The Empire Model for Blockchains

Dear Bankless Nation,

In case you haven’t noticed, crypto is full of tribalistic inner-fighting. It’s characterized this industry from the very beginning.

But why? Can’t we just make peace?

Because the stakes are incredibly high. There are superpowers that only the #1 market cap crypto-asset can have.

Liquidity begets liquidity. Capital begets capital. Network effects beget network effects. The chain that wins is the one that captures all of these things, and makes it easier to stay in the #1 spot.

Today, we say the quiet part out loud. We all want to be in the #1 spot.

I explain my thesis for why this is true, and how investors can use this to navigate the incredibly complicated process of L1 valuations.

Let’s get back to first principles, and breaks down for us the empire model for blockchains.

Spoiler alert: The Ethereum empire is coming.

- David

Crypto is tribal, and it always has been.

I’ll say the quiet part out loud: There’s only one #1 spot at the top of CoinGecko, and we all want to be there.

There is plenty of room to ‘grow the pie’ in crypto; we are only in the first few innings of a very long growth phase for crypto networks. At the beginning of this Cambrian explosion, there’s so much room for so many chains, that it seems like there’s no limit on how many L1 blockchains the ecosystem can host!

What’s with all the tribalism and in-fighting? There’s room for us all, right? Kumbaya, everyone!

Wrong.

It doesn’t matter that we can grow the pie; the game ultimately and inevitably collapses on which ecosystem can claim the largest share, and the larger the better.

Blockchains are like chess: Making good moves isn’t good enough. If you don’t make the best possible move, then you made a bad move. If you give your opponent an inch, they are sure to take it. If you leave anything on the table, someone will snatch it up. If you’re not competing for the #1 spot, then you’re at the mercy of someone else who is.

Therefore, everyone must compete for the #1 spot. If you’re not playing for the #1 spot, then you’re not playing.

Liquidity begets liquidity. Capital begets capital. Network effects beget network effects. The chain that wins is the one that captures all of these things.

The fight to be Money is the fight of the crypto industry.

‘Monetary premium’ is the most scarce resource in crypto. It’s the thing that every blockchain wants, but not every blockchain can have. Bitcoin has a lot of it. Ethereum has some. Every other chain has very little.

There’s only so much monetary premium to go around.

This is why we’re tribal. This is why crypto-twitter is toxic. This is why we fight all the time. There can only be one #1 crypto-network, and we all want to be it.

Nation-states compete to be Money

This same competition occurs at the Nation-State level.

If you zoom out to centuries-long time frames, you’ll see Nation-States jostling, colluding, and warring with each other to take the #1 spot in global power.

Nation-States compete to obtain a monopoly on violence. Whichever country has the most powerful army gets to have the reserve currency for the world. They use their physical power to assert their currency as the global reserve currency.

When your currency is the global reserve currency, you hold the world’s most powerful asset: the ability to print desired money.

When the world uses your money, you have reached the peak of the jungle. You are the top dog. You have the one power that no one else has.

Any subdominant nation-state can print money. But without the global demand to back it up, they can quickly print themselves into hyper-inflation if they’re not careful. Only the #1 Nation-State has the privilege of ‘sustainable’ money printing.

When you have the #1 currency, the global demand for your asset mitigates much of the negative impact of money issuance. This is why the U.S. has been able to get away with it for so long; any new supply of dollars is immediately sucked up by global commerce due to the petro-dollar system.

But wasteful spending and corruption is finally rearing its head, and the confidence of the U.S. dollar is waning.

Just in time for credibly-neutral and incorruptible blockchain networks to take the place of the global reserve currency.

Positive feedback loop

The Nation-State with the world’s reserve currency also has the world’s most powerful military—they go hand-in-hand. Military power secures the value of the currency by commanding global trade. It ensures that the global economy is always using its money (or else!).

This manifests in a positive feedback loop of power. Once the #1 Nation-State spot is achieved, the costs of maintaining an army become cheaper thanks to control over the world’s reserve currency.

The value of a dominant reserve currency further subsidizes military costs, which in turn cements the value of the currency, etc.

Putting it in blockchain terminology

Nation-State armies translate to blockchain security.

Bitcoin’s army is its miners.

Ethereum’s military is its stakers.

Every blockchain has security expenditure. Blockchain sustainability is achieved by optimizing the amount of currency issued for security produced. How much security can you get for the minimum amount of money printing i.e., token inflation? Whichever blockchain answers this question best will likely find themselves at the #1 spot on CoinGecko (eventually).

Blockchain security forces are strictly defense-only armies. No attack! Only defend.

Proof-of-Work (PoW) erects a wall of electricity around the Bitcoin economy. Anyone with a shorter energy-wall cannot penetrate through the Bitcoin PoW force field.

Proof-of-Stake (PoS) erects a wall of capital around the Ethereum economy. Anyone with a lesser amount of capital cannot penetrate through the walls that protect Ethereum.

The price of BTC and ETH is a significant factor in how cheap security is for these ecosystems. If the assets of a chain increased 10x in value, then the security budget also increases by 10x. A 10x higher price means that the system can access 10x the level of security for the same amount of issuance.

Monetary premium is security.

The supply of Bitcoin hash power increases as the BTC price goes up.

The incentive to stake ETH increases as the price of ETH goes up.

BTC issuance is hard-programmed, so an increase in BTC value increases the security-expenditure of Bitcoin (at least until its block reward subsidy runs out!). This can lead to over-expenditure of security. If Bitcoin was secure at $1,000, it is 10x as secure at $10,000… but it still would have been secure anyways.

In contrast, Ethereum has been more flexible with its issuance. As the price of ETH increased, the block reward issuance of ETH has been reduced:

- Block 0 to Block 4,369,999: 5 Ether

- Block 4,370,000 to 7,280,000: 3 Ether (2017, changed via EIP-649)

- Block 7,280,000 to now: 2 Ether (2018, changed via EIP-1234)

In 2021, EIP-1559 began recapturing excess ETH via fee burning.

Later in 2022, issuance will be further reduced by 90% with the merge to PoS.

Ethereum security philosophy’s is one of minimum viable issuance. How does Ethereum issue the least amount of ETH to achieve the required amount of security?

Putting in back in Nation-State terms: How can we optimize our army to be maximally effective, for the least cost? Less tanks, more drones.

The reduction of ETH issuance makes ETH more scarce, increasing its value on secondary markets. A higher price on the secondary market increases the security of Ethereum, creating a positive feedback loop where more security is achieved at less issuance.

That’s monetary premium.

Rollups: The Empire Model of Security

Ethereum’s modular design structure enables it to be infinitely scalable.

Rather than trying to host an entire global economy on top of a single blockchain, Ethereum becomes the settlement layer for other blockchains.

The U.S. has the most powerful military, and secures and facilitates global trade between countries, so long as they use the dollar.

Ethereum has the highest security, and it secures and facilities global trade between L2s, so long as they use ETH to make an L1 transaction.

The strength of the dollar doesn’t come from domestic production of the U.S. economy; it comes from external demand for dollars in order for countries to engage in global commerce. The U.S. doesn’t control the economy of Germany, France, Argentina, etc, but it still captures upside of these economies, because in order to trade with others, they must translate their GDP into dollar demand to import and export.

Likewise, Ethereum doesn’t control the economies of L2 blockchains. Each L2 has complete sovereignty over its own economy. But when it comes to exporting the GDP from one rollup to another rollup, L2’s must consume ETH to make L1 transactions. Rolling up tens of thousands of transactions into a single L1 transaction is how the commerce on an L2 becomes interoperable with the rest of the Ethereum ecosystem.

The beauty of Ethereum’s modular design is that you can append basically infinity L2s on it, making the Ethereum as an L1 the most fundamentally scalable blockchain design, allowing it to grow from a kingdom to an empire.

The costs of spinning up a new L2 on Ethereum are close to zero. This is the equivalent of an empire simply manifesting new territories and economies out of thin air, so long as there is sufficient demand. Every new L2 adds to the net GDP of Ethereum, and Ethereum is free to add as many L2s as the market demands.

As I wrote in 2020, all roads in Ethereum lead to ETH.

Simplicity at the center, complexity at the margins

The Federal / State structure of the U.S. is emulated in the L1 / L2 structure of modular Ethereum. Simplicity at the center; complexity at the margins.

⚠️ Flaws in the U.S. System. I know there are differences between the theory of the US model versus how it has manifested in reality. The U.S. is far from perfect. I’m ignoring these imperfections to drive home the point in this article.

The Federal government of the United States is the L1. It determines the universal ‘meta-laws’ that all states (L2s) abide by. These meta-laws are designed to facilitate interoperability between the States. It enables trust for efficient interstate commerce.

For example, the FDA maintains food standards across states, making sure that food can be traded across states with assurances that one state won’t sell tainted food to another. The EPA maintains environmental regulations, ensuring that the negative environmental externalities of one state doesn’t impact the economies of other states.

But the Federal government is supposed to only offer the minimum amount of rules and regulations needed to produce a ‘United States’. All other laws and rules are left up for the individual states (L2s) to decide for themselves.

This same pattern exists on Ethereum.

The law of the Ethereum Virtual Machine (EVM) on the Ethereum L1 is designed to coordinate economic resources across the L2s. The EVM is the shared set of laws that all L2s agree to abide by, and this common standard is how L2s can share in the economic upside of each other’s growth. What is good for New York is much better for California than it is for Canada!

Sharing the same L1 protocol is how each independent blockchain turns from antagonistic to aligned. The success of an L2 rollup on Ethereum has positive externalities for other L2 rollups on Ethereum, due to the interoperability on the underlying L1 chain. There is shared upside among the United L2s.

The beauty of the L2/States rights model is that every L2/State gets to determine what works best for themselves. Ethereum doesn’t determine the laws of the L2; only the laws required for inter-L2 coordination.

An L2 rollup can be:

- An optimistic rollup like Optimism, or Arbitrum

- A zk-rollup like zkSync or Starknet

- A validium like Immutable X

- A centralized ledger like Coinbase or Wells Fargo

- A consortium chain like Hyperledger

- Your own personal playground, for whatever reason.

There are no limitations on how to construct an L2 on Ethereum; only that you must abide by the interoperability standard of the EVM.

Complexity at the edges, simplicity at the center

This illustrates the principle of ‘complexity at the edges, simplicity at the center”, a shared principle found throughout nature.

It’s how organisms grow; genetic code at the center, genetic expression at the margins. This is how an app-store works; a basic distribution platform at the center, developer innovation at the edges. This is the Federal/States model; meta-laws at the center, innovation at the edges. This is the modular Ethereum structure; the EVM at the center, L2s at the margins.

‘Simplicity at the center’ maximizes the expression of the margins. Enable the humans of the world to build whatever their heart desires, and they’ll create something amazing. Restrict humans with overbearing laws and regulations and you’ll stifle innovation and progress. Do one thing and do it well, while enabling a developer/entrepreneur ecosystem to flourish to take things the rest of the way.

Voting with your feet/money

The L1/L2, Federal/State model is an individual empowerment mechanism.

Is your state becoming coercive and domineering? Are they extracting more taxes from you than services they provide? Your solution is easy: move to a different state.

With the States model, the ability for an individual to exit from a coercive state of affairs is a check on the coercive state. Because individuals can leave, states must compete with each other to make their constituents happy and retain their residency. States that do this better are rewarded with more economic resources and more people moving in.

The same dynamic will play out in L2s.

Is your L2 charging too high fees? Is it making sufficient investment into its infrastructure to make life easier for its users? Is it keeping up with the pace of innovation, or is it falling behind?

If the L2 you’re on isn’t up to your satisfaction, you can just hop to a different one. L2s will compete with each other for users and their money, and this competition is good for the user.

Who pays taxes to who?

Ethereum is a modern instantiation of the same patterns of global coordination we’ve seen throughout the millennia.

Kingdoms produce armies to battle other kingdoms. The winning kingdom subsumes the loser kingdom, and the loser kingdom begins paying taxes to the winning kingdom empire. The empire would then become responsible for protecting its new sub-kingdom from external attack by leveraging the resources inside the new sub-kingdom to bolster its army and grow its reach.

As soon as humans evolved from hunter-gatherers to settled agrarian society (the same moment we established the idea of ‘property’), the question of “Who pays taxes to who” became the foundational question of human coordination.

Over the ages, this process has become less and less violent, but the fundamental structure is the same. The US doesn’t maintain its empire by violence (okay, often it does), but instead by ensuring global trade is denominated in its currency.

The Ethereum Empire

The Ethereum empire will grow in two ways:

- New L2s are created and added to the ecosystem

- Insecure L1s roll themselves up into Ethereum L2s

Adding new rollups is quick and easy. Rollups (Arbitrum, Optimism, zkSync) are produced internally; they leave the congestion of the central empire and establish new subkingdoms outside the main castle.

These new satellites of Ethereum govern themselves and produce their own economies. But after every few blocks, they bundle up their aggregate economic activity and make a transaction to the L1. In exchange for an ETH tax to process a transaction, the security power of the Ethereum L1 is bestowed on the L2.

Other L1s turning into Ethereum L2s is a more complex story.

Summarized: Alt L1 chains issue more currency than Ethereum to pay for lesser security. If they want to stop inflating their currency, they can just choose to be protected by Ethereum instead.

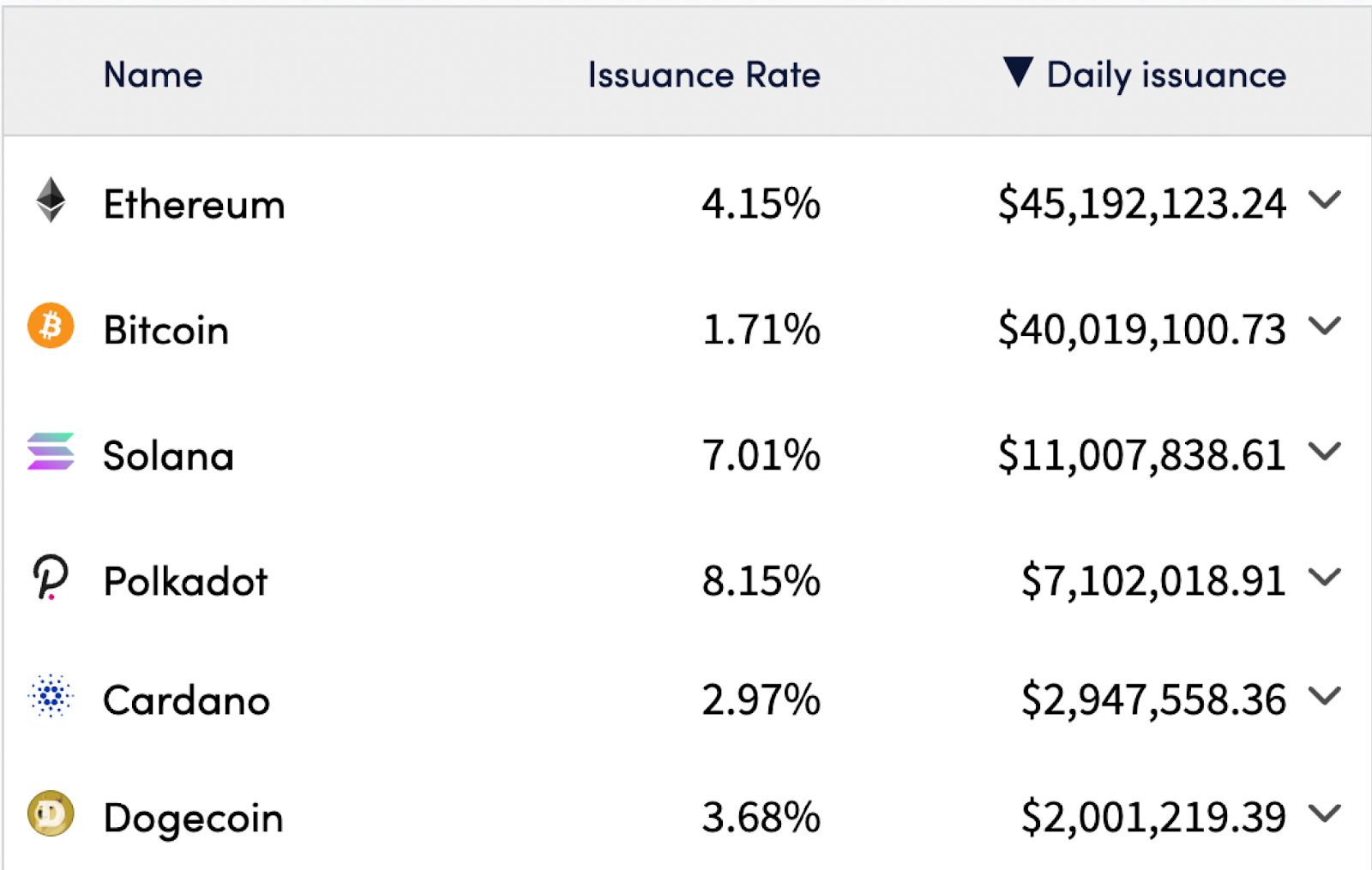

The Numbers:

Ethereum is currently inflating @ 4.15% while providing $45m in daily security payments to its network (this does not include the burn, which reduces inflation!).

The monetary premium that BTC currently holds is evident here. It’s only inflating @ 1.7%, yet is providing $40m in daily security.

BTC is inflating 2.4x less than ETH, while producing 89% of the security of Ethereum. That's 2.7x more efficient security! Too bad it can’t do smart contracts, otherwise I’d probably be way more bullish BTC. No smart contracts = no DeFi & no L2s.

You can see the following metrics at MoneyPrinter.info

Solana is inflating @ 7%, while only achieving $11m in daily security. That’s 1.75x more issuance than ETH, while achieving only 24.4% of Ethereum’s security. Ethereum has 7.17x more efficient security than Solana.

AVAX is inflating @ 5.5%, while achieving $5.7m in daily security. That’s 1.3x more issuance than ETH, while achieving only 12.5% of Ethereum’s security. Ethereum has 10.4x more efficient security than Avalanche.

This is before Ethereum switches to Proof of Stake (which Solana and Avalanche already are), and the issuance of ETH drops 90%, while simultaneously strengthening its security mechanism.

⚠️ Note: Although this is a very big piece of the puzzle, this is not a holistic illustration of all the variables that go into security. A deep dive into that subject is outside the scope of this article.

The Monolithic Trap

This is the trap that ‘scaled’ Monolithic blockchains fall into. Both Avalanche and Solana market themselves as the low-fee L1, but this property forces them into issuing more currency to pay for security. Both Solana and Avalanche have much higher throughputs than Ethereum. They produce more total blockspace to host more data. If you have more blockspace, you have to increase the security spend to defend that extra space.

More blocks require more armies!

Scaling a monolithic kingdom is like expanding the fortress walls out further and further out, rather than allowing people to leave the Kingdom to produce satellite settlements.

In order to differentiate from Ethereum, alt L1s have increased their L1 throughput in order to reduce fees. The consequences of this are likely catastrophic for the long-term monetary premium of these L1 chains. This design choice creates high issuance while also limiting how much fees can be collected.

More issuance, less fees. This kills the monetary premium.

In contrast, Ethereum’s priority of decentralization at the L1 and scalability at the L2 produces high L1 fees, while minimizing the need to issue ETH.

Less issuance, more fees. This is how you produce a monetary premium.

With the issuance already minimized, the fee burn from EIP-1559 captures the economic energy of the Ethereum ecosystem, and injects it into the value of ETH (by making it more scarce). ETH value goes up, requiring less ETH to be issued to pay for security. This issuance reduction increases the scarcity of ETH, increasing its value, and further reducing the need to issue. It’s a positive feedback loop into monetary premium.

Chains that attempt to scale at the L1 have a positive feedback loop in the opposite direction. Scaled L1s require high issuance, and cannot capture meaningful fee revenue. This forces supply inflation, decreasing its scarcity and putting downwards pressure on the currency. It cannot subsidize issuance with fees, because that’s antithetical to the purpose of these Alt L1s. As more and more issuance occurs, the lowered value of the currency (due to inflation) incurs further issuance demands.

Now, these Alt L1 assets can still go up in price, causing a reduction of the need to issue. But remember what I said at the beginning of this article:

Blockchains are like chess: Making a good move isn’t enough. If you don’t make the best possible move available to you, then you made a bad move.

Even if an Alt L1 currency goes up in price, the fundamentals of a scaled L1 blockchain are always that it has to issue more than a decentralized L1 blockchain.

The playing field for the fight to be the #1 L1 blockchain is always tilted towards who can issue the least currency to achieve the maximum amount of security. If you have security, you can have everything. If security is expensive for you, then your options are limited.

If you’re not playing to be an empire of blockchain networks, then you’re not playing at all.

The Alt L1 Game of Chicken 🐔

Optimism and Arbitrum are already functioning L2s, and they don’t even have tokens (yet). They’re economically viable without any issuance. They generate revenue by selling blocks, and then they pay a little bit in taxes to the Ethereum economy every time they make an L1 transaction.

Avalanche, Solana, Terra, and basically all blockchains with subdominant security all have a hole in their boat. Their boat is leaking, and the longer they let inflation go rampant, the worse the problem gets.

By becoming an Ethereum L2, their issuance (the source of the leak) can drop to 0. They instantly become revenue-positive, and they can even increase the throughput of their chain.

All Alt L1 blockchains are in a game-of-chicken.

Will they ever get it? No one wants to bend the knee. Hubris and ego get in the way.

The arguments articulated in this article are generally why alt L1 communities illustrate me as an ‘ETH Maxi’.

In reality, it’s decentralization maximalism that is what enables this empire model of blockchains to exist. Ethereum’s commitment to a decentralized L1 and constrained L1 blockspace is how it creates a vibrant and rich L2 ecosystem. It’s how we produce a network of blockchains that extend the decentralization and security of Ethereum’s L1 to an infinite array of L2 blockchains. Not having to be concerned about security puts winds on the backs of these L2s, allowing them to scale much further than any L1 ever could.

We just need to get past this awkward L2 bootsrapping phase, in which alternative L1s have found a niche to thrive in the confusion.

Just as all roads lead to Rome, all chains lead to Ethereum.

- David