How to boost your yield farming rewards

Dear Bankless Nation,

We saw the explosion of interest in yield farming earlier this summer. And while the yield farming craze has mellowed out a bit since then (which is good), there’s still a substantial amount of opportunity out there.

If you’re interested in maximizing the returns on your yield farm, Alpha Homora is one way to do it. Alpha Homora allows you to borrow ETH from lenders to juice your liquidity provisions and boost your rewards by up to 2.5x.

Have an INDEX farm from the DPI/ETH pool? Instead of earning 20% APY, you can earn up to 72%. But not without added risks!

You can get liquidated. You can lose funds in a hack. Adding leveraged is serious business so please be careful when approaching this tactic, and make sure you recognize all the risks! (When in doubt, don’t add leverage!)

And for those ETH holders out there, you can also lend out your ETH to Alpha Homora and earn one of the highest APYs on ETH that we’ve seen to date. Average rates range from 7-10% with spikes to upwards of 20-30%.

Alpha Homora is a unique product to say the least.

So let’s level up on how you can maximize your yield farming returns.

- RSA

Tactic Tuesday #76: How to get leverage on your yield farm

Guest Writer: Tascha Punyaneramitdee, Co-Founder & Project Lead at Alpha Finance Lab

Alpha Homora is a decentralized protocol for leveraging yield farms and other liquidity provider (LP) positions in order to boost passive rewards. Both yield farmers and LPs can take on leveraged positions by borrowing capital from the protocol to provide additional liquidity to their respective farms, and in turn, allowing users to earn higher yield farming APYs and higher trading fees.

Alpha Homora also provides an opportunity on the supply side. ETH holders can lend out their ETH to the protocol’s borrowers and earn high interest rates for doing so. The lending rate comes from leveraged yield farmers/liquidity providers paying a fee for borrowing ETH.

This tactic will explore how you can take out a leveraged position on your yield farm, the risk associated, as well as how you can earn a passive income on ETH via ibETH tokens!

- Goal: Take out a leveraged position on your favorite yield farms or earn from ibETH

- Skill: Intermediate

- Effort: 10 mins

- ROI: Up to 2.5x on your yield farm earnings

What’s Alpha Homora and how does it work?

Alpha Homora is a decentralized protocol for leveraged yield farming. The protocol acts as a two-sided market place between borrowers (yield farmers) and lenders (ETH depositors).

Alpha Homora uses the capital from lenders to automatically deposit and earn on the behalf of yield farmers, as opposed to giving users the borrowed amount to then manually deposit themselves. Yup that’s right! Rather than going through the cost-intensive process of taking out a loan, and depositing it into your favorite yield farm, this whole process is done automatically in a non-custodial fashion.

On the other side of the market, lenders have an incentive to deposit their ETH (along with other assets in V2) to Alpha Homora as they’re earning one of the highest yielding interest rates in DeFi from borrowers paying a portion of their yield to the lenders.

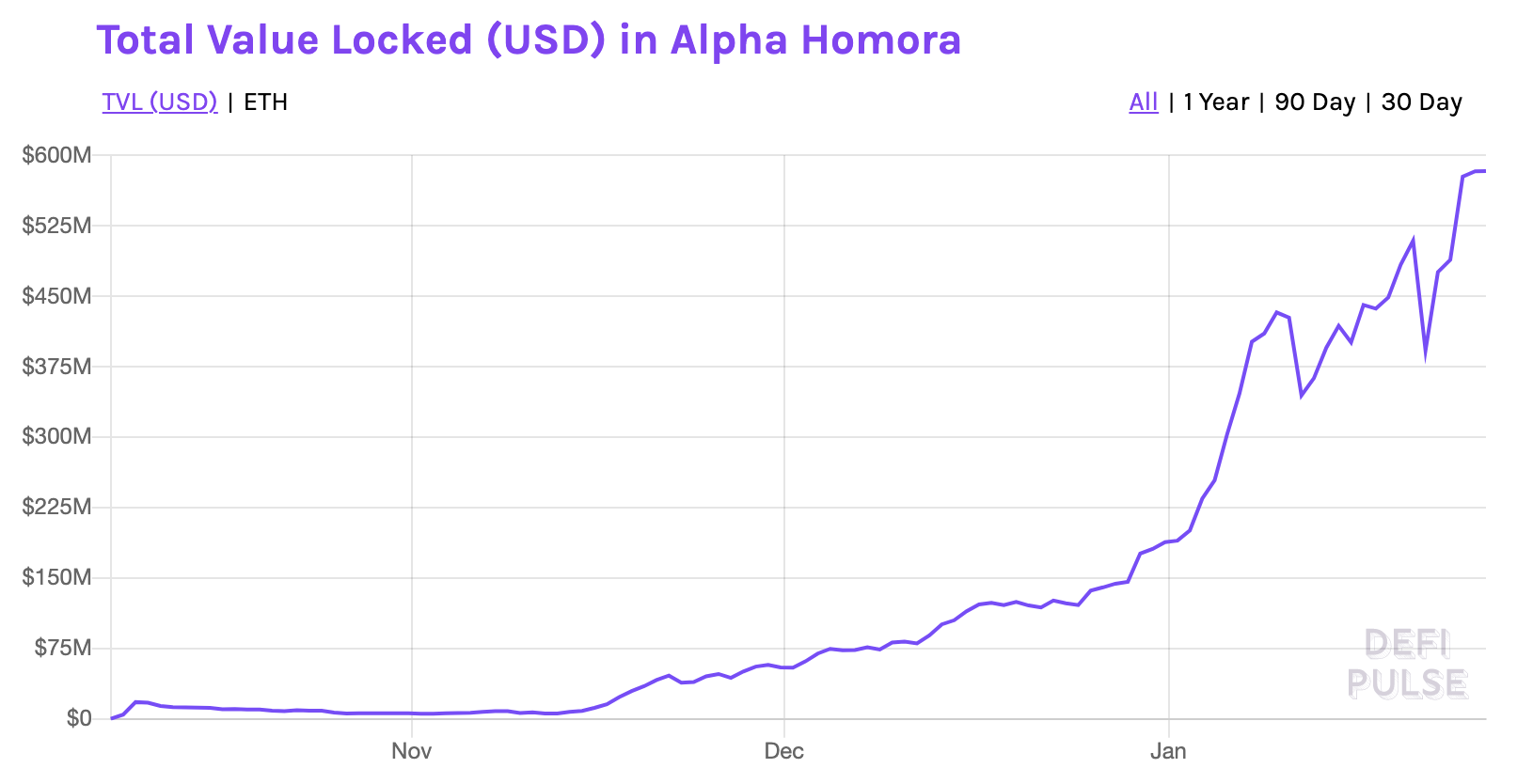

Alpha Homora launched in October 2020 and experienced an explosion of interest following the yield farming craze earlier this summer. Since launch, Alpha Homora has accrued over $500M in value locked, according to DeFi Pulse along with the protocol’s native token, ALPHA, experiencing a meteoric rise in recent weeks.

With the interest from the community, Alpha Finance Labs set out to improve the product with V2. And earlier this month, Alpha Homora released details on the upcoming upgrade, set to go live in the coming weeks (if not days).

What you need to know about Alpha Homora V2

Yield Farmers:

- Increase in the amount of liquidity pools available for leveraging including Curve, Balancer, SushiSwap, and Uniswap

- Yield farmers can now take leverage on multiple assets including ETH, stablecoins, and more.

- In terms of borrowing capabilities, users will be able to borrow stablecoins with up to 9x leverage!

- Similar to Alpha Homora v1, users don’t need to have equal value of both tokens in order to provide liquidity or yield farm.

Lenders:

- Lenders will be able to deposit a more diverse range of supported assets at high lending interest rates through ibTokens (interest-bearing token). Alpha Homora V1 only featured ibETH, but the upcoming upgrade will support ibDAI, ibUSDT, and more, providing lenders with more options on how they want to earn!

Lastly, Alpha Homora v2 has deeply integrated with Cream v2. The protocol has been whitelisted by Cream v2 contracts, allowing Alpha Homora to take out under-collateralized loans and tap into Cream’s deep liquidity pool of various assets.

As a result, Alpha Homora can offer users a significantly wider range of assets they can take leverage on without having to bootstrap all of the liquidity ourselves. This is a massive win for the Alpha ecosystem, and users will reap the benefits in the coming weeks!

Risks with Leveraged Yield Farming & Lending

Like any DeFi protocol, and any sort of borrowed leveraged, Alpha Homora has its own risk. Below are some things you need to consider if you’re looking to use Alpha Homora:

Yield Farmers & Liquidity Providers

As with all AMMs, liquidity providers are exposed to impermanent loss. If you’re unfamiliar with impermanent loss (IL), you can read more about it here. This nuance can be relatively annoying for those that are unaware of the potential losses associated, so make sure to recognize your risk of IL when becoming a liquidity provider!

In addition, those who elect to leverage their yield farm also incur the risk of being liquidated. Liquidation takes place when Debt Ratio (debt / position value) reaches the liquidation threshold (e.g. 80% for ETH/DAI pool) which can take place when your position value falls.

Position value falls when the price of another token (e.g. DPI for the DPI/ETH pool) drops significantly compared to ETH or if the ETH price increases significantly compared to your trading pair.

You can view the risk parameters for each pool here.

Lenders

Lenders don’t bear risks from impermanent loss and liquidation risks from leveraged positions like the protocol’s yield farmers. Instead, lenders share the risk of debts accrued by underwater positions in case liquidators did not liquidate in time. While this may be scary, this scenario has never happened in V1—a notable testament to the solvency of Alpha Homora.

Regardless, it’s worth noting as it’s the only major risk for holding ibETH and other interest bearing tokens on Alpha Homora. And even though it has never happened, it doesn’t mean it can’t!

ibETH: High Yields for ETH Holders

ibETH has become one of the more popular products with the launch Alpha Homora as it currently holds 0.38% of all ETH in circulation.

ibETH, which stands for interest bearing ETH, generates substantial passive returns for holders to create an attractive place to park your idle ETH. As mentioned, the yield comes from farmers paying a portion of their earnings out to the lenders. As a result, ibETH currently dwarfs other lending protocols in terms of yield and even competes with the returns of Eth2 staking (without all the hassle of running a validator!).

For reference, yields have historically held around ~7% APY. But during times of high demand for capital, rates have spiked to upwards of ~30% APY for brief moments. Even at the time of writing, rates had surged to over 20%!

That’s one of the best parts about ibETH—you never know when you’ll have a period of substantially higher earnings due to an increase in demand for capital.

How to get ibETH

For those interested in acquiring ibETH, it’s really simple! You can do so by directly depositing ETH on Alpha Homora here. But for the sake of this tactic, let’s run through it real quick.

👉 Note: ETH/ibETH liquidity on Uniswap is extremely thin, so minting ibETH from Alpha Homora directly is the best way to acquire any substantial amount.

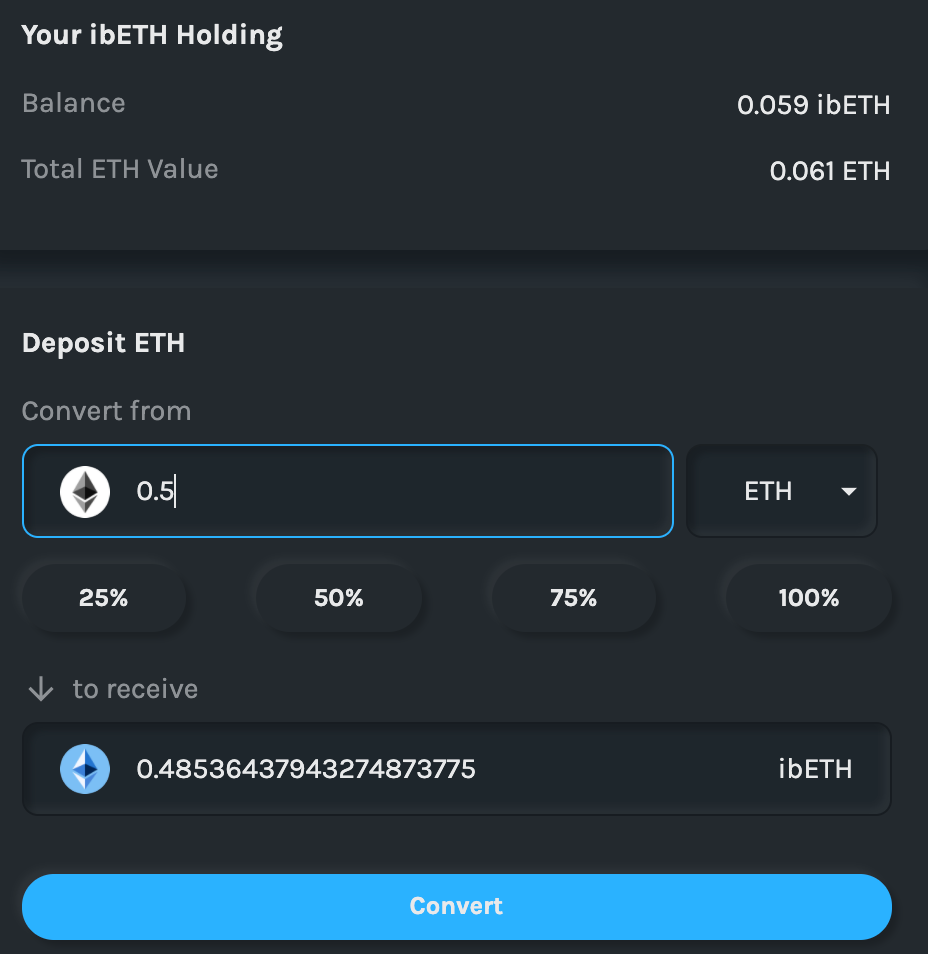

Step 1: Head on over to Alpha Homora’s ibETH page and connect your Ethereum wallet. The protocol currently only supports Metamask.

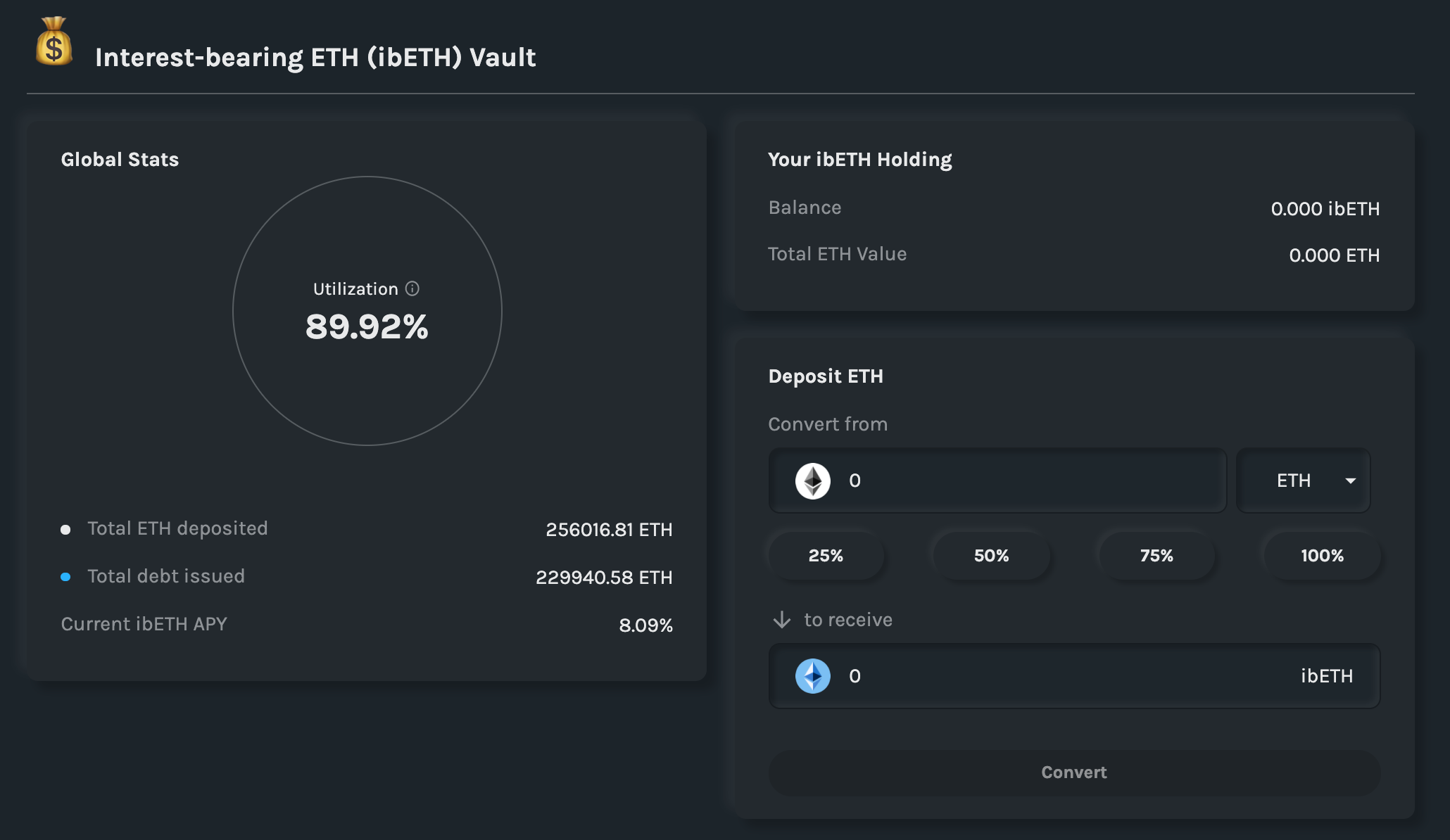

Step 2: Once connected, you’ll see the current interest rates (they change on a block-by-block basis), the utilization rate (which is a key determinant in the yield), and the amount of ETH locked in the protocol.

Step 3: Set the amount of ETH you want to convert to ibETH. Click on convert, and confirm all the transactions. Remember if it’s your first time using Alpha Homora, you’ll have to approve ETH spending before converting.

And that’s it! Once confirmed on-chain, you’ll receive your ibETH and you’re automatically earning interest from leveraged yield farmers.

You can verify your ibETH holdings by looking at the “Your ibETH holding” tab in upper right above the deposit module. Now, let’s dive into how you can leverage your yield farm to maximize your passive income.

How to boost yield farming rewards with Alpha Homora V1

For those who are interested in getting leverage on your yield farm, please reference the risk section and ensure you recognize what you’re getting into. Getting leveraged is risky business! But done properly, it can be lucrative strategy for responsible farmers.

Here’s how you can get leveraged with Alpha Homora V1.

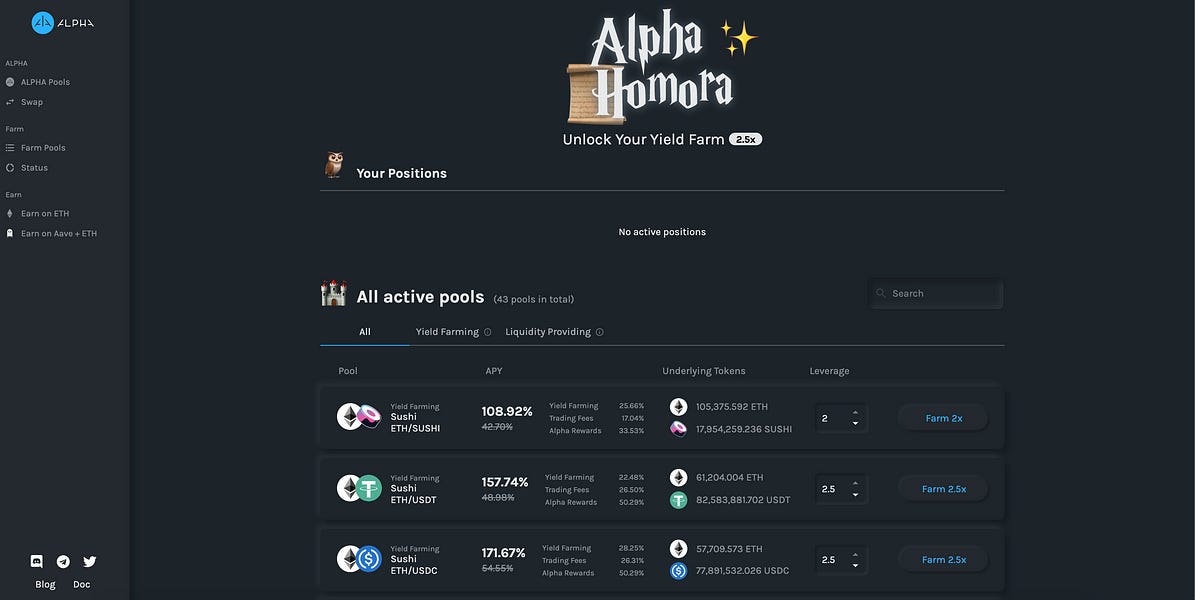

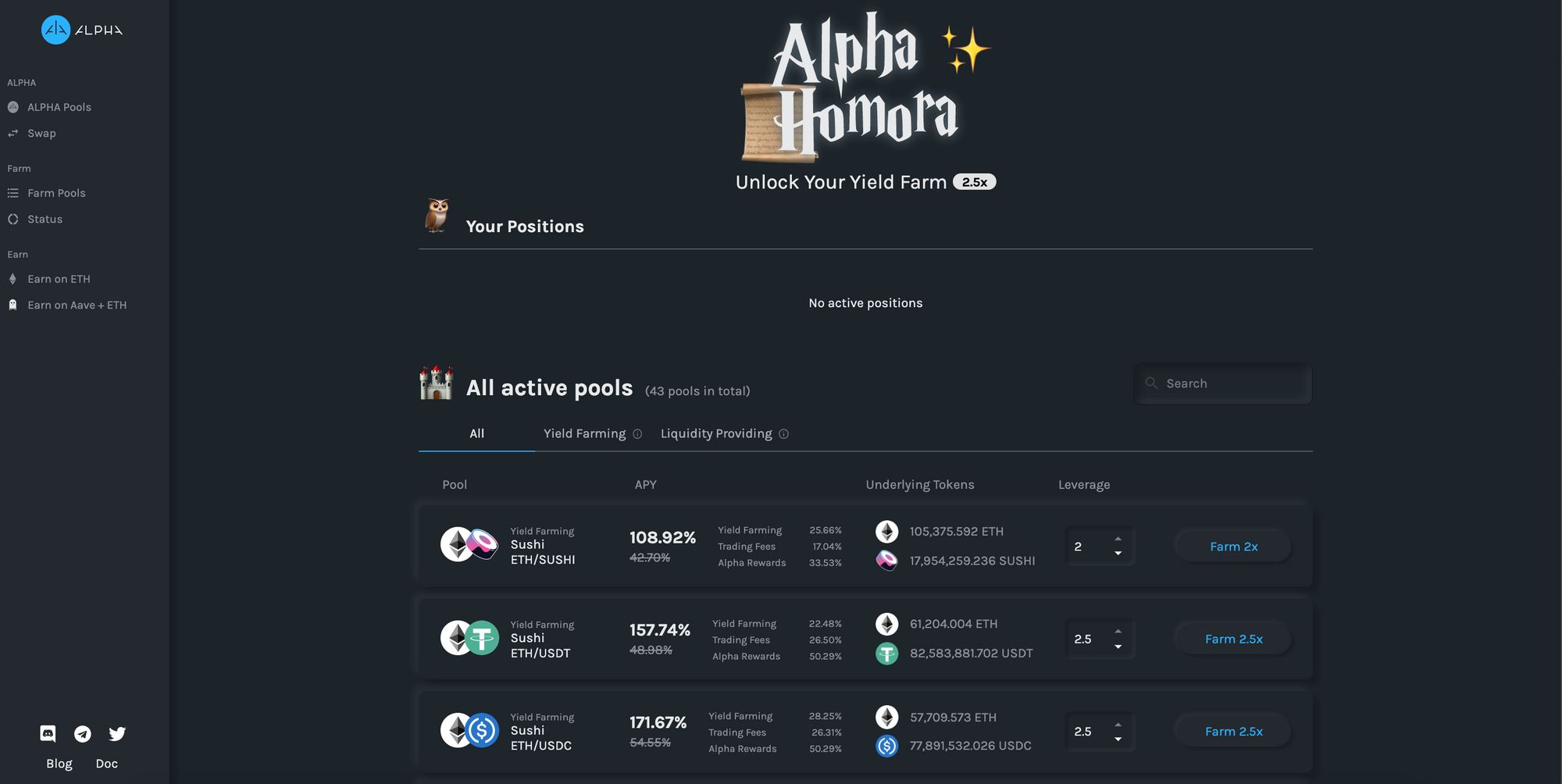

Step 1: Head on over to Alpha Homora’s Farm page. Per usual, connect your Metamask wallet.

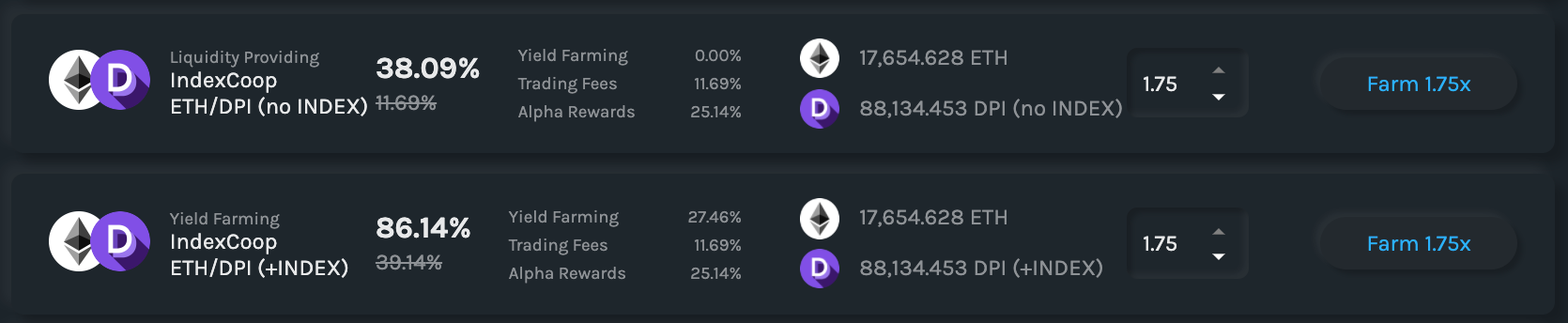

Step 2: Identify your yield farm of choice. For this tactic, we’ll take a look at the DPI/ETH pool. Note that there are two DPI/ETH pools, one that accounts for INDEX rewards and one that doesn’t. Since we’re yield chasers, we’ll go with the one that includes INDEX rewards. Go ahead and click on “Farm”.

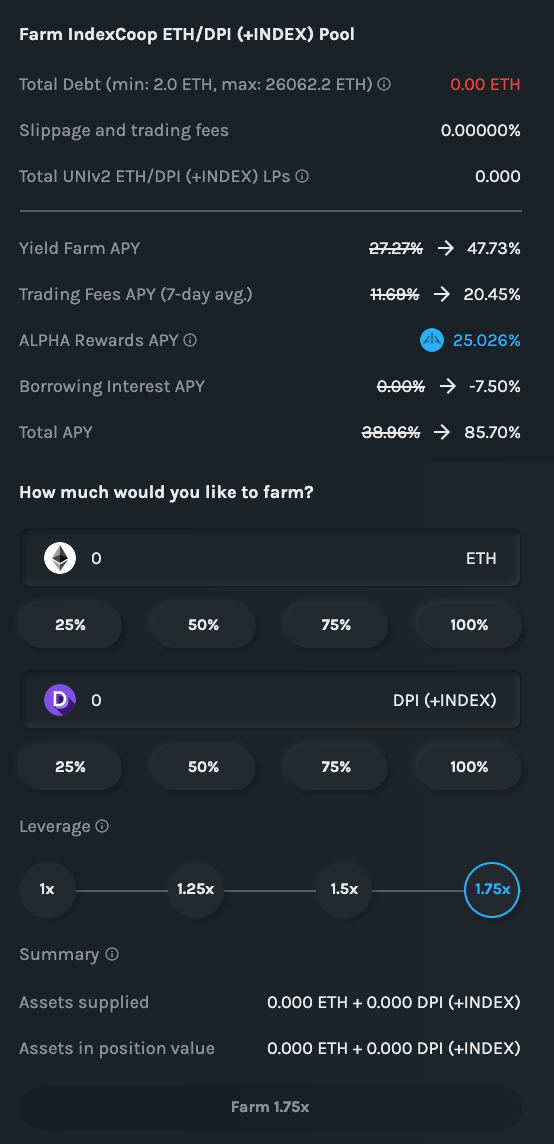

Step 3: Once you select your pool, you’ll be able to see an in-depth view on where rewards are coming from and how much you’re paying for that yield. This includes the normal yield farming APYs, the trading fees from the pool, as well as the bonus rewards from ALPHA (the protocol’s native token). From there, you can select your the amount of leverage you want to receive ranging from 1x to 1.75x (and upwards of 2.5x for some pools!).

Step 4: Input the amount of ETH and DPI you’d like to deposit. While you don’t have to deposit equal parts of both assets, you do have to deposit both assets into Alpha Homora. Also note that there’s a minimum of 2 ETH in debt! This can be a fairly high capital requirement for some users, so definitely worth mentioning. Once you’re ready, finalize all the above parameters and click on “Farm”.

Step 5: Confirm the transactions via Metamask! Per usual, if it’s your first time using Alpha Homora you’ll have to approve spending on the respective assets.

And that’s it! Once your transaction has confirmed on Ethereum, you’ll be earning leveraged yield from Alpha Homora.

⚠️ Note that anyone can compound rewards by executing a transaction on the pool by going to the Status page and clicking on “reinvest” on your pool (or any pool for that matter). Be sure to monitor your position and ensure you’re well collateralized according to the risk parameters. You don’t want to get liquidated!

Sneak Peak: How to leverage your yield farm with Alpha Homora V2

👉 Note: Alpha Homora V2 has yet to be released on mainnet. But it’s coming soon! This is a sneak peak tutorial on how you can leverage Alpha Homora v2 to maximize your yield farming gains. If you’re interested in doing this now, you can use v1 here!

- Select the pool on Alpha Homora V2. As mentioned above, Alpha Homora V2 will enable leveraged yield farming for liquidity pools on Curve, Balancer, SushiSwap, and Uniswap.

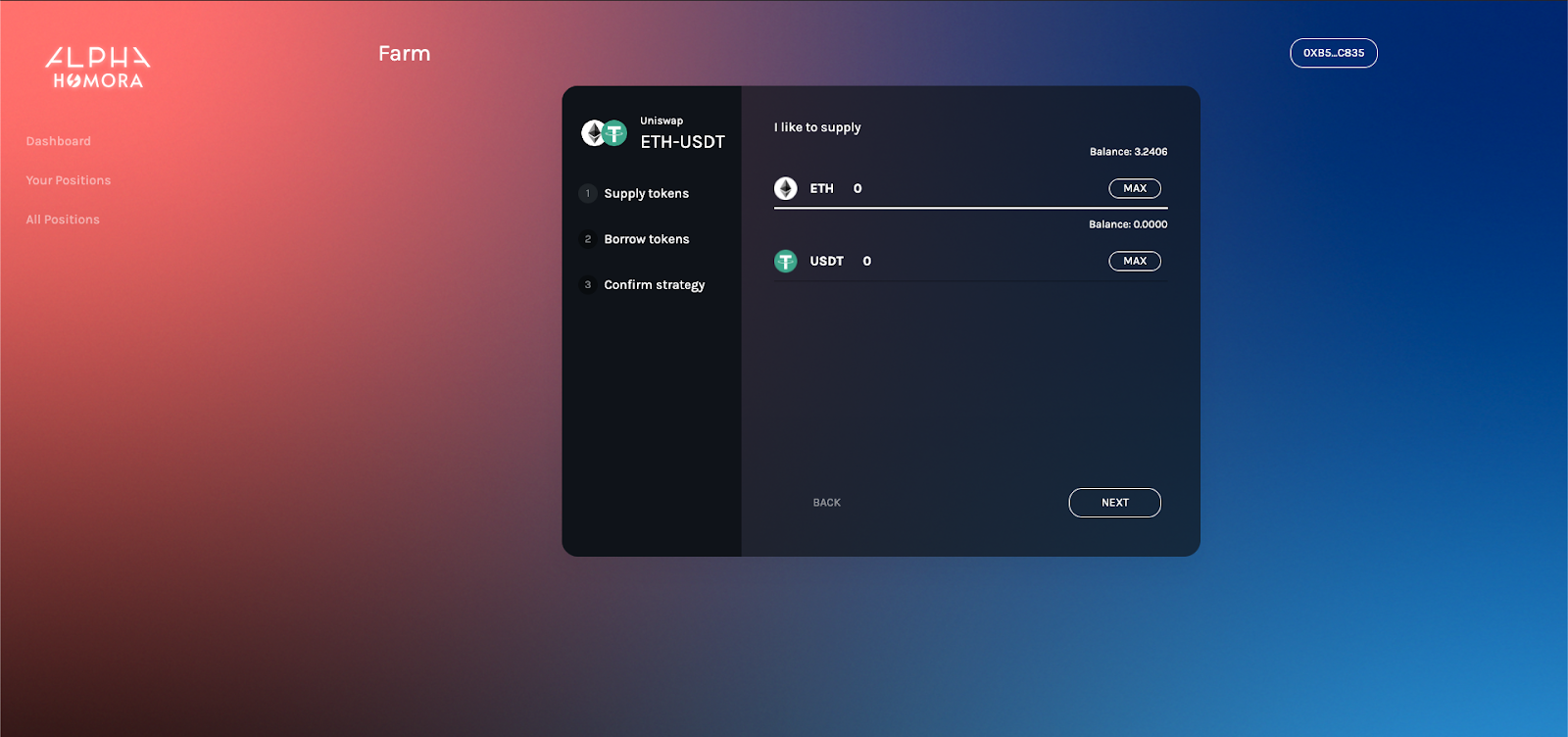

- Supply any of the 2 tokens for that pool. For instance, when leveraged yield farming on ETH/USDT pool on Uniswap, you can supply only ETH or USDT or both.

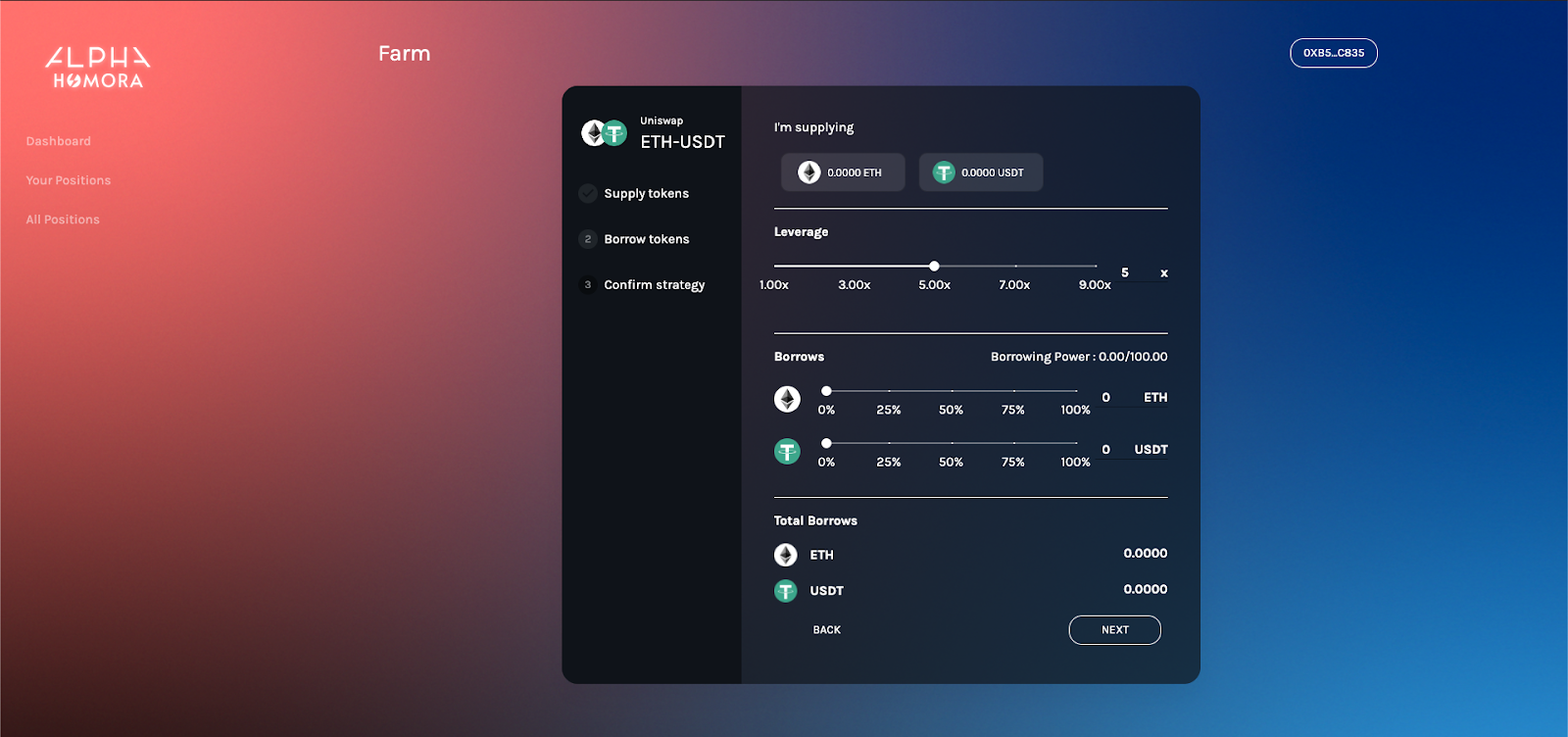

- Enter which asset you want to borrow at the leverage you’re willing to take on. You will be able to borrow multiple assets. For leverage on stablecoins (USDT, USDC, DAI), you can go as high as 9x!

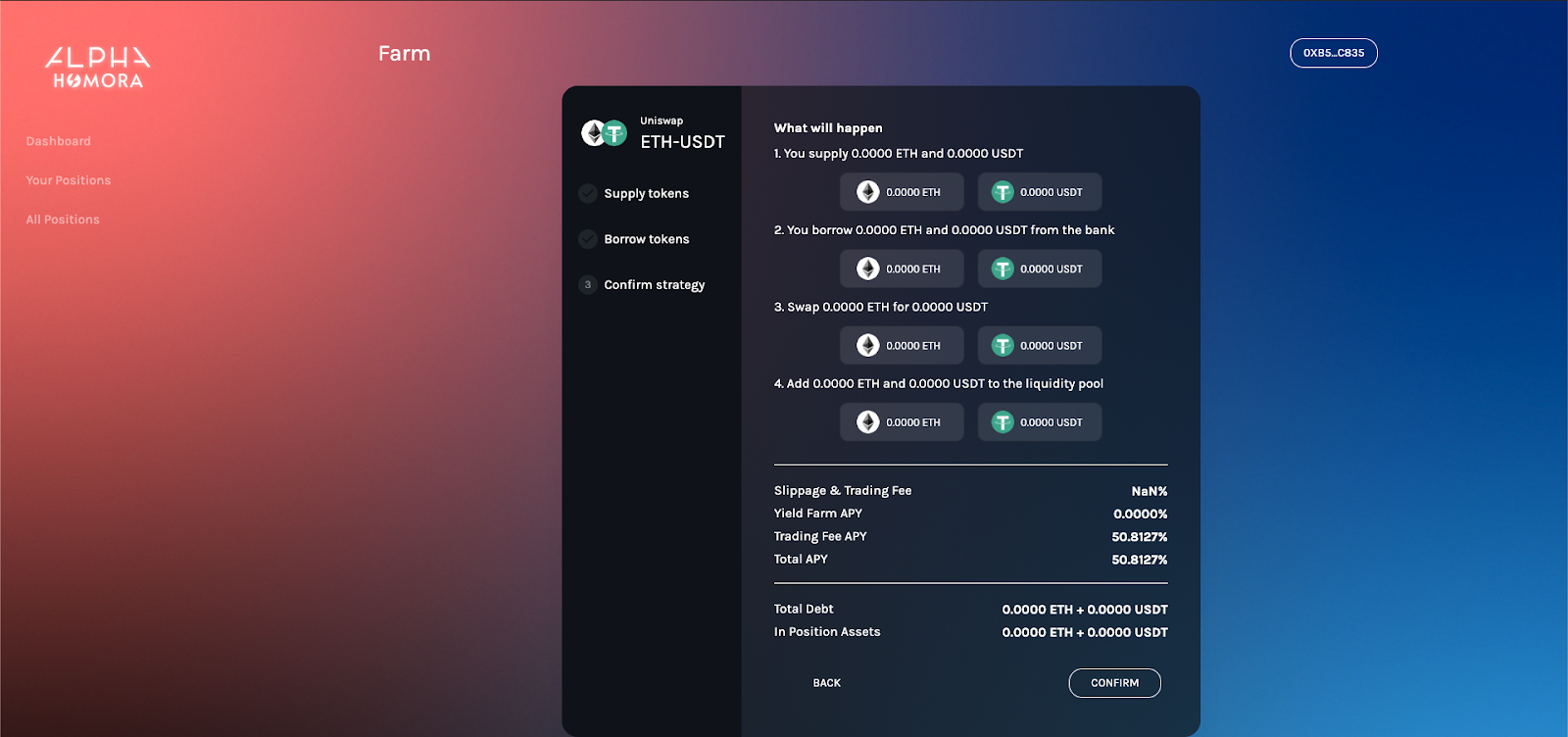

- Once you’ve inputed all your parameters, you can go ahead confirm the strategy. After that, Alpha Homora will take care of everything for you.

And that’s it! You’re all set. Once the transaction is confirmed on-chain, you’re earning bonus yield on your liquidity position.

Alpha Finance: What’s Next

Leveraged yield farming is only the first of many products slated for Alpha Finance Labs. The team intends to build a handful of products that will ultimately interoperate with each other to create a unique DeFi ecosystem in order to provide users with maximized yield while minimizing downside risk.

With that in mind, Alpha has a second product that is in private testnet now called AlphaX.

It’s a non-orderbook perpetual swap trading product that aims to allow anyone in DeFi to be able to easily trade perpetual swaps on-chain. As an example on the synergies between these two products, AlphaX will integrate with Alpha Homora and allow yield farmers to hedge their leveraged positions as a way to minimize their downside risks.

If you’re interested in learning more about Alpha Homora and the Alpha ecosystem, you can check out the website here and join the Discord to hop into the discussion.

Happy farming!

Action steps

- Leverage your favorite yield farm to earn bonus yields

- Lend out your ETH for ibETH and start earning a passive income

Learn more about Alpha Finance and what’s next

Still want to learn what is yield farming and how to invest in DeFi? You’re in the right place.

Author Bio

Tascha Punyaneramitdee is the Co-Founder and Project Lead of Alpha Finance Lab. She studied Economics at UC Berkeley and started her career as a Technology Investment Banker in San Francisco then in London. Previously, she was also a Product Manager at Tencent in Thailand and Head of Strategy at Band Protocol.