NFTs 🤝 DeFi

Dear Bankless Nation,

Crypto going “mainstream” isn’t what I thought it would be.

With recent regulatory drama behind us (and plenty more ahead of us), the conversation in recent weeks has turned to…JPEGs.

We have brand new capital assets like UNI, YFI, AAVE that power paradigm-breaking financial applications. We invented our own monetary assets, and then created our own trading venues, and then bootstrapped our own liquidity. We built the foundation for the future financial system in a just few years.

Yet, the thing that actually takes this ecosystem into the mainstream conversation?

Trading JPEGs for tons of money.

For the first time ever, ETH overtook BTC in quarterly trading volume on Coinbase. Would that have happened so quickly without the mainstream attention of NFTs?

Pudgy Penguins got featured in the New York Times, which is pretty insane for an NFT project that is just a few weeks old.

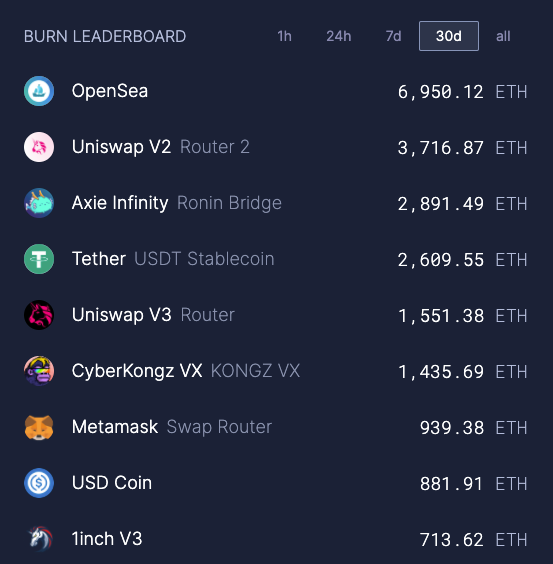

OpenSea—the NFT explorer—has burned almost twice as much ETH from transactions on its platform than Uniswap!

This Chromie Squiggle just sold for 750 ETH ($2.5M), which triggered a decent bump in other Chromie Squiggle valuations.

It’s simultaneously insane and obvious that this is one of Ethereum’s greatest discoveries of product-market fit: attaching a financial asset to pictures.

Buying and selling pictures is such a simple concept that it seems to be destined that this would become a large part of the Ethereum economy. Just slap on a token onto digital pictures, and all of a sudden we have a trillion-dollar industry.

Will the majority of people care about the nuances of NFT ownership? Will people care where the data of the picture is actually stored? Will people ask about the nature of what they are buying?

Or are they just going to see a picture, a price tag, and a buy button, and proceed?

I think society will just go “ok, we trade pictures now…makes sense”

The New York Times Pudgy Penguin article title answered why NFTs succinctly—“because apparently, that’s what we do now”.

Have we lost the plot?

This wasn’t exactly what I had in mind when it comes to crypto finally getting the global attention it deserves. During the 2018-2020 bear market, the common daydreams of a future crypto-enabled world was focused on DeFi and permissionless market inclusivity.

Instead, we’re getting JPEG speculation.

Some are concerned that crypto has ‘lost the plot’ of what its original goals and intentions are. When we see the majority of Ethereum economic activity is buying and selling pictures on OpenSea, it’s harder to illustrate all the amazing good that open permissionless financial tools can bring to the world.

Crypto is about banking the unbanked, and unbanking the banked. It’s attempting to usher in a more equitable financial system and open, free markets.

So what are we doing with it? Trading pictures for insane prices.

This is the pessimistic take on the current state of crypto, but I take a much more optimistic perspective.

DeFi + NFTs = Ethereum

I think there’s a growing case that DeFi + NFTs are the entire story. When you combine DeFi tokens, aka the fungible ERC20 tokens on Ethereum, and NFTs the Non-Fungible ERC721’s, that’s it.

That’s the show. There’s no other kind of assets on Ethereum.

We are absolutely in the early days of the maturity of the NFT side of Ethereum.

DeFi started in 2018 and really got rolling during DeFi Summer in 2020. DeFi has had a decent start, but the pace at which the NFT side of Ethereum is growing is extremely fast. Some even think that the NFT ecosystem will ultimately become orders of magnitude larger than the DeFi ecosystem.

The reasoning is that fungible tokens are how we measure value, but non-fungible tokens are the things we actually value, which is a perspective I find compelling.

So is trading JPEGs crypto losing the plot? Or are we bootstrapping an entirely new asset class and stress-testing what we can do with our fancy new economy? Is crypto for the privileged elite who can pay $2.5M for a Chromie Squiggle, or are we proving the utility of the tools we’ve built?

The answer?

The DeFi 🤝 NFT Perpetual Motion Machine

Economic activity on Ethereum has been dominated by NFTs lately. But the amount of economic spillover into DeFi will be just as large. When NFTs trade hard, Uniswap volume is higher. When there’s a Penguin mania, ETH holders win.

NFTs and DeFi are complimentary for each other and Ethereum.

NFTs are DeFi-native assets, and thus spurs DeFi native commerce. The symbiosis between DeFi and NFTs will propel both into the mainstream.

NFTs are giving Ethereum and DeFi the most marketing that it’s ever had, in ways that DeFi alone could never achieve. A lot of people just don’t care about the numbers and digits of finance—they never will.

But NFTs can become anything that’s culturally significant! Not all humans are finance geeks, but all humans are culture animals. NFTs are the marketable surface area that Ethereum needs in order to go mainstream.

So maybe right now, the state of crypto might seem kind of…weird.

But that’s only because we’re just getting started with NFTs and DeFi.

Weird to one generation is normal for the next.

Apparently, this is just what we do now.

- David

Actions

- Execute any good market opportunities you saw

- Listen to Institutional DeFi Infrastructure | Michael Shaulov