Institutional Investors ❤️ DeFi

Dear Bankless Nation,

Institutions are finally coming around to crypto.

They’re starting to understand BTC as a digital gold. They’re just starting to understand ETH and Ethereum. It’s taking so long because they have a hard time valuing neo-monetary assets like BTC and ETH.

There’s no recent comparisons. Like when’s the last time we saw a global, decentralized, digital currency emerge as a world reserve asset?

Traditional investors are used to analyzing capital assets like stocks and real estate—they focus more on revenues, cash flows, and user growth. And this is exactly what makes DeFi easier for them to understand!

They’ve already lived through part one of Marc Andreessen’s Software Eats the World. They’ve seen software eat entire industries—music, media, and shopping.

And guess what?

DeFi is software that automates the finance industry. It makes financial services and assets available to everyone in the world.

No banks. No paper.

Software eating banks.

This is why institutional investors ❤️ DeFi written by a guy who has a front-row seat.

- RSA

P.S. Consensus 2021 starts next week! Listen to David talk ultra sound money. You can register here for $20 off your ticket. Heard they’re giving out $DESK to all attendees too 👀

THOUGHT THURSDAY

Guest Writer: Matt Hougan, CIO at Bitwise

Why Professional Investors Will Adopt DeFi Faster Than They Did Bitcoin

Professional investors “get” DeFi much faster than they get Bitcoin (or Ethereum for that matter).

That’s not conjecture; it’s fact.

As the CIO of Bitwise Asset Management, I’ve had a front-row seat to a test case of that hypothesis.

Bitwise is one of the largest and fastest-growing crypto asset managers in the world, with $1.5 billion in assets under management [1] . We primarily serve professional investors, including financial advisors, family offices, and institutions.

We’re most known for having created the first and running the world’s largest crypto index fund, the Bitwise 10 Crypto Index Fund. The Bitwise 10 holds the 10 largest crypto assets weighted by market capitalization. For investors, it’s is an easy way to gain exposure assets like bitcoin, ethereum, and chainlink in a simple fund package.

We launched the Bitwise 10 in November 2017. Today, the fund has around $1 billion in assets. That growth, however, took time: The fund didn’t cross $100 million until after October 2020, nearly three years after launch.

By contrast, this February, we launched the world’s first DeFi index fund (we like being first). The Bitwise DeFi Crypto Index Fund holds the ten largest DeFi asset—Uniswap, Aave, Compound, Maker, Synthetix, and so on—weighted by market cap. It is designed to make it easy for investors to make a bet on DeFi’s growth, without trying to pick and choose winners.

Unlike its large-cap peer that took years, our DeFi fund hit $100 million in under three months.

Part of the DeFi fund’s rapid growth was due to market conditions, and part was better execution by the team at Bitwise. But the other is that DeFi is simply easier for traditional investors to understand than bitcoin or ethereum.

This Time Is (Not) Different

One of the first things you learn when you get a job in traditional finance is that the four most expensive words in the English language are “this time is different.”

Investing history is riddled with the carcasses of overhyped paradigm shifts that never panned out. The scars of the Internet Bubble, the Housing Bubble and a dozen other speculative manias are etched into the memories of many on Wall Street. While a minority of investors keep their eyes open to new ideas, most run skittering away.

Bitcoin is decidedly “new.” No one looks at bitcoin and says: Remember the last time a new global currency emerged with no sovereign support and became a roughly trillion-dollar asset? [2]

DeFi, however, seems familiar.

Over the course of the last forty years, traditional investors have watched software and technology disrupt industry after industry. Manufacturing, media, telecommunications, retail… it’s been a relentless, slow-moving wave of disruption that’s gobbled everything in its path.

As Mark Andreesen puts it, software is eating the world. [3]

So when you tell investors that decentralized finance involves using software and automation to disrupt the financial industry, their eyes light up. They’ve seen this movie before. They know how it ends. And they like the ending. A lot.

Examples Are Powerful: Uniswap and Aave

The thing that really crystallizes the excitement around DeFi for traditional investors, however, is real-world examples like Uniswap and Aave.

When you first describe DeFi to someone who is not crypto native, it can feel like a message from the future: A cool idea in concept, but one whose practical application is a long way off.

Examples like Uniswap and Aave show that DeFi is here today.

For instance, while it’s an oversimplification, it’s easy to introduce Uniswap as a decentralized competitor to Coinbase. Traditional investors know Coinbase, which recently went public with a $60 billion valuation, making it the largest publicly traded crypto company in the world. It’s a phenomenal business, with a fast-growing user base and enormous revenue growth.

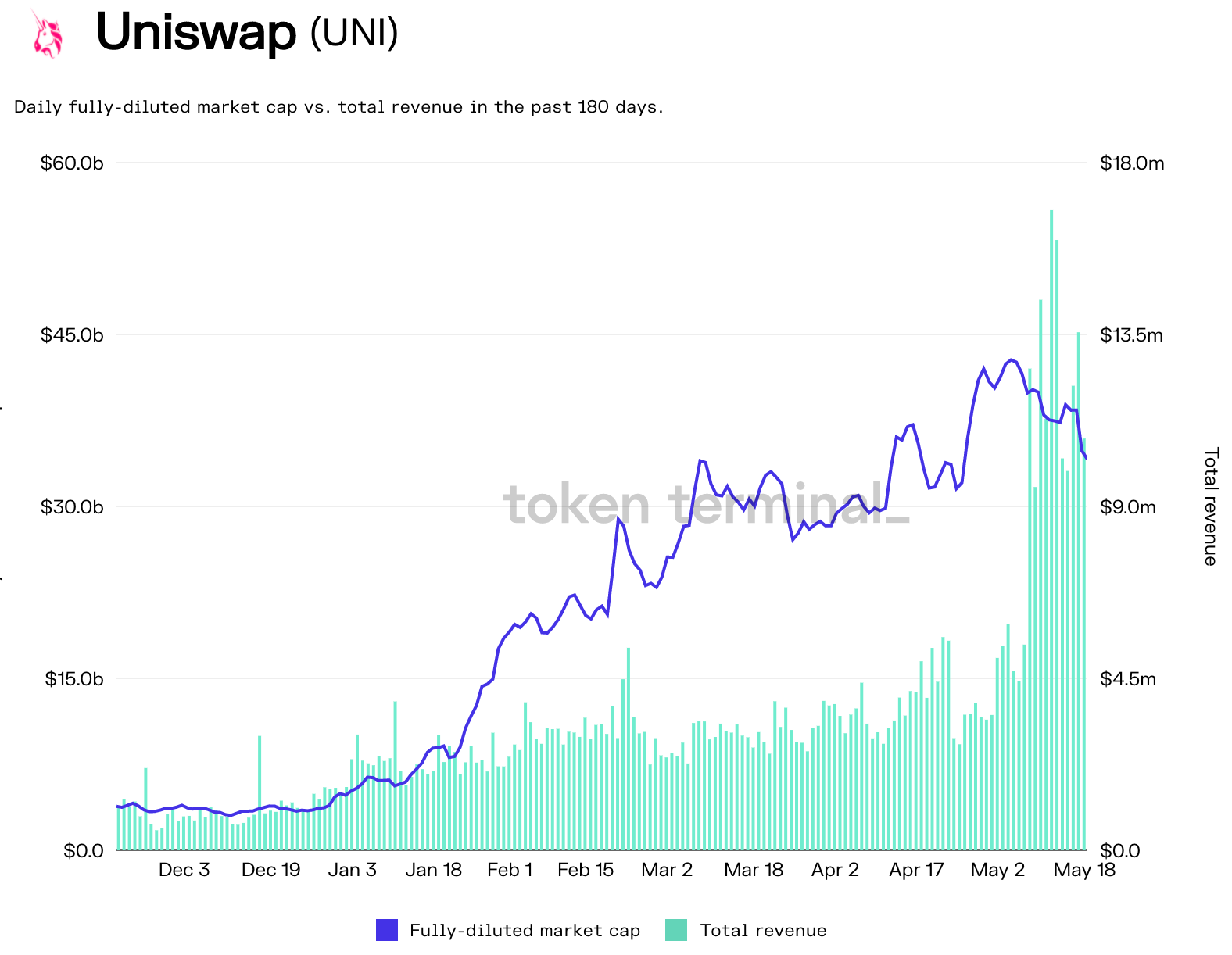

But Uniswap is growing faster. From a starting point of zero a few years ago, Uniswap did $50 billion in turnover last month while generating over $250 million in fees. [4] That’s incredible.

Similarly, Aave is a relatively new lending protocol, a decentralized competitor to BlockFi. The last time I checked, on May 16th, it had more than $8 billion in loans outstanding and was generating more than $1 million in revenue per day. [5]

These are numbers that traditional investors can get their heads around. They are the vernacular of Wall Street: revenue growth, user growth, and so on. You can even apply traditional valuation techniques like price-to-sales multiples, whereas valuing bitcoin is extraordinarily difficult. [6]

Educational Edge: The Most Precious Commodity

In traditional investing, edge refers to knowing something that other people do not know. It’s the Holy Grail: A mythical thing that most investors chase after but many never see.

One of the reasons I love talking to traditional investors about DeFi is that it’s a rare opportunity to, just maybe, given them a possible edge. Because while many investors get excited about DeFi once they hear about it, almost no one has heard of it yet. The mainstream media and much of Wall Street has so far turned a blind eye.

Imagine for a moment that Uniswap was not a decentralized crypto protocol but a well-funded, traditional Silicon Valley start-up. Investors would be falling over themselves to sing its praises.

Look at that business! It was nothing two years ago and now it’s generating $250 million in revenues per month!

The founders would be on the cover of Forbes, posed on a rocky promontory wearing Patagonia vests and staring out towards the ocean under some breathless headline: The Fastest Growing Startup of All Time.

But because it’s a crypto asset with a pink unicorn logo and an improbable back story, it’s overlooked. To this day, the word Uniswap has never appeared in The Wall Street Journal.

The way forward for DeFi is going to be extremely volatile. This is a very early market that faces a huge array of challenges, from regulatory risks to procyclical leverage to security concerns and more.

But the long-term outlook is exciting, and the story is compelling, and I believe institutional investors may be entering the market in size sooner than many people think. [7]

📺 Want to hear more on this?

Watch our March episode w/ Matt on DeFi for Financial Advisors. Awesome convo.

Footnotes

- CNBC. “Some well-known PayPal veterans just invested in the world’s first crypto index fund,” December 12, 2017.

- Source: CoinMarketcap.com. Data as of May 16, 2021

- Source: A16z.” Why Software Is Eating the World.” Marc Andreesen.

- Source: The Block and Token Terminal. Data as of May 16, 2021.

- Source: Token Terminal. Data as of May 16, 2021.

- Critics would point out that Uniswap token holders do not currently accrue any of the revenues generated by the protocol. This is not an issue: Expectations are that token holders will arrogate a portion of the fees in the near future. Traditional investors have seen pre-revenue companies like Facebook before, and understand that user growth is the key metric to observe.

- Investments in crypto assets are inherently risky and include the possible loss of principal. Nothing in this article is or should be construed as a recommendation to buy or sell any securities. Past performance is not an indicator of future performance.

Action steps

Explore the state of DeFi tokens on Token Terminal

Read up on our previous token analyses:

Author Bio

Matt Hougan is the chief investment officer of Bitwise Asset Management, one of the largest and fastest-growing crypto asset managers in the world. Prior to joining Bitwise in 2018, Matt had a decade-long career in the exchange-traded fund (ETF) industry, where he was the CEO of ETF.com and Inside ETFs.