The Bull Case for Ethereum Challengers

Level up your open finance game 5x a week. Subscribe to the Bankless program below.

Dear Bankless Nation,

Let’s be clear: the Bankless editorial thesis is fundamentally bullish Ethereum.

I believe DeFi can only fulfill its potential on a credibly neutral, censorship resistant, fully permissionless, property rights system backed by a store-of-value asset and that that Ethereum is by far the strongest contender—this is just a rational extrapolation of the protocol sink thesis.

But what if this whole Ethereum thing doesn’t work out? What if everyone wants to build on other base layer chains?

The Ethereum killers succeed??? Impossible!

As Ethereum bulls, we have to challenge our assumptions. We need to steel man alternative arguments compare them to our own. It’s necessary to build conviction. And at the end of the day, the goal isn’t be a bitcoiner or etherean, it’s to go bankless.

Could all this happen on a non-Ethereum chain?

Or more fundamentally what if the Bankless thesis is wrong? What is maximally decentralized and credibly neutral isn’t the path to global adoption?

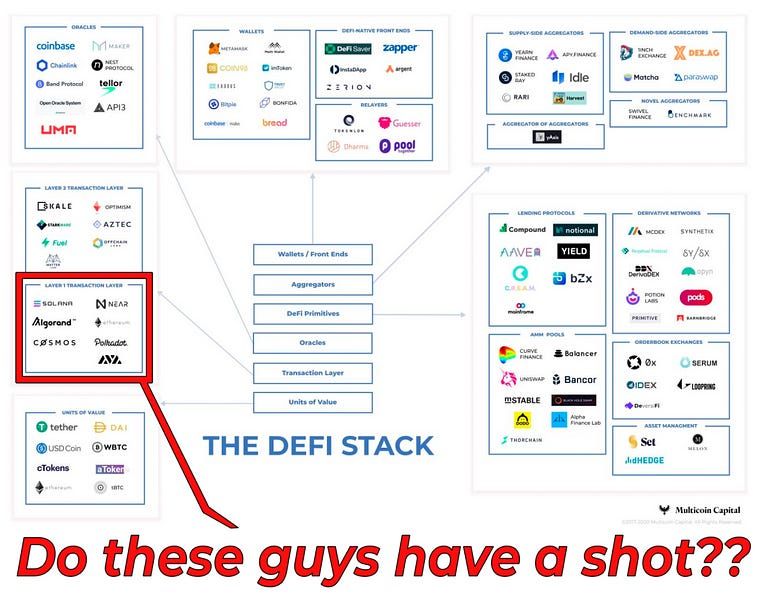

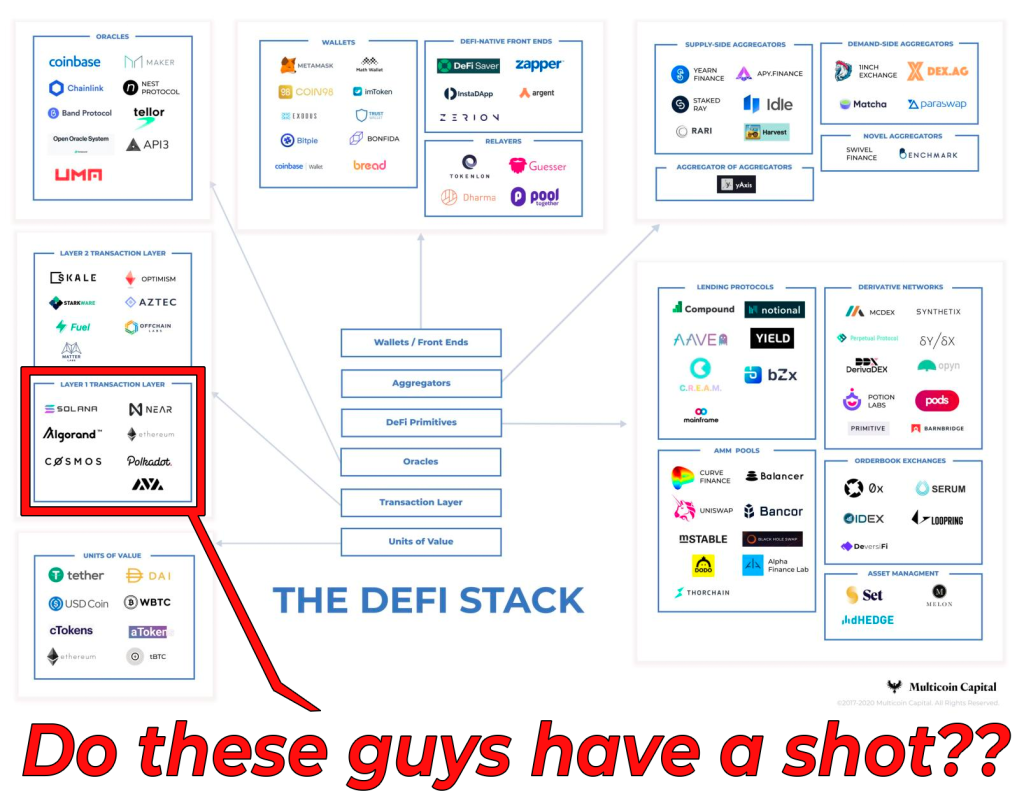

We brought in Kyle Samani to tell us why Ethereum challengers have a shot.

So let’s entertain the idea.

- RSA

P.S. You can still get Ledgers for 40% off. Deal ending soon, get ‘em while it lasts! 🔥🔥🔥

🙏 Sponsor: Argent – DeFi in a tap (👈 go download this wallet now - RSA)

We dropped a special episode of ALPHA LEAK on Andre’s new product—Deriswap!

Learn everything you need to know about Deriswap for capital efficient loans, swaps, futures, and options. Andre is a legendary builder in DeFi, so you know it’s good 👀

WRITER WEDNESDAY

Guest Writer: Kyle Samani, Co-Founder & Managing Partner of Multicoin Capital

Smart Contracts in 2021: The Bull Case For Challenger Chains

Ethereum is often positioned as the protocol with the highest probability to win DeFi.

That’s because today Ethereum has a lot going for it:

- It has the most moneyness: a base layer whose asset has a monetary premium has a massive security advantage over one that does not;

- It has the largest network effect: DeFi protocols, developer tools, mindshare, Layer 2s, everyone’s building bridges to Ethereum as an economic nexus. The Ethereum level network effect for DeFi is powerful.

Given all of these strengths, how is it possible for challenger chains to compete?

It’s a difficult question, and one that I’ve thought a great deal about as we invest across the crypto landscape. I’ll address this question from two angles: the DeFi angle, and the outsider angle.

The DeFi Angle

“I very frequently get the question: 'What's going to change in the next 10 years?' And that is a very interesting question; it's a very common one. I almost never get the question: 'What's not going to change in the next 10 years?' And I submit to you that that second question is actually the more important of the two -- because you can build a business strategy around the things that are stable in time. ... [I]n our retail business, we know that customers want low prices, and I know that's going to be true 10 years from now. They want fast delivery; they want vast selection. It's impossible to imagine a future 10 years from now where a customer comes up and says, 'Jeff I love Amazon; I just wish the prices were a little higher,' [or] 'I love Amazon; I just wish you'd deliver a little more slowly.' Impossible. And so the effort we put into those things, spinning those things up, we know the energy we put into it today will still be paying off dividends for our customers 10 years from now. When you have something that you know is true, even over the long term, you can afford to put a lot of energy into it.”

- Jeff Bezos, Founder & CEO, Amazon

Crypto evangelists (myself included) like to discuss the moneyness of base layer protocols. It is warranted, at least to some degree. After all, there are generally two perspectives on crypto: money crypto and tech crypto.

But I think most of the discussion about money crypto is misplaced, at least for now. It’s just too early to talk about these trust-minimized assets as money. The reality is that very few non-crypto people are going to use anything other than stablecoins as money in the foreseeable future. For now, base layer monies like BTC and ETH are best suited as collateral.

Today, what matters for smart contract platforms is tech crypto, not money crypto. If a smart contract is successful as a technology, it creates the opportunity to attract some sort of monetary premium, but that will take a long time, and the monetary premium will only accrue once the technology has proven itself in the public domain over an extended period of time.

There are a few hundred thousand daily Ethereum users, and DeFi users are some fraction of that. Since when in the history of technology has a few hundred thousand daily users cemented a technology as the runaway winner?

The Problem With L2 Scaling

Over the next 12 months, Layer 2s will emerge, but they don’t really solve the problem at a holistic, ecosystem level, given the realities of how capital flows through the system.

They only partially address the problem, but even in the most optimistic circumstances, they really do not fully address the core problems.

To understand this, let's consider some examples of how capital flows through DeFi on Ethereum today:

Scenario 1: A Retail User

This person has ETH, deposits in Aave, withdraws USDC, deposits USDC in dYdX (Starkware Layer 2) to trade leveraged ETH.

They make USDC-denominated profits, and want to use those profits to buy some AAVE. So they withdraw USDC from dYdX. But in this world of Layer 2s, Uniswap has cloned itself on Optimism Layer 2, so there are two Uniswaps. In order to receive best execution, the retail trader uses something like Paraswap, which gets a quote from a market maker that is bridging Layer 1 to Optimism Layer 2. This USDC-AAVE trade results in 3 on-chain transactions: 1) hitting the Uniswap pool on Layer 1, 2) trading USDC-AAVE atomically with the market maker on Layer 1, and 3) the market maker hedging their risk on Optimism Uniswap by submitting a transaction there.

Is this capital flow really more gas efficient than the status quo? Not by much.

Scenario 2: Market Makers

Assume we’re in a world in which there are a handful of Layer 2 derivatives exchanges, each of which want to control its execution layer given the subtleties of their matching engines, technical capabilities, and go-to-market focuses.

Let’s say that there are Perpetual Protocol, dYdX, DerivaDEX, MCDEX, Futureswap, Injective, and Vega (similar to how CEX crypto derivatives currently trade across ~8 major venues). There’s a volatile day, and market makers need to move their capital from venue to venue to re-collateralize their positions to make sure they don’t get liquidated. Meanwhile, because there is a large move, Uniswap, Balancer, and other Layer 1 liquidity pools experience a spike in traffic. Layer 2 deposits and withdrawals are much more gas expensive than Uniswap trades (and much more gas expensive than withdrawing directly from 1 CEX and depositing straight to another CEX in a single transaction, which is common practice today).

Is this capital flow more gas efficient than the status quo? I think it’s actually more expensive because the gas costs of entering/exiting Layer 2 are at least 10x higher than simple ERC20 transfers from CEX to CEX (which is what happens today).

As these examples show, the problem with scaling via Layer 2s is that you break the fluidity of capital flow that makes DeFi magical. And to be clear, DeFi is magical today (other than gas costs, latency, and failed transactions).

While Layer 2s may solve idiosyncratic problems for individual chains or applications, moving to a world of many Layer 2s actually breaks the foundation that makes DeFi feel magical. In addition to making it slower and clunkier, moving to a world of fragmented Layer 2s also increases trading and borrowing costs by severing liquidity pools.

This becomes even more problematic as existing liquidity fragments. For example, consider the new AaveDAO proposal from Delphi (which breaks up Aave into smaller pools to reduce global risk). These new pools will become even more expensive to borrow from as liquidity fragments across many AaveDAO pools, which will exist on Layer 1 and many Layer 2s.

Scaling via Layer 2s solves for isolated and incremental speed improvements but does not solve the core problems related to capital efficiency and composability—two of the key ingredients that make DeFi fascinating as the next evolution in finance. This isn’t to say that Layer 2s cannot help at all. They are very useful for self-contained capital flows (e.g. someone walks into a casino, and plays 10 different gambling games before leaving). But they do not solve the problem of scaling global, fluid capital flows across many financial primitives.

It’s also worth noting that while everything above was written in the context of rollups (both optimistic and zk-flavors), all of it applies to sharding as well.

Sharding provides one nice benefit over rollups: in a well-designed, sharded system, the base-layer system can automatically route transactions between shards without the developer or user being aware of which shard(s) are being impacted. But automatically routing messages between shards does not solve the problems described above.

Liquidity always concentrates in a handful of venues, whether for spot, borrow/lend, futures, or options. Liquidity is not a winner-take-all, or even a winner-take-most moat, but liquidity does concentrate into a limited number of venues. There is not going to be a long tail of liquidity venues (e.g. 100+ exchanges, each of which live in a separate rollup or shard with separate liquidity pools and/or market makers). And that means that in order to scale, you need to scale transaction volume for a limited number of venues, rather than simply scaling by increasing the total number of venues.

An Optimal DeFi Venue

So, what is the right solution?

Before I answer that, let’s consider what makes for the ideal trading venue. The substantial majority of trading is not actually spot; instead, it involves levering up on some collateral (futures, options, etc).

The ideal trading venue should support:

- Spot for as many assets as possible

- Borrow/lend for as many assets as possible

- Allow for using the broadest array of assets as collateral, given risk limits of using less liquid collateral

- Portfolio-level margining (instead of position-level or account-level)

- Using offsetting longs and shorts - even across assets - to increase portfolio leverage

In traditional finance, prime brokers provide all of the above. They have enormous balance sheets, so they provide this service across an array of venues (NYSE, CME, NASDAQ, Fx markets, bond markets, etc.) for hedge funds.

In crypto, the closest thing to this is FTX. FTX came out of nowhere in 2019 and out executed the competition because the FTX team understood how traders wanted to trade, and they built the crypto exchange they had always wanted to trade on. FTX doesn’t quite offer everything above (for example, FTX doesn’t use offsetting long/shorts across assets to increase portfolio leverage), but they are the closest.

The reason FTX works is because there is a logically-centralized risk engine that manages global risk.

Some examples: for every $1 of BTC a user has as collateral, users only get credit for $0.95 of collateral. ETH gets $0.90. These designations are arbitrary, and will be tweaked over time. The specific parameters are not important. The important part is that there is a consistent and global ruleset that applies across the entire venue, and that makes the venue the most efficient place to trade.

So, in order to build the best DeFi venue possible, there are two major requirements:

- A blockchain that provides a stable, predictable foundation on top of which you can scale transaction volume across a small number of venues.

- A logically-centralized venue that manages risk.

Solana provides #1, and Serum provides #2. This combination doesn’t exist on Ethereum or any challenger chains.

The blockchain and the exchange are interdependent. The FTX team chose to build Serum on Solana not only because Solana scales transaction throughput for a single venue, but also because Solana provides a stable foundation. The FTX team believes that DeFi can rival CeFi. They believe that in order to scale DeFi to CeFi scale, they need a stable foundation on top of which they can build for years. Stability is paramount.

Consistent with Moore’s Law, every 1-2 years Nvidia will release new GPUs with ~2x the number of cores as the previous generation. As validators upgrade their hardware over time, Solana’s global throughput will organically grow alongside GPU core count.

Now, let’s consider the outsider angle.

Outsider Perceptions & Normalcy Bias

Let’s go back to Bezos’s quote again:

“I very frequently get the question: 'What's going to change in the next 10 years?' And that is a very interesting question; it's a very common one. I almost never get the question: 'What's not going to change in the next 10 years?' And I submit to you that that second question is actually the more important of the two -- because you can build a business strategy around the things that are stable in time. ... [I]n our retail business, we know that customers want low prices, and I know that's going to be true 10 years from now. They want fast delivery; they want vast selection. It's impossible to imagine a future 10 years from now where a customer comes up and says, 'Jeff I love Amazon; I just wish the prices were a little higher,' [or] 'I love Amazon; I just wish you'd deliver a little more slowly.' Impossible. And so the effort we put into those things, spinning those things up, we know the energy we put into it today will still be paying off dividends for our customers 10 years from now. When you have something that you know is true, even over the long term, you can afford to put a lot of energy into it.”

- Jeff Bezos, Founder & CEO, Amazon

I’m repeating this for a reason: stability is paramount.

2017 was a crypto bubble. Bubbles are awesome. The best thing about bubbles is that they draw attention. In 2017, a lot of entrepreneurs and businesses around the world looked at Ethereum (as the only available smart contract platform at that time), and seriously considered what they could build on top of it.

What did they ultimately build? Not much.

Why? Because they couldn’t identify a stable technology foundation on top of which they could scale smart contracts to millions of users.

Three years later, Ethereum doesn’t provide a clear and stable scaling solution that developers can depend on for years to come. There are lots of theoretical scaling solutions for Ethereum, but there isn’t an obvious way to scale. Case in point: Reddit’s scaling bake-off. They want to use Ethereum, but they simply can’t figure out how.

There are a lot of big businesses who really want to scale permissionless crypto today, some of which are public about their ambitions:

- PayPal

- Square

- Brave

Plus the Libra consortium, which gave up permissionless scaling, and opted for a permissioned model (primarily for legal reasons).

All of these companies—and hundreds more that haven’t publicly discussed their crypto ambitions—are looking for a stable foundation that scales. When they identify such a platform, they will pull the trigger, and there will be a Cambrian Explosion of crypto-fueled innovation that is distributed via web2 companies.

Imagine the perception of a casual outsider (who is not familiar with the tribalism of crypto) that observes PayPal running on Algorand, or Reddit on Near, or Brave on Solana. It’s certainly possible that one of these apps routes millions of their users through one of these challenger chains while Ethereum has <1M users using the current DeFi stack.

If that happens, perceptions will quickly change!

Having a stable foundation on top of which developers can scale is paramount.

Ethereum will develop this foundation, but it’s not clear when or how that will manifest. Meanwhile, challenger chains, which have less baggage (e.g. the EVM), offer credible scaling solutions today.

Generally speaking, companies that want to leverage permissionless chains to roll out new features for millions of users are not ideological. They just want something that scales now, and that they know how it will scale tomorrow. They don’t care if there are 1,000 or 10,000 or 100,000 nodes participating in consensus. They are not aiming for sovereign-grade censorship resistance, since they are by definition subject to the whims of sovereigns.

Bankless readers often forget just how removed the rest of the world is from the day-to-day of crypto.

Adoption will drive optics, which will drive more adoption. While Ethereum has a major head start within crypto, outsider participation still rounds to 0.

The bull case for challenger chains is that developers and companies value permissionless innovation, that they place a premium on speed and costs for their users, and that they value above all else a predictable, extensible, unwavering foundation on top of which they can build.

Action steps

Consider the bull case for Ethereum Challengers

Understand the drawbacks Ethereum currently faces

Read up on previous Multicoin Favorites:

Author Bio

Kyle Samani is a Co-Founder and Managing Partner of Multicoin Capital, a thesis-driven investment firm that has backed a number of smart contract chains including Solana, Near, Algorand, Mina, and Dfinity.

Multicoin Capital invests across two funds: a hedge fund that invests in public markets and a venture fund that invests in private markets. The funds' LPs include university endowments, fund of funds, world class-technology investors, storied venture capital funds, and family offices.

Subscribe to Bankless. $12 per mo. Includes archive access, Inner Circle & Badge.

🙏Thanks to our sponsor

Argent

You were promised the future of money. Instead you got '90s banking UX and a paper password. Enough is enough. Argent protects your assets and gives you peace of mind. Earn interest and invest in a tap. No seed phrase. No problem. This is one of the best DeFi mobile wallets in the game today. Start exploring DeFi on the go with Argent. 🔥

👆Guys…this is my #1 recommended DeFi wallet. Stop reading this and go download it. - RSA

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.