The Case for $100 SUSHI

Dear Bankless Nation,

We’ve said it before: we’re leveling up our understanding of DeFi tokens.

We like to call them crypto capital assets. Why?

Because these assets have on-chain cash flows—they’re productive assets! That means we can apply time-tested metrics like the PE ratio and models like the Dividend Discount Model…wait what was that last one?

The dividend discount model (DDM) is a traditional model used by investors to measure the value of a capital asset by projecting out future dividend payments. The models make assumptions around future growth, but it can serve as a foundation to make a base case for the current value of any productive asset.

Not all DeFi tokens can use this model though—they have to be distributing dividends to token holders. MKR, SUSHI, and KNC are perfect examples.

Today, John uses traditional valuation methods to make the case for SUSHI.

This one’s good.

SUSHI is under $20 today.

Here’s how it could be worth $100.

- RSA

📺 Watch This Week’s AMA With Devin Finzer from OpenSea

A discussion with OpenSea’s co-founder on scaling with L2 & the next innovation in NFTs.

⚠️ Disclaimer

None of this is financial or tax advice. This post is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Do your own research.

TOKEN THURSDAY

Guest Writer: John Todaro, Head of Business Development at TradeBlock

SUSHI Valuation Analysis & Model

SushiSwap is a decentralized cryptocurrency exchange (DEX) and community-led AMM built on Ethereum.

Over the last six months, SushiSwap has consistently ranked as one of the largest DEXs by trading volume and total liquidity. At time of writing, SushiSwap is averaging $200-400 million in notional trading volume everyday and has generated over $100M in cumulative revenue since launch.

Recently, SushiSwap initiated a process whereby a portion of trading fees across the platform are paid out to token holders. With this initiation, investors and market participants can now receive rewards in a productive asset through an ownership stake. Moreover, assets that pay out a reward can be valued on a more quantitative level as rewards can be modeled into the future in a somewhat predictable fashion.

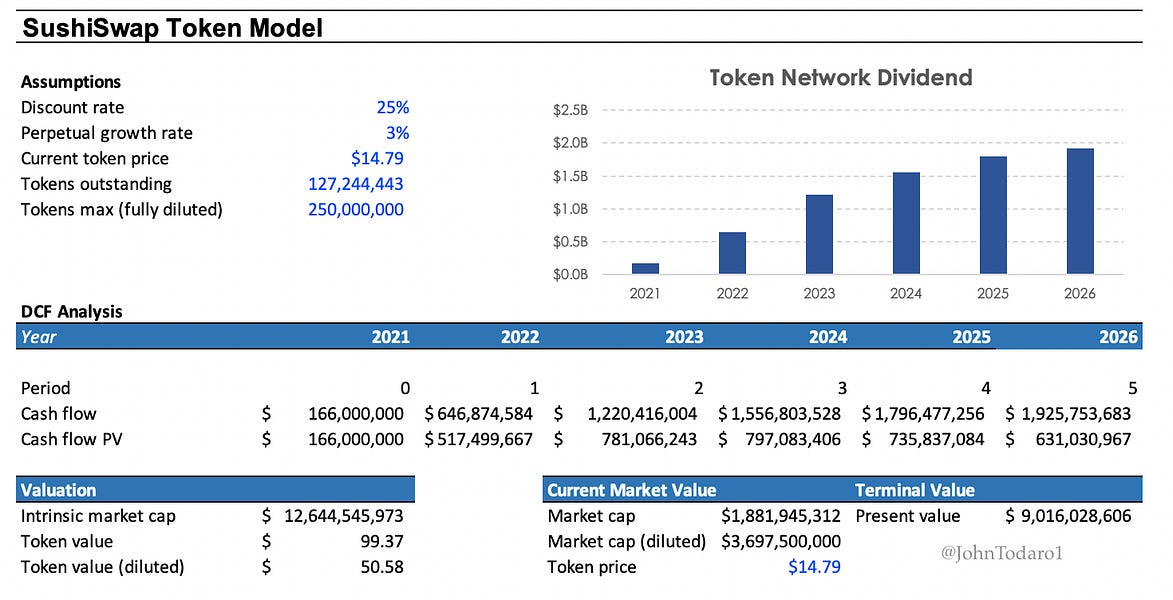

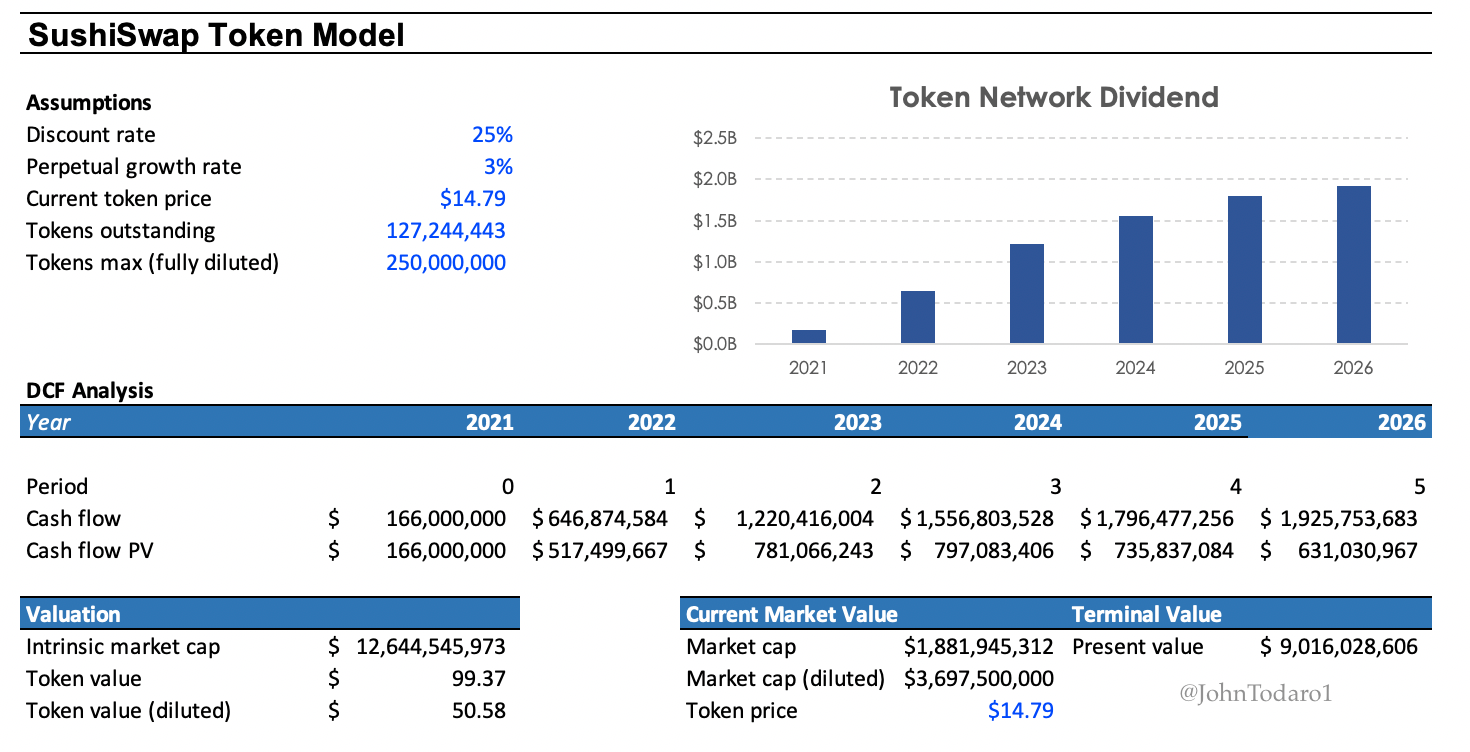

I built out a valuation model that approximates an intrinsic value for the SushiSwap platform and corresponding native token, SUSHI.

This article breaks down this process and how I arrived at an intrinsic value of ~$100 for SUSHI.

SushiSwap tokens: SUSHI and xSUSHI

SushiSwap’s native token, SUSHI, is a ‘governance’ token whereby the community votes on all major changes to the protocol. While a number of DEXs offer similarly structured governance tokens, SushiSwap is one of the first to initiate a payout to token holders—this payout comes from the pool of trading fees that are collected on the platform.

When market participants trade on the SushiSwap DEX, a 30 basis point fee is charged. A 5 basis point fee is added to the SushiBar pool in the form of LP tokens for the relative pool which are then sold for SUSHI. The newly bought SUSHI is divided up proportionally across xSUSHI holders in the pool—with xSUSHI holders receiving these tokens.

The net effect of this fee payout is similar to a dividend in traditional equity markets and allows for token holders to accrue value in a productive asset.

This represents one of the first instances whereby a token project has an incentive mechanism built in whereby token holders can share or participate in the fees that are accumulated on a protocol. I would expect in the future other governance tokens to initiate similar models whereby token holders can participate in fee accruals.

⚠️ RSA Note: Let’s talk about the reason some DeFi tokens haven’t added cash flows—SEC regulation! The elephant in the room: if a DeFi project team is located in the U.S. or not pseudonymous they’re less likely to rush the addition of cash flows into their token even if it makes sense. This leaves “token governance” to vote to add the cash flows at a later date.

📺 We talked to 0xMaki about this recently on the podcast.

Valuation Model Basics & Assumptions

In traditional equity markets, dividend paying stocks are often valued by discounting future cash flows to the present by an expected discount rate—a model which is aptly called a ‘dividend discount model.’

These discounted cash flows from future periods are then summed together to create a total net present value (PV). In this model, I utilized historical trading volumes and fees to build a starting point for calculating cash flows.

Because the first full year of dividends is not yet known, I projected cash flows out for the remainder of the year assuming volume growth over the last three months continued at a similar rate for the remainder of 2021. This is period 0 in the model.

In periods 1-5, I projected out growing cash flows that waned in further out periods (years 3-5) as the DEX market likely becomes more mature and saturated. As such, the projected volume growth rate resembles an J-curve. This is common modeling in early stage companies that see accelerated growth in early years before slowing over time.

After year 5, I calculated a terminal value for the network—this is the net present total value of the network from successive years projected into perpetuity.

Rate assumptions

- Discount rate: 25%

- Terminal growth rate: 3%

- Fee growth in periods 1-5: ~10x

- Trading fee rate: remains steady at 5bps

The terminal growth rate was modeled at 3% annually, which is inline with the broader industry and economy at large. In such models, it is typical to model the terminal growth rate inline with the GDP of the country the company resides in. In the US this is typically between 1.5-4% per year.

The discount rate was placed at 25%. In early stage networks and companies a 25% discount rate is fairly standard.

The discount rate is calculated by taking bond yields—typically the 10-yr (effectively deemed the risk free rate) and adding in some risk component. SushiSwap is a new entity and as such carries a considerable risk over traditional companies and more mature networks.

However, SushiSwap has been around for close to a year and has seen a reliable user base with a fairly transparent team and governance structure—as such the risk should not be too significantly higher than similar endeavors.

This rate can still be tweaked depending on assumptions and a rate of between 20-40% would also be deemed appropriate. In the past I have done work on building out a discount rate that is unique to cryptocurrency projects—this can be found in a Medium blog post from 2018. The discount rate can be quantified as the ‘cost of tokens’.

Note that as bond yields rise, discount rates also rise and as such the value of the network is decreased—especially if a large portion of a network’s cash flows are from periods farther in the future. Over the last six months we have seen bond yields rise considerably from 0.6% to 1.6%.

Because SushiSwap’s discount rate is still quite a bit higher than bond yields, even a large re-pricing in bonds will not significantly impact the NPV of SUSHI.

SushiSwap model

As shown in the figure above, taking into account my assumptions which I would deem as fairly base case and assuming the overall market continues to grow, SushiSwap has a current intrinsic market value of ~$12.64 billion and a token value of ~$100.

There are considerable risks in the market including a drawdown in DeFi cryptocurrency trading, which would severely impact SushiSwap’s volumes and hence trading fees.

A rise in competitors which can fork various aspects of the project as well as competition on liquidity/fees/and volumes would also negatively impact SUSHI. This report should be considered as educational material and a thought exercise on how reward paying tokens offer an interesting value accrual to token holders.

This report should in no way be considered financial advice. Always do your own research.

If you like this report and the content, please feel free to follow @JohnTodaro1 on Twitter!

Action steps

- Analyze the above model and adjust the assumptions to fit your own outlook!

- Learn about the Dividend Discount Model & how we can apply it to DeFi tokens

- 📺 Watch The Rise of SushiSwap with 0xMaki

Author Bio

John Todaro leads business development at TradeBlock, a leading provider of institutional trading tools, indexes, and research for digital currencies. Prior to crypto, John was a former bond trader at Citi.