5 Things We Got Right

Dear Bankless Nation,

2021 is almost over. Anyone else feeling reflective?

I mean wow crypto just had its best year yet. Like…incredible.

We were right about a lot of things this year.

But let’s not rest on our laurels. The journey is long and crypto’s just getting started.

So let’s reflect on 2021 and keep leveling up…

Here’s:

- 5 things we got right 💪

- 5 things that surprised us 😲

- 5 mental models from 2021 🧠

- 5 bets going into 2022 💸

What are your reflections from this year?

- RSA

If you’ve spent the whole year with Bankless I expect you’re feeling pretty good right now.

Number went up. Our big predictions held strong. Crypto felt unstoppable.

Let’s run through five things we got right:

1. Crypto became a multi-trillion dollar asset class

The total market cap of crypto went up from $780 billion to $2.3 billion and hit a peak over $3 trillion. We predicted a multi-trillion dollar crypto as a layup last year. Crypto has now reached escape velocity. 🚀

2. ETH showed remarkable strength relative to Bitcoin

ETH was strong relative to Bitcoin this year with a high of $4,600 and strength on the ratio. We’ve called for overperformance of ETH relative to BTC for quite a while and we saw it play out this year big time—ETH up 490% on the year vs BTC up 101%.

3. ETH became money

ETH as money was a fringe idea prior to 2021, but this year our longest-held and most contrarian ideas finally broke into the mainstream. EIP1559 was just an idea when we first wrote about it in 2019 but now it’s ever-present proof that ETH is money. ETH as a monetary asset, an internet bond, and a store-of-value—these are now the commonly accepted investment narratives for Ether the asset.

What’s more important, the meme or the fundamentals? Both! The meme gets tested by the fundamentals. Hollow memes die. False memes become fundamentals.

4. It rained Airdrops!

We like to say crypto pays you to learn about crypto! We predicted airdrop for 2021 and they came! Our airdrop guide became one of the most popular content pieces in crypto as DeFi users were rewarded with millions in token drops.

5. DeFi usage up!

We said DeFi on Ethereum would hit $100 billion in total locked value and it did. But also…just barely! A good year for DeFi but not a great year. Why? We think DeFi was overshadowed by a few of the surprises below…

5 things that surprised us 😲

Is there ever a year where crypto doesn’t do something surprising? The surprises this year were mostly surprises of timing—things happening faster than we thought.

1. NFTs blew up faster than we thought

Here’s a tweet from 2018 that aged well…

We’ve been bullish NFTs for years—someday they’d be huge we said.

But we had no idea someday would happen all at once in 2021.

Our Bull Case for NFTs at the end of DeFi summer last year was my first hint they were about to explode. In that episode, Andrew and Jake predicted NFTs would grow to eclipse DeFi. But even they were surprised how fast they took off this year.

Beeple. Cryptopunks. Bored Apps. OpenSea.

I underestimated how quickly mainstream would adopt these things.

I’d never seen anything like it. NFTs brought in an entirely new cohort of artists, celebrities, and creators basically overnight. DeFi was for geeks. But NFTs were for everyone.

NFTs got us Jimmy Fallon and SNL and Snoop.

Not Bitcoin. Not DeFi. NFTs.

What did this teach me?

It taught me that not being serious is a competitive advantage. NFTs threatened no one. No threat to mainstream brands—they saw NFTs as a new medium for IP. No threat to big social media empires—they happily added NFTs as features. Not threat to regulators and governments—crypto is scary but NFTs are just…cute.

I totally underestimated the surface area of NFTs.

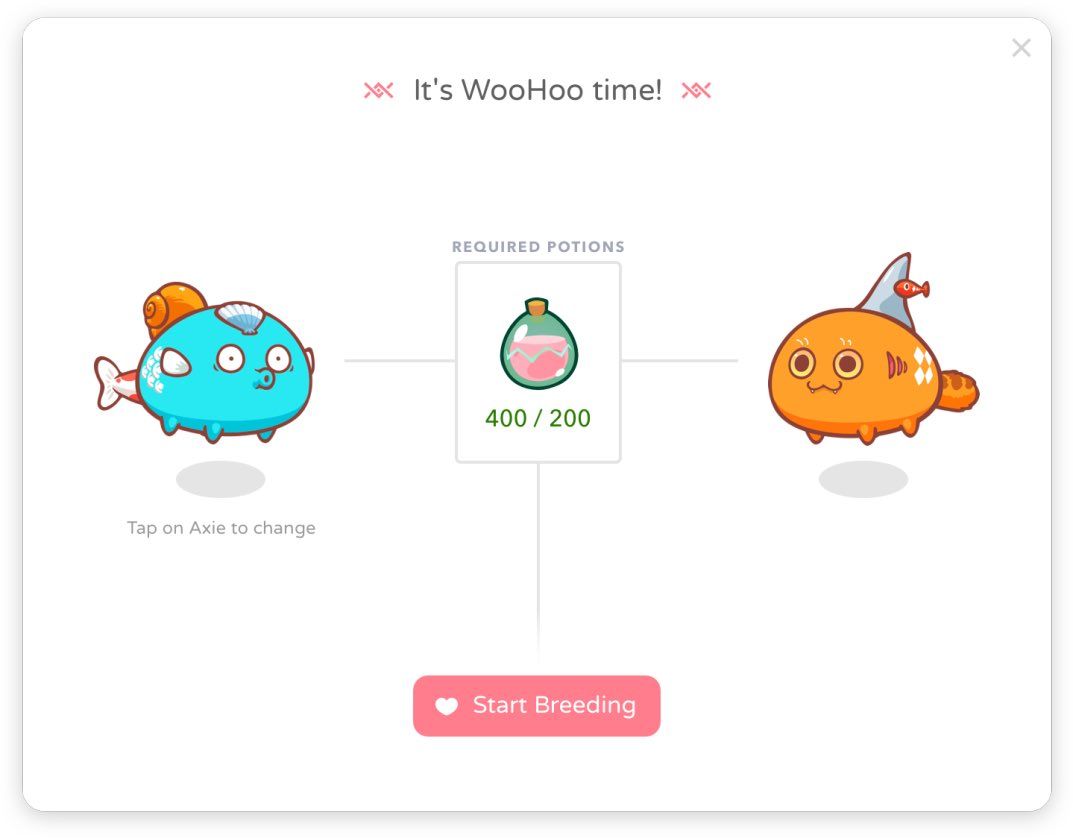

2. Axie surprised us

We were bullish on Axie Infinity by the beginning of 2020. We’ve been bullish on the entire category of crypto gaming for even longer. But it’s hard to convince others without an app to point it and going into this year…crypto gaming was kinda dead.

So what happened with Axie in 2021 defied all predictions.

Axie melted faces this year.

Biggest discord server in the world. Billions of dollars in revenue. Millions of players from all over the world. AXS value went from $30 million to $8 billion.

A four-year overnight success story that launched crypto gaming into mainstream consciousness with the power of 1,000 cryptokitties.

Crypto gaming is now a category thanks to Axie.

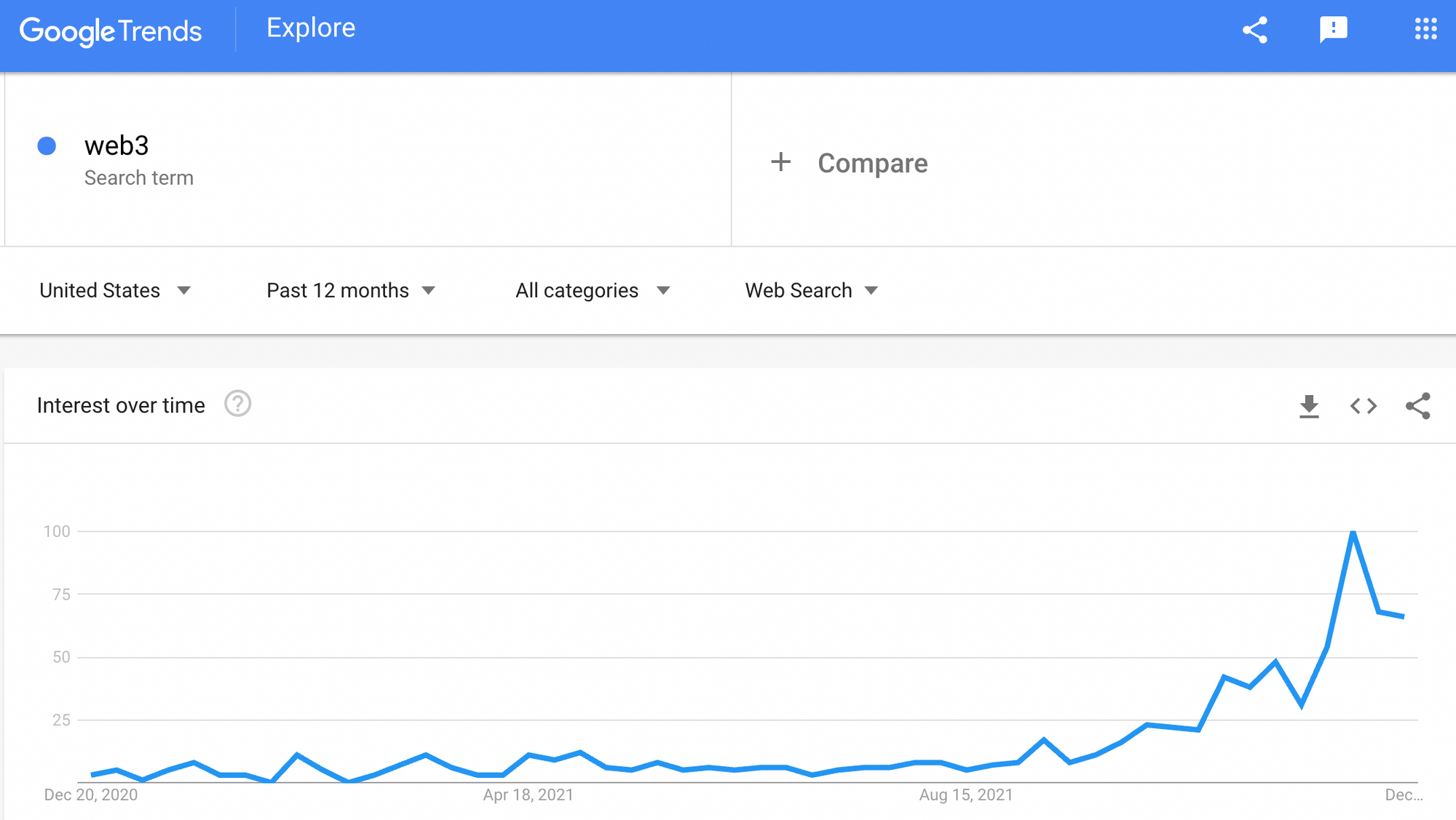

3. Web3 became a narrative

After a false start in 2017 Web3 became a real narrative in 2021.

I gotta confess…I didn’t like the term Web3 much before this year.

Previous iterations of Web3 felt either completely disingenuous or hopelessly naive. Crypto was create a new Uber…but decentralized! Our ICO idea is to take twitter…and launch it on Ethereum. These 2017 era “Web3” ideas collapsed in a puff in 2018.

But today Web3 is real.

The creator economy, the ownership economy, NFTs and DAOs, self sovereign identity, crypto as the digital property layer for the Metaverse…

We’ve abandoned the skeuomorphic phase of copying Web2 apps and we’re finally getting to the Web3-native use cases this technology was made for.

There’s a side benefit to the Web3 narrative too…

Web3 is a regulatory heat shield. Officials and lawmakers who dismissed crypto as drug dealer money will find it much harder to dismiss the next generation of the internet. ♟️

Ms. Lawmaker…how are you planning to stop tech incumbents from stealing our data and selling your citizens as a product like feudal lords? Cause our plan is Web3.

🎙️ Listen to our 5 Mental Models for Web3 podcast with Chris Dixon

4. DeFi wasn’t the golden child

After a colossal 2020 DeFi was largely overshadowed by NFTs this year. The DPI index of bluechip DeFi assets was up 115% on the year—barely gaining more than Bitcoin. We saw pockets of growth in Alt-L1 ecosystems and in DeFi 2.0 projects like Olympus and Tokemak…but the big crypto energy wasn’t focused on DeFi this year.

Why?

Three reasons for this.

First, everyone was distracted by NFTs.

Second, this was written in the fractals. There’s a familiar pattern to crypto cycles:

- Builders build for years with no market reaction

- Prices suddenly catch up to fundamentals in violent upward bursts

- Prices overshoot fundamentals and drops or flattens out

- Attention moves to other sectors

- Go back to step 1 and repeat

DeFi as a sector is somewhere between step 4 and 5 right now. Btw that what’s so exciting. The time to get bullish is when the attention moves elsewhere but the builders keep building.

Third, DeFi is still in its low bandwidth days. Blockspace is expensive, user experience is hard, and fiat onramps kinda suck. DeFi is like using the internet with a 56k modem in 1996.

DeFi took a year off to build and that’s good.

Rest up DeFi because next year we enter the high bandwidth era…I expect big things.

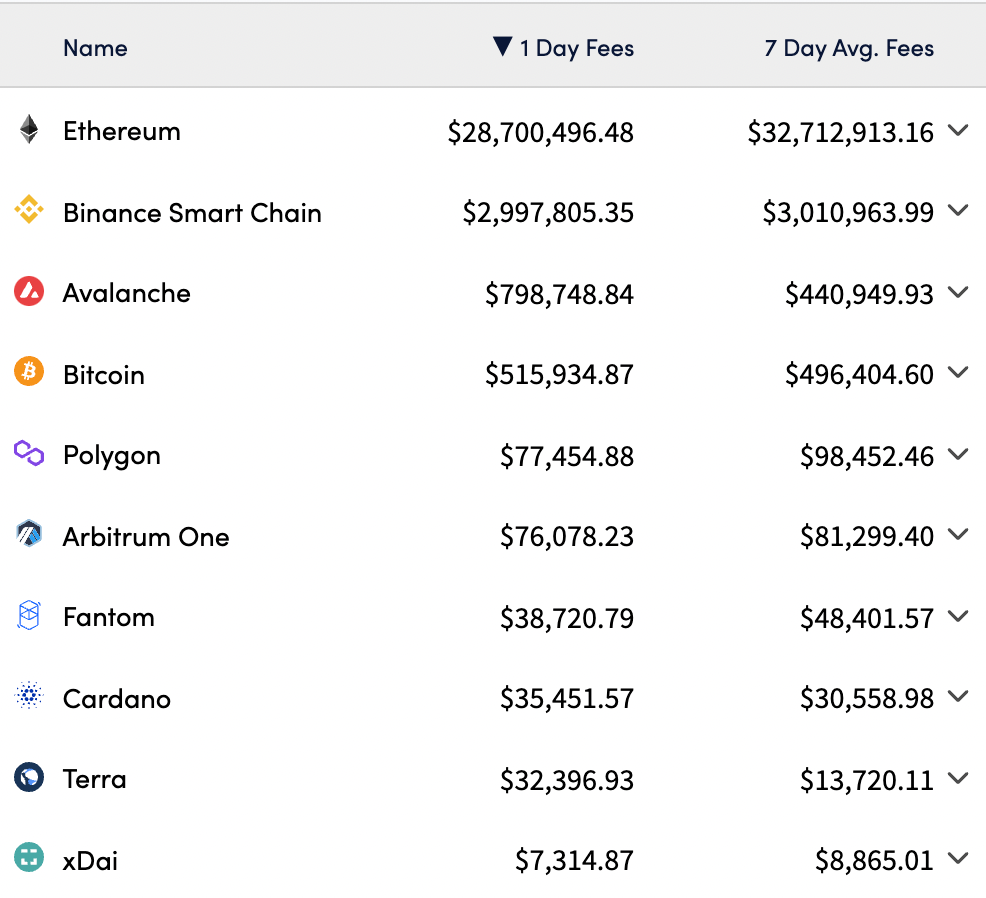

5. Alt-L1s tokens pumped

As the bull market raged and new people jumped in, Ethereum fees skyrocketed. This was not a surprise. Spillover transactions went to chains with cheaper blocks. Also not a surprise. But then…and this surprised me…then alt-L1 tokens like SOL, LUNA, and AVA mooned as NFT and financial projects launched on these chains and started getting usage. 🤔

“It’s a multichain word.”

“Ethereum abandoned its users.”

“Ethereum is getting leapfrogged by better technology.”

These were the narratives explaining the rapid alt-L1 price movement.

Blockspace demand didn’t surprise me but the massive token price rises did. What’s happening here? Are these new assets becoming monies? Are they pricing in future transaction fee growth that justifies these heady valuations? Are these chains long-term competitors to Ethereum?

Or maybe I’m asking the wrong questions and none of this matters?

Maybe it’s just memes all the way down.

Maybe we still don’t know what fundamentals are in crypto and the market is showing us why we’re so foolish to assume as if we do.

This is one of the biggest questions facing investors going into 2021.

I’ll share my thoughts on the answer later in this post. But first…some mental models!

5 new mental models in 2021 🧠

Every year Bankless unlocks a new set of mental models for understanding crypto. Ideas like the Protocol Sink Thesis, ETH the Triple Point Asset, and Economic Bandwidth become foundation ideas we test and reference as we journey further west.

Here were my favorite mental models of 2021.

1. Cryptography is the only real breakthrough

Sometimes we forget that the crypto in cryptocurrency stands for cryptography. I developed a holy reverence for cryptography this year through episodes like The Bull Case for Cryptography with Justin Drake.

Blockchains are trust computers and cryptography not only makes them possible but also sets the processing limits of these computers. Cryptography breakthroughs are the only things that actually scale blockchains—everything else is a hack.

This lens makes me more bearish on the “high TPS, high node requirement” shortcuts taken by many alt-L1 and makes me more bullish on cryptographic breakthroughs of zk rollup chains.

Bullish on cryptography.

🎙️ Listen to the The Bull Case for Cryptography podcast with Justin Drake

2. Legitimacy is the only scarce resource

All the cryptography in the world is just a means to an end. What we’re really constructing are systems for social coordination. And the output of these systems is the scarcest resource of all: legitimacy.

Legitimacy is why Bitcoin is a store of value and Bitcoin Diamond isn’t. Legitimacy is why Ethereum has a larger security budget than Ethereum Classic. Legitimacy explains the Doge pumps, the rise of Binance Chain, and why CryptoPunks are more valuable than pudgy penguins.

Understanding legitimacy opened my eyes to the different paths a social system like a blockchain might take to success. There’s brute force (e.g. China’s state blockchain), continuity (e.g. Bitcoin’s 12 year history), fairness (e.g. Ethereum’s public ICO), and performance (e.g. Binance Chain’s price rise) among others.

I’m no longer asking what’s the path to the most secure blockchain. I’ve now started asking what’s the path to the most legitimate blockchain.

Bullish on legitimacy.

🎙️ Listen to Legitimacy podcast with Vitalik Buterin

3. ETH is Ultra Sound Money

ETH is on track to become the best monetary asset the world has ever seen. The fixed supply 21 million cap of Bitcoin is not the optimal system to maximize value and network security—Ethereum’s approach is better.

We made the case earlier this year in a series of influential podcasts and articles with Justin Drake. Anyone who owns ETH or is considering buying ETH will want to listen to these episodes.

Start with Ultra Sound Money.

Bullish on ETH.

🎙️Listen to Ultra Sound Money podcast with Justin Drake

🎙️Listen to Modeling Ultra Sound Money podcast with Justin Drake

4. Modular chains will beat Monolithic chains

The writings of Polynya on modular chains had a profound impact on how I thought about blockchain scalability. I fully subscribe to their underlying idea—modular blockchains are the best scaling solution for crypto.

When crypto people usually make the case for decentralization it usually sounds so…religious…why care about decentralization? Think about the greater good, don’t sacrifice the temporal for the long-term, for future generations, don’t give in to the temptation of centralization.

But Polynya’s argument is refreshingly utilitarian. A technical and economic argument: decentralization is an adaptation strategy and it will outcompete centralized strategies.

Why? Because modular chains easily outscale monolithic chains and modular chains only scale with decentralization. Modular chains invert the scalability trilemma.

This is fully explained in our Ultra Sound Ethereum article and our accompanying episode on Modular vs. Monolithic Blockchains.

Reminds me of biology.

You know there are some biologists who say there’s no such thing as a tree?

A tree is just a strategy.

Nature has evolved different species into crabs at least five separate times. Fish too. Steven Jay Gould said his lifetime of studying evolution has made him realize that “there is no such thing” as a fish, because the ocean environment drives things to end up looking like fish, again and again, from disparate ancestors.

The same is true of trees. Nature just keeps making trees.

A tree is a winning strategy in nature. Wood is a winning strategy.

Decentralization is a winning strategy.

Bullish rollups. Bullish Ethereum roadmap. Bullish modular chains.

Bullish on decentralization.

Bearish monolithic chains until they embrace their role as an execution layer.

🎙️Listen to our Modular vs Monolithic Blockchains episode

5. We’re living in a Crypto Renaissance

There were two technologies that brought on the renaissance. First, the printing press. This democratized and scaled communication. Second, the double-entry ledger system. This democratized capital formation and scaled commerce.

Communication technology and ledger technology. These two technologies were responsible for bringing humanity out of the middle ages of monarchs and feudal lords and into a golden era of culture, science, and human progress.

Well…we’re at it again.

The internet is our new communication technology and crypto is our new ledger. We’re at the beginning of a new renaissance brought on by crypto. Legacy institutions will erode and fall, new governance systems will rise, culture will bloom, new lands will be settled, and a new class of Medici will create a world of economic opportunity.

We’re living in the crypto renaissance.

That’s the big idea from historian Josh Rosenthal in probably my favorite podcast we’ve ever recorded.

Bullish crypto. Bullish Medici. Bullish humanity. Bullish optimism.

Bearish pessimism.

🎙️Listen to our Crypto Renaissance podcast

🧠 Bonus: 5 Mental Models for Web3

We’ve talked about Web3 across our podcast throughout the year and this episode with Chris Dixon is the best explainer of Web3 we’ve ever come across.

🎙️Listen to our 5 Mental Models for Web3 with Chris Dixon podcast

🧠 Bonus: The Metaverse

The Metaverse is much more about property rights than it is about virtual worlds. Here’s our take on a definition of the Metaverse and how it emerges.

🎙️Listen to our Defining the Metaverse podcast

5 bets going into 2022 💸

So what’s all this mean?

Where will I be investing most of my time and resources going into 2022?

Here are my concentrated bets:

1. ETH, Layer 2s, and Bridges!

Chris Dixon called blockspace the most valuable asset of 2021. I agree with this, but I think some blockspace is currently overvalued and some is undervalued.

The modular blockchain thesis makes me bullish on Ethereum and the Layer 2 ecosystems like Polygon, Immutable, Starkware, Optimism, Arbitrum, Aztec, and the slew of others that are bound to enter in 2022.

I think Ethereum’s path to scalability is massively underrated. I think the Layer 2 ecosystem is going to explode next year. I expect all of these Layer 2s to issue tokens.

I also like exposure in bridges like Hop, Connext, Across, and Li.Finance. I also expect these bridges to issue tokens.

I’m neutral on alt-L1s. I think some will find success as monolithic chains for a time, others will pivot and become execution layers for crypto banks, still others will fast follow Ethereum and compete against it as a modular chain. I don’t feel a strong need to be exposed to these chains relative to Ethereum and Layer 2s.

2. Next Generation DeFi

While the attention in crypto is elsewhere I see DeFi builders continuing to build. The opportunities in Layer 2 will bring a new cohort of breakout DeFi applications. I’m watching for these.

Additionally many of the DeFi bluechip assets in indexes like the DPI seem like an absolute steal from a P/S perspective. Are these the value assets of crypto? There’s more…if you assume Layer 2 takes off many of these assets become growth plays as they expand into new territory. Value assets and growth assets?

I’m also keeping an eye on promising alt-L1 DeFi projects. Some of these might expand into Layer2 and give Ethereum incumbents a run for their money. I welcome the competition!

3. DAOs of all types

It’s weird to have an investment category called DAOs. It’s like having an investment category called LLCs. But going into 2022 it actually makes sense.

There are thousands of DAO experiments about to spin up. Creator economy DAOs, fan token DAOs, media DAOs, social DAOs, and DAOs that do weird things like get into bidding wars with billionaires for priceless artifacts.

I’m monitoring as many as possible.

Some of these will be breakout successes.

Some of these will grow to be larger than their traditional peers.

Getting exposure to DAO’s at this early stage means participating in them directly, investing in the infrastructure they need, and…when it makes sense…buying their tokens.

A bet on DAOs is a bet on coordination.

DAOs are the opportunity of a lifetime.

4. Crypto Gaming and the Metaverse

Ever noticed how the “work” you do is starting to feel more and more like a video game? I’m pretty convinced crypto-games will usher humanity into the Metaverse.

But it’s extremely early and we probably have several bull/bust cycles in between.

Listen to our podcast on the Crypto Gaming Revolution with Arianna Simpson or Crypto Gaming 101 with Amy Wu for a primer on this exciting category.

What’s the best way to get exposure?

Play games, buy tokens and items or invest in gaming guilds for broader exposure. I’m particularly excited about games that can attract a new class of casual players on mobile, but there will be other categories that break out.

Look for this to emerge on Layer 2 and sidechains.

5. Decentralized Identity

At some point, we’ll have a killer app for decentralized identity and I’m here for it.

We have some of the basic primitives in place now, there’s sign-in with Ethereum, self-soverign ENS names, and ecosystems of NFTs. What we need is identity attestations. Primitives that prove the identity of an individual without giving up their privacy.

Proof of reputation is one place to start, I’m tracking several projects related to this. Someday we’ll all have onchain resumes.

What would a crypto native social network powered by decentralized identity look like? A fascinating question.

Eyes peeled. 👀

Other Category Bets

A few other categories I like as we enter 2022:

- Crypto banks!

The exchanges and neo banks like Coinbase, Gemini, BlockFi, FTX, Crypto.com, and Binance will have a field day as they outmaneuver their legacy incumbents. I prefer those that stay more DeFi aligned. - Infrastructure!

A broad category of block explorers, analytics tools, decentralized storage, and indexing and messaging protocols that service crypto networks. These are the picks and shovels of crypto. - Super Wallets!

I’m bullish wallets that own the user experience and provide a front-end to DeFi. MetaMask, Zerion, Zapper. I expect to see smart contract wallets like Argent flourish with the advent of Layer2. These are bankless banks. - NFT meets DeFi!

One of my favorite hybrid investment categories is NFTs + DeFi. Fractionalized NFTs, indexes for NFT exposure, hedging projects. Bullish hybrid projects. - NFT apps!

OpenSea is great but it’s not the final app for NFT. OpenSea is eBay in 1997. The Googles and Instagrams and Yelps of NFTs have yet to launch. There’s several generations of opportunity to build on top of NFTs.

That’s a wrap.

Those are my notes on 2021.

Another incredible year on the bankless journey with lessons, learnings, and wins. It’s an honor to level up alongside this incredible community of pioneers.

See you in 2022!

- RSA

Action steps

- Reflect on the past year—what were you right about, what surprised you?

- Start thinking about your 2022 predictions!