The best argument against crypto

Dear Bankless Nation,

Last December, we posed a question in our weekly open thread:

What's the best argument against crypto?

We got a number of interesting replies, including:

- Code vulnerabilities

- On-chain immutability as a threat vector

- The State tracking your on-chain identity

- Reliance on electricity and the internet

- Unknown unknowns in upsetting the financial world order

Some valid arguments. But there was one that really stuck out to me. One that didn’t focus on the attacks from outside but rather the threat from within.

What if the real threat is the separation of crypto from crypto values?

After the Great Recession, the Bitcoin whitepaper became a rallying cry against the corrupt failing of opaque banking and big government that left the everyday-man holding the bag 💰

Bitcoin became the flag bearer of a new financial system. One that was not bound to centralized intermediaries, operated transparently, and could not be manipulated.

But are we truly living up to that promise? Or are we reverting back to our old ways because they are easy?

Are we afraid to be free?

Donovan shows us the costs of sacrificing the values of decentralization for convenience and what we can do to correct course.

- RSA

In a now-classic 2005 essay, the free market libertarian Nobel Laureate economist James Buchanan argued that the predatory growth of nation-states is, to a large extent, fueled not only by opportunistic politicians but also by the desire of citizens to evade personal responsibility.

Buchanan wrote that politicians are empowered because freedom comes with having to shoulder added responsibilities, and people are simply afraid to be free. They would rather embrace the “cocoon-like protection” of the regulatory state and delegate personal responsibilities of civic life to a central custodian who will bandage our cuts when we fall, rather than face the spontaneous orders and unpredictabilities of a free market economy.

This is not a unique observation.

Almost two centuries before, the French political scientist, Alexis de Tocqueville, made a similar observation when he left the monarchy of France for the newly established republic of America. Tocqueville marveled at the new republic but also feared that the costs of democratic self-governance may be too high to bear. He thought that this may lead to a trend where citizens gave up more and more of their liberties to a paternalistic and overbearing government.

In his 1835 magnum opus Democracy in America:

“The will of man is not shattered, but softened, bent, and guided: men are seldom forced by it to act, but they are constantly restrained from acting: such a power does not destroy, but it prevents existence; it does not tyrannise, but it compresses, enervates, extinguishes, and stupefies a people, till each nation is reduced to nothing better than a flock of timid and industrious animals, of which the government is the shepherd.”

In many ways, this parallels crypto’s biggest weakness today. It is a stateless system that requires self-governance, but it is hard to imagine that the majority of users in crypto today have much interest in decentralization, or possess the self-regulatory discipline that decentralization demands.

Decentralization means self-governance

The raison d'être of DeFi is the democratization of the world of finance. Thanks to the Internet and smart contracts, DeFi eliminates or reduces the influence of central entities — governments, corporations, or worse, the entanglement of both — on banking. A combination that had devastating effects, looking back at the Great Recession of ‘07-’08.

Decentralization is desirable because it makes it hard for organized groups to collude and manipulate the rules in their favor, rather than serve as a public good. DeFi promises to create a permissionless world of finance, where the average user is empowered to pursue their own financial freedom.

Yet, a stateless financial system doesn’t equate to zero governance. This is an important point worth restating twenty times over. A common misconception is to take the absence of government as a synonym for the absence of governance.

This is dead wrong.

Much of daily life is regulated by self-monitoring mechanisms that emerge from bottom-up spontaneous orders and collective action, from something as trivial as social norms that regulate workplace behavior, to the informal rules that police the public communities we live in.

The economist Elinor Ostrom won a Nobel Prize for her extensive breadth of empirical work that detailed citizenry self-governance in forests, inshore fisheries, irrigation systems, and policing systems, without the need for central intervention. A wealth of peer-reviewed social science research shows that efficient self-governance has a way of emerging, even in the most precarious of social circumstances like underworld prisons, poverty-stricken authoritarian nation-states, and 17th century Amsterdam stock markets.

DeFi is no different. The absence of political regulations only means that self-governance will be even more of a self-responsibility. Rather than trusting politicians or centralized parties to regulate DeFi, it is a self-custodial duty we choose to take on and develop.

Contrary to mainstream perception, DeFi is already replete with self-regulatory mechanisms. These rules and self-adopted policies discipline shirking and guard against predatory behavior:

- The most common are capital overcollaterization models used in staking and yield farming to deter debt accumulation.

- Another is the ubiquitous use of protocol tokens as a form of voting on protocol changes.

- Despite the lack of financial laws, many blue-chip DeFi protocols such as Compound, Uniswap or MakerDAO, have willingly submitted their smart contract codes for auditing.

- DeFi also offers insurance against smart contract hacks. Protocols in this submarket include Armor and Nexus Mutual, with $1.3 billion in TVL as of December 2021.

The mainstream media will continue to paint DeFi as a “wild west of finance”. But the reality is far less volatile and lawless than the metaphor suggests.

Self-regulation is widespread.

We are accustomed to centralized solutions

While formal rules and mechanisms are going to play an important role, it only forms half the puzzle of governance. As Buchanan and Tocqueville pointed out, systems are only self-sustainable if users themselves are willing to participate in self-governance.

An apathy for decentralization is explicitly visible. The best example of this can be seen in DeFi’s gravitation toward centralized platforms and solutions.

Take for instance the third-largest blockchain Binance Smart Chain (BSC), whose validator network carries a grand total of approved 21 validators, a pitiful fraction of the tens and hundreds of thousands in validator nodes compared to blockchains like Bitcoin and Ethereum.

The entry barrier to be a validator on BSC requires an astronomical upfront stake of 519,000 BNB ($277 million), compared to 32 ETH (~$80,000) on Ethereum 2.0, or 2000 AVAX ($136,000) on Avalanche, not to mention decentralized staking pools like Rocket Pool that lower the cost even further.

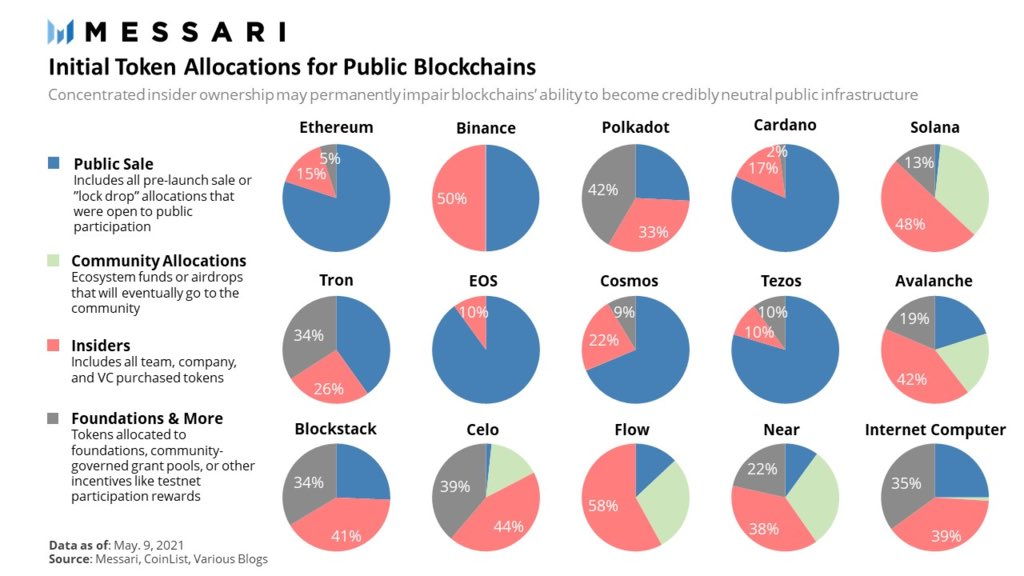

Its native token, BNB, is also one of the least publicly distributed, with 50% of it allocated to insiders.

From the perspective of decentralization, these are all red flags. 🚩

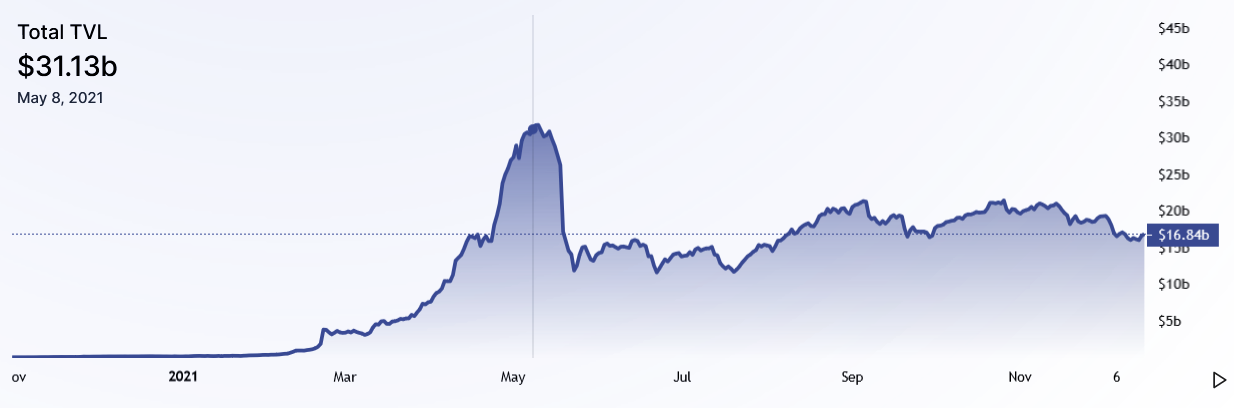

Yet, the fact that BSC’s network is relatively centralized doesn’t concern the majority of its users. The network has a TVL of $16 billion as of December 2021, and users continue to flock to its chain in increasing numbers.

The appeal is easy to understand. Centralization allows scalability in the short-term so users can side-step the typically high gas fees that decentralized node validation requires. In the area of blockchain gaming, where users perform frequent minting and trading of in-game NFT assets, a Dappradar report finds that BSC takes the lead over all other smart contract Layer-1’s, with more than 750,000 daily unique users on average during July.

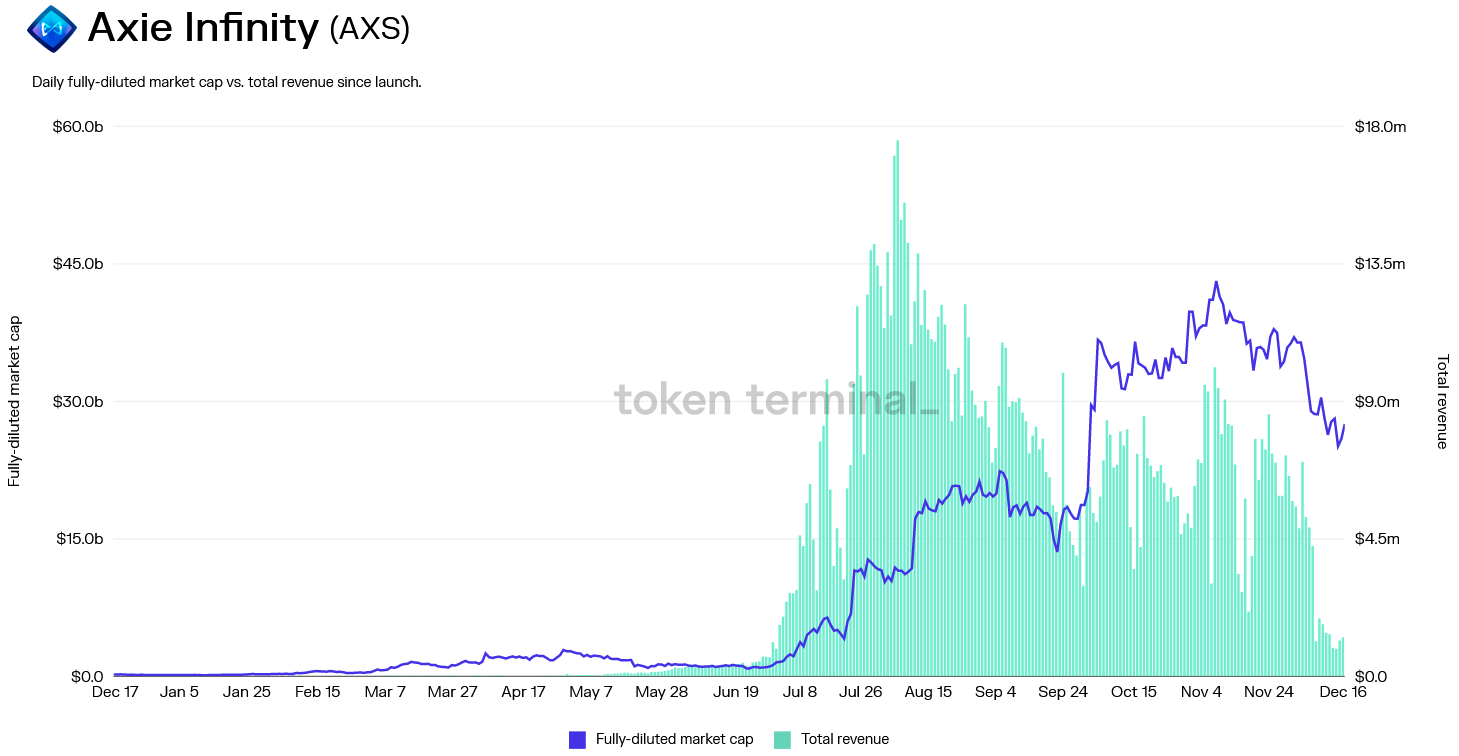

The tendency towards centralization is plainly visible elsewhere. Take, for example, the wildly successful blockchain game Axie Infinity. In order to accommodate its explosive growth in June, it introduced the centralized Ronin sidechain within the very same month for scalability.

As a business decision, it proved to be ingenious and highly lucrative. But from the perspective of crypto ideals, this is problematic. A centralized custodial bridge like Ronin adopts a “trusted” model, which essentially means players rely not on decentralized validation of their transactions, but on their reputation and integrity of the developers not to exploit them. Axie players traded away security for short-term efficiency.

But if developers have the power to remove or modify the hard-earned assets of players, then play-to-earn is not play-to-earn, but play-to-hopefully-earn. That simply takes us back to the world of traditional gaming, where big developer studios have too much control over how their in-game economies should be run. When we consider that the bulk of Axie players depended on the game as a respite in the economic devastation of COVID-19, immutable, economic ownership over their in-game assets should have mattered much more.

Axie Infinity is not alone. Many other cross-chain solutions such as BitGo’s “Wrapped Bitcoin” (WBTC) have traversed down the same prickly path of centralization, as wrapped assets are fundamentally managed by a centralized entity that oversees the gateway and rules by which assets are locked and minted. As of 19th December 2021, about 259 thousand Bitcoins ($12.2 billion) are held by BitGo.

When asked about the multi-chain future in a Messari Mainnet panel, Terra’s co-founder and CEO Do Kwon jokingly quipped that users trusted him and that he “probably wouldn’t steal the billion dollars” contained in Terra’s Shuttle bridge which connected to Ethereum. (To his credit, Kwon also acknowledged that such solutions are too centralized and will not stand the test of time.)

Trading Off Security for Costs

These are but a few examples of severe centralization, but there are far more threatening the future of crypto and DeFi’s potentials. It is perhaps ironic that, in a world where “decentralization” is professed to be its biggest selling point, there are this many successful centralized solutions.

Why is centralization succeeding in a space where decentralization is supposed to be its core value? The most straightforward explanation is simply that users don't care. Perhaps users do care, but they don’t care enough to sacrifice costs/efficiency/economic upside.

Users forget that Ethereum gas fees are merely a realistic price to pay as an alternative to the existing centralized financial system that can afford to give us “free” transaction fees because it has already achieved economies of scale.

We make use of blockchain products that are dressed and marketed in the language of decentralization, immutability, and user ownership. But false marketing masks the institutional reality that these products are centralized.

Messari analyst Ryan Watkins puts it aptly: “Every cycle people get hoodwinked by the latest centralized solution to all blockchains problems.”

Crypto faces a fundamental tension between DeFi’s long-term philosophical ideals and practical usage of DeFi in the here and now. Technology and developers are moving fast towards a decentralized world, but user demand and mainstream culture are still far too accustomed to the speed and ease that comes with centralization.

Software may be eating the world, but users aren’t hungry. This is a problem that crypto will have to confront, sooner rather than later.

With every high-profile protocol hack, the long arm of the state finds more and more of a reason to reach for DeFi.

How long before DeFi extends its arm back?

Implications and conclusion

It’s hard to blame centralized crypto products.

After all, companies merely respond to user demand. If users did not want them, they would cease to exist. Before we get to the nirvana of non-custodial, fully trustless transactions and immutable assets, it’s inevitable that CeFi will be playing some kind of role and DeFi’s landscape will resemble an archipelago of CeFi, DeFi, and or CeDeFi solutions.

What then?

We cannot forget that decentralization is the whole point.

History is chock full of great societies that took disastrous turns when they made short-term tradeoffs for gains. The path toward decentralization will not be easy. It shouldn’t be easy. It will be met with strong resistance by rent-seekers exploiting the apathy of the average user trying to preserve their share of centralized profits. Insofar as users are disinterested in self-governance, they will continue to fall victim to protocol hacks, rug-pulls, exploitation, and ongoing turbulence from predatory actors.

From a free-market perspective, this is not necessarily a bad thing. Attacks expose flaws and disrupt complacency which spurs a trial and error discovery process that leads to new knowledge. It’s why banks pay millions to white hat hackers annually. Error and failure are merely the cost of innovation and progress.

Crypto communities that care about decentralization need to support and prop up the developers that are pushing these frontiers. In exchange for Wrapped Bitcoin products that depend on centralized custodians, we should support protocols and developers with decentralized networks like renBTC. Instead of centralized stablecoins, we should make use of decentralized stablecoins like Dai and Frax, wherever possible.

Instead of centralized NFT marketplaces by FTX or Coinbase, artists and developers need to rethink the merits of decentralized platforms like Genie, NFTX, or Rarible. Users in their own DAOs must be hypersensitive to trends of centralization, such as how their native token might be distributed.

It’s going to get a lot tougher before it gets better and plenty of user education is needed.

Most users jumping on the crypto bandwagon are lured by high yields first, and considerations of security later. The lessons of decentralization and dangers of centralization must be restated repeatedly for newcomers and as a reminder to ourselves. After all, compromising the ideals of decentralization would simply defeat the whole point of DeFi.