Dear Bankless Nation,

Big box retailers owned the 90s—WalMart, Sears, Barnes & Noble. These were the kings of commerce. Utterly invincible.

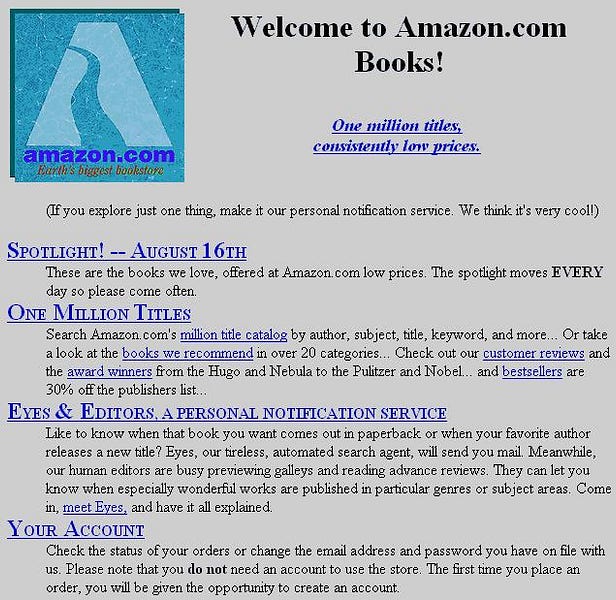

Amazon who?

In 1996 Amazon’s corporate office shared the street with a pawn shop and a heroin-needle exchange. And its storefront had an even worse location! How could it attract real customers on the internet?

Using the internet for shopping?

People just used the internet for gambling and porn.

No one would ever trust a website with their credit card.

Today Amazon is the 3rd largest company in the world. Its competitors have either been forced out of business or pivoted to adapt Amazon’s internet native model.

I want you to take a minute to realize just how impossible this outcome would seem to someone in the mid-1990s. At the time many considered the internet “Baloney”. It did nothing that CD-ROMs couldn’t. Websites were “expensive toys”. Hardly any users. Internet advocates were “hucksters”.

Read Why the Web Won't Be Nirvana published by Newsweek in 1995.

Even if…(and that’s a big IF)…IF…this internet thing worked out then the WalMarts would just adapt. They’d spin up a WalMart.com and drink Amazon’s milkshake.

What can Amazon do that the retail kings can’t?

Remind you of something?

Today Uniswap shares the street with ponzi schemes, twitter hackers, and seedy scam projects. Many consider Ethereum intellectually interesting but overhyped. Too hard do use. Too slow. A toy for geeks and a platform for scammers. Not real money.

Let’s be serious—they say. A couple hundred thousand DeFi users is a joke. If you want to speculate on silly digital assets just use RobinHood—Coinbase even.

What can Uniswap really do that banks can’t?

The answer to the “why DeFi” question sounds an awful lot to me like the “why eCommerce” question they asked in 1996.

Uniswap and Amazon can do three major things the incumbents can’t do:

- Build markets for the long-tail. For Amazon, this meant starting with the long-tail of obscure books the retail kings didn’t carry. Their shelf-space wasn’t physical it was pixels—and pixels were near free. Likewise, Uniswap makes markets for the long-tail of digital assets. Uniswap’s unfair advantage—anyone can list. No permission required. Liquidity for assets the exchanges don’t list.

- Set up shop in a hypergrowth economy. Amazon didn’t build their storefront in a place where consumers lived. They built in a place where consumers were going to live. 16 million internet users in 1995—20 years later there were 3.6 billion. Ethereum is attracting capital the way the internet attracted users. Four years ago there was less than $1 billion on Ethereum. Today there’s $50 billion. How long until there are trillions? Uniswap has its storefront at the center of this.

- Have impossibly low overhead. Amazon didn’t have stores. No need for large inventories. Lower acquisition costs. More sales less overhead. Profits were used to lower prices for customers creating a virtuous cycle that built market share. How about Uniswap? $300m in volume! Built by one guy on a YOLO grant. Liquidity surpassing centralized exchanges yet operating with 1/100th of the overhead. A network effect like Amazon. Profits used to lower prices. No fees.

The banks seem so strong. JPMorgan and WellsFargo and Binance. But there’s a chink in their armor. In his book, David and Goliath Malcolm Gladwell talks about the hidden advantages of underdogs who use technology to change the game.

David with armor and a sword? Goliath wins.

But David with a slingshot—the ancient equivalent of a firearm? Different story.

I can’t predict the Amazon of DeFi with certainty. Maybe Balancer beats Uniswap. Maybe both lose to another liquidity robot.

But I do know this:

DeFi is way more inevitable than people realize.

The banks can’t compete with disrupter protocols that operate on 1 one-millionth of overhead and set up shop in the middle of a hypergrowth digital economy. The banks seem downright antiquated in comparison.

I used my Ethereum accounts 50 times last week.

I don’t know the last time I logged into Wells Fargo.

- RSA