JPEG Mania

Dear Bankless Nation,

NFT sales continue to smash records.

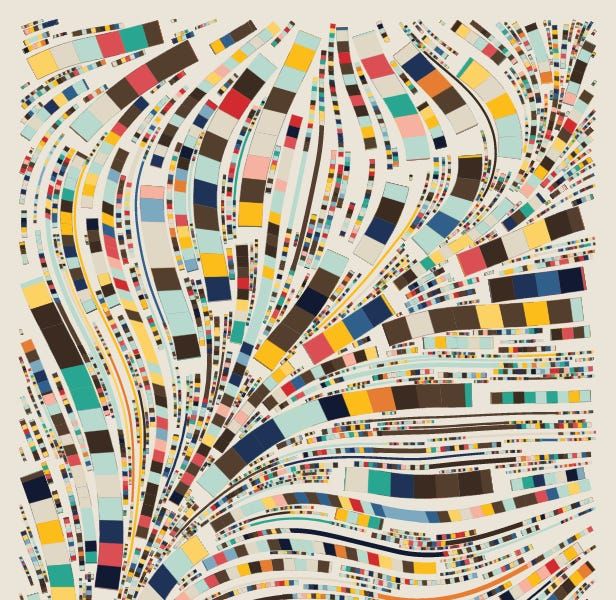

While the recent star of the show has been Art Blocks and generative art, it seems that no NFT project has been left behind. Almost everything seems to be in up-only mode with no signs of stopping.

This Fidenza (#313) just sold for 1,000 ETH 🤯

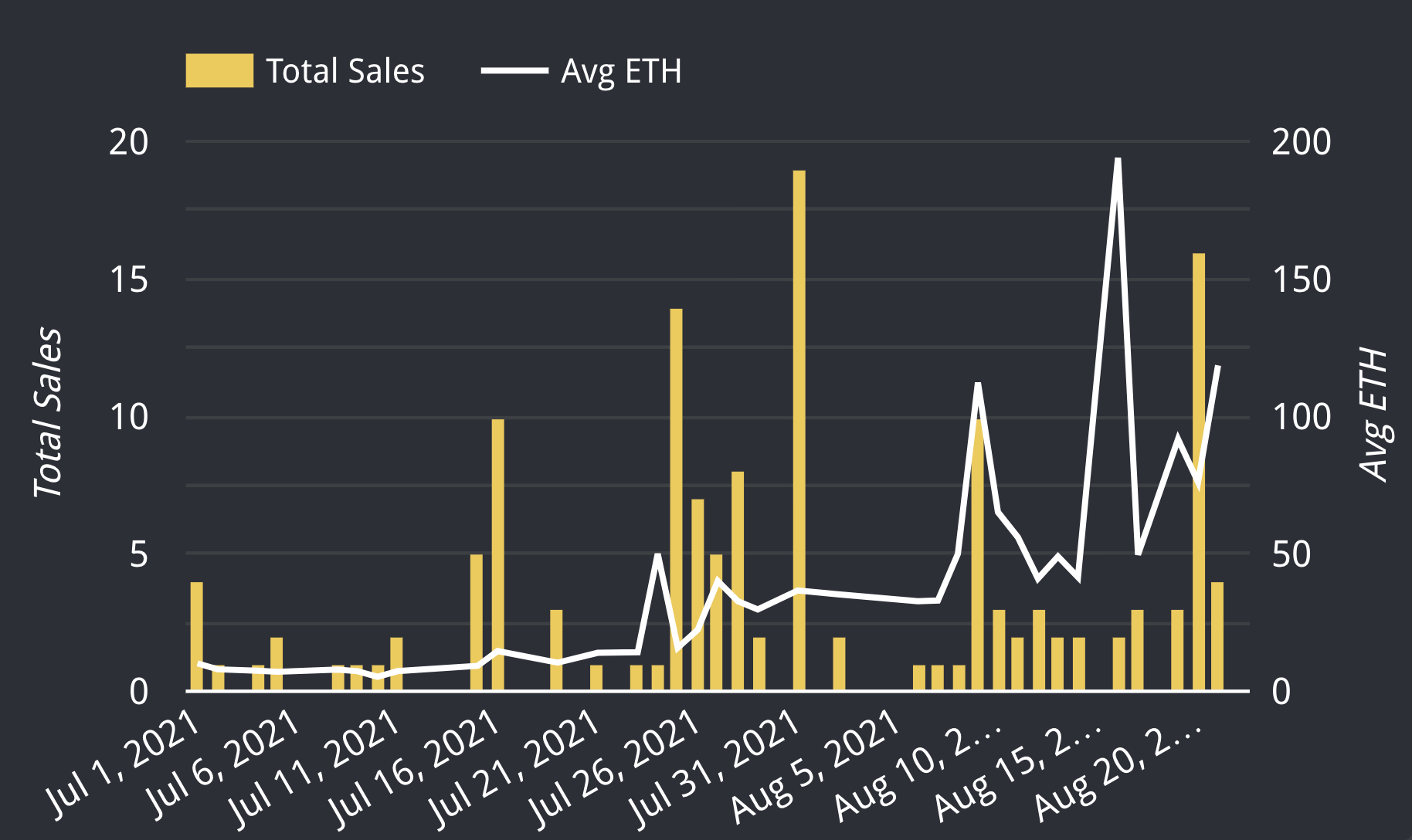

The price floor for Ringers is currently at ~100 ETH, which is up roughly 4x from where it was just a few weeks ago.

To give you a better idea, here’s the price of Ringers over time:

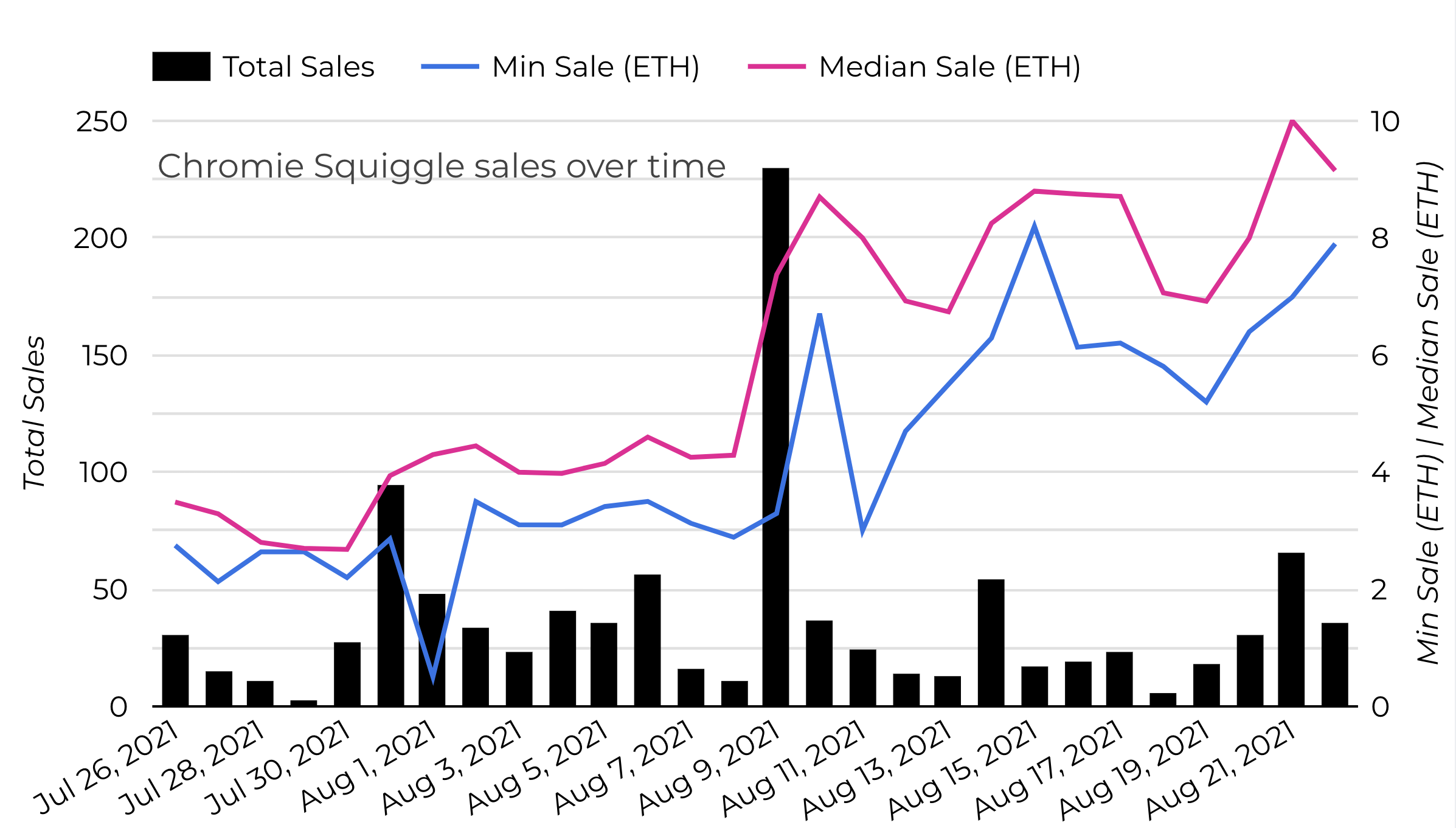

Chromie Squiggles, which are literally just rainbow squiggles, have gone from 2.5 ETH to 10ETH average sales over the last 30 days.

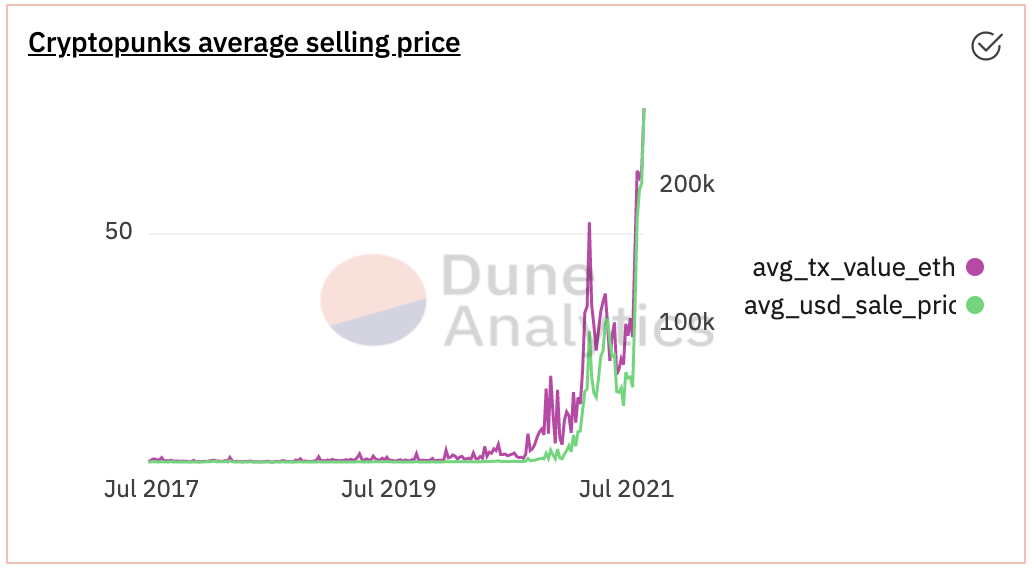

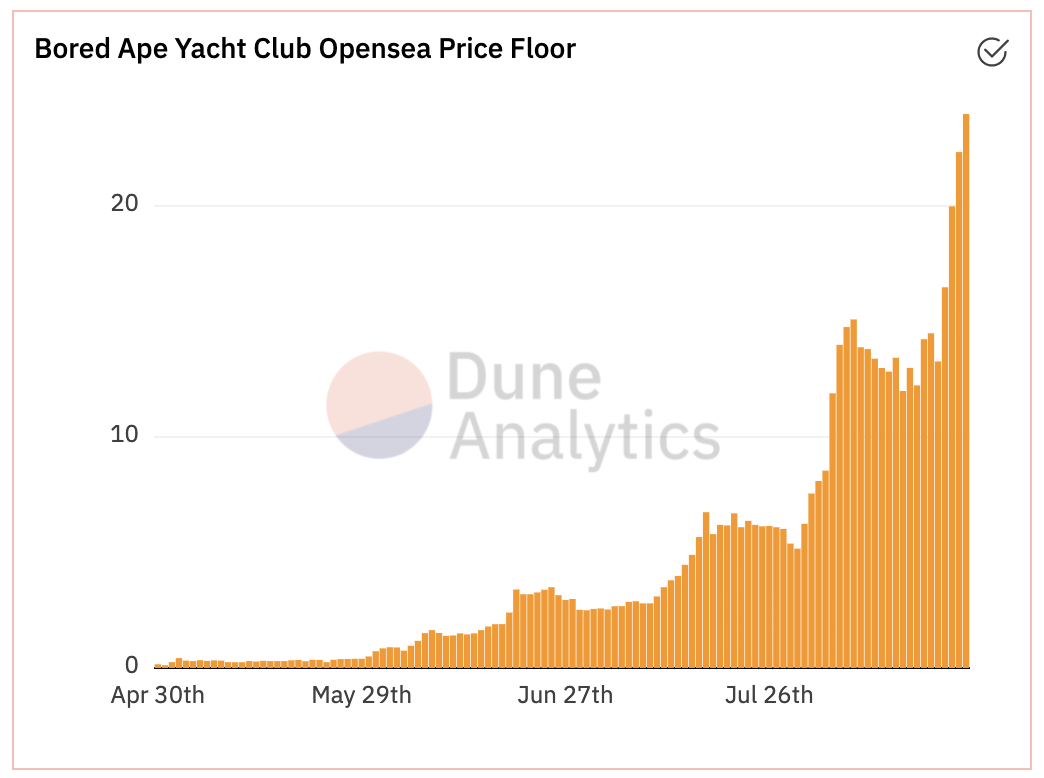

Meanwhile, NFT Avatar projects like Cryptopunks, Bored Apes, Pudgy Penguins, and others have seen new levels of buying demand.

The Cryptopunk floor has never been higher as it approaches 70 ETH.

The same is true with Bored Apes:

The charts all paint a similar story as our friend Cooper said it best:

Visa Buys a Cryptopunk

Today, payments company Visa announced that they w̶i̶l̶l̶ ̶s̶e̶t̶t̶l̶e̶ ̶p̶a̶y̶m̶e̶n̶t̶s̶ ̶o̶n̶ ̶E̶t̶h̶e̶r̶e̶u̶m̶ bought a Cryptopunk.

So this is a weird timeline, isn’t it?

In last week’s Market Monday issue, I wrote “going “mainstream” isn’t what we’d thought it would be”, which continues to play out as described. There’s a weird irony in how a payments company elected to buy an NFT as one of its first major forays into the Ethereum ecosystem.

Granted, Visa already announced that it settles USDC on Ethereum (read “Visa is going to pay ETH holders”). And now, from a completely different angle, Visa is also legitimizing the nascent world of NFTs.

So Visa, a payments company on target to settle $3.1 trillion in volume this quarter, and which is already settling stablecoin payments on Ethereum, bought 50 ETH and sold that ETH for a (kinda ugly 🤫 ) CryptoPunk.

I’ve said it before and I’ll say it again: as Ethereum and NFTs become more and more mainstream, we will have fewer conversations about “what are these NFTs actually worth?” and instead more simple statements like “Look at this NFT that I just bought!”.

This is what we do now.

We have firmly stepped into the era of society trading pictures… and they are doing it with ETH.

NFTs… the Next ICO Mania?

The term ‘ICO’ is severely tainted, and for good reason. The entire phenomenon was built upon impossible ambitions and false promises, and a lot of people got burned by it.

So, when I suggest that NFTs are the next ICO, I am not suggesting that we bring all the baggage that comes along with the term. This is not to say that the NFT Mania will be baggage-free, just that it will be a different flavor than what we’ve seen historically.

There’s a book “Devil Take the Hindmost: A History of Financial Speculation” that I consider a must-read if you want to survive in crypto.

The two important takeaways that I want to bring up are:

- Financial bubbles are created entirely inside the psycho-social layer of humans.

- Humans will trade literally anything.

The crypto-economic revolution is a revolution in scarcity. We have completely re-engineered scarcity, what it means, how its created, and what we do about it.

This is why crypto is so prone to bubbles of all types and of all sizes.

We invented scarcity on the internet, and that is bound to trigger financial bubbles of all types. ‘Pictures on the internet’ is almost as old as the internet itself.

Pictures, meet scarcity. Scarcity, meet pictures.

Let the mania begin.

Another takeaway from the book is the disregard for any kind of fundamentals or rationality as it comes to asset prices.

This is fantastic because NFTs literally have no fundamentals! And also why they are meaningfully different than the ICO mania which was a litany of projects that promised a new financial paradigm with earth-shattering new fundamentals.

NFTs make no such promises and are literally just pictures. Traction on these things is completely determined by mimetic games.

“I like this one. Will others like it? I think so. I’ll buy it”

If you think you’re good at the game of mimetics, good luck!

A Renaissance of Human Culture

With the absence of any financial fundamentals, the NFT markets can only be evaluated by the images they represent. If we do enter a period of mania with NFTs, it’s going to inject a lot of capital towards picture speculation.

What happens to the quality of NFT pictures that emerges on the other end of this?

After trillions of dollars are pumped into competing artists and art projects, what will the quality of digital art be on the other side of the mania? New innovations like what Art Blocks brought us with generative art could completely change the paradigm of digital art.

And since these things are markets based on artistic taste rather than financial fundamentals, we can only imagine that the art that emerges out the other side of the mania would be extremely tasteful.

I really like art, so I would love to see what humans can produce on the frontier of art speculation mania! Hopefully, we unlock new methods of individual and community expression, as well as stronger ways to financially reward the arts!

📚 More on all of this here: The Digital Culture Revolution.

Sitting Comfy on the Sidelines in ETH

Speculating on NFTs is hard. I don’t even get it most of the time.

You shouldn’t feel compelled to partake in this just because everyone else is doing it. There are also no guarantees that any sort of mania will ever unfold, and this post itself might “mark the top”.

For those who are wary, it’s a good time to remember that everything that occurs on Ethereum flows back to ETH.

There’s a bunch of silly ETH whales and weird zoomers gambling on JPEGs?

Well, if you’re an ETH holder, and especially as an ETH-staker, you have exposure to all of this—especially when companies like Visa are legitimizing ETH as an asset and using it as money to purchase NFTs. At the end of the day, ETH should capture a decent amount of any speculative mania that occurs on Ethereum.

A mania in any market brings winners and losers, and the winners win by taking money from the losers.

If you are risk-averse and want to ensure you remain a winner, you can simply play as ‘the house’ by holding ETH.

If the NFT mania does indeed develop into an ICO-sized market, you can bet that ETH will be running alongside it.

- David

P.S. Need to get caught on Bankless from last week? Tune into our new TL;DR video summary and get downloaded on the week in 10 mins. 📺

Actions

- Execute any good market opportunities you saw

- Listen to The Crypto Coalition | Ryan Selkis