How to use perpetuals for non-speculators

Dear Bankless Nation,

Perpetual swaps are normally a tool for speculators. They’re a way to get leveraged and bet on future price of an asset. (We covered them here, here and here.)

Mark Yusko said it well in our recent chat…there’s nothing wrong with speculating—as long as you recognize what you’re doing is effectively gambling.

But are there ways to perpetuals in non-speculative ways?

Yes!

For instance—perpetuals can be a great tool to hedge yields against impermanent loss! They also a provide a way to escape staking lock-up periods (e.g. lock-ups in Aave).

I think it’s time we learn how to use perpetuals for non-speculators.

- RSA

P.S. Earn in Kyber. So Kyber just launched its Dynamic Market Maker (DMM) and you should try it out. Higher earnings for liquidity providers! Alpha Leak: KNC rewards coming soon! 👀

Writer Wednesday

How to use perpetuals for non-speculators

Guest Writer: Weiting Chen, Growth Manager at Perpetual Protocol

If this is the first time you’ve ever heard of the perpetual contract, you should check this issue of Bankless before diving into this issue. It’ll provide the much needed background!

People trade perpetual contracts most of the time because it’s an easy way to access leverage where you use stablecoins as the collateral to open a leveraged position. If the price goes in the direction you expected, you receive more stablecoins back; otherwise, you receive less. Simple and easy. But it’s for speculative purposes. No one knows if the price is going to go up or down in the short term, so you’re virtually gambling (which is fine as long as you recognize it!).

However, you can also use perpetual contracts for non-speculative purposes. In this article, we’ll show you how to use said derivative to secure your gains and hedge yield farming risks.

⚠️ Disclaimer: Leveraged trading is risky and not recommended for beginner traders. Please rationally judge your investment ability and make decisions prudently once you’re well informed about how perpetual contracts work. Perpetual markets are not currently available to U.S. users.

Strategy 1: Escape Staking Lock-up Periods

Before diving into this strategy, we must first understand what staking is.

In the crypto space, if a token is stakeable, it means that the token holders can voluntarily lock up, or “stake,” their tokens into the protocol’s smart contracts for a particular duration. In return, they will receive some benefits from the protocol, such as revenue sharing, governance rights, or staking rewards (usually in the protocol’s token).

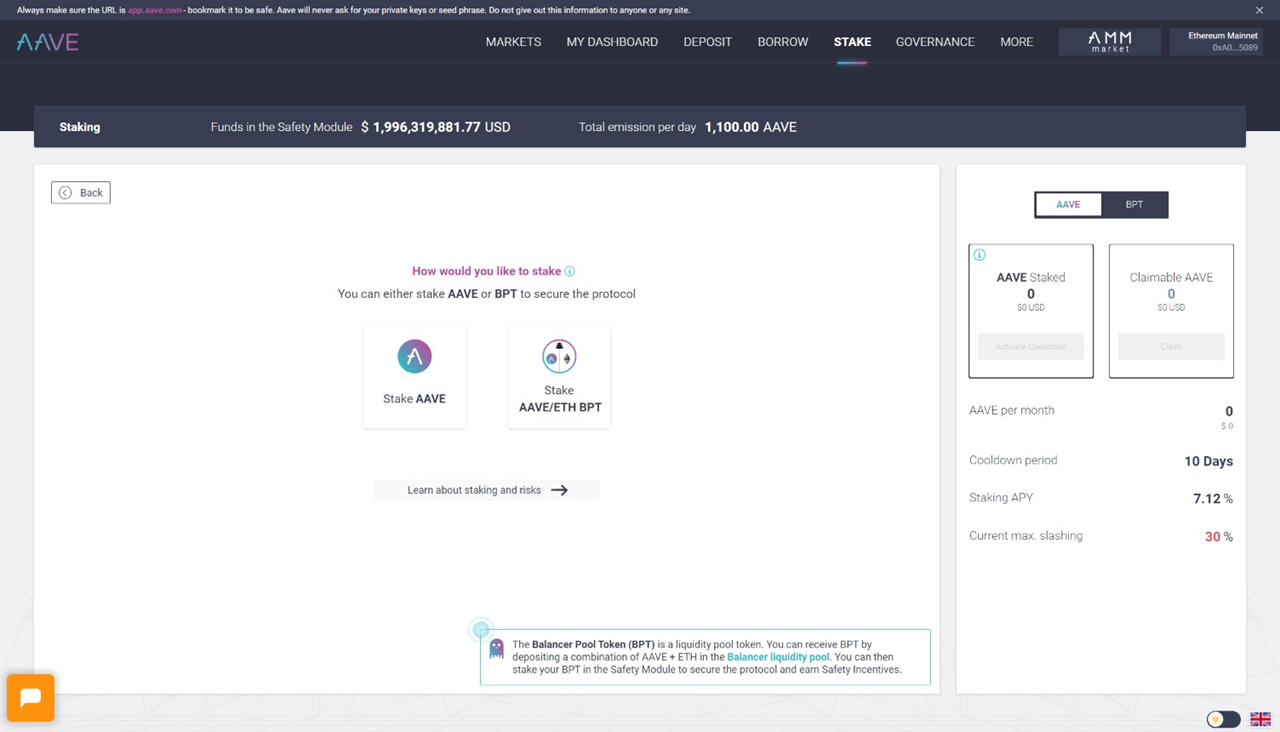

One of the most well-known examples for this token category is AAVE, which is the governance token for the Aave protocol. You can stake your AAVE to act as the backstop for the protocol. If the protocol even goes underwater, the stakers incur the risk and are responsible for re-collateralizing the system. In exchange, you receive staking rewards in AAVE.

Notably, there’s a cool down period of 10 days, meaning that you need to wait for ten days before withdrawing your staked assets.

Since you cannot move your tokens when they’re staked, your investment is subject to the market risks during the lock-up period (or the “cool down period,” as AAVE calls it). However, as a smart trader looking to cash in on the gains right now, you can escape these restrictions by using perpetual contracts.

The following is the step-by-step guide for how to do this. Assuming you’ve staked 100 AAVE on the AAVE protocol and 1 AAVE is traded at 496 USDC on the spot exchanges right now. Here’s what you do:

- Open a short position: If you want to secure your gains at that price, you can open a short position with the position size the same as the staked amount. In our example here, that would be a 100 short AAVE position.

- Initiate the cool down period: As the second step, you need to send out a transaction on-chain to “notify” the smart contracts to initiate the cool down period of 10 days.

- Withdraw the tokens and sell them: Once the 10-day cool down period is over, you need to send out another transaction so you can receive your 100 AAVE. If the price of AAVE drops to 396 USDC in this step, you will get 39,600 USDC (100*396) after selling the previously staked AAVE on the market.

- Close the short position: The last step is to close the short position, which will realize a profit of 10,000 USDC (100*100) as a result of the price drop.

If you add the proceeds from step 3 and the profits from step 4, you’ll find out that you receive 49,600 USDC in sum, which effectively means you sold 100 AAVE at 496 USDC despite you didn’t have any AAVE in the first step.

Apart from the profit from your short position, you are likely to receive funding payments if this tactic is executed during a bull market. With an hourly funding rate of 0.005%, you can receive an extra 535.2 USDC ((496+396)/2*100*0.005%*24*10) from this short position.

📚 If you’re not familiar with the funding payments, check out this article!

But what will happen if the price of AAVE ends up becoming higher?

In this case, you’ll miss out on some profit. Back to our previous example. Supposing AAVE’s price jumps to 696 USDC after the cool down period is over.

- Your short position generates a loss of 20,000 USDC (200*100)

- The proceeds from selling the previously staked 100 AAVE now becomes 69,600 USDC (696*100)

So the net receive amount still stands at 49,600 USDC despite the price of AAVE increases in the end.

Strategy 2: Reduce Yield Farming Risks

While the annual percentage rate (or “APR”) for yield farming can be as high as 3-digit, sometimes, the impermanent loss can still make participating one not profitable.

If you don’t know what impermanent loss is, please check this article.

🐻 Here is an example of the bear case:

Assume the APR for a new yield farming opportunity is 150% and the token for this project (“Token A”) is traded at 300 USDC each. You put 500 Token A and 150,000 USDC into a liquidity pool on Uniswap for this project. After selling the yield farming rewards for 45 days and the cumulative yields stand at 55,479.5 USDC (150,000*2*150%/365*45), you want to stop providing liquidity.

However, you’re surprised to find out that the price of Token A has dropped to 150 USDC each. So when you withdraw your tokens from Uniswap, you get 700 Token A and 105,000 USDC in return. (You receive more Token A than the amount you put in because of the drop in price)

If you sell the returned 700 Token A at 150 USDC each and combine the proceeds with the returned 105,000 USDC, you’ll find out you lose 90,000 USDC in total ((700*150+105,000)-150,000*2) due to the impermanent loss.

So as you can see, despite a three-digit APR, you can still lose money participating in yield farming. In our example, the net loss was 34,520.5 USDC (55,479.5-90,000).

Yikes!

But what can you do to hedge this downside risk? One way to do this is to open a short position with the perpetual contract right after you provide liquidity.

Let’s take a look at how adding a short position can help our previous example:

- Provide liquidity: As stated above, Token A initially is traded at 300 USDC, and the stable APR is 150%. You deposit 500 Token A and 150,000 USDC into a liquidity pool.

- Open short position: Once the deposit is made, you open 500 short positions for Token A with the perpetual contract. As a reminder, you need to provide other assets as collateral to open your position.

- Lock in profits from yield farming rewards: Keep selling the rewarded tokens on the market for 45 days and receive 55,479.5 USDC (150,000*2*150%/365*45) overall.

- Withdraw liquidity: Withdraw your liquidity from the liquidity pool and get 700 Token A and 105,000 USDC in return. The amount on both sides is a rough estimation. You sell the 700 Token A and realize a 90,000 USDC loss (150,000*2-700*150-105,000).

- Close short position: But since Token A’s price drops from 300 to 150, which makes the short position you opened in the second step a profitable trade for you. You should profit 75,000 USDC (500*150) after closing the short position.

To sum up, thanks to the profit from the short position, you turn the previous 34,520.5 USDC net loss into a gain of 40,479 USDC.

Additionally, if you execute this tactic in a bull market, chances are you can get paid by the funding payment. Assuming the average hourly funding rate during these 45 days is 0.003%, you can receive an extra 3,645 USDC ((300+150)/2*500*0.003%*24*45) from your short position.

You might also wonder what if the Token A moons instead. Let’s walk through the scenario below.

🐂 Here is an example of the bull case:

If the price of Token A increases to 400 USDC, the following is the updated PnL:

- When you close your short position, you’ll end up realizing 50,000 USDC (500*100) of loss due to the price increase.

- Assuming the APR stays at 150%, you cumulatively receive 55,479.5 USDC (150,000*2*150%/365*45).

- When you withdraw the liquidity from Uniswap, you get 435 CREAM and 174,000 USDC. Again these numbers are rough estimations. The reason why you get less CREAM in return is that 1 CREAM now worths more than you previously put in. If you combine the process from selling 435 CREAM at 400 USDC and the withdrawn USDC, you’ll find you make a profit of 48,000 USDC. (435*400+174,000-300,000)

So, all in all, you make 53,479.5 USDC profit, which is less than participating in this yield farming without any hedge.

Conclusion

Perpetuals are one of the most traded derivatives products in crypto. It’s mainly used for speculative purposes but not always! You can leverage advanced strategies with these derivatives products to your advantage. No more speculation, but rather hedging your risk. 🧠

This article was written based on this presentation used in Perpetual Protocol’s workshop. Check the videos their YouTube channel for more.

Action Steps

Try out Perpetual Protocol, the largest derivative DEX by daily trading volume.

Read previous Bankless resources on perpetual contracts

Author Bio

Weiting Chen, Growth Manager at Perpetual Protocol, the leading DeFi derivatives exchange that allows users to trade and deposit with minimal gas fees.