Which DeFi Protocols Are Profitable?

Dear Bankless Nation,

Today, it’s standard for startups to optimize for growth in the early years.

They forget about profitability and instead entirely focus on gaining a strong product market fit.

It’s a tested strategy that has built some of the largest web2 companies in the world.

Here’s the alpha: DeFi protocols aren’t that different.

Today, protocols are focused on gaining users, liquidity, and anything else that it needs. And because DeFi projects control their own “money”, they can rely on nifty tricks like token emissions to generate short-term traction.

But is it sustainable?

Is that usage just masked with token incentives?

Are users actually willing to pay for the service the protocol offers?

Could it be profitable?

Today, Bankless analyst Ben Giove answers this by taking a deep dive into six major DeFi protocols—Uniswap, Aave, Compound, Maker, Lido, and Maple—and assesses their path to profitability.

— Bankless team

Introduction

A defining theme of the 2022 bear market has been the increased focus on fundamentals across all sectors of crypto and in particular DeFi.

As prices have decreased, wanton spending habits and the lack of sustainable business models have come into the limelight. While many blue-chip DeFi protocols have been praised for their ability to generate revenue, there has been less attention on whether or not they are really profitable.

Let’s examine the profitability of six market-leading, blue chip protocols in Uniswap, Aave, Compound, Maker, Maple, and Lido over the past six months and dive into the broader implications.

Defining Profitability

Before beginning our analysis, it is important to define what it means for a protocol to be profitable, of which there is a lack of clear consensus.

While all DeFi protocols generate revenue to compensate participants for the risk they incur, such as lenders or liquidity providers, not all protocols capture a percentage of this value for themselves.

Furthermore, there is often little discussion on the primary costs to generate this revenue. As with many businesses, protocols “need to spend money to make money.” They have expenses, with the largest and most common regardless of the sector in which they operate being token emissions.

Tokens are an incredibly powerful tool that can be used to incentivize all types of behaviors and are most commonly used in DeFi to incentivize usage in the form of liquidity mining.

With these concepts in mind, for our analysis, we will use the same definition of profitability that is outlined in the piece “Comparing the Profitability of DEXs” by Talking About Fight Club.

In it, the author defines profitability (net income) as:

Net Income = Protocol Revenue - Emissions

While the author refers to protocol revenue in the context of fees accruing to tokenholders, we will expand this definition to encompass all DAO earnings, whether they are directed to token holders, accrue to the native treasury, or are used for any other purpose.

Emissions refer to tokens that are distributed to participants within a protocol, such as through a liquidity mining or referral program. This definition does not include team or investor unlocks.

While it does not cover all operational expenses, such as compensation, it does give a good sense of how profitable the protocol operated by a given DAO is.

Profitability Ratios

Along with looking at net income, we’ll also cover profitability ratios. Profitability ratios are a valuable metric that allows us to see just how efficient each protocol is at capturing a slice of the total revenue it generates, and will allow for more nuanced comparisons of profitability.

The two ratios we will use are the “protocol margin” and “profit margin.”

Protocol margin is a measure of the protocol’s take rate, or what percentage of the total revenue generated accrues to the DAO. It is calculated by dividing protocol revenue by total revenue.

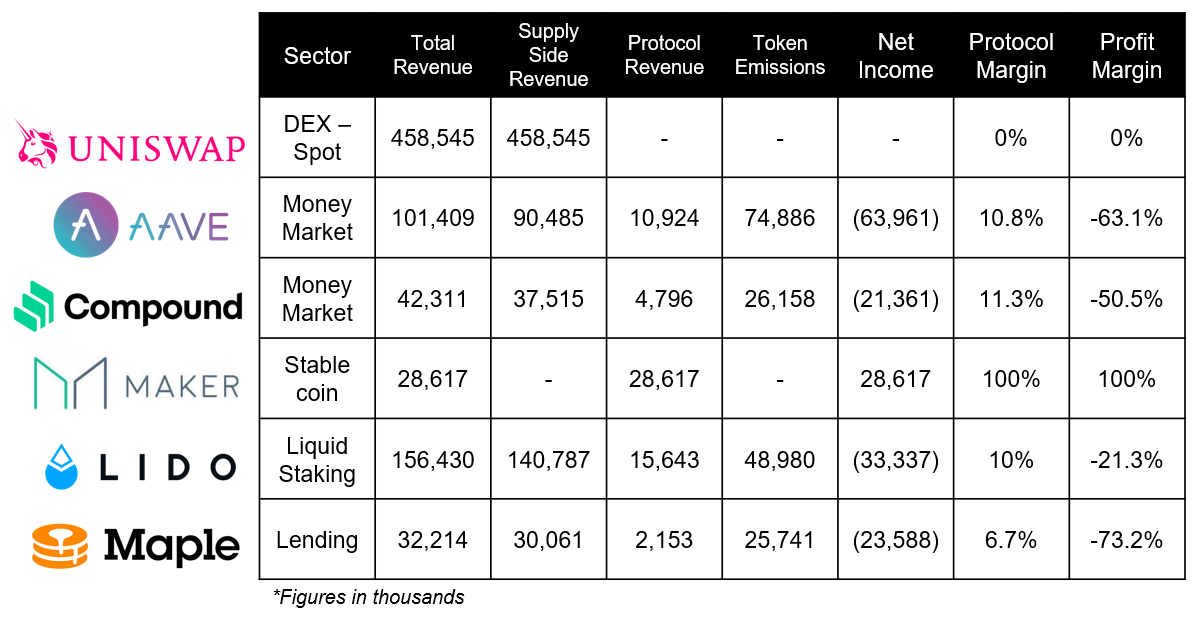

Results Table

🟢 Profitable Protocols

Maker

Maker generates revenue by charging interest to borrowers (known as the stability fee) as well as by taking a cut of protocol liquidations.

For the six-month period, the protocol generated $28.61M in total revenue, all of which accrued to the DAO. Since Maker has no token emissions, this puts both its protocol and profit margins at 100%. Despite this, it is worth mentioning that Maker is one of the DAOs which provides insight into their operational expenses, though the protocol has managed to remain profitable during this time.

🔴 Unprofitable Protocols

Aave

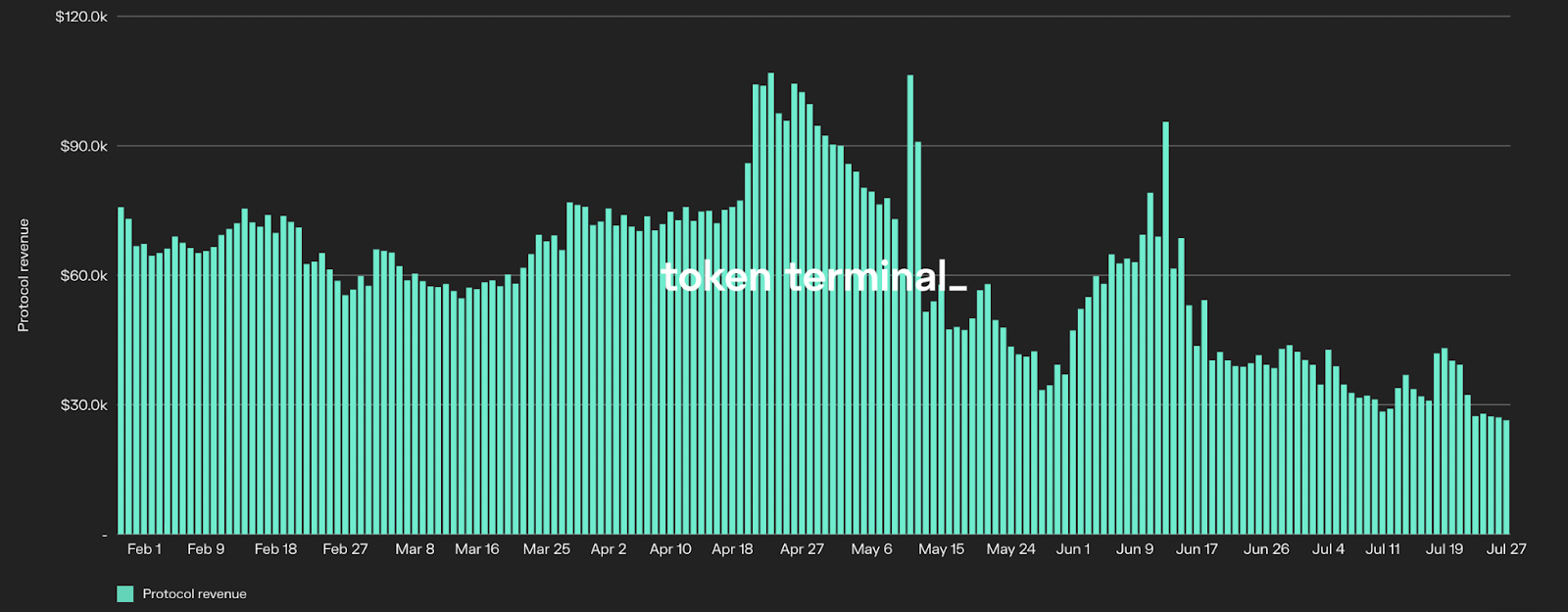

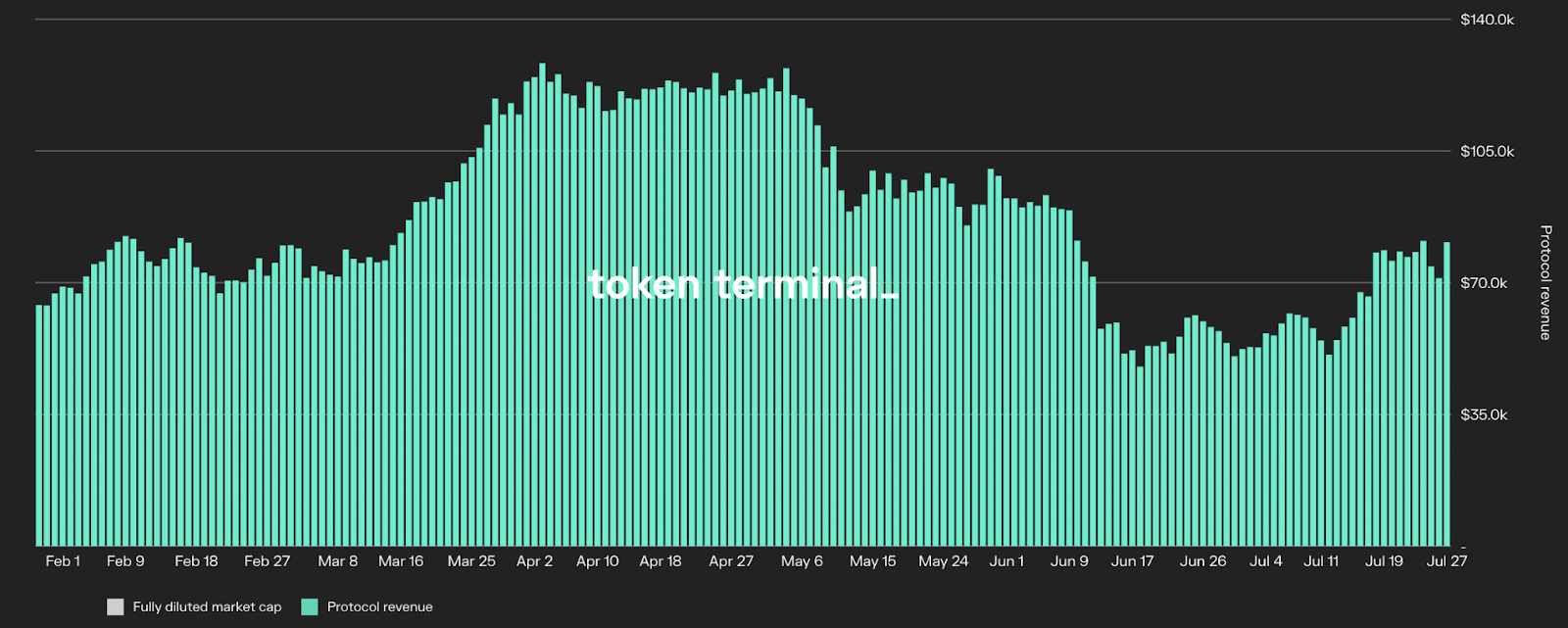

Aave generates revenue by taking a cut of the interest paid out to lenders on the platform.

Over the past six months, Aave generated $101.41M in total revenue, of which $90.48M was paid to lenders (supply-side revenue) and $10.92M to the protocol. This puts their protocol margin at 10.8%.

However, Aave paid out $74.89M in incentives as token emissions over this time, leaving the protocol with a loss of $63.96M.

Compound

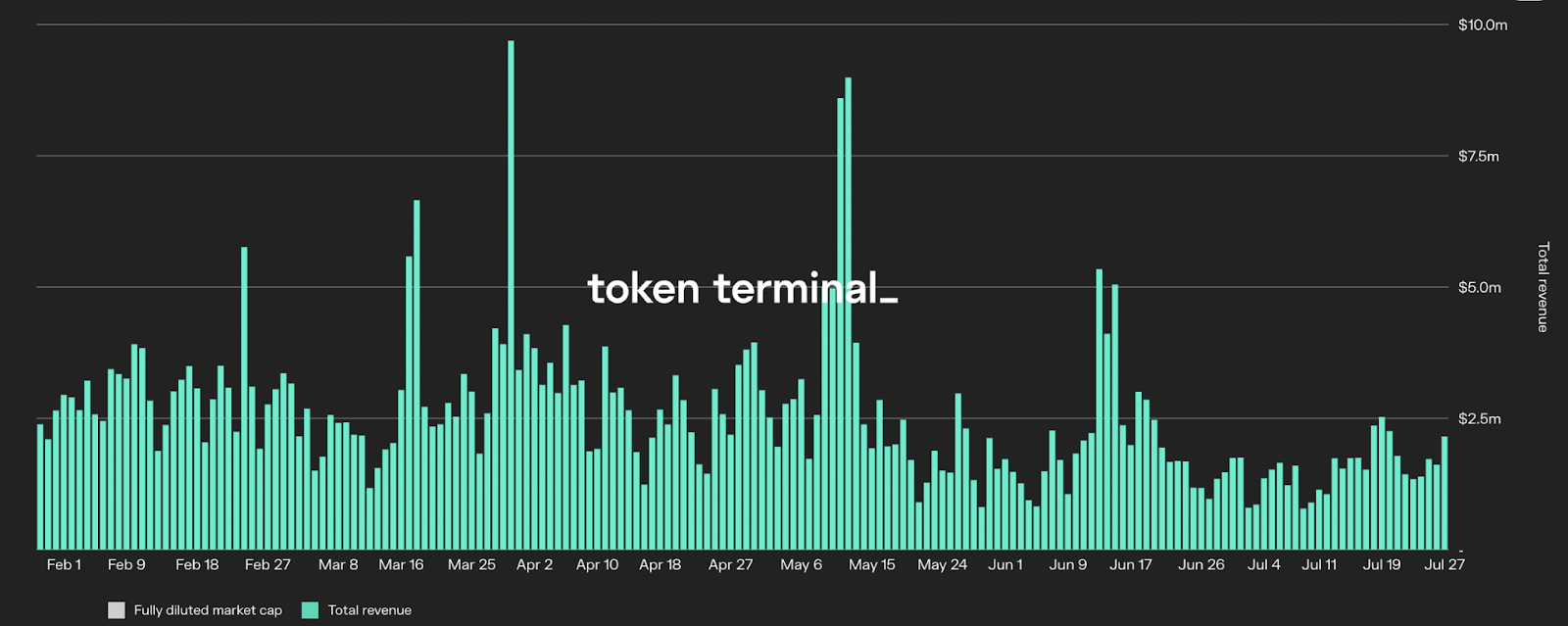

Compound generates revenue by taking a cut of interest paid to lenders (though this is currently being used to buffer protocol reserves).

Compound generated $42.31M in revenue, with $4.8M accruing to the protocol. This puts their protocol margin at 11.3% — 0.5% higher than their primary competitor in Aave.

Despite the higher margins though, Compound still operated at a loss of $21.36M for the six months (albeit smaller than Aave).

Maple Finance

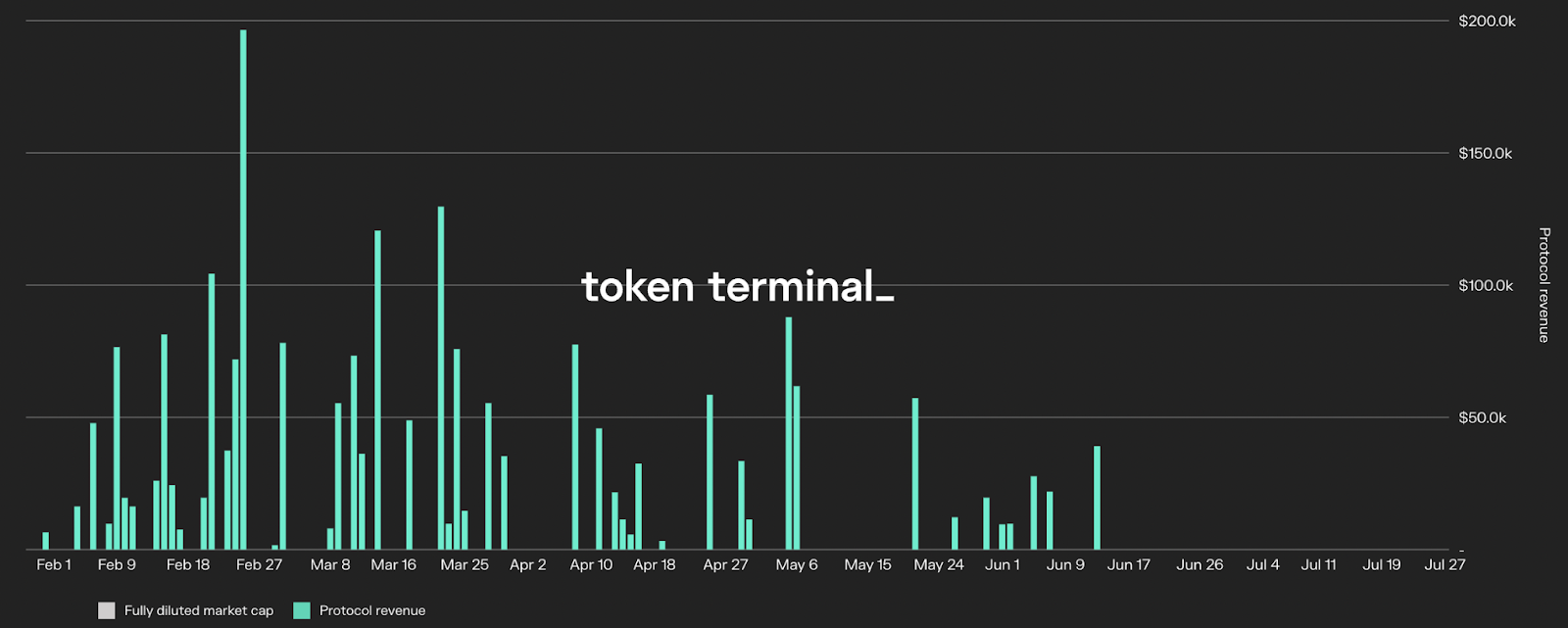

Maple generates revenue from origination fees that are charged for loans issued by pool delegates, the entities which manage pools on the platform. Currently, the fee is 0.99%, with 0.66% for the protocol (split between the DAO treasury and xMPL stakers) and the remaining 0.33% going to the pool delegate.

Maple generated $2.15M in protocol revenue for the past six months while paying out $25.74M in MPL incentives to encourage deposits into various pools, putting them at a loss of $23.58M for the period.

Lido Finance

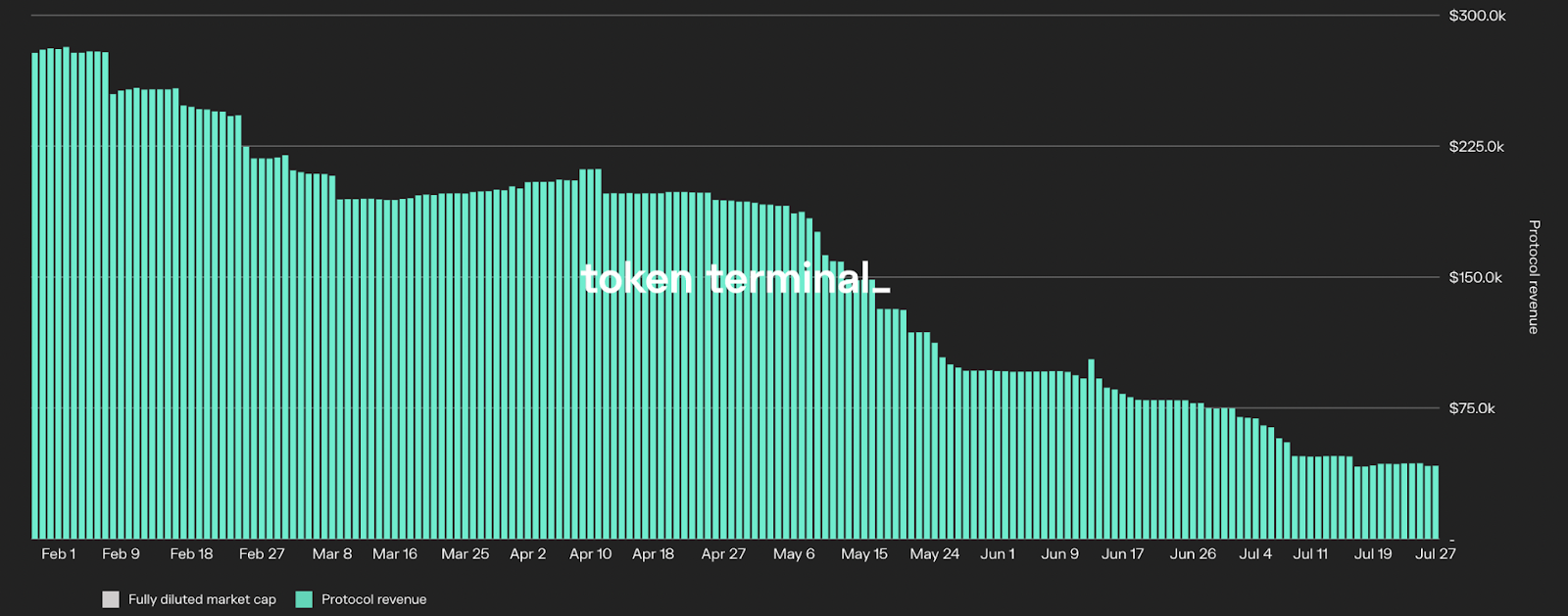

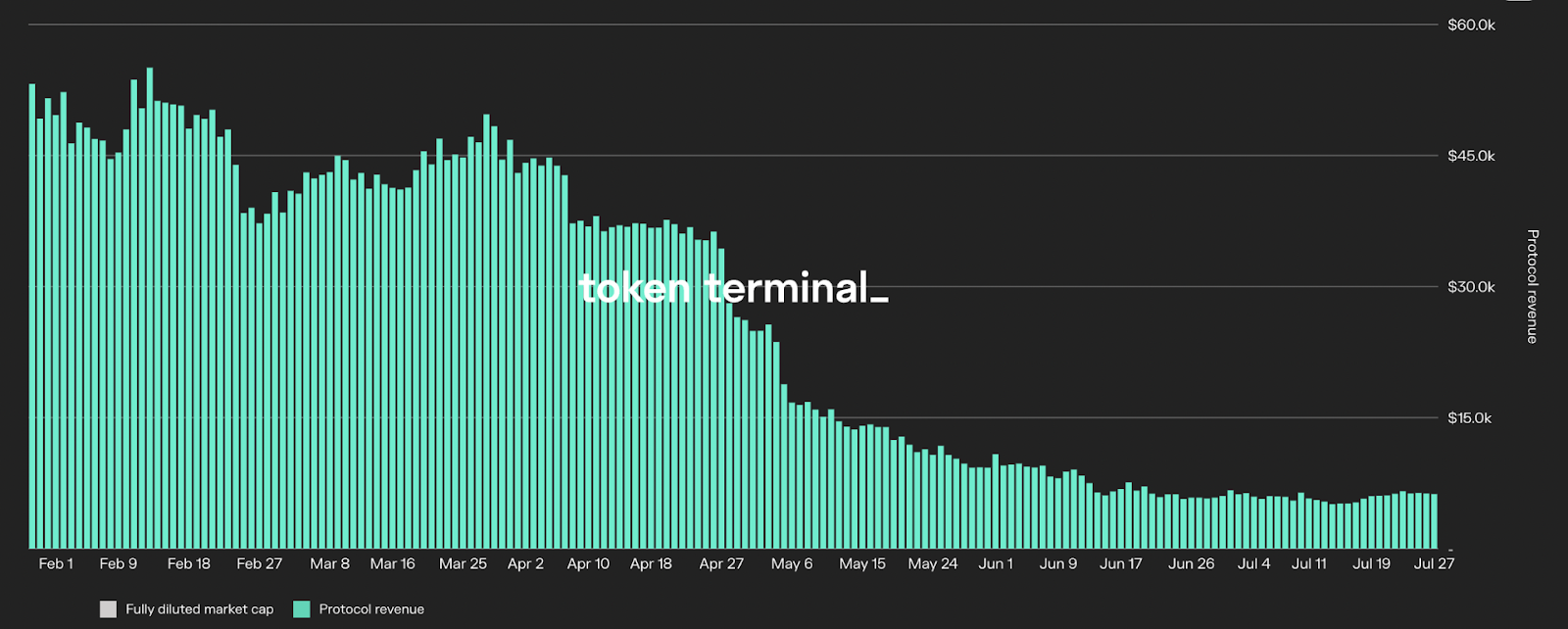

Lido generates revenue by taking a 10% cut of the staking rewards earned by validators on the Beacon Chain.

On that front, Lido generated $15.64M in protocol revenue, while emitting $48.98M in LDO through incentivizing liquidity on exchanges like Curve and Balancer, as well as via Voitum bribes and the protocols referral program.

This meant Lido operated at a loss of $33.34M during the period.

🟡 Potentially Profitable Protocols

Uniswap

Uniswap generated $458.5M in revenue for liquidity providers over the past six months. However, none of that accrued to the protocol, as Uniswap has yet to turn on the “fee-switch” in which the DAO could earn between 10-25% of LP fees for the pools in which it is turned on.

It is unclear what impact the fee switch would have on Uniswap’s liquidity, as cutting into fees for liquidity providers could cause them to migrate to other platforms. This could worsen trade execution and therefore decrease volumes in the fiercely competitive DEX sector.

What Uniswap has going for it is that it paid out $0 in emissions over the past six months, making it highly likely that the protocol would be profitable should they elect to turn on the fee switch.

Takeaways

As we can see, based on our definition, MakerDAO was the only of the six protocols to be profitable.

On the one-hand, this is understandable. The vast majority of early-stage startups— for which DeFi protocols certainly qualify—are unprofitable.

In fact, the protocols listed above, as well as many others, are simply following the Web2 playbook of operating at a loss to fuel growth, a strategy that has proven immensely successful for an assortment of different startups and companies.

Despite this, emitting tokens is of course an inherently unsustainable strategy. Money is not infinite, and liquidity mining programs are highly reflexive, losing their potency and effectiveness the longer they persist due to the perpetual sell-pressure they place on the token being emitted. Furthermore, the sell-pressure from token emissions often robs a protocol of the ability to capitalize itself, since DAO treasuries are often denominated in a protocol's native token.

Perhaps more concerning than the lack of profitability of these blue-chip protocols are their razor-slim margins.

For example, lenders such as Aave, Compound, and Maple have protocol margins of just 10.8%, 11.3%, and 6.7% respectively, meaning they capture just a small fraction of the total revenue generated on their platforms. Lido, which has an 89.9% market share of the liquid staking sector, has a protocol margin of just 10%.

Given the cutthroat competitive dynamics present within DeFi, it is unlikely that these protocols will be able to meaningfully increase their margins else they put themselves at risk of losing market share to a competitor or being forked.

For these protocols to achieve profitability, the real solution may be to think outside the box and create higher margin streams of revenue.

While this is of course challenging, we have seen the earliest signs of DAOs doing this, such as with Aave’s launch of their GHO stablecoin, which will have a similar business model to Maker (who boasts higher margins and to date has not had to rely on token incentives).