Crypto Advice from a Poker Player

Level up your open finance game three times a week. Subscribe to the Bankless program below.

Dear Crypto Natives,

We did an Open Thread recently on how to deal with the mental stress of crypto. A post from Bankless member Fiskantes blew me away.

I learned to be cool with wins and losses long time ago, during my poker pro days.

That’s how he started, he then dropped wisdom bombs on how to stay mentally fit in crypto. I needed more.

You see Fiskantes wasn’t the first poker player turned crypto investor I’d known. Haseeb Qureshi at DragonFly Capital was a poker champ at 17. Ari Paul of BlockTower played semi-professionally. There’s a dozen more I could name.

What can we learn from these poker players turned crypto investors?

So much.

Here’s 7 ways to improve your mental game and thrive in crypto.

Written by a poker player.

- RSA

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

THURSDAY THOUGHT

Crypto advice from a Poker Player

Guest post: Fiskantes, Investment Director of Sigil Fund

Before I got into crypto full time, I was making a living playing poker—mostly online. Online poker is nothing like poker from movies. Instead of visiting casinos and reading body language of your opponents, online poker pros need to get technical—odds, game theory, EV calculations, simulations of various scenarios and analysing of opponents plays in special software.

Early crypto days remind me of early online poker days—young nerds making a lot of money sitting at home, dealing with obscure concepts, largely disconnected from the real world. And as far as I know, many poker players were early crypto adopters too. Not for ideological reasons mind you, but for practical ones—chasing fish playing on shady asian poker rooms which only accepted bitcoin. Online poker nerds, like crypto folks, have their own culture, memes and their own lingo.

Couple of examples:

- Fish - recreational players, who play for fun and usually lose against pros

- Reg - regular player or shark, usually good player, playing solid strategy

- GTO - Game Theory Optimal, we say something is GTO if it doesn't deviate from Nash Equilibrium. GTO is usually the best strategy if we do not have any info (reads) on our opponents. We could use this term in crypto too. Not attacking the PoS network as a staker should be GTO, if crypto economic incentives are aligned.

- TAG - Tight Aggressive player, a player who only plays a narrow range of hands, but when he does play, he plays them aggressively—usually the best strategy to play. This transfers well to investing—be picky and strict about your investments, but when you invest, go deep and be an active investor, participate in the project you invested in.

- EV - Expected Value of a play. We say something is EV+ if it is a profitable play in the long run (regardless of the outcome of the current game).

- Bad beat - Holding cards that are ahead vs his opponents and losing it on the last card with low probability.

- Bad run - Ongoing streak of bad beats, when a player keeps getting bad cards and keeps losing to his opponents more often than usual.

- Under EV - situation, when a player makes EV+ decisions but has a bad run and keeps losing, despite playing a good game.

- Tilt - suboptimal state of mind, where a player is frustrated and prone to making mistakes. Usually happens during bad run, after a big bad beat, or when under EV (e.g. fish is winning despite making EV- moves against the player)

- Mental Game - range of psychological strategies and processes which help us to train, learn, play our best game and avoid tilt.

- Bankroll Management - set of rules that every poker professional should strictly follow in order to not risk too much capital on one game

- Exploit - a systematic mistake a player keeps making, that can be used against him by other players (e.g. never bluffing in certain situations or bluffing too much).

- Busto - Poker player who did not adhere to his bankroll management and went broke.

- Flip - a situation with roughly 50/50 win or loss. More generally a flip doesn't give a big advantage to any opponent and its result is the outcome of randomness rather than of skill.

- Rigged - a game is rigged if it includes cheaters or mechanisms that favor some players over others. There are a lot of “rigged games” in crypto too.

Poker players are a bit like intraday traders—they have their capital, which they are risking everyday to make a living, clicking buttons in a zero-sum game. They need to constantly adjust their strategy in order to exploit their opponents and fix their own exploitable holes. They need to be good with data and understand the tricky nature of statistics and variance. They also need to react fast, make quick numerical estimates and focus on patterns in their opponents game.

(Above) Unknown poker player grinding zillion tables

I used to play up to 12 tables simultaneously. That meant making about a hundred decisions every minute. Most of them were quick and almost automatic, but some of them were very hard and required deep thinking. It was super exhausting to play for 6 - 8 hours a day like this. Dealing with the volatility of winnings wasn't easy neither.

But the lessons I learned the hard way playing poker serve me well in many areas in my life. In this article I would like to share a couple of tips from my poker career, which are transferable to other areas of life, such as business, investing and trading.

I hope these lessons will be EV+ for you, help you to avoid tilt in such a volatile environment as crypto and inspire you to work on your mental game in order to behave in GTO way in a whole range of situations.

1. Ditch result oriented thinking

Every good poker player needs to focus on making good decisions in the long run and stop caring about short term results, which are more or less subject to randomness.

- Just because we lost with two Aces against some crap hand, we shouldn't consider giving up the next time we get dealt two Aces.

- Just because we made money on Verge XVG in the 2017 frenzy, it doesn't mean that trading shady altcoins is a good long term strategy that we should pursue.

- Just because the price of ZRX went up, it doesn't mean it is a fundamentally good investment.

- Just because we got lucky in a casino, it doesn't mean we can make a living out of it.

Learning to differentiate luck from skill is always a challenge, especially for people who got into crypto in 2017 and got rich quick without knowing what they are doing. This bad feedback loop they got has prevented many of them from reflecting and learning essentials. If you struggle with this too I recommend reading Fooled by Randomness.

2. Focus on the game, not on the score

Number go up, number go down, fear, greed, chart anxiety—these demons drain energy, occupy our precious mental space and distract us from the important, actionable stuff.

Many online poker players counted their winnings/losses only once a week to avoid being fixated on them. They rather read, made notes on their opponents, learned, analyzed, tested new stuff. I remember having a piece of duct tape on my screen in the place, where my cashier balance was on one poker room. Usually poker rooms allowed to hide the balance, but this one didn't.

This one translates very easily to crypto. In order to decrease result oriented thinking, it is good to stop checking crypto prices and your balance too often.

If you are not intraday trading and plan to HODL, maybe your time and energy should be spent on studying new crypto projects, going Bankless or learning to code...rather than refreshing prices every 5 minutes. If you are buying, dollar cost averaging will probably work out better for most people than trying to time the market.

3. Think in bets

This one is juicy. To evaluate if a decision is good in the long run, you can try thinking in bets. In order to do that, you need to estimate Expected Value and Risk:Reward ratio.

EV in poker is calculated pretty easily, since it is a closed game with fixed rules (52 cards, 4 aces…). Crypto and real life are more fuzzy.

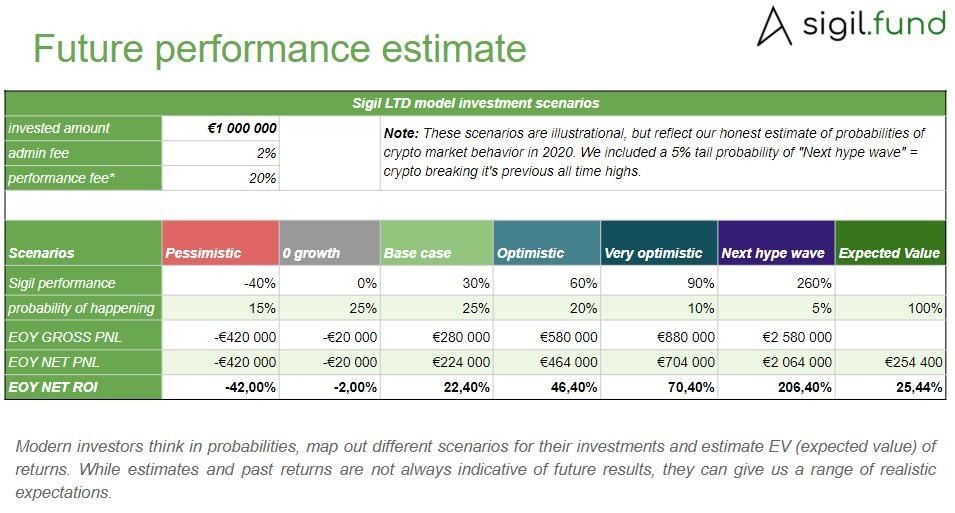

In order to estimate EV of let's say crypto investment you should define a range of realistic scenarios (from optimistic to pessimistic) and assign your profit or loss values for every scenario. Then you multiply it by probability weights and count them together to get the final EV estimate. This estimate will not be perfect, but if you made at least semi-accurate assumptions, it shouldn't be off by order of magnitude either.

Constantly re-evaluating available information and adjusting estimates is also part of the process. In a poker game I may hold two Aces—very strong hand under normal conditions. But when the board comes 7,8,9,10 I know that if an opponent has a 6 or J, he has me beaten with a straight. So my two Aces are no longer as strong and I should be much more careful.

I will provide a concrete example for our investment fund performance in 2020:

This estimate was created in December 2019, before we knew anything about the pandemics that will hit us. We estimated the EV of our investment fund, taking into account a range of scenarios and assigning probabilities to them. This should give us realistic enough expectations, given that our estimated errors average out in theory (see Fermi estimate).

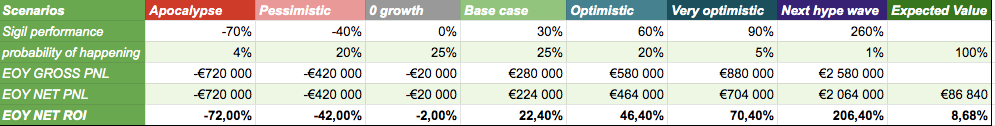

With 3 months of hindsight into 2020, counting with all new information we have, we would need to re-work our estimation quite drastically:

We still think we should be in profit EV-wise (thanks to our income from staking, and thanks to our cash reserves, but our expectation is nowhere near as high, given the uncertain macro conditions). Also as a rule of thumb it is always good to add a bit more to the downside.

Risk:Reward is pretty self-explanatory, but it may be worth mentioning that it can be applied to time, not just money. Is really reinventing the wheel by focusing on the 37th obscure Ethereum killer worth your energy? Won't it be much more useful for you to focus on learning the basics of Solidity and building something cool on top of Ethereum?

4. Follow bankroll management rules

Conservative poker professional only risks 1-5% of his capital for one table (depending on various factors). Invest in crypto only the amount that you are comfortable with losing.

If you trade, go for 1-3% of capital per position. If you invest in alts, you should go for 3-7% in one position (except BTC and ETH, these can be higher, but still don't be "all in'' in anything).

You should always have plenty of cash on the sidelines to tap into, in case something bad happens. This is even more crucial in unprecedented times like these, where there are no safe havens, a lot of volatility and potentially opportunities.

Bankroll management should be your religion. No matter what I did, I always adhered to it like my life depended on it. Only thanks to obeying these rules I could build a poker career out of free 50 dollars I got in a poker promotion, never going busto.

5. Improve your Mental Game

My poker beginnings were wild. Sometimes I would play my best game and kept losing against inferior opponents because I had a bad run. Sometimes I ran tens of thousands of USD under EV (according to my poker simulations). One time I got on tilt, smashed my mouse on the wall and couldn't play anymore (which probably saved me much more than the cost of a new mouse to be honest). Other times I won a couple of big pots, and subsequently made big and completely avoidable mistakes by getting too cocky. Counting it all, I left really huge money on the tables just because my mental game was off.

Needless to say I had to work really hard on my mental game, to be able to withstand everyday volatility. I would say that when a poker player learns basic TAG strategy and bankroll management rules, mental game is THE MOST IMPORTANT aspect to focus on.

Everything changed with a book Mental Game Of Poker—written by a professional golf coach, who also trained some poker players. Mental Game is not exclusively focused on poker or sports, it provides a set of general concepts that can be applied to almost any activity, where training, skill and discipline is needed.

One of the cool concepts I'd like to mention is inchworm learning. It divides the training into two parts: 1. Improving our best game, learning bleeding edge new techniques and skills, advancing forward. 2. Focusing on our bad game, avoiding the biggest mistakes we tend to make, solidifying basics, minimizing the losses if things don't go well.

6. Data over intuition

Many beginners deviate from their strategies, because they think that “this time is different”, “this is their lucky card” or “they have a hunch”.

Now, I am not saying that intuition is worthless. However, intuition of a beginner is. In order to train your intuition you need to see a lot of action, analyze a lot of data and get rid of biases you might have. You will lose money if you play AK too aggressively because it is your lucky hand. You will be much better off knowing that e.g. QQ is stronger than AK. And it's even better for your strategy to learn that QQ wins 57% of games vs AK on average.

In crypto beware of having a positive bias towards an investment, that makes you blind to its risks.

I recommend reading Thinking Fast and Slow to tackle major fallacies and biases that stand in a way of our rational decision making.

7. Don’t go busto

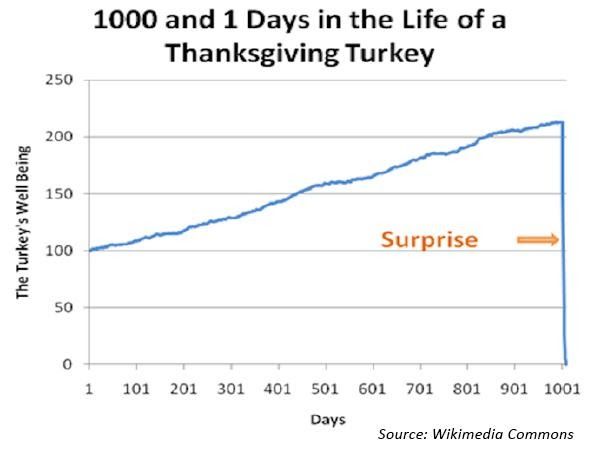

Adhering to Bankroll Management rules is crucial to prevent busto, but it's not enough. You also have to be able to survive tail risk and Black Swan scenarios.

Most of the online poker pros I knew were young introverted nerds that went to poker full time and failed to develop other skills. In April 2011, online poker went through its own Black Friday. The result was that overnight, the USA banned online poker and shut down one of the biggest poker rooms. This poker room later turned out to be insolvent and many users lost their entire bankrolls there. Essentially a Mt Gox situation.

But the effect of the US ban was even worse. Online poker lost the majority of fish (rich recreational players were mostly American) and professionals ended up fighting over smaller and smaller pie. Many had to quit and find another job. The rest of us kept playing, but started to diversify our interests, learn different skills and created rainy day reserves. The thing about poker pros is that they balance on a grey zone and many times arrange such a lifestyle that makes them free but without a safety net of government support. Many people in the crypto community are no stranger to this either.

Most recently —pandemics and coming crisis are making the immediate future very uncertain. Those who live in the past and fail to adjust will have a hard time. But those with enough reserves and ability to adapt quickly will benefit.

We are lucky to be exposed to an industry that:

- is fully remote and digital

- aims to provide alternative to failing financial system

- offers lot of different roles for people to fill

- is still small enough for anyone to make it to the top without harsh competition

- has many untapped opportunities and inefficient markets

But our industry is also extremely niche and insignificant—a drop in the bucket. It's not as small as online poker, that American regulators killed like a fly by swathing a hand. However, we need to acknowledge it is still small enough to be crippled for a long time if things turn ugly. Crypto markets (both centralized and DeFi) are less robust than we would hope.

I am a big fan of Taleb's books. The dominant theme of his work is uncertainty and how to adapt to it and avoid the risk of ruin. One way to position ourselves in an uncertain world is to create redundancies—learn skills from different areas, hold substantial cash reserves and risk-off assets, create multiple sources of income, and remain small and flexible.

The opposite—becoming complacent and too comfortable, ignoring risk and essentially being a thanksgiving turkey—is very dangerous.

Conclusion

There are probably many more lessons playing poker professionally could teach you. It spans topics from investing, trading, business, psychology, self confidence, statistics…

But these seven I shared with you are my favorite ones. I truly hope they will help you make better decisions on your journey in crypto and life. If you have any questions or if you are struggling with any concept mentioned above, do not hesitate to contact me. (RSA note: Matej hangs out in the Inner Circle Discord channel—good place to catch him!)

P.S. If you want to try out some poker action within Ethereum ecosystem, I recommend checking out Virtue Poker.

Author bio

Fiskantes is an Investment Director of Sigil Fund private hedge fund, investing in digital assets, crypto money and decentralized networks. Matej also co-founded Crypkit—digital assets tracking and accounting toolkit for crypto companies and acts as a partner in Zee Prime Capital - venture style investment firm.

Action steps

Recap the 7 ways to level up your mental game for crypto:

Ditch result oriented thinking

Focus on the game, not on the score

Think in bets

Follow bankroll management rules

Improve your mental game

Data over intuition

Don’t go busto

Check out Matej’s book recommendations:

The “Incerto” books by Taleb (RSA—recommended!)

Go Bankless. $12 / mo. Includes archive access, Inner Circle & Deals—(pay w/ crypto)

🙏Thanks to our sponsor: Aave Protocol

Aave protocol is a decentralized, open-source, and non-custodial money market protocol to earn interest on deposits and borrow assets. It also features access to Flash Loans, an innovative DeFi building block for developers to build self liquidations, collateral swaps, and more! Check it out here.

New to the Bankless program? Start here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.