Layer 2 Tokens Are Coming

Dear Bankless Nation,

Layer 2 tokens are coming.

Arbitrum, Optimism, zkSync, Starkware—all of these prominent L2s are tokenless!

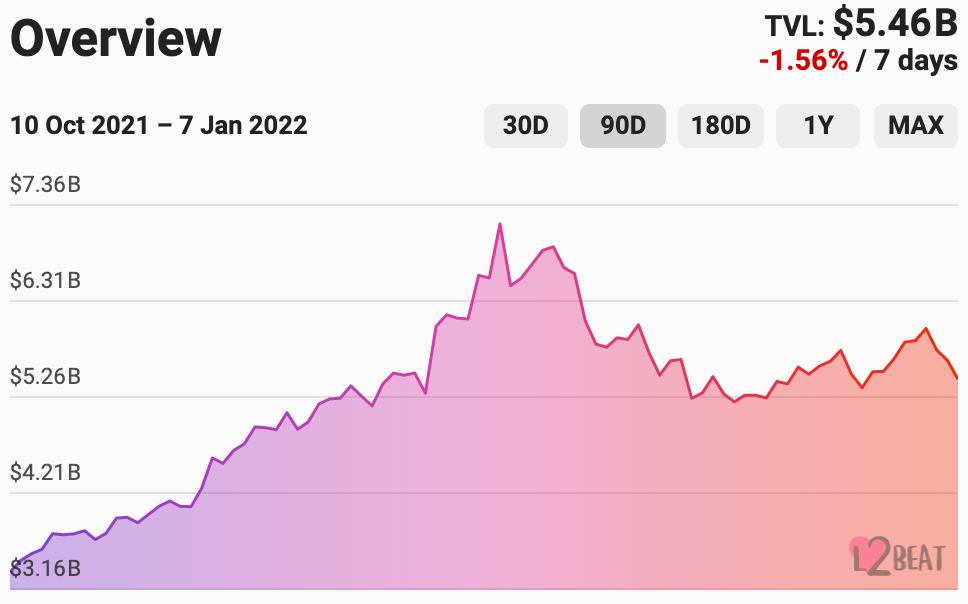

Yet they’re growing fast, with billions of dollars in value locked and amassing more economic activity each day. The future of Ethereum is Layer 2.

So the question is “wen token??”

zkSync has confirmed it will be community-owned.

Arbitrum and Starkware haven’t commented.

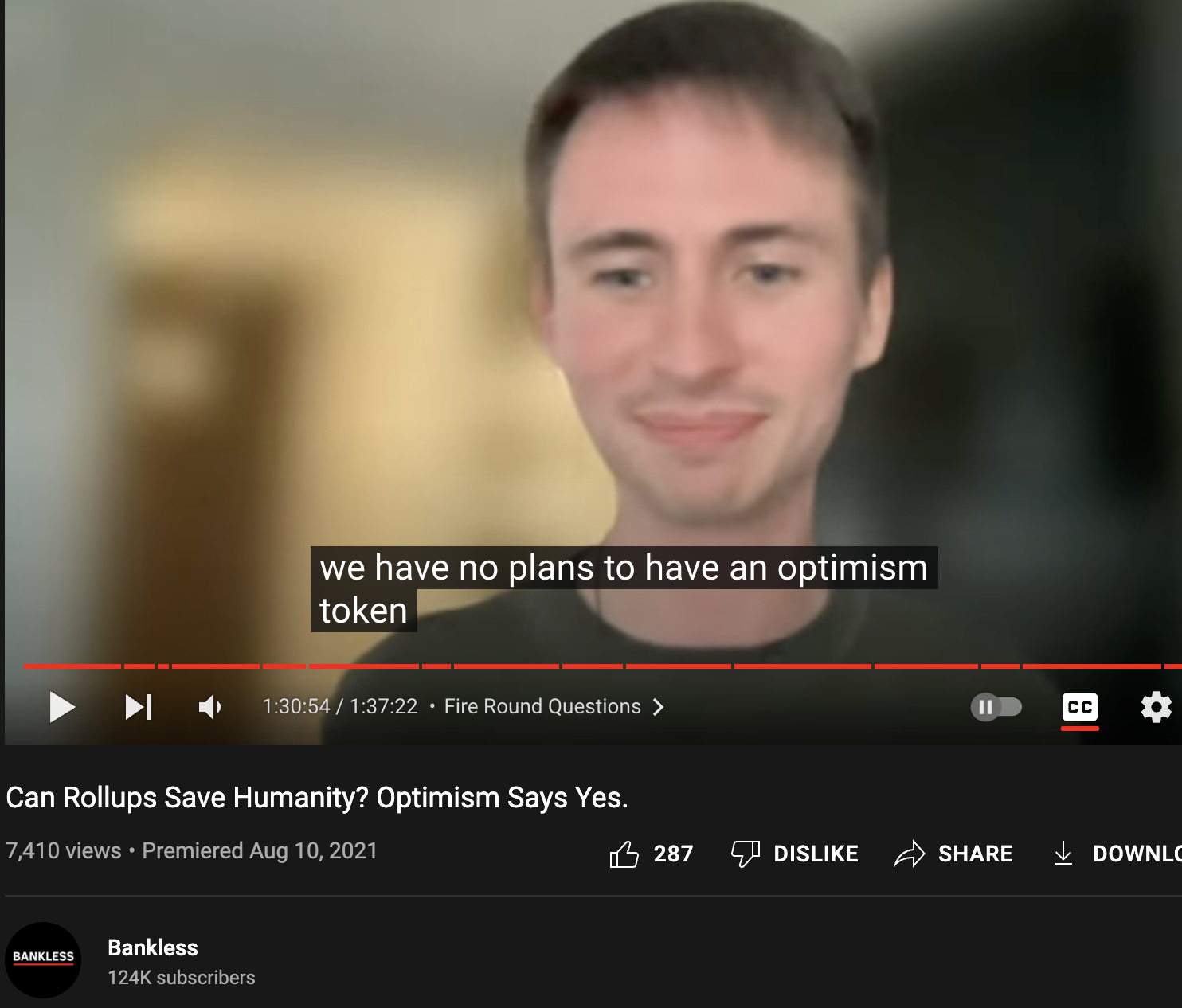

The Optimism said on our podcast recently they have no plans for a token.

Whether or not they publicly confirm tokens isn’t really relevant. They all have cap tables—filled with team members and investors. They all need to incent growth and liquidity.

In the word of Charlie Munger: Show me the incentive and I'll show you the outcome.

The incentives are there—the outcome seems obvious.

In order to front-run the L2 gold rush there are many questions to answer:

- What will L2 tokenomics look like?

- What sort of incentives will they launch with?

- What would they govern?

- What would the token allocations look like?

- What are they waiting for?

- And could rollup tokens be parasitic to ETH?

We brought in the guy who helped launch Immutable’s IMX token to share his thoughts on all of this.

Let’s get prepped for the L2 gold rush.

- RSA

Layer 2 (L2) tokens are coming and they will explode in popularity, but there’s been very little info about what L2 tokenomics look like, and importantly, “wen token?”

This article will dive into exactly that.

For context, I led Immutable’s token launches for IMX, GODS, and GOG on StarkEx. As such, I want to share my experience in this emerging area in crypto.

Although I worked with the Starkware team, I have no insider information about any of these L2 tokens. This is mainly what I think good rollup tokenomics look like and how I think they’ll come about. All of this is just an educated guess.

Agenda

- Vampire attacking alt-L1s through aggressive airdrops/incentives

- Staking tokenomics and Governance

- Rollup cost subsidization

- Token allocations

- Bridges, fiat on-ramps, and Tokemak partnerships

- EVM-compatibility

- MEV Accrual/Prevention

- Whether rollup tokens are parasitic to ETH

The Rollup Landscape

If you need a rollup refresh, check out DCBuilder’s great article that takes a deep dive into the existing rollup landscape.

The Big Four—Arbitrum, Optimism, zkSync, and StarkNet—currently have whitelisted apps and/or centralized sequencers and provers, but have ambitious plans to decentralize sequencers and increase permissionless in 2022. Notably, Arbitrum recently went down because of this central point of failure.

They need to decentralize, especially as value locked in these technologies continues to grow. The obvious answer here is to launch a token.

So…Wen Token??

I believe rollup tokens will arrive late 2022 and sometime in 2023 in the following order: zkSync (confirmed) → StarkNet (no comment) → Arbitrum (no comment) → Optimism (public denial).

With that said, any project—including Layer 2s—should only launch their token after they find product-market fit. And I think rollups will only find product-market fit after sorting out:

- Decentralized sequencers

- Bridges/On-ramps

- EVM Compatibility/Equivalence

We’ll touch on some of these needs later in the article.

Aggressive Incentives

Are you ready to witness the greatest vampire attack in history?

The SushiSwap vs. Uniswap wars will seem meager. To compete with alt-L1s, rollup tokens should heavily incentivize L2 migration through aggressive airdrops, staking/liquidity mining programs, and ecosystem funds. Cross-L2 token bridges will allow rollups to overtake more centralized L1s.

Rollups should strategically airdrop to early rollup adopters/ETH users, and active users across different L1s, whilst filtering out mercenary chain-hoppers. Developer incentives can also be structured so that payouts are proportionate to the activity of their contracts. Rollups could also work with DeFi 2.0 projects such as Olympus Pro to create L2 liquidity mining rewards or L2 bonding.

However, to properly attract TVL we need better L1<>L2 bridge infrastructure. Rollup teams know this, and will probably only launch tokens then.

But what would tokenomics look like?

L2 Token Staking Mechanisms

Incentives can be aligned by requiring slashable stakes from:

- Sequencers and Provers for zkRollups (hinted)

- Fraud Proof Producers and Verifiers for Optimistic Rollups (hinted)

- Data Availability Committee members for Validiums/zkPorter

- Data Availability Guardians for zkPorter (announced)

- $METIS model: Incentives for Rangers (validators) to fraud-challenge Sequencers (winning party has their METIS slashed)

For reference, Immutable’s IMX diverted a % of tx fees to a staking rewards pool — a model which could be replicated with other rollup tokens.

Staking greatly increases the security of rollups as staked tokens are not available for purchase. Matter Labs stated: “To make data in zkPorter unavailable, an attacker would need to accumulate two-thirds of all staked token value.”

METIS’, a tokenized fork of Optimism, features a Dynamic Bond Threshold staking design. This requires that Sequencers cannot sequence blocks if their staked value is lower than the amount they are sequencing. Transactions are blocked until an eligible sequencer is found, limiting the size of the transaction value.

Cost Subsidization

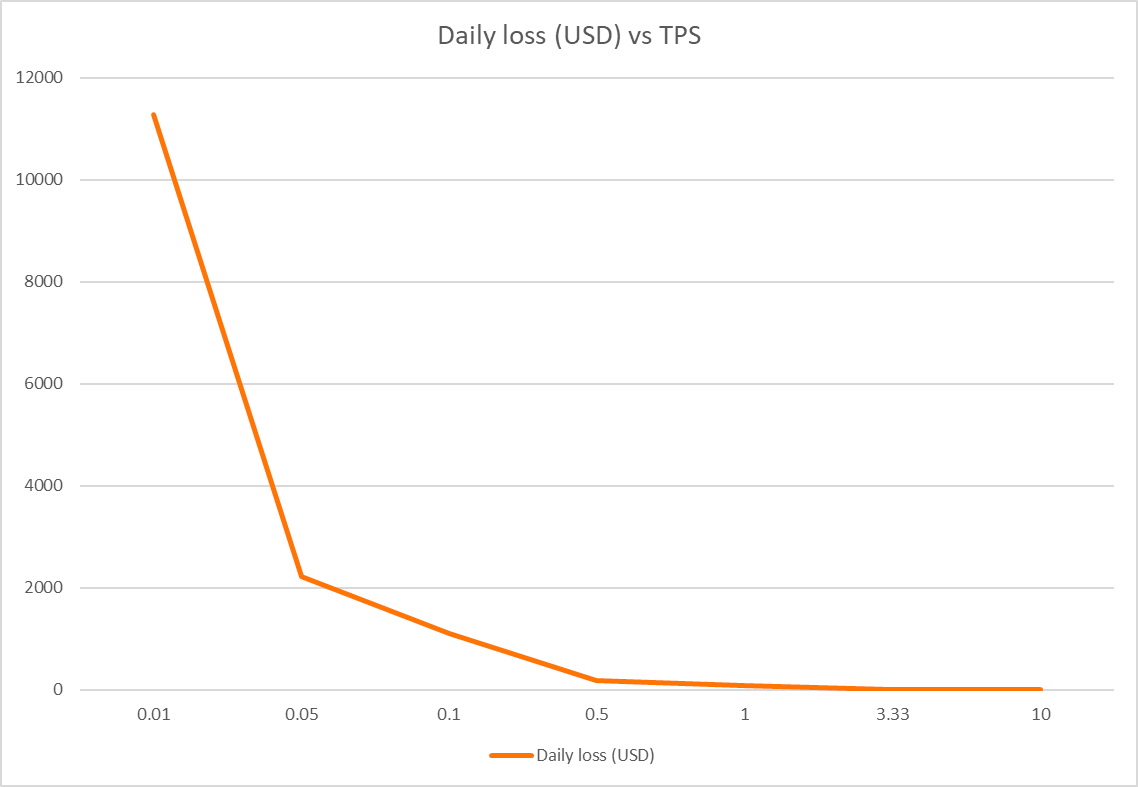

ZKRs should pursue a loss-leading user growth strategy by subsidizing early user costs.

Polynya’s model projected that as TPS increases, tx fees will break even at 3.33 TPS and keep decreasing from there. Matter Labs concurs: “Currently, the service operates as close as possible to break-even costs and will remain so until the system becomes decentralized.”

This can come from either their marketing budget or from token inflation. Subsidizing with a couple thousand per day is nothing compared to the >$10M per day required to secure SOL, DOT, AVAX, NEAR’s Aurora, etc. For reference, Solana costs $18M per day to secure and only sells $225k worth of blocks daily. At Immutable, we went for subsidizing straight zero gas fees in hopes that trading fee volume would make up for it.

In comparison, Optimistic Rollups…

Governance Design

All rollups currently have multisig smart contract operators on L1.

Rollups are nascent, so will need upgrades and bug fixes on the L1 side in the early stages. What's important for now is that we have detailed transparency reports and emergency exit mechanisms like escape hatches.

As DAOs mature, rollup L1 smart contracts should be voted on by governance tokens, and eventually, be immutable. Multi-sig smart contracts on L1 definitely mean rollups are currently a trusted setup, but once again, due to the timelocks in place, it's not a substantial security risk as you'll always be able to withdraw your funds.

Other governance topics include MEV mitigation design for sequencers, fee models, implementing fraud proofs on Optimism, treasury spendings like ecosystem grants and DAO partnerships, data availability layers, and funding public goods with MEV Auctions.

As you can see, there’s no shortage of governance proposals to vote on for L2 DAOs.

Token Allocations

I commend zkSync for publicly announcing that 67% of their token will be distributed to the community. This sets a competitive floor for others to follow suit.

Existing L2 dApp tokens have absurdly high $10b+ FDVs already, and L2 smart contract rollup tokens could be at least 10x that, placing them easily in the top 30 by market cap.

Starkware recently raised at a $2b valuation and zkSync at $1.25b.

If we roughly assume industry averages for token distribution using Cooper’s data—35% for Team/Insiders—and reverse-engineer the steep early VC discount, these tokens should have an initial market cap of $7B min.

One disadvantage of L2 tokens compared to L1s is lack of token distribution. Even if airdrop and incentive programs are executed well, alt-L1's have had the benefit of longer timeframe distribution as a result of underperformance for several years. Strong L2 token performance in the early stages could further concentrate holdings amongst whales.

We can tackle this by underwriting rollup transaction fees via inflationary L2 token rewards (like Bitcoin), attracting users, and ensuring a wider distribution for more security in the long run.

Barriers to Launching L2 Tokens

Bridges

Bridges and direct fiat on-ramps to L2’s will be critical to attracting TVL and resolving liquidity fragmentation.

There are already liquidity bridges that shorten the 7-day Optimistic rollup withdrawal period such as Hop Protocol, Connext Network, Argent, Celer Network, Maker, PolyNetwork, Layerswap, MultiChain.

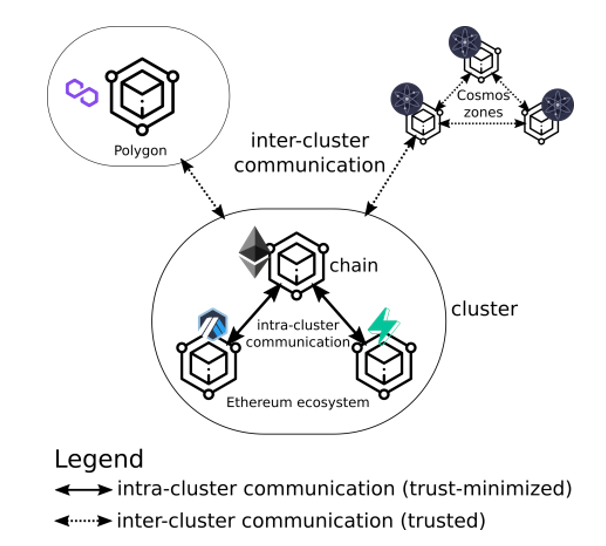

Direct L2 bridges only make up 17.7% of total Ethereum bridges TVL right now. Compared to other L1s, ZKRs have superior bridges since you can verify the state transitions on the target L1 through validity proofs for a trust-minimized bridge. In the long run, rollups will be the most composable execution layer, even when settled across multiple shards or external DA sources.

Celestia Founder Mustafa Al-Bassam put it succinctly: “with trusted bridges, the bridge operator can steal your funds. This is because the chains don't verify the state transitions of each other, and instead rely on a committee of validators to sign off on transactions. Example: the Eth-Polygon bridge or Eth-Solana Wormhole.”

Starkware and Loopring collaborated on dAMM, a cross-ZKL2 AMM allowing asynchronous liquidity sharing with other L2s and L1 pools such as Uniswap.

L2 tech will require a lot of manual integration from existing infrastructure. CEXs, CoinList, oracles like Chainlink, and data indexing like Graph Protocol must all do custom integrations. BitGo/institutional custodians don’t even have concrete plans for this, as far as I know, thereby restricting the institutional accessibility of L2s.

“Incentivizing liquidity within these bridges through inflationary mechanisms or centralized market makers would render the L2 ecosystem vulnerable to either highly fluctuating mercenary liquidity or a centralized dependency. In order to incentivize liquidity to its pools, Hop Protocol conducted a liquidity mining program with Polygon that distributed MATIC rewards to liquidity providers. As expected, once the liquidity mining program ended, the liquidity that was present in those pools suffered a sharp decline.”

As you can see, there’s still a lot of work to be done on bridges.

EVM Compatibility/Equivalence

Software composability is crucial.

EVM compatibility/equivalence will be on all of the Big Four within the coming months.

For true composability, it’s important to have EVM equivalence, not EVM compatibility.

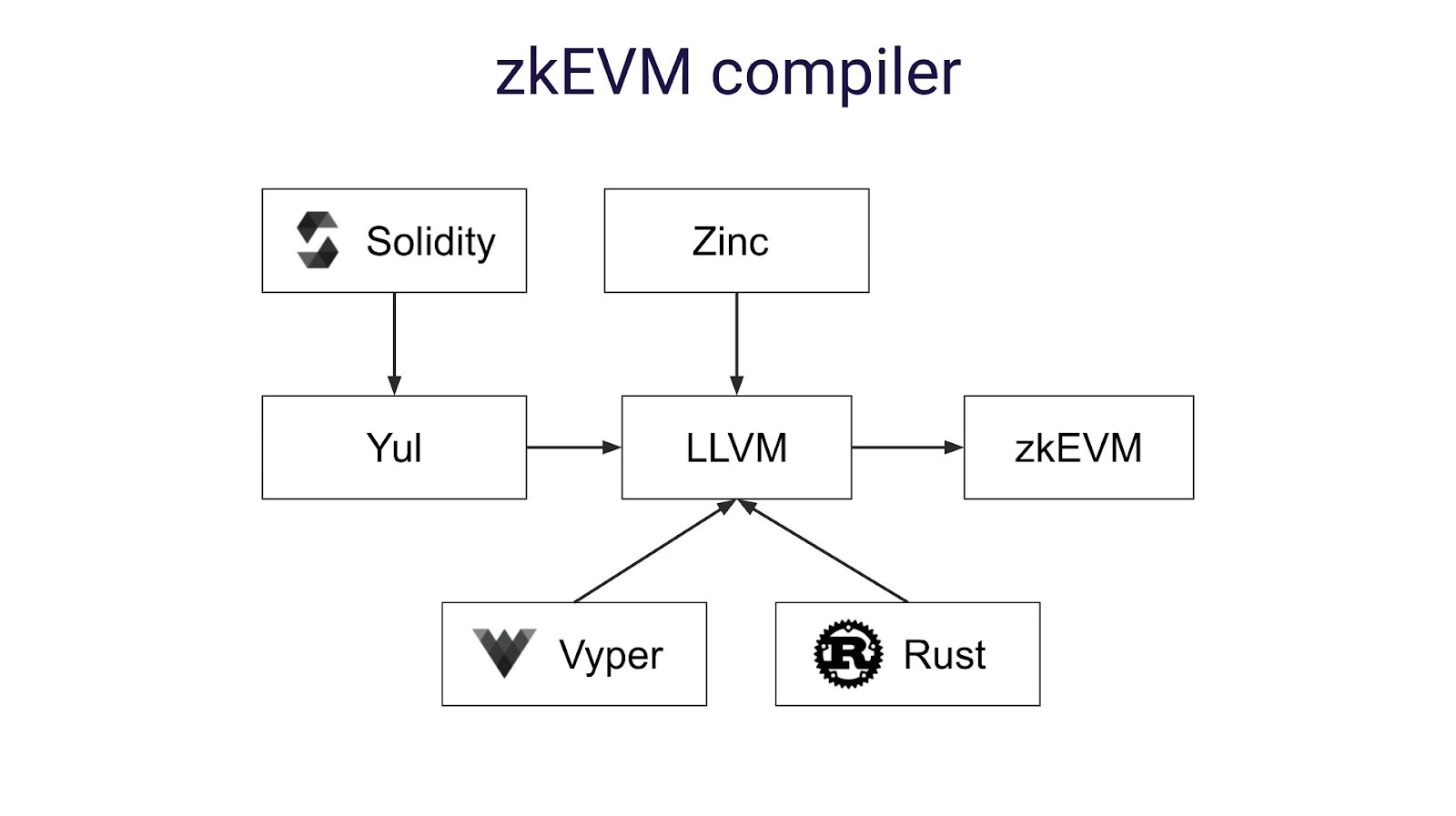

Metis DAO and Optimism have EVM-equivalence. Optimism 2.0 integrates an EVM interpreter in their Geth clients instead of having to reimplement the EVM on-chain. This future-proofs the system against future upgrades to the EVM. Developer tools like DappTools (smart contract libraries and command-line tools - formal verification, symbolic execution, project management, etc), Hardhat, Solidity, Vyper, and all other tooling will work natively on OVM 2.0 without the developers of these tools having to worry about supporting fragmented codebases.

In contrast, Arbitrum One (post-Nitro), zkSync 2.0, and StarkNet are EVM-compatible. Simple syntactical differences between Cairo and Solidity harms code interoperability. With that, zkSync admits it’s not yet at full compatibility either.

Standard Solidity contract ABIs can be deployed on the network with minimal changes to the codebase. However, there's currently no seamless way for cross-L2 messaging communication nor smart contract invocation.

zkEVMs are highly complex, and devs are still trying to solve problems such as denial-of-service attacks due to provers not being able to deal with reverted transactions.

Are Rollup Tokens Parasitic to ETH?

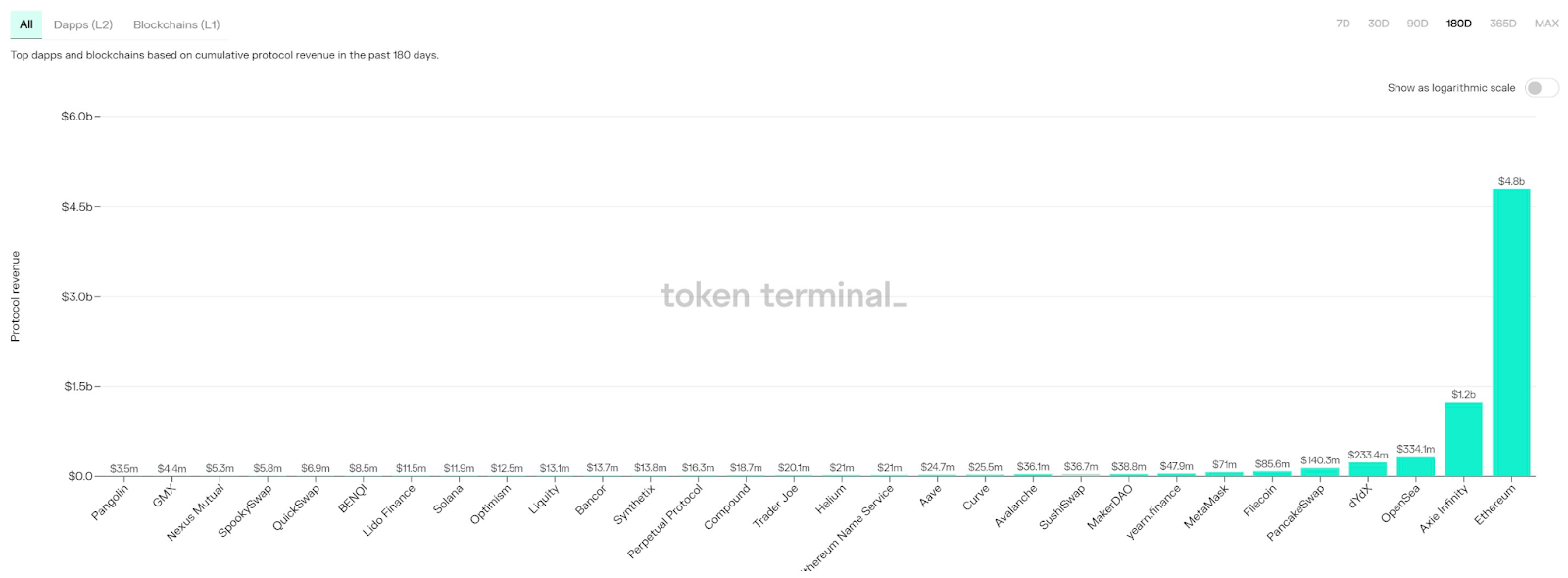

L2 rollups are responsible for verification and contract execution, while the L1 exclusively stores immutable transaction data. L1 ones barely accrue value as it stands today. Look at Solana and Avalanche.

Value accrual will occur mostly on the application layer. This means that settlement, execution, and security layers are competing for MEV and store-of-value ‘moneyness’.

In fact, "MEV can increase validator rewards by 75.3%" in Eth 2.0, according to this Flashbots paper!

As more liquidity moves into L2s, L2 tokens are intrinsically parasitic to the MEV accrual of L1 tokens. L2s divert revenue away from L1 miners who secure the network, decreasing the security budget, thereby making it less costly to perform 51% attacks.

This is a deep-seated issue the ETH community isn’t taking seriously.

⛏️ To get up to speed with Maximal Extractable Value, check out Charlie Noyes’ article.

Why will MEV accrue to L2s?

L2s may see more sophisticated MEV and coordination between miners and sequencers. The background of people running PoS validators is much closer to the background of people who actually understand MEV, compared to current PoW miners.

Cross-rollups enable a combinatorial explosion of MEV with the interplay between different ordering mechanisms. There is a great Flashbots paper on this, where they suggested that sequencers may “amass votes across the networks with the most MEV… to bring their cost of cross-domain MEV extraction down” and “mechanisms like Flashbots or an SGX-based DAO may lower the cost of collusion” cross-chain.

🤓 Check out this website for detailed research on this topic.

However, as Flashbots founder Stephane Gosselin said, “there really isn’t much MEV from settling rollups on mainchain—the only thing that a miner could do is delay the settlement by a few blocks, which doesn’t really impact the rollup experience and is quite costly.”

A Net Gain for Ethereum

Although L2s may be parasitic to ETH in the short run, the long-run relationship is positive-sum. Yes, as usage moves to L2s, they will accrue more MEV than L1 and may create downward pressure on fee revenue in the short run compared to if we lived in a non-rollup world.

Since rollups batch thousands of transactions into one on L1, rollup transaction fees scale logarithmically. It’s almost like the ‘High volume, Low margin’ vs. ‘High margin Low volume’ common sales dilemma. L1 transactions from rollups will pay greater fees than normal transactions from the size of providing data availability roots.

Another poignant issue is that miners could leave the network, lowering L1 security. Worse, more L2 transactions translate to more state bloat and higher storage requirements for full nodes, decreasing decentralization.

Ultimately, the question we should be asking is: would ETH price fare better in a world with or without rollups?

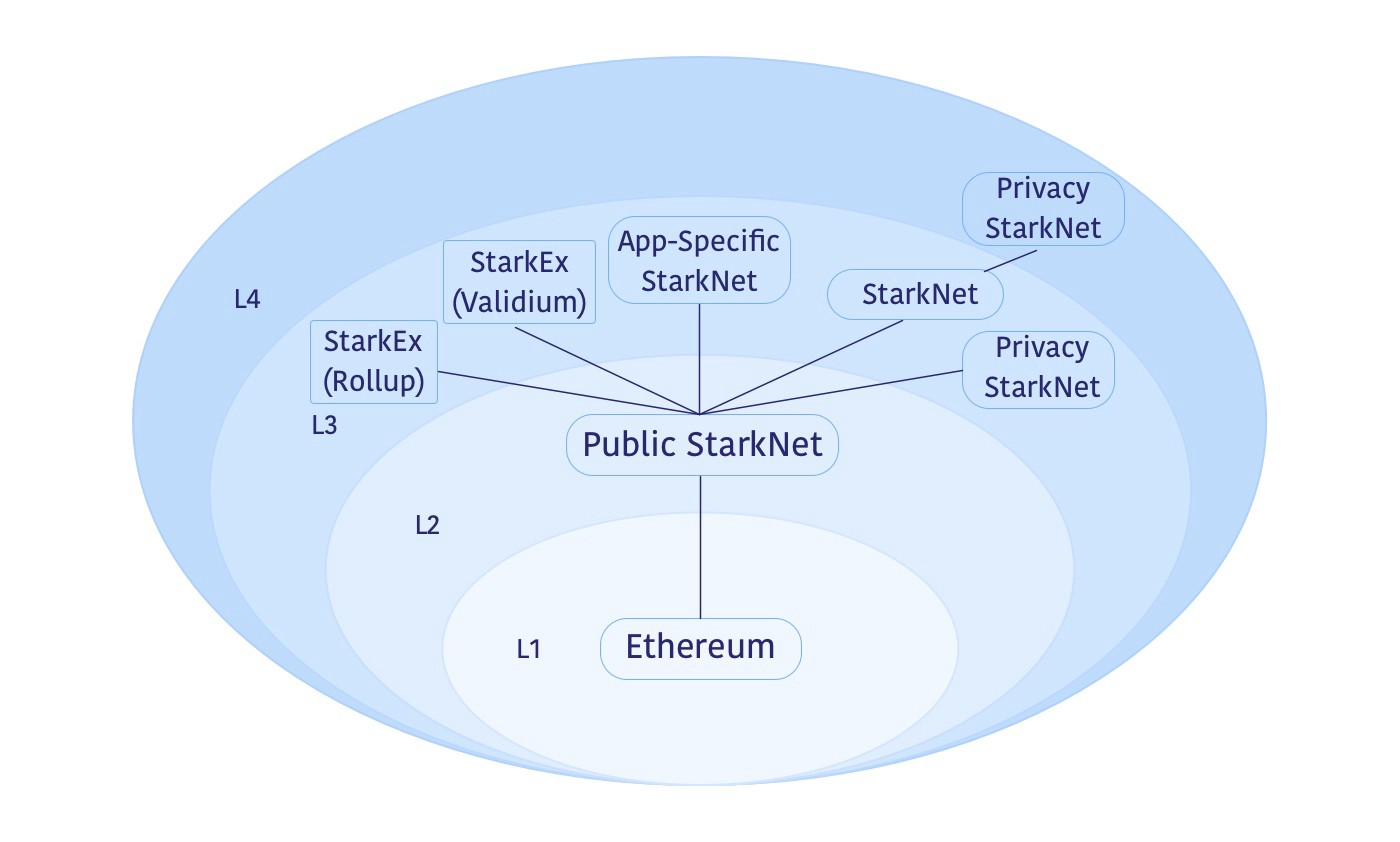

There’s a demand ceiling for activity directly on Ethereum L1 due to saturated blockspace reaching terminal capacity and pricing out the majority of users with expensive gas fees. In a world with L2s and recursive, fractal-layered L3s, the user TAM is in the billions.

Rollups pack more network effects into the same, fixed L1 blockspace supply.

Ethereum growing to global ubiquity means all L1 gas gets used, always. An L2 sequencer receives the L2 fee, uses it for their L1 transaction, pockets the spread, everyone's happy.

Further, I don’t think MEV and fee generation are the driving factors of ETH’s value. Solana generates minimal fee revenue yet it’s still $80B.

ETH’s value should be calculated using a blend of commodity pricing and the quantity theory of money (Ethereum is a nation-state and ETH is its currency). Security layers derive value from the economic activity which occurs on top of them, and the ‘moneyness’ of ETH. Although with high TPS and low fees, L2s also greatly increase the velocity of money.

Many skeptics have said that L2s undermine ETH’s moneyness. @TaschaLabs claimed:

“You can buy, say, ZKTOKEN on a centralized exchange, transfer to your ZK wallet and spend ZKTOKEN on ZK L2 chain, all w/o touching ETH.”

In reality, ETH’s moneyness is far from being eroded. ETH would have much more stable tx demand from the sum of rollups than specific L2’s which may fluctuate due to volatile demand for specific dApps or use cases. In a cross-rollup world, ETH will be the common currency.

People buy ETH not just for gas but because things are denominated in ETH as a base. ETH will be the primary utility token to pay for gas (even on rollups). NFTs are priced in ETH. The largest Uniswap pools are paired with ETH.

ETH is reliable collateral, and the go-to for payments.

ETH has a first-mover advantage for the ‘moneyness’ network effects of widespread distribution.

The Lindy effect of 🔊 🦇 is already set in stone.

Deflationary tokenomics assist with the moneyness narrative. As @epolynya put it, “rollups have a significant advantage as they pay a small fraction or zero of alt-L1s on inflation budgets.”

L2 Tokens Are Coming

Rollup tokens are genuinely exciting, however, there is a lot to be done before they are ready. I don’t expect most rollup tokens to launch until the end of the year, and into 2023.

But I think it’s inevitable. Layer 2s need tokens to compete with alt-L1s. Launching their own native tokens with a suite of incentive programs and airdrops will fuel this technology to fulfill its prophecy: to scale Ethereum.

And once they launch, they will melt faces.

Get ready.

Action steps

Prepare for Layer 2 tokens (actionable guide coming on Tuesday)

Level up on Layer 2s with these Bankless Resources:

Author Bio

John Wang is an independent researcher and builder, previously working as Head of Growth at Saber (Solana), and Product Manager at Immutable (Starkware). Hear more from him on Twitter or read more on his blog.