Dear Bankless Nation,

Compound is one of the most resilient protocols in DeFi.

It’s never been hacked. It survived the Black Thursday crash in 2020. It survived an oracle malfunction in December. It even held up during this recent crash in May.

But for some reason, it’s one of the least talked about tokens in DeFi.

Why is that?

It has billions of dollars in value locked, offers some of the best borrowing rates in DeFi, and even kickstarted the yield farming craze that ultimately allowed DeFi to proliferate into what it is today.

The issue for investors is that COMP strictly represents governance rights (which can be kinda boring). There are no rights to cash flows.

But underneath the hood, everything is going right for the protocol. And as we discussed last week, do cash flow rights truly matter? A little bit, but not really.

What matters is the underlying fundamentals in the protocol—is it being used? How much has it grown this past year? These are the questions that matter the most.

And Compound fits the bill.

So we had Ben (who’s on fire lately 🔥) dig a bit deeper into one of the most battle-tested protocols in DeFi.

Here’s what he found.

- Lucas

P.S. Ledger launched their Paraswap integration—allows you to swap any tokens at the best price directly from your Ledger Live app. Who knows….might be worth it

TOKEN THURSDAY

Bankless Writer: Ben Giove, Bankless Contributor & President of Chapman Crypto

An Overview Of Compound and COMP

Legendary investor, and raging boomer, Warren Buffet has a famous quote: “In the short run, the market is a voting machine but in the long run it is a weighing machine.”

Buffett’s quote is applicable to any market, and crypto is no exception. These markets seem to continuously move from one exciting thing to another, whether it’s dog tokens, meme coins, or bored apes.

Perhaps no project has been more of a victim of this mentality than Compound. Despite being one of DeFi’s oldest projects and preeminent money markets, COMP is perhaps the least discussed token among the DeFi blue chips. There’s seems to be no apparent reason for this: a deep dive into the protocol reveals it’s just as interesting as these other tokens.

Let’s see what investors may be missing, and if COMP is worth considering for your portfolio.

What is Compound?

Compound is a money market on Ethereum. Users can deposit assets to earn interest, and these deposits can then be used as collateral to borrow against. Rates for depositors and borrowers are determined algorithmically, varying by asset based on its supply vs. demand ratio inside of the protocol.

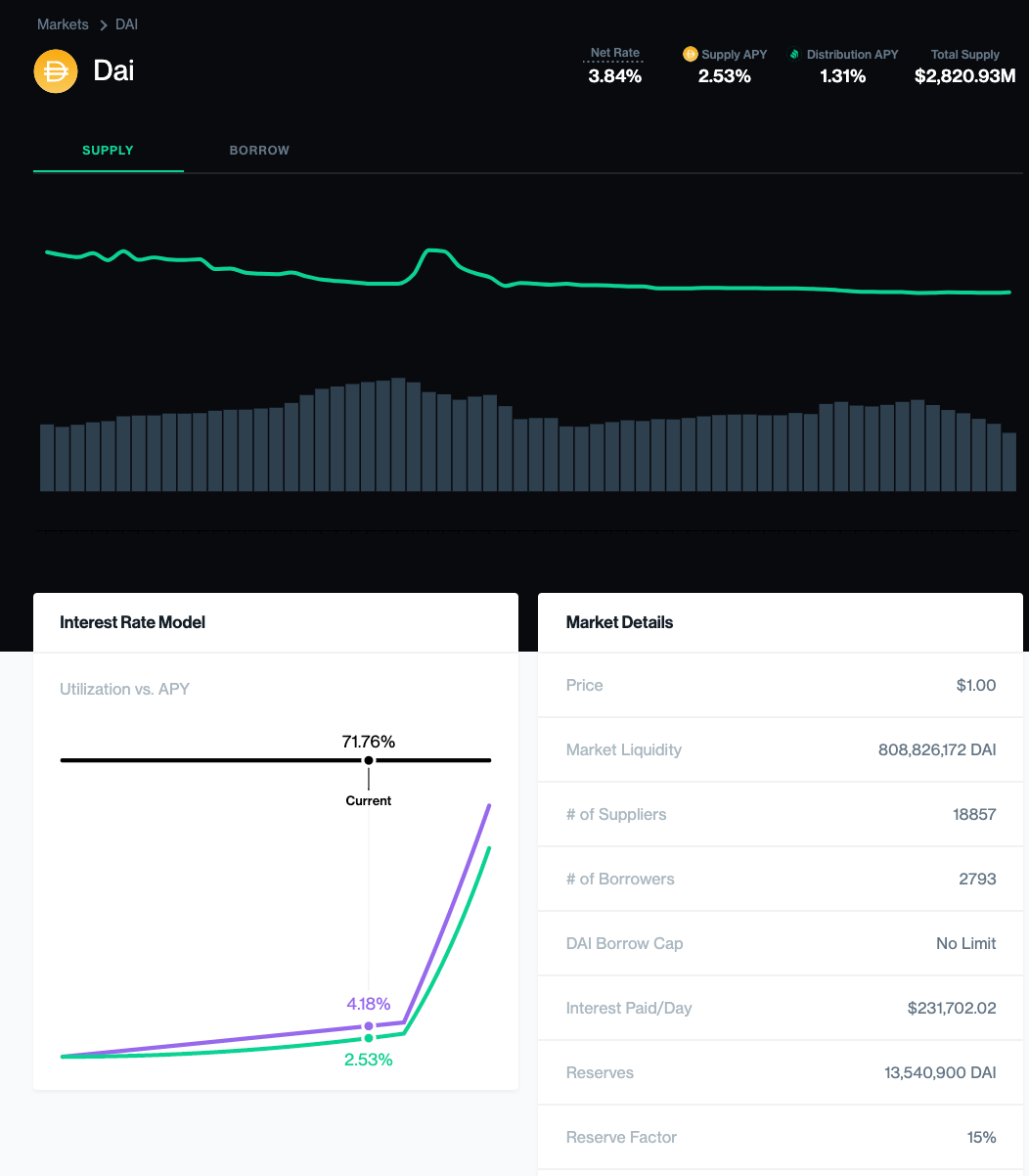

This is expressed in the form of a utilization rate, which measures how much of an asset's underlying liquidity is borrowed. The protocol itself takes a cut of the interest paid to suppliers as reserves, which are used to backstop the protocol in the case that it becomes insolvent.

To allow permissionless, global use of the protocol without the need to evaluate participants’ creditworthiness, all borrowings on Compound are over-collateralized. When the value of a user’s collateral drops below a certain threshold, it becomes eligible to be purchased at a discount (liquidated) by a third party.

While relatively straightforward, Compound provides a valuable service for DeFi users with plenty of optionalities, enabling them to utilize their existing assets in a variety of different ways, such as:

- Leveraging longing

- Going short

- Accessing liquidity without triggering a taxable event

- Borrowing assets to yield farm (my personal favorite)

Okay, boomer: Compound’s Moat

Like any other business, DeFi protocols are seeking to build a competitive advantage (or moat), so they can be positioned to both thrive in a bull market and survive in a bear.

Compound has proven able to do this for several different reasons:

Brand

A key reason is that Compound has an incredibly strong brand. Shepherded by a world-class team of DeFi OGs, Compound has garnered a reputation as one of the safest and most battle-tested protocols in the space.

The project has never been hacked or exploited, survived Black Thursday of March 2020, an oracle malfunction in December 2020, and the recent crash of May 2021. This trust among users is further enhanced by the project's conservative approach to listing new assets.

Compound only supports 11 assets, significantly fewer than the 26 and 80 listings by competitors such as Aave and C.R.E.A.M. While this may invite criticism by some investors that Compound is “slow moving,” it’s important to realize that this limited selection of assets reduces the risk of insolvency, as depositors in a money market pool inherit the risk of every asset within it.

The number of assets available to use as collateral is a variable that can be tweaked. More assets means more options to users, but also more risk. Compound has chosen the path of fewer assets and less risk.

Integrations

Another reason why Compound has been so successful is that the protocol is among the most widely integrated across DeFi, with projects such as Zerion, Instadapp, and DeFi Saver providing ways for advanced users to interact with the protocol. These partnerships bring added functionality to Compound that other protocols may lack. It’s worth considering that Compounds choice to be a risk-reduced money market compared to its competitors makes it a more attractive money-lego to build upon.

Barriers to Entry For Money Markets

There’s a reason why you don’t hear much about Compound being forked (other than C.R.E.A.M and Venus on BSC): Managing a money market is a lot of work.

Between evaluating new assets to be listed, making sure liquidations are functioning properly, and adjusting risk parameters such as collateral and reserve factors, money markets require an active, engaged, and long-term oriented community to function properly.

Beyond just management, money markets need liquidity, as the more capital they have locked within them, the more borrowing they are able to facilitate. Unlike DEXs, because they are over-collateralized, these protocols are not in the business of capital efficiency to nearly the same degree as a Uniswap, SushiSwap, or Curve.

This is a primary factor as to why both Compound and Aave have faced little competition: It’s not easy to attract tremendous amounts of liquidity across a plethora of different assets. Unless…

Yield Farming

We’d be remiss when talking about factors contributing to Compound’s success without mentioning the key driver for DeFi’s Cambrian Explosion: Liquidity mining.

Compounds liquidity mining program is the stuff of legend, as in June 2020 the protocol began distributing COMP tokens to its users, helping kick off DeFi Summer 2020. While not the first project to implement this mechanism, this proved to be an incredible catalyst for both Compound’s growth, as the TVL increased nearly 10x within five months. All of DeFi followed in Compound’s wake, and this event has meaningfully changed the trajectory of the entire industry.

While it’s fair to question the long term sustainability of liquidity mining and what will happen once the program ends, to some degree capital will be sticky in both bull times or bear, as there will be a perpetual incentive for DeFi participants to use the protocol as they look to scoop up the protocol’s native token… so long as the native token has a market value.

Token Economics

Currently, the only right bestowed to COMP holders is governance. Unlike its competitor Aave, COMP plays no role in the functioning of the underlying protocol. Instead, COMP is more akin to a non-dividend paying equity that we see in TradFi.

Despite this, investors should totally ignore token economics.

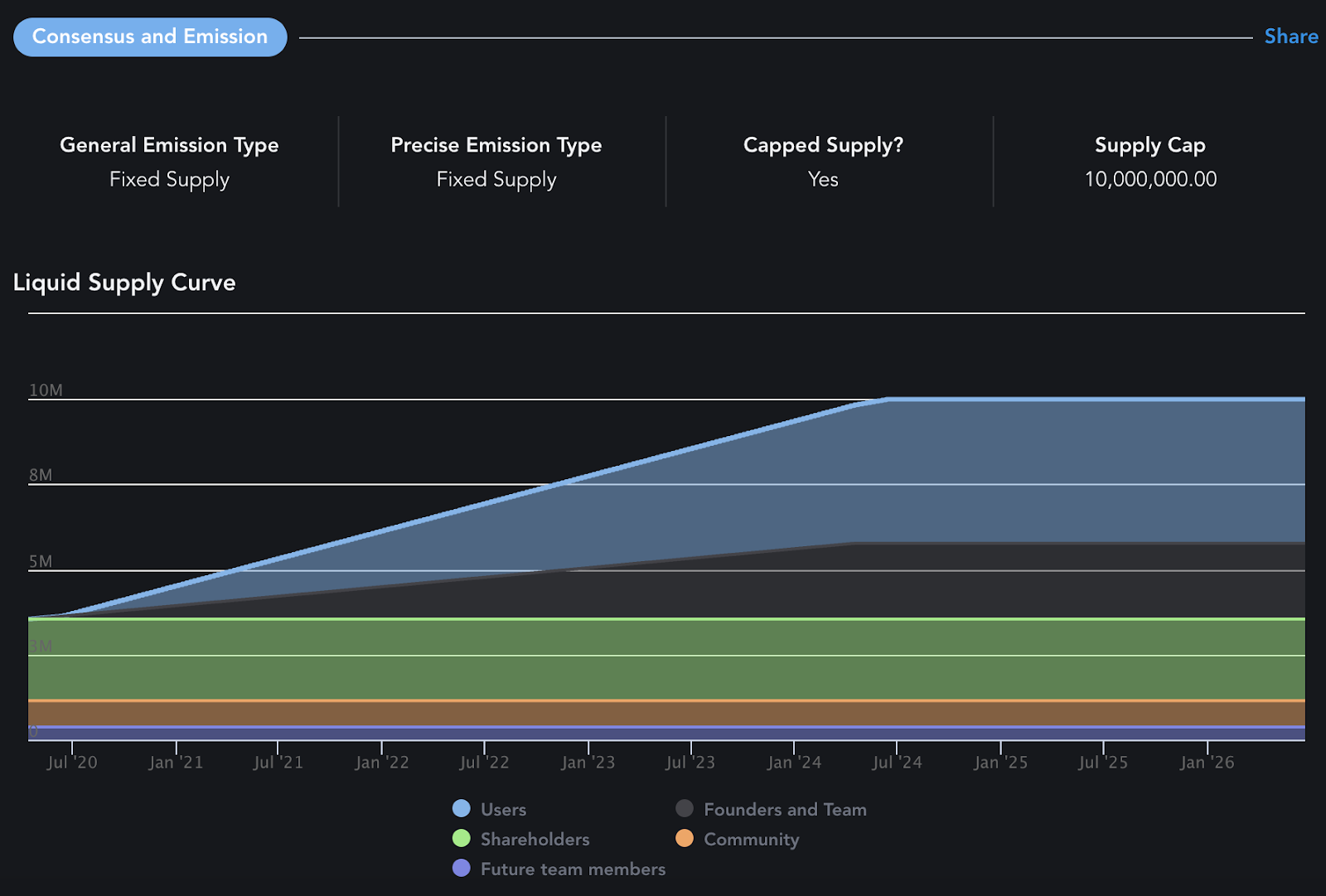

With Compound in particular, one important metric to pay attention to is the supply schedule.

Despite having a fixed supply of ten million tokens, COMP has a liquid inflation rate (how much the current outstanding supply will increase over the course of one year) of 30.57%.

That’s a high number, especially when you consider that only 29.6% of this issuance is being funneled into the protocol treasury, which effectively removes it from circulation, while the remaining 70.4% of the COMP is being distributed directly into the open market via liquidity mining.

While COMP distributions help the protocol attract and keep liquidity, it places downward pressure on the price of the token itself, as it has constant sell pressure from those who are farming COMP in order to immediately sell it. This may be a reason as to why, unlike other DeFi blue chips such as MKR and UNI, the token has underperformed relative to ETH, returning “just” 61% YTD compared to the 152% rise in ETH.

There is a strong chance that this may even intensify during a bear market, when farmers have even less of an incentive to keep devaluing COMP rewards, pushing the price down even further. Although the amount of COMP distributed relative to the circulating supply will decrease over the next three years, with no underlying supply sinks to help cushion the blow, Compounds token economics are not particularly “bear market-friendly.”

Governance

Governance is perhaps the most important, yet under-discussed aspect of DeFi (listen to our governance and capital podcast to learn more). This is despite it in many cases being the only right conferred directly to token-holders.

This is surprising, given that it’s an area capable of making or breaking a project. Without a sensible system of governance and an active community of participants, a protocol may cannibalize itself and fail to adapt to the ever-changing DeFi landscape. It can also be a warning sign for investors, as low activity on its forums and poor voter turnout can be a warning sign that a project's community is disengaged.

So, how does Compound hold up?

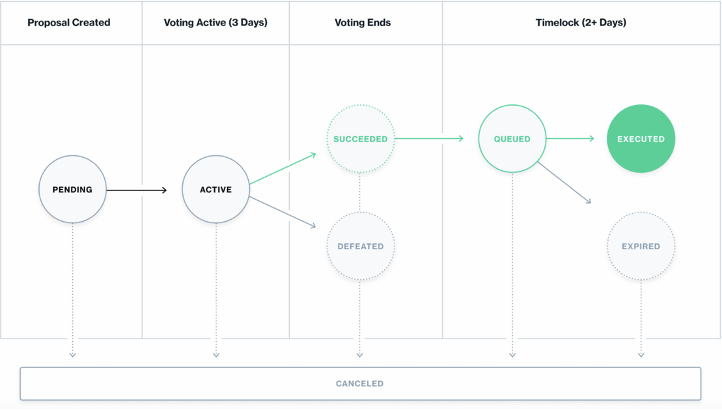

For starters, governance of the project is completely decentralized. COMP holders maintain full control over the protocol, as alterations can only be made by proxies that are owned by the Compound governance contracts.

This system is mostly straightforward: COMP holders with 100,000 tokens owned or under their purview via delegation, or 1% of the total supply, can create proposals, which tokenholders have three days to vote on.

🧠 Click here more about how smaller COMP holders can make governance proposals.

If the proposal is approved with at least 4% of the supply (400,000 COMP) voting in favor, the proposal self-executes 48 hours later. This system has become one of the industry standards, adopted by other major projects like Uniswap, Gitcoin, and PoolTogether.

While Compound itself has been very actively governed, with 49 proposals having been voted on since governance went live (for comparison, other blue chips like Aave have voted on 18, while Uniswap has voted on 5), the decision-making process has been concentrated among a small group of holders.

For starters, 46% of the COMP supply is held by the team and investors; however, they have often abstained from votes. Furthermore, in a problem that is not just specific to Compound, voter turnout and engagement has been very low as just 0.55% of COMP holders have participated in governance, 53 votes per proposal on average.

There are a few reasons as to why this may be the case, such as the difficulty of keeping up with proposals and the gas fees that come with on-chain voting. However, it does illustrate that while Compound is a decentralized protocol, its governance has yet to meet that same threshold.

It’s important to note that token democracy in DeFi does not translate 1:1 to traditional democracy that we are familiar with. A lack of voter participation can indicate that there is consensus among token holders, as there is little-to-no incentive to vote on a proposal that you support, if its trajectory indicates that it will be accepted.

High voter turnout is much more likely to occur under a controversial upgrade that impacts all the stakeholders, and incentives them to get out their private keys in order to make a vote.

Performance Metrics

One of the beautiful aspects of evaluating crypto assets built on a public blockchain, when compared to say, stonks, is the ability to access and analyze an infinite treasure trove of real-time data. Rather than deal with quarterly wait times and a menu of metrics hand-picked by corporate management, DeFi investors can verify exactly how well the protocols their assets govern are performing.

Let’s do this for Compound.

At first glance, the protocol appears to have grown at a rapid rate in 2021. Total value locked has increased 210% from $1.9 billion to $5.9 billion, while borrowing volume has risen 183% from $1.8 billion to $5.1 billion.

These metrics indicate that despite high gas fees on Ethereum L1, there has still been strong demand among users to utilize the borrowing capabilities afforded by the protocol. This demand likely comes from the bull run that took place in the first half of 2021, as when prices rise, market participants have a greater desire to take on risk and will borrow more.

While these numbers seem great on the surface, a deeper look at the data shows that this growth is not what it may seem at first glance, as when denominated in ETH, the protocols TVL is up only 15.1% on the year, increasing from 2.7 to 3.1 million ETH.

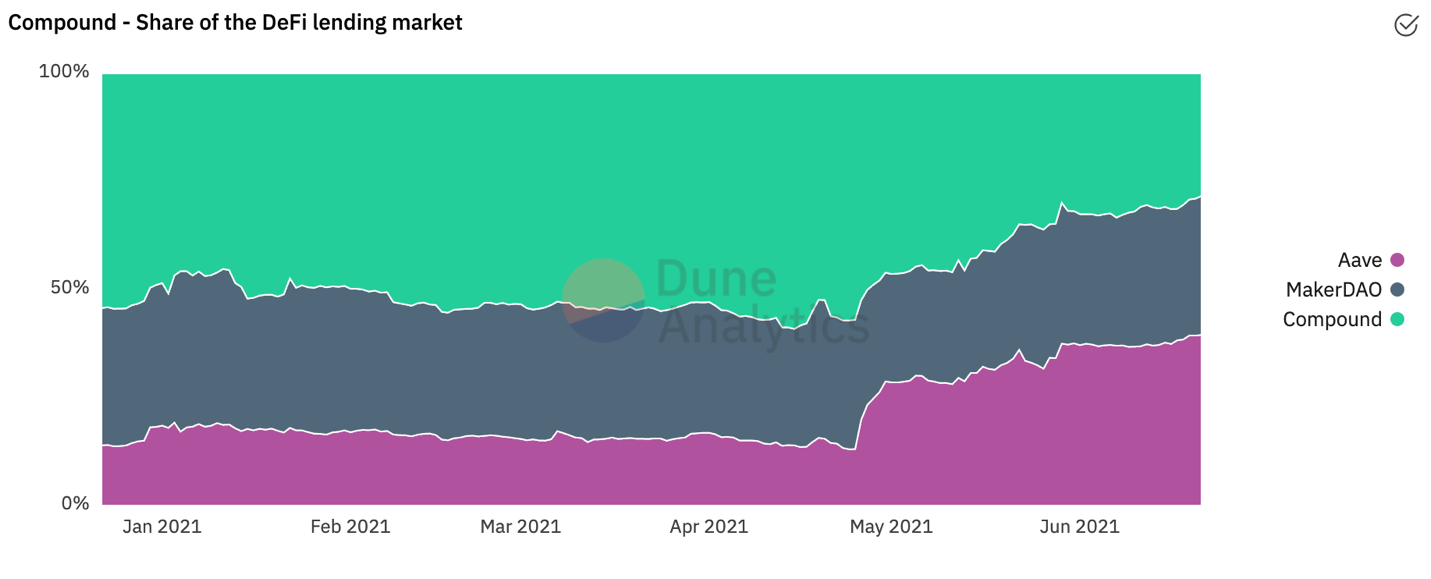

Compound has also ceded market share in recent months to its chief competitor, Aave. While the project opened the year at a 48.5% share based on outstanding debt among the three top multi-asset lending protocols, this has since declined to 28.4%. This comes while Aave has increased its share from 18.2% to 39.5%.

The point at which the tables turn is clear: Compound began losing share once Aave launched its own liquidity mining program in April, which has led to a dramatic migration in capital between the two protocols. While it remains to be seen what happens when Aaves program ends in July, it illustrates that competition for capital between the two protocols remains fierce.

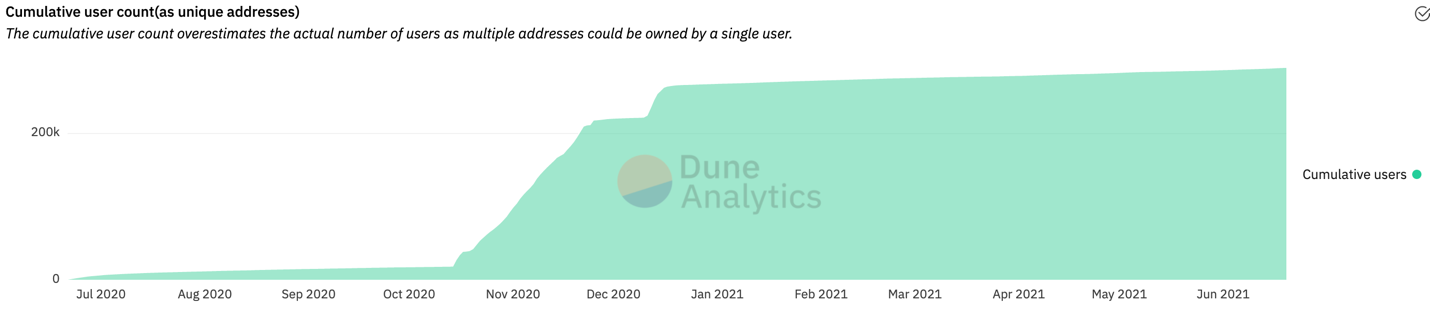

We can also see this picture of stagnating growth when looking at users metrics. While the protocol experienced a meteoric rise in unique addresses interacting with it during DeFi summer and winter, user growth has plateaued in 2021.

While this is likely more an indictment on expensive Ethereum L1 gas fees than Compound itself, it does represent an area of concern, especially since the project has no current plan to deploy onto any Ethereum scaling solution.

Scaling Strategy

In a route more akin to application-specific rollups such as Loopring and DyDx, Compound has chosen to create its own separate blockchain, Gateway. This stand-alone chain will allow users to borrow any asset on any other chain, with Gateway itself governed by COMP holders through Proof-of-Authority consensus.

(To read more about the architecture, click here)

While this is an ambitious vision that has the potential to greatly increase the revenue the protocol can earn, along with the value of governance, it could pose problems for Compound in the near-term by causing them to miss out on the growth opportunities presented by generalized scaling solutions. For instance, Aave’s deployment on Polygon has attracted over $2.2 billion in TVL within two months, and has allowed the protocol to establish a virtual monopoly over that chain's lending market. This has proven to be a missed opportunity both competitively, and from a marketing perspective, as new users onboarded through Polygon are introduced to Aave rather than Compound.

However, it is worth reiterating the potential for Gateway is massive. For instance, there has been speculation that the chain is positioning itself to be able to interoperate with Central Bank Digital Currencies (CBDCs).

Revenue

One of the distinguishing features of DeFi protocols, and their native assets, is their ability to produce cash flows.

As we discussed earlier, Compound generates revenue by taking a cut of the interest that lenders earn, which at this time is directed towards building up reserves to backtop the protocol.

This means that revenue is ultimately determined by two factors:

- Interest rates, which are based on supply and demand

- Reserve factors, which are determined on an asset by asset basis

While this source revenue is not one that holders, or the protocol treasury, are currently tapping into, there is a high likelihood that this may change in the future.

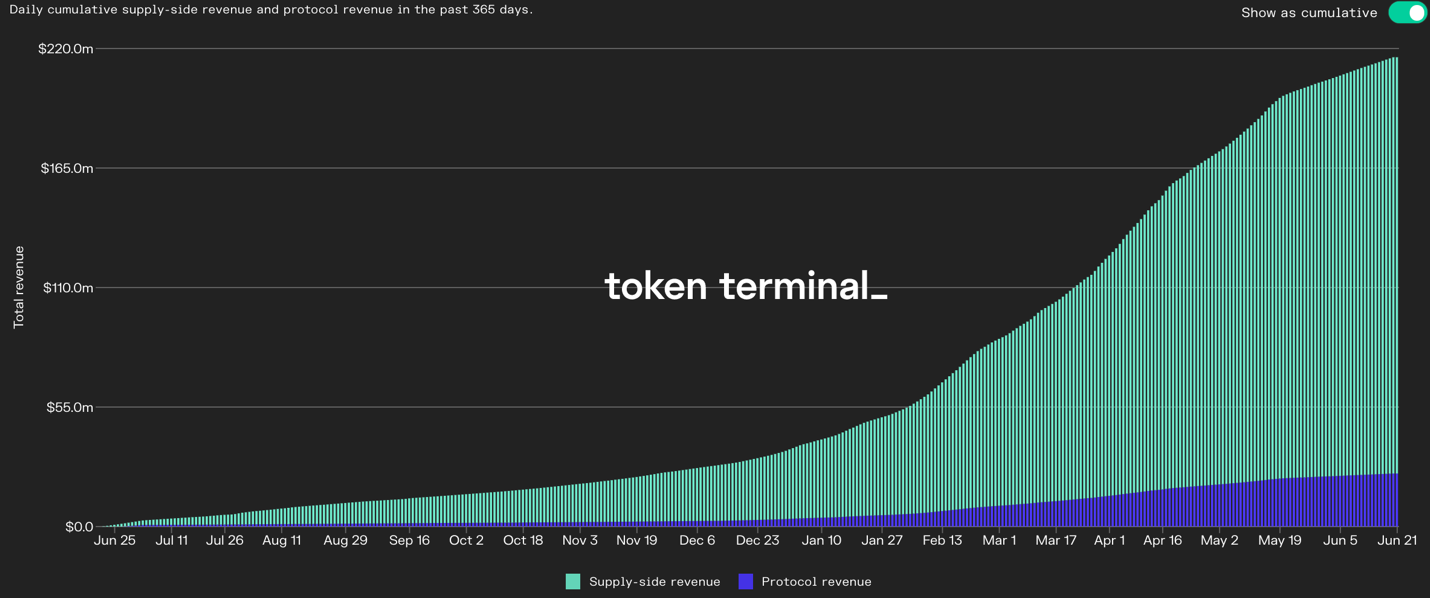

With this model, Compound has been able to generate the third most cumulative revenue of any DeFi project, taking in over $216 million in total revenue over the past year, with $191 million accruing to suppliers (89%), and 24 million (11%) to reserves.

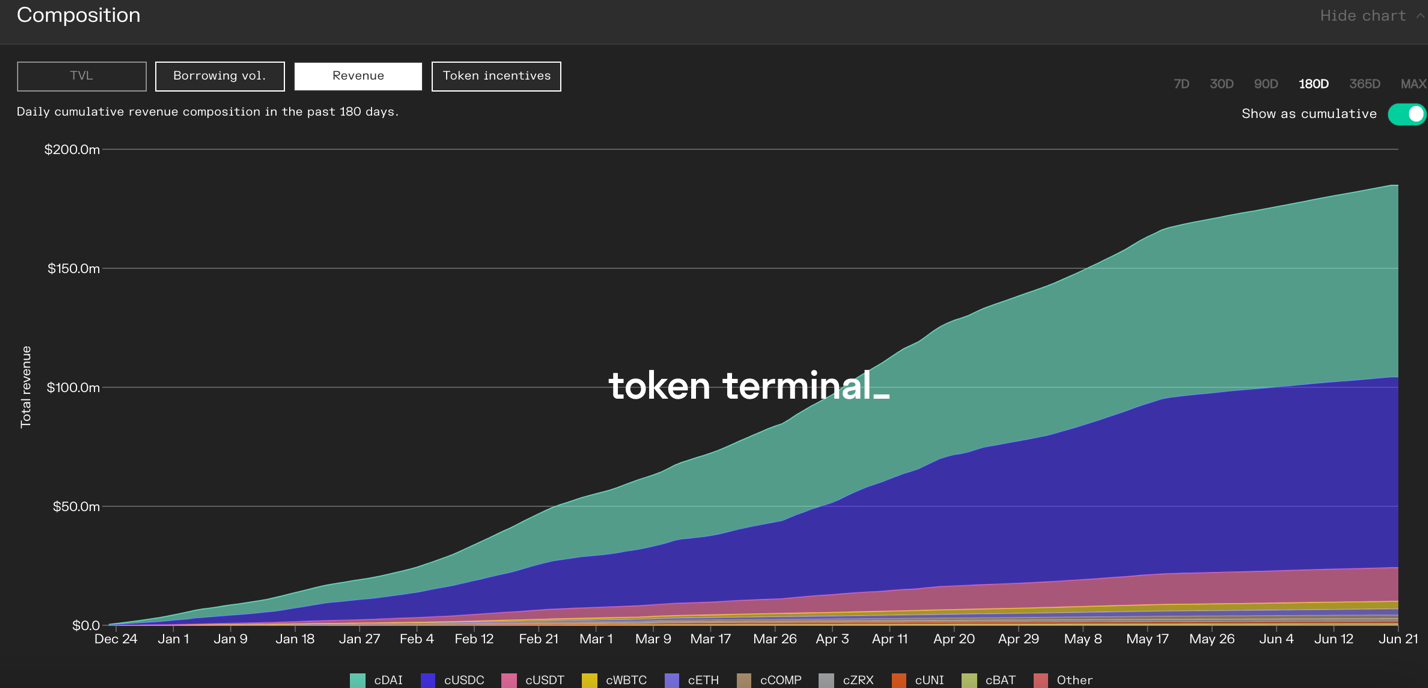

Looking deeper into the composition of total revenue, we can see that the overwhelming majority of it, 80.9%, comes from the big three stablecoins, with DAI, USDC, and USDT each accounting for 37.4%, 37.0%, and 6.5% respectively.

This seems to make sense: Stablecoins are almost always the assets that see the greatest levels of utilization, i.e. borrowing demand, meaning that the interest rates paid on them are the highest. Remember, borrowing an asset on a money market means you are effectively shorting it, and many DeFi users, at least as of now, have been hesitant to take on that risk.

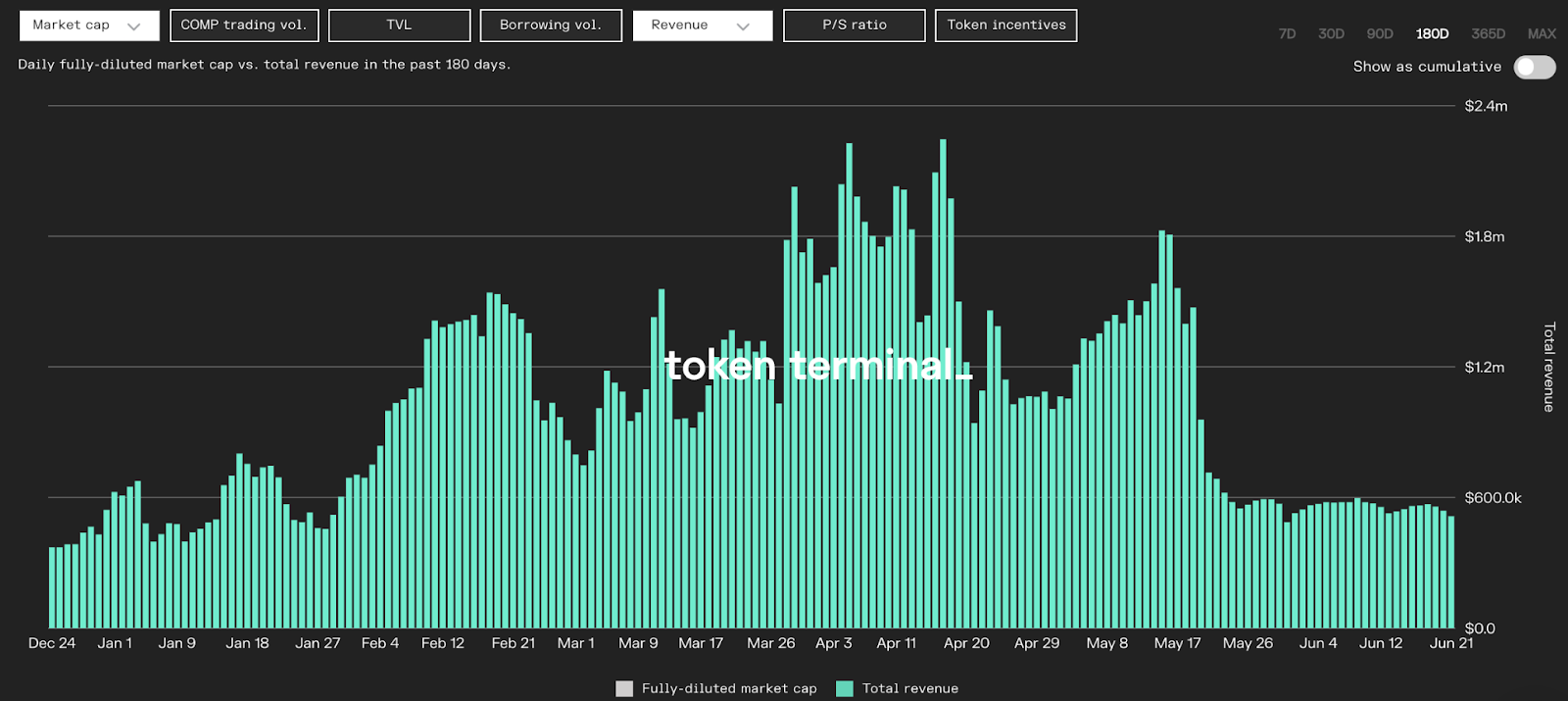

It also underscores the fact that revenue is highly dependent on borrowing demand, which has a strong correlation to the performance of the broader crypto market. In essence: When prices go up, borrowing demand increases, and revenue increases. The converse of this is also true, as when prices go down, borrowing demand decreases, and revenue decreases.

We can see this playing out by looking at daily revenue, which in just over a month has decreased more than 71% from its local peak before the May crash.

That being said, it is important to remember that interest rates are not the only factor at play when it comes to determining the revenue that accrues to Compounds reserves (or potentially the protocol and token holders in the future).

The reserve factor, or take-rate, plays a significant role in determining how much, and the composition of, the revenue accruing to reserves.

For instance, while DAI and USDC have a near-even split of total revenue, due to having a 15% reserve factor, the former accounts for 55% of interest accruing to reserves, while the latter, with a 7% reserve factor, accounts for 26%.

This disparity adds an interesting (pun intended) wrinkle to the dynamics of Compounds revenue, because it illustrates the reserve factor represents a form of pricing power. For example, in a bear market, Compound could raise the reserve factor to help offset the lower levels of revenue due to the decline in interest rates. While it is often posited that DeFi fees are in a race to the bottom, given the limited amount of money market competition due to the high barriers to entry, it stands to reason that Compound would have a better chance of being able to “raise prices” than say a decentralized exchange that faces a litany of challengers.

Conclusion

Compound is a paradoxical project. While liquidity mining has been extremely successful in initially fueling its growth, it has come at the expense of putting downward pressure on the token’s price. Maybe in the long term, this will be good for the distribution of COMP, and therefore decentralization of the protocol, but only time will tell.

Furthermore, this growth has now largely plateaued, as the protocol has ceded considerable market share of late to Aave. In addition, although the protocol itself is decentralized, a small group of participants has had outsized influence over its governance. Finally, while the project has a hugely ambitious plan to scale, the eschewment of generalized scaling solutions has led to missed opportunities for growth.

However, Compound is still a dominant force within DeFi and is positioned for that to remain the case, with a wide moat that stems from its brand, liquidity, integrations and the difficulty of running a money market. Furthermore, the protocol is a cash cow with a trait that all businesses covet: pricing power.

Yes, it’s not perfect. But COMP is certainly worth a conversation.

Action steps

Research the Compound protocol

Dig into the data yourself, check out these COMP resources: