Tips and Tricks for DeFi Season

Dear Bankless Nation,

If DeFi Season is indeed ahead of us, there are some useful things you should know to help navigate the stormy seas. When bull markets really get going, there tends to be so much signal that everything turns to noise, and you end up getting drowned in information and analysis that pulls you in every direction.

I’ve put down 6 tricks I use to keep my head above water when it comes to interpreting signal during a bull market. Following these tricks can help you:

- Save on gas

- Discover hidden gems

- Establish trustworthy connections and find good friends

- Land a job for a decentralized protocol

In the last week, we’ve seen a number of prominent players publicize their entrance into the crypto space.

Even the r/wallstreetbets crew is getting exposure to DeFi and Uniswap.

Speaking of which, Tyler and Cameron Winklevoss are coming on the State of the Nation stream TOMORROW, to talk about the r/WallStreetBets, GameStop, Robinhood, and Melvin Capital drama…and of course how DeFi fixes all this mess.

But for now, let’s study up on these 6 tricks that can help you navigate a bull market.

1. Track the DPI / ETH Chart

I am closely watching the DPI / ETH ratio on Trading View. For those unfamiliar, DPI is the DeFi Pulse Index, one of the first successful DeFi Indices on Ethereum. It uses the ETH/DPI pair on Uniswap for it’s price oracles, which is pretty cool!

Here’s the DPI / ETH chart:

The DPI launched this past September which means the chart history is fairly young. And yet many of the DeFi tokens that have exploded into the forefront of the DeFi ecosystem (YFI, SUSHI, UNI, etc.) are also very young, so this makes sense!

I think DPI vs ETH has plenty of price discovery ahead of it. And I think as DPI outpaces ETH, the bull run will accelerate.

DeFi Season is here.

2. Finding Liquidity and Reducing Gas

This is a trick that I use to two things:

- Discover where liquidity is for a specific token

- Potentially reduce my gas fees in the process

1inch Exchange is a DEX aggregator that spreads trades across many different exchange platforms, in order to give you the best possible price on your trade.

This is especially useful for large orders in low liquidity tokens. As an example, here’s an order for 300 ETH worth of UNI. You can see it spreads the exchange over Sushi, Balancer, and Uniswap. Great!

Here’s a similarly sized order for ETH <> DAI, it actually does a double-routing!

But here’s a much smaller order of just 3 ETH for USDC, and 100% of this order goes through Uniswap.

Using this information from 1inch, you can recognize that you don’t actually need to use the DEX Aggregator as all it’s going to do is swap the tokens on Uniswap and increase the gas costs (and potentially take a spread).

Once you realize where the liquidity is, you can save on gas by just going straight to the respective liquidity source, rather than incurring the gas and swap fees on the aggregator.

Here’s the list of exchange and aggregators to keep in mind when swapping tokens:

Exchange Links:

Aggregators:

1inch (see our tactic)

DEX.AG

Matcha (Built on 0x)

ShapeShift (No MetaMask support 🚫🦊)

SlingShot👀 (Coming Soon!)

🚨PRO TIP: Bookmark these so you don’t get phished!

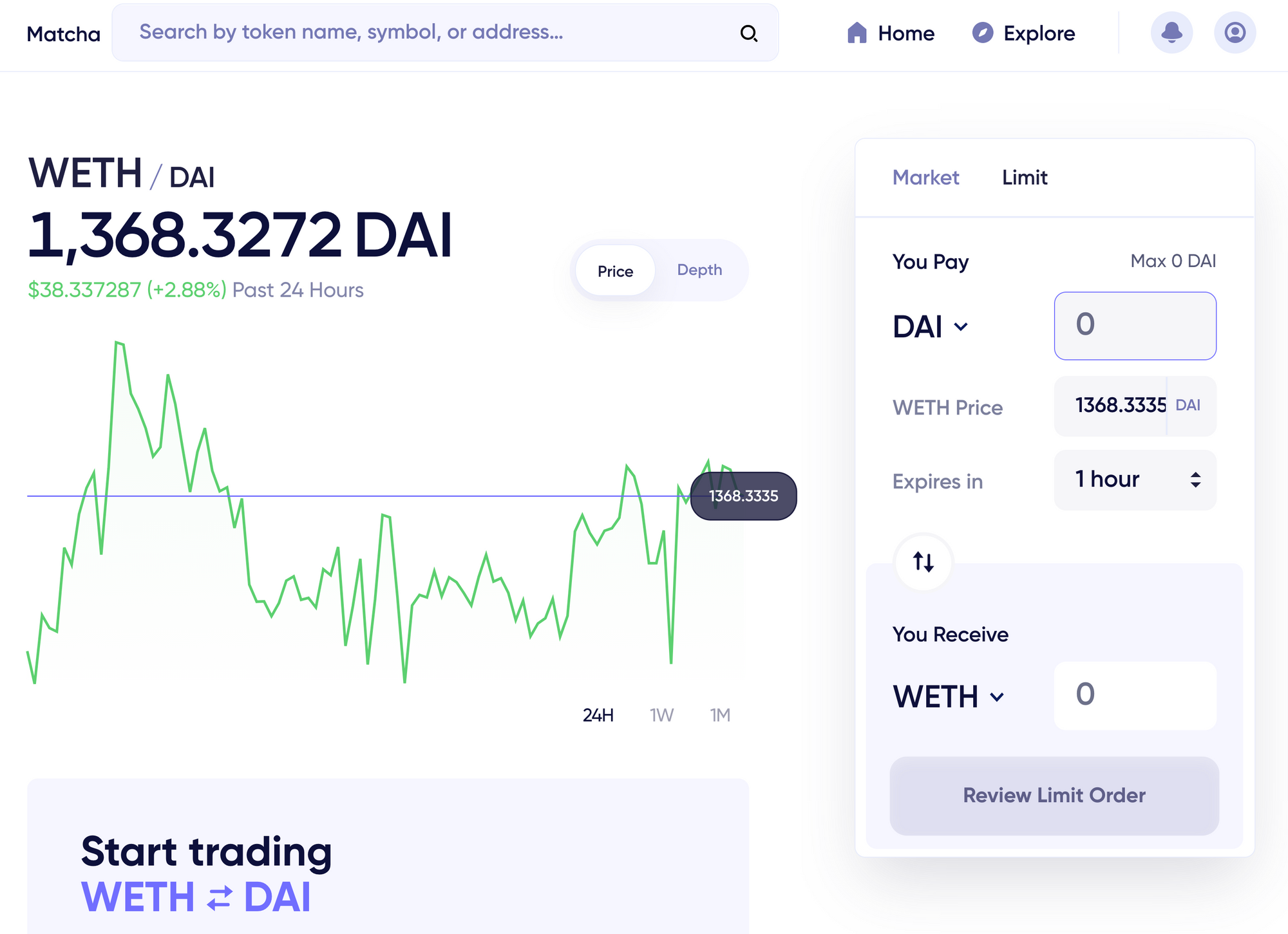

3. Set Limit Orders in DeFi with Matcha

Uniswap, and AMMs in general, have great user experiences because you can shed the order-book and focus on what you want to do: swap tokens. But many traders want the stronger tools they’re used to, like limit orders, when moving into their positions.

Matcha has a familiar and easy UI and UX that Coinbase users will feel familiar with, yet it is entirely DeFi and non-custodial. Importantly, Matcha enables limit orders on top of AMMs, giving the best of both worlds.

Only works with wETH, the ERC20 version of ETH

4. Recognize Unique Token Liquidity Venues

Most ERC20 tokens trade against ETH or crypto dollars like DAI or USDC—like 95% of tokens. But some tokens have unique trading pairs as part of their tokenomic system, and DEX Aggregators and Uniswap/Sushiswap order routing often miss this!

If you read last week’s tactic on Alpha Homora and liked what they’re building, you may be keen on buying their native token, ALPHA. Let’s try and get some.

Uniswap will tell you how much slippage there is on your order, and this is where you can see where this specific token has its liquidity.

10.9% loss on a 30 ETH<>ALPHA trade, but only 0.19% slippage on the liquid pair between ibETH <> ALPHA. Some tokens have these specific liquidity routes, so if you are buying a new token you should double-check where its liquidity is!

More info on ALPHA and ibETH from Bankless.

5. Every Token Has A Story

Every token was issued by someone or some entity and was distributed to people in some specific way. Every token has a genesis story, which is important to understand when evaluating different tokens.

Three places to look when trying to understand the story behind the token:

CoinGecko

Market Cap vs Fully Diluted Valuation (FDV)

- Market Cap: [Token Price] * [Number of Tokens in Circulation]

- FuDiluteduted Value (FDV): [Token Price] * [Number of Tokens Total]

FDV numbers include the valuation of the tokens that are locked, and not available for purchase by the secondary market. This can be for many reasons (again, learn the story of each token), but the most frequent is early investors or team members that have a large share of the tokens that are vesting.

If there is a large discrepancy between the Market Cap and the FDV of an asset, it is worth considering that there may be long-term sell pressure, as these new tokens get introduced into the market and many early stakeholders need to exit their positions.

Here’s Uniswap:

- $5B Market Cap

- $18B FDV

I would call this discrepancy between MC and FDV ‘large’, but not really all that crazy. It’s also worth noting that large UNI holding funds and team members have 4-year vesting schedules, which is one of the longer vesting schedules that I’ve come across. Details available in the Uniswap blog. More importantly, a significant amount of the supply is vesting into a community treasury, governable by UNI token holders.

You can’t just compare MC to FDV discrepancies between tokens like apples to apples. You need to understand the full story behind the token.

It’s also useful to look at who holds the token to understand its story. Every token has its own Etherscan page, and on that page you can sort by amounts held, giving you a view of who holds the most tokens.

The top 10 UNI holding addresses hold 56% of the supply. Investigating who these addresses are and what their game plan is can give you better assurances about your investments.

After doing this, the next stop should be the Discord channel for the token in question:

✍️ Writer’s Note

Retail investors tend to focus on circulating market cap and ignore FDV value. This is because new entrances tend to focus on the short term, over the long term. If you’re a long term investor, knowing the full story behind the token supply can be invaluable when making your decision and preparing for future events.

6. Alpha comes from Discord

The place to do the deepest research is not usually newsletters (even this one!). We can help guide you and point you in the right direction, but you have to do the actual labor yourself.

If you want to get into the weeds of tokens and deeper information, you need to be in the Discord channels of the projects you care about or heavily invested in. Here’s what you can expect to find in DeFi Discord communities:

- Other market participants who are seeking to learn and share valuable information.

- Team members actually working on the project who can help to answer questions.

- Job and work opportunities for those that have proven to contribute value to the community/protocol (work first, job follows. Don’t go asking for jobs before you’ve contributed value).

There are also project subreddits that can be relatively active. There’s also more open subreddits like /r/EthFinance and even /r/Bankless that offers a neutral public square for discussing general information and even specific tokens.

I would say if you’re invested in a token, but you haven’t visited the discord or got involved in the community, your due diligence process is incomplete.

👏Communities👏create👏the👏value👏

There are big bucks available to those who are competent community managers and can be useful resources for new and veteran members, for this very reason.

Community Manager is basically an executive position with DeFi protocols (Let’s be honest, that’s basically what Kain is nowadays 🤣)

So as we sail through DeFi season, keep the above in mind and you’ll make it out alive.

Remember, the only goal in crypto is to put yourself in the position to keep playing the game.

-David