Dear Bankless Nation,

In crypto, the smart money isn’t hedge funds or asset managers.

It’s DAOs.

These are crypto native entities with massive war chests. They have some of the smartest crypto-minded people in the world working for them and managing their treasuries.

And we’re starting to see that they’re the earliest money into rising tokens.

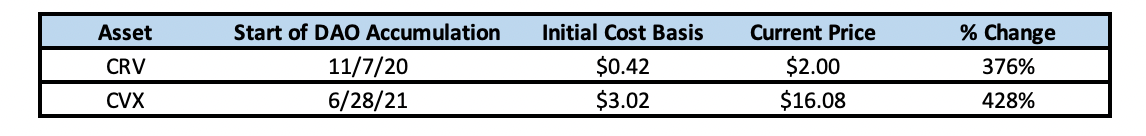

- They started buying CRV at $0.42. It’s now over $2. (+376% increase)

- They were buying CVX at $3.00. It’s now over $16. (+426% increase)

This is also after a -50% drawdown.

And it all happened in plain sight. 👀

Anyone can figure this out by looking at governance forums or diving into the on-chain data.

So what are DAOs buying next?

That’s what Ben dug into.

Here’s what the smart money is buying.

- Lucas

There is a new type of market participant within DeFi.

No, this is not referring to the much-ballyhooed arrival of TradFi institutions, whether they be hedge funds, asset managers, or pension funds. Instead, these increasingly influential entities are crypto-native, live entirely on-chain, and have operational experience and insight into DeFi—something meatspace entities could only dream of.

This emerging force is DAOs.

A part of the larger trend of “DaoFi,” which refers to the emergence of DAOs as DeFi users and investors, DAOs are a class of DeFi investors that have shown themselves to be among the earliest money to certain tokens.

The idea of DAOs as smart money makes sense. They are DeFi native entities with massive war chests, run by some of the smartest people in the world, and collectively possess an incredibly high level of expertise.

A defining and obvious example of DAOs as smart money is the CRV and CVX War. This subject has been covered ad nauseam, but for those who are not familiar, beginning in Q2 2021 protocols such as Yearn Finance, StakeDAO, and Convex Finance raced to accumulate and lock CRV tokens. These locked tokens, in the form of veCRV, give their holders the right to earn boosted rewards when providing liquidity on Curve, as well as the right to vote on the direction of CRV emissions.

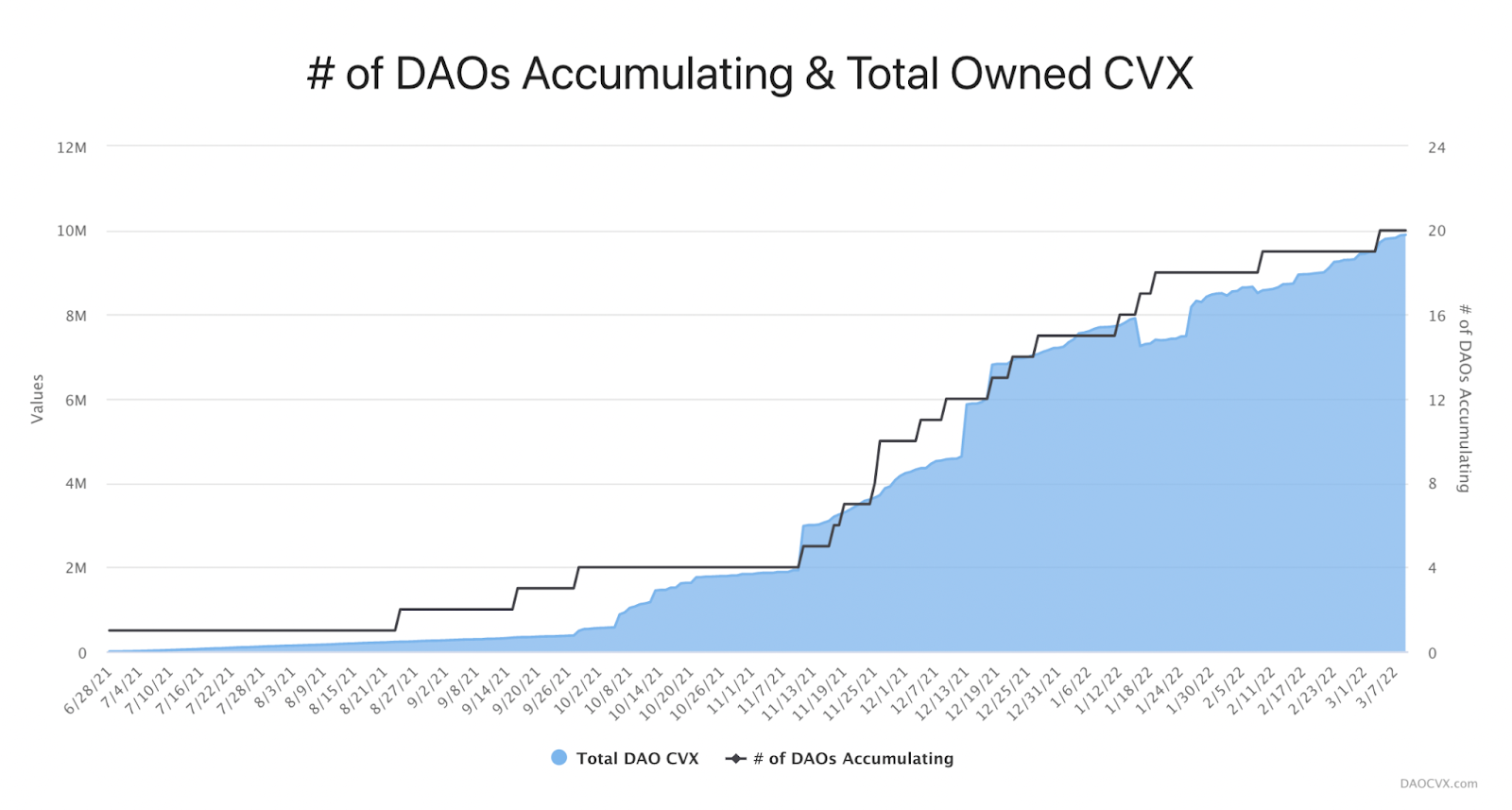

Convex quickly won this battle, stockpiling a plurality of CRV. The crosshairs then shifted to CVX, as holders are entitled to meta-governance rights over the CRV held by Convex.

CVX is now sitting in twenty DAO treasuries.

While it is widely known that these wars have been fought by DAOs, what has been less discussed is the cost basis at which they began their accumulation.

As we can see from the table above, DAOs began stockpiling both CRV and CVX at substantially lower prices than what they are trading at today. These gains come even after both assets have seen 50%+ drawdowns from their January 2022 peaks. An interesting wrinkle to this is that these moves took place in broad daylight, available for anyone to see in real-time on governance forums, Twitter, and of course, on-chain.

These DAOs could’ve been easily copy-traded.

Although the sample size is small, the takeaway is clear: DAO purchases are a source of signal and alpha for investors.

This begs some questions…

- What’s next?

- Besides CRV and CVX, what tokens are DAOs accumulating?

- And why are they doing so?

- Will more DAOs follow the early adopters in aping in?

Let’s poke around some treasuries to find some answers.

A Look At DAO Holdings

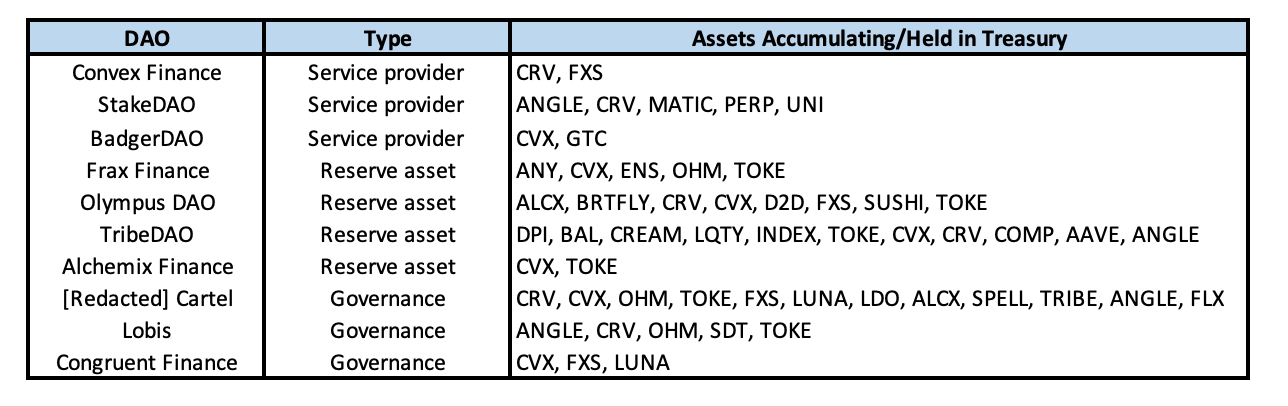

For this analysis, we’ll be taking a look at ten different treasuries of DeFi DAOs.

It is near-impossible to get every DAO on this list, as there are hundreds on Ethereum with incredibly smart and talented contributors. However, these ten represent a diverse mix based on their size, their confirmed interest in acquiring various governance tokens, and their motivations for doing so.

The assets listed in the table below exclude common treasury assets such as ETH, BTC, stablecoins, LP-tokens, and native tokens, and include holdings that are currently larger than $20,000. It is also worth pointing out that these assets were acquired through several different means, whether it be through open market purchases, farming rewards, token-swaps, or seed round allocations.

These ten DAOs have been organized into three main groups:

- Service Providers: These DAOs are accumulating governance tokens in order to enhance the quality of their products for users, such as by providing boosted yields. The DAOs used for this analysis that fit this description are Convex Finance, StakeDAO, and BadgerDAO.

- Reserve Asset Issuers: These protocols are issuing a reserve asset of some kind, whether it be fiat-pegged, or one that has a floating exchange rate. These DAOs are stockpiling various tokens for either use as collateral, for meta-governance rights, and/or to direct liquidity to their issued token. The DAOs selected that fall within this category are Frax Finance, Olympus DAO, Tribe DAO, and Alchemix Finance.

- Governance DAOs: These DAOs are stockpiling tokens with the intention of accumulating governance power and influence in different strategically important protocols. These include [Redacted] Cartel, Lobis, and Congruent Finance.

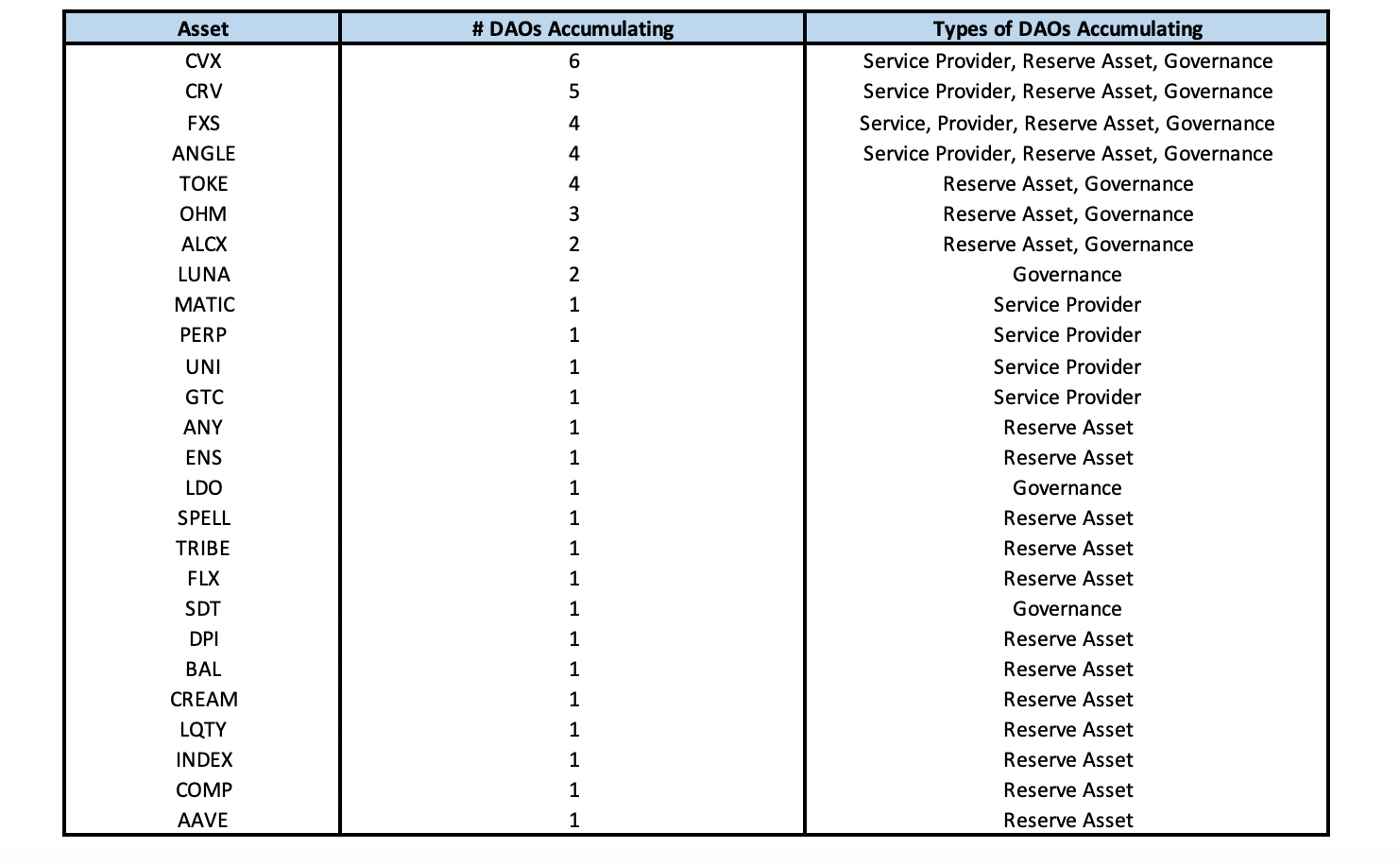

As we can see, there are 26 unique assets held across the ten DAOs on our list, with each DAO holding at least two non-native governance tokens in their treasuries.

The average number of tokens held per DAO is 5.5, while the median sits at 4. The two DAOs with the greatest number of tokens held are [Redacted] Cartel, and Tribe DAO holding 12 and 11 respectively.

Breaking the data down by asset, we can see that unsurprisingly, the most commonly held asset is CVX, which sits in six treasuries, and CRV, which is in five. They are two of the just four assets that are held by all three types of DAOs.

Moving down the list, the next most commonly held assets are FXS, TOKE, and ANGLE at four. TOKE is held by reserve asset and governance DAOs, while FXS and ANGLE sit in the treasuries of both those and service providers.

The 3 Most Commonly Held Assets

Now that we know the most commonly held tokens among our sample group of DAOs, let’s explore a few of them in more detail so we can understand the possible reasons as to why these assets have found themselves in the crosshairs of DAOs, and their strategic importance.

We’ll focus on the three most widely held assets other than CRV and CVX: FXS, ANGLE, and TOKE.

1. Frax Finance (FXS)

- # Of DAOs Holding: 4

- DAOs Holding: Convex Finance, Olympus DAO, [Redacted] Cartel, Congruent Finance

- Types of DAOs Holding: Service Provider, Reserve Asset, Governance

Frax Finance is a stablecoin issuer, whose FXS token serves as seigniorage, accrues fees, provides holders with boosted rewards, and governs over the protocol. Like CRV and CVX, FXS can be locked for veFXS, which gives holders the right to vote on gauge emissions for different FRAX pairs across any decentralized exchange.

Possible Motivation for Accumulating

The utility of the FXS token is likely driving the desire to accumulate it among the three types of DAOs. Service providers like Convex want to lock FXS to offer the highest possible yields to their depositors, reserve asset issuers likely are interested in locking FXS to drive liquidity to FRAX based trading pairs, while governance DAOs can utilize the token to generate cash flow for their token holders via vote-selling.

2. Angle Protocol (ANGLE)

- # Of DAOs Holding: 4

- DAOs Holding: Stake DAO, Tribe DAO, [Redacted] Cartel, Lobis

- Types of DAOs Holding: Service Provider, Reserve Asset, Governance

Angle is a stablecoin protocol that is currently issuing agEUR, which is pegged to the Euro. The ANGLE token plays a key role within the protocol that may be encouraging DAOs to purchase the token or hold it if they accrued them via liquidity mining rewards.

Like FXS, ANGLE, when locked as veANGLE, accrues protocol fees, entitles holders to boosted emissions, and can be used to vote on gauge weights. As with Frax, gauges can be stood up for any agEUR pair on any exchange.

Possible Motivation for Accumulating

Although agEUR has not yet seen the same level of traction as FRAX, its market cap of $129 million is just 4.4% of FRAX. If adoption were to increase, there is a strong possibility that ANGLE would be increasingly in demand from all three types of DAOs for similar reasons.

3. Tokemak (TOKE)

- # Of DAOs Holding: 4

- DAOs Holding: Olympus DAO, Tribe DAO, [Redacted] Cartel, Lobis

- Types of DAOs Holding: Reserve Asset, Governance

Tokemak is a decentralized market-making protocol. The protocol's native token, TOKE, is utilized within the protocol as a means to allocate and direct liquidity to different tokens and exchanges.

TOKE holders who stake their assets to a given token reactor earn yield in the form of TOKE emissions, while also serving as a protocol backstop in the case that a reactor becomes undercollateralized due to a major impermanent loss event.

Possible Motivation for Accumulating

As with FXS and ANGLE, TOKE is likely in demand from both reserve assets and governance DAOs due to its ability to control the liquidity flows. Reserve asset DAOs may want to accumulate TOKE in order to increase liquidity for the token they issue, while governance DAOs can sell the rights to their holdings to bidders who are interested in standing up a reactor or directing more liquidity to their token.

Potential Future DAO Targets

Now that we’ve touched on the most widely held assets, let’s go over some that are on the list that could be targeted by an increasing number of DAOs in the future.

1. [Redacted] Cartel (BRTFLY)

- # Of DAOs Holding: 1

- DAOs Holding: BRTFLY

- Types of DAOs Holding: Reserve Asset

One potential future target of DAOs is BRTFLY, the governance token of [Redacted] Cartel. A sub-DAO of Olympus DAO, [Redacted] aims to accumulate governance power across various strategically important protocols. [Redacted] boasts a treasury of assets worth more than $46 million at current market prices, with their largest holdings being CRV, CVX, OHM, FXS, and TOKE.

BRTFLY currently uses a rebase model similar to its parent-DAO, but will soon be pivoting to a two-token model. These new tokens, rlBRTFLY (revenue locked BRTFLY) and glBRTFLY (governance locked BRTFLY) will split the cash flow earned from bribes, and the meta-governance rights of the treasury assets respectively.

Possible Motivation for Accumulating

The primary reason why DAOs may begin to accumulate BRTFLY is for the meta-governance rights glBRTFLY possesses. Due to holding an increasingly large share of many of the strategically important assets that have been touched on in this piece, it’s possible that glBRTFLY becomes a popular meta-governance token among DAOs looking to attain the benefits that come with holding those tokens.

We are already beginning to see signs of interest among DAOs, as Olympus recently proposed adding BRTFLY to their strategic asset whitelist.

2. Index Coop (INDEX)

- # Of DAOs Holding: 1

- DAOs Holding: Tribe DAO

- Types of DAOs Holding: Reserve Asset

Index Coop is a decentralized asset manager, responsible for the creation of thematic indices such as GMI, DPI, and MVI as well as leveraged products such as ETH 2x-FLI. Although INDEX is used for governance within the Index Coop DAO itself, like glBRTFLY, holders of the token are granted meta-governance rights over the assets held in Index Coop products.

Although this functionality is currently only active for DPI, it is theoretically capable of being applied to all the indices under the Coop’s purview.

Possible Motivation for Accumulating

Like glBRTFLY, the primary reason why DAOs may be interested in accumulating INDEX is due to the broad swath of meta-governance rights that are and will be under the tokens purview.

We’ve already seen Tribe DAO take advantage of INDEX’s meta-governance capabilities. The DAO holds 100,000 INDEX (~$463,000 at current prices), which they used to help get their stablecoin, FEI, listed on Aave. Given the utility and value provided by having FEI listed on DeFi’s largest money market by TVL, it is not improbable that other DAOs will follow suit.

3. Balancer (BAL)

- # Of DAOs Holding: 1

- DAOs Holding: Tribe DAO

- Types of DAOs Holding: Reserve Asset

Balancer is a decentralized exchange that enables the creation of highly customizable AMM pools, governed by the BAL token. The protocol is planning to overhaul the BAL tokenomics to implement a ve-model. Like Curve, BAL holders will be able to lock their tokens for up to one year in order to receive a share of trading fees generated on the DEX, as well as the right to vote on gauge emissions to different pools.

Possible Motivation for Accumulating

As with Curve, the driving force behind the potential mass accumulation of BAL is the right to control future emissions, i.e. liquidity to a given pool. This could drive demand for the token among service providers, reserve asset issuers, and governance DAOs.

The Implications of All This

DAOs are DeFi’s smart money. And they are on the move. As we’ve seen, these DeFi-native entities are holding and accumulating far more than just CRV, setting their sights on many other strategically important assets.

A common characteristic of the most widely held tokens is that they possess valuable governance rights, which can be attained through either directly holding the token, such as with FXS and ANGLE, or through meta-governance, like with CVX, glBRTFLY, and INDEX. Furthermore, in many cases, the coveted rights these assets hold is the ability to direct the flow of liquidity, DeFi’s most valuable resource, through token emissions.

They say to follow the money…

Is there any money smarter than that of DeFi gigabrains?

Disclaimer: The author holds INDEX, and has exposure to other assets mentioned through GMI.

Action steps

- Follow what the smart money is buying

- Read 5 analytics tools that will make you a better investor