What if Uniswap Turned On the Fee Switch?

Dear Bankless Nation,

Did you know that Uniswap technically makes no profit?

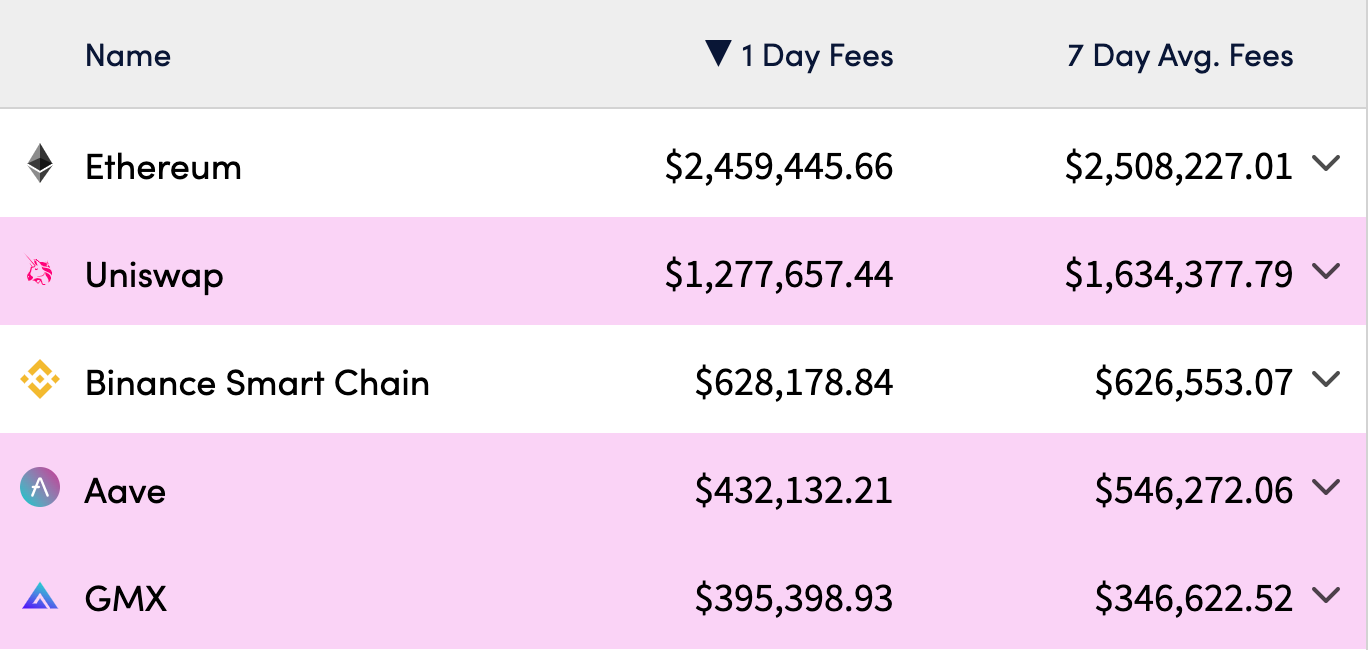

How is that possible? It’s the biggest application on Ethereum by fees, generating millions of dollars every day for liquidity providers.

But profit margins are at 0% because the Uniswap fee switch hasn’t been turned on. 🦄

This finally might change!

After months of debate, a recent governance proposal looks set to finally turn on the profit faucet—for only three liquidity pools.

What happens for Uniswap when they do so?

Would they lose market share to competitor DEXs?

How much profit would they rake in?

What if they turned the fee switch on for every pool instead?

Ben answers all these questions for us today.

- Bankless team

What if Uniswap Turned On the Fee Switch?

To date, one of the clearest examples of a disconnect between the success of a protocol and the performance of its token has been Uniswap.

Uniswap is the largest decentralized exchange by volume on Ethereum L1 with a commanding 67.9% share. The protocol is a cash cow, having generated $1.20B for its LPs over the past year.

On some days, its daily fee revenue even exceeds that of Ethereum itself.

Despite this reigning position, and its status as the largest by market cap, UNI has underperformed considerably, having lost 51% of its value against ETH over the past year.

Although there has been considerable volatility within the broader market, a common argument for the underperformance stems from the fact that Uniswap has been unable to turn on the “protocol-fee switch.”

By toggling the fee switch, which can only be done via a governance vote by UNI holders, the Uniswap DAO is able to accrue between 10-25% of the fees earned by liquidity providers on a pool-by-pool basis.

It is how the Uniswap protocol itself can monetize.

Since the launch of Uniswap V3 in May 2021, the fee switch has not been activated. However, that may soon change, as a proposal by Leighton Cusack, the founder of PoolTogether, to turn on the fee switch for three pools has made its way through the first two stages of Uniswap’s governance.

The implications of the proposal cannot be understated: Should it pass, it would signal to the market that Uniswap governance is capable of turning on the fee switch.

It also raises a handful of key questions:

- Can Uniswap turn on the fee switch without losing market share?

- How much could the protocol earn from this proposal?

- How much would they earn from activating the fee switch for all pools?

- What could this mean for the UNI token?

Let’s explore.

The State of the Proposal

Before diving into our analysis, let’s take a look at the details of the fee-switch proposal itself.

The proposal suggests taking a 10% cut of LP fees for three pools on Uniswap’s Ethereum deployment. This is the smallest possible take-rate, as the protocol permits pocketing between a 10-25% cut of LP fees on a per-pool basis.

The selected pools, and their fee-tiers, are as follows:

- ETH-DAI (0.05%)

- ETH-USDT (0.30%)

- ETH-USDC (1%)

The fee switch will be activated for 120 days (~4 months) and fees earned will accrue to the Uniswap DAO treasury. After this period, another proposal will be brought before governance in which tokenholders can then, if they choose, vote to turn off the fee-switch for these three pools.

So far, the proposal has passed through the first two phases of Uniswap governance: The Temperature and Consensus Check votes, which are held on Snapshot.

The initial draft of the proposal to pass Temperature Check called for flipping on the fee switch for ETH/USDC (0.05%) and USDC/USDT (0.01%) and setting the protocol fee at 10%.

This proposal passed the Temperature Check with near-unanimous support, as 3.5M UNI voted in favor compared to just 54 UNI voting against.

After community feedback and research, a second iteration of the fee-switch proposal was brought before governance for the Consensus Check vote. Rather than activate the fee-switch for two of the most active pools on the DEX, this secondary implementation called for more of a trial approach in activating the fee-switch for the three pools listed above in order to test multiple fee-tiers for a predetermined period of time.

This revised implementation passed once again with overwhelming support, with 19M UNI for and just 418 UNI opposed.

While the proposal needs to pass the final, binding on-chain vote, based on the turnout and governance forum comments, there seems to be broad support to do so within the community.

Although the final vote is sure to be less lopsided, there seems to be a strong probability that Uniswap will be able to activate the fee switch for these three pools.

Would Uniswap Lose Market Share?

Before diving into our analysis, let’s examine why Uniswap could turn on the fee-switch without losing a material amount of market share.

The case against turning on the fee switch is simple: If Uniswap turns on the fee-switch, they will lose market share as LPs, and therefore liquidity, will migrate off of the exchange due to their margins being compressed.

This risk is due in large part to the fact that providing liquidity on Uniswap V3 is notoriously difficult due to its use of concentrated liquidity, which requires far more active management than being an LP on a constant-product or stableswap AMM.

Given that it is already difficult to be profitable, cutting LP margins could create a negative feedback loop in which Uniswap loses liquidity leading to worse trade execution, and therefore generating lower trading volumes and returns for LPs, causing the DEX to bleed market share to its competitors.

This risk is amplified in a hyper-competitive sector such as the DEX space, where there is little differentiation between competitors and as a result, perpetual, long-term pressure on fees. DEX’s are also easily forkable — though it is worth noting the Uniswap V3 code is protected under a business license, which is likely why there have been scant unauthorized forks to date.

While this argument is compelling, Uniswap should be able to turn on the fee switch for several reasons, with one of the most compelling being the idea of “sticky volumes and liquidity.” This refers to the concept of trading volume and liquidity that is solely loyal to Uniswap, as described in the paper “The Economics of Automated Market Makers” which examines the viability of turning on the fee switch.

This notion of sticky protocol participants is built around the idea that due to its strong brand, many traders will exclusively use Uniswap, and not seek out the best possible execution by routing all of their trades through an aggregator. This is also true for liquidity providers, as due to Uniswap’s track record and protocol design where contracts are immutable (other than toggling the fee-switch), LP’s may prefer to continue market-making on the DEX despite a protocol fee instead of migrating to a competitor or a fork.

In addition, nearly every other major spot or derivatives DEX, such as Curve, Balancer, SushiSwap, GMX, dYdX, and Perpetual Protocol takes a cut of LP fees. Given this, it seems likely that Uniswap would also be able to charge a fee without losing a meaningful percentage of market share.

What If The Fee Switch Had Been Turned On For The Three Pools

Let’s begin our analysis by taking a look at how much Uniswap would have earned if the 10% protocol fee was toggled for the three pools in the proposal. To get a sense of the earnings in different market conditions, we’ll take a look at the fees earned during the past 30, 120 (the length of activation in the proposal), and 365 days.

In addition, we’ll also take a look at what portion of total Uniswap trading volumes and LP fees over these periods was derived from the three pools.

30 Days

Over the past 30 days, the three pools facilitated a combined $1.31B in trading volume, with LPs earning roughly $2.90M in fees. If the fee switch was active, Uniswap would have earned $290K in protocol income over the past month, or ~$3.48M annualized.

The largest contributor to the bottom line is by far the wETH-USDT pool, which would have contributed 74.4% of protocol income during this period. All three pools also would have accounted for 3.08% and 5.71% of the total trading volume and fees earned respectively on Uniswap during this window.

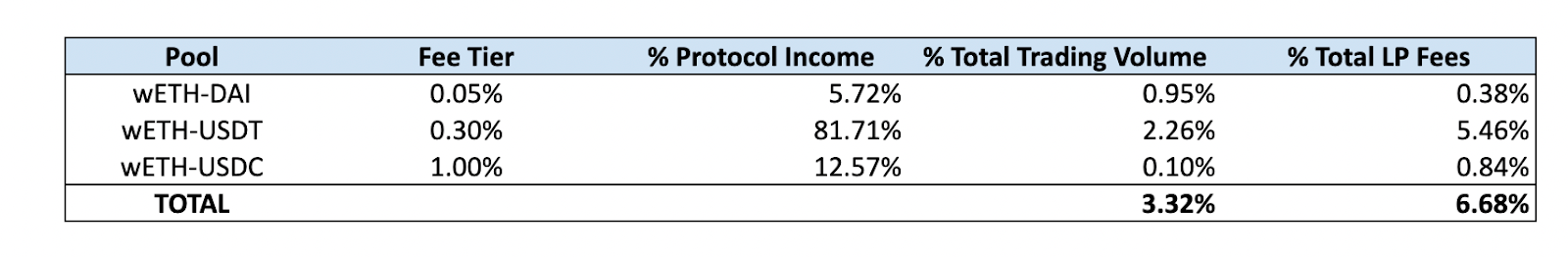

120 days

Over the past 120 days, which is the proposed length of activation for the fee switch, the three pools would have done about $6.41B in volume while generating $16.04M in fees for LPs.

At a 10% cut, this comes out to $1.60M in protocol income or $4.87M annualized.

The largest contributor to protocol income during this period is once again the wETH-USDT pool at 81.7%, while the three pools in total would have accounted for 3.32% and 6.68% of total volumes and fees on Uniswap.

365 days

Over the past year, a time period that factors in both periods of high and low on-chain trading activity, the three pools facilitated $40.40B in trading volume with LPs earning $78.19M in fees.

Were there to have been a 10% protocol fee, Uniswap would have raked in $7.82M in profit.

Once more, the largest contributor to protocol income would have been wETH-USDT at 80.8%. In aggregate, the three pools accounted for 5.69% and 6.47% of trading volume and fees respectively over the past year.

Takeaways

As we can see, depending on the period of time, Uniswap would have generated anywhere between $3.48M-$7.82M in annualized profit had the fee switch been turned on for the three pools.

We can also see that the largest contributor to the bottom line across each of the three time periods would have been the wETH-USDT pool, as it accounted for between 74.5%-81.7% of protocol income.

Most importantly, the three pools only accounted for a small portion of the aggregate activity on Uniswap, making up just 3.08-5.69% of total volumes and 5.71-6.68% of total fees depending on the period.

All in all, this suggests that this proposal is just scratching the surface of Uniswap’s ability to monetize. Should the fee-switch trial prove to be successful, this suggests that there is significant further upside for the DAO to pull in more earnings.

What if the fee switch was active for every pool?

We now have a sense of Uniswap’s revenue-earning capabilities from flipping on the fee switch for the three pools in the proposal. But what about every single liquidity pool?

By doing that math, we can get a better sense of where the upper bound of Uniswap’s potential profitability may lie.

At first glance, turning on the fee switch for all pools may seem unrealistic. However, should the trial be successful, it is quite likely that Uniswap governance would elect to turn on the fee switch for many more pools. Furthermore, remember that it is the industry standard for a DEX to earn a cut on every trade made on their platform.

It is likely that in the mature state, the protocol’s overall take rate, or the percentage of the total trading fees generated on Uniswap that accrues to the DAO, would not be a flat rate across all pools. Individual pools with scarce liquidity may have a higher-take rate, while others may have no active fee switch at all.

However, we’ll assume a flat 10% fee across all pools for simplicity’s sake. For ease of comparison, we’ll measure again across the same 30, 120, and 365-day periods.

At a base 10% protocol fee, Uniswap would have earned $5.07M (~$61.68M annualized), $23.99M (~$72.96M annualized), and $120.8M over the past 30, 120, and 365 days respectively.

It is important to note that this would be pure protocol “profit” as, during this period, Uniswap did not emit any tokens to liquidity providers.

Looking at the 365-day figure, we can see that per Token Terminal, Uniswap would have generated the 7th highest protocol revenue of any dapp, behind Axie Infinity, NFT marketplaces like OpenSea and LooksRare, DEX’s PancakeSwap and dYdX as well as MetaMask with its swaps feature.

Uniswap would have the third highest Protocol Earnings (Protocol Revenue - Emissions) behind OpenSea and MetaMask, which is fueled by the fact that neither of the three has any token emissions.

A Productive UNI Token

Now that we have a sense of how much Uniswap could have earned if the fee switch was active, let’s take a look at how much value it could drive to the UNI token.

Although the fee-switch proposal does not call for distribution earnings to tokenholders, it is certainly possible that in the future, UNI holders will choose to allocate some protocol fees to themselves in the future via buybacks or distributions in assets such as ETH or stablecoins.

This would be significant, as it would turn UNI from a pure “valueless governance token” into a productive asset.

For our purposes, let’s assume that the Uniswap DAO elects to distribute 50% of all income accrued from the fee switch via a mechanism in which UNI holders can stake their tokens to receive these earnings in USD. T

o be conservative, we’ll also assume that 75% of all circulating UNI would be staked to earn this yield, as some supply remains on venues such as centralized exchanges or be used as liquidity on DEXs.

As we can see, were the fee-switch to have been active at a 10% rate for all pools on Uniswap, assuming the same 75% stake rate and 50% payout ratio, UNI holders would have earned anywhere between 1.25%-2.44% based on the trading activity of the past 30, 120, and 365 days.

Although this return would be lower than those earned from other DEX tokens such as veCRV and GMX, which typically pay yields between 4-8% in 3CRV and ETH respectively, this return would likely still be highly attractive to investors considering Uniswap’s position as the clear leader within its sector.

The Bigger Picture

As we can see, the implications of turning on the Uniswap fee switch are immense.

The activation of three pools merely scratches the surface of its monetization capabilities. A broad-based fee-switch activation instantly turns Uniswap into one of the most profitable applications across all of Web3.

Furthermore, were the DAO to direct a portion of earnings to tokenholders, the UNI token would become a productive asset with an attractive yield that while being on the lower-end of its DeFi peers, would still exceed that of many mature, meatspace businesses.

Of course, these figures are backward-looking — they use historical data and do not account for any potential (and expected) future growth.

Perhaps more importantly, given its status as DeFi’s most well-known protocol, Uniswap successfully turning on the fee-switch, would signal to the market that “valueless governance tokens” can in fact capture value.

Action steps

- 🔖 Read What's the Best Token Model? by Lucas last week.

- 🧑🔧 Read 5 Ways to Fix DeFi Tokens by David.