The first $100m in NFTs

How cool would it be to have Bankless in video format? That’s where I want to go next. But I need your help! If you want the Bankless program in video give 1 DAI & let’s make it happen!

Dear Bankless Nation,

The non-fungible token (NFT) market is about to hit a major milestone.

I believe NFTs will be a trillion dollar market some day. That means $999.9 billion in future opportunity. We’re just .01% of the way in.

This is the earliest of early days.

We’ve talked about redemption NFTs in the past. We’ve learned about NFTs across gaming, art, culture, collectibles, and domains. But we’ve never zoomed out to look at the market as a whole.

What are the categories? Collectibles, Gaming, Worlds, Art, Culture

Which categories are winning? Volumes, Value, Projects

Andrew is one of my favorite pioneers and investors to help us with this. Today he’s sharing a breakdown of the first $100m NFTs. There’s likely billion dollar opportunities in each of these categories.

Assets to own. Startups to start. Worlds to build.

If you want to understand the NFT market today to prepare yourself for the opportunities of tomorrow—this your article.

- RSA

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

Writer’s Corner

Guest Post: Andrew Steinwold, partner at Polynexus Capital & founder of Zima Red.

The State of the NFT Market - June 2020

Per usual, I’d like to give a huge shout out to nonfungible.com for providing the vast majority of data quoted in this blog. They recently made a huge upgrade to their website and it's amazing, so check it out.

Overall Market Stats

- Total Lifetime Trade Volume: $96,186,581.56 USD (June 5, 2020)

- Average Monthly Trade Volume: $2,581,233.01 USD (June 5, 2020)

- Average Price: $20.90 USD (June 5, 2020)

- Total Number of Wallets on OpenSea: 18,552 (April 27, 2020) (Source)

The above stats show just how early we are in a market that one day could be worth trillions of dollars. Of course, that trillion-dollar figure will only be reached once there’s a functioning metaverse (read my previous blog about the Metaverse to learn more), but I strongly believe we are headed in that direction.

It’s incredible that roughly $100M has been traded throughout the lifetime of the non-fungible token (NFT) market, however, its origin date is debatable. Most would claim the NFT market really became popular in December 2017 with the viral launch of CryptoKitties. But the first NFTs on Ethereum were CryptoPunks, which launched in June 2017. Perhaps the true origin date is around 2014 with non-Ethereum based NFTs like Rare Pepes on the Counterparty blockchain. Despite the uncertainty, for this blog, we will conclude the NFT market started in December 2017 because trade volumes were so minimal before then that the ecosystem was hard to notice.

With December 2017 as our starting point, the NFT market has only been around for ~2.5 years, an extremely small amount of time compared to bitcoin (11 years) or traditional markets (hundreds of years). While monthly trade volumes are low at roughly $2M per month, the NFT market has seen a steady increase overtime.

Perhaps the most shocking statistic is the number of wallets on OpenSea: about 18,500 wallets have either purchased or sold an NFT. Since OpenSea (RSA—see tactic #32) is the dominant NFT marketplace, this metric should give us a rough indication of the current number of NFT users overall. These users are spread across different NFT projects, which I categorized into six groupings:

- Collectibles

- Game Assets

- Virtual Worlds

- Crypto Art

- Culture Tokens

- Other

Let's take a closer look at each category.

Collectibles

- Projects: CryptoPunks, CryptoKitties, Avastars, and more

- Total Lifetime Volume: ~$37,618,057

- Monthly Volume: ~$375,521

(Above) Cryptopunks for sale!

The collectibles category includes NFT assets with little to no functionality, such as rare coins, autographed memorabilia, and rare books. Rare coins have no use, and although you technically can wear autographed sports jerseys or read rare books, collectible NFTs still hold their value without any use at all. Similarly, projects like CryptoPunks and Avastars are collectibles with no functional use (besides maybe using them as your social media avatar). Possible use-cases may arise in the future, but for now they are just cool, rare items to collect. CryptoKitties differ slightly in the sense that owners can breed their assets together and create new cats in the hopes of creating rare traits, but even if you get a cat with rare traits it has no function besides more breeding. While this is an important part of the CryptoKitty universe, they still do not have enough functionality to be included in our second category, Game Assets.

Game Assets

- Projects: Gods Unchained, Axie Infinity, My Crypto Heroes, CryptoSpaceCommanders, and more

- Total Lifetime Volume: ~$10,568,255

- Monthly Volume: ~$167,956

Games assets have specific traits, properties, and stats that have functional use within their environment. For example, Axie Infinity (RSA—see tactic #28) is a Pokemon-like game where users acquire cute monsters and battle them against each other. Each monster has its own stats that directly impact gameplay.

(Above) Buy Axie #107679

There are also numerous trading card style games, like Gods Unchained, where users acquire a deck of cards and battle against others. Although limited in scope and functionality now due to using a blockchain, I foresee the game assets category to expand dramatically over the coming years and become one of the dominant NFT categories.

Virtual Worlds

- Projects: Decentraland, Cryptovoxels, Somnium Space, The Sandbox, and more

- Total Lifetime Volume: ~$27,516,010

- Estimated Monthly Volume: ~$986,489

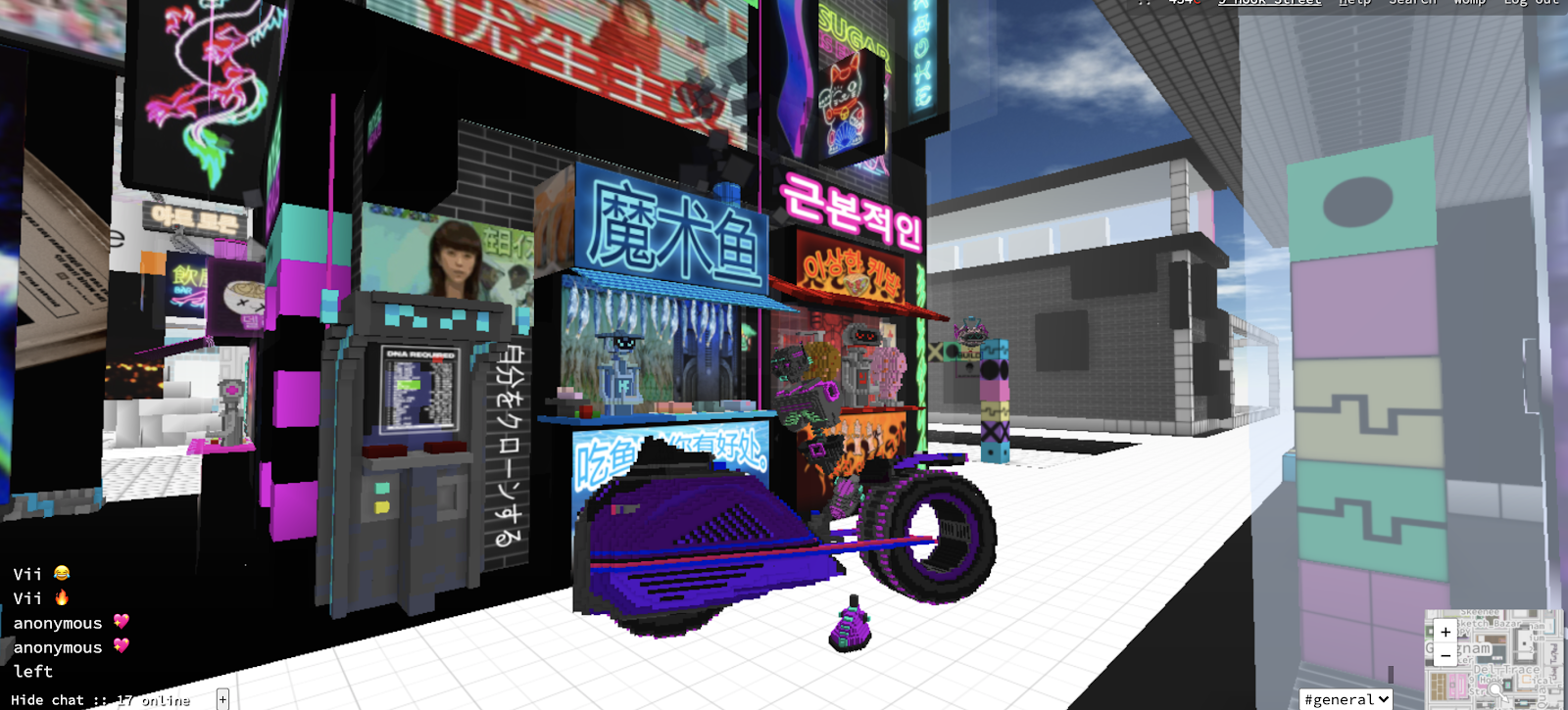

(Above) The streets of Cryptovoxels

Cryptovoxels, a user-owned virtual world.

Virtual worlds have essentially unlimited functionality in the sense that users are able to build any type of structure imaginable on their own land. For example, a user could create a virtual house, a crypto art gallery, an e-commerce store, a mini-game (if they know how to code), and more. The options are limitless.

Virtual land can be thought of as buying “webspace” on a social media platform. Purchasing this web space allows users to create anything and possibly earn revenue from their assets through advertising, renting, or even selling digital goods. I am extremely excited about blockchain-based virtual worlds because they provide their users with equity. If users create interesting things on their land it not only adds value to the platform but also creates upside for the user in the form of their land value increasing.

These user-owned platforms are a paradigm shift when compared to a platform like Facebook. Facebook’s value comes from its users, but users receive no monetary reward for building up the platform. However, in blockchain-based virtual worlds, users can receive direct monetary benefits from improving the platform. This type of next-generation platform has incredibly strong network effects.

Crypto Art

- Projects: Async Art, SuperRare, Nifty Gateway, KnownOrigin, MakersPlace and more

- Total Lifetime Volume: - $1,725,391

- Monthly Volume: - $303,261

Crypto art (see tactic #21) is simply art that has been tokenized onto a blockchain. Although these NFTs have no functionality, I am a firm believer that digital art (especially digital art that users can truly own thanks to blockchains) is going to be the next major movement in the art world. It makes sense that digital art’s popularity will grow immensely as people spend increasingly more time online and get more familiar with buying digital items within video games. If anyone wants to read more on crypto art and how to value different pieces, I suggest you check out my blog comparing Sotheby's valuation metrics to NFTs.

From the artist's perspective, crypto art is a huge win because it allows artists to finally have control of their own finances. Before the internet, galleries controlled the entire backend infrastructure of the art world: they controlled the art media through their connections and art financial rails by acquiring art to be sold through their gallery (which often can take a 50% cut of any sale). The internet democratized the media by allowing artists to gain their own following online with apps like Instagram, but the galleries still controlled the financial rails. Now, by tokenizing artwork, artists can finally control their finances because they are selling their work on a global, uncensorable financial system (Ethereum).

(Above) Crypto art piece titled “Ether Makes the Moon go Around” on Async Art. Created collaboratively by mlibty, Gary Cartlidge, PR1MAL CYPHER.

Crypto art enables buyers, art enthusiasts, and collectors to “experience” the art more completely through immersive experiences not possible with static, physical art. For example, the art could be a GIF, video, or augmented reality piece that makes the viewing experience more intense and perhaps more favorable when compared to traditional mediums. Also in the physical realm, collectors can't always show off their pieces easily unless their work is in a museum, but with virtual worlds becoming a new form of social media they can easily display artworks of all forms.

Culture Tokens

- Projects: n0wear, Zora, Foundation, and more

- Total Lifetime Volume: Unknown

- Monthly Volume: Unknown

Culture tokens or “fashion tokens” are characterized as assets with little to no functionality but are used to display an owner's personality. They can include virtual clothing, physical clothing, or even music albums (see tactic #37) from Grammy award winning artists.

An example of a culture token: a pair of signature edition Josie n0wear shoes made for the virtual world Cryptovoxels.

These tokens are usually sold for the actual digital asset itself or are sold to be redeemed for a physical good (like a limited edition T-shirt). Just as some people either choose to wear a white $10 T-shirt from Walmart or a white $200 T-shirt from Supreme, culture tokens signal status and showcase an individual's style.

What’s interesting about culture token projects is the unique sales model many of them employ to sell goods. Zora and Foundation both issue digital tokens that can be traded before a product actually launches. This trading allows the artist or creator to essentially pre-sell their product before it actually launches, which enables the good producer to create an item with zero upfront capital. It is also a great method to determine the popularity of an item before its launch, which has obvious advantages.

Other

- Include: Ticketing for events, property titles, digital identity, and more

- Total Lifetime Volume: Unknown

- Monthly Volume: Unknown

The last category includes miscellaneous items like domain names, Urbit ID, and other traditional physical products like event ticketing or property titles. The traditionally non-digital use-cases like event ticketing or property titles are still in their infancy, but I believe they will become more popular as people realize the efficiency gains from moving from paper to digital.

Once digital and tokenized, ticketing, property titles, digital identity, and more will become massive components of the NFT market.

While these uses will eventually happen without a doubt, they will be more difficult to change because many of these use-cases function today in physical format. It's often more difficult to change the existing ingrained user behavior in the physical world than it is to change user behavior in digital worlds.

For example, consider the following situations: Physical tickets currently work fine for users so they might not necessarily want to switch to a digital version (although digital tickets are expanding rapidly). Property titles involve government agencies who are notoriously slow to change anything at all. Digital identity also has the same issue but has extremely high stakes as someone could steal an NFT identity and cause lasting damage.

When comparing these physical uses to gamers doing some new behavior in a virtual environment, the pace of innovation is often much higher in the digital world.

Nonetheless, I believe this “other” category will expand into a multitude of subcategories over the years with the potential to grow to have the largest market cap and impact. NFT-based property titles alone would revolutionize real estate worldwide.

Going forward, I expect more differentiated NFT categories to arise and NFT market activity to increase dramatically. I will create an updated post of this type a year from now so we can see the dramatic changes that have taken place within the ecosystem.

Action steps

- Consider which NFT sector has the most upside in the coming years

- Collect your favorite NFT and hold onto it! It might be valuable in the future

- Read the past Bankless NFT articles!

Author Bio

Andrew Steinwold is a partner at Polynexus Capital and founder of Zima Red. Zima Red produces blogs, podcasts, and videos about the emerging ecosystem of non-fungible tokens and virtual worlds.

Subscribe to Bankless. $12 per mo. Includes archive access, Inner Circle & Deal Sheet.

🙏Thanks to our sponsor

Aave

Aave is an open source and non-custodial protocol for money market creation. Originally launched with the Aave Market, it now supports Uniswap and TokenSet markets and enables users and developers to earn interest and leverage their assets. Aave also pioneered Flash Loans, an innovative DeFi building block for developers to build self-liquidations, collateral swaps, and more. Check it out here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.