Most crypto monies won't make it (Market Monday)

Level up your open finance game three times a week. I’m releasing this Free for Everyone until November 1. Get the Bankless program by subscribing below.

Dear Crypto Natives,

Receiving blows while running between two rows of men with clubs—it’s know as running the gauntlet. This ancient punishment reminds me of crypto. Every crypto money must run the gauntlet. Many are dispatched on the running line—clubbed to death by regulators and authorities.

Just this week…

The SEC cudgeled Telegram’s TON tokens by obtaining a temporary restraining order against Telegram. And Libra was knocked to its knees by the departure of Mastercard, Visa, even PayPal—the result of intense pressure from governments worldwide.

It seems obvious to some: modern governments were never going to allow private companies to mint their own global currencies. Would the U.S. permit Facebook a private army—why then a private currency?

They know that minting money gives the power to wage economic warfare. So private companies will issue a currency with the cooperation of the state or not at all. “And remember” says the government to big tech, “those that cooperate with the us already have a name—they’re called banks. Are you a bank?”

Thus the private tech companies are running the money gauntlet with their hands tied. Nothing to shield them. No protection. Every blow a direct hit.

But what of protocols?

What of decentralized social movements?

These are tricky for the state. They’re like ghosts. Difficult to spot as they run the line. And if attacked, the blows can pass right through them.

Bitcoin is making its way through the crypto money gauntlet as a ghost, unscathed so far. Ethereum too—this week the CFTC officially recognized ETH as a commodity—incredibly bullish news.

BTC and ETH started their run before governments had time to react. Before they felt threatened. Ironically, this might provide them a regulatory moat as the window closes to the would-be crypto monies trying to follow after them. Will there be another ICO the CFTC labels a commodity? Probably not anytime soon.

All of the BTC and ETH killers out there will need to run the gauntlet.

And most won’t make it. They’ll be beaten to the ground before their first steps.

- RSA

Ethereum’s DevCon conference was held last week—I wasn’t there in person but somehow made the main stage anyway—good things happening in ETH land

MARKET MONDAY:

Scan this section and dig into anything interesting

Market numbers

- ETH up slightly at $182 from $176 last Monday

- BTC barely up at $8,243 from $8,144 last Monday

- Maker stability steady at 10.5%— vote to decrease to 8.5% still waiting on quorum

Market opportunities

- (Lend/Borrow) at the best rates by checking new MyDeFi Best Rates feature 🔥

- (Earn) By buying undervalued ETH & stablecoins w/ Set auctions (auction list)

- (Invest) in .crypto Ethereum domain name (link saves you $10 on $40 purchase)

- (Insure) a DAI Compound loan for 1.3% while still making 6% using Nexus

- (Lend) Outlet DAI lending offering free insurance when you use it

- (Spend) Mosendo DAI-first wallet goes to Alpha test (RT to get access)

- (Lend) BlockFi still best rate for a crypto bank at 6.2% BTC / 4.1% ETH

- (Hold) BTC with new Casa 2 node (I like gold offering but this concerned me)

New stuff

- Multi-Collateral DAI going live Nov 18th w/ DAI Savings Rate 🔥

- .crypto domains on Ethereum are a new competitor to ENS

- StablePay Beta live on MainNet (see “What I’m Doing” for more)

- Vulcanize coming up w/ a way to dollar-cost average DAI to ETH (testnet only)

- Coinbase launches Coinbase pro exchange on mobile!

- ETH 2 interest calculator looks awesome

- TrustWallet allowing (non-ETH) staking—money protocols next?

- We won’t understand how awesome this Metamask news for a couple years

- Watching this new thiftcoin DAI experiment—burns DAI when people withdraw

What’s hot

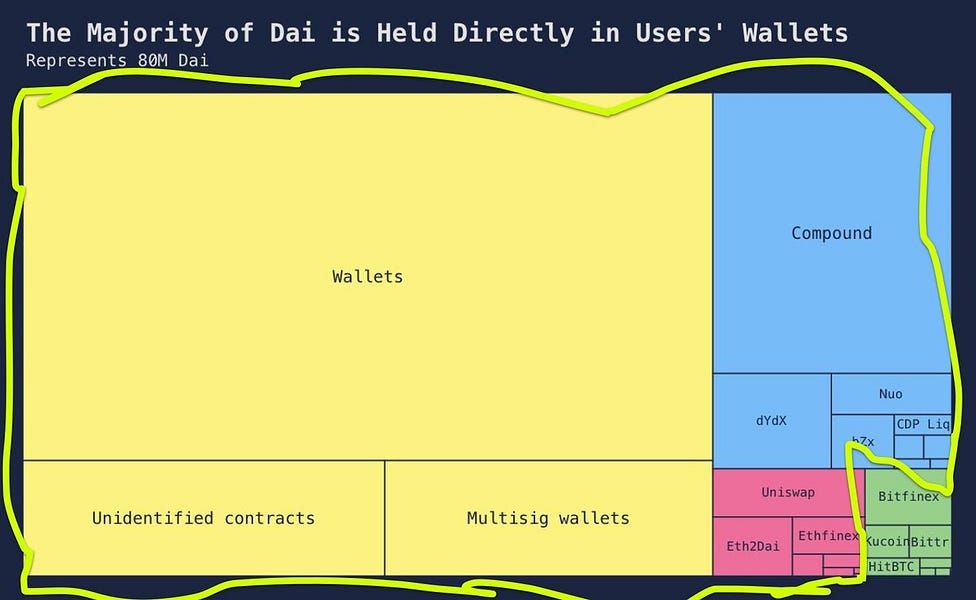

- 3 million worth of ETH now locked in money protocols 🚀

- The 4 main money protocol liquidity pools visualized

- Dex.ag (a DEX aggregator) is on a tear (easy UX—check it out)

- GodsUnchained w/ the most viral tweet I’ve seen in crypto (uncensorable games)

- Fulcrum showing some steady growth (listed #14 on DeFi Pulse)

Money reads

- Don’t call it QE4 but it’s QE4 (bullish non-sovereign money) - Jeanna Smialek

- Great thread on the Next Internet (from DevCon preso) - Kevin Owocki

- DAI in the numbers w/ notes (the most bankless money yet) - Maker Foundation

Reminder—a limit of 100 slots for the Bankless Inner Circle open up at 5pm EST today. Subscribe now for access. Plus no interruption in program and 20% off forever.

WHAT I’M DOING

Check out a few opportunities I’m capturing right now with my crypto money

Explored a crypto card. Update: investigated Nexo which a crypto bank card. They have not released their card yet, but it will be EU first when they do. Custody provided by BitGo—would like more info on internal risk management, but loans appear to be overcollatoralized. Too soon to recommend. Looking at crypto.com next.

Tried MyCrypto beta. My go-to app for Ethereum transactions just released a new beta. Simple enough to use for most intermediate-level users. Great stuff for power users. I liked the changes, though the fiat onboarding feature was expensive—8% to buy ETH directly w/ USD. Won’t be using that part much.

Tried Unipig exchange demo. This demo application uses some cool tech to scale Ethereum on Layer 2. Really optimistic about this approach—does not require ETH 2.0 and the UX is comparable to Uniswap today.

Setup MyDeFi. Finally setup MyDeFi w/ an Ethereum address. Really like where this app is going, think I’ll find myself referring back to the Best Rates tracker weekly.

Setup StablePay. I accept crypto as payment for Bankless through Coinbase Commerce. However, I’m looking for more bankless payment solutions which is why I’m excited to test StablePay’s beta. It took 10 seconds to create a way for me to accept tips in DAI. Very cool! (Tips added to footer)

WEEKLY ASSIGNMENT:

Make time to complete this assignment before next week

Register an ENS name. (30 mins, cost $5) ENS is a domain name service for Ethereum. This week we’re going to register one and connect it to an ETH address you own.

On the web, you can buy a .com to address your website. You do this to make it more human readable than the IP address someone would need to use otherwise. Similarly, on Ethereum you can buy a .ETH address and map it to an Ethereum account. It’s easier to read yourname.eth than 0x964950b576C547bE9DB0ce98B6024CCbF338DB7c.

Here’s the assignment:

- Get $5 worth of ETH (ENS names cost $5 per year)

- Have an ETH address to map

- Follow the tutorial here to buy & setup your address

Many wallets are now supporting ENS names and I expect human readable addresses to become a standard part of the open finance experience before long—it’s good to keep ahead of the game. And who knows—some of these address might become valuable some day.

Extra Credit Learning

- (Beginner): VIDEO: What is DeFi?

- (Beginner) VIDEO: Crypto as an Asset Class

- (Intermediate) VIDEO: Transitioning from single to multi-collateral DAI

- (Intermediate) List of all DevCon talks (videos here use agenda to find a talk)

- (Intermediate) How Compound Protocol works

- (Advanced) Create a google spreadsheet that updates DeFi lending rates

MAIN TAKES:

Read my takes but draw your own conclusions

- The IRS gives good guidance on gains/losses treatments. This means you can use specific identification rather than FIFO to calculate gains/losses—previously, this was a gray area. Specific ID is a useful tool given the volatility of crypto. Example: Say you have a group of ETH with a cost basis of $200 you bought in early 2017 and a group of ETH at $1000 cost basis you bought in early 2018. With specific ID you can choose to sell the $1000 ETH first and realize a capital loss to offset future capital gains. Effective specific ID treatment may be the single best thing you can do to minimize your taxes. I may write a tactic on this.

- The IRS gives bad guidance on forks and airdrops. Here’s one take on the troublesome language the IRS used in its guidance on forks—in short, if someone spams you an unwanted airdrop or fork it’s unclear if it creates a tax obligation for you. My take: despite the unclear language, I don’t think the IRS is intending to create tax obligations on the forks or airdrops that a tax payer does not want to receive or intend to claim. The forks you intend to receive are taxed as income—but I’d worry less about claiming this list of useless forks. (Consult your tax advisor)

- Some say you should operate a blockchain like a business but Chris Burniske disagrees. I liked the take from Castle Island Ventures on this debate—“When you have a venture fund buying 10-20% of the tokens on a given network you are either operating a business or you are proposing a new private money that is controlled by venture fund ABC.” This is mostly true and a good mental model.

MINI TAKES:

- I won’t take the competitors to Ethereum seriously until I see them actually being uses as money systems—Tezos is a potential money bet in the future—but I’m waiting to see traction

- I think an underemphasized risk facing proof-of-work systems is future environmental scrutiny—this report claims that each $1 of BTC cost $0.49 in health and climate damages for instance—you can argue against these points, but it would be hard argue against a working proof-of-stake crypto money system

- The UK putting KYC on all crypto wallets would be like requiring government ID to log onto the internet—if the surveillance state wants to require KYC everywhere they may find innovation fleeing their borders—I hope that’s enough to disincent them

- Compound added a 2-day delay to admin functions on its contract—some progress on the back of their commitment to further decentralize

- If the IRS is asking about “virtual currencies” on a 1040 it’s both bullish that we’ve gotten this far and evidence that they’re paying attention

- This is what it looks like to submit an application for your token to be considered as collateral in multi-collateral DAI—the governance that comes with multi-collateral DAI will require Maker to operate more like a bank and less like a pure protocol—I don’t see a way around this

- No BTC ETF any time soon and I’m fine with this outcome—we have programmable money protocol—we should use them

TWEET-A-QUESTION

Tweet me your question—I reply to one per week

Question from my DMs:

Hey Ryan, should I buy X new crypto asset?

My answer:

I get this question on a weekly basis in some form. While I don’t offer specific investment advice, I think this general advice holds:

If you can’t use it don’t buy it!

This doesn’t mean there aren’t good opportunities out there. It means the best way to evaluate these opportunities is by doing—actually using the stuff. I think going bankless is one of the best ways to become a better crypto investor. Crypto rewards the self learner.

- RSA

Some recent tweets…

Actions

- Execute any good market opportunities you saw

- Complete the weekly assignment: Setup an ENS Address for an ETH account

Level up—no interruption. $12 per mo. 20% off includes Inner Circle & Deal Sheet.

Let’s onboard 1 billion people to open finance…

If you believe in what we’re doing don’t keep it to yourself—share Bankless with as many people as possible.

Post. Tweet. Tell. That’s how we take back our money system.

👉Send Bankless a DAI tip for today’s issue

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.