UNI the oracle token?

Dear Bankless Nation,

Last month something interesting happened that slipped below the radar.

Vitalik Buterin (just some guy) wrote a proposal to create an off-chain oracle using Uniswap, secured by the UNI token.

Oracles are a crucial piece of infrastructure for crypto. Public chains are insular (they don’t know about real world data) so we need price oracles to feed DeFi off-chain price data—like the ETH/USD price! Since DeFi relies price feeds, it’s important that our oracles are well designed and highly secure.

At first glance Vitalik’s proposal seemed a bit weird…why Uniswap?

Uniswap is a decentralized exchange, not a decentralized oracle provider. Oracles are now a huge market segment that billion dollar projects like Chainlink are working on.

How can UNI get involved..and why?

Could this become another value accrual mechanism for UNI?

We dug in to figure this out.

Governance forums and Githubs…that’s where you find the alpha.

- RSA

P.S. Check our our State of DeFi panel livestream w/ 3 of the smartest brains in crypto.

📺 Tune in for our panel livestream…in less than an hour!

WRITER WEDNESDAY

Guest Writer: Ben Giove, Bankless Contributor & President of Chapman Crypto

UNI As An Oracle Token: Breaking Down Vitalik’s Proposal

There’s never a dull day in DeFi. Due to it’s open-source, permissionless, and agile nature, protocols are constantly iterating, improving, and evolving.

One instance that exemplifies this is a proposal by Vitalik Buterin for Uniswap to create an oracle, using the UNI token to secure it. At first glance, this idea may seem a bit strange, and poses some questions. Uniswap is a decentralized exchange, not an oracle service. Why would they do this? And why would UNI holders want the token to be used in such a way?

Looking past the confusion and peeling back the layers, this idea is deeply interesting.

For one, it’s the first time we know of where Vitalik has waded into protocol governance, or shared his view on how a particular asset should be utilized. In addition, although he does not explicitly mention it, this proposal introduces new value accrual mechanisms for the UNI token that could radically change its value proposition.

Let’s unpack the proposal to see what this would look like in practice, and the implications for Uniswap and UNI.

Oracles 101

Before we dive into Vitalik’s proposal, let’s refresh our memories on what oracles are, and the role they play in DeFi.

Blockchains are insular: They are only aware of events occurring on-chain. Without any type of outside assistance, they cannot access off-chain data. This is where oracles come in, as they provide a means to bridge the gap between the external state of the world, and the on-chain state of Ethereum.

Currently, oracles primarily deliver price data to DeFi apps, so that they can understand the value of the assets deposited inside of them. This information is vital to a protocol’s ability to function properly.

Using Maker as an example, Maker needs to know the value of the underlying collateral that is used to mint Dai, in case the value of the collateral falls below the outstanding value of DAI debt. If this price data is incorrect, corrupted, or manipulated, liquidations will be unable to occur properly, and the protocol will be at risk of becoming insolvent. Because of this, it’s essential that the oracles delivering these price feeds are highly accurate and secure.

While they provide a valuable service, to maintain the level of security and trust that we come to expect when using applications on a decentralized network, it is critically important that these oracles be trustless as well. What good would a decentralized application be if the information needed for it to operate properly was dependent on a centrally controlled entity, or only one source of information? Like with the base layer of a blockchain, to achieve this level of trustlessness, decentralized oracles utilize crypto-economic incentives.

Vitalik’s Proposal: The TLDR

Vitalik is suggesting that Uniswap should create their own decentralized oracle, capable of fetching off-chain data in order to provide an accurate price feed for DeFi protocols.

This would be a different system than the Uniswap time-weighted average price (TWAP) oracles that are present on Uniswap V2 and V3.

While TWAP oracles are difficult to manipulate, their functionality is limited in that they are only capable of communicating on-chain data. Instead, this new oracle would be able to trustlessly communicate both on-chain and off-chain data, utilizing the UNI token as an incentive mechanism to provide security and to coordinate the system.

Utilizing UMA’s DVM

Vitalik is suggesting that Uniswap model their oracle after UMA’s Data Verification Mechanism (DVM).

UMA is a protocol for creating “priceless” synthetic assets and derivatives. Like many DeFi protocols we’re familiar with, a token-creator on UMA will post collateral and use it to mint a synthetic asset. When the value of the collateral goes below a certain threshold, it is eligible to be liquidated.

Where UMA differentiates itself is through the liquidation process. As discussed earlier with Maker, most DeFi protocols will hook up to price feeds to monitor a position's solvency, in order to know when to liquidate it. However, UMA functions differently in that it does not utilize continuous price feeds. Rather, prices are monitored off-chain, and positions can be liquidated by third-party actors at any time. Because it only utilizes price feeds during liquidation, derivatives on UMA are considered “priceless.”

This may bring an obvious question to mind: Couldn’t someone liquidate my position even if it’s still solvent? The answer is yes. However, there are crypto-economic incentives in place to encourage honest behavior. Liquidators are required to post collateral before liquidating a position, a portion of which can be slashed if the liquidation is disputed. This is where UMA’s oracle, the DVM, comes into play. The DVM utilizes UMA tokenholders to settle disputes and make sure the system functions properly.

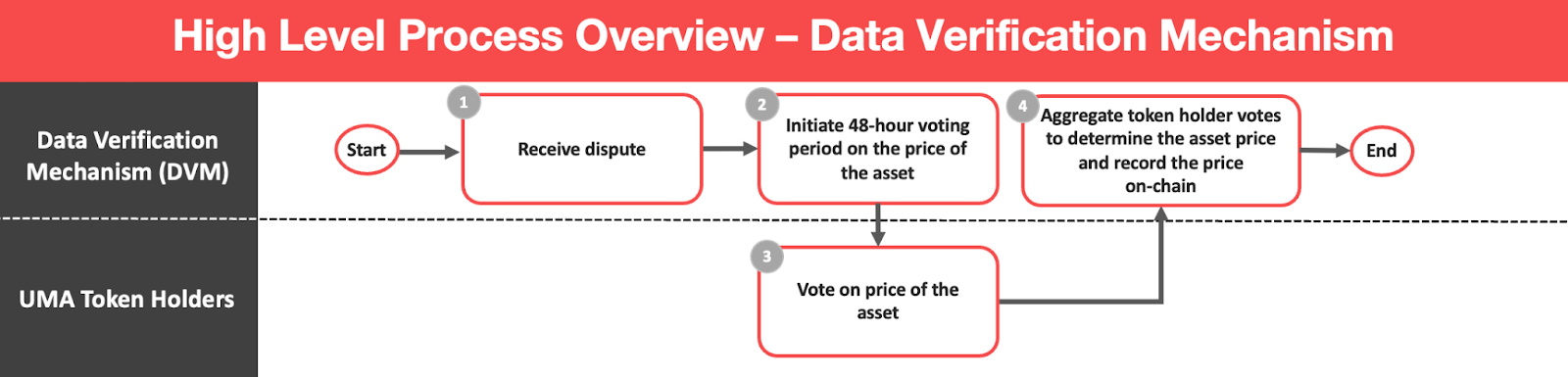

The DVM works as follows:

- A dispute is raised, and a voting request is sent to the DVM (requiring a fee payment)

- UMA token-holders vote on the correct asset price

- The results of the vote are recorded on chain and the dispute is settled (Click here to read more about the dispute resolution process)

Token-holders are incentivized to vote correctly via UMA rewards. In addition, an incorrect or malicious vote could cause reputational damage to UMA, causing a decrease in the value of the token.

With this in mind, we can see that the cost of corrupting the DVM is equal to the value of 51% of UMA tokens active in voting. If a malicious actor were to acquire this amount, they could hijack the DVM and steal the funds under its purview. Because of this, it is critical that the value of these tokens is greater than the value they secure. Were this not the case, it would become profitable to buy up all the UMA tokens and initiate an attack. This creates a clear incentive for the protocol to keep the market cap of UMA as high as possible. To help with this, fees paid to the DVM are used to buyback and burn UMA.

This attack vector is a primary reason as to why Vitalik suggests the Uniswap and the UNI token are a good fit for this type of design. With a FDV of over $24B, Uniswap has plenty of economic bandwidth to leverage for oracle security.

How This Oracle Differs From Chainlink

Chainlink is the most popular decentralized oracle service, as their price feeds help secure tens of billions in value for over 240 DeFi projects such as Aave, Synthetix, SushiSwap, and Curve. This adoption has helped propel the LINK token to a FDV market cap of over $25 billion. While Chainlink has a dominant position in the oracle market, there are certain trust assumptions users of the system take on.

For instance, there is currently no direct mechanism to punish bad actors. While this will change in the future once LINK staking goes live, as of now the system does not require node operators to stake LINK tokens. This means that Chainlink currently relies on security via implicit incentives. These include loss of revenue for node operators via reputational damage, as malicious actors would be less likely to receive future requests for data, as well as a potential decline in the LINK token.

One tradeoff to consider is that there is more latency in the UMA oracle design than with Chainlink. While Chainlink price feeds operate off a “heartbeat” that continuously updates at a given time-interval, the dispute period for the UMA DVM lasts 48 hours. As a result, Chainlink’s design may be suited for a broader set of use cases than UMA’s.

While Chainlink oracles are battle tested, Vitalik argues that Uniswap can fill a niche by serving as an oracle for protocols willing to tolerate increased latency for the tradeoff of having an “automated mechanism” to punish malicious actors. Although the oracles appear to be complimentary, should the Uniswap design gain traction, it poses the question as to whether it could eat into Chainlink’s market share.

How This Helps UNI Accrue Value

Now that we have a greater understanding of what Vitalik is proposing, it begs the question: Why would Uniswap and UNI holders want to do this?

The Uniswap oracle proposal provides clear financial benefits for UNI holders.

As of now, the only rights UNI holders have is that of governance over the protocol. UNI token holders can vote on a pool-by-pool basis to turn on a “fee-switch” that will divert between 10-25% of liquidity providers fees to the protocol. This revenue can then be redirected to UNI holders via traditional means, such as dividends or buybacks and burns. While these mechanisms would turn UNI into a productive asset, they would also reduce revenue for liquidity providers, meaning that these cash flows may come at the cost of hampering the protocol’s growth.

This leaves Uniswap between a rock and a hard place: Continue to remain a non-dividend paying governance token in the eyes of the market, or accrue value to the token while risking competitive positioning.

UNI as an oracle token adds on a novel value-capture mechanism to the asset.

Let’s review how UMA protocol accrues value to its token:

- Participants in the DVM receive inflation rewards

- Fees paid to the DVM are used to buyback and burn UMA

Sounds familiar? That’s because these value accrual mechanisms are identical to those of Ether. After EIP-1559 and the PoS merge, ETH stakers receive inflation rewards, and fees paid to the network are used to buyback and burn ETH.

These mechanisms make Ether a highly productive asset, and these same value capture mechanisms can be used for UNI as well, using Uniswap as a microcosm.

Uniswap already has a 2% perpetual inflation in its token supply, and Uniswap governance can direct this towards rewarding participants in the DVM. In fact, there is a strong incentive for token-holders to do this, as it would create a positive feedback loop for the price of UNI, and therefore the security of the DVM.

Let’s go through it:

- UNI holders, not wanting their share of supply diluted, would be incentivized to participate in DVM voting

- Greater participation would increase the cost of corrupting the DVM, as an attacker would need to acquire more tokens to take control of it

- This enhanced security would lead to greater trust in the DVM, increasing the likelihood it would be utilized

- The greater the adoption of the DVM, the more fees will be paid into it

- The more fees the DVM collects the more UNI is burned, and the more net-buying pressure there is on the token

As we can see, this is a game changer for the value proposition of UNI. The UNI token will go from just a fee-capture capital asset, to an asset that also has a buy-back and burn value capture mechanism, without impacting Uniswaps core competency of being a decentralized exchange.

Is This Feasible?

While Vitalik’s proposal has the potential to radically change both the competitive dynamics of the oracle market and the value proposition of UNI, this can only happen if the proposal makes its way through Uniswap governance.

So far, this has proven easier said than done.

Of the three proposals that have made it to the formal vote, only one, the creation of the Uniswap Grants Program, has received a requisite turnout (40 million UNI voting in favor, or 4% of the total supply) to pass. Despite overwhelming support for the other two proposals, one of which was to reduce that threshold to 3%, neither proposal reached a quorum and thus were unable to pass.

However, in recent days things have begun to change, as engagement in Uniswap governance has exploded. Spurred by a post on the Uniswap governance forum to deploy Uniswap on Arbitrum, since May 26, five “temperature checks” (the first stage in Uniswap governance) have been put to vote in Snapshot. At the time of writing, three have received enough votes to reach the second stage of governance, known as a “consensus check”. This increased activity indicates that should the time come, there may be greater likelihood of Vitalik’s proposal making it through governance than previously thought.

It’s one thing for a proposal to pass, but another for it to be successfully implemented. Even if the oracle is based on an existing design, the creation and implementation of one is a massive undertaking. That said, if any project has the resources to pull it off, it’s Uniswap. The protocol’s treasury is massive, worth over $4 billion dollars at current market prices, giving them ample funding to complete this task.

The exact way in which Uniswap would go about this is interesting to think about as well. Would an additional development team be hired? Might they acquire another project or protocol? Could they even call on the community to develop one via the grants program?

As we say on Bankless: DAOs have money and are in need of labor.

Could somebody provide labor, likely in exchange for a very substantial reward, to Uniswap by creating this oracle?

Conclusion

As we can see, Vitalik’s proposal has widespread implications for the oracle landscape, Uniswap, and the UNI token. Not only would Uniswap create a highly secure and specialized oracle, it has the potential to completely change the value proposition of the UNI token.

Crypto is referred to as programmable money for a reason: There are endless ways in which tokens can be utilized and accrue value. Through the melting pot of meritocracy that we call DAOs and protocol governance, we are beginning to scratch the surface of what is possible.

Action steps

- Read Vitalik’s proposal

- Consider whether or not UNI should become an oracle token (you can weigh in on the forums!)