How to take a DeFi governance bribe

Dear Bankless Nation,

Psst, do you hold CRV? Want to take a bribe?

I have to admit the term bribe threw me until I took some time to understand the mechanisms in Curve.

This isn’t shady, cigar-smoking backroom deals type of bribery. This is a transparent, auditable, and permissionless mechanism by which assets that want liquidity can pay CRV holders to get it.

Less of a bribe, more of an on-chain dividend!

So why are people willing to pay CRV holders?

Curve has a flywheel effect that puts buy pressure on CRV. It goes a bit like this:

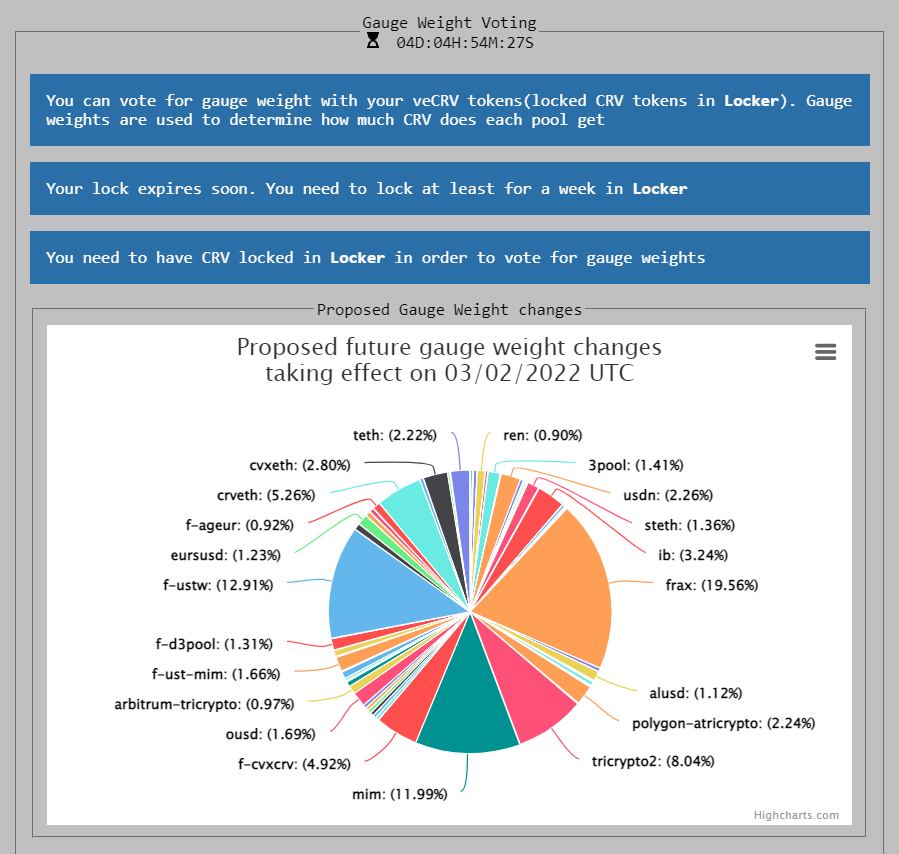

- Curve gives CRV for token emissions across all Curve LP pools

- CRV holders vote with their tokens on where CRV emissions should go

- The more CRV you hold, the more influence you have on CRV emissions

CRV token emissions are such a valuable incentive for LP pools that various protocols have gobbled up CRV in order to direct emissions to their preferred pools.

This is governance utility done well.

So… how do you get exposure on this race to accumulate CRV? For one, you can buy CRV and reap the rewards of massive buy pressure.

But if you want to level up your DeFi exposure, you can also participate in the governance process—you can start accepting getting paid for your votes.

Call it a bribe, call it a dividend, call it payment for direction liquidity. Either way, let’s learn how to earn 50% APR by participating in the Curve Wars!

- RSA

P.S. This is hard stuff! If you to go from 0 to 100 fast then listen to our Curve Wars episode.

The specter of the Curve Wars has created a whole new sector in DeFi: bribe platforms. These platforms help their users earn higher yields in exchange for greater influence over CRV emissions. This Bankless tactic will show you how to join the Curve Wars by staking your tokens with Convex Finance, the leading DeFi bribe platform to date.

- Goal: Learn how to stake on Convex Finance

- Skill: Intermediate

- Effort: 30 minutes

- ROI: Up to +50% APR at current rates

Farmers for hire: Welcome to the Curve Wars

In Jan. 2020, physicist Michael Egorov deployed Curve, a decentralized exchange for efficient stablecoin markets, on Ethereum.

Since then, Curve has expanded beyond stablecoins, deployed to seven other chains and counting, and upgraded its infrastructure while becoming one of the largest and most influential DeFi apps yet.

A lot of that influence stems from Curve’s CRV token emissions, which have become a central source of yield for many DeFi projects. CRV’s also highly sought after because holders can steer and increase CRV emissions to particular Curve liquidity pools via Curve governance.

Accordingly, Curve Wars is the nickname given to the efforts of DeFi projects that are competing for CRV and fighting to aim CRV emissions toward their preferred pools.

This metaphorical battling has intensified recently thanks to a growing wave of “bribe platforms,” which make it easy for users to earn higher yields by putting the influence of their CRV up for rent.

⚠️ The Curve Wars is a fairly complex topic. If you’re only vaguely familiar, I would recommend you spend some time with the following resources:

- 📑 Bankless article on the yield wars between Curve, Yearn, and Convex

- 🎧 Bankless podcast on The Curve Wars with CurveMarketCap

- 🧵 Jack Niewold’s excellent Twitter thread

A quick history of the Curve Wars

The “shot heard ‘round DeFi” came in Aug. 2020, when CRV and Curve DAO launched. Though most of the ecosystem wasn’t aware of it at the time, this occasion marked the de facto beginning of the Curve Wars.

The first major salvo to follow the launch of CRV was Yearn’s release of the “Backscratcher” vault circa Nov. 2020. This one-way vault lets yield farmers deposit in CRV, which Yearn thereafter permanently locks for vote-escrowed CRV (veCRV), in exchange for yveCRV and optimized yields.

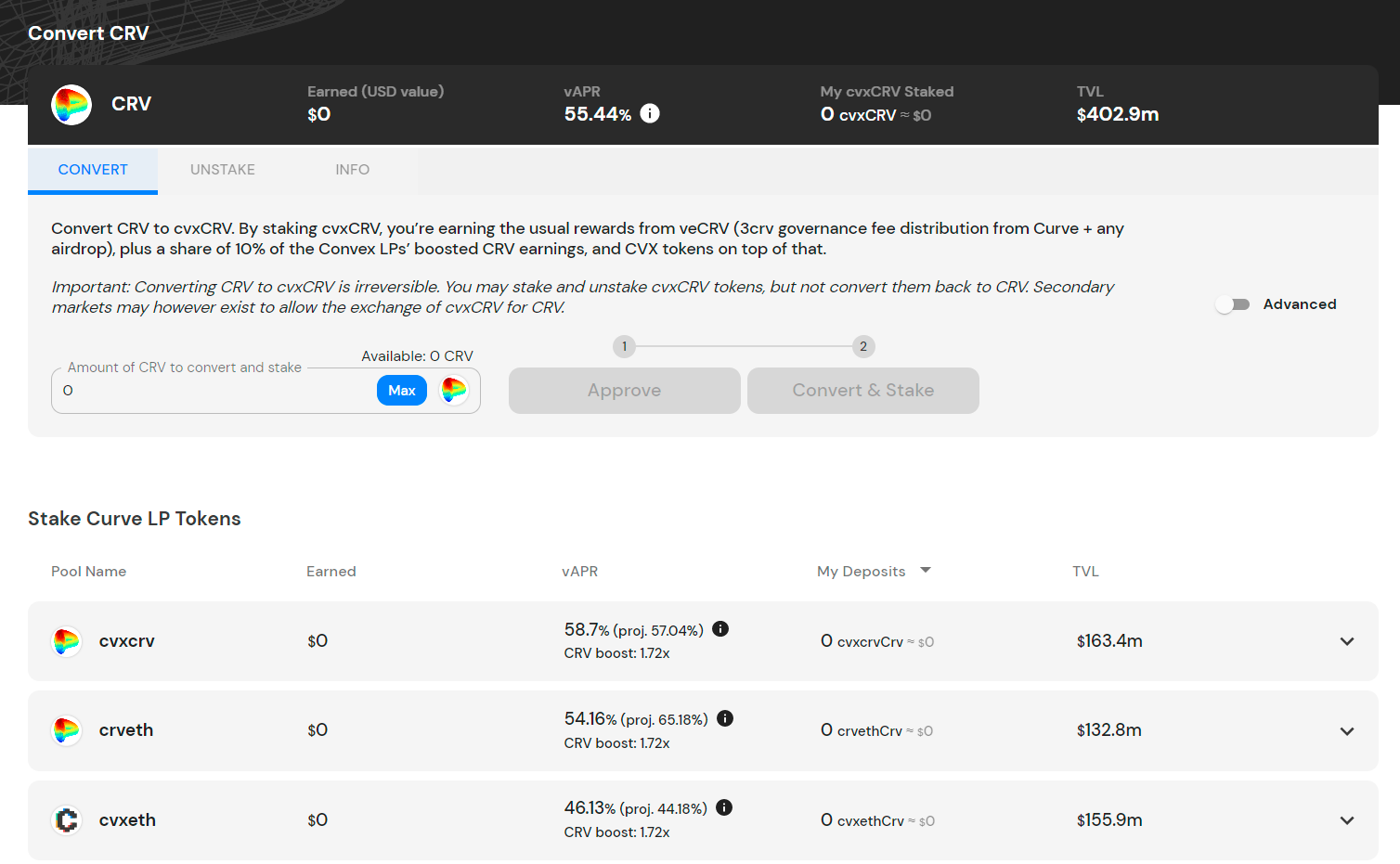

The next great escalation in the Curve Wars came in May 2021, when Convex Finance deployed on Ethereum. Convex allows Curve liquidity providers (LPs) to stay liquid and stake with cvxCRV instead of having to lock CRV to earn Curve trading fees and boosted CRV emissions.

Because of the centrality of CRV emissions in DeFi, Convex gained popularity — and considerable capital — in rapid fashion. Other DeFi projects started decisively pivoting toward Convex, too (e.g. Badger in June 2021), as they started realizing the protocol could be a Curve governance kingmaker going forward.

Things heated up further in Aug. 2021 when Yearn’s founder Andre Cronje released bribe.crv.finance, a platform that allowed projects like Abracadabra and CREAM to offer token rewards to steer CRV emissions votes in their favor.

Then in Nov. 2021 we saw the unveil of REDACTED Cartel. A fork of Olympus DAO, REDACTED isn’t attempting to become a reserve currency; rather it’s accumulating as much CRV and CVX as it can so that its DAO becomes a kingmaker in Curve and Convex governance.

Later that month, we also saw the most pivotal moment in the Curve Wars yet: an alliance between Yearn and Convex Finance! This partnership was forged by Yearn delegating 23M veCRV to Convex; in doing so the two sides solidified themselves as the dominant force to beat when it comes to influencing CRV emissions.

How to join the Curve Wars & take gov bribes

With its TVL currently over $10B, Convex Finance is the largest and most active DeFi “bribe platform” live today. So if you’re interested in optimizing your yields by joining the Curve Wars, Convex is an obvious starting point.

If this opp is up your alley, keep in mind that you’ll need either CRV (to convert into cvxCRV for staking) or Curve LP tokens (tokens you receive from depositing into Curve’s popular CRV-ETH pool). To join, follow these steps:

- Go to convexfinance.com/stake and decide among the available CRV or Curve LP token farms. Note that converting CRV to cvxCRV for staking is irreversible; however, you can unstake and trade cvxCRV however you want via secondary marketplaces.

- Once you have your CRV or Curve LP tokens prepped, go to your opp of choice back on convexfinance.com/stake and connect your wallet; then input the number of tokens you want to deposit and complete an approval transaction to let Convex use your funds.

- You’re ready to rip! Complete the final staking transaction and then you’ll be earning via Curve War bribe action. You can then unstake through this page and claim your CVX rewards as you please.

Conclusion

Love it or hate it, it seems the genie’s out of the bottle when it comes to the influence of the Curve Wars.

Will this lead to plutocracy winning out in DeFi? Is this just a temporary tokenomics phase that will eventually fall by the wayside? These are open questions for now. Yet what is clear is that the Curve Wars aren’t going anywhere any time soon.

Indeed, we’re starting to see new bribe projects like Votium and REDACTED’s Hidden Marketplace offer unprecedented bribe services. And we’re also seeing related bribe dramas expand to other chains, e.g. Fantom. Your grand takeaway, then? All this DeFi bribing is here to stay for now, for better or for worse.

Action steps

- Try staking (i.e. accepting bribe action) on Convex Finance

- Watch The Curve Wars by Bankless

- Read Is Convex the YFI Killer? by Bankless

- Read our previous tactic How to get started with music NFTs if you missed it