The best ways to invest in Layer 2

Dear Bankless Nation,

Layer 2 is still early…but it’s already taking off.

Yet I believe its potential is still dramatically underestimated by the market. There’s a lot of opportunities still ahead.

The question is: how does a savvy crypto investor get exposure to this upside?

One of the best ways is to just buy ETH.

Layer 2’s like Arbitrum, Optimism, and dYdX burn ETH each transaction. They use ETH as money. And they use ETH as reserve collateral for DeFi. Bullish ETH. 🚀

But aside from ETH…are there other ways to get exposure to Layer 2?

That’s what Ben explores today.

- RSA

Never underestimate the power of degeneracy.

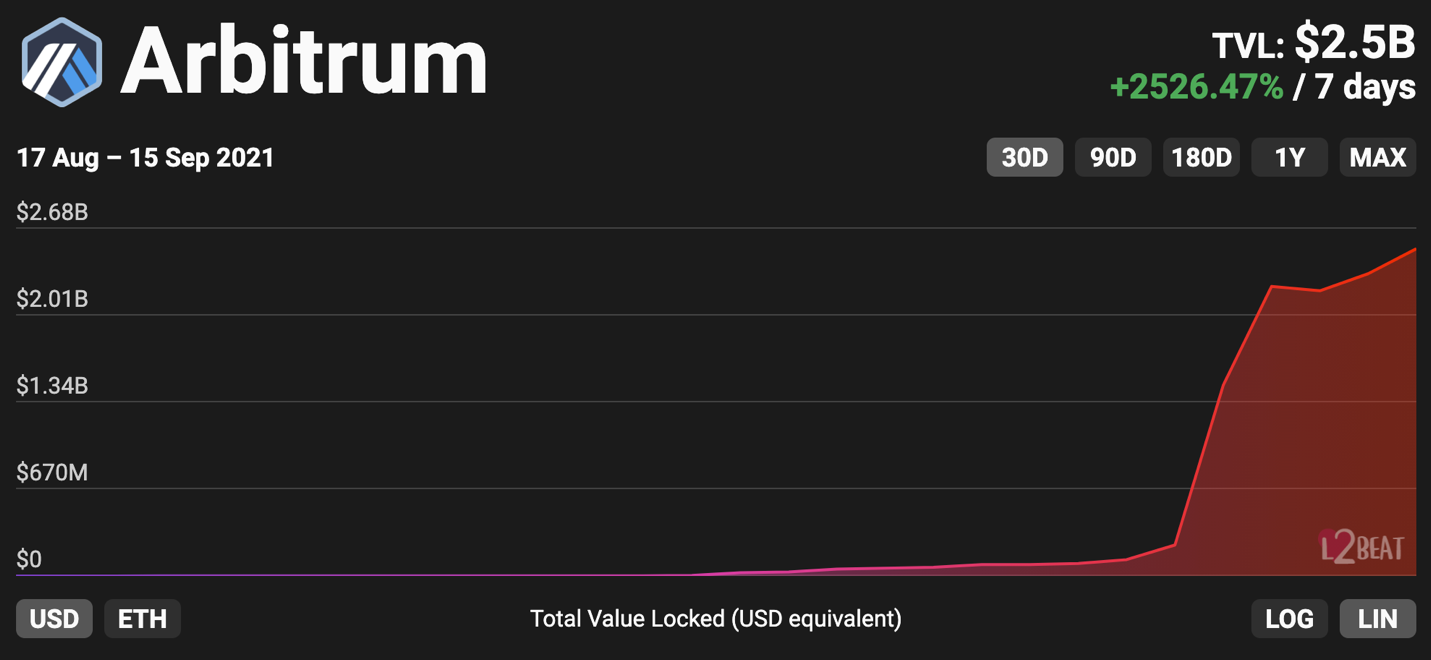

While the benefits of Layer 2, such as reduced gas fees, near-instant confirmations, and inheriting Ethereum’s security, there had yet to be a catalyst to spur their adoption. That changed with the launch of Arbinyan, the first major yield farm on Arbitrum, with the TVL of the network rising from $238 million to over $2.5 billion in under five days.

Despite still being in its early stages, this has been a significant demonstration of the overwhelming demand to use Ethereum L2.

It of course also poses the question: How can an investor gain exposure to this trend?

Let’s explore a few ways of how to do so.

⚠️ DISCLAIMER: NOTHING IN THIS ARTICLE SHOULD BE CONSTRUED AS INVESTMENT OR FINANCIAL ADVICE. DO YOUR OWN RESEARCH.

Opportunity #1: Infrastructure

Layer 2 infrastructure represents a “pick and shovels” approach to getting exposure to L2. Rather than betting directly on the success of an individual application or network, investors can allocate to the infrastructure layer instead, choosing to gain exposure via the tools used to power them.

This approach may be suited towards investors that want to avoid picking winners in the Layer 2 ecosystem, but still want ownership stakes in assets that will benefit from its growth. Additionally, due to their network effects and the large barriers to entry for competing services, many infrastructure protocols are quasi-monopolies and have limited competition.

Let’s touch on a few that are already integrating into Layer 2.

Chainlink (LINK)

DeFi protocols need secure, trust-minimized oracles feed in order to enable activities such as contract pricing and timely liquidations. For instance, nearly every major DeFi protocol that has deployed on an optimistic L2, including Synthetix, Aave, Curve, SushiSwap, Dopex, and others have already integrated Chainlink (LINK) oracles for their price feeds to enable activities such as timely liquidations.

In addition to providing broad exposure to DeFi as a whole, Chainlink may also be more deeply integrated into Arbitrum in the future.

The Graph (GRT)

Not only do protocols need access to off-chain data, but on-chain as well.

The Graph is a key component in the infrastructure stack that provides this service by indexing on-chain data and allowing applications to query it in a decentralized and trustless manner. The protocol supports a variety of different networks including L2s such as Arbitrum and Optimism and is utilized by several applications with L2 deployments such as Uniswap, Synthetix, and Futureswap.

Similar to Chainlink, this can provide broad-based exposure to both L2 networks, and prominent applications without needing to make specific bets.

Hop and Connext (Retroactive Farming)

While the speed and reduced gas fees of L2’s offer significant improvements to user experience when compared to L1, they still present a unique set of challenges. A few to note are the seven-day withdrawal times from Optimistic Rollups, as well as the difficulty in migrating liquidity between L2s.

Two projects that aim to solve this are Hop Protocol and Connext, which allow for users to seamlessly transfer assets between different EVM-compatible networks, and enable for “fast” withdrawals where users can circumvent the withdrawal period.

While these projects do not have tokens, it could be worth experimenting with these systems on the chance they offer a retroactive airdrop to early users!

Opportunity #2: Applications

A second way investors can get exposure to Layer 2 is through investing in popular applications. Any blockchain or L2 will only go as far as the quality of the applications built on top of it — nobody will use a network if there is nothing worth using.

Because of this, applications that live on one, or multiple L2s, can provide investors with exposure, varying in degree, to those ecosystems. Importantly, L2s represent new, emerging markets where established protocols can grow their customer base, thereby increasing their usage and revenues.

There are two main categories of applications that can provide an investor with L2 exposure: “Early Adopters” who migrated over from L1 and “L2 Natives” whose applications are either exclusive to L2 or experience a substantial increase in functionality as a result of the deployment. Early Adopters may prove “safer” as it doesn’t entirely rely on the success of the underlying Layer 2, while L2 Natives can represent a more concentrated bet on a particular network.

While certainly a non-exhaustive list (there are plenty of opportunities not included) let’s go through a few examples of each below.

Early Adopter #1: Uniswap (UNI)

Uniswap is the largest decentralized exchange on Ethereum L1 by volume and one of the earliest adopters of L2 through their years-long partnership with Optimism. The partnership culminated in their deployment to that network in July 2021. The protocol currently holds over $31 million in liquidity on the network, and has facilitated north of $10 million in volumes in recent days.

Along with Optimism, Uniswap has also recently launched on Arbitrum. That deployment has experienced even greater usage, with over $37 million in value locked and generating over $20 million in daily volume over the past four days.

Early Adopter #2: SushiSwap (SUSHI)

SushiSwap is another prominent decentralized exchange that has been an early adopter of L2. Already holding significant market share on Polygon, and with deployments on other chains such as Fantom, Avalanche, and Harmony, SushiSwap was also one of the first protocols to go live on Arbitrum.

The protocol’s deployment on Arbitrum has been massively successful, with over $33 million in liquidity, and facilitating more than $24 million in trading volumes every day since September 10. Furthermore, Sushiswap has even managed to outperform its chief rival Uniswap at times, with volumes that have exceeded $125 million on certain days.

While the SushiSwap team has indicated that they may hold off on immediately deploying to Optimism, given their multi-chain strategy, it seems likely that they will eventually migrate to the network.

Early Adopter #3: Curve (CRV)

Curve is yet another decentralized exchange that has swiftly embraced L2. Owners of a near-monopoly on like-asset swaps on both Polygon and Fantom, the protocol has also recently gone live on Arbitrum. The deployment currently offers two-like asset pools, and one V2 pool which combined already hold over $131 million in liquidity and are facilitating over $5.9 million in daily volume, while serving as a hotspot for yield with a minimized risk of impermenant loss.

As with SushiSwap, while it is unclear if the protocol has plans to launch on Optimism, given their multi-network inclinations it also seems likely that they will deploy upon the full mainnet release.

L2 Native #1: Synthetix (SNX)

With their growth stifled by high gas fees on L1 due to the computationally intensive nature of their transactions, Synthetix is one protocol set to see its full capabilities unlocked by L2.

The synthetic asset protocol has been an early supporter and adopter of Optimism, and is seeing other projects build on top of their deployment. This includes Kwenta, an exchange where users can mint and trade Synths, as well as Lyra, an options protocol that has recently gone live and has two incentivized pools that hold over $12 million in value locked.

L2 Native #2: Dopex (DPX)

Another derivatives project that may be poised to reap the benefits of the reduced fees and faster confirmations offered by L2 is Dopex.

A decentralized options protocol backed by prominent figures in DeFi such as Tetranode and DeFiGod, the protocol’s farms currently hold more than $75 million in value locked. While the options protocol itself is currently on testnet, it is planning to deploy its mainnet on Arbitrum.

This means the project could not only provide a way to invest in the emerging DeFi derivatives sector, but provides increased exposure to the optimistic rollup ecosystem as a whole.

L2 Native #3: dYdX (DYDX)

dYdX is yet another derivatives protocol that has seen its capabilities unleashed by L2.

Building its own rollup on StarkWare, the decentralized perpetuals exchange has recently launched its liquidity mining program that included a retroactive airdrop of the DYDX token that for some users was north of $50,000. The protocol has begun to see increased traction as a result, with daily volumes on the platform rising over 10x in the span of six weeks and now sitting consistently north of $600 million.

Retroactive Farming for L2 Assets

Perhaps the most direct way for an investor to gain exposure to the success of a particular L2 is investing in the native token of the network itself.

While the design space for L2 tokens is emerging, and it is unclear if all networks will have one, L2 tokens can play a similar role to L1 tokens in providing index-like exposure to a given network. Although it is unclear if all L2s will issue tokens, there are some opportunities for users to put themselves in position for retroactive farming rewards.

Loopring (LRC)

Loopring is one of the most prominent application-specific rollups within the Ethereum scaling ecosystem, providing a suite of products built on their ZK-rollup including an AMM and order-book exchange.

Investors can gain exposure to the protocol, which has generated over $2.7 million in revenue over the past year through the LRC token, which governs the system and used as a collateral of last resort. Investors can either buy the token directly or earn it by providing both liquidity to either exchange and by placing among the top-25 traders by volume for a select group of incentivized pairs.

Immutable X (IMX)

Immutable X is a ZK-rollup built on top of StarkWare.

Optimized for NFT exchange and usage within the emerging gaming sector, the protocol is currently incentivizing usage of its platform with play-to-earn rewards via the IMX token. The token plays several key roles within the functioning of the network, as users are required to pay 20% of transaction fees in IMX and can use the token to vote for governance proposals. In addition, IMX holders who stake their tokens can earn a share of fees paid to the network by users in the form of IMX.

Optimism & Arbitrum (Retroactive Farming)

We’d be remiss to talk about Layer 2 without mentioning the two elephants in the room: Optimism and Arbitrum.

The two largest optimistic rollups, both of which have raised millions of dollars in funding, currently both do not have tokens. Furthermore, despite being live in limited form for only a few months, the networks are generating millions of dollars in fees which are not being directed in any way to their users. While it is unclear if these projects will ever have tokens, it is likely worth being an active user of these systems in the event that they ever launch a retroactive airdrop for their early adopters.

Conclusion

Layer 2 season has finally arrived.

No longer theoretical, there are several different ways in which investors, with varying risk tolerances and desired degrees of exposure, can benefit from the boom in L2.

Whether it be through infrastructure, applications, or native asset farming, there are plenty of different opportunities. Will you choose any?

Action steps

Capitalize on any of the opportunities to get exposure to Layer 2

📚 Onboard to Layer 2s with these guides: