Institutional Money Managers Are Going Bankless

Gitcoin Grants Matching is live! Give a $1 to help spread the message of self-sovereign money.

Dear Bankless Nation,

Robert Sharratt is an institutional money manager, bankless believer, and the author of this article—he believes institutional money managers will be driven to DeFi as a result of the terrible interest rates in traditional finance.

We recently got introduced to Robert as we learned about the hybrid bank/DeFi startup he co-founded called CrescoFin. It’s a neat concept.

The goal of CrescoFin is to tokenize real world, regulated collateral on Ethereum. Specifically invoices. The cool part—the tokenized invoices are insured and represented on chain by iCRES tokens.

Owners of iCRES tokens get:

- Ownership of the tokenized invoices

- Insurance guarantees to back the value of the invoices

- 3% interest in daily in new iCRES tokens

The 3% interest is the carrot. Assuming CrescoFin pulls it off, iCRES becomes a low-risk, real-world collateralized and fully insured DeFi primitive. A money market money lego. 🔥

Of course there’s some AML/KYC tradeoffs to make this happen, hence our hybrid bank/DeFi description. But there’s also benefit to having a bridge in meatspace. For example…it allows them to list DeFi products on a Bloomberg terminal like this:

We’d say the CrescoFin model is somewhere between Coinbase and a Compound on the DeFi trust spectrum. It’s a bridge from traditional finance to DeFi. David calls it the crypto mullet—traditional finance in the front and DeFi in the back. 😎

We expected companies like this to emerge.

The Protocol Sink Thesis predicted it.

The Bankless Thesis predicted it.

And while there’s much to execute, we liked the CrescoFin vision so much we joined as advisors to see if we can help make it happen.

There’s a new landscape for bridge companies like this! And if they’re successful…it means more money managers are going bankless.

- Ryan & David

Disclosure: Both Ryan and David now hold equity in CrescoFin as part of advisory roles.

P.S. Congrats Bankless Badge #12722! You won the rare DeFi Socks Raffle and have been airdropped the token. Check your ETH address and claim your winnings here.

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

Watch Meet the Nation with the author of this piece, Robert Sharratt!

Learn how CrescoFin is building a traditional bank on top of DeFi

WRITER WEDNESDAY

Guest Writer: Robert Sharratt, Managing Director at CrescoFin

Institutional money managers are going bankless. Here’s why

- Negative interest rates are driving a search for banking alternatives.

- Banks disadvantage money managers just like they do everyone else.

- However, money managers are more motivated than most, as bank costs impact their livelihood.

- Regulated low-risk DeFi opportunities will attract significant institutional money.

- Institutional money managers are powerful allies in the effort to create a bankless future

For context, we are a regulated blockchain-based company in Switzerland that operates in fiat and we are developing a stablecoin offering. Our goal is to replace banking with code.

It is striking how many of our institutional money manager clients have started exploring crypto since last spring. The catalyst seems to have been when Paul Tudor Jones revealed that he had allocated about 2% of his fund to bitcoin.

This interest in crypto isn’t driven by technology. And it isn’t driven by ideology. These money managers are looking to cut out the bank for an existential reason to them: a search for yield—risk-adjusted yield to be more accurate.

Historically, savers have been able to earn a decent return just from having their funds in a bank account or holding government bonds. This changed after the 2008 banking crisis. For the past decade there has been a quiet war on savers.

The advent of negative rates over the past year has caused a crisis amongst institutional money managers. While many people have complaints about their bank, these money managers are on the front line of trying to figure out alternative solutions to bank middlemen: it’s their day job.

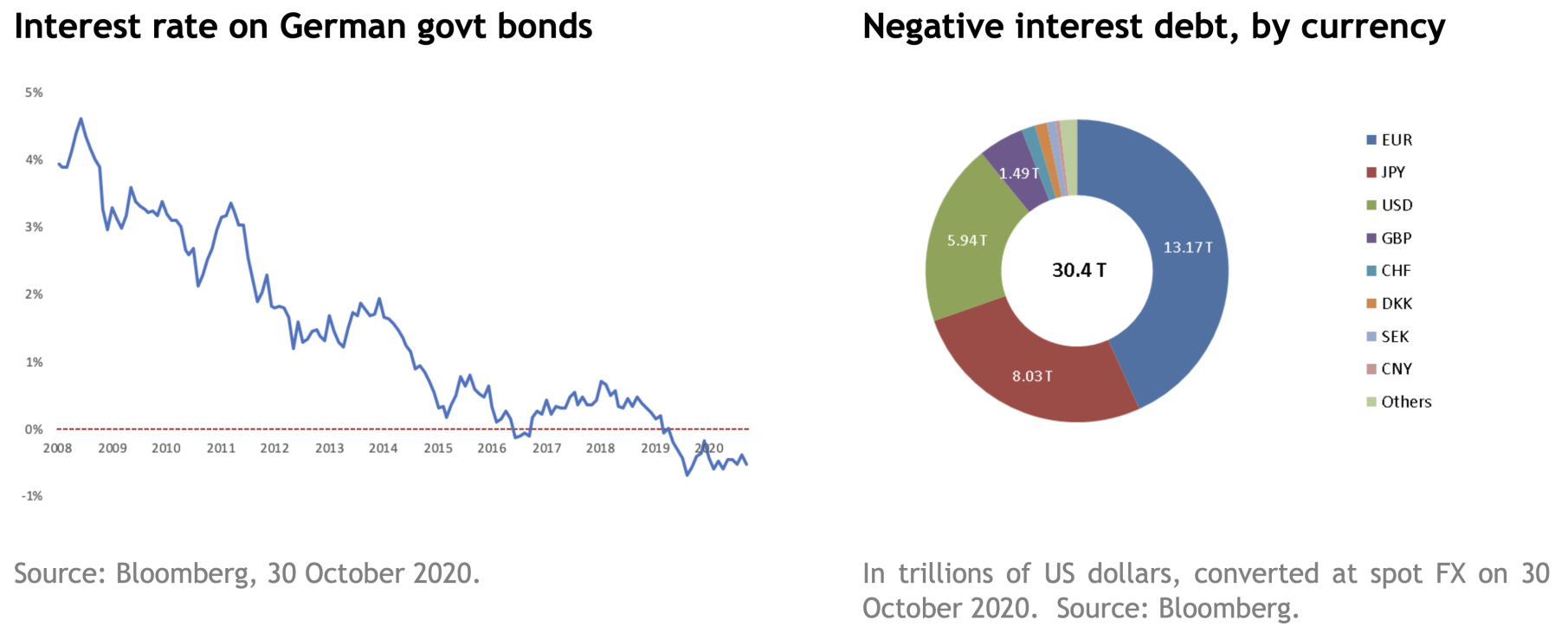

This decline in yields and the size of negative interest debt can be seen in the graphs below.

But these graphs paint too positive of a picture. After adjusting for inflation, returns are actually lower than depicted as more debt should be included when measuring in real terms. In addition to these debt securities, there’s also $60.5 trillion in bank accounts globally where little or no interest is paid.

In the face of negative rates, these money managers have some unappealing options for clients: buy longer duration bonds (and take interest rate movement risk); buy real-estate (which presents liquidity issues); or buy stocks (which are riskier).

In many cases, their livelihoods depend on the risk-adjusted returns they deliver to clients. These options matter to them more than most.

Escaping Negative Rates

As an anecdotal story, when interest rates first went negative in Switzerland, a large regional money manager calculated the cost of paying the 75 bps in annual interest versus storing the cash in a secure location. The secure location option won and senior management approached their bank and asked to withdraw several hundred million Swiss francs. The bank said no.

If you read the fine print on your banking agreement, it isn’t legally your money. It’s the bank’s money. The bank has a debt obligation towards you, whether you are just the little guy or a prestigious Swiss money manager. However, they are not required to satisfy this obligation in cash.

The bank told the money manager that they would transfer the amount to any other bank they wanted—no problem. But the bank would simply not allow them to take it out in cash. Nor would any other bank it turns out. This is just another day in the life of the banking guild.

In some ways it’s kind of nice to know that, sometimes, banks screw everyone equally, regardless of who you are.

The Options For Money Managers

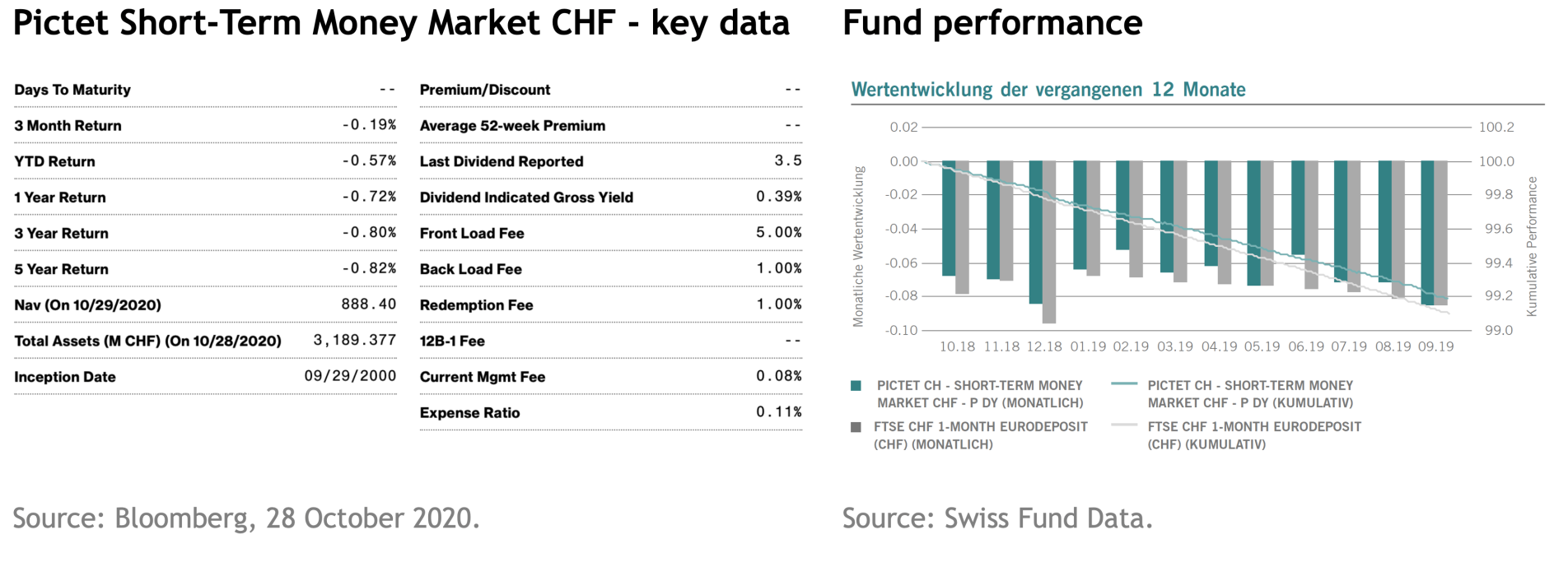

Historically, there are few good options for money managers looking to cut out the banks. An illustrative money market fund example is included below, from a medium-size bank.

The fund has lost money every year for the past three years, even if the fine print warns that the bank is not able to guarantee such performance in the future.

There’s a 5% fee to get into this loss-making fund and 2% to get out, although the annual fee you have to pay to the bank for them to manage the value destruction is quite low. The chart on the right shows performance against the benchmark that the bank has decided to use.

Even if your German isn’t very good, you might be able to tell that all of the columns are less than the money that you initially would put into the fund. The good news is that the fund managers consistently beat the benchmark, so everyone keeps their job.

You might say to yourself: no one is so stupid as to put any money into this, right? Well, actually, the fund has over $3 billion dollars equivalent in it. Almost every bank has their own (siloed) version of this. If you want more of a guaranteed loss, from a higher-rated entity, you could consider a number of sovereign short-term bonds in Europe.

For example, there is more money invested in Italian government bonds maturing in less than three years, all of which pay negative interest rates than the entire market cap of Bitcoin. The negative interest to be paid is backed by the full faith and credit of the Republic of Italy.

You can see that this interest rate environment, together with the almost complete lack of alternatives, has driven traditional money managers to consider a bankless future. They are motivated by their own survival.

In finance, pricing and trends are often set by the lead steers in a herd. Then, the rest follow. In the spring a few lead steers emerged. These include Michael Saylor, Square and PayPal. For money managers, no one had as much influence as Paul Tudor Jones.

Our conversations with potential clients over the past four months went from explaining blockchain and fighting the popular misconception that crypto is used by criminals, to discussing how DeFi could work for them.

In the end, the users often don’t care much about the tech. They care about the benefits. In finance, most things are measured in risk and return. These past months feel like a genuine breakthrough, a movement from “if” to “how” do I take advantage of this new world.

As a tangible example, we have had in-depth discussions with some clients about plans to create a money market on Aave for an insured savings product. This is similar to what we offer in the traditional space, but it provides greater liquidity, the potential to boost returns through staking, and a gateway to other DeFi products.

To be sure, there are some important considerations for money managers before they move into DeFi. Some of them are:

- A requirement that products be regulated.

- A risk management evaluation of protocol security.

- Legal protections.

This doesn’t exactly fit with the open, permissionless spirit of DeFi.

There are some potential solutions, including that some products are permissioned (via common-sense KYC) but not arbitrary. An interesting possibility is that KYC may only have to be undertaken once, and then compliant addresses can use any money lego that requires regulated access.

Since the spring, the psychological borders between traditional finance and DeFi seem to be coming down, at least for some money managers. These people see that if you cut out the bank, the risk-return opportunities offered in DeFi are simply superior to what traditional finance can offer, in addition to the convenience benefits.

In our view, the DeFi revolution is more likely to come from savers than anywhere else.

Just based on the trend over the past few months, expect adoption by institutional money managers looking for yield to lead to an increasingly bankless future.

They have to catch on eventually or they’ll die trying to live in a world of negative rates.

Action steps

- Consider how negative rates affect institutional money managers!

- Learn how CrescoFin is merging DeFi with traditional finance with iCRES

Author Bio

Robert Sharratt is the Managing Director at CrescoFin, a regulated institution in Switzerland offering insured, interest-bearing deposit accounts on-chain. Robert worked for a global bank in Russia and China doing emerging markets investment banking and then for a Wall St investment bank doing mergers & acquisitions.

He’s the author of 1%, the book that the financial establishment doesn’t want you to read. He lives in Geneva, Switzerland where his interests include mountain climbing, playing the piano, and distrusting authority. He is going to replace banking with code or die trying!

Join the Chess for Public Goods Chess Tournament!♟️

To celebrate the Public Goods of the world, Bankless is hosting a chess tournament with Gitcoin, to kick off Gitcoin Round 8.

$50 entrance fee for 90 minutes of chess, and all funds go to the Gitcoin matching pool for round 8! This is a great chance to play chess with fellow members of the Bankless Nation, and contribute to public goods funding at the same time. Sign up!

Subscribe to Bankless. $12 per mo. Includes archive access, Inner Circle & Badge.

🙏Thanks to our sponsor

Aave

Aave is an open source and non-custodial protocol for money market creation. Originally launched with the Aave Market, it now supports Uniswap and TokenSet markets and enables users and developers to earn interest and leverage their assets. Aave also pioneered Flash Loans, an innovative DeFi building block for developers to build self-liquidations, collateral swaps, and more. Check it out here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.