What's the Best Token Model?

Dear Bankless nation,

Just as central banks conduct different types of monetary policies for their own fiat currencies, DeFi projects, by issuing their own “money”, face a similar task.

For example, founders want to drive economic value to their tokenholders, but it’s extremely difficult to deliver market utility when having to juggle regulatory hurdles, optimizing issuance schedules, and more.

It’s complicated.

We are probably still years away from finding the optimal token designs.

But even though we don’t know everything yet, we know some things.

The past two years of experimentation in DeFi with different token designs has net some invaluable knowledge about token designs.

Lucas breaks down the three categories of tokenomics today: (valueless) governance, productive, and vote escrow tokens.

Which ones are holding up in this bear?

Let’s find out.

- Bankless team

Token economics is a new and emerging field.

The industry is collectively exploring optimal designs, distributions, utility, governance frameworks, and everything else. It’s virtually a blank canvas.

As token teams have experimented over the years, we’ve seen a couple different token models emerge as the standard.

We’ve seen the rise of valueless governance tokens like UNI and COMP amid DeFi summer.

There are also cash flow tokens like MKR and SNX that have been staples for years.

More recently, we’ve seen the vote escrow model (veToken) garner more and more traction among industry-leading projects.

So what’s the best one?

That’s what we’ll dive into.

First, an overview of the different token models and their designs.

Second, we’ll evaluate an index of these tokens on their price performance to see if there’s a consistent winner.

Let’s get into it.

Different types of token models

As mentioned, there are primarily three types of token models that we’ve seen:

- Governance

- Staking/Cash Flow

- Vote Escrow (veTokens)

🏁 Governance Tokens

Examples: UNI, COMP, ENS

For awhile, governance tokens were the standard in DeFi. Popularized by Compound and Uniswap in 2020, governance tokens have exactly what the name sounds like–governance rights over the protocol.

The meme was that these were valueless. They have no economic rights. One token equals one vote - that’s it.

Generally, governance tokens get a lot of flack from the community.

There are no cash flows! Why would this be valuable?

This is a fair critique. Prominent governance tokens like UNI and COMP don’t earn any dividends from the protocol’s business activities (i.e. trading for Uniswap and lending for Compound). This was predominantly for legal reasons. For the most part, governance tokens help minimize regulatory risk due to their lack of cash flow rights.

But as Joel Monegro outlined on our podcast with him, there is obviously some value in having influence over protocols. It’s harder to value, but it’s there.

There’s also a common assumption that these tokens will eventually vote in economic rights to the protocol in the future–something that’s in motion for Uniswap right now. The protocol is currently debating to turn on the fee switch, taking a cut of profits from liquidity providers.

While the fee switch profits won’t directly accrue to UNI tokens (it’ll go to the DAO treasury), it’s an early indication that this thesis will play out in the long run. All it takes is one proposal.

And while the haters will say that governance tokens don’t have a place in a portfolio, Uniswap’s $9B valuation begs to differ.

Whether or not its the best performing token model is another question (we’ll answer that below).

💵 Staking/Cash Flow

Examples: MKR, SNX, SUSHI

While some protocols have chosen to take the valueless governance token route, others like MKR, SNX, SUSHI decided to bestow economic rights to their tokenholders.

In every instance, these tokens earn revenue from the protocol’s business activities. MakerDAO was one of the first to pioneer this effort. Protocol revenue from Dai loans (accrued interest) is used to buyback and burn MKR. This has been in effect for years now. By holding MKR, you indirectly earn the cash flow rights by the perpetually decreasing supply of MKR available on the market.

While MKR offers passive holding, SNX and SUSHI require users to stake the tokens in order to start receiving dividend rights. Both protocols generate fees from trading activity and redistribute it to stakers on the protocol. For SNX, users can also earn sUSD (Synthetix’s native stablecoin) every week for staking, in addition to vested SNX. On the other hand, SUSHI stakers earn more SUSHI from the protocol automatically buying it on the market.

Note that with staking/cash flow tokens, we shouldn’t consider native inflation as part of the revenue! The prime example of this is Aave. It’s like a pseudo-productive token. While the protocol offers users to stake AAVE (stkAAVE), staking doesn’t earn any exogenous cash flows from protocol activities–it’s just AAVE from the DAO treasury.

🗳️ Vote Escrow (veToken model)

Examples: CRV, BAL, YFI

Vote Escrow Tokens are the current meta in the lens of token economic design, popularized by Curve Finance. Through this model, holders have the option to lock their tokens for a predefined amount of time (typically ranging from 1 week to 4 years).

By locking their tokens, users receive a veToken (veCRV for CRV) based on the amount of time staked. As an example, a user that stakes 1,000 CRV for 1 year will receive 250 veCRV versus if they stake the same amount for 4 years, they receive 1,000 (250 x 4) veCRV.

The key here is that veTokens typically have a special range of rights over the protocol. For Curve, veCRV holders have the right to vote on which liquidity pools receive CRV liquidity mining rewards as well as given boosted rewards for when they LP. In addition, veCRV holders receive dividend rights from trading fees and any bribes that flow through the protocol.

Overall - the veToken model takes the above two token models and adds some additional utility around it, creating a very compelling case for the crown.

But let’s dive into how these tokens have performed.

Historical Performance

In order to do this, let’s take a very simple methodology (I’m a simple person).

We’re going to take an even-weighted index of three tokens that fall into each category and then measure their price performance YTD–near the relative top for the crypto market.

From this, we’ll be able to gauge which token model is most price-resilient as the market dives into a prolonged bear market. Obviously, there are a TON of nuances that go into this–fundamentals, catalysts, narratives within the space, and more.

Regardless, this will give us a simple evaluation of the different prominent types of token models around today.

How the different models have stacked up

Indices:

- Governance: UNI, COMP, ENS

- Productive: MKR, SNX, SUSHI

- Vote Escrow: CRV, BAL, FXS

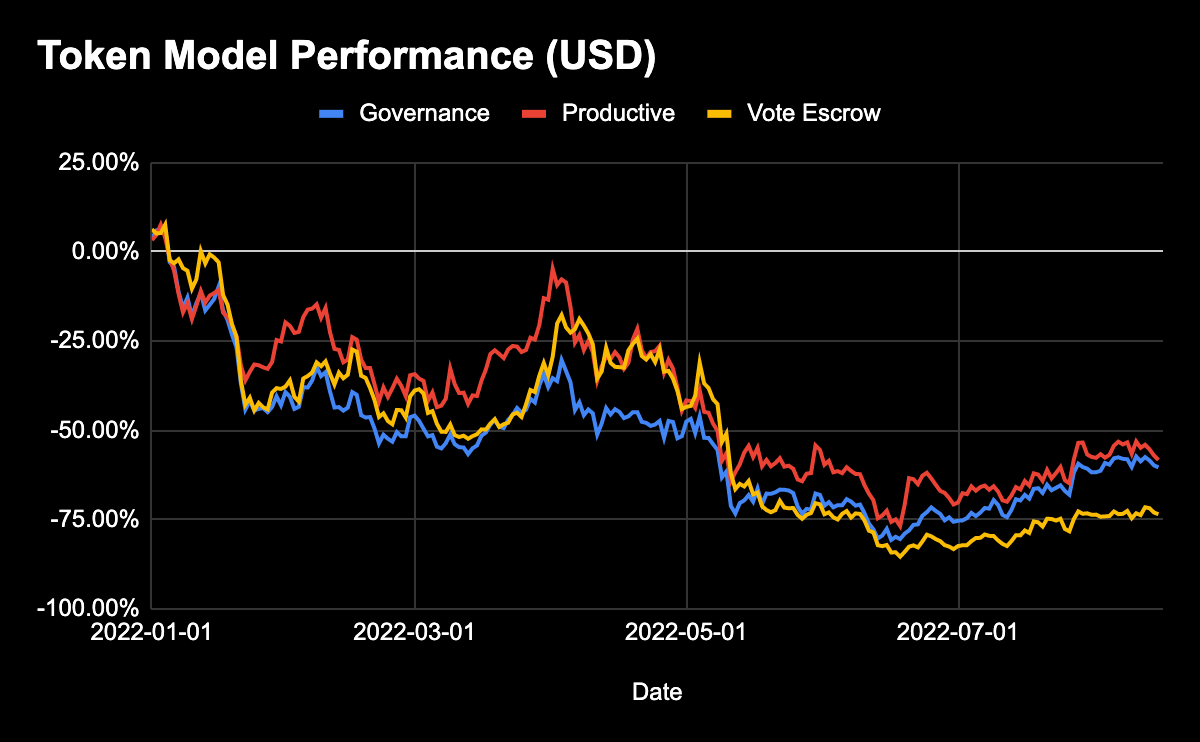

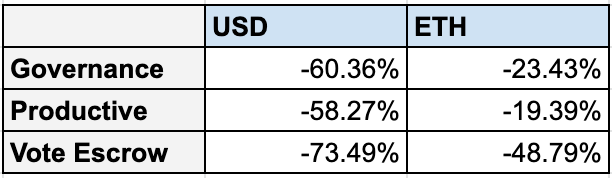

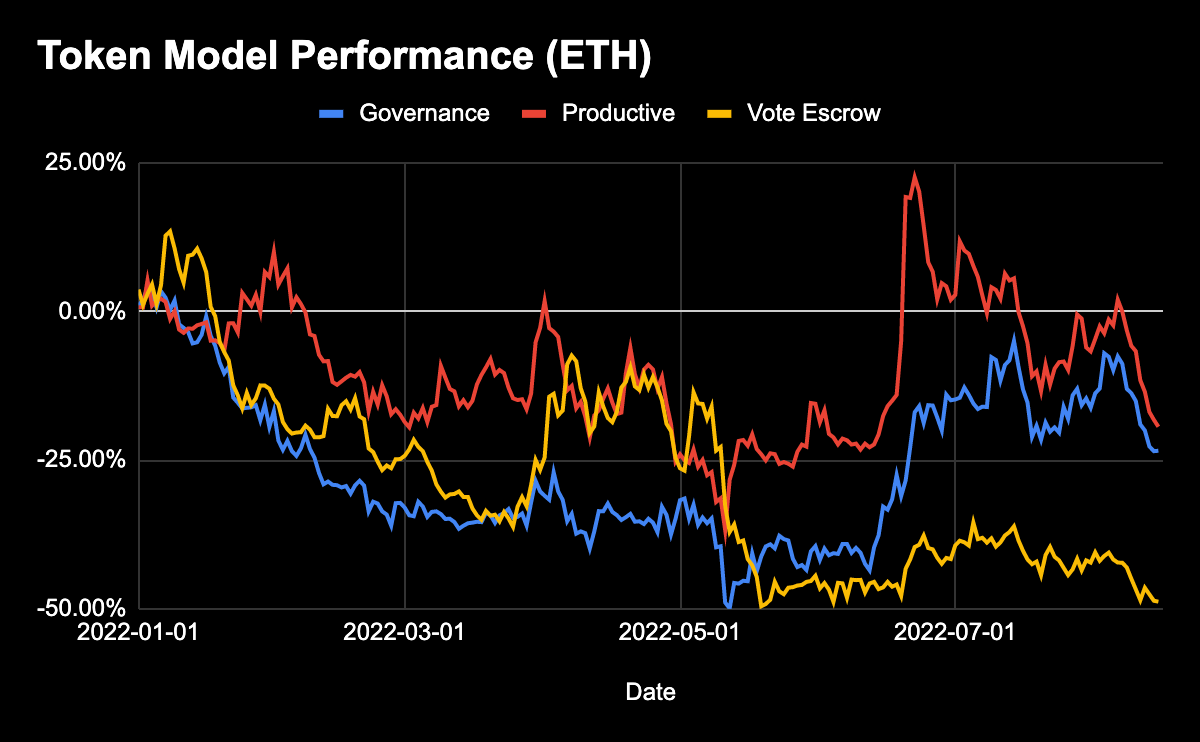

Right off the bat, let’s recognize that 2022 hasn’t been the best year for crypto. Both BTC and ETH are down about -50% from the start of the year.

As a result, it shouldn’t be a surprise if most other tokens are down the same amount or even worse given that their higher risk plays, and financial markets as a whole are in a risk-off environment.

Regardless, it is really interesting to see the performance of these assets when categorized by their token model.

When taking an even-weighted index of three tokens in each category, here’s what we get on price performance YTD.

While intuitively many believe that governance tokens should’ve performed the worst given their widely regarded as ~valueless~, vote escrow tokens have actually performed the worst on average out of the three token models.That said, it’s important to note that this performance doesn’t account for any dividends earned by holders from protocol fees, bribes, and any other cash flow positive activities.

Either way, this is still rather surprising given the positive sentiment of the token model among crypto investors. Vote escrow models are the current meta in the world of token economic design. It has compelling lock-up dynamics, earns cash flows, and has strong governance rights (like directing liquidity incentives).

Interestingly, it wasn’t just one significant token that brought the rest of them down. All 3 tokens performed rather poorly against USD and ETH. Curve, the pioneers of the model, is down -71%. Meanwhile, Frax’s FXS tanked -84% while BAL has decreased -61% even after implementing the vote escrow model back in March.

The reasoning?

One angle is that vote escrow tokens typically have large token emissions. For example, Curve is currently distributing over 1M CRV per day to the protocol’s liquidity providers. This amounts to over 100% inflation over the next year according to circulating supply reported by CoinGecko. Similarly, Balancer is currently distributing 145K per week–surmounting to over 21% in annualized inflation.

On the other hand, Frax is only emitting roughly 7% of its token supply as incentives to LPs. While this number isn’t crazy, Frax’s poor performance may largely be attributed to the fall of algorithmic stablecoins following Terra and the resulting failed launch of the 4pool.

Taking a step back, on average, productive tokens performed the best. This was largely driven by SNX, which only experienced a -35% drawdown since the beginning of the year. This may be driven by the recent successful integration of the protocol’s atomic swaps across different aggregators–namely 1inch–as the token has jumped 135% from its bottom in June.

Outside of SNX, MKR performed on par with the basket at -57% with the biggest drawdown being from SUSHI at -87% amid its governance and operational turmoil.

While USD price performance has been mediocre amid choppy macro conditions, when looking at these assets in ETH terms – as we’re always looking to outperform ETH – it’s not as bad.

For a moment in time, productive tokens were actually gaining in ETH terms near the recent market bottom.

Fundamentals > Cash Flows

There are obviously a lot of nuances here. Value accretive token models aren’t the end-all-be-all.

Each protocol has its own independent drivers. At the end of the day, it’s largely these catalysts, not the underlying token model, that drive the macro price movement. While it helps to have mechanisms that lock up the float or dividends that benefit tokenholders, it’s not a panacea.

There’s no doubt that for tokenholders, cash flow rights have a positive upside and increase the attractiveness of holding the asset, especially when the protocol is earning meaningful fees.

But at the end of the day?

Fundamentals matter. Narratives matter.

The underlying token model—unless terribly broken—should simply be a tailwind for what’s happening underneath the hood.

Action steps

- 🧰 Read David’s previous on how to fix DeFi tokens

- 📚 Check out Ben’s previous on WTF are veTokens