Is custodial staking bad for Ethereum?

You’re on the free version of the program so you’re getting the full article but not the bonus round at the end. Become a paying subscriber & get the full program today!

Dear Crypto Natives,

There will be two ways to stake your ETH in the future:

- You hold your ETH and stake (non-custodial)

- You give up your ETH to someone else and stake (custodial)

Staking is either custodial or non-custodial.

There’ll be plenty of non-custodial staking options. Some will require you to run your own gear, others won’t require much tech skill at all.

You’ll have plenty of non-custodial staking options in time. Some will require you to run your own gear, others won’t require much tech skill at all.

But we’re not talking about non-custodial staking today. I’m less concerned about it. Hundreds of thousands of non-custodial stakers? That’s the happy path for Eth2. That helps keep Ethereum decentralized.

I’m more concerned with custodial staking. Who are the likely custodial staking providers? Binance, Coinbase, BitGo—the same big exchanges and custodians that provide staking for other crypto networks today.

And what if big crypto banks end up owning Ethereum’s staking?

Will all this whole staking thing end up custodial?

I asked Jim McDonald, one of the most knowledgeable people on Ethereum staking this question. Jim’s written some fantastic posts on staking including “Evaluating Staking Services” and “Exploring Validator Costs” and offers an informed perspective.

And…guess what? I was surprised at his answer!

Read on to find out why.

Btw, this’ll be the first of many in our Ethereum Stakeanomics series. So if you want to learn the whys, hows, and whens of ETH staking stay tuned to the program as always.

Ready? Staking level ups in 3…2…1…

- RSA

Series: Ethereum Stakeanomics

THURSDAY THOUGHT

Custodial staking in Ethereum 2

Post by: Jim McDonald, co-founder of Attestant

Ethereum 2 staking is on the horizon and a great opportunity to put otherwise-dormant Ether to work. A number of exchanges and custodians have announced they will start providing interest on Ether held in custody. Is this free money, or is there a catch?

Basics of Ethereum staking

Ethereum 2 is due to launch in the second half of this year. Although hardly the first cryptocurrency to use proof of stake as a mechanism to secure its chain, it is by far the largest and for many will be an introduction to proof of stake with a currency they personally hold.

The basics of staking with Ethereum 2 are relatively simple: you deposit 32 Ether into a "staking contract" on the Ethereum 1 chain to become a validator on the Ethereum 2 chain. To validate, you run a computer program to either propose new blocks in the chain or vote to affirm that blocks proposed by other validators are valid. If you do a good job, you are rewarded with additional Ether; if you do not, some of your Ether is forfeited.

Validating in Ethereum 2 has no credit risk: there is no chance of the Ethereum 2 network failing to meet its obligations to give rewards or return staked Ether. This makes validating an inherently safer way to earn with your Ether, as opposed to lending it out via a DeFi platform. With lower risk comes lower reward: staked Ether is expected to earn somewhere between 3% and 8% p.a., depending on the total amount of Ether staked by all validators. Not the big double-digit returns that some products might offer, but still a not inconsiderable amount.

Benefits & risks of staking with a custodian

If staking with a custodian, the custodian uses your Ether as a stake so it can participate in validating, earning rewards and passing a portion back to you. On the surface this sounds very attractive for everyone. Your money grows while being held in custody, the custodian is paid by the network for participating in validating rather than taking a percentage of your assets, and the Ethereum 2 network improves its security the more Ether is staked with it. What's not to like?

Well, there are a few catches when staking with Ethereum 2 that are worth understanding, especially those in the short- and mid-term (i.e. next couple of years) before the Ethereum 2 network matures.

Risk of fractional reserve

Perhaps most importantly, in the initial release of Ethereum 2, there is no mechanism for transferring staked Ether to another account, or even back to the Ethereum 1 chain. This very much locks in your Ether; there is literally nothing else you can do with it. However, this also means that any staked Ether cannot be returned to the owner and remains locked in to the Ethereum 2 chain. This creates a fractional reserve system: if, for example, 50% of the Ether held by a custodian is being used for staking then, at most, only 50% of the Ether cumulatively held by owners can be returned to them. If Ether makes a sudden price movement that results in a request for much of the Ether to be returned, this could put strain on the custodian. Crypto is a skittish world, and any idea of a custodian being unable to return all of its customers' Ether may prompt the type of bank run we've seen in the past in both crypto and fiat worlds.

Moreover, a custodian might be tempted to move more and more Ether from cold storage to staking in order to make more ‘free money’ gains. This would result in a reduced fractional reserve in the chase for profit (sound familiar?).

Risk of slashing

A separate security issue arises from the fact that validating in Ethereum 2 is an active process, which means that Ether used for staking is protected by keys that are “hot”. The design of Ethereum 2 is such that there is a separate "withdrawal key" that controls movement of the Ether, which can be placed in cold storage, but there remains a "validator key" that is required to be used every 6 minutes or so, and so cannot be placed in cold storage. If the validator key is compromised the funds can be destroyed by a process known as "slashing". Alternatively, an attacker could blackmail the custodian, threatening to destroy the funds unless the custodian pays them a ransom. In both situations, a custodian could suffer significant damage in both monetary and reputational terms.

The custodian also has to be capable of running a staking operation. Staking in Ethereum 2 is neither free nor simple, and requires both understanding and on-going effort on the part of the custodian to be successful. Failure to operate correctly can result in financial penalties being applied to the validator.

So we have two sources of risk with custodians staking Ether: the custodian over-staking resulting in a shortage of Ether to pay back to its owners, and the danger of running an inefficient, insecure, or non-optimal staking process resulting in lower (or negative) interest.

What if custodians tokenize staked ETH?

Tokenization is often touted as a solution in such situations: could issuing a token in lieu of staked Ether be a solution to the problems with fractional reserve? Unfortunately not, for a couple of reasons. First, this could be looked upon as a disposal of Ether, which has tax implications in many jurisdictions. Second, the value of such tokens would very much be tied to the risks and reputation of the custodian. As such, the value of such a token would likely be at a steep discount to the Ether it represents, and who would want to own that?

Is custodial staking bad?

All this said, custodial staking is not an inherently bad thing and the aforementioned benefits to owners and custodians, as well as the network itself, are real. So what is the way forward? In a word: transparency.

Most importantly, staking should be offered as a product separate to any existing custody service, with clear information about its longer-term outlook and lock-up requirements. Custodial services should be clear from the outset on the % of Ether under management that they are staking on behalf of their customers. They should have up-to-date information on the current rewards they have made to date on staked Ether. And they should have contingency plans in place to allow them to cover their Ether position in case there is a higher than expected demand for withdrawals.

Over time these problems are likely to go away: as the Ethereum 2 network matures it will become easy (if never quick) to move Ether in and out of staking positions, and custodians will develop and learn the financial and technical rules to provide safe staking with suitable capital adequacy requirements. Until then, make sure that your custodian gives you suitable visibility and control. That way, you can benefit from staking without finding yourself unexpectedly cut off from your funds, and custodians can benefit from staking rewards without suffering monetary and reputational damage, whilst boosting the security and stability of the Ethereum 2 network.

Action steps

- What are the two risks of custodial staking this article highlights?

- What’s your take: is custodial staking good or bad for Ethereum?

Author Blub

Jim McDonald has been involved in technology for over 30 years, and is more excited about blockchain than any technology he’s seen before. He has built blockchain products from an early Bitcoin explorer to an Ethereum 2 wallet, and is a co-founder of Attestant, which provides managed validator services for Ethereum 2.

BONUS ROUND: Three Followup Questions for Jim

My follow up questions for Jim after reading this article

Subscribe to Bankless. $12 per mo. Includes archive access, Inner Circle & Deal Sheet. Costs less than a coffee per week. Don’t invest in crypto until you invest in yourself.

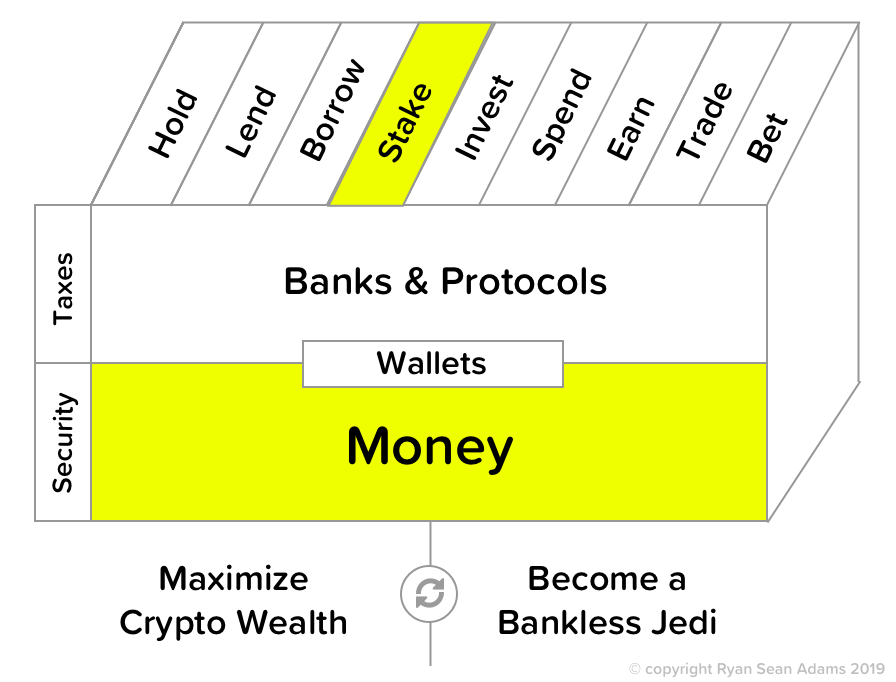

Filling out the skill cube

ETH staking will be a big deal. It’s like an initial bond offering for Ethereum. Today you put in some work to level up on staking in the skill cube. Keep it up!

👉Send us a tip for today’s issue (rsa.eth)

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.