Is Convex the YFI killer?

Dear Bankless Nation,

DeFi is weird.

The open and programmable nature of DeFi protocols allows them to intertwine with each other beyond anything we’ve seen before. It’s confusing sometimes.

One example of this is the current yield war going on between Yearn and Convex. Both protocols are in competition to acquire and lock up as much CRV as possible (Curve’s native governance token).

And it’s resulted in some interesting dynamics.

We like simple answers: are these protocols in competition? Or is this symbiotic?

Turns out the answer is more complicated…

So we had Ben dig into this situation and explain. After writing this piece, he said he thinks the Curve, Yearn, Convex saga may be the highest stakes battle in crypto.

Why?

Over 15% of all value locked in DeFi is within these 3 protocols. And a majority of that relies on Curve’s yield as its foundation.

Could this yield war make CRV one of the most important assets in DeFi??

Only way to find out is to dig into what’s going on underneath the hood.

- RSA

P.S. If the recent Chrome update is messing with your Ledger + Metamask combo, you should try Ledger Live—lets you stake, borrow, lend, and more with security in mind :)

WRITER WEDNESDAY

Bankless Writer: Ben Giove, Bankless Contributor & President of Chapman Crypto

The Yield Saga: Curve, Convex, and Yearn

The competitive landscape of DeFi is in a constant state of flux.

The permissionless and composable nature of money legos has created a never-ending explosion of innovation and excitement that, aside from being impossible to fully keep up with, is becoming increasingly complex.

This is fully on display with the recent race between staple yield protocol Yearn Finance, and newcomer Convex Finance, to lock up Curve’s CRV token, in what has been dubbed as “The Curve Wars,” or “The Lockening.”

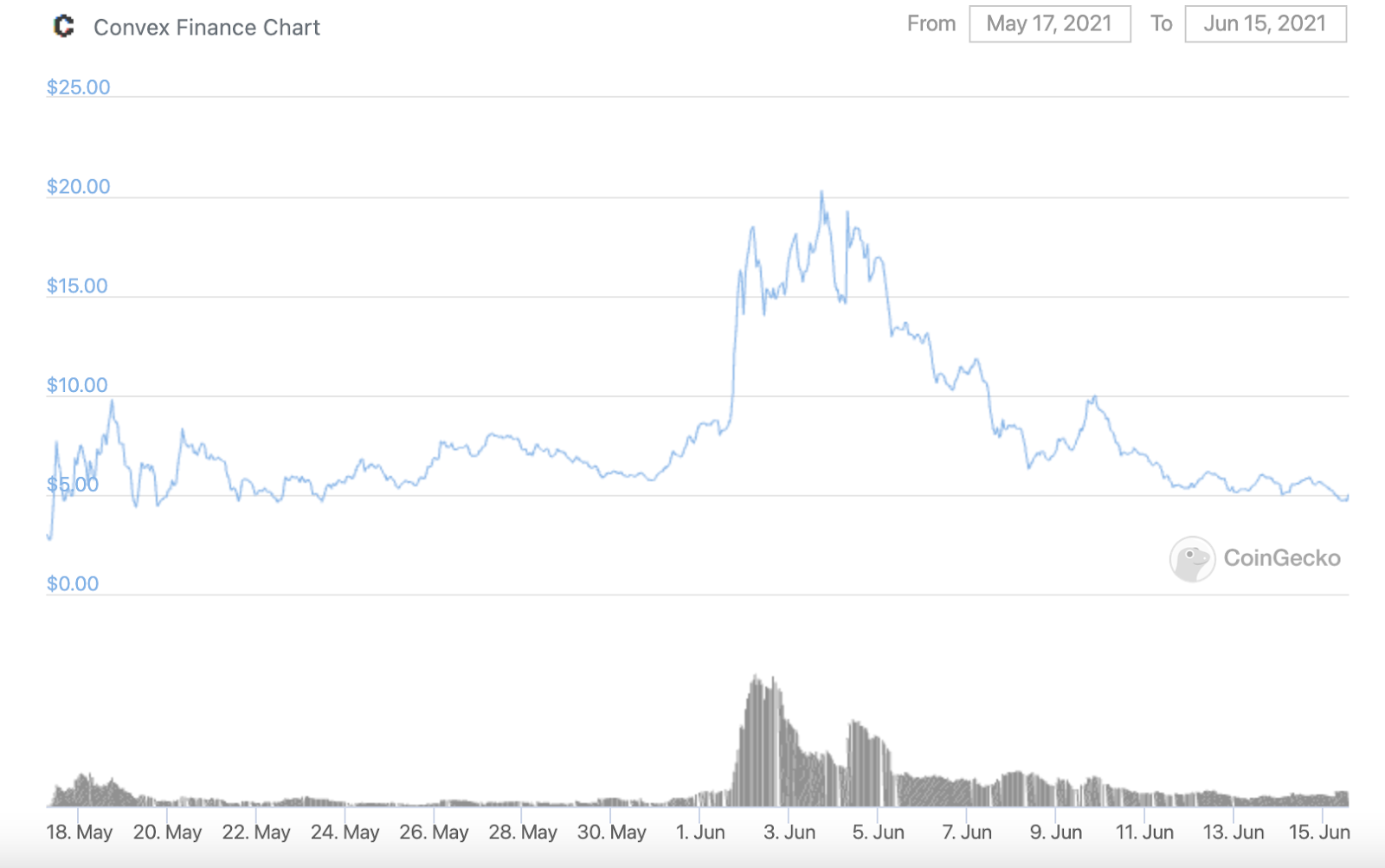

Convex’s meteoric rise, along with a 78% increase in the price of CRV, has sparked discussion as to if it is a “Yearn killer.” However, like with nearly everything in crypto, the answer is not so clear, and uncovering the truth requires some digging.

As such, let’s bust some DeFi myths so we can figure out what exactly is going on between the three protocols.

Curve 101

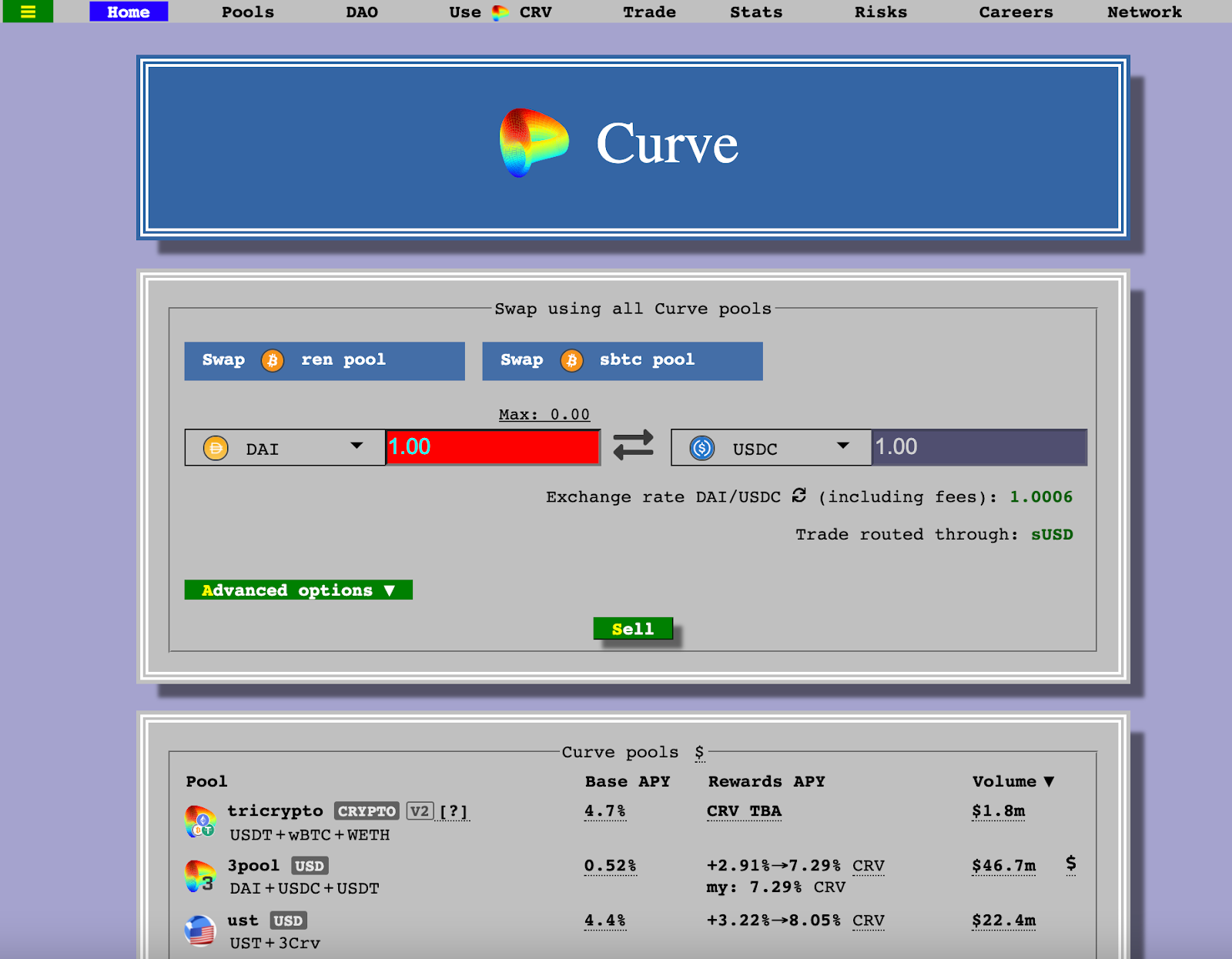

Curve is one of DeFi’s largest decentralized exchanges, with over $10 billion in value locked and facilitating hundreds of millions in daily volume across their Ethereum and Polygon deployments.

While they recently announced Curve V2, which allows for the creation of pools for trading between volatile assets, the protocol initially optimized for low-slippage trading between “like-assets.” These refer to assets that are intended to have the same price, whether it be dollar-pegged stablecoins, or different variants of the same asset such as ETH and stETH.

Curve’s popularity is attributable to several different factors. One is the minimal impermanent loss risk for liquidity providers. While members of the Bankless Nation are likely familiar with the concept, a liquidity provider on an AMM faces impermanent loss when there is volatility between the underlying assets in a pool.

As the tokens in Curve pools are intended to have no or identical movements in price, the risk of impermanent loss is substantially decreased.

🤓 Extra Credit: Need to level up on impermanent loss? Read this.

A second reason as to why Curve has been such an attractive venue for capital are its yields. In addition to receiving 0.02% of every trade, along with some pools accruing lending interest from money markets such as Compound and Aave, LPs can earn yield farming rewards.

Each Curve pool is incentivized with CRV inflation, the protocol's governance token. Due to partnerships with other projects such as Synthetix, Alchemix, and Lido, some pools are even paying out additional rewards on top of fees and CRV in the form of these protocols’ native governance tokens.

Between the reduced risk of impermanent loss and lucrative APYs that exceed 40%, based on current prices, liquidity, and volumes, Curve has become a liquidity hotspot by providing a considerable return for farmers in a risk minimized way relative to other opportunities in DeFi (though the Degens among us may scoff at “just” a mid-double digit yield).

CRV and veCRV

A big reason as to why the yields on Curve are so high is due CRV’s unique token economics.

Although it can be held like any other asset, tokenholders can lock their CRV to access the full benefits of the asset. Locking is the process of staking CRV tokens within Curve for a period of time, between one week to four years, in order to receive vote-escrowed CRV (veCRV).

It should be noted that this process cannot be reversed, meaning that once you convert CRV to veCRV, you will not have access to your underlying tokens until the lockup period ends. In addition, veCRV is non-transferrable.

To incentivize longer lockups, the amount of veCRV you’ll receive is proportional to how long you decide to lock your CRV. For instance, you’ll receive 1 veCRV for every CRV you decide to lock for four years, 0.50 veCRV for every CRV locked for two years, 0.25 veCRV per CRV for one year, and 0.02 veCRV per CRV locked for one month.

Post locking, veCRV holders are then entitled to:

- Governance rights (like deciding on the allocation of CRV inflation between different pools)

- 50% of protocol trading fees (0.02% of every trade for non-volatile pools)

- Boosted CRV rewards

While the first two are relatively straight forward, this final point needs some unpacking. Boosts act as a multiplier on the amount of CRV inflation a liquidity provider can earn. Boosting can be highly lucrative, as it is capable of increasing an LP’s CRV rewards by up to 2.5x.

It’s important to note that boosts are not uniform: They vary for each LP based on the amount of veCRV they hold (more veCRV = a higher boost), and the liquidity in the pool.

🧮 Bonus Tool: To play around with the veCRV boost calculations, check out this resource

This boost forms the crux of the “conflict” between Yearn and Convex: Both protocols are trying to get their hands on as much CRV as possible to lock it for veCRV, so they can earn the largest possible boost, and therefore the highest yield, for their depositors.

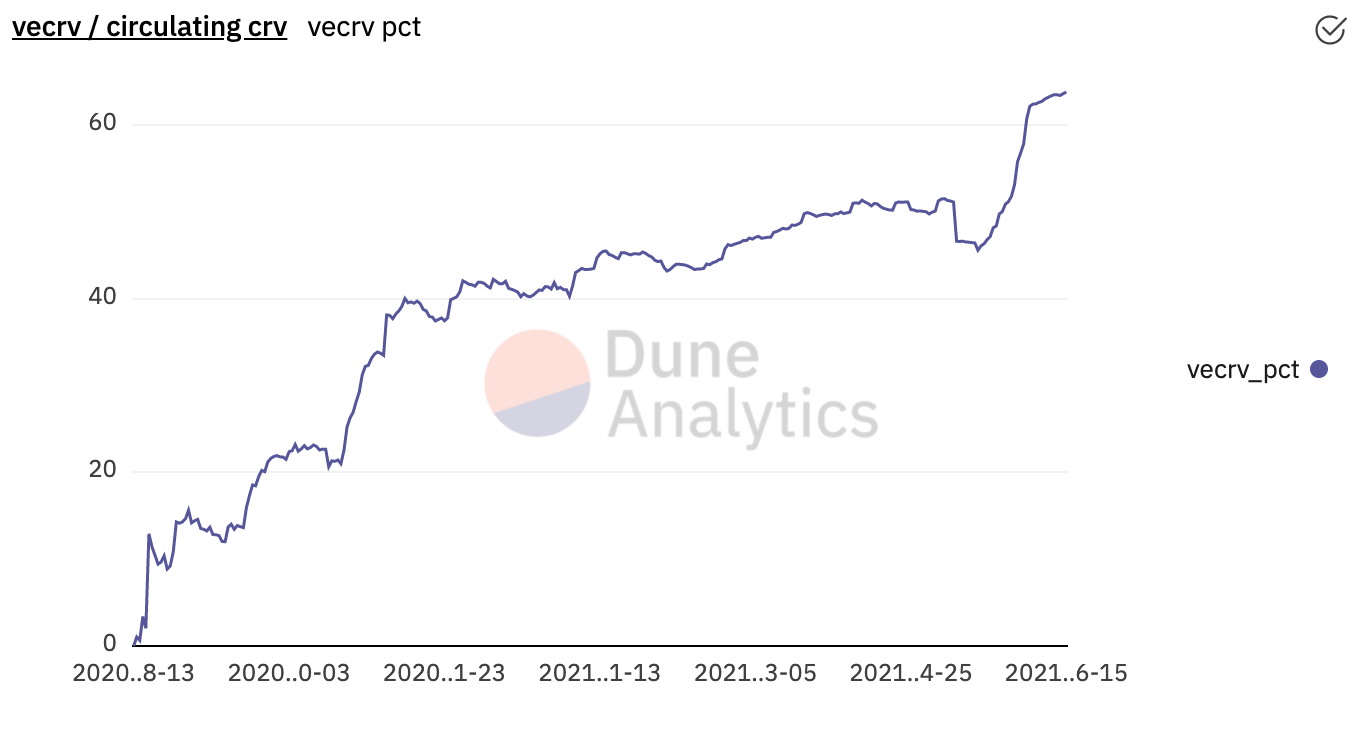

This has been the driving factor behind the sudden dramatic increase in the amount of CRV locked, with now over 63% of the supply taken out of circulation.

Let’s dive under the hood of each protocol to see the mechanics of how they work, how they’re similar, and how they differ.

Yearn and the Backscratcher

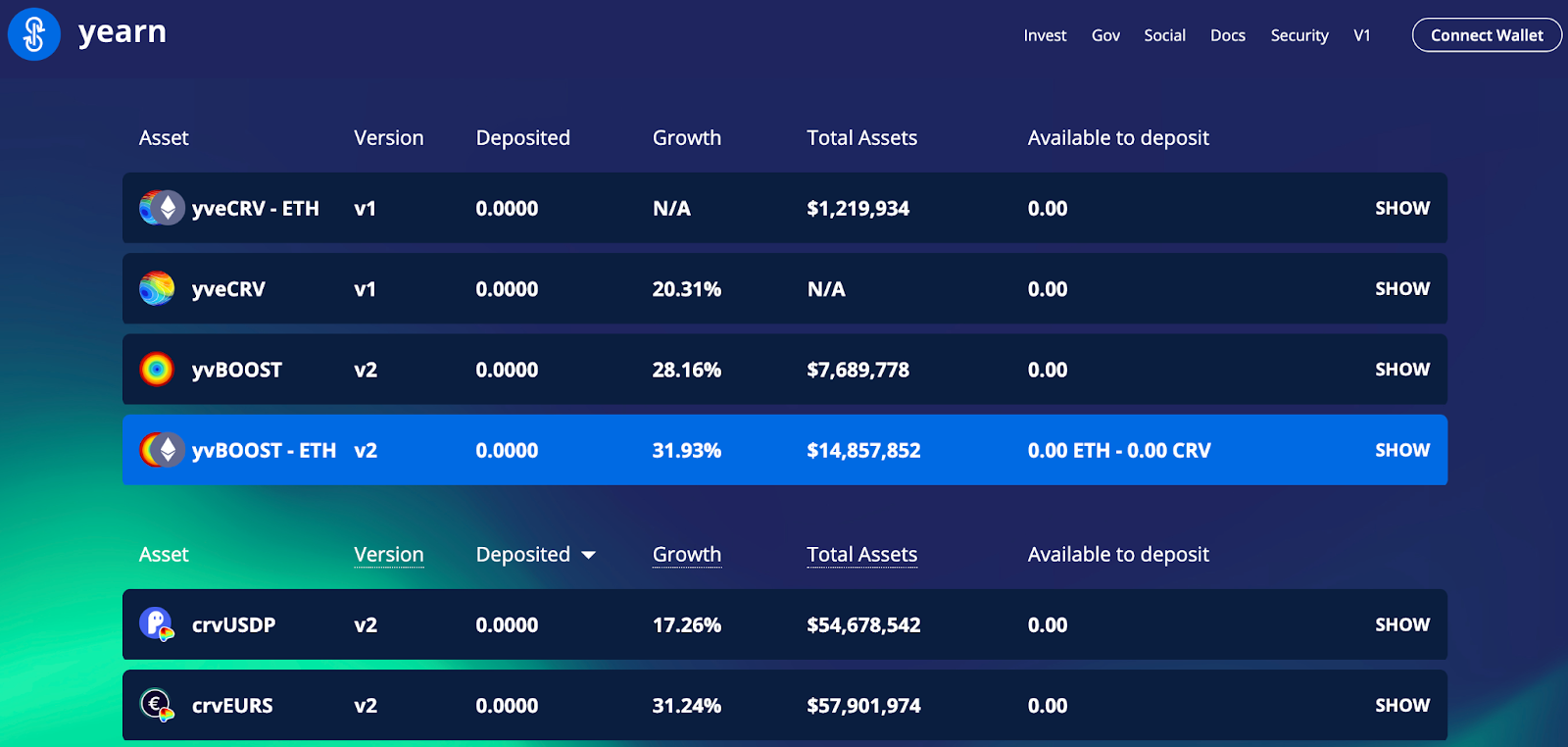

With over $5 billion in TVL, Yearn is DeFi’s largest yield generating protocol. Their vaults, where users can deposit tokens for which Yearn will then develop and deploy different yield optimization strategies, are among the most popular and useful products in the space.

One of the primary sources of Yearns yield comes from Curve, as 41 of the 46 V2 vaults employ some sort of strategy that involves earning CRV through boosted rewards. Remember, boosting requires locking up CRV, meaning that Yearn has to have some sort of way to funnel CRV into the hands of the protocol.

This is where the “backscratcher vault” (yvBoost on Yearn’s interface) comes into play.

With the backscratcher, users can deposit CRV to convert it into yveCRV, which represents a tokenized version of veCRV (this also cannot be undone). Both tokens function identically: yveCRV holders will still earn 50% of Curve trading fees.

However, yveCRV also allows holders to reap the benefits of locking CRV without losing access to its liquidity, as it can be traded on SushiSwap. The backscratcher also automatically compounds returns by reinvesting the trading fees earned from Curve back into the vault through either minting or buying more yveCRV.

✍️ Writer’s note: Yearn also offers a yvBoost-ETH vault which allows users to deposit yveCRV, which is then deposited into the yvBoost-ETH SLP in order to earn both SUSHI and PICKLE rewards…Yes, it can be confusing.

The benefits of the backscratcher are clear: It provides depositors with increased capital efficiency, yields, and liquidity.

Yearn also utilizes the CRV in the backscratcher to boost rewards for depositors in their other vaults. An example of this are the vaults for Curve LP tokens, in which depositors can earn the standard trading fees, along with boosted CRV rewards. This also increases capital efficiency and yields for users in that they can access these rewards without having to own and lock CRV themselves.

Furthermore, 10% of the CRV earned from these vaults is deposited back into the backscratcher and locked to continually maintain and increase boosts.

To summarize:

- Yearn stockpiles CRV through deposits into the backscratcher

- The backscratcher is used to boost CRV rewards for Yearns other vaults

- 10% of the CRV rewards from all vaults are deposited back into the backscratcher

Yearns objective is clear: Accumulate as much CRV as they can to achieve the highest possible boost for all vaults.

Until recently, Yearn faced little competition in their quest to accumulate CRV.

That is, until the emergence of Convex Finance.

Convex 101

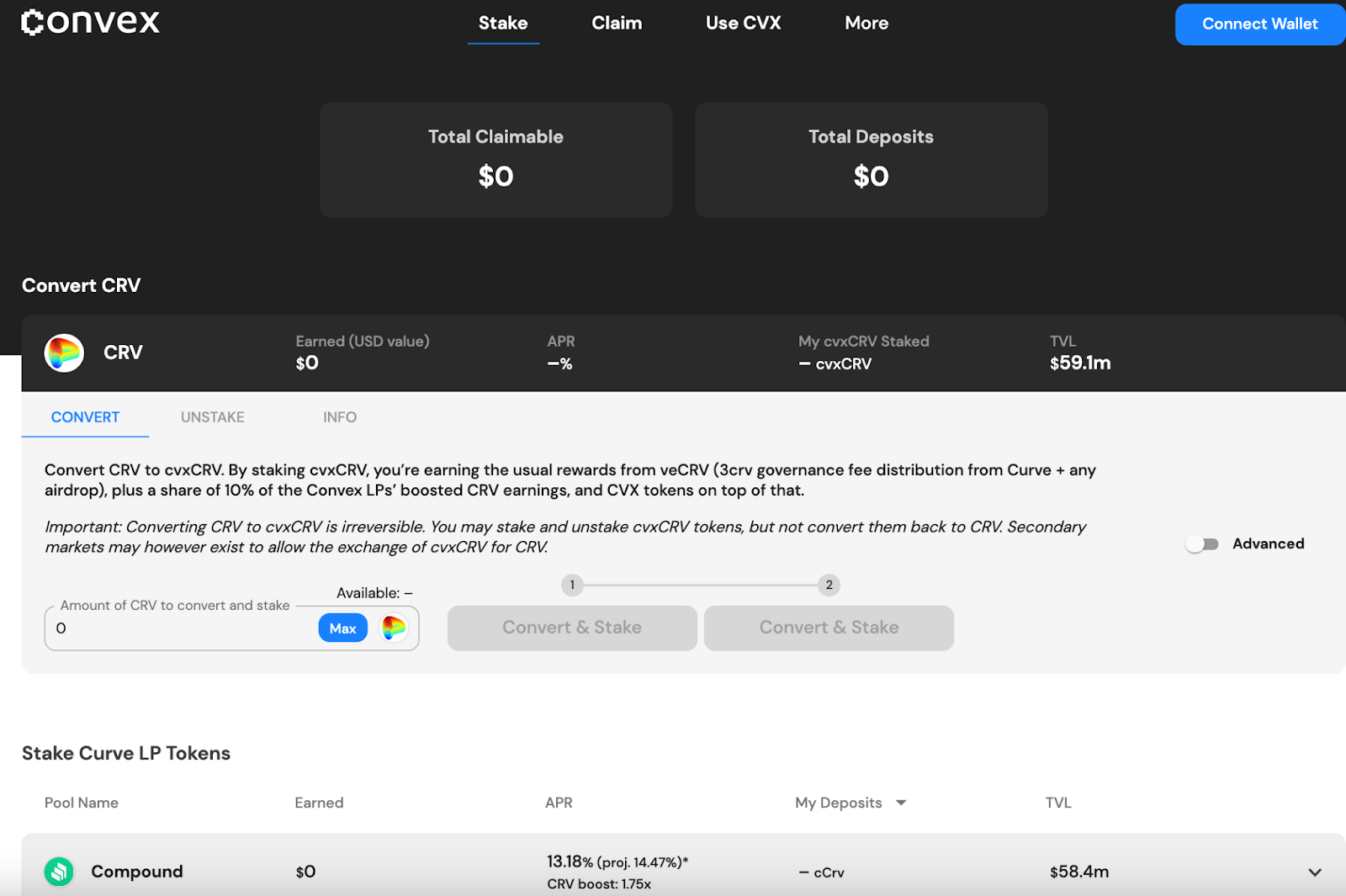

Convex is a protocol designed to help Curve liquidity providers and CRV holders maximize their yields. Despite launching under a month ago, the project has exploded in popularity, already attracting over $3.4 billion in TVL.

Like Yearn, Convex provides the ability for CRV holders to convert their holdings into a tokenized version of veCRV, cvxCRV (again, this cannot be undone).

Users can stake cvxCRV to earn Curve trading fees, boosted CRV rewards, paid out using earnings from LP vaults performance fee (10% of the total CRV earned), along with CVX rewards. CVX can also be staked on the platform, earning users more cvxCRV.

In addition to farming rewards, holders of cvxCRV also can access liquidity, as cvxCRV is tradable on DEXs like SushiSwap.

🚨 Alpha: The SLP’s for cvxCRV/CRV and CVX/ETH can also be staked on Convex to earn more CVX rewards.

As with Yearn, the CRV locked from the cvxCRV vault is used to boost the rewards of the vaults for Curve LPs. In these, users can stake their tokens to earn trading fees, along with CVX rewards, and boosted CRV rewards. Similar to Yearn, this increases capital efficiency and maximizes yield for LPs in that they can earn the boosted rewards without needing to hold and lock CRV.

There are three key differences between Convex and Yearn:

- On Convex, users will have to manually reinvest their rewards back into the different vaults to compound rather than it being done automatically on Yearn

- Convex has a lower fee structure, as they keep 16% of profits in the form of a performance fee, while Yearn charges a 2% management fee along with 20% of profits

- On Convex, users can farm CVX (which can also be reinvested back into the various vaults)

It’s clear why Convex has had such a meteoric rise. Like Yearn, it provides similar increases in capital efficiency, yield, and liquidity for LPs and CRV holders, with the added benefit of additional CVX rewards.

So is Convex really a Yearn Killer?

Now that we understand how these two protocols work, let's try to put all the pieces together.

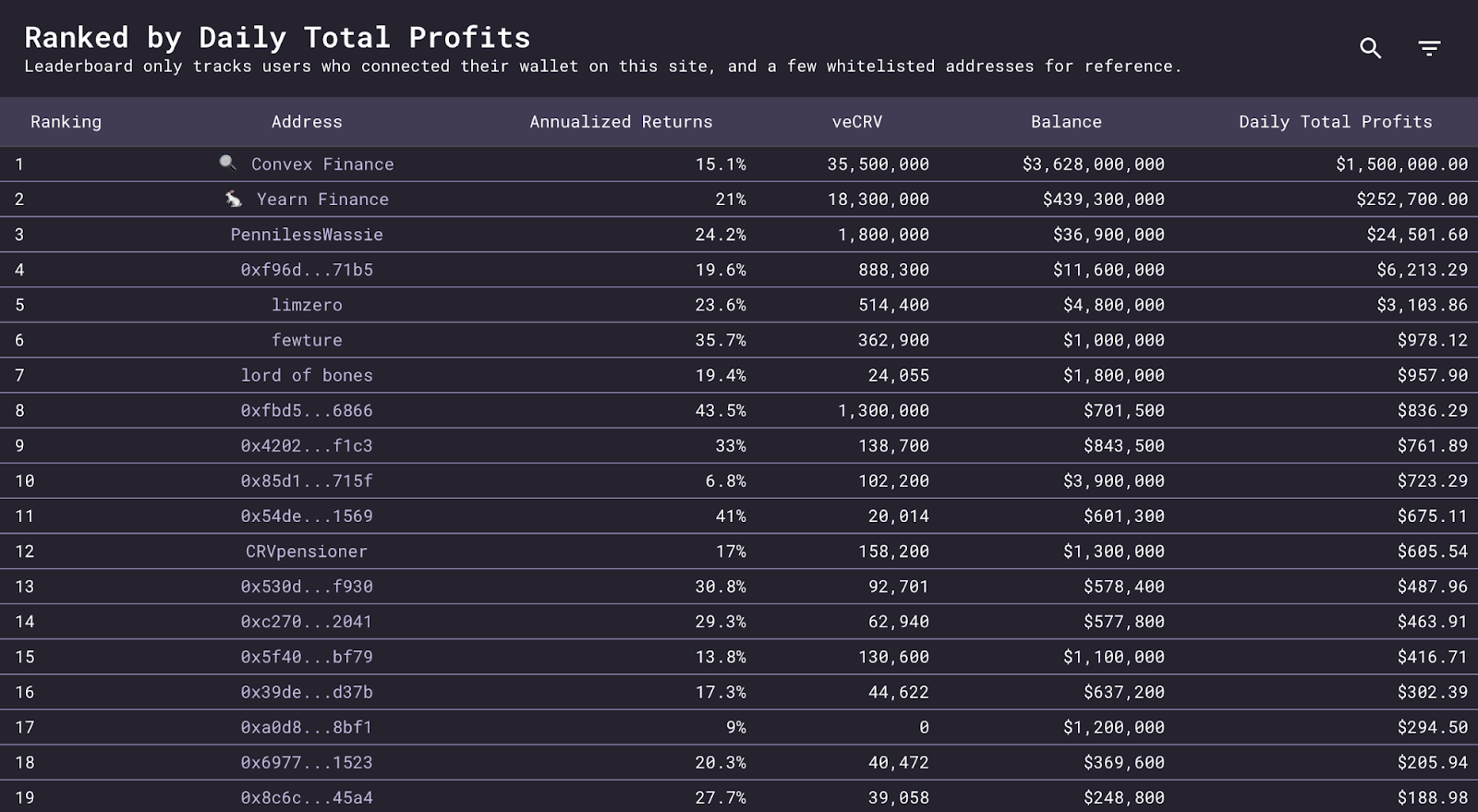

As we discussed earlier, 63% of the circulating CRV supply has been locked for veCRV. Of the 212 million veCRV, the two entities holding the most are Convex with 35.5 million (17.1% of the supply), and Yearn with 18.3 million (8.7% of the supply).

At first glance, it appears that due to their enormous advantage in veCRV, Convex should be earning higher yields and boosts. However, a deeper look reveals that this is not actually the case.

We can see that despite having fewer tokens and earning a lower gross profit, Yearn is the one generating a higher return, with an annualized yield of 21% APY when compared to Convexs 12.7%. This is likely attributable to the dispersion of boosts between the different Curve pools. Remember: The boost amount is dependent on the amount of veCRV held and liquidity in the pool.

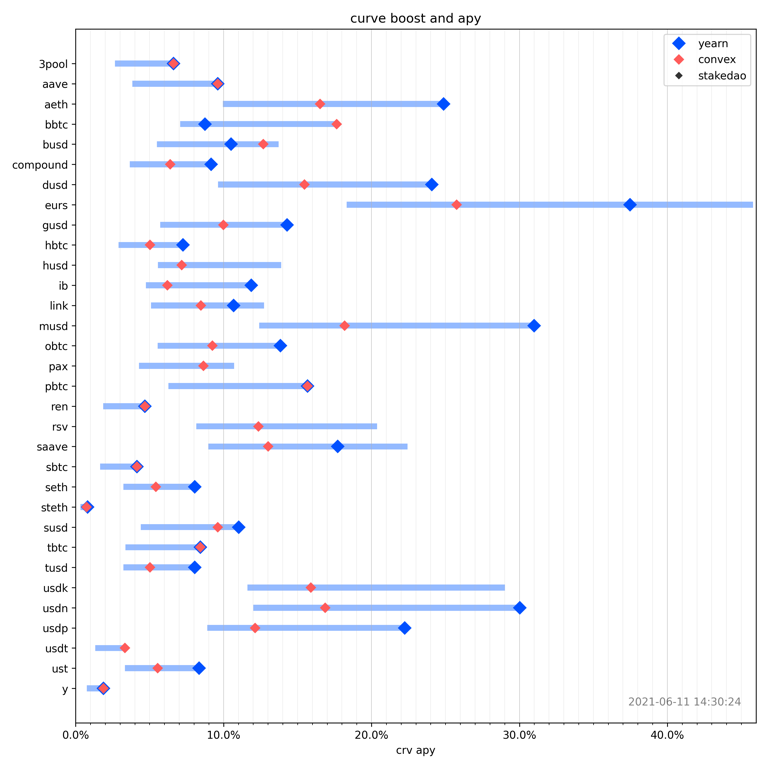

As we can see from the graph above, Yearn has a boost, and thus APY, advantage across a majority of the different pools. This creates an interesting situation in which Convex vaults are earning a higher overall APY due to CVX rewards, while Yearn is providing depositors with a better return on their CRV.

One interesting factor to consider are the two protocols' governance power within Curve.

As we know, veCRV holders can determine the allocation of CRV inflation across the different pools. As Convex now holds the greatest number of votes, they’ll be able to have considerable say in where newly issued CRV is directed. We could see a scenario in which Convex votes to allocate CRV to pools which would maximize their boosts rather than Yearn’s.

An early test of this influence may be occurring as you read this piece, as just yesterday a proposal was put forward by the Curve team to remove CRV rewards from the alUSD pool.

As Alchemix sources its yield from Yearn vaults, which in turn earn some of their yield from harvesting CRV, it will be interesting to see if Yearns considerable stake winds up being the deciding factor in this vote (@banteg from the Yearn team has already indicated they plan to vote no).

It's also not entirely clear if reallocation of CRV inflation would hurt Yearns competitive positioning because any increase in boosting power for Convex vaults also benefits Yearn.

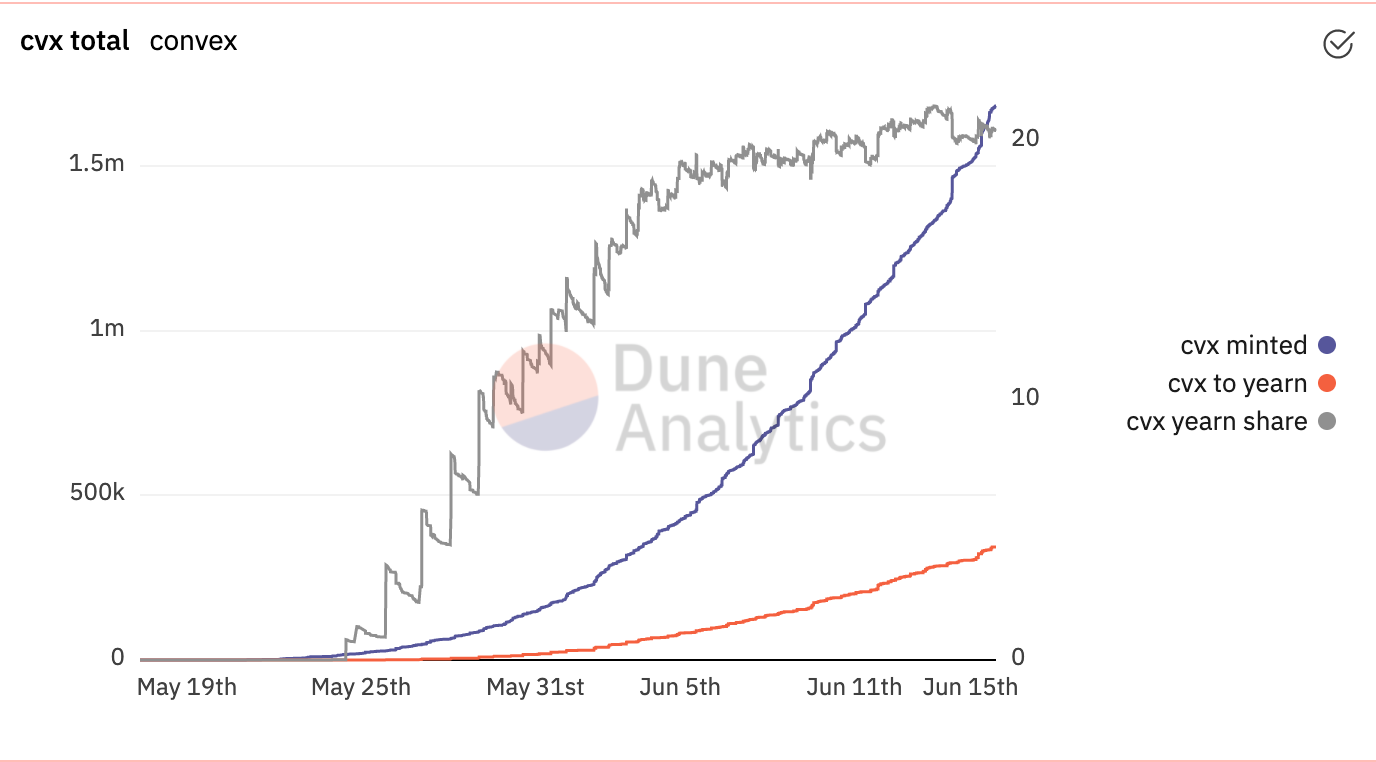

That’s because a considerable portion of Convex’s TVL comes from Yearn itself, as 33 of Yearns Curve LP vaults are utilizing strategies that involve depositing capital into Convex. In fact, Yearn is currently earning over 20% of the total CVX rewards that have been paid out.

There is also a clear connection between the amount of CVX rewards earned by Yearn, and the price of CVX. While this may be related to general market conditions, as Yearn’s share has increased, the price of CVX has decreased. That indicates that Yearn’s massive CVX harvests have been putting considerable downward pressure on the tokens price.

While this decline decreases the yield for CVX rewards, it does not necessarily increase the attractiveness of Yearn vaults. A lower CVX yield means that returns in Yearn vaults will also decrease.

All these factors indicate that the protocols are both complementary and competitive. Yearn benefits from Convex locking CRV because it boosts their yields as depositors, while Yearn locking CRV is beneficial to Convex, as higher Yearn yields can lead to an increase in Yearn deposits, and therefore an increase in Convex TVL.

Conclusion

As with much of DeFi, money legos blur the line between friend and foe. While Convex may have been labeled a Yearn killer, it's clear that each protocol benefits and suffers from “The Lockening.”

Aside from users of both protocols, there is one obvious beneficiary from the whole situation: CRV holders. As more CRV continues to be locked, a potential supply shock is looming as the token becomes more and more scarce.

Action steps

Review the Yearn, Curve, Convex dynamic

Catch up on the recent saga between the communities