What's driving the market

Dear Bankless Nation,

A number of things are all impacting the markets right now, and price action seems convoluted. However, there is a central theme here. It helps by pulling each one apart.

Here’s what I think is defining the market right now:

- New COVID Relief Package - $1,200 💸

- Election Uncertainty 🗳

- BitMEX dead, BTC alive 📈

- Public companies ♥️ BTC

- Legacy Correlation 🚶🏻♂️🚶🏼♀️

- Eth 2.0 is happening 🌐

1. New COVID Relief Package - $1,200 💸

Another COVID relief stimulus package is in negotiations from the White House. Initially, Trump threatened to end negotiations with Democrats because they were asking for too much. A few hours later, he pivoted to advocating for MORE RELIEF!! from the package.

As of now, a $1.8T stimulus package seems ready to get pushed through Congress, which means another round of $1,200 checks and $400/week more onto unemployment benefits. Jerome get the money printer warmed up!

Crypto did pretty well after the last stimulus…upside exposure to the money printer.

2. Election Uncertainty 🗳

The U.S. election is right around the corner. And there’s a lot of uncertainty around it.

If Biden wins, it’s likely that the Dems continue a strong MMT agenda. The Republicans don’t seem to be willing to say no to getting checks into the hands of Americans either. In fact, it seems as though both parties are held hostage by not wanting to be the party that doesn’t put money into the hands of Americans. Really, the election seems to be focused on ‘how much money’ not ‘yes’ or ‘no’ to free money.

On the other side, we have a president who is posturing about not accepting the results of the election, along with an armed base of supporters who take the President’s words as truth. Fears of civil unrest abound not matter who wins.

Election uncertainty = market uncertainty.

3. BitMEX dead, BTC alive 📈

Founders of offshore derivatives exchange, BitMEX, have been charged with operating an illegal trading platform (big deal) and violating the Bank Secrecy Act (HUGE deal).

Is BitMEX good or bad? Proponents would say BitMEX has played an important role in BTC’s price discovery. BitMEX was a KYC-free, no limits BTC derivatives exchange, allowing complete free-market price discovery.

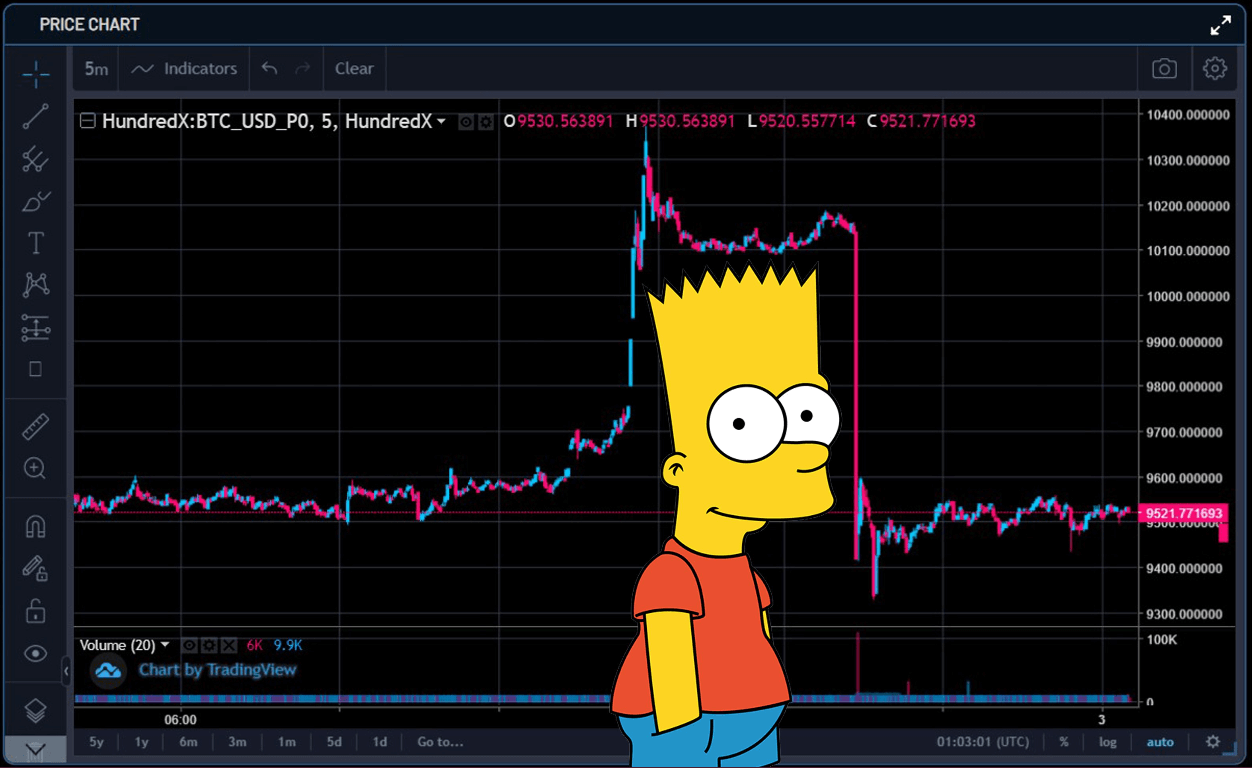

Detractors would say BitMEX preyed on its customers by auctioning the ability to hunt & snipe over-leveraged retail traders through targeted market manipulation.

In my opinion, good riddance to BitMEX. Now that BTC price discovery is happening on regulated approved venues and trust-minimized DeFi, bitcoin and crypto at large can access a broader market.

Hopefully, this is the end of BARTs.

4. Public companies ♥️ BTC

Square, ran by possibly the best possible ally of Bitcoin (Jack Dorsey), recently announced its allocation of $50M in BTC on its balance sheets, marking the second public company in just a few weeks to do this.

Public Companies placing BTC on their balance sheet is a part of Bitcoin’s ultimate scarcity game. As the conversation around inflation/deflation and economy vs. stock market continues, Bitcoin is growing more and more understood in its role in the macro-environment.

Having bitcoin understood as a macro asset is bullish because people can more coherently articulate why they have purchased something. This all began with the Paul Tudor Jones statement many months ago.

5. BTC / ETH correlation with Macro

One of my least favorite things in the world is the current BTC & ETH correlation with the macro markets.

ETH vs S&P

BTC vs S&P

This correlation means any volatility around the U.S. election and civil unrest will be expressed in the ETH & BTC charts in the short-run. I hate this fact.

But we can’t discount the value of having exposure to the money-printer. Correlation means that any COVID relief and MMT behavior is extremely bullish.

5. Ethereum 2.0

The entirety of the 2017 bull market had a carrot dangled in front of it by the promise of ETH 2.0 and ETH staking. The ability to stake ETH and receive dividends was a huge component of the 2017 bull market.

That said, we are now just weeks away from the Phase 0 launch, where staking rewards will become available. The actual impact on the secondary market price as a result of ETH being moved to stake will be minimal, in my opinion. For at least the first month or so, the ETH that will be staked on ETH 2.0 will likely be long-time holders who weren’t participating in Yield Farming and also don’t frequent the markets very often. In other words, dormant ETH.

What will create ETH price movements will be a huge reduction of execution risk of ETH 2.0, as well as a hit to the ‘ETH 2 will never ship’ crowd. Simply put, the market anticipating the arrival of fully-fledged of ETH 2.0 will be fun to watch in the ETH price, and maybe triggers a de-correlation event, at least in the short term.

TL;DR:

There’s a lot of things happening all at once.

While there’s room for caution, they all seem to be bullish!

- David