Dear Bankless Nation,

Someone recently asked when I plan to sell my ETH.

“Never” I replied half smiling.

It’s actually a really interesting question, have you thought about it?

When will you sell your ETH?

And why would you sell it? Why does anyone sell?

Here are some common answers to the question of Why Sell:

- “Because you hit your price target”

- “To buy something else”

- “Because it’s topping out and I’m want to buy it later at a discount”

- “To pay off debt”

- “To cash out”

These are all fine answers. Maybe they’re the right answers for you.

Maybe they’re the right answers for most people.

But here’s another fine answer:

Never.

I’m going to buy, hold, and stake and I’m never selling my ETH.

Is #neversell a crazy option?

Tomorrow we’re going to have Justin Drake on the podcast for a third time. This time we’re going to model out ETH staking when you consider ultra sound upgrades:

- EIP1559: Ethereum starts burning 10k ETH / Day or so (ETA July 2021)

- The Merge: ETH issuance drops from 4.5% to 0.5-1.0% (ETA Q1 2022)

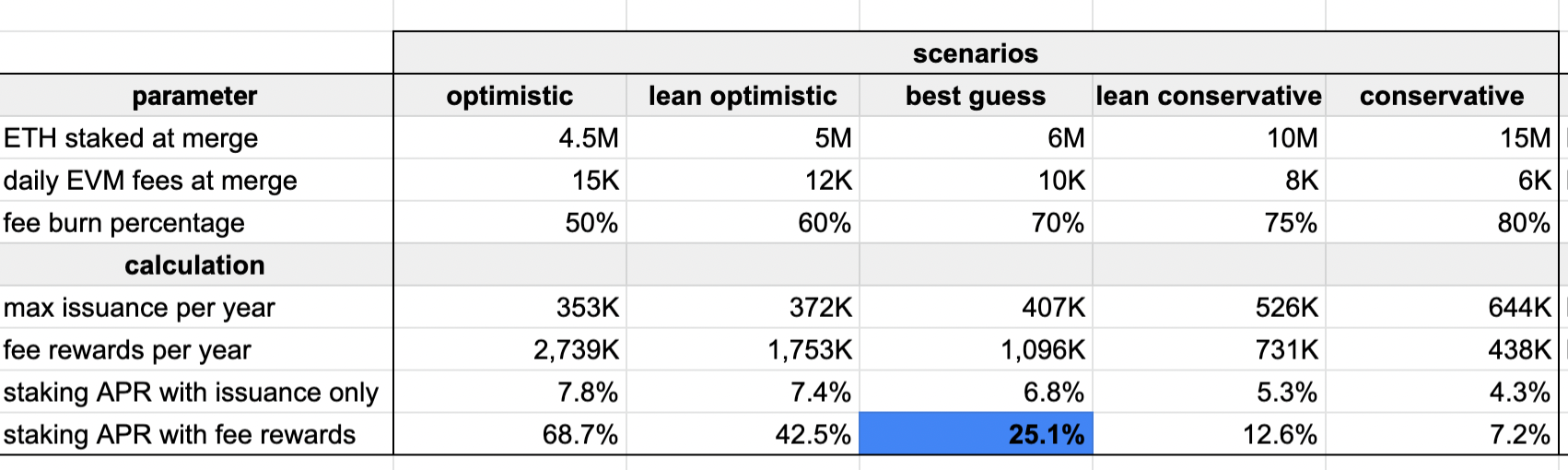

What happens to ETH staking APR after these events? Remember: post merge ETH stakers get to collect both issuance and fee rewards.

Here’s Justin’s model:

With ‘best guess’ assumptions we end up with an ETH staking APR of over 25%.

This means ETH stakers receive 25% annual returns, in ETH terms, while the global Ethereum network only experiences a max of 0.3% ETH annual issuance.

25% YoY returns to stakers. 🤯

Now a 25% ETH APY will not last long…it’s too lucrative. Especially when you consider the decreased execution risk and a stronger narrative post-delivery of these ultra sound upgrades. New stakers will pile in fast.

But the way the 25% APY gets arbitraged down is by net buying pressure on ETH.

People who want exposure to this 25% APY need to buy more ETH. The 25% APY gets arb’ed down by new buying demand on ETH. In the long term, maybe we only have 5% ETH APY from staking, but ETH will likely be priced significantly higher as a result.

Justin summarized this effect nicely:

more rewards → more staking → more economic security.

The more fee rewards (and there are a lot of fee rewards), the more incentive to stake (to access these fee rewards), which leads to more economic security for Ethereum.

Enough rewards to live on?

Living off staking rewards

If you don’t need the money, if you’re not trading the tops and bottoms, and if you believe in the long-term of ETH as a new form of money—why sell when you can stake?

As the internet bond of a new self-sovereign economy, staked ETH is a productive asset with three magical properties: it’s scarce, dependable, and permissionless.

1) Scarce

The returns of staked ETH are denominated in ETH—a non-sovereign ultra sound money. No other bond, no other productive asset in the world produces returns denominated in a digitally scarce commodity money. If you believe we’re in a late stage fiat credit cycle, ETH is the type of asset you want to stake, stack, and hold.

2) Dependable

ETH rewards are paid to validators no matter what. Whether the Ethereum economy is hot or cold, growing or contracting, ETH issuance to compensate for security is secured at the protocol level. ETH stakers are guaranteed to be rewarded in ETH. While Ethereum cannot guarantee a specific market value for ETH, it can guarantee that its security providers are going to get paid.

3) Permissionless

No one stands between you and the Ethereum protocol. You don’t have to ask permission to access ETH rewards. You don’t have to wait for someone to sign your monthly paycheck, or for the funds to clear, or for creditors to be paid. ETH produces rewards for its stakers every block, and that ETH goes directly to the staker with no other dependency.

Aside benefit of this strategy is that you never have to pay capital gains taxes on your ETH principle. Never sell your ETH, you never pay capital gains tax.

Not for everyone…

The #neversell option isn’t crazy…but it isn’t for everyone.

If you have fiat goals, need the cash, want to decrease risk, like to trade cycles, or have something to buy—create a sell plan of some kind.

There’s always the possibility Ethereum fails.

There’s the possibility this whole crypto thing doesn’t pan out.

It’s smart to protect yourself from downside.

And of course you can mix strategies! You can sell some without selling it all.

Here’s the takeaway: ETH isn’t an asset like stocks or bonds. It’s a base layer store-of-value with digital scarcity. It’s becoming more financialized, more sound. It’s a productive asset. It generates ETH denominated returns and those returns are about to increase dramatically over the next 12 months.

Why would you sell your golden goose? Keep the goose—sell the eggs!

- Ryan & David