How to start a Moloch DAO

Level up your open finance game three times a week. Subscribe to the Bankless program below.

Dear Crypto Natives,

You know when you put on an old pair of jeans and find $20 in your pocket?

That’s this week on Bankless.

Cause today you’re getting an extra weekly tactic!

Yesterday we covered margin trading in tactic #35. Today we’ll learn how to create a Moloch DAO in tactic #36.

DAOs are awesome—the crypto equivalent of an LLC—a building block for capital.

There are 21.6 million LLCs in America.

How long til there’s millions of DAOs on Ethereum I wonder?

It’s still early days—so let’s level up on Moloch DAOs and front-run this opportunity!

- RSA

🙏Sponsor: Aave—earn high yields on deposits & borrow at the best possible rate!

TACTICS TUESDAY (ON WEDNESDAY):

Tactic #36: How to start a Moloch DAO

Guest post: Cooper Turley, editor of DeFi Rate and MetaClan lead

Today we’re diving into the the world of Distributed Autonomous Organization—herein referred to as DAOs. DAOs are a way for like minded individuals to collectively band together and solve common goals. Thanks to smart contracts, funds are pooled together and governed onchain providing a trustless proposal system to allocate capital using predefined rules.

In recent months we’ve seen the emergence of a number of different DAO frameworks, each with their own sets of benefits and tradeoffs. This tactic will use the MolochDAO framework, largely popularized by DAO’s like MetaCartel due to their simplistic nature and ability to “raqequit” capital at will.

The tactic leverages Moloch V2, an updated framework adding in a suite of new features such as multi-token support, non-voting shares, guildkicks and new proposal types—all of which are described in more detail here.

We’ll dive into the key aspects of DAOs, specifically highlighting what they are good for and what can be done to better manage them and encourage participation. Finally, we’ll show you how to summon your very own Moloch V2 DAO in a few simple clicks using a DAO summoning kit called Daohaus.

- Goal: Summon a MolochV2 DAO on Daohuas

- Skill: Intermediate

- Effort: 10 minutes

- ROI: ~$5 in transaction fees to spawn a globally accessible distributed fund coordinator

Just DAO It

In the past few months, we’ve seen a rising trend of projects looking to further distribute governance through the introduction of a DAO. By the end of 2020, we’ll see DAOs for major DeFi projects including but not limited to Maker, Kyber, Synthetix and Uniswap. While it’s easy to say that DAOs are on the rise, it’s actually far more interesting to examine what’s going on underneath the hood, specifically focusing on the reason why they add value to any given community.

TLDR: DAOs will not magically engage your community or create one. They are simply a way to better coordinate a group of passionate individuals eager to make a collective impact.

So, what are DAOs even good for? Coordination!

Coordinating capital:

- Expediting funding to value-added projects or individuals

- Aligning incentives through skin in the game

- Creating network effects around a shared value or mission through social signaling (we’re all in this together)

- Distributing capital allocations across all ecosystem actors

Coordinating community:

- Inspiring motivation and participation due to close proximity with other wizards

- Propagating genuine friendships in a remote fashion.

MolochDAO

To date, the biggest use-case for DAOs has been grant funding. Best exemplified by MolochDAO, nearly $300k in funding was allocated to Ethereum development across over 40 projects which are explained in detail here. The improvement vs other public funding mechanisms is speed and efficiency, with funds being distributed to a grantee in roughly ~2 weeks thanks to the permissionless management of a DAO.

MetaCartel

Another example—the MetaCartel DAO uses grants to fund consumer-facing Ethereum applications in their earliest stages. While efficiency also plays a role here, receiving a grant from MetaCartel also provides signal of product market fit. This commonly takes the form of helping teams cut down product feedback cycles, get ecosystem feedback and finding what aspects of the project resonate with people and which don’t. MetaCartel helps remove the barrier of not having an audience.

Given MetaCartel grants are typically only $1-5k in size, the value for a grant recipient is mostly about accessing a specialized network of individuals and projects centered around finding new use-cases for Ethereum. Grants to projects like Sablier, DeFi Zap and Kickback—all of which provide novel use-cases to better interface with DeFi and Ethereum at large. (More grant examples here)

So what are DAOs good for?

This growth oriented mindset also places a degree of social pressure on those who receive grants and interface with the DAO. With some grants, half is given upfront while others are milestone based. This places a strong element of social reputation on grantees which is probably more important than the capital itself.

To summarize the question of “what are DAOs good for?” I would answer that DAOs are an excellent way for people to trustlessly coordinate, put skin in the game, and socially encourage one another to put their funds to good use.

What Makes a Successful DAO?

While the obvious success metric for a DAO may be the amount of capital it coordinates, maybe more importantly it’s about the number and quality of unique value-added individuals contributing to DAO.

There’s a common maxim that in order for a business to be successful it must acquire 1000 True Fans—individuals who will support anything and everything that you do.

When it comes to starting a DAO that’s exactly what’s needed—1000 True Fans

There’s a fine line between having too few members and too many members (and thus too much noise)—hence the largely permissioned nature of many popular DAOs in which new members must *prove* themselves through either capital or work in order to become one of the community. Like a pledge.

Ok, now you know the basics. You ready to get started?

Step 1: Find or Create a Community With a Shared Goal

Creating an engaged community is one of the most difficult tasks in starting a DAO. In a world of endless of noise and competition—how does your mission stand out?

Here’s a great way to find the right shared goal:

- What is the most pressing issue in your environment that’s not being addressed?

- Who are the players trying to address this problem & what are they failing to do?

- What is your unique leverage or specialized knowledge that makes you suited to solve this problem?

- Who are 5 other people (fellow summoners) who can solve this problem?

- What can you do to incentivize them to solve this problem with you?

One you’ve explored this, there’s a fork in the road. You can either:

- Find and join an existing DAO which shares the same goal(s)

- Create your own DAO.

Instead of trying to reinvent the wheel, first explore the existing DAOs to see if something already fits your mission. Here’s a quick list of notable DAOs today:

- Moloch DAO

- MetaCartel DAO

- Venture DAO (MetaCartel Ventures)

- Raid Guild

- MetaGammaDelta

- Orochi DAO

- Rocket DAO

- LexDAO

- PieDAO

- MetaFactory

- Saint Fame

- MetaClan

Anything above that resonates with you? The best thing you can do is find their respective forum and figure out the next steps to pledge.

⚠️For more info on how to join any of the DAOs described above, please feel free to reach out to me on Twitter.

Nothing jumping out to you? Time to lay out a blueprint for how you can initiate your own DAO community around a shared goal.

Step 2: Establish Funding Goals

Consider how a shared pool of capital would allow you to better solve these goals:

- What is the focus of your DAO? (consumer-facing applications, ETH2 development, crypto-gaming, clothing line, etc.)

- How can you DAO make as big impact with as little funding as possible?

- Why would others want to help fund your DAO? (incentives, end-goals, etc.)

- What are the different roles required fund allocation & admin?

Many DAOs are created with too big a vision and far too little support. Don’t be afraid to start small. For instance, instead of solving world hunger, make a DAO which provides food to one underdeveloped neighborhood in an at risk city.

The point here is that while DAOs are commonly pitched as revolutionary, they actually work far better with a very narrow focus. The more refined the focus with tangible steps to creating value-added experiments, the more likely it is that others are will support the mission.

Now that you’ve narrowed down your mission, it’s time to do the damn thing!

Step 3: Summon a DAO

Perhaps the most novel aspect of the MolochDAO framework is the permissionless nature of DAO creation—you just need some basic DeFi skills.

⚠️Aragon or Moloch? People always ask—should I use Moloch over Aragon? This is like asking if you should use iOS over Android. Both are incredibly powerful tools which vary slightly in their edge use cases. Moloch is a bit more open and wild, Aragon is a bit more turnkey and polished. At the end of the day, use whichever stands out to you more and whichever you feel most comfortable with when playing around.

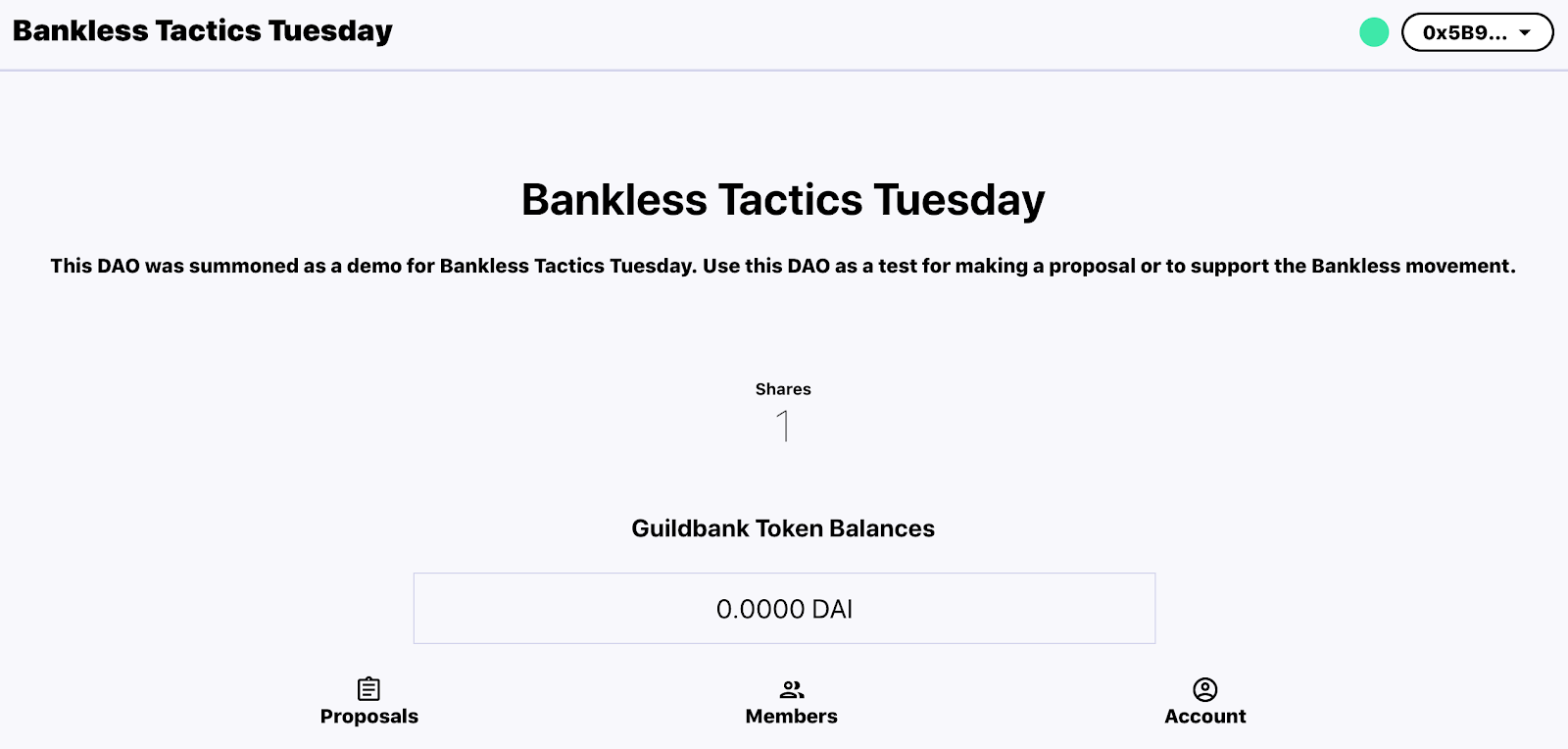

When it comes to the Moloch framework, tool like Daohaus and Pokemol allow you to spin up a DAO in a few simple steps for under $10.

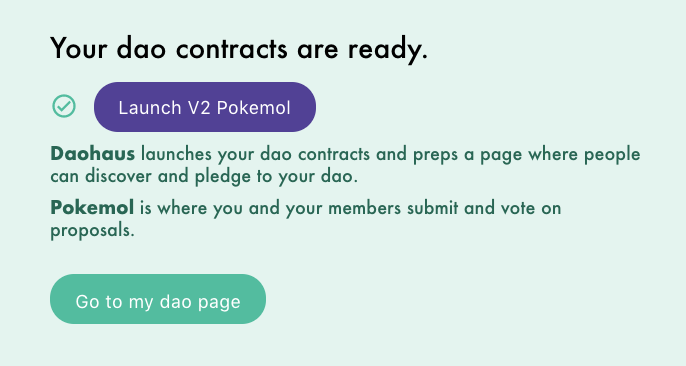

What is Daohaus?

For those unfamiliar, Daohaus is the back-end tool used to input details about your DAO and launch the smart contract. It contains a list of all Moloch-forks along with where to access the front-end associated with each. Pokemol is that front-end access point, and is automatically summoned following the creation of a DAO on Daohaus. Stated another way, Daohaus is where you launch and monitor all Molochs, while Pokemol is where your community will tangibly interact with the DAO.

Using Daohaus to summon a DAOO

First, head on over to Daohaus.club and connect a web3 wallet like MetaMask. On the left hand side of the screen, click the “Summon a DAO” button.

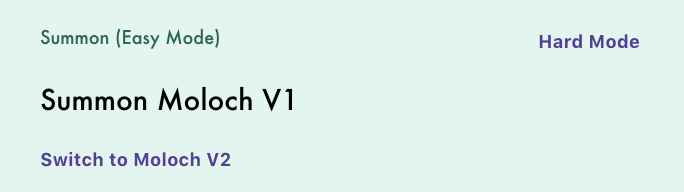

On the top of your screen, you’ll see two modes: Easy and Hard. The TLDR; is that Hard mode allows you to customize more aspects of your DAO like smaller period durations and adding whitelisted tokens—for the most part Easy mode has all the requirements you’ll need to get started.

Please be sure you are summoning a Molcoh V2 which you will see as “Summon Moloch V2” at the top of your screen.

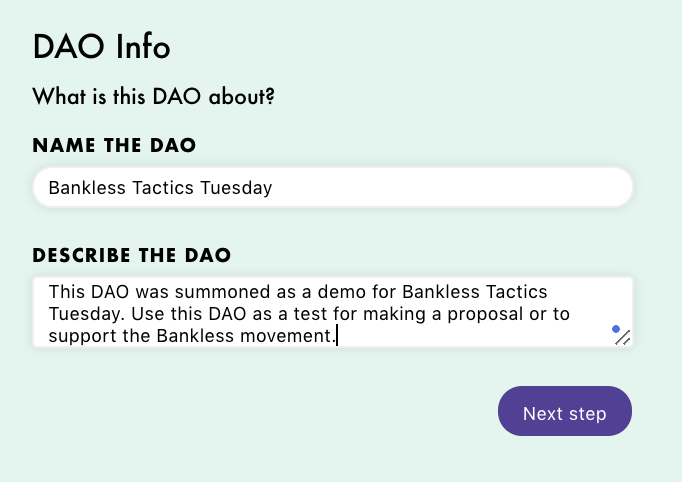

Next, enter in the name and description of your DAO. We recommend keeping your description short and to the point.

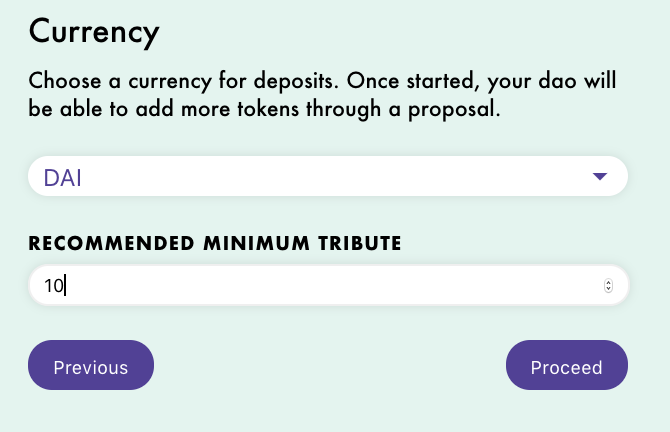

When clicking “Next Step” you’ll be brought to the Currency page which allows you to set your base currency and recommended minimum tribute. Please note that one of the great aspects of MolochV2 is that users can pledge as tribute in multiple currencies (which can be added after summoning).

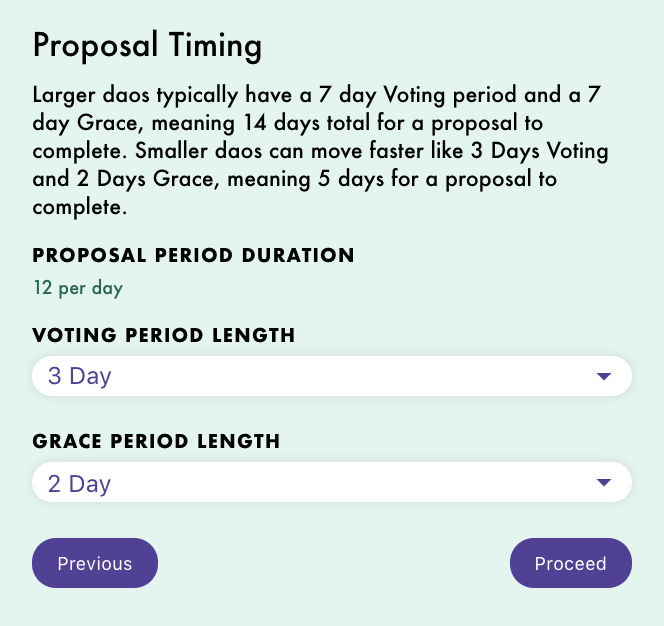

Clicking “Proceed” will bring you to the Proposal Timing Page. This is where you will set the parameters for Voting Period—the amount of time members have to vote on a proposal—and Grace Period—the amount of time members have to raqequit if they do not like the outcome of a vote. A couple quick notes for this section:

- Ensure that your voting window is long enough for other members to be able to see and act on proposals

- The “proposal period duration” is the amount of times in which new proposals may enter the queue. This is done to avoid spam and ensure all proposals are issued chronologically.

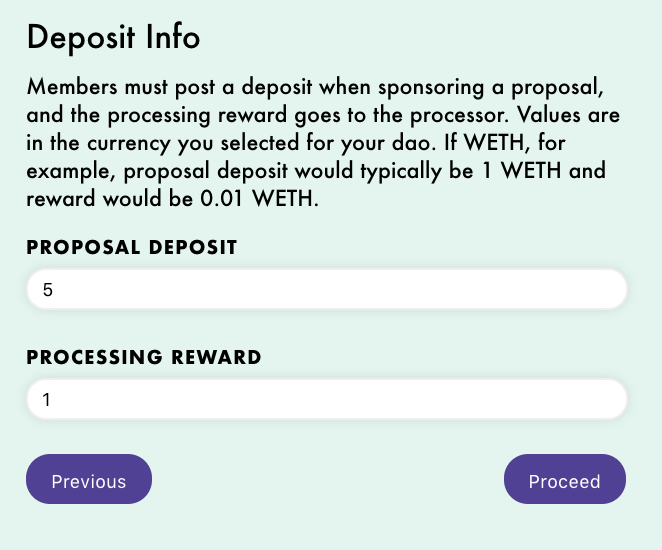

Click “Proceed” to complete the Deposit Info. With Moloch V2, existing members must “sponsor” or “champion” a proposal to move them through the queue. Quick notes for this step:

- By requiring a deposit in the base currency set above, the DAO can add an extra level of security that a bond must be posted for a proposal to be voted on. This requires additional capital for someone to sponsor each and every proposal which is unsponsored.

- The deposit is returned to the sponsor after a vote passes or fails.

- We recommend setting the deposit at roughly a quarter of the min. tribute size.

- The processing reward is paid to whoever pushes a sponsored proposal to voting. Given there are now bots to do this, we recommend setting it low, but not low enough that even a bot would not bother processing it.

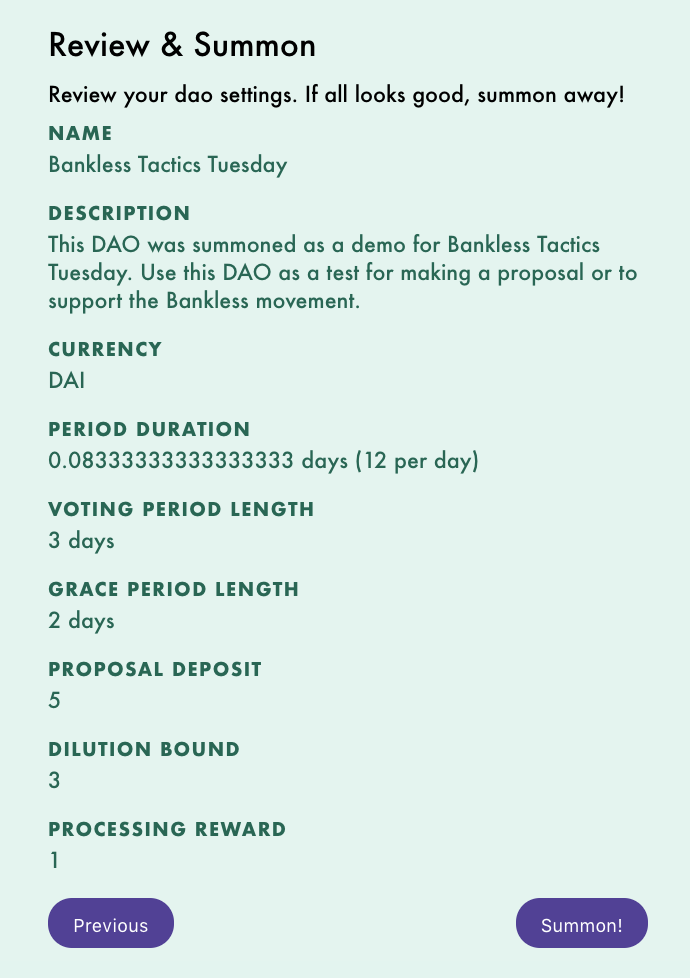

The last step is to review your existing parameters!

⚠️Note—once summoned the core parameters such as voting and grace periods can not be changed. Additional tokens can be whitelisted after summoning.

Press “Summon!” and approve the MetaMask transaction. Lastly, stand up and take a bow - you’ve just summoned your very own MolochV2!

Here’s the cool thing—all DAOs summoned on Daohaus come with their very own front-end interface called Pokemol. This is where you’ll handle all your proposals, tributes and more!

Conclusion

If you’ve made it this far you are one of the first 1000 people to ever pledge or summon to a MolochDao.

Now that you’re off the ground it’s time to get serious. If you’re looking for guidance on how to better activate a community or put together a suite of documents for your DAO, you might consider hiring Raid Guild—a collective of web3 mercenaries who are about as far down the DAO rabbit hole as you can get.

In the coming year, I fully expect the DAO movement to accelerate. Learning how to coordinate capital in a DAO now will give you the ability to front-run the opportunity.

Remember, there are no requirements to spinning up a DAO. The are meme DAOs like JamesDAO (solely for people named James) and TallDAO (solely for people who are tall)—it just goes to show that it’s not about who can pool the most money, it’s about who can pool the most humans.

If all this is overwhelming don’t worry—Bankless will keep you close to the epicenter of the DAO movement.

And who knows?

Maybe the Bankless community will have its own DAO one of these days.

Action steps

- Start a DAO to coordinate capital & community around a shared goal

Author Blurb

Cooper is contributes to many projects in Ethereum. As the editor for DeFi Rate and a scout for MetaCartel, he’s kept an eye on the wider DeFi and DAO ecosystems for the better part of a year. He’s currently leading a new project called MetaClan—an eSports DAO focused on enhancing play-to-earn mechanics in crypto games through member-exclusive quests. He’s also Ambassador for Set Protocol and frequently helps projects distill their value proposition as a member of Raid Guild and as the Managing Director of Fitzner Blockchain Consulting where he leads Token Tuesdays with another Bankless writer—Lucas Campbell. To keep up with Cooper, follow him on Twitter.

Subscribe to Bankless. $12 per mo. Includes archive access, Inner Circle & Deal Sheet.

🙏Thanks to our sponsor: Aave Protocol

Aave protocol is a decentralized, open-source, and non-custodial money market protocol to earn interest on deposits and borrow assets. It also features access to Flash Loans, an innovative DeFi building block for developers to build self liquidations, collateral swaps, and more! Check it out here.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.