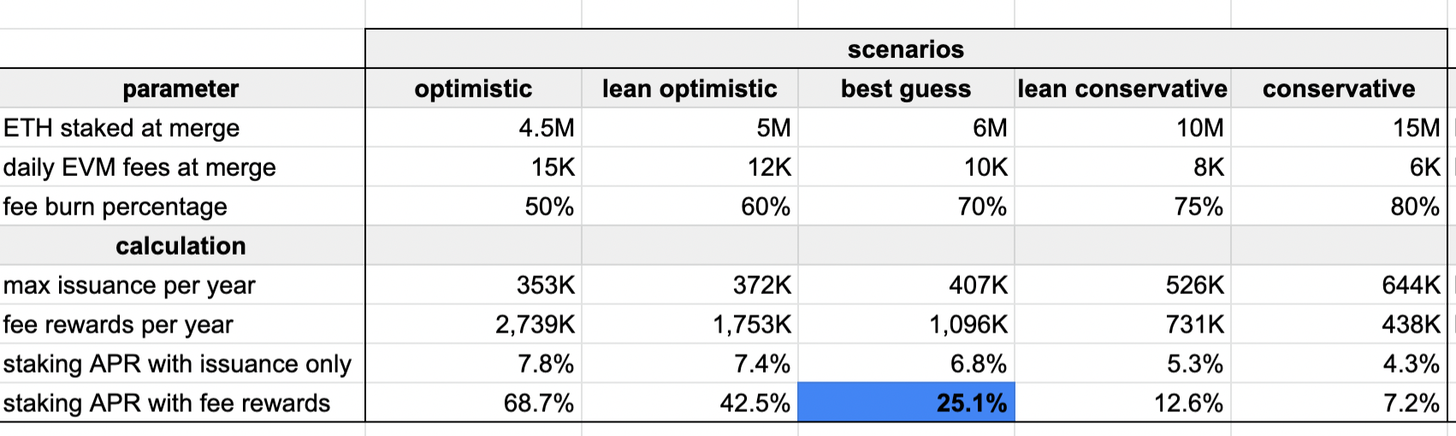

In weathering this inconvenience, many users who are running their own Eth2 nodes in these early days are doing so as activists who are aligned with Ethereum in the long run. Moreover, the actual yield prospects of Eth2 staking are compelling. According to a model created by Ethereum researcher Justin Drake, the ETH staking APR could eventually reach 25% and maybe beyond.

Not bad, right?

Additionally, the ways in which Eth2 stakers earn is compelling.

For example, Eth2 validators are assigned their validation work so they can count on steady earnings if they operate successfully. This is in contrast to Eth1 PoW where there are no guarantees you’ll win the contest for the next block. All you have to do is be honest and keep your validator online.

Also, ASIC miners can rapidly depreciate in value and become outdated; yet 1 ETH is always 1 ETH and can’t become outdated for Eth2 validation.

The Rocket Pool 101

Not everyone can afford the 32 ETH minimum required to become an Eth2 validator. It’s actually very expensive to do it at this point—over $150K at the time of writing. Even fewer people have the technical know-how or willpower to run an Eth2 node on their own.

That’s where a project like Rocket Pool comes in and looks to shine.

In short, Rocket Pool is a decentralized staking-as-a-service (DSaaS) protocol. While the project is admittedly “as decentralized as feasible” in its adolescent days, its mission is to eventually provide totally decentralized and trustless Eth2 staking infrastructure to anyone who needs it.

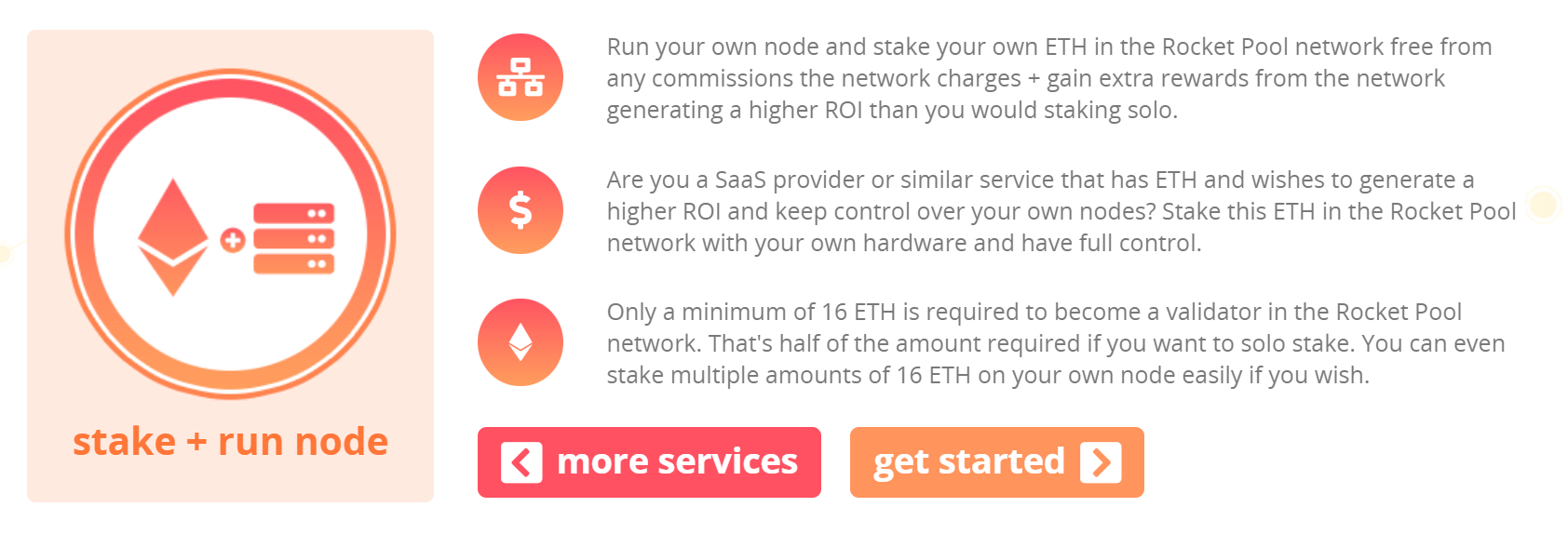

In this way, Rocket Pool caters to users who want to stake and run their own Eth2 nodes with their one-stop software and to users who want to easily stake more than 0.01 ETH (the project’s minimum) without having to bother with the responsibility of managing an Eth2 node themselves.

So now that we’re refreshed on the basics of Eth2 staking and Rocket Pool, let’s explore the protocol’s two main services: Node Operations and Tokenized Staking.

Node Operators

A Rocket Pool Node Operator must deposit a minimum of 16 ETH, plus insurance of at least 1.6 ETH worth of the project’s RPL token, for each validator they’re interested in backing; they can stake multiples of 16 ETH too.

The protocol’s system takes a node operator’s 16 ETH and combines it with 16 ETH from the staking pool (where anyone can accessibly stake any amount over 0.01 ETH) to create a new Eth2 validator. Rocket Pool dubs a validator created in this way a mini-pool, but to the Beacon Chain, it’s the same as any other validator.

Serving as a node operator is an advanced responsibility, as it involves configuring and maintaining one or multiple validators indefinitely and being familiar with how to use the command line. As such, we won’t focus on becoming an operator here, but for anyone interested in diving deeper check out these awesome resources:

Tokenized Staking

Rocket Pool’s tokenized staking service has broad appeal, as it lowers the Eth2 staking deposit threshold to >01.ETH.

Deposits into the protocol’s staking pool make up the other side of the aforementioned minipools, i.e. Rocket Pool validators.

All depositors receive rETH, the Rocket Pool liquid staking token that represents their underlying staking positions. As Rocket Pool accrues earnings over time, the value of rETH grows against ETH leading to a dynamic exchange rate between the assets.

A crucial advantage of rETH right now is that it offers Ethereum users access to Eth2 staking but in liquid terms, i.e. without having to wait until as late as 2023 to access ETH deposited to the Beacon Chain.

This is the best part: You can have your cake and eat it too. With Rocket Pool, you can earn Eth2 staking rewards while having access to liquid rETH that you can put to use around DeFi, e.g. lending or liquidity providing.

There’s still some work to do around integrations in DeFi given it’s still new, but we can only imagine they’ll happen over time as the protocol scales upwards.

Staking ETH on the Rocket Pool

As of November 8th, anyone can stake real ETH and contribute to securing Eth2 through Rocket Pool’s decentralized staking service.

Interested in participating once the project goes live on mainnet?

If so, you can follow these steps to join in:

- Start by going to stake.rocketpool.net. After, connect your Ethereum Wallet. The protocol currently supports Metamask and WalletConnect.

- You’ll be asked how much ETH you want to stake. Input your desired deposit amount and see how much rETH you’ll receive in kind.

- When you’re ready to proceed, press “Start.” Your wallet will prompt you to complete the deposit transaction. Configure the gas fee if you’d like, then press “Confirm.”

- Once the transaction is confirmed, you can access your new rETH balance in your wallet whenever you want. Remember: the ETH-rETH exchange rate is dynamic, so it’s typical to receive slightly less rETH than the ETH you staked.

- If you ever want to unstake your ETH, simply head back to stake.rocketpool.net and press the double-arrow button in the center of the page. This brings up an interface for you to input how much rETH you want to exchange back for ETH. Carry out the ensuing transaction, and that’s that!

A few words of warning

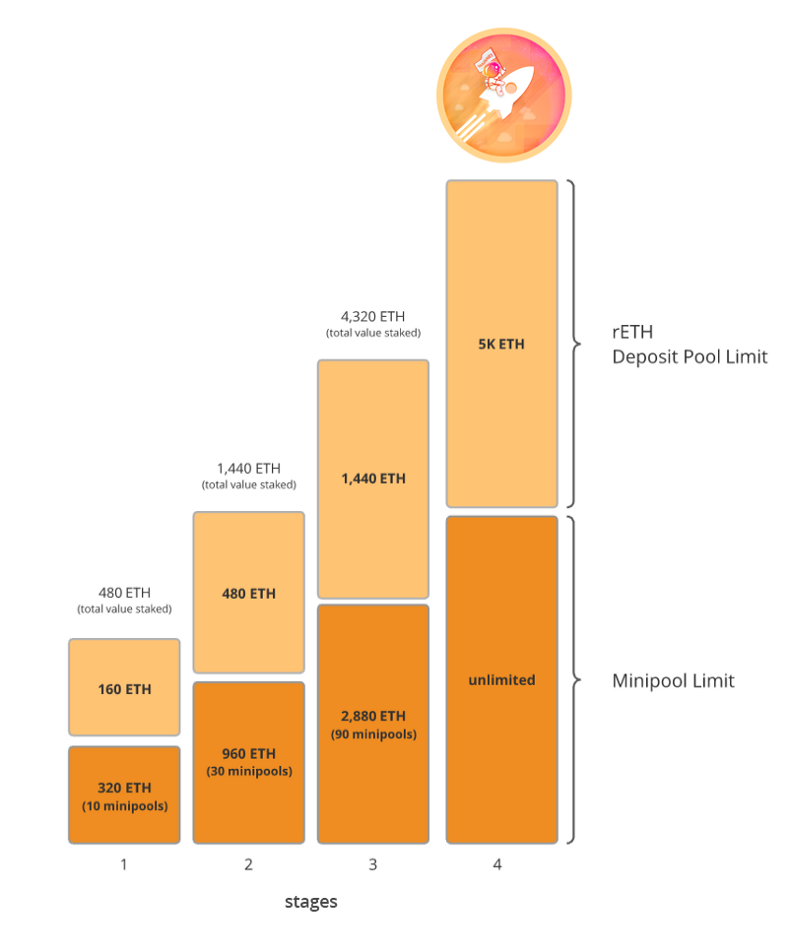

Keep in mind that Rocket Pool’s mainnet launch will occur in four phases, so you won’t necessarily be able to ape in right off the bat. It’ll simply depend on availability at the time.

A graphic illustrating the deposit limit of these phases is as follows:

These phases don’t have set timelines, so be sure to monitor Rocket Pool’s official comms channels in order to stay abreast of updates on how they proceed.

The first phase has already reached the threshold, so you’ll have to wait until the next one on November 9th, 2021 at 00:00 UTC to get in on the action. If you want to stay updated on the next phase release, hop into the Discord and keep an eye on the announcements channel.

Additionally, it’s important to note that you’ll only be able to unstake rETH through Rocket Pool if the project’s staking pool has enough liquidity. Prior to The Merge there are occasions where the pool may acutely run short on liquidity.

With that said, you can always resort to DEXs like Uniswap for your liquidity! However, just be careful as there’s a chance you’ll pay a premium on the swap.

Conclusion

Decentralized staking protocols are a crucial piece of infrastructure for Ethereum. In an article on democratizing staking earlier this year, my colleague David Hoffman put it this way:

“Rocket Pool is a math-driven protocol, meant to serve any and all requests no matter what. Coinbase is a trust-driven company, which will never be able to offer stronger assurances than what is offered by decentralized applications on Ethereum like Uniswap or Rocket Pool.”

For many, Coinbase’s offering will work just fine. For others, a decentralized service like Rocket Pool offers users a means to earn ETH block rewards and ensure the decentralization of the Ethereum network, a win-win if an Ethereum fan’s ever seen one!

So with Rocket Pool’s arrival on mainnet now achieved, what comes next for the project?

The near-term plans are preparing for The Merge and researching potential MEV opportunities. “We are in collaboration with Flashbots to explore capturing MEV to benefit node operators and rETH holders,” Rocket Pool’s Darren Langley said this summer.

Action steps

- 📝 Check out the Rocket Pool Glossary for further research!

- 👀 Check out beaconcha.in and stakingrewards.com to compare the nuances of today’s available Eth2 staking services.