How to Trade Interest Rates with DeFi

Dear Bankless Nation,

Times like these are all about leveling up.

While devs build tech, traders brush up skills and knowledge, ready for the next opportunity to build wealth.

As DeFi continues to eat up TradFi, we’re finding new ways to interact with markets every day.

Today, we’ve got a tactic on a strategy with which you’re probably not yet familiar.

Interest rate swaps are huge in TradFi. We’re talking trillions notional. They represent a big slice of the global derivatives market. But until now they’ve been reserved for institutions only.

Now, interest rate swaps are hitting DeFi with Voltz Protocol.

Let Will Nicoll of Voltz Protocol walk you through how to swap interest rates — with leverage if you are so inclined — in DeFi.

Get smart. Be safe! See you on the other side.

— Bankless

Swap Interest Rates with Voltz Protocol

Tactic Tuesday // Guest Writer: Will Nicoll, Community Manager at Voltz Protocol

A staggering $1000 trillion notional in trading volume is exchanged each year in TradFi interest rate swap markets.

For the first time, Voltz Protocol is bringing the power of interest rate swaps to DeFi.

Knowing how to trade rates and provide liquidity in IRS markets puts you at the cutting edge of crypto, and enables you to generate attractive market-neutral returns.

- Goal: Learn how to harness the power of interest rate swaps in DeFi

- Skill: Intermediate

- Effort: 1 hour

- ROI: Potential for >100% APY in a bear market

What are interest rate swaps?

The concept of interest rate swaps (IRS) may be new, even to seasoned degens. That’s because the ability to actively trade in IRS markets has historically been reserved for centralized institutions, not individual investors.

If you’re new to these kinds of swaps — worry not! Once you learn the basics of IRS and make a few practice swaps on Voltz Protocol, you’ll have access to a massive range of DeFi strategies that are effective in both bull and bear markets. In this Tactic, we’ll cover the basics you need to know to get swapping.

Not yet convinced of the importance of interest rate swaps in crypto?

Let’s sketch out a basic trading scenario to show you what’s possible:

If you believe that APYs on Lido stETH will increase in the future with The Merge, you can take that view with leverage on Voltz Protocol. In some cases, you can use over 300x leverage, turning a 1% increase in stETH rates into a 300% APY return! That’s an extremely risky example, but the returns are there to behold.

Now, let’s talk about what interest rate swaps actually are. In their simplest form, interest rate swaps allow you to exchange one rate of return for another. This could mean exchanging a variable rate for a fixed rate, a fixed rate for a variable one or a variable rate for another variable rate.

The best way to understand the basics of interest rate swaps is through examples.

Two examples of interest rate swaps

First off, let’s meet Alice, who will illustrate the value of variable-to-fixed swaps:

- Alice owns an asset with a variable rate of return

- She’s nervous about the rate going down in the future

- Instead of holding on to that volatile variable rate, Alice swaps it for a fixed one

- Alice now has peace of mind knowing her fixed rate won’t fluctuate 😌

- Alice is known as a Fixed Taker (FT)

Why Alice would swap a volatile variable rate for a secure fixed rate is easy to understand, especially in crypto. But what about fixed-to-variable swaps?

Let’s take a look:

- Bob owns an asset with a fixed rate of return

- Based on market analysis, Bob thinks a variable rate could earn more than his fixed rate

- Since he has some tolerance for risk, Bob swaps his fixed rate for a variable one

- If the variable rate goes up, Bob could earn substantially more than he could with the fixed rate, but if it goes down, he risks losing money

- Bob is known as a Variable Taker (VT)

As you can see, FTs and VTs can have different levels of risk tolerance and different trading goals. Variable-to-variable swaps also exist but are a more advanced topic to explore in a future Tactic.

One of the coolest things about interest rate swaps is that you don’t actually need to own an asset with a variable rate or an asset with a fixed rate to enter a swap. Instead, you just need to deposit enough margin to cover the potential interest rate payments that those assets would have.

This means you can speculate as a Variable Taker without ever owning a fixed rate asset and speculate as a Fixed Taker without ever owning a variable rate asset.

What is Voltz Protocol?

Voltz Protocol is a noncustodial Automated Market Maker (AMM) that allows you to trade interest rate swaps with leverage.

By utilizing DeFi advancements such as concentrated liquidity, Voltz Protocol is up to 3,000x more capital efficient than alternative IRS models that could be built, unlocking a wide range of trading and liquidity providing strategies.

What does “capital efficiency” mean? Put simply, it means you can use less capital to generate returns, meaning the APYs have the potential to be much higher.

Before we dive into a sample strategy that could earn you >100% APY in a bear market, let’s cover the fundamentals of the Voltz Protocol UI.

First off, we’ll check in with Alice and Bob from our previous examples and walk through the Fixed Taker (FT) and Variable Taker (VT) flows alongside them.

The FT and VT flows

The time has come to load up the Voltz Protocol app!

Ethereum Mainnet | Kovan Testnet

Need testnet tokens? Head on over to faucet.paradigm.xyz to get some free fake ETH, then swap it for the desired tokens at Kovan testnet Uniswap

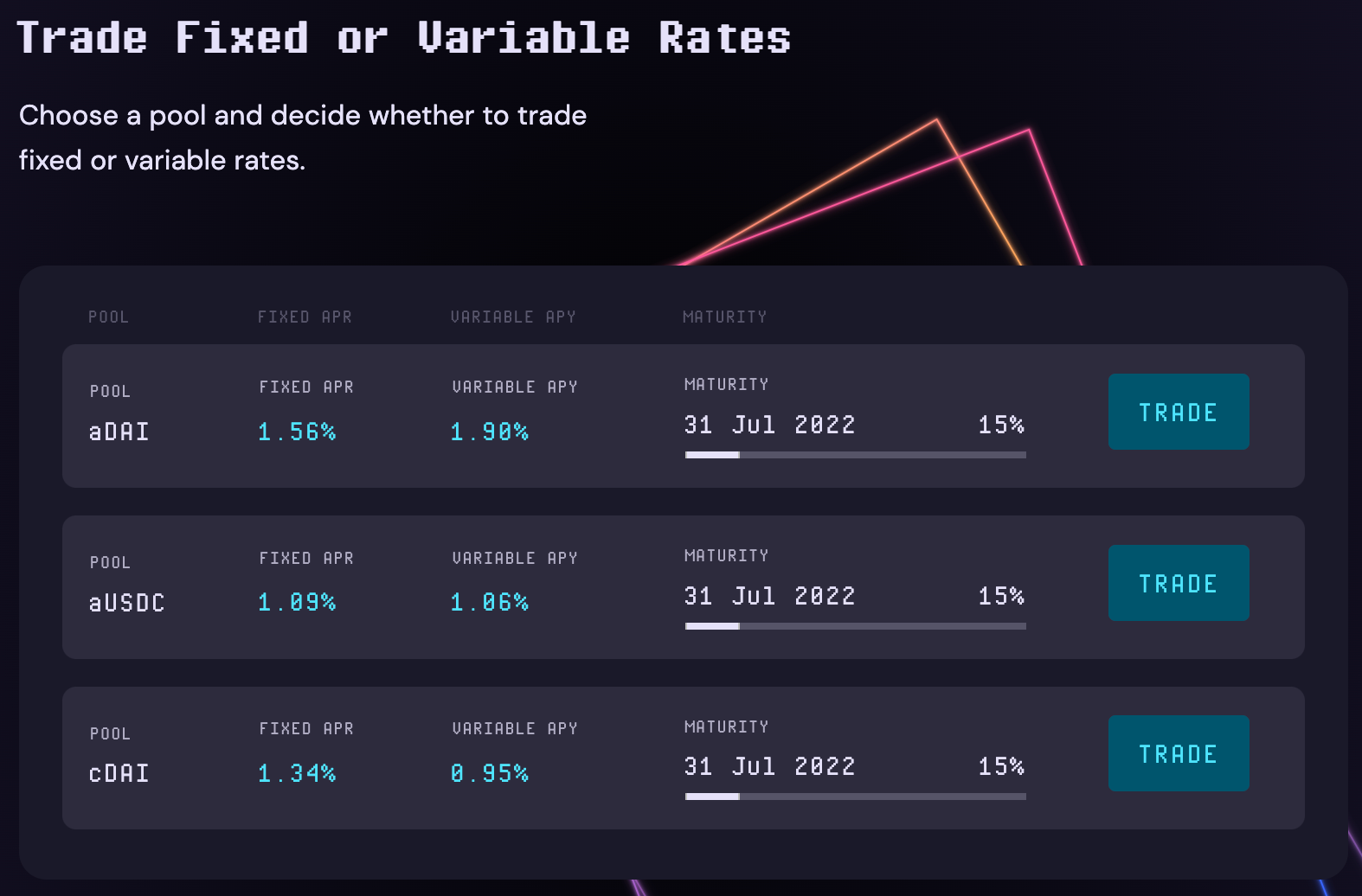

Once you connect your wallet, you’ll be brought to the trader screen, where you can see the pools that are currently available:

For each pool, you’ll see the underlying yield-bearing asset, the current rates, and the maturity date. We’ll learn more about each of these categories while we use the app.

Let’s click trade on our desired pool and see what happens!

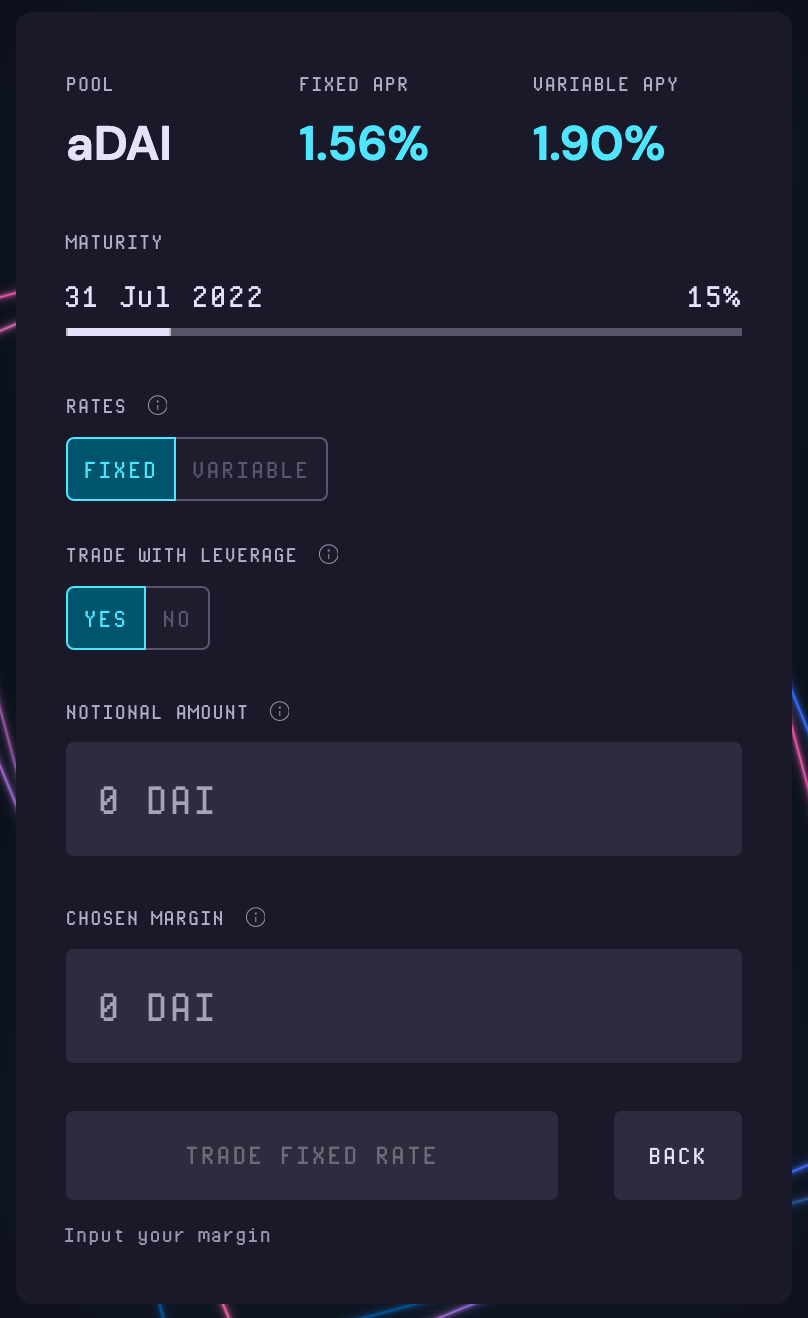

We can now decide what kind of swap we want to enter. Alice is up first with a Fixed Taker trade — she’s exchanging a variable rate in return for a fixed one. Therefore, we’ll choose the fixed option under rates.

Now, we choose whether or not to leverage our position. Trading with leverage means we need to deposit less margin to cover our total trade size (notional). If we do not trade with leverage, the notional and margin amounts are equal. Trading with leverage involves the risk of being liquidated, so use it with care, but it also means your upside can be much higher.

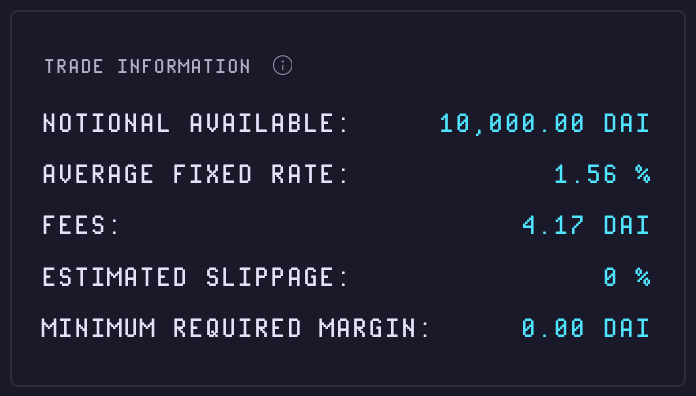

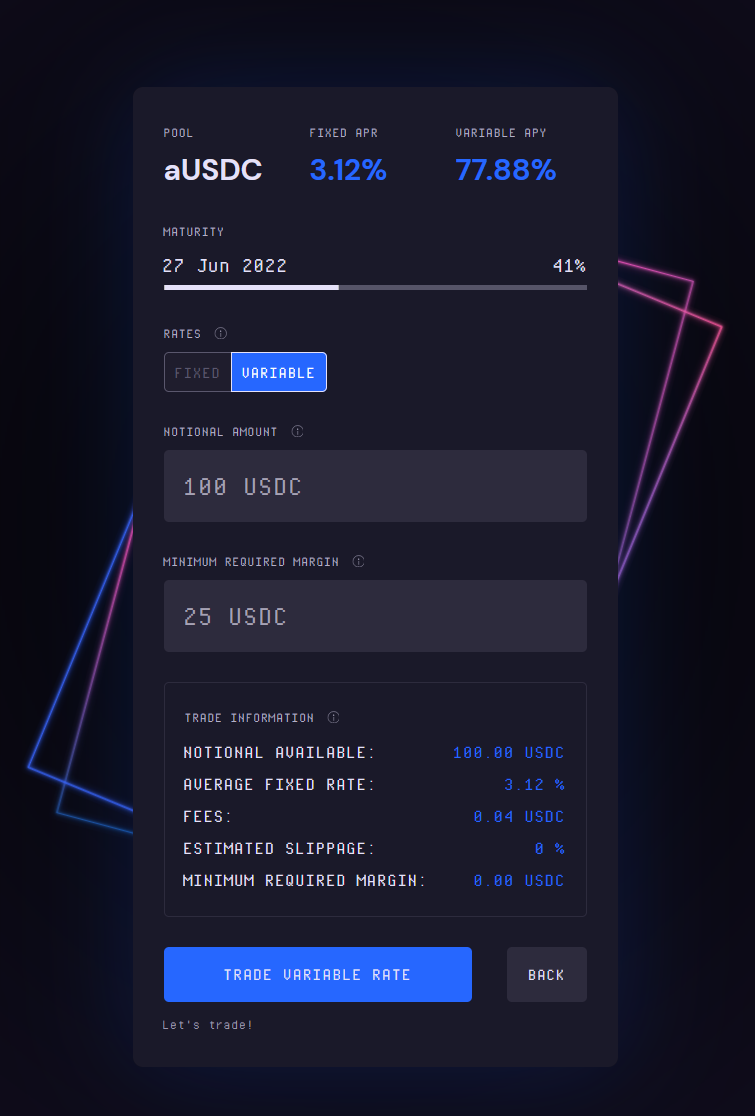

Once you’ve input your desired margin, a trade information box will appear, showing you the breakdown of your swap:

Hover over the trade information tooltip to find out more about each of these stats. Before entering the swap, you’ll be prompted to approve the pool and fee tokens (DAI in this example). If your position is fully collateralized (no leverage), you’ll also need to submit an approval for the protocol’s Full Collateralization Module (FCM).

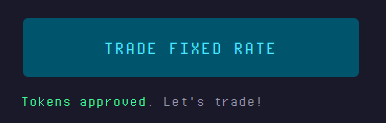

Now we’re ready to swap!

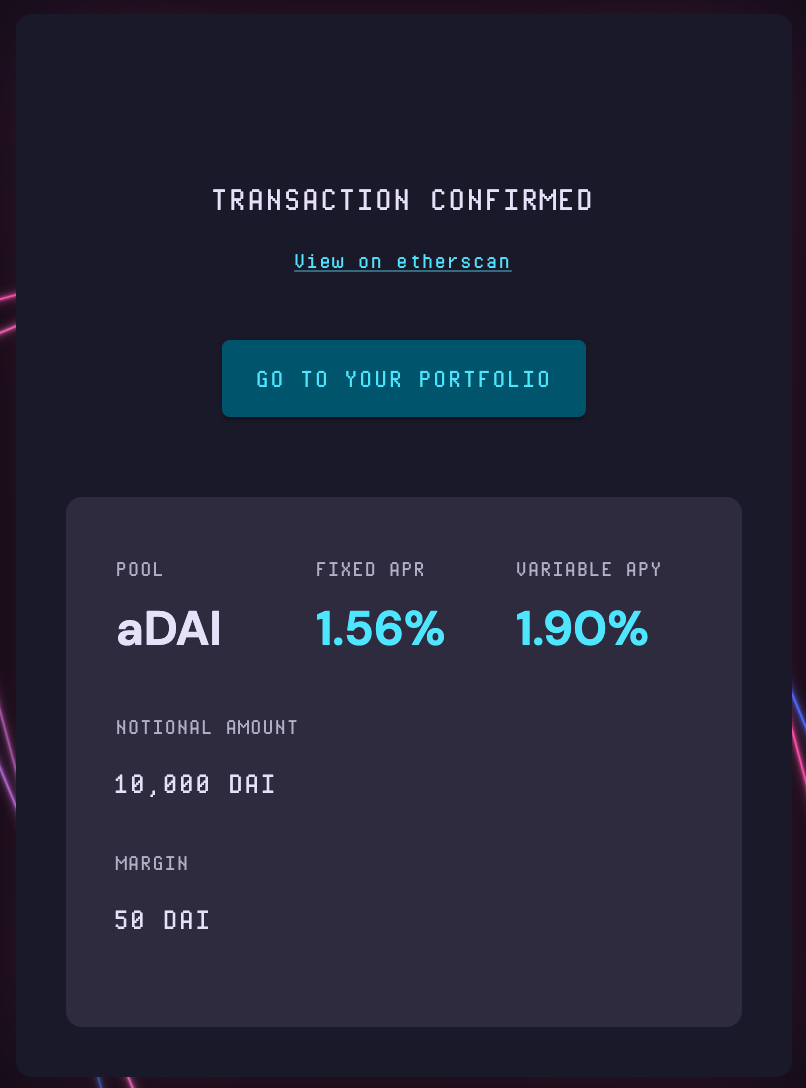

Once the transaction has confirmed, you’ll see a summary page and a link to your portfolio:

The experience for Bob and other Variable Takers is even more straightforward than the FT flow. Return to the trader pools page from the traders dropdown and select the pool you’d like to use for a VT swap, then click variable and hold onto your seat!

Input your desired notional and margin, click trade variable rate, and that’s it! You’ve now successfully entered a VT position.

The Trader’s Portfolio

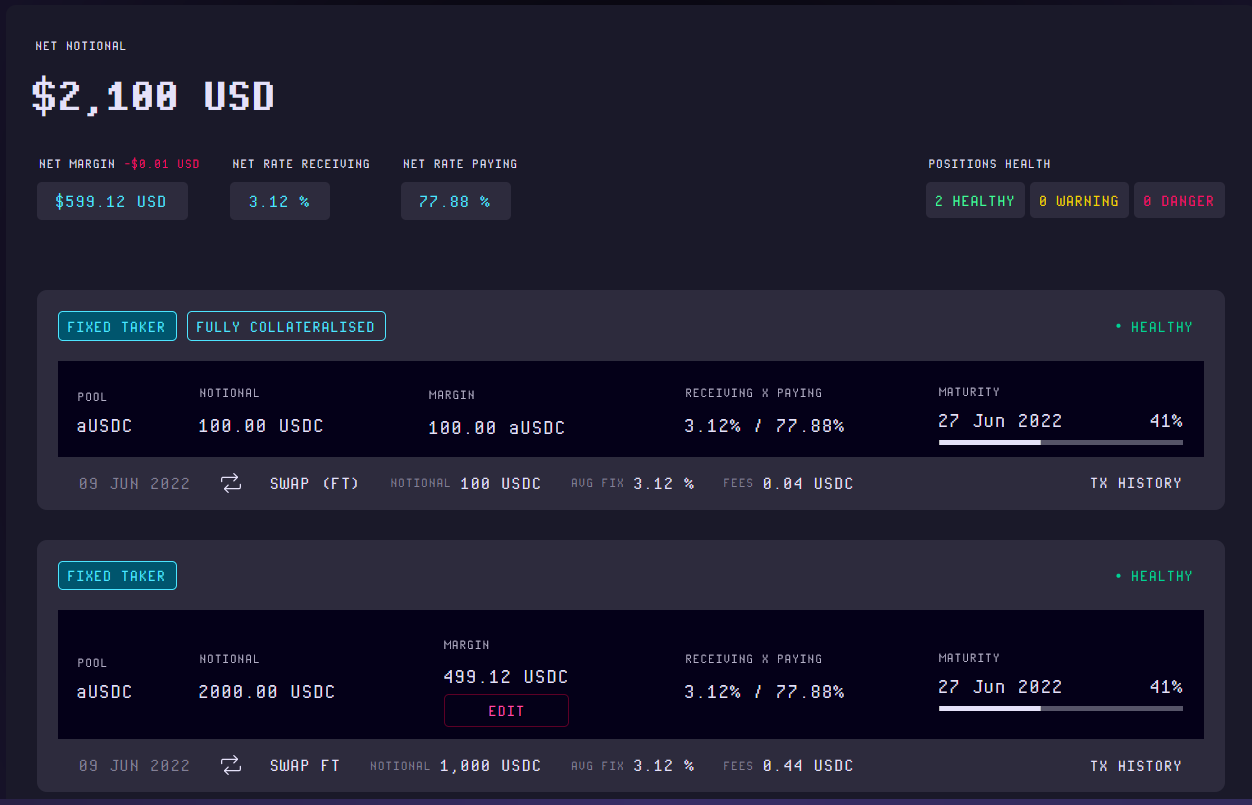

The trader’s portfolio page is where you can monitor your active interest rate swap positions.

For each pool, you can click on tx history to see more details about the swaps you’ve entered. Be sure to keep track of the position health of your leveraged positions.

If you see warning or danger, you may need to deposit more margin to avoid liquidation. The pool maturity date lets you know when you’ll be able to settle your position.

LPing on Voltz Protocol

Liquidity Providers (LPs) supply the liquidity needed to trade interest rates on the Voltz Protocol AMM. LPs only need to provide a single asset to collect fees, which are maximized through a novel combination of concentrated liquidity, margin recycling and the margin engine — all of which can be read about in the Voltz Litepaper.

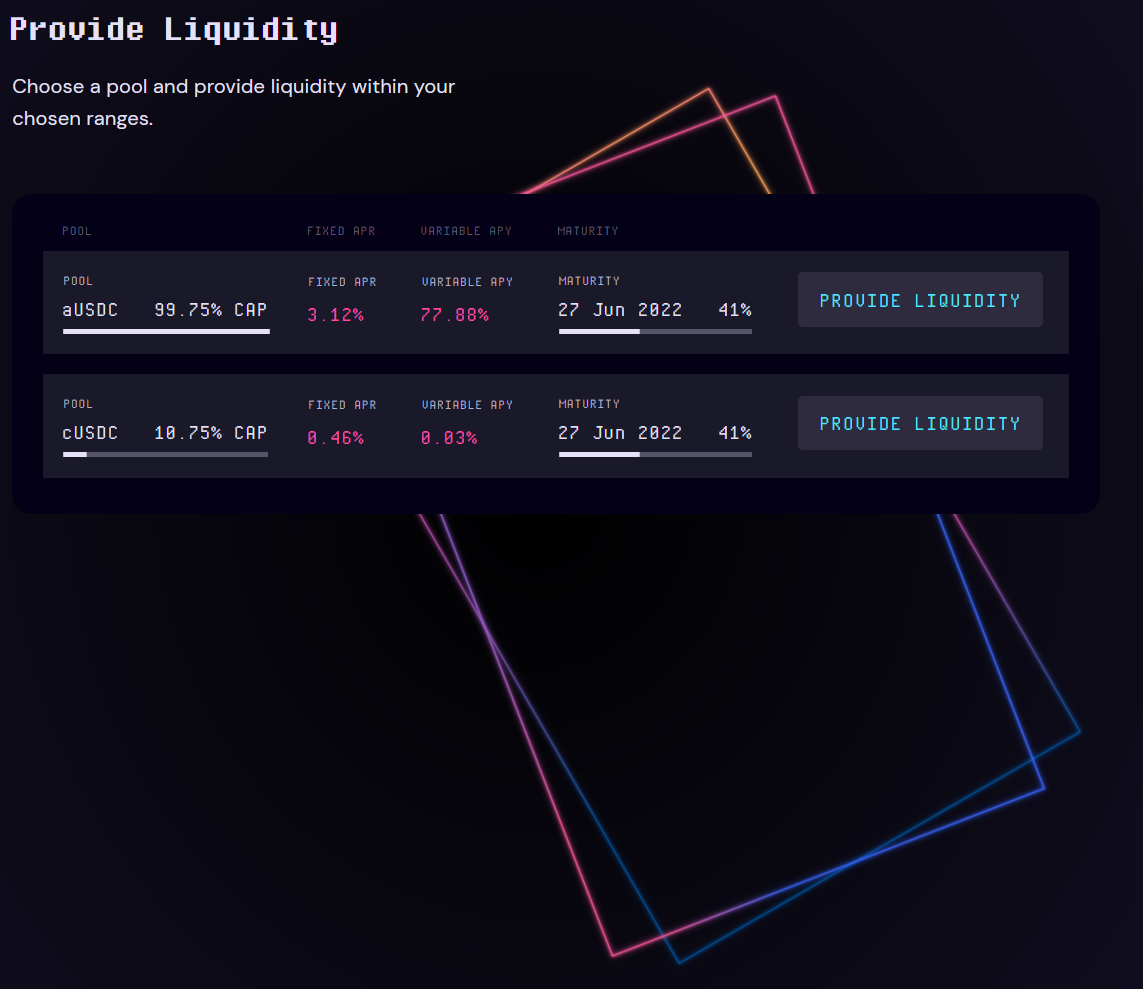

To get started, navigate to the liquidity provider tab and click lp pools.

Here, you’ll notice that there is a cap on the pools. This is in effect while the Voltz Protocol is in alpha state. Click provide liquidity on a pool that is not at capacity to continue.

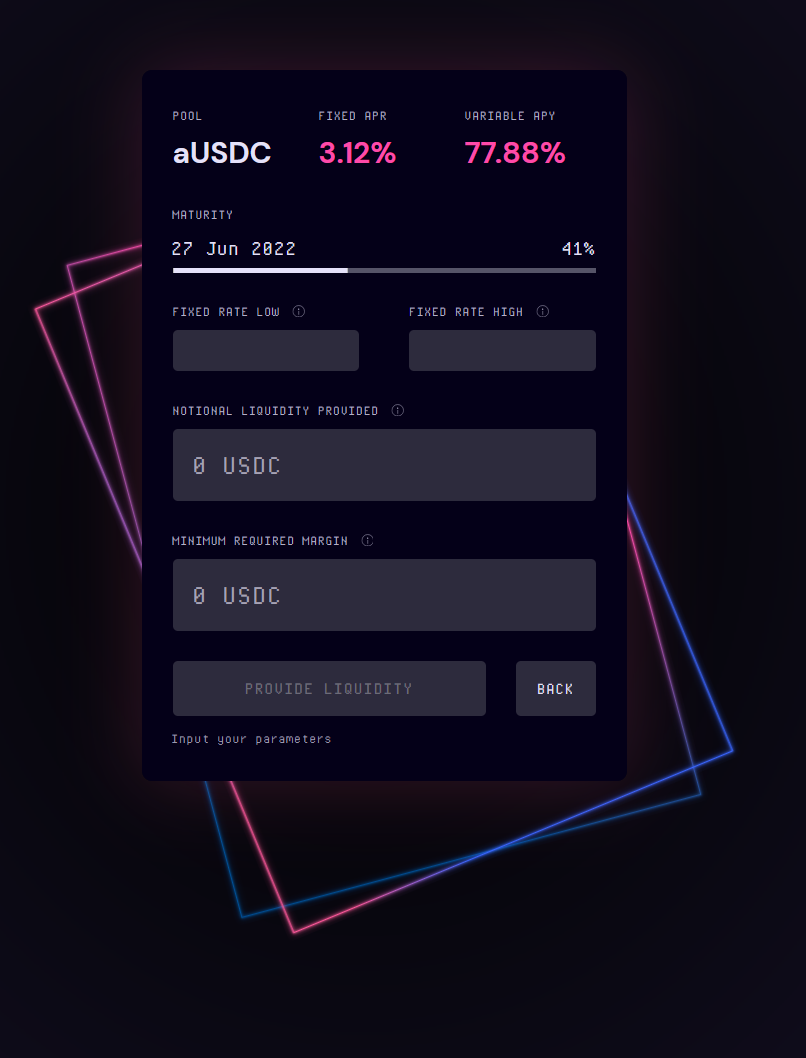

This module looks similar to the trading module, but with a couple key differences. The fixed rate low and fixed rate high sections refer to the tick ranges that liquidity providers need to specify when supplying concentrated liquidity. Read more about tick ranges in the Uniswap docs.

Your LP Positions

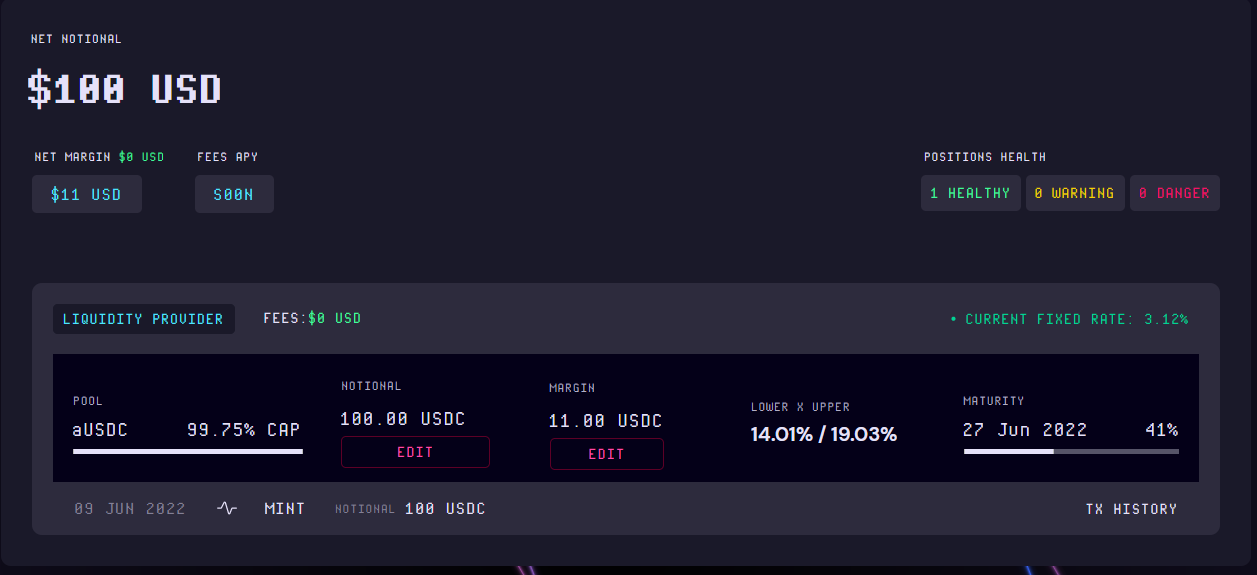

After you’ve added your liquidity, you’ll see the positions page. You can navigate to this page anytime through the liquidity providers tab.

Here, you’ll notice you have the ability to edit your LP positions. You can add margin to improve your position health, or withdraw the funds into your wallet. You can also add notional to increase the leverage of your position or burn it to lower your amount of leverage.

>100% APY in a bear market?

Now that you know how to use Voltz Protocol, you can start diving into IRS strategies and optimizing your returns — even in unfavorable market conditions. Feeling bullish on stETH rates going up? Open up a highly-leveraged VT position to turn even a small rate hike into a significant payoff. Looking to de-risk your portfolio? Lock in some fixed rates and rest easy.

We’ll explore many different strategies in future Tactics, but for now, this alpha drink from Voltz Labs CEO Simon Jones will give us plenty reason to start swapping:

Action steps

- Learn about IRS swaps in TradFi

- Read 5 ways to earn fixed interest rates in DeFi