Ultimate Guide to Metagovernance

Dear Bankless Nation,

By now you know the adage: It's during the bear market that the building gets done, where the innovation happens.

One such innovation is blossoming as we speak in DeFi: Metagovernance.

Metagovernance is the act of one DAO participating in the governance of another to achieve strategic goals. We talked about this on Tuesday.

So far, metagovernance has been used to direct liquidity incentives, participate in key protocol decisions, and even get tokens listed on money markets like Aave.

But there are a lot of questions…

What can metagovernance be used for?

Who’s using it?

How do you value it?

The future of metagovernance looks far more complex, and perhaps even far more impactful.

Today, Bankless Analyst Ben Giove breaks it all down and shares a new valuation framework for metagovernance tokens.

Big brain stuff. 🧠

- Bankless

With protocols collapsing, yields compressing, and prices falling, many DeFi observers have begun to wonder when, if ever, we’ll begin to realize the potential of an open, permissionless, composable, blockchain-based financial system.

There are pockets of DeFi in which its value proposition continues to shine bright. These flashes continue to prove that DeFi enables things that cannot be done through the traditional financial system.

One such example of this is metagovernance: The act of one DAO participating in the governance process of another through the use of a token. Metagovernance is an emerging strategic lever that digital organizations can pull in order to pursue specific objectives.

Metagovernance shares similarities with investment stewardships in traditional finance, where asset managers vote on shareholder proposals of products held within their assets. However, metagovernance in DeFi is far more transparent and open. Any holder of a metagovernance token can utilize this tool. Unlike in TradFi where decision-making is shrouded in secrecy, there is the potential for individual investors to generate alpha from this trend.

DAOs are DeFi’s smart money. They are a class of investor with its own unique set of criteria for making investments, and greater insight into the inner workings of the sector than retail or institutional investors. There is alpha in being able to anticipate and front-run the tokens that DAOs are — or will be — interested in buying.

Are metagovernance tokens in this class of asset? What is the value proposition of metagovernance? Let’s evaluate the efficacy of metagovernance tokens from first principles.

Metagovernance 101

As defined above, metagovernance is the act of one DAO participating in the governance process of another through the use of a token.

Let’s walk through a quick example so we can gain a better understanding of this definition.

For our purposes, we’ll pretend that there are two media DAOs named after the co-founders of a certain nameless company: RyanDAO and DavidDAO.

Each DAO operates a flagship podcast hosted by its namesake founder, and has its own native token — $RYAN and $DAVID — whose holders are entitled to governance rights over RyanDAO and DavidDAO, respectively. Among other matters, $RYAN and $DAVID holders are able to vote to select the guests that will come onto their DAO’s podcast.

Amidst a bitter ratings war, the members of RyanDAO, via a Snapshot vote, have made clear their desire for Ryan to appear on the DavidDAO podcast. To pursue this goal, $RYAN holders authorized an OTC deal to purchase 100 $DAVID, which is the minimum number of tokens required to make quorum on the weekly votes in which DavidDAO selects the next guest to come on their podcast.

In going through with this transaction, $RYAN holders now have the ability to vote on governance proposals within DavidDAO. When the next guest vote comes around, RyanDAO uses its $DAVID holdings to vote for Ryan to appear on DavidDAO’s podcast.

Although it was highly contested, RyanDAO’s stake was enough to help them win the vote. Their founder will be coming on DavidDAO’s podcast!

Through this lighthearted example, we can see metagovernance in action:

A DAO (RyanDAO) participated in the governance process of another (DavidDAO) through the use of a token (DAVID).

We can also see that metagovernance can be an incredibly valuable tool in helping DAOs pursue strategic objectives.

Metagovernance as a Strategic Tool

Now that we have a high-level understanding of how metagovernance works, let’s dive into some more complex examples so we can gain a better understanding of the ways in which DAOs have begun to utilize metagovernance to further their strategic interests. In doing so, we’ll be able to understand the role that metagovernance tokens play in this process.

The most well-known example of metagovernance being used to achieve a strategic goal thus far involved Fei Protocol, Aave, and Index Cooperative. In this instance, the stablecoin issuer FEI Protocol was able to successfully get its FEI token listed on the Aave money market by utilizing the metagovernance rights held by the INDEX token via DPI.

Let’s break down how this happened in some more detail.

Fei Protocol is the issuer of FEI, a fully-reserved, USD-pegged stablecoin. In June 2021, the DAO expressed interest in getting FEI listed on Aave, the largest on-chain money market by TVL. This listing was highly coveted by the protocol, as an integration with a popular application such as Aave could increase the utility, and therefore demand, for FEI.

However, in order for FEI to be listed on Aave, it had to pass through the money market’s decentralized governance process. Given the lack of certainty in how AAVE holders would vote, as well as the minimum 80,000 AAVE (worth ~$20 million at the time) requirement to make a governance proposal, Fei decided to purchase 100,000 INDEX tokens (worth ~$2.5M at the time) to aid in securing this integration. INDEX is the governance token of the Index Cooperative, an asset management DAO behind the creation of thematic indices and structured products such as DPI (DeFi Pulse Index) and GMI (Bankless DeFi Innovation Index).

Although it must be enabled on an per asset basis, INDEX holders are entitled to the governance rights of the underlying tokens held within the DAO’s products. This makes INDEX a metagovernance token, or an asset which serves the purpose of conveying metagovernance rights to its holders.

INDEX metagovernance is currently enabled for five assets within DPI: UNI, COMP, YFI, BADGER, and AAVE. This means that instead of needing to purchase each token individually, a DAO can instead purchase INDEX and obtain the governance rights for each of these underlying assets.

After close collaboration with both communities, in September 2021, Fei Protocol utilized the metagovernance rights held by its 100,000 INDEX to participate in the official vote to list FEI on Aave, successfully securing the integration.

In doing so, Fei exercised what is known as “levered metagovernance.” This term was coined because the DAO was able to “leverage” or extend its governance power. At the time, roughly $4 million worth of INDEX was able to influence the voting power of the ~$36 million of AAVE held within DPI.

To put a long story short, Fei used $1 of INDEX to control $9 worth of AAVE.

This vote demonstrates the incredible power and cost effectiveness in DAOs utilizing metagovernance to pursue strategic ends. Through the INDEX token, Fei was able to essentially purchase the governance power needed at a 9x cheaper rate as compared to buying the same amount of AAVE outright.

Not only was this event the first major instance of metagovernance within DeFi, it marked the birth of metagovernance tokens as a sub-asset class.

**For a thorough writeup on the intricacies of Fei-Aave-Index metagovernance, check out these pieces by 0xKydo and Shawn Grub.**

Examples Of Metagovernance in Practice

There are numerous other prominent instances of metagovernance being utilized within DeFi.

For instance, the “Curve Wars” are a prime example of metagovernance in action. Holders of — the native token of Convex Finance — utilize metagovernance to vote on allocations of CRV emissions on Curve Finance, the largest decentralized exchange by TVL.

More than 20 DAOs have purchased CVX outright, or pay bi-weekly bribes to its holders to achieve a number of ends. For example: Some stablecoin issuers do so to direct liquidity to strengthen the peg and confidence in their issued currency.

Along with being utilized within protocols, we’ve also seen the development of tokens specifically designed to maximize levered metagovernance power.

One asset currently in development that fits this bill is [Redacted] Cartel’s glBTRFLY.

[Redacted] is a metagovernance DAO aiming to “create and extract value through the incentivization of governance in DeFI.” The entity behind the creation of the Hidden Hand bribe marketplace, [Redacted] is governed by the BTRFLY token. As a part of the Redacted V2 upgrade, the DAO will employ a two-token model, in which BTRFLY holders can lock their tokens into either rlBTRFLY or glBTRFLY.

rlBTRFLY entitles holders to a share of revenue generated by the DAO, and is slated to launch within the next several weeks, while glBTRFLY will confer holders with the metagovernance rights for the underlying assets in the [Redacted] Treasury, worth ~$47.87 million at current prices. It is worth noting that there has yet to be a timeline given for the release of glBTRFLY.

A Framework For Evaluating Metagovernance Tokens

Now that we have an understanding of metagovernance and how it has been used throughout DeFi, let’s create a framework for evaluating metagovernance tokens.

Whether it be a DAO wanting to add one to its balance sheet or a retail investor hoping to anticipate and front-run future interest from these entities, there are three main criteria to keep in mind when scouting for and determining the efficacy of a metagovernance tokens.

Criteria #1: What are the underlying governance tokens?

The first thing to be aware of in regards to a metagovernance token is the set of underlying tokens that it controls. It’s important to remember that not all governance power is of equal importance or value to a DAO. For instance, looking back at our previous example, Fei was only interested in utilizing the INDEX token for its AAVE governance rights to secure a listing. Despite INDEX metagovernance controlling a greater quantity of tokens such as UNI, Fei had no strategic interest in utilizing these governance rights.

This is an important reminder: Think critically about the utility conferred by a metagovernance token’s underlying governance rights, and to which types of DAOs said utility would appeal.

Criteria #2: What is the process for enacting metagovernance?

Another important thing to keep in mind when evaluating a metagovernance token is the process through which its metagovernance is enacted. Like most on-chain governance systems, a metagovernance vote is typically required to reach a certain minimum voting participation threshold, or quorum, in order for the underlying rights to be activated.

While protocols with direct financial incentives for voting, i.e. bribes, almost always reach this minimum threshold, ones without that mechanism in place — such as in the case of INDEX — have shown a tendency to fail to reach quorum. This voter apathy can lead to wasted governance power. As we’ll see later, voter participation rates are critical in determining the extent to which metagovernance capital can be levered.

In addition, investors must keep in mind the distribution of metagovernance power based on votes. For example, are votes “all or nothing,” meaning that 100% of the underlying tokens are allocated to one voting choice? Or, is the governance split proportionally among different choices based on the number of tokens voting for each option?

In addition, investors and DAOs should be conscious of the requirements to participate in metagovernance. For example, to participate in Convex governance, and in the future, glBTRFLY metagovernance, token holders must lock their tokens for a minimum period of time, whereas INDEX metagovernance does not necessitate that participants take on this liquidity risk.

Criteria #3: What is the potential levered governance power (LGP) per token?

Finally, and perhaps most importantly, investors must assess whether or not they are getting a “good deal” in buying a metagovernance token. In essence, this entails determining whether or not on a per dollar basis, a DAO would be able to wield a greater amount of governance power through utilizing a metagovernance token when compared to just buying the underlying tokens individually.

Like with Fei, does $1 of the metagovernance token influence more than $1 of governance power? And furthermore, based on voter participation rates and the value of the underlying assets held, to what extent can this governance power be levered (LGP)?

Metagovernance Token Analysis: INDEX

Now that we have our framework for evaluating metagovernance tokens, let’s apply it to the INDEX token. Here, we’re looking to get a sense of how we can analyze the token in practice.

Underlying Governance Rights:

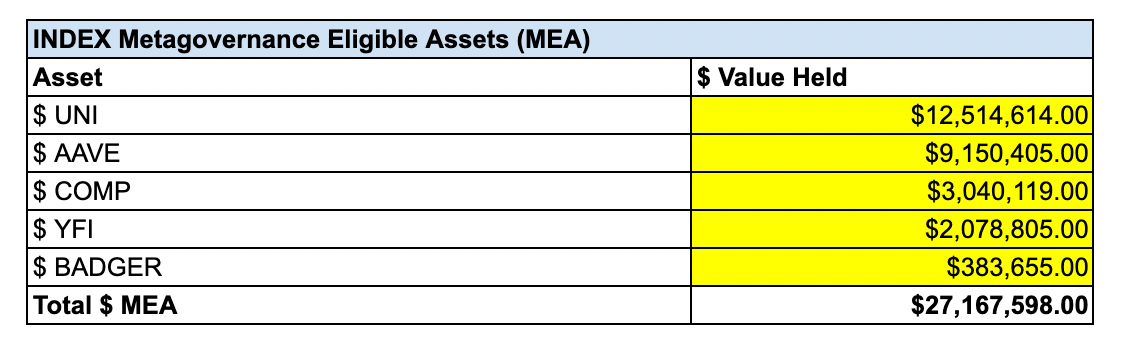

As discussed above, INDEX holders are entitled to governance rights to the UNI, COMP, YFI, BADGER, and AAVE held within the DeFi Pulse Index.

As we can see, the current total value of these assets is $27.1 million. Of these assets, as seen with Fei, the most strategically valuable are likely AAVE, and COMP, which can be utilized to secure listings on the two largest money markets by TVL.

Process For Enacting Metagovernance:

INDEX holders are able to vote on governance proposals for the five assets listed above via Snapshot vote. In order to reach quorum, 5% of the circulating INDEX supply must participate in the vote. At current prices and based on the circulating supply, this comes out to roughly $1.2 million in voting power. INDEX metagovernance votes are “all or nothing,” meaning that the entirety of the underlying assets will go towards supporting one option within a vote.

If a vote does not reach quorum, the metagovernance committee made up of five Index community members, will step in and vote. Any INDEX holder can participate in metagovernance, and there is no vote-locking required to do so.

Estimated Maximum Levered Governance Power (LGP) per INDEX:

Now, let’s calculate the maximum potential levered governance power for every $1 of INDEX participating in governance.

Before proceeding, it’s worth noting that these values are estimates. As previously mentioned, the voter participation rate in INDEX metagovernance votes varies widely by proposal, with many minor proposals failing to reach quorum. As such, using a single average participation rate per metagovernance vote will not provide us with a useful figure.

Because of this, we’ll utilize a range of voter participation rates to get a sense of the different possible LGP’s.

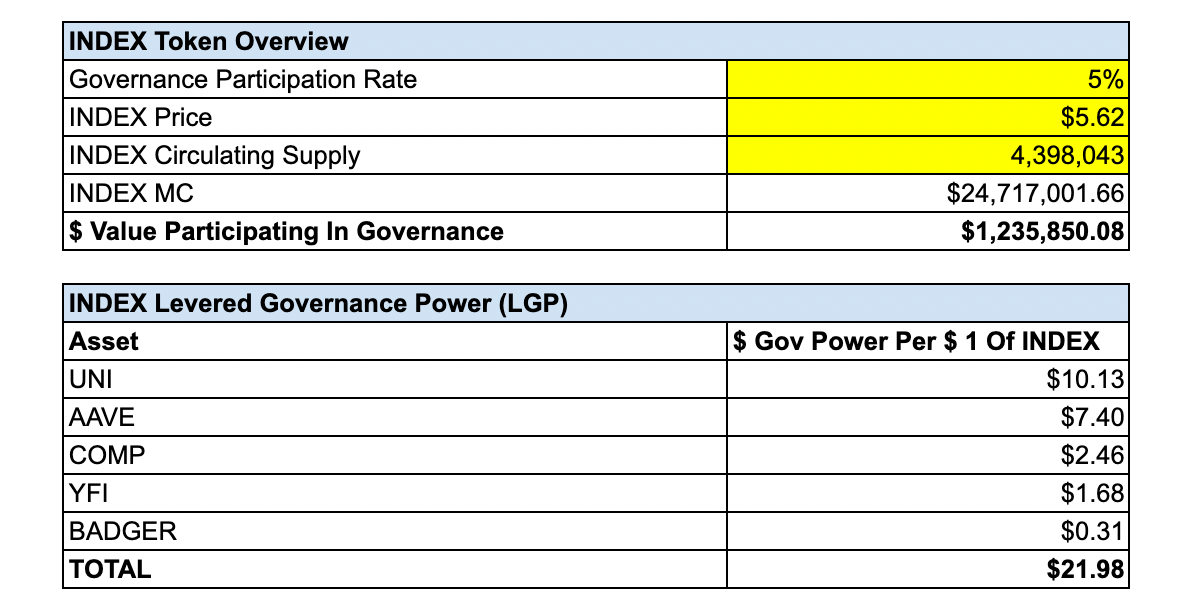

5% Governance Participation

To establish the lower end of our range, we’ll use the minimum 5% required voter participation rate to meet quorum in order for INDEX metagovernance votes to be implemented.

As we can see, based on the current value of the tokens that would be participating in governance, $1 of INDEX could influence up to an aggregate of $21.98 of governance power. This includes $7.40 of AAVE, and $2.46 of COMP, the two aforementioned money market tokens. It is worth pointing out that for a meaningful or contentious vote, it is very unlikely that the voter turnout would be this low.

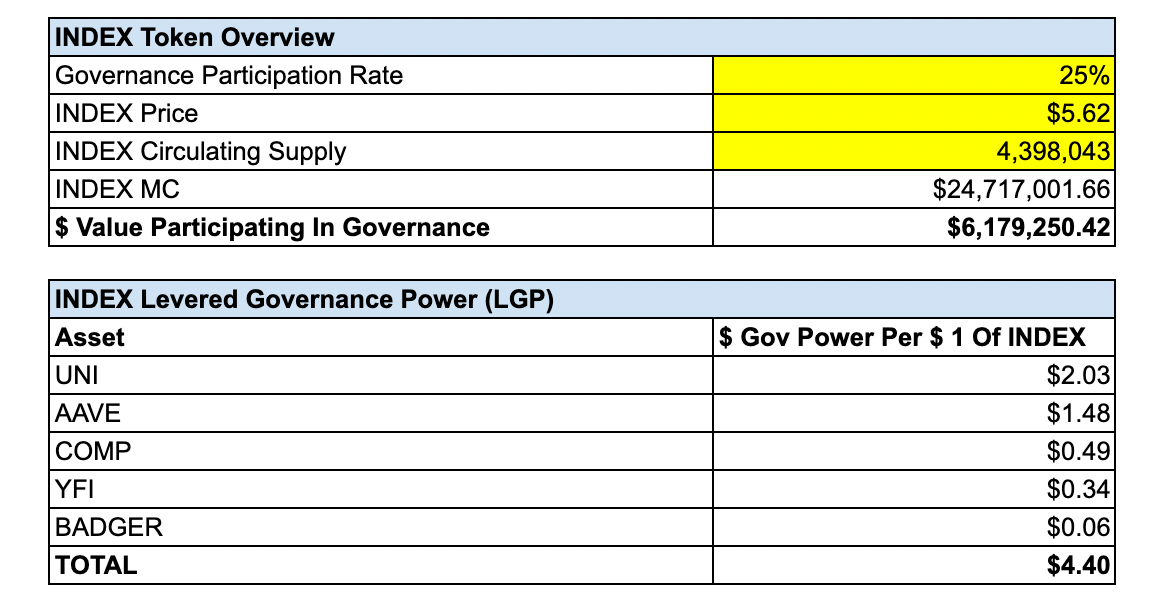

25% Governance Participation

As we can see, the individual governance power held per $1 of INDEX decreases as a greater percentage of the supply participates in voting.

With 25% of the circulating supply participating, the aggregate value of the total governance power that can be influenced falls to $4.40 per $1 of INDEX. While this number may seem large, a closer look reveals that in this scenario, it would only be cost effective to utilize INDEX metagovernance for Uniswap and Aave, as these are the only assets for which $1 the token has influence over more than $1 of governance power.

Takeaway: As we can see, at lower voter participation rates, a DAO can greatly leverage its metagovernance influence through INDEX. However, a closer look reveals this power to be largely concentrated within two assets, UNI and AAVE. This likely limits the pool of prospective DAO’s who would be interested in acquiring the token to those wishing to get listings on money markets.

The Broader Implications

As we can see, innovation is not dead in DeFi.

While TVL figures may be stagnant, metagovernance represents a new, exciting way in which DAOs can participate in DeFi governance. By being able to leverage their governance power through metagovernance tokens, a DAO can pursue a strategic objective at far lower costs. Furthemore, we are beginning to scratch the surface in how we evaluate and analyze these tokens as a sub-asset class within DeFi.

However, with great power (pun intended) comes great responsibility. Due to the outsized influence an entity can exert by utilizing levered metagovernance, it stands to reason as to whether or not this will open up the ecosystem to more governance attacks.

Disclosure: The author has exposure to CVX through GMI.

Action steps

- 🧐. Learn more about INDEX, FEI, and the Curve Wars.

- 📖. Check out our guide to getting bribes with REDACTED