The Digital Culture Revolution

Dear Bankless Nation,

Our institutions are failing us.

But crypto brings a whole new land of opportunity—a revolution for younger generations. David explores this idea in detail today.

We’re about to enter the golden age of digital culture.

- RSA

WRITER WEDNESDAY

Writer: David Hoffman, Bankless Founder & Co-Host

The Digital Culture Revolution

The cryptocurrency revolution is typically viewed as a revolution in money and technology. Crypto-economic systems promise to usher in a new age of unbridled value-transfer and value-expression, via the improvements in both scarce financial assets and technological mediums for leveraging these assets.

Together, technology and money compose so much of what makes society…society. When we change these things, we change everything. Much of what defines a society is mediated by the technological tools we have available to create cultural expression.

The cryptocurrency revolution is a revolution in money and technology, but the legacy of crypto will instead be a renaissance in human culture.

Summary

This article is on the longer side. Here’s a roadmap and a tl;dr:

- The culture that is found in the world of crypto is unique and offers a strong tailwind towards the growth of this industry. The vibrancy of crypto-culture offers a compelling environment to the younger generations who are struggling to find their place in the world.

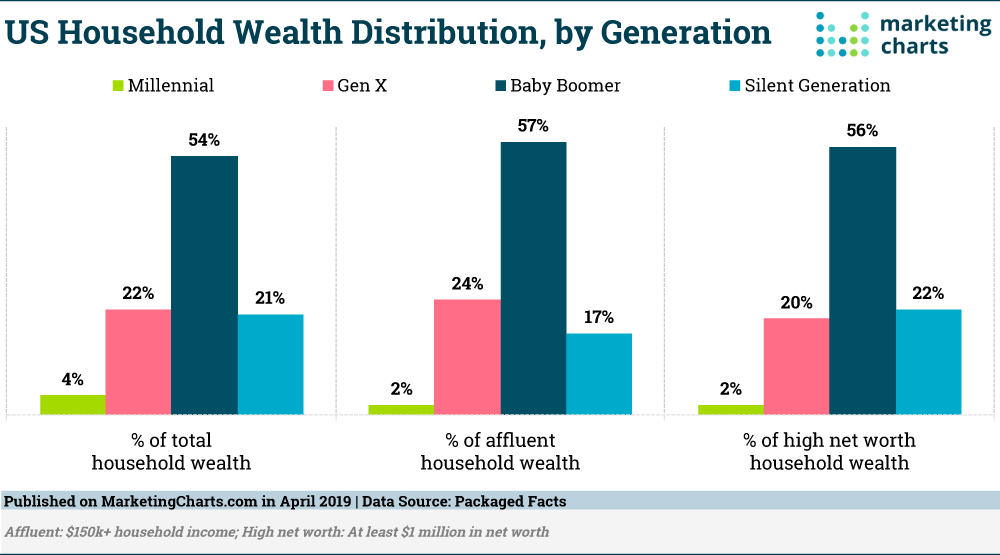

- The social institutions that are supposed to be vehicles of wealth generation are actually only generating wealth for the older generations that have captured them.

- Younger generations are not benefiting from these institutions. The institutions have rejected them, so in turn, they reject institutions.

- This is creating a societal crisis that is causing younger generations to be pessimistic about their future, and they are succumbing to massive compromises in their well-being; compromises that their parents never had to ever make.

- New social institutions are being constructed in the realm of crypto, and these new social institutions are particularly suited to the needs and wants of the younger generations.

- NFTs and tokens at large offer opportunities for people to create rather than just labor. Tokens are tools for the monetization of one’s own labor and enable those who can use them to route around the entrenched institutions and established intermediaries and generate a self-sovereign livelihood.

- Ethereum is well suited to enabled the creation of infinite different cultures, as these cultures have an economic foundation to stand on, that the legacy world was not offering them

A cultural renaissance is upon us, and it will be powered by crypto.

Much thanks to Ameen Soleimani and Chris Burniske for their invaluable counsel for the formulation of this article.

Also much thanks to members of the Bankless Nation 🏴 who provided critical feedback to make this article more digestible and coherent.

Crypto Culture

The world of cryptocurrency has cultivated its own unique culture, values, and communication styles. There are esoteric terminology, slang, and memes, and people are versed in their ability to express these things through purely digital means.

The crypto-economic foundations that make up this industry, Bitcoin and Ethereum, are responsible for creating the environment from which crypto-culture has been established. The specific flavor of cultural expression found in crypto-culture is directly downstream of the code that produces Bitcoin and Ethereum. The values that are baked into these crypto-economic systems extend outwards from the code itself and into the community, and the art that we share and value.

There is a relationship between the nature of the cryptography that underpins these systems and the resultant communities that come to surround them.

Value: A Collective Agreement

If something has value, it’s because humans collectively agree that it does. ‘Value’ is true because humans make it so. It’s a myth maintained by the social layer shared by the collective.

Value is intangible, yet it is a powerful unifying force of everyone that shares the myth. Because all humans know all others believe in the same story, value becomes self-fulfilling.

Value: the monetary worth of something; the importance or usefulness of something; a fair return or equivalent in goods, services

Values: a person's principles or standards of behavior; one's judgment of what is important in life.

The assets that humans value are determined by our values. The market value of our financial assets is derived from our values created by the ethic that we live by.

The true power behind the cryptocurrency revolution is its ability to eliminate the is-ought gap between what humans value and human values. With crypto, humans have the tools to become more closely aligned with how we desire to be.

The net result of crypto is the production of new cultural-expression vehicles that enable humans to express their values with fidelity.

This is critically important and is perhaps the prime reason to why this industry is so massively revolutionary. Humanity is perpetually on a mission to discover ways to express what it sees as ‘good’, and crypto offers a platform that makes this process more effective, efficient, and accurate.

Most humans are ‘Good’ and want to do Good things for the world. Most humans wake up with the intention of helping improve society in whatever ways they can, while still making ends meet and living a comfortable life.

Our ability to achieve Good results depends on the systems that humans use to organize and coordinate. Not all organizational systems are equally capable of enabling humans to successfully achieve the desired results of being 'Good.' Certain environments and human organizational schemes enable the expression of more Good than others. Environments flushed with resources make it easier to reduce suffering and to spread wealth, which is Good, but there’s variability in how humans manage to organize inside the environment they find themselves in.

It’s one thing if there are ample resources, but being able to distribute these resources in Good ways requires organizational scaffolding to enable it.

Organizational Schemes

As discussed in A Bankless Nation, humans have organized and then reorganized themselves under different schemas across time, and these organizational schemas tend to be more and more socially scalable. Steve Jobs said ‘technology is a bicycle for the mind’ implying that innovations in technology enable the human brain to achieve more with less effort. Extrapolating that from the single human brain to the collective human hivemind, new and improved human organizational schemes (Feudalism, Religion, the State, Democracy, the Internet, Crypto) are enabled by innovations in social coordination technology.

Our ability to organize and focus our energies is mediated by the technology we have at our disposal.

Crypto offers new social scaffolding that allows us to better distribute our valuable resources in a way that is better aligned with our human values.

Learned Helplessness

Learned Helplessness is a term coined by Martin Seligman, a pioneer of the Positive Psychology movement.

Learned Helplessness is a condition in which a person suffers from a sense of powerlessness, arising from a traumatic event or persistent failure to succeed. It is thought to be one of the underlying causes of depression.

Learned helplessness is related to the concept of self-efficacy; the individual's belief in their ability to achieve goals. Learned helplessness theory is the view that clinical depression and related mental illnesses may result from such real or perceived absence of control over the outcome of a situation

Learned Helplessness in Society

Societal institutions are entrenched. Wealth isn’t circulating. Attempts to climb the social ladder and achieve the ‘American Dream’ are thwarted. Millennials are the first generation in history to believe that they are going to be worse off than their parents. Home-ownership in young people is down. Inflation-adjusted income is down. Debt is up; both in student loans and credit cards.

A young person’s positive beliefs about the future are at all-time lows.

Millennials and Zoomers are the two current generations in which positive beliefs about the future are critically important. These two generations need to be positive about the future, as it's the primary source of motivation to get out of bed in the morning and work towards achieving goals. Young adults need to believe that they have the power to positively impact their own lives and the lives of the people around them, via their own agency and self-actualization.

If they don’t learn that these things are possible now, then these generations may become stuck in a state of learned helplessness.

If you believe that the future is going to be worse, building motivation to expend the energy to try and build a better future will be difficult. If you don’t believe that you have the ability to direct your own personal future for positive outcomes, then why bother to even try? Keep your head down, go to your 9-5, come home, and watch Netflix. At least Netflix is only $12 a month. If you meal prep and don’t eat so much avocado toast, you may even be able to pay off your credit card!

Meanwhile, Millennial and Zoomer memes about depression, suicide, and loneliness are relentless on Instagram and Reddit. If a meme catches traction, it’s because many people can relate to it.

Internet memes are a way for young people to express their emotions and offer a way to funnel their depression and pessimism into a creative outlet. We should take notice that a common way to establish commonality and express oneself with internet strangers is via memes about depression, suicide, and loneliness. While these are intended to be a lighthearted jest, they are also the product of the environment that Millennial and Zoomers find themselves in.

Society is in a state of Learned Helplessness

…and it’s because our institutions are rigid, fixed, and designed to protect entrenched players and to protect the status quo.

Unhelpful Institutions

The institutions that were erected after the Great Depression and WWII produced one of the most progressive periods of human history. The 1950s to 2008 was one of the greatest periods of economic prosperity and technological advancement humanity has ever had.

But just like everything else in this universe, institutions age. What was originally built to benefit all of society now only works for a small part of society. Older generations were able to enjoy the best years of these newly established institutions, and they latched onto them and never let them go. Rather than passing the torch to younger generations, and allowing the institutions of the 21st century to adapt, evolve, and be inclusive of further generations, older generations instead captured these 21st-century institutions and sucked them dry.

The older generations are still steering the Ship of Wealth, and declining to pass control down the line.

The last 5 presidents of the United States have been Baby Boomers. The United States has been led by a Baby Boomer since 1992—that’s my entire lifespan.

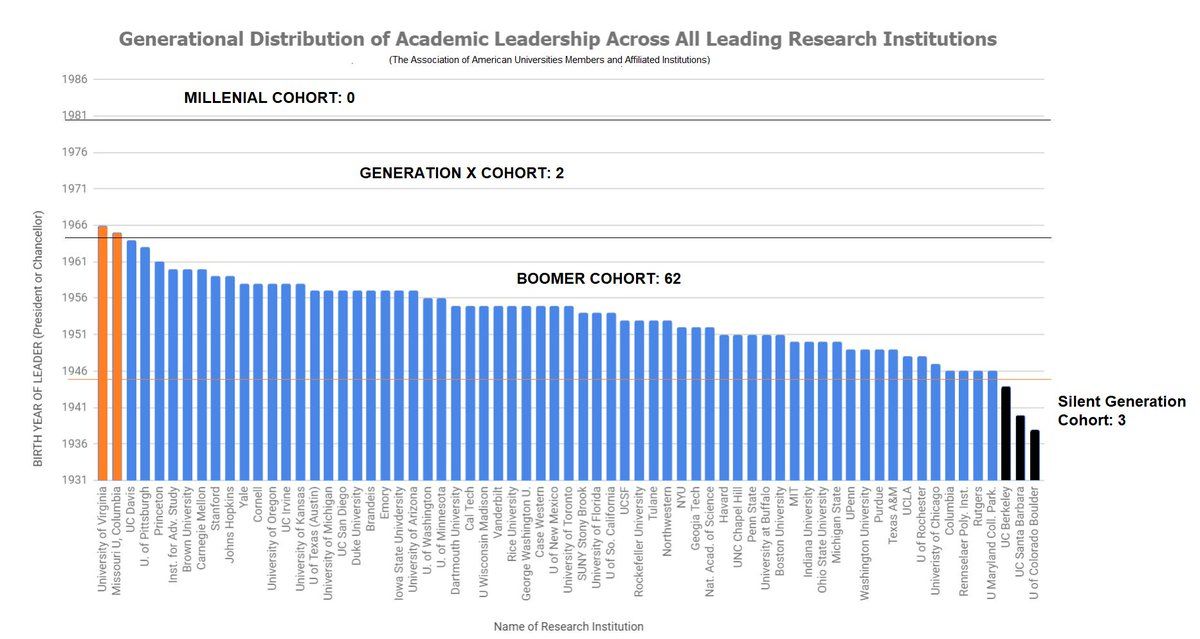

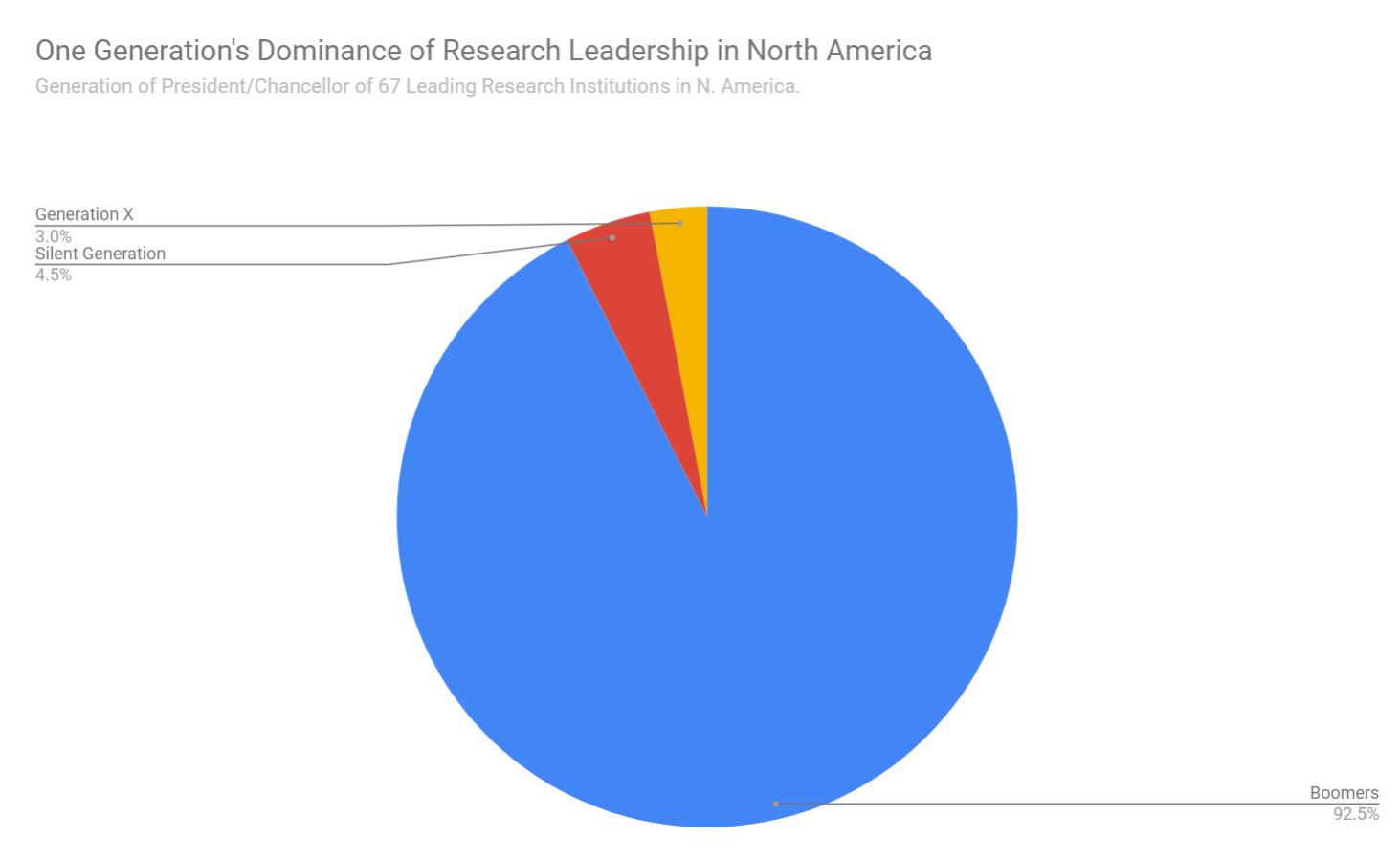

‘Research Leadership’ or the direction that we focus our energies into “Society R&D” is a Baby Boomer-lead movement.

At the same time that student debt is reaching critical levels, University administration is inflated and leadership decisions are made by Baby Boomers.

It takes roughly the lifespan of one long human life for a social institution to be birthed, mature, then age and become decrepit and senile. The generation that happens to be in their prime working years during the era in which institutions are at their best latch onto these institutions and capture all the value that they create.

By happenstance, the generation that was positioned to take advantage of the prime years of these new institutions uses this era of prosperity and wealth to further expand these institutions to their maximal degree, as these generations believe that these institutions are ‘Good’.

Obviously they believe that these institutions are ‘Good’, because of how much value and wealth they created from the relevant generations!

These new institutions are wealth-generating machines and the generations that benefit from this wealth-generation latch onto the institutions and proliferate them into monolithic gargantuans that grow to commandeer the lives of everyone.

The generations that helped create these institutions never pass up the helm of the ship. They continue dictating the direction of everyone under the umbrella of these institutions, even though they were erected under completely different leadership, under completely different paradigms. Society and generations move on, but the institutions stay the same. Eventually, there is such a large discrepancy between the needs of society, and what the institutions in power are is capable of offering.

As a result, the generations that come after these lucky generations receive less and less of the wealth that is created by these institutions, as the prior generations find more and more ways to capture all the value that is produced.

The wealth does not trickle down.

Because these institutions never find new leadership, new brains, new innovators, and new entrepreneurs, they begin to age just like the people that compose them. Eventually, they turn old and senile too, and the social leadership these institutions offer is fundamentally misaligned with the desired goals of subsequent generations that came after them.

As a result, the social institutions reject the young folk, the young folk reject the institutions, and a societal crisis occurs.

In 2020, both the Left and the Right in America took to the streets and rioted.

“Distrust in institutions is at an all-time high”

“Wealth inequality”

Younger people are increasingly pessimistic that we will be able to ‘vote’ our way out of our issues because the older generations never seem to acknowledge their perspective them get their way (see the 2020 Democratic Primary with Bernie vs. Biden).

Instead of playing the society game, younger people seem to just rather ‘opt out’ and make memes about depression and helplessness. They have learned that they cannot succeed in this environment, because the institutions are not on their side.

New Institutions, New Culture

Younger generations are in dire need of new institutions.

We can see this in the ways they attempt to express themselves in their culture. Younger generations are in a state of learned helplessness, as they struggle to discover where they fit in today’s society. Many are discovering that they actually can’t find themselves a niche to build and excel in, and instead find ways to compromise on their expectations about the future and learn to be satisfied with minimum wage jobs and living with their parents.

For younger generations, Crypto Culture is product-market fit. Our memes are hilarious, our conversations are efficient, and our lifestyle is digital. Crypto Culture offers a new landscape of both economic output and cultural expression, and it is specifically tailored to digital nomads, forum-surfers, laptop jockeys, counter-culturalists, content-producers, swipers, meme-artists, bloggers, internet squads… cypherpunks.

The Cypherpunks Created Crypto Culture

The history of crypto doesn’t begin with Bitcoin in 2009; it begins with Martin Hellman, Ralph Merkle, Whitfield Diffie, Horst Feistel, Peter Elias, David Chaum, and many others who were critical to the rise of cryptography and the cryptographic systems that our industry relies on.

What started out as a counterculture fight against the establishment for the freedom of cryptographic information has blossomed into crypto-economic systems that create the foundational substrate on which infinite crypto-cultures have been established.

Cypherpunks know that cryptographic protocols make social structures.

Cypherpunks don't care if you don't like the software they write.

Cypherpunks know that software can't be destroyed.

Cypherpunks know that a widely dispersed system can't be shut down.

Cypherpunks will make the networks safe for privacy.

Cypherpunks write code.

The story of the Cypherpunks is a story of permissionless creation. A group of people banded together under a commonly shared set of beliefs and values, each with unique capabilities to contribute towards something they believed in and stood for.

The desire to create. A counter-culture of permissionless problem-solving. A disregard for nonsensical, outdated establishment norms. A readiness to escape from tyranny and oppression, and the willingness to venture into new lands.

The foundation of all crypto-cultures is built on the backs of the cypherpunks.

Infinite Cultures

Thanks to the efforts of the Cypherpunks, we have an alternative universe for money and finance. This realm is uninhabited and fertile. There are just two things missing in this new empty landscape: people and structures.

The migration of people and their capital into this new realm has perpetually grown ever since the first Bitcoin block was mined in 2009. Slowly but surely, people have been migrating into this new digital realm and setting up camp. These initial pioneers of crypto are most culturally similar to the cypherpunks that established the foundation of this land in the first place: independent, adventuring creators who have a vision for the future outside of the status quo.

Ever since Bitcoin was introduced in 2009, and especially since Ethereum was formed in 2015, the migrants into this digital realm have taken on different flavors than the purely Cypherpunk cryptographers. Each new community that arrives in the crypto-verse is a new spin on the OG cypherpunk culture, and each community brings something new to the table that expands the fold.

One of the first communities that settled in the crypto-verse were the libertarian gold-bugs who saw the dormant potential that lay in Bitcoin.

Each different application of the crypto-verse entices its own varieties of users to migrate over. After the ultra-libertarian goldbugs and early cypherpunks came more casual cohorts, all interested in a specific flavor of what crypto has to offer.

- Dogecoin brought in a cohort of internet memesters. (Nic Carter came in via Doge)

- Bitshares brought in economic tinkerers. (Rune Christiansen came in via BTS)

- Monero and privacy coins brought in the privacy-minded.

But with the introduction of Ethereum, an entirely new dimension opened up.

Ethereum enables applications that don’t want or care to be concerned with the fundamentals of what makes a crypto-economic system operate. App developers on Ethereum don’t have to worry about the hard problems of crypto-economics (monetary policy, security, consensus etc)

The Ethereum protocol takes on the hard problems of crypto-economic system design and lets the application developers focus on what they want to focus on: producing their application.

This is a massive boon to cultural creation. By eliminating the labor and energy that needs to be dedicated to blockchain design and sustainability, app developers can focus on creating value in their apps, and incentivizing a community to band together and circle around the campfire that the app creates.

Sadly, Dogecoin is just another L1 blockchain masquerading as a meme, and much of its vibrant community from 2013 to 2016 has moved on.

Dogecoin was not a place of final settlement for migrants looking to live inside the crypto-verse. Bitshares similarly was economically flawed and constraining to developers. While Monero and other privacy coins maintain a strong community, their growth hasn’t kept up with the rest of the crypto-verse. These systems have not proven to be sufficiently sticky for migrants to be convinced of settling there.

This is the power of Ethereum’s application layer: a foundational substrate that creates economic viability for all possible forms of culture to be expressed.

Early Micro Cultures

The 2018-19 bear market saw a mass exodus from the crypto-space. As capital leaves, so do the people. Yet, a few communities managed to hold on and kept their fires going. The Link Marines. The Synthetix Spartans. The Aave Avengers.

These communities suffered through significant drawdowns in asset values. Then, they suffered through 2 more years of flat crypto-prices, before things began to pick up again. This was 2 years of poverty—2 years of communities contracting into their truest and most convicted believers.

The Discord channels for these communities were the campfires that kept the energy alive through a long, cold winter. Community members turned into community leaders and tended to the fire to make sure it kept everyone warm.

Culture was created in these shared experiences of unexciting, low asset prices, yet relentless optimism and conviction about a successful future. Each different bear-market-community generated its own style of memes, jokes, and coping mechanisms as they waited out the winter together.

And then spring came. AAVE, SNX, and LINK violently ended their bear markets by completely rejecting the pessimism expressed by all other assets in crypto, and lead the charge into DeFi Summer 2020 and where we are today in the markets.

DeFi Summer happened, and out of it came the communities of Yearn, Sushi, Yams, Harvest, and many more, each with massive treasuries to help fund the development of both the product and the community.

Each ecosystem has its own contributors, investors, developers, leaders, organizers, memers, or just believers. Some don’t do much other than sitting at the campfire and be present, and that is enough.

Each ecosystem has its own culture, and that culture is alive due to shared conviction and sufficient funding via a collectively-owned asset.

The asset makes the community, and the community makes the asset.

These communities and their shared cultures are amplified via the financial and economic tool that lies in their respective token. The token is the thing that funds these communities and allows them to tap into resources that help the community grow and proliferate. When these tokens go up in value, it brings in more community members who find resonance in the value of the token and the values of the community.

NFTs are Vehicles for Cultural Creation

Though it might seem like NFTs have burst out of nowhere and into the news, the phenomenon has been inevitable since 1975. That was when two academic computer scientists, Whitfield Diffie and Marin Hellman, made the public-key breakthrough that brought us modern cryptography, enabling security and privacy in an online world. Their discovery also opened up cryptography as a creative tool through which scientists could cleverly transport the conventions and regimes of physical reality to the newly burgeoning digital world. One of those innovators was cryptographer David Chaum, whose ideas made digital money possible. It was only a matter of time before Chaum’s cryptocurrency concepts became mainstream, especially when merged with another cryptographic innovation, the blockchain. If you could ascribe value to verifiably unique strings of bits used as money, why not other strings of bits that represented artwork, tunes, or slam dunks? And once you’ve made the transition into collecting blockchain valuables, you can get really creative.

It’s no accident that NFTs are going wild during our lockdown state, when so much of our lives are played out on Zoom, Twitch, Clubhouse, and Amazon Prime. Novelist William Gibson famously described cyberspace—what became the internet—as a “consensual hallucination.” On a practical level, digital reality is just as real as the stuff that hurts our knees when we bang into it. NFTs merge that illusion with our longstanding consensual hallucination that something void of intrinsic value is actually precious and fungible.

Our embrace of those hallucinations long ago overstepped what we once considered its bounds. Even when we’re somewhere, we’re somewhere else. If you don’t buy that, try not touching your phone for a day. So why shouldn’t our ideas change about what holds value? As new as they are, NFTs are just confronting us with the evidence of how much we’re already in the Matrix.

We’re people who need Beeple.

- Steven Levy, Wired

The power that lies dormant under the innovation that is NFTs is about to erupt into the world of artistic creation.

Justin Blau, more commonly known as 3LAU raised $12M in 24 hours by selling a combination of digital collectibles, exclusive music, and the rights to musical direction.

In return, Justin was able to create a direct connection between his artistic creations, and a list of 60 people that put $12M into his pockets for the rights to these items. While Spotify is great for distribution, it sucks for data. That’s because Spotify keeps all the data for itself. It provides the artists with no insight into who their fans are, or the ability to communicate with them.

3LAUs top 60 fans were willing to collectively pay him $12M, yet a platform like Spotify treats them like every other 3LAU fan… or worse: people listening via Radio mix.

As a result of the NFT tokens Justin 3LAU issued on Ethereum, his fans were more capable of communicating their value of the music he produces.

Intermediaries broker the emotional relationship between artistic creators and artistic consumers. With intermediaries replaced by financial and economic software on Ethereum, the expression of culture through the digital arts will be able to flourish.

Art is simply the ability for an artist to strike the senses of the experiencer; what happens when we generate incentivization vehicles (tokens) for the funding and development of the digital arts?

The emotional response humanity will be able to access from its art will be revolutionary.

Lowering the Barriers

Ethereum democratizes finance, and what is happening with NFTs is just the beginning of democratizing the value derived from art. Suddenly, the sharpest and most precise financial tool ever created is in the hands of the content creators and artists of the world.

Through the power of tokens, and at the scale of the Internet, Ethereum disintermediates the distribution of art between art creator and art consumer. We have already seen the immense amount of energy that ICOs sparked in 2016-2018, and ICOs made no sense at all. Yet, the takeaway was Ethereum’s innovation in “capital formation”.

NFTs are taking the power of capital formation and directing it into the arts.

Tokens are the tool for artistic creators of all scales to tap into the power of their creative energies and produce something of cultural expression. If the market values cultural expression, it will have the ability to communicate this to the creator, 👏through👏the👏token👏.

How many jobs will Ethereum create, by reducing the barriers for capital to flow into new lands of artistic creation? How many labor-hours can be redirected from meaningless tasks in gargantuan companies, into the land of free-market cultural generation?

NFTs offer a way for the younger, digitally-native creators of the world to not rely on established and entrenched, permissioned, infrastructure to help fund their personal well-being.

While the issue of large, misaligned social and political institutions are not simply ‘fixed’ by NFTs, NFTs offer a cypherpunk alternative to allow the younger generations to bypass these gatekeeping institutions, and empower them/us to secure a livelihood outside of the status quo.

Not only do the legacy institutions of the world have to compete with the permissionless labor-monetization tools offered by Ethereum, but they also have to compete with the lifestyle that these tools offer: the freedom to work for oneself. No 9-5, no boss; just a creator and their computer.

“…even a billion dollars of capital cannot compete with a project having a soul.”

- Vitalik Buterin, Endnotes on 2020: Crypto and Beyond

The Crypto Wealthy Will Subsidize Digital Art

It makes logical sense that NFT Spring is occurring after DeFi Summer. It’s simply the correct order of operations. $ETH runs from $200 to $2,000, along with insane amounts of new issuance from DeFi tokens, and hundreds of billions of dollars gets injected into the ecosystem. Meanwhile, this high-powered growth also drives in funding and investments into companies and supporting infrastructure as well, adding in jobs and salaries into crypto.

And now, this newly-created wealth is rotating out of Digital Finance and into Digital Arts.This is only, like, like the millionth historical example of this.

From Tracing Renaissance art to the birth of modern banking:

When it comes to the Renaissance, few of us would immediately equate the rich cultural fruits of the period with the birth of the modern banking system.

Entitled "Money and Beauty: Bankers, Botticelli and the Bonfire of the Vanities" the exhibition in Florence's Palazzo Strozzi looks at how Florence's famous families got rich -- and how they then used their wealth to commission works from some of the world's most celebrated artists.

"You could say that some of these gestures were simply penitential, but then the banker begins to realize that in giving them money he can also begin to define the image that is produced by his money, and of course one of the things he instinctively does, whether it's conscious or not, is to use the image to change the attitude to money, that is, begin to use the image to undermine the resistance to money," said Parks.

Money was feared, he said, not only because Christianity espoused poverty but crucially because it allowed for social mobility and therefore undermine the set Medieval hierarchies. Still, for a few years, the Medicis were in charge of papal finances.

…the artists were often happy to oblige in order to ensure their own economic prosperity.

It’s simple: Society advances and learns how to create wealth and prosperity. Wealth naturally concentrates and generates a wealthy cohort of people, who have nothing better to do than to fund and finance the art that they wish to see created.

Artists want to capture this wealth generated from innovations in finance and banking, and then they start making art that suits the taste of the wealthy.

Entire revolutions in art have come and gone due to this cycle.

Ethereum is the new frontier. We have completed the exploration of the Earth, and now the frontier of money, finance, and art has moved into the digital realm.

The next cultural renaissance is digital, and it will be financed on Ethereum.

Conclusion

The culture that is being cultivated in this space is a result of the awakening of younger people who are turning away from the notion of being simple cogs in the machine and are instead focused on becoming self-actualized contributors to the world.

Andrew Yang warns of a world in which much of the world’s labor has been automated by machines and robots. We stand at a fork in the road where our future can turn into either a utopia or a dystopia.

Without a place to redirect the energies of our younger generations into productive outputs, we will lose these generations forever to the basements of our parents, and the spirits of these generations could wither into nothingness. That’s a dystopia.

But, with a place in which creative energies can be expressed and valued, we have the opportunity of automating away all the low-value work, and replacing it with time spent creatively. If robots are doing the labor, and humans are creating art, that’s a utopia.

Let’s choose the latter—let the robots flip burgers and let the people create art.

Let’s choose the future in which people are free from limitations on their paths towards producing a livelihood for themselves and others.

Let’s choose Ethereum. Let’s choose Crypto Culture.

Action steps

- Reflect on crypto culture and its role in the future

- Read: NFTs and a Thousand True Fans

- Listen: The Bull Case for NFTs