Dear Crypto Natives,

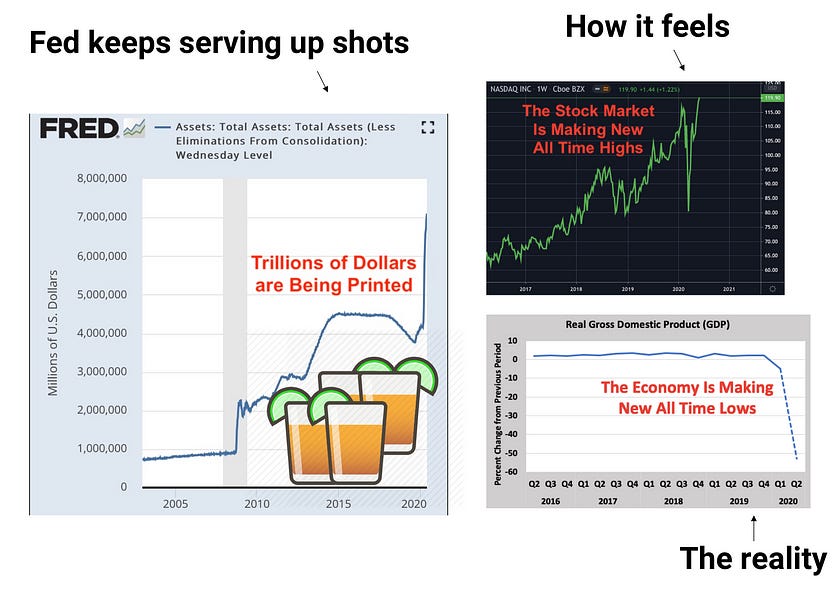

Someone’s gotta say it—stocks are drunk.

They’re not themselves. Slurring their words. Getting sloppy.

They’re not even acting like capital assets anymore.

What have they become?

They’ve become a savings account for the wealthy insured by the Fed. Pretending to be capital assets. Worse…like ICOs in 2017 they’ve become a speculators playground.

I’m not saying they’re a bad investment btw.

I’m saying who knows.

It’s impossible to tell. Right now stocks are based on the Fed, not the fundamentals. You can play the Fed’s game if you want. (Or you can wait till the hangover like Buffet)

We know what drunk looks like cause we’ve been there.

In 2017 DeFi was drunk.

Yes DeFi the concept was very much alive in 2017—we called it ICOs then. The new ability to raise capital pools without intermediaries—no VCs, no investment banks, no borders—just an idea and a few lines of code on Ethereum.

Fund was our first DeFi verb.

And it was quickly followed by another—speculate.

No boundaries. No models. It was intoxicating.

ICO. Speculate. ICO. Speculate. ICO. Speculate. ICO…floor.

Upload

-

When DeFi came to its senses the party was over. Just a trashed hotel room to clean up and a few builders remaining.

DeFi sobers up.

The last two years DeFi has sobered up and matured in three ways:

- Fund and speculate aren’t the only DeFi verbs. Now DeFi is performing all the money verbs: Pay, Lend, Borrow, Save, Trade, Invest, Earn, Govern, Hedge, Margin, Invoice, and Bet—the prototype of a complete financial system rather than a speculator’s casino.

- Scaling is here. Live exchanges capable of 1000s of transactions per second (TPS). A swiss army knife of layer 2 tech. And it’s not just TPS, economic bandwidth is scaling too—$7.3B in stablecoins, millions in tokenized Bitcoin, and a clear understanding of the role of ETH as trustless collateral.

- On-chain DeFi capital assets are here and we’re starting to figure out how to value them! Stocks generate cash flows settled in the legal system but the cash flows of these DeFi assets settle on-chain. Now we’re pouring on the rocket fuel on DeFi assets by unlocking new growth and governance mechanisms.

I’ve been excited about this last one recently because it’s just getting started. Just today Compound released a way for the bankless community to earn Comp tokens—in fact that’s this week's assignment!

(Above) How to Earn Comp Tokens—this week’s assignment

What I’m saying is the best capital assets of the 2020s won’t be sold on the NASDAQ.

They’ll be sold on the Uniswap.

No this doesn’t mean I think all DeFi assets are good buys. Nor do I think all stocks are overvalued. But as an asset class, I’m confident the best is yet to come for DeFi.

I don’t have this confidence for stocks.

This won’t always be the case…but right now…

Stocks are drunk.

DeFi is sober.

Someone should take away the S&Ps keys before he hurts someone.

- RSA