On Coordination vs. Defection

Dear Bankless Nation,

The story of humanity is one of coordination vs. defection.

Over time, humanity improved its coordination mechanisms allowing us to go from tribes, to towns, to cities.

Coordination is how we progress. It’s how we move forward.

#DeFiSummer2020 was a period of coordination, defection, and coordination again. An experimental sandbox of learning how to generate coordination-incentives that outweigh defection-incentives.

Increasing the returns to coordinate beyond the returns to defect is how we build scalable organizations.

And it’s how we’ll use Ethereum to build the Bankless Nation.

David explores this in detail today.

- RSA

On Coordination vs. Defection

Choosing to Coordinate

The progress of life is a story of coordination versus defection.

Dogs choose to be in packs, birds fly in flocks, fish form schools, and humans form tribes.

The world is a rugged, unforgiving place and your chances of survival are better if you choose to coordinate with others. We don’t group into tribes because we enjoy socializing, we enjoy socializing because grouping in tribes makes survival easier.

Things are easier in groups! Not only that, but things tend to get easier as groups expand. Over thousands of years, humans went from tribes of 50 to towns of 50,000 to cities of 5 million. This growth occurred because time and time again, groups chose to ‘coordinate’ rather than ‘defect’.

At the core of this story is the prisoner's dilemma; a thought-experiment that illustrates a scenario in which two prisoners are rational to choose to ‘defect’ from one another, even though it means a net-worse outcome for both parties. Only by a mutual understanding that playing the long-term game is a better choice, and a willingness to sacrifice for this outcome, can two prisoners choose ‘coordinate’ in the name of this potential better future.

The long winding path

The path from hunter-gatherer tribes of 50 to cities of 5 million was not a linear path of people finding better and stronger ways to coordinate. It was a long, winding, curving, detouring path of defection, spying, misinformation, malice, aggression, violence, and then eventually coordination.

Every single instance of defection: theft, cheating, sabotage, treason, murder, oppression, genocide, or war, was eventually overwritten by coordinating around those outcomes.

Looking into history, one can claim that humanity is using the planet as one giant sandbox of coordination experimentation in an attempt to create the largest possible coordinating group.

From A Bankless Nation:

If someone were to ask us: What are you doing here?, humans could answer ‘We’re trying to get coordinated!’ Or perhaps, humans first need to ‘get coordinated’ so they can begin to formulate an answer to the question ‘What is our collective purpose?’. Either way, our prime objective as a species is to create an organization structure that can enable coordination on a large enough scale so that we can begin to work collectively towards a common goal.

A group is formed when rewards for coordinating together are greater than the rewards for defecting. Part of the incentive to choose to coordinate vs defect is that groups are able to coordinate a better world for themselves. The product of good coordination is the ability to manifest the rewards for coordination in the first place.

Currently, the Nation-State is the largest vehicle of human coordination. The Nation-State has achieved this by leveraging strong defection-prevention strategies, in which the individuals of a Nation are highly incentivized to follow the rules of coordination that ultimately compose the State as a whole.

Fines, jail, prison, and capital punishment are all tools leveraged by the state to generate coordination incentives that significantly outweigh defection incentives. Hobbe’s Leviathan is an illustration of how the Nation-State ‘stays composed’ as a unified body.

He claims that a strong, centralized, executive leadership, which has a monopoly on violence, is the necessary tool for enforcing the social contract of a nation. The combination of accessing the upside of coordination with the Nation-State, in addition to the avoidance of the stick of punishment, keeps the body of the nation running smoothly in a coherent fashion.

Disputes are processed through a system of arbitrations (the judicial system) and the social contract is revised and reformed by the rule-makers (legislative), in order to inform the role of the law enforces (the executive).

And thus, a unified body of humans have generated a system of mass coordination.

A Blank Slate

It’s often said that the crypto industry is speed-running the development of finance across history. Starting with a new form of money and working upwards, the cryptocurrency world is learning to re-invent the same financial primitives humans have already discovered in meat-space, and recreate them in their digital form in the crypto world.

This is absolutely true. But I believe it’s bigger than that. In addition to the recreation of money and finance inside of a pure substrate, we are also re-discovering systems of coordination.

The combination of free and open-source software, internet-native value, and value-management (finance) creates a new kind of sandbox for research and development. I recently wrote a Coindesk piece about how Ethereum is producing financial innovation at light-speeds as a result of the open sandbox for developer experimentation.

Open-source software is free, and copying, changing, and iterating on open source software costs the absolute minimum amount of resources: time. Through this effort, any developer that produces something of value while experimenting adds something to the common library of knowledge in this space, which only further reduces experimentation and development costs.

With thousands of users and billions of dollars only a single transaction away, developers are able to quickly discover either failure or success, and move forward.

Now, replace ‘money and finance’ with ‘human coordination’, and you have the next chapter of humanity.

To Fork, or Not to Fork

Like the nation state, crypto-economic systems (Bitcoin, Ethereum, MakerDAO, Uniswap, Compound, Yearn, YAMs, etc.) are perpetually in a state of friction between defection incentives and coordination incentives. These systems are primarily bottom-up structures in which success is determined by the protocol's ability to attract attention and capital from the world around it.

No government aid or regulation here; whether or not a protocol ‘survives’ is entirely determined by its fitness inside the free market. If a protocol is fit, it will generate coordination incentives that outweigh defection incentives. The moment where defection incentives pass coordination incentives is the moment the protocol dies.

When we look at the Total Value Locked leaderboards on DeFi Pulse, we are looking at coordination leaderboards. How strongly does a particular protocol’s coordination incentives outweigh their defection incentives?

Forking

The low costs of forks is one of the most advantageous characteristics this industry has. When the costs of experimental iteration approaches 0, innovation naturally explodes.

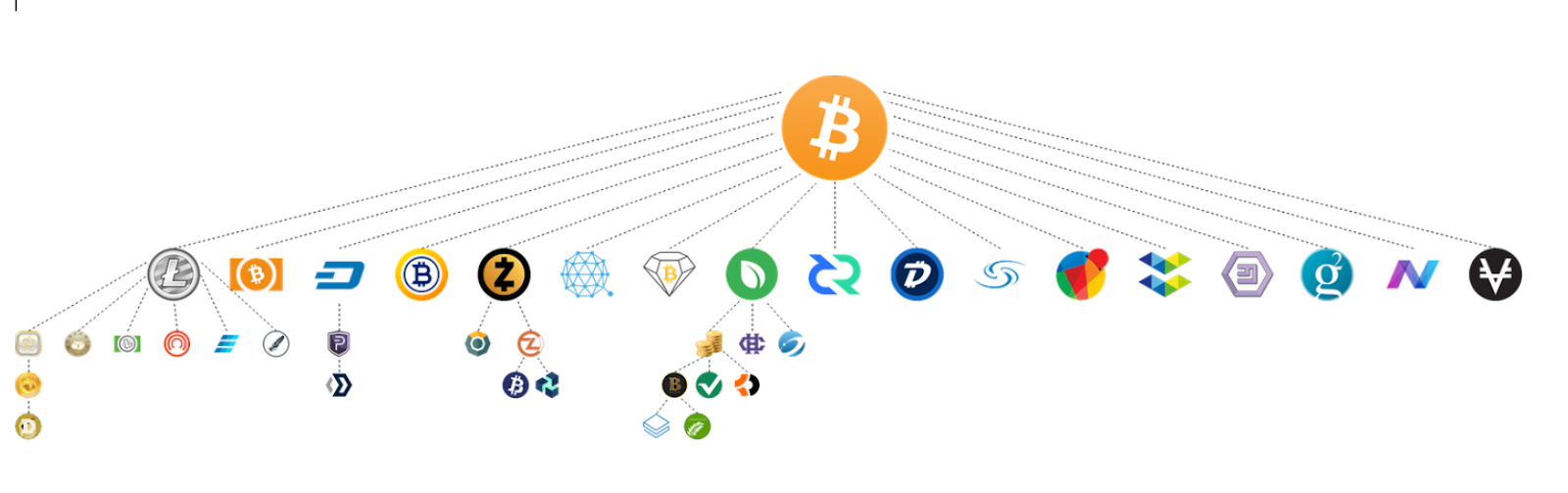

Before the vegetable yield farm copy-catting of #DeFiSummer2020, there was the Proof-of-Work fair launch era in 2013-15.

Bitcoin Cash, Litecoin, Dogecoin…

Bitcoin XT, Bitcoin Classic, Bitcoin Unlimited, Bitcoin Gold, Bitcoin Diamond, BitcoinDark, Bitcoin Private, Bitcoin SV

Monacoin, LitecoinCash, CloakCoin, Einsteinium, Feathercoin, Peercoin, Novacoin, Blackcoin, Stratis, Greencoin, Vertcoin, Hshare, Nexus, Decred, DigiByte, Syscoin, Reddcoin, Elastos, Emercoin, Groestlcoin, NavCoin, Viacoin, Komodo…

Replace all those names with vegetables, and you have #DeFiSummer2020.

Ethereum is an open sandbox for financial experimentation, where the costs of experimentation and innovation are as close to 0 as they ever have been. Not only is there plenty of code available to leverage, but also thousands of users and billions of dollars are always just one transaction away from whatever you can build.

The YAM story illustrates this well. Five individuals got together and borrowed code from Compound, Synthetix, Ampleforth, and Yearn to produce a project that garnered hundreds of stake-holding community members and a multi-million dollar market cap…in just 10 days.

YAM didn’t really ‘fork’ any one of these protocols. The goals of the YAM system, whatever they may be, are materially different from any of the above protocols. Synthetix aims to make a decentralized synthetic asset exchange, Compound: a money market, Ampleforth; a weird new form of money, Yearn; a yield-maximizer.

The end goal of all these protocols is a zero-sum game: Maximize value.

The goals of Synthetix, YAMs, Compound, Yearn, and Ampleforth is number go up. Each of these protocols has a token, and the success of the protocol is directly reflected in the value of their respective token. SNX, YAM, COMP, YFI, AMPL. Every system is a value-maximizing system, and each system attempts to achieve this in its own way.

Value is inherently scarce, and a protocol can only capture so much value before it starts to compete with the value captured by others.

Carbon Copy Cats

While YAM’s method of achieving this goal is adjacent, rather than in opposition, to the protocols it borrowed code from, it also was the main inspiration to the fork-and-fair-launch movement, where many protocols were carbon-copied with their token swapped out with a new one. Cream forked Compound, SushiSwap forked Uniswap, BASED came out of YAMs, then there’s YFII that forked YFI, and then YFIII that forked YFII.

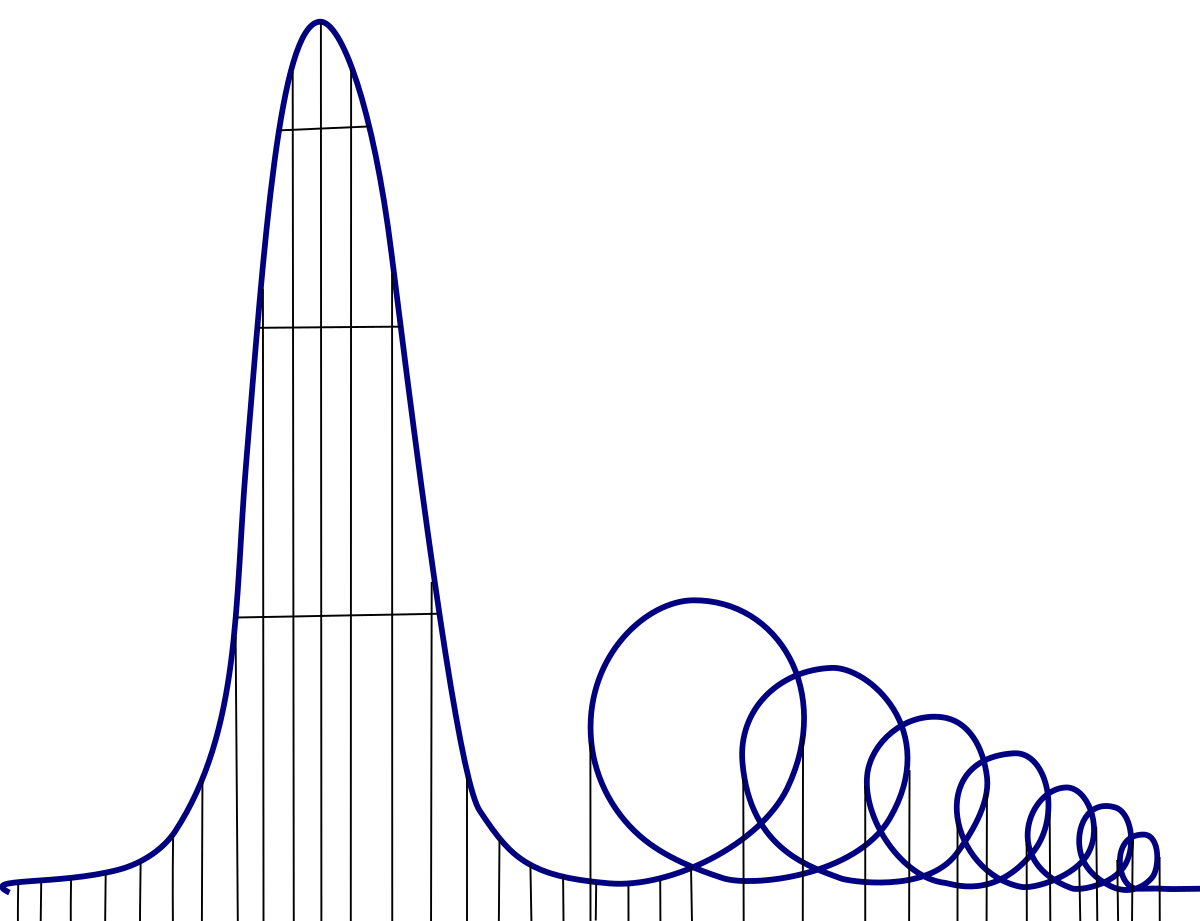

Su Zhu of Three Arrows Capital illustrates this phenomenon with the Euthanasia Roller Coaster, a theoretical design of a roller coaster that kills its passengers by exposing them to too strong G-forces for too long.

The end of #DeFiSummer2020 came when every single major DeFi protocol had 17 forks each, and each of the forks had their own set of forks, which had their own set of forks etc etc. At some point, we ran out of emojis. Also, gas sustained 400+ gwei for multiple days, putting pretty hard breaks on the Ethereum economy at large.

It’s highly likely that the significant majority of these forks will bleed into nothingness. The few that make it through the Great Filter of shitcoinery are going to be the ones that tapped into something novel and also learned how to harness that energy to generate sufficient anti-fork incentives.

Fork-Resistance Strategies, Defection Incentives

Successful protocols will deploy fork-resistance strategies in order to achieve in-group coordination. The fair-launch phenomenon was an experiment in spinning up projects with minimal defection incentive, as the genesis token distribution was (hopefully) something that rewards stakeholders for their alignment with the protocol.

Uniswap’s retroactive airdrop of tokens to previous value-providers was a fantastic deployment of a defection-resistance strategy. Because everyone got their $1,200 UNI-versal Basic Income, everyone loves Uniswap.

The concept of fair token distribution was extremely attractive, and it generated significant forking incentives for developers, and defection incentives for users and their capital. Liquidity mining and yield farming were extremely lucrative, and even with a low percentage chance of the protocol and its token not working out, it was still rational to farm the shit out of every token on the potential upside of becoming a massively-coordinating protocol. The mere possibility of this outcome generated the value in the token, which generated the incentive to farm, which contributed to the forking and defection incentives.

The only problem with this movement was that it created a pro-defection environment. While it was trivial to carbon copy the DeFi Darlings (Compound, Uniswap, Yearn) in the hopes to entice some gamblers who want to take the 3% chance of a 100x gain, the reality was that it was also trivial for someone to carbon-copy you and steal all your users and capital in an attempt to offer it to people who didn’t get on your ride.

Yield farms learned how to leverage defection-incentives, but they ignored the other half of the equation: coordination-incentives.

Every single crypto-economic protocol operates because it has sufficiently strong anti-fork incentives.

This doesn’t just only apply to DeFi protocols; fork-resistance strategies could also be named as ‘consensus algorithms’. Proof of Work and Proof of Stake are two gigantic fork-resistance primitives. The costs of mining on the wrong chain, or of validating incorrect blocks, are incredibly high. In PoW, you are burning electricity without BTC rewards, and in PoS you are literally burning money instead of receiving it. Pretty strong fork-resistance mechanisms!

The Social Layer

The design space for creating anti-fork incentives doesn’t stop at well-designed code. The social layer behind a protocol is equally important for generating fork-resistance.

No coordination group has leveraged the power of the social layer better than Bitcoiners.

Bitcoiners (at least the ones on crypto-twitter) have a very firm line drawn in the sand, which signals to the rest of the group what is and what is not appropriate. I do not mean to generalize to all ‘Bitcoiners’, but like many in-groups, Bitcoiners are defined by a set of concentric circles, in which in the inner-most circle are the most radical and things get more moderate as you move outwards. The mere presence of the radical center-most circle moves the Overton window of acceptable behavior closer and closer to their goals of hyper-bitcoinization.

Speak well of an alternative protocol? Expect a paddling. Express moderation about Bitcoin’s future success? Expect a paddling. Everything is a shitcoin unless it’s Bitcoin.

Bitcoin’s social layer is one of its greatest features, although people from the outside of the Bitcoin group express (significant) reservations about this culture’s ability to scale with this strategy.

Bitcoin’s Barrier Troops

‘Barrier Troops’ are anti-retreat forces that were located in the rear of the front line, to maintain military discipline, prevent the flight of servicemen from the battlefield. Famously, the Soviet Red Army deployed barrier troops who would shoot any retreaters (defectors), in order to generate sufficient defection-prevent incentives for these soldiers to never stop fighting Nazi Germany.

‘If you retreat you die, so you might as well not retreat’.

Dan Held is one of Bitcoin’s ‘Barrier Troops’. Don’t you dare defect!

This is the same strategy that the Leviathan of a Nation-State imposes, albeit in a more humane manner, with fines and prison. ‘If you defect, you go to jail, so don’t defect’.

Punishment, aka ‘the stick’, is only one half of the equation. ‘The carrot’ is all about producing rewards that prevent thoughts of defection from even arising in the first place. Bitcoiners have leveraged the social layer very well to this end:

Get enough Bitcoiners together to all claim how 'Bitcoin will become the worlds next defacto currency’, and the voice of any skeptic-defector gets drowned out by the rest of the in-group.

The goal of Bitcoin’s social layer is to generate enough FOMO about Bitcoin, that no one thinks twice about selling the world’s next money. This leaves the potential of ‘memeing it into existence’, regardless of the technological capacity of the system to do the job.

Value = The OG Defection-Prevention Strategy

DeFi protocols on Ethereum generate revenue (checkout the Bankless Q3 Token Report).

DeFi tokens govern over how the protocols are constructed and therefore have the ability to direct these cash flows as they see fit. Some protocols don’t charge fees to the governance token, and instead direct 100% of the revenue to the supply-side (Uniswap, Compound). Other protocols are further along in maturity and are redirecting that captured revenue into their native token (Kyber, Maker, Yearn).

Revenue is coordination-incentive. If a protocol has revenue coming through its contracts, there is an incentive to be a part of that system. While the costs of forking a DeFi protocol are minimal, no one wants to defect from a system that turns out to be a huge winner.

This is the power behind Bitcoin’s narrative, and that’s why the beloved DeFi protocols that were around from before #DeFiSumer2020 are still the dominant protocols, and even the most successful fork-farms are distant seconds to the OGs (Yearn being the significant exception).

Coordination-Defection Incentive Ratio

Behind every coordinating group is a Coordination-Defection Incentive Ratio. What is the ratio of a groups coordination incentives to defection incentives? If coordination incentives are greater than defection incentives, the protocol grows. If they are lesser, then the protocol reduces.

The spread between the coordination incentives and defection incentives is the accessible revenue of a protocol.

The more and more a protocol can develop its coordination incentives, the higher percentage of revenue it can capture in its native token. So long as the fees being captured aren’t sufficiently high to incentive defection (and a carbon-copy-cat), then the protocol will continue to capture fees.

Previously in Ethereum, there was a frequent conversation about how Ethereum was destined to be a place where middlemen are cut out, and all fees are forked away into nothingness.

If anyone built a protocol with a fee in it, it would be forked into an alternative protocol without the fee, and then that protocol would then become the new protocol because why would anyone use a protocol that has fees in it when there's an alternative without fees?

What this conversation was missing was the difficulty in coordinating the migration to an alternative protocol. This is the same reason why we all hate Facebook, but we still can’t ‘pick up and move’ to an alternative social media platform. We’re all on Facebook, and coordinating everyone to pick up and move at the same time is too much of a coordination challenge.

Where Facebook has users, Uniswap, Aave, Compound, DAI have liquidity. These protocols all have very strong liquidity moats that act as defection-prevention mechanisms. The liquidity behind these protocols is the spread between the greater coordination incentives vs the smaller defection incentives. As these protocols grow in liquidity, they can also grow their Coordination-Defection Incentive Ratios, and therefore the fees that they capture.

Bitcoin: Schelling Point of Anti-Defection

As discussed above, Bitcoin’s social layer employs extremely strong social incentives to not defect from the group values. The most extreme Bitcoiners consider all other digital assets other than Bitcoin as inferior assets, or even ‘Shitcoins’.

The reason why the word ‘shitcoin’ is so frequently used in Bitcoin culture is to signal the intolerance to those who prefer any other asset other than Bitcoin.

Bitcoin Maximalists, as defined by those that actively denounce all other crypto-assets other than Bitcoin, are the Spartan Phalanx of crypto assets.

NOT. ONE. SHITCOIN

To the average Bitcoiner, a shitcoin represents the embodiment of defection. A denial of the Bitcoin narrative and the Bitcoiner social contract. Shitcoins, Shitcoiners, and Shitcoinerry are all instances of when the Bitcoin narrative broke down, and someone defected from the ranks.

From Wikipedia:

There was a leader in each row of a phalanx, and a rear rank officer, the ouragos (meaning tail-leader), who kept order in the rear. The hoplites had to trust their neighbors to protect them and in turn be willing to protect their neighbors; a phalanx was thus only as strong as its weakest elements. The effectiveness of the phalanx therefore depended on how well the hoplites could maintain this formation in combat and how well they could stand their ground, especially when engaged against another phalanx. For this reason, the formation was deliberately organized to group friends and family close together, thus providing a psychological incentive to support one's fellows, and a disincentive, through shame, to panic or attempt to flee. The more disciplined and courageous the army, the more likely it was to win – often engagements between the various city-states of Greece would be resolved by one side fleeing before the battle.

Bitcoiners are the embodiment of ‘do not defect’. This is why Bitcoin has really abandoned any interest in improving itself as a technology and seems to be primarily focused on improving its social layer: its narrative.

Bitcoiners are extremely smart in encouraging this behavior! The opposite of coordination is… defection, and we’ve all seen what happens during periods of high-defection rates: the euthanasia roller coaster.

If we encourage a pro-defectionary-environment, then we can likely never discover a new Schelling point for coordination. We need to encourage coordination around some commonly shared values, or else we devolve into shitcoinery. While financial experimentation is good, shitcoinerry is bad.

However, extreme rigidity and intolerance to anyone who is interested in expanding the design space means that defection from the extremely tight in-group is the only possible choice if one wants to experiment with building something new.

This was how Ethereum was created.

One day a guy named Vitalik proposed a Bitcoin hard fork to include new op-codes that would make Bitcoin more expressive. Vitalik loved Bitcoin, and wanted it to be able to do more things and grow into a larger possible design space. However, this was against the Bitcoiner social construct and changing Bitcoiners social layer is basically impossible.

So, Vitalik ‘defected’ and made Ethereum, and it’s made the inner-most concentric circle of Bitcoiners extremely upset to this day.

Ethereum was the first successful example of ‘coordinated defection’, where a group of then-Bitcoiners ‘migrated’ to Ethereum in a coordinated fashion, but without triggering a pro-defection environment which triggers the Euthanasia Roller Coaster.

A bunch of then-Bitcoiners metaphorically linked arms and all agreed to take ONE STEP away from Bitcoin, and TO Ethereum.

Those people choose to coordinate.

The Tao

The Tao (often called Yin-Yang, but this isn’t accurate) is called ‘The Way’ in Taoism.

Yin, representing Chaos, is the black side, and Yang, representing Order, is the white.

The entire Universe is built upon a balance between Order and Chaos, and the Tao, or ‘The Way’ is the line between them, that represents the healthy balance of order and chaos that produces positive outcomes.

Defection is Chaos, and Coordination is Order. In order to produce healthy outcomes for the world, you need both. You need Coordinated-Defection. This is how humanity chooses to abandon a previous status quo, in the name of a better alternative. When humanity makes the correct choice, it’s representative of proper alignment between Order and Chaos, or defection vs coordination.

Order creates hierarchies and structures for humans to depend on and leverage for their well-being. It also creates oppression and inequality. The Nation-State is the largest Ordered structure we have created so far.

Chaos is creative destruction; the recycling and renewing of calcified systems which creates newer, more modern structures.

The Bankless Nation is a new Ordered structure that is being formed out of the Chaos of crypto assets and endless games of coordination-defection. If we do things right, the Bankless Nation can become a new structure that surpasses the organizational capacity of the Nation-State, with new mechanisms that are fairer, more inclusive, and more scalable. 🏴

An expert from The Three Nation Problem:

At the end of the 1800s, Nietzsche proclaimed “God is Dead!”. Nietzsche was an atheist and didn’t mean that there was a God who had actually died, rather than our idea of one had. After the Enlightenment, the idea of a universe that was governed by physical laws and not by divine providence was now a reality. Philosophy had shown that governments no longer needed to be organized around the idea of divine right to be legitimate, but rather by the consent or rationality of the governed — that large and consistent moral theories could exist without reference to God. Europe no longer needed God as the source for all morality, value, or order in the universe; philosophy and science were capable of doing that for us.

“God is Dead!” was less a proclamation, and more a warning. Nietzsche was warning that, if humanity was no longer organized around God, then we need to find something different and new to organize around, or else chaos would consume the world. Without the scaffolding of Religion, the societal structure would collapse, and rebuilding it would be a long, arduous process filled with debate and conflict.

This is exactly what happened. Religion, the main organizing force of the people, was relegated to history without a viable successor to offer an alternative organization schema in order to keep the people of the world stabilized and coherent. The world, absent of any organizational substrate, fell into the most bloody and brutal century in human history.

Out of the chaos emerged the world order that we know today. Democratic Nation-States that uphold the values of classical liberalism.

And with the Bankless Nation, the Wheel turns yet again.

Religion grew out of the chaos and turned into calcified, oppressive, non-iterative system. Humans needed something newer, and more modern to organize around. So they created the Nation-State which iterated into the liberal democracies that we know today. Now, those, in turn, have become calcified, oppressive, and non-iterative.

And so, we choose to defect, in a coordinated way, into the world of crypto assets and digital organizational structures.

Eventually, the world of crypto will likely calcify into an oppressive, non-iterative structure.

But that won’t be for generations. Today, Bitcoin and Ethereum are the iterative, flexible structures we need to coordinate humanity into a better world.

Action steps

Consider how coordination and defection have impacted humanity

Identify a protocol’s coordination to defection incentive ratio

Read David’s previous pieces on relevant topics