The Layer 2 Token Endgame

Dear Bankless Nation,

The Layer 2 race is on.

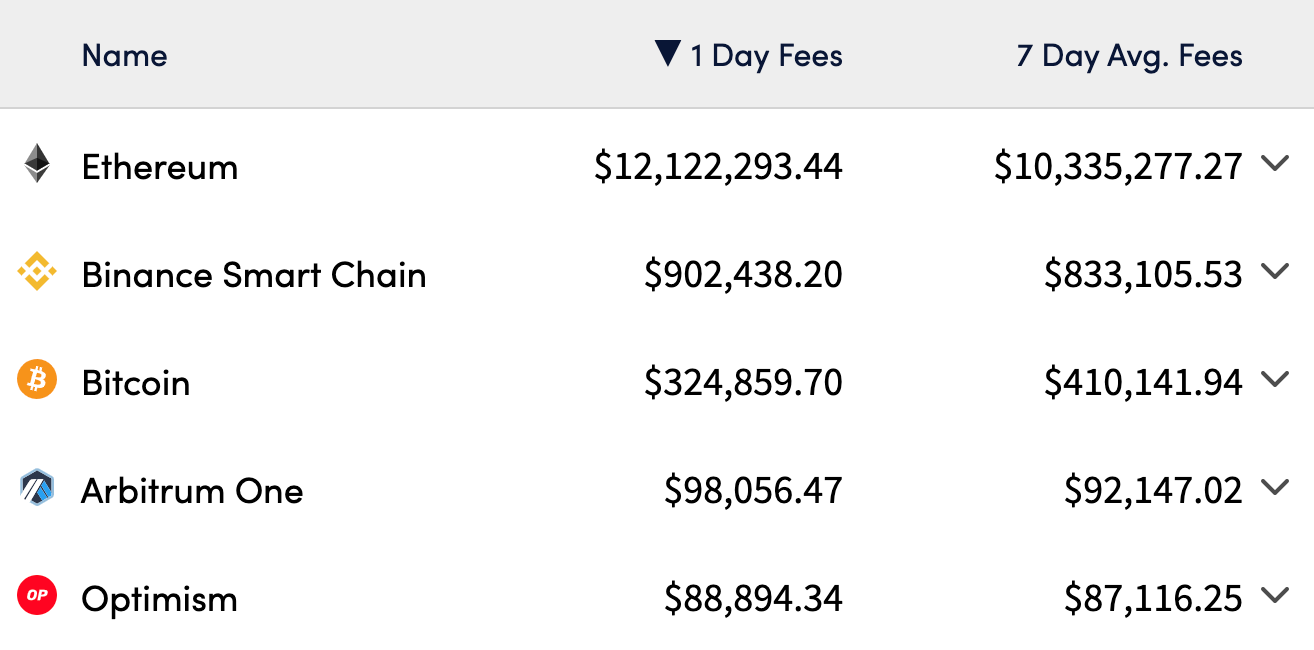

Arbitrum and Optimism sit 4th and 5th when it comes to fees earned by all Layer 1 and 2 networks — behind only Ethereum, BSC, and Bitcoin.

But the value accrued by Layer 2 networks — and in particular Layer 2 tokens — is just beginning. There’s a massive growth curve ahead.

The success of Layer 2 tokens all comes down to how they’ll implement value accrual into their native tokens in the future.

That’s why investing in L2 tokens is all about forecasting.

Join Bankless analyst Ben Giove in a deep dive on the Layer 2 token investment endgame.

It’s basically an alpha bonanza. Enjoy.

— Bankless

Investing is an exercise in forecasting. Savvy investors don’t make decisions based on the present, but rather the future and the potential for long-term value creation.

One sector of the crypto market in which traders are exhibiting short-term thinking right now is L2 tokens. This represents a big opportunity for prescient investors.

Layer 2 rollup tech on Ethereum continues to grow in user adoption, developer focus, and practical utility. It represents the bleeding edge of Web3. Recently, Layer 2 tokens — and in particular the valuation of L2 tokens — have come into the limelight following the launch of Optimism’s OP.

OP has been met with skepticism from traders and investors across crypto.

Let’s breakdown the three top areas of concern I’ve seen:

1. There’s no utility.

Right now, OP is currently only used for governance via Optimism’s bicameral governance system. In this system, OP holders make up what's known as the “token house.” The token house is able to vote on upgrades and the allocation of incentives to different projects within the rollup’s ecosystem.

2. The token does not accrue any value.

Rather than be directed to token holders, network revenue — generated from the rollups’ sequencer (more on this later) — is being used for retroactive public goods funding. The allocation of this value will be determined by the second branch of Optimism governance — citizen’s house — of which membership will be conveyed through a non-transferrable NFT.

3. There is a low circulating supply, and large supply overhang.

OP currently has a market cap of $187.9 million and an FDV of $3.7 billion. That means just 5% of the OP total supply is circulating.

These critiques are warranted. But they’re based on the OP token of the present — not how it and Layer 2 tokens will look in the future.

This disconnect represents an opportunity. The OP token, along with L2 tokens like it, is on a path towards greatly increasing in utility and becoming highly value accretive. That’s because the design of L2 tokens in the future will look radically different from what it is today.

Let’s take a look at why this will be the case..

The L2 Business Model

To get a better sense of how L2 tokens will accrue value, you need an understanding of the Layer 2 platform business model.

You can think of rollup tech providers as resellers of blockspace: They purchase blockspace on L1, make use of it more efficiently, and sell it at a premium to users via Layer 2.

Revenues

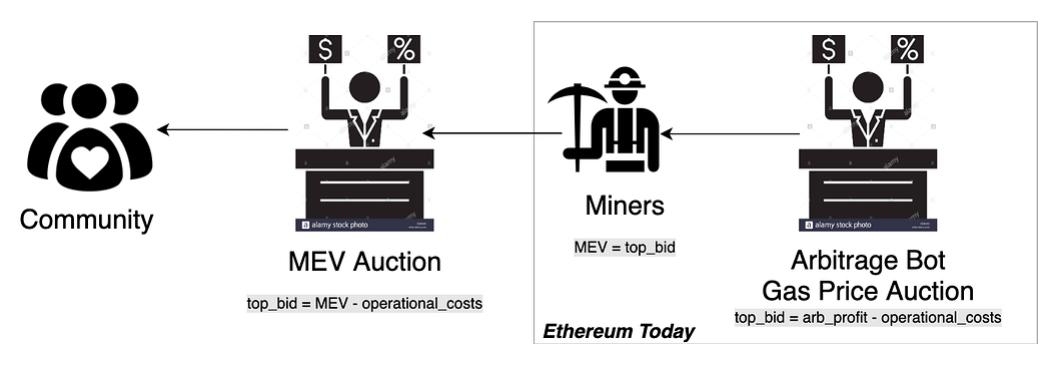

Rollups generate revenue from two sources: transaction fees and miner/maximal extractable value (MEV). MEV is a form of rent-seeking extraction of value that opportunistic block producers (miners in PoW, validators in PoS) can perform by specifically reordering transactions (More on MEV as explained by David here).

Just as users pay a gas fee to a miner or validator on Ethereum, they must also pay one on L2 to what's known as a sequencer. The sequencer is the entity responsible for ordering, batching, and submitting transactions to L1. As the sequencer fulfills the role of determining the order of transactions, it can also earn revenue from extracting MEV .

Costs

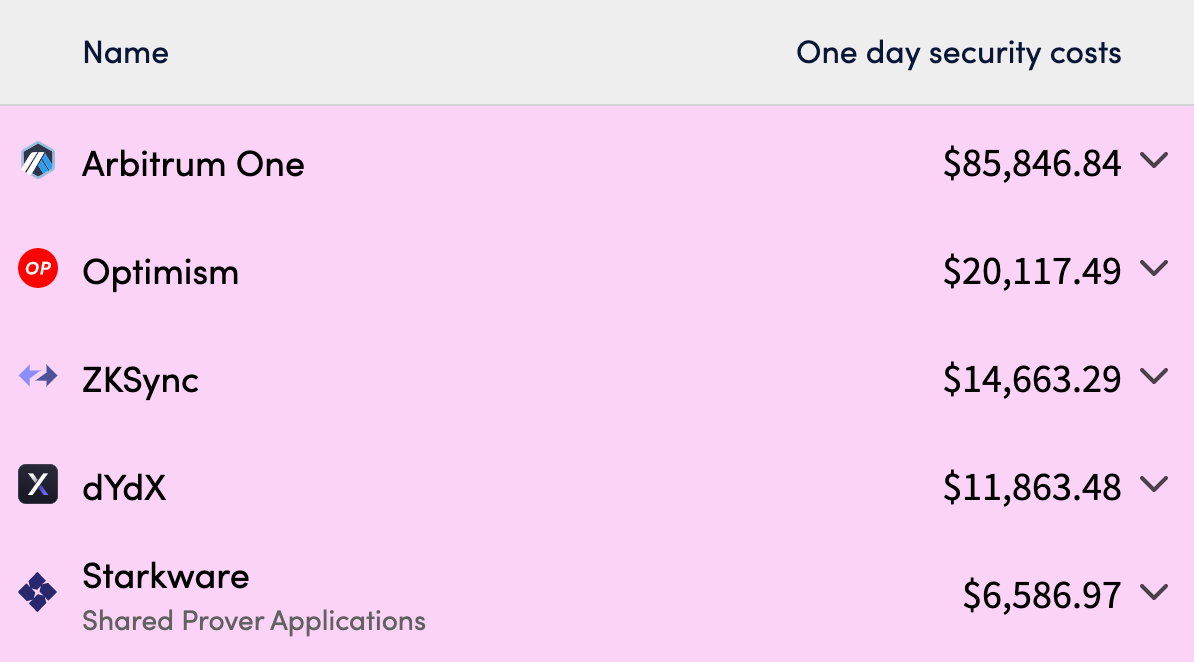

To function, rollups incur several costs which are passed on to users in the form of gas fees.

The first component of this cost structure is that of the computational resources required to execute a transaction on L2. The second is the cost of batching and verifying transactions. For optimistic rollups, that entails a fraud/fault proof, and for zkRollups, a zero-knowledge proof.

Layer 2’s also incur a cost for publishing transaction data — known as calldata — on the L1. The calldata cost makes up the heart of what is known as the “data availability problem,” which refers to the costliness of publishing and storing data on a network such as Ethereum.

There are a number of solutions in the works to solve for Layer 2 costs.

The first is calldata compression, which decreases the size of data posted by an L2 to L1. While rollups can utilize data compression techniques on their end, an upcoming EIP proposed by Vitalik — EIP-4488 — aims to help on this front as well.

Other options include danksharding and proto-danksharding, which increase the amount of data that can be stored on Ethereum, and special-purpose data availability layers like Celestia.

Profit

The way in which rollups can “profit” through this model is by charging a “premium,” i.e. pocketing the spread between the transaction fees paid by users and the cost of purchasing L1 blockspace.

This is what Optimism has done through implementing what it calls a “fee scalar,” a dynamic additional fee charged to users per transaction. Optimism is targeting a 10% margin for sequencer profits. This profit represents a potential source of both value that can be directed to an L2 token and its holders.

MEV

Another source of revenue for rollups is MEV. Increasingly a key differentiator between L2s, each rollup platform’s approach to MEV has significant implications for the future value accrual of its native token.

To better understand this, let’s explore the differences between the Optimism and Arbitrum approach to MEV.

Optimism is taking what’s known as an “offensive” approach to MEV. Rooted in the belief that MEV is fundamental to blockchain and attempts to remove it are futile, Optimism will eventually incorporate what is known as MEV auctions (MEVA).

MEVA seeks to isolate and redirect the revenue generated by MEV by auctioning off the right to extract it to the highest bidder.

Optimism plans to allocate the revenue it earns via MEVA to funding public goods via retroactive public goods funding. In doing so, the L2 believes it will be able to create a self-sustaining ecosystem that, in the long run, will provide more value to all its stakeholders.

Arbitrum on the other hand, is taking a “defensive” approach to MEV, which is grounded in the idea that MEV is a tax on users. Rather than seeking to capture and re-allocate it, Arbitrum focuses on minimizing MEV within its system.

To do this, the Arbitrum network will implement what is known as Fair Ordering or Fair Sequencing, wherein all transactions in a batch are processed based on the order in which they are received. In doing so, Arbitrum intends to reduce the amount of MEV extracted, thereby making the rollup less expensive and more attractive to users and builders.

The debate surrounding how L2s should handle MEV is nuanced and complex, and extends far beyond the scope of this article. However, there are some implications for the value accrual of L2 tokens that are worth unpacking if we’re talking about investment strategy.

What MEV means for your Layer 2 investment strategy

Offensive MEV provides an L2 with a stream of revenue that can be used to directly accrue value to its native token. While Optimism’s MEV revenue will at first be used entirely to fund public goods, a portion — or even all — can eventually be allocated to tokenholders through either a traditional single-sided staking pool, or through the decentralization of the sequencer (more on that later).

In being used to fund public goods, MEV may help an L2 token indirectly accrue more value through improving the overall health and long-term sustainability of its ecosystem.

While defensive MEV deprives a rollup of a source of revenue that can be used to directly accrue value to its native token or bolster its ecosystem, it may indirectly improve the value of an L2 token. Users may be more inclined to transact on a network in which MEV does not run as rampant, bolstering its adoption and network effects.

Although it remains to be seen which approach will lead to greater long term adoption, it’s clear that MEV could be used to accrue value to L2 tokens. The Layer 2 platforms that embrace MEV will accrue value more easily to their native asset than those that do not.

Decentralizing The Sequencer

Although L2 tokens can be used to decentralize a variety of protocol functions, the clearest method through which one can capture the value of transaction fees and MEV — while also increasing utility — is by being used to decentralize the sequencer.

Currently, sequencers on many prominent rollups are centralized and operated by a single entity. For example: Offchain Labs and Optimism PBC are the sole operators of the sequencer for Arbitrum and Optimism respectively.

These systems were put in place as a guardrail due to the nascency of each platform.

Moving forward, it’s critical that these sequencers eventually decentralize in order to maximize censorship resistance.

Layer 2’s like Arbitrum and Optimism can achieve this through the use of their native token. There are a few designs for a decentralized sequencer which can take shape. For instance, the sequencer can be selected through a proof-of-stake (PoS) methodology.

Here’s how that could work: similar to PoS on an L1, a prospective sequencer would stake a rollup’s native token for the right to serve in the role. The likelihood of each staker being selected would be proportional to the size of its stake, with the newly selected sequencer able to capture the value generated by the rollup through earning profits from transaction fees, MEV, and potentially token rewards.

In the case of a rollup like Optimism with an offensive MEV strategy, this mechanism can be implemented in conjunction with MEV auctions:

A staking mechanism would provide a source of utility — and therefore demand — for L2 tokens. In order to participate in the system and earn the aforementioned cash-flows, prospective sequencers would be required to purchase tokens on the open market.

While the details have yet to be confirmed, zkSync has confirmed its token will be used for this purpose.

The Path Is Clear

There is a clear path for L2 tokens to evolve in usage and accrue value. Rollups generate profit from transaction fees and MEV, which can be used to directly accrue value to native tokens, or indirectly through reinvestment into areas such as public goods.

L2 tokens can capture that value by being used to decentralize the sequencer or other protocol functions, such as through a PoS system. This creates further utility and demand for L2 tokens.

If these tokenomics look familiar, it's because they are: They mirror that of ETH itself.

Post-merge, ETH will be used within a PoS system that will enable stakers to earn cash flow in the form of issuance, gas fees, and MEV.

Although it is very unlikely L2 tokens will be net-deflationary — or have the same monetary premium as ETH — they may still trade with an “index premium,” as they represent the broadest way to gain exposure to their respective ecosystems.

While much of the specifics surrounding L2 token design are still in flux, one aspect is certain: the L2 tokenomics of today will not be the L2 tokenomics of tomorrow.

Savvy investors should be looking at how each L2 platform is implementing value accrual strategies into its token — what L2 tokens will represent in 2023 and beyond — and then act accordingly.

Action steps

- 🔍 Explore Layer 2 business models and tokens

- 📚 Read The Best Ways to Invest in Layer 2