How to protect yourself from impermanent loss with Bancor

Level up your crypto finance game five times a week. Get on the Bankless Program.

Dear Bankless Nation,

Impermanent loss is one of the biggest drawbacks for AMMs.

One minute you’re providing liquidity to a pool earning a juicy APY in swap fees, the next you see you’re losing money due to volatility between the assets you just provided!

This is an LPs worst nightmare.

And solving the impermanent loss problem is no easy task. We’ve seen different attempts over the past year—different pool weights or single sided liquidity, nothing quite works.

Some smart people are pretty certain it can’t really be eliminated. But are they right? Or can we eliminate a major deficiency in one of DeFi’s biggest innovations?

Bancor takes their shot here. Read this tactic and decide for yourself.

Here’s how you can protect yourself against impermanent loss with Bancor.

- RSA

P.S. Ohh…the first Bankless Art was just released to our Collection—buy the Moloch Slayer! There can only be one! Might be sold by the time you read this.

🙏 Sponsor: Zerion – Invest in DeFi from one place. 🚀 (I use this app daily - RSA)

We just released episode 20 of State of the Nation!

📺 Watch State of the Nation #20: HARDENING w/ Demian Brener of Open Zepplin

Harvest Finance exploit, the definition of ‘trustless’, and Open Zepplin’s DEFENDER

We’re now live streaming State of the Nation—join us at 2pm EST every Tuesday!

TACTICS TUESDAY

Tactic #62: How to protect yourself from impermanent loss with Bancor

Guest Writer: Nate Hindman, Head of Growth at Bancor

Bancor is an on-chain liquidity protocol based on automated market makers (AMMs).

Unlike other AMMs like Uniswap or Balancer, Bancor uses its protocol token, BNT, as the counterpart asset in every pool. With last week’s introduction of Bancor v2.1, BNT evolved into an elastic supply token. This new protocol functionality allows Bancor to offer two key features to AMM liquidity providers: single-asset exposure and impermanent loss insurance.

Users who provide liquidity to Bancor pools can stay long on their tokens while collecting swap fees and liquidity mining rewards, without having to live in fear of impermanent loss.

This tactic will cover how you can provide single-sided liquidity and protect yourself from impermanent loss.

- Goal: Provide single-sided AMM liquidity with impermanent loss insurance

- Skill: Beginner

- Effort: 5 minutes

- ROI: Depends on the pool

What’s new with Bancor v2.1

While enormously successful, AMMs present two well-known points of friction for users who provide liquidity with the intention to generate yield from swap fees and mining rewards.

The first is that LPs must take on exposure to every asset in an AMM. This involuntary token exposure leads to an issue known as impermanent loss (IL), whereby normal price movements cause an LP to be worse off than if they simply hold the pool’s assets on their own.

The crypto industry has been collectively banging their heads against the wall trying to understand and mitigate impermanent loss. Orderbook maximalists point to IL as the underlying flaw of AMMs and evidence of their toxic order flow.

Some AMM designers have attempted to use variable reserve weights (e.g., 95/5 pools vs. the more efficient 50/50 weights) to minimize IL, only to find the resulting high slippage rates reduce trade activity and, in turn, profitability. Other AMM designers have largely written off IL as “unsolvable”, hoping that fees and mining rewards will exceed such losses. In some cases they do, but in many cases they don’t, especially as mining rewards inevitably dry up.

In an effort to solve this issue, Bancor piloted a dynamic weighting system earlier this year that utilized oracles in order to mitigate the risk. The strategy was quickly adopted by several newer AMM protocols. However, we soon found (and have since seen our peers discover) that adjusting weights based on a price feed actually increases the risk of IL in certain market conditions, due to arbitrageurs moving faster than any price feed can update the pool.

In Bancor v2.1, we decided to take a different approach. What if we could eliminate impermanent loss for LPs by shifting the risk to the Bancor Protocol?

What if we allowed the protocol’s owners—BNT holders—to not only manage the risk, but also participate in the upside via swap fees collected by the protocol. By diversifying the risk of impermanent loss across a wide array of pools, we could potentially deploy a system where the revenue from swap fees exceeds the network-wide cost of IL insurance.

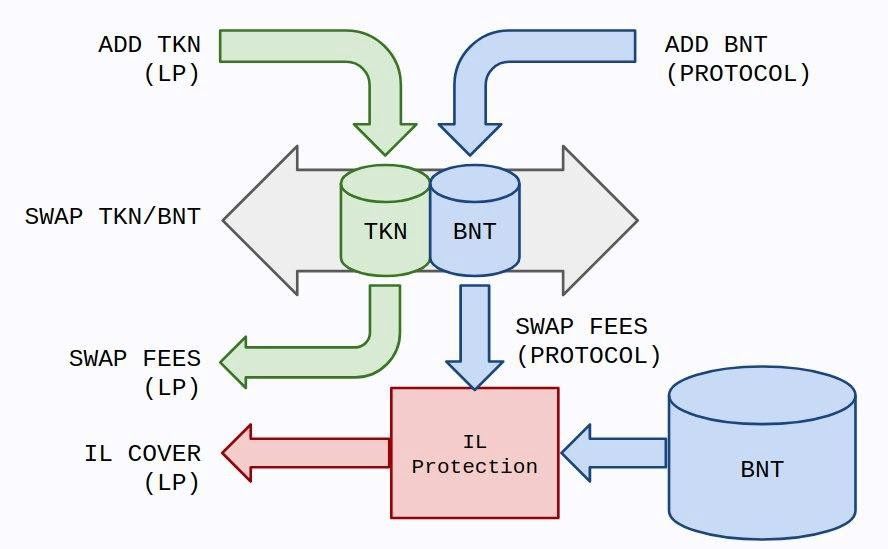

This is effectively how Bancor v2.1 works. The protocol co-invests BNT alongside liquidity providers so when an LP supplies liquidity to a given pool, the protocol provides an equal value of BNT to the other side of the pool.

The protocol generates fees off this liquidity, which are eventually burned along with the co-invested BNT whenever the LP withdraws their liquidity. The burned fees are used to compensate the LP for any impermanent loss on their stake when they withdraw, while any excess burned fees are used to reduce the overall supply of BNT (benefitting all BNT holders).

Notably, a BNT holder can always provide their BNT to a pool, which effectively takes over the protocol’s position in the pool and burns the co-invested BNT along with its earned fees.

For both LPs providing the “risk” asset (i.e., single-sided ERC20 liquidity), protection against impermanent loss accrues over time. The longer you remain in the pool, the more IL insurance you earn. The system’s default settings have LP’s impermanent loss insurance growing by 1% each day until they reach 100%, and are fully protected thereafter.

Keep in mind you can withdraw liquidity at any time, you just may be exposed to some IL—for instance, withdrawing liquidity 30 days after staking would result in 30% coverage against any IL.

🧠 Learn more about the mechanics of Bancor v2.1 or level up with an economic analysis of Bancor v2.1

In general, these mechanics are designed to increase the profitability and predictability of AMMs. If impermanent loss is fully covered by the protocol, then it’s not eating into the value of your fees or mining rewards. As a result, Bancor LPs are able to generate higher, more reliable ROI on their collected swap fees and rewards.

Moreover, the design aims to make AMM liquidity provision less chaotic and more deterministic in nature. This would mean no more misleading APYs that look juicy on the way in but paltry on the way out.

The aim is to introduce a “set it and forget” AMM solution, so lazy liquidity can actually be lazy.

How to provide single-sided liquidity on Bancor

Here’s a step-by-step guide on how to provide single-sided AMM liquidity in Bancor v2.1 so you can start earning swap fees and collecting impermanent loss insurance.

❗Note: Bancor v2.1 recently went live and the screens below are evolving, with new features and additional data being added in the coming days and weeks.

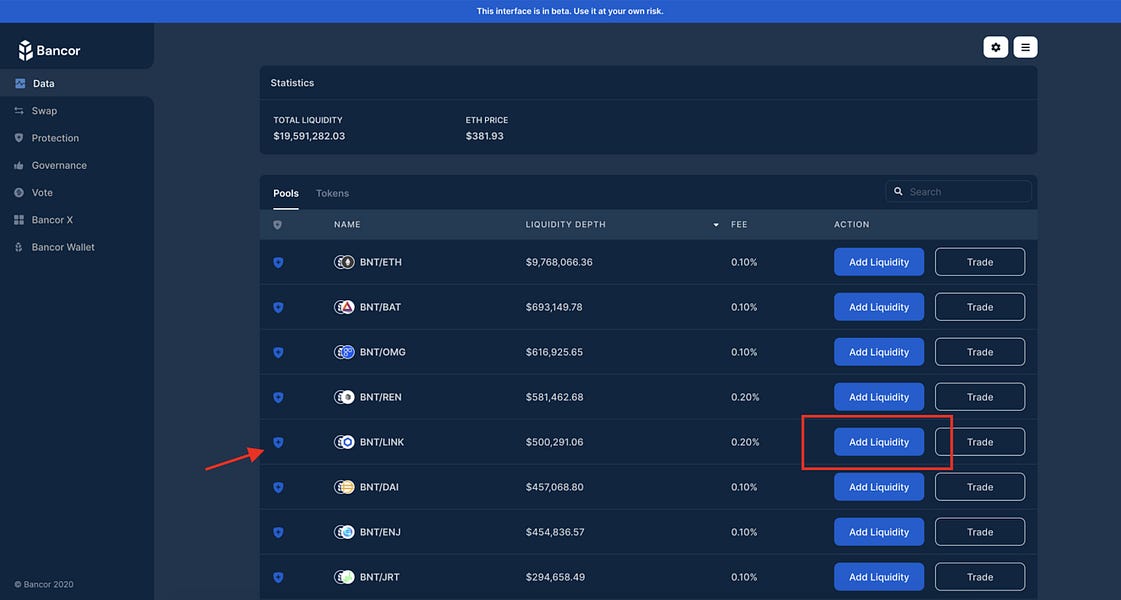

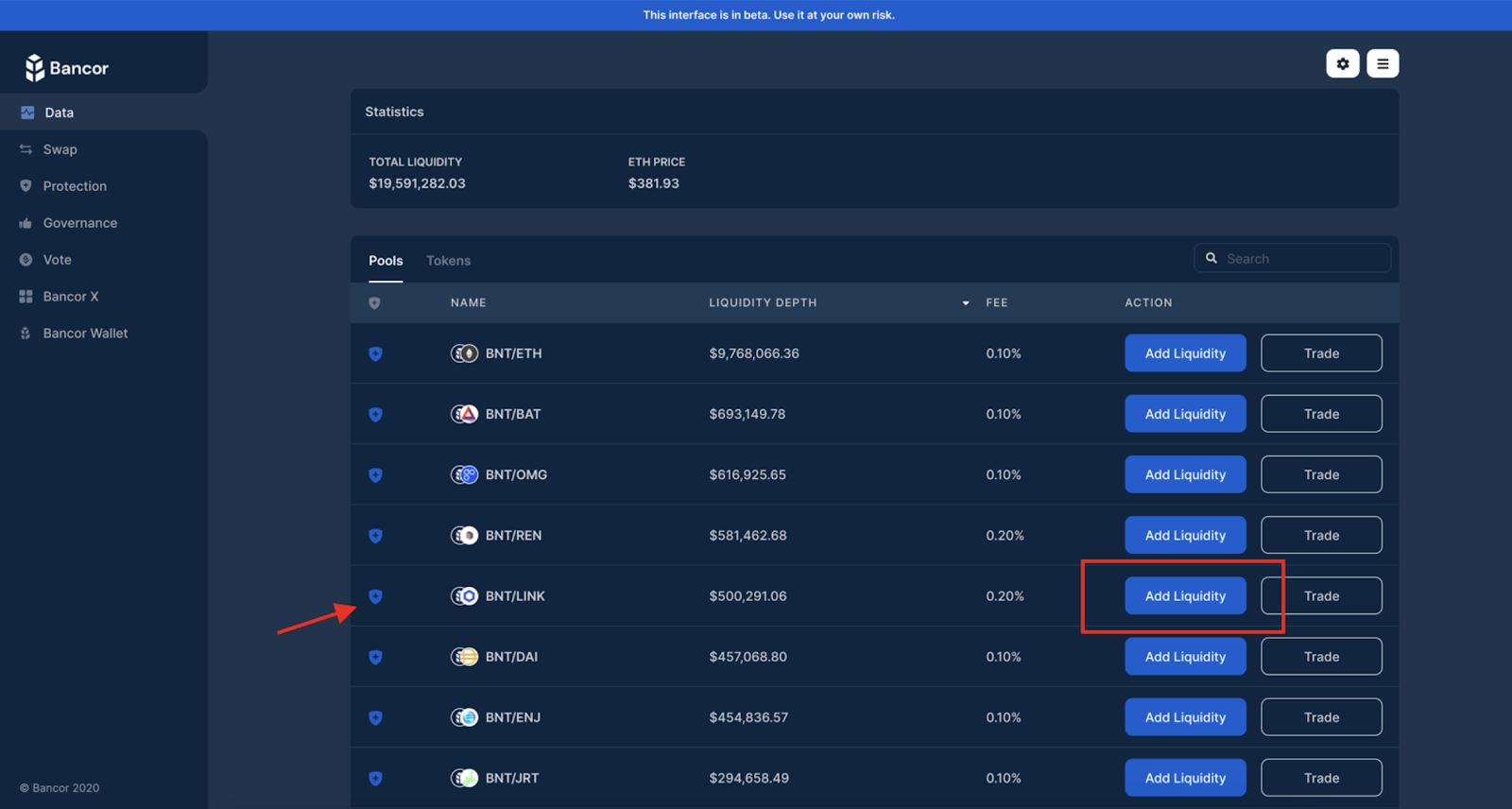

Step 1: Go to bancor.network, find a pool to join and click “Add Liquidity”. The blue shield to the left of each pool indicates if a pool is “whitelisted” and therefore protected against impermanent loss and available for single-sided staking.

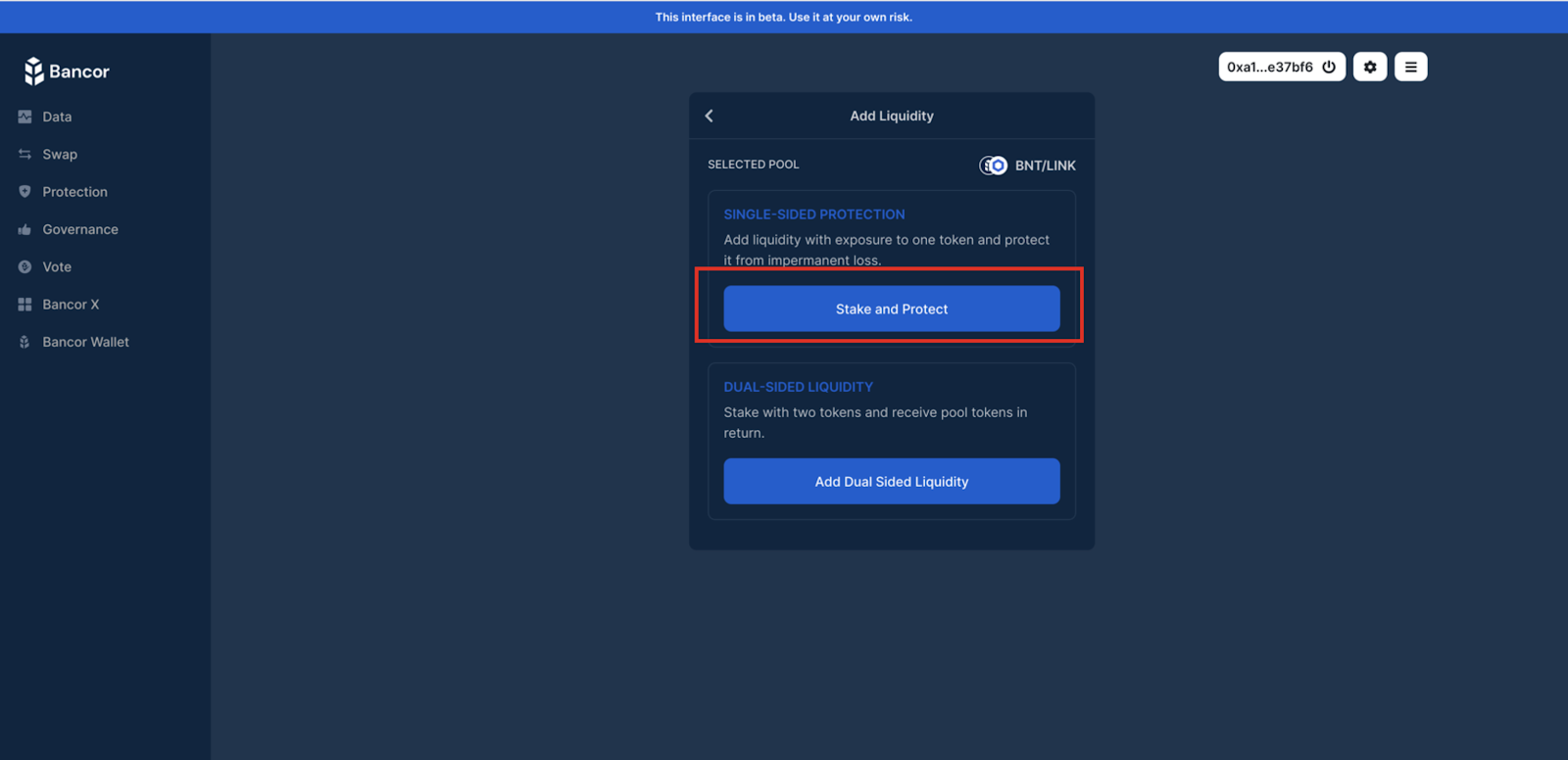

Step 2: Under the Single-Sided Protection option, click “Stake and Protect”.

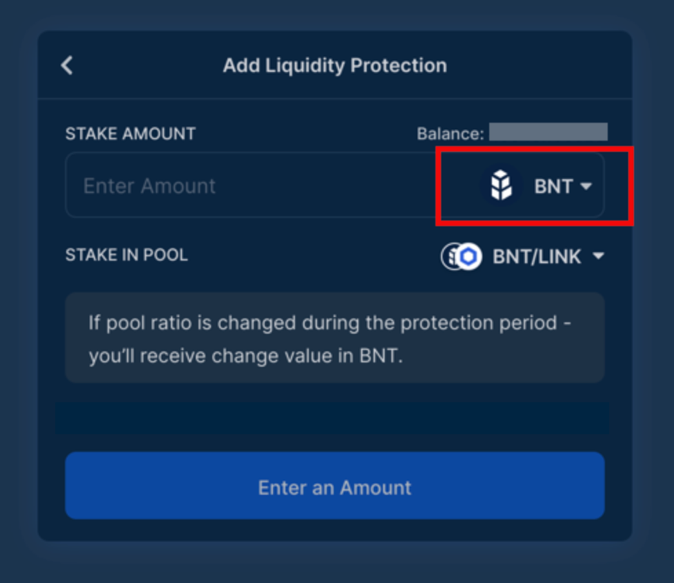

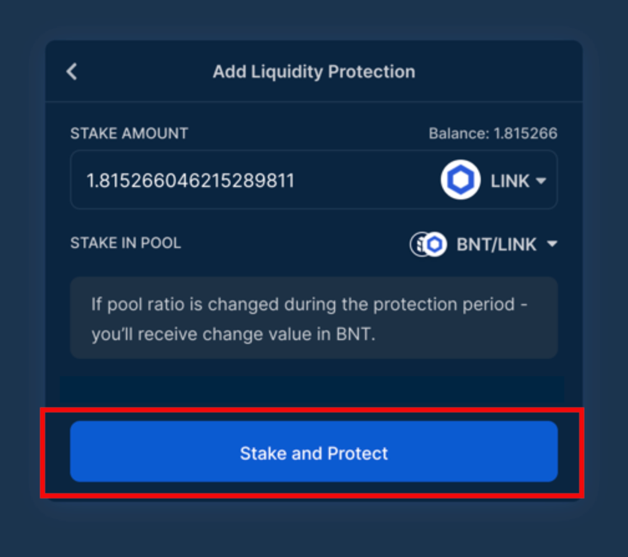

Step 3: Select if you want 100% exposure to the ERC20 token (in this case, LINK) or BNT. Click the dropdown menu to toggle between BNT and LINK. Input the amount of tokens you wish to provide. Clicking “Balance” will select the full balance.

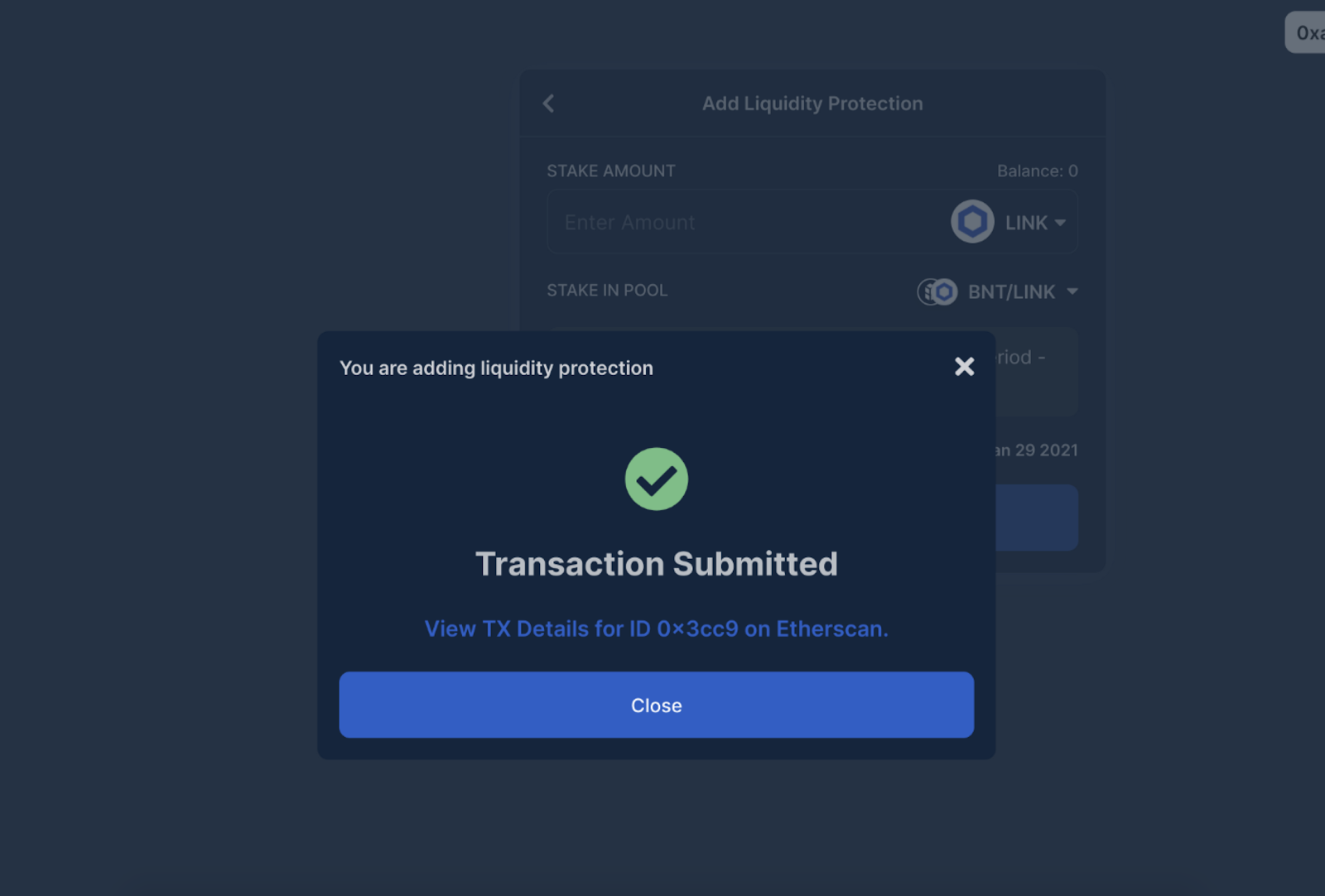

Step 4: Click “Stake and Protect” and confirm the transactions in the app and in Metamask (x2).

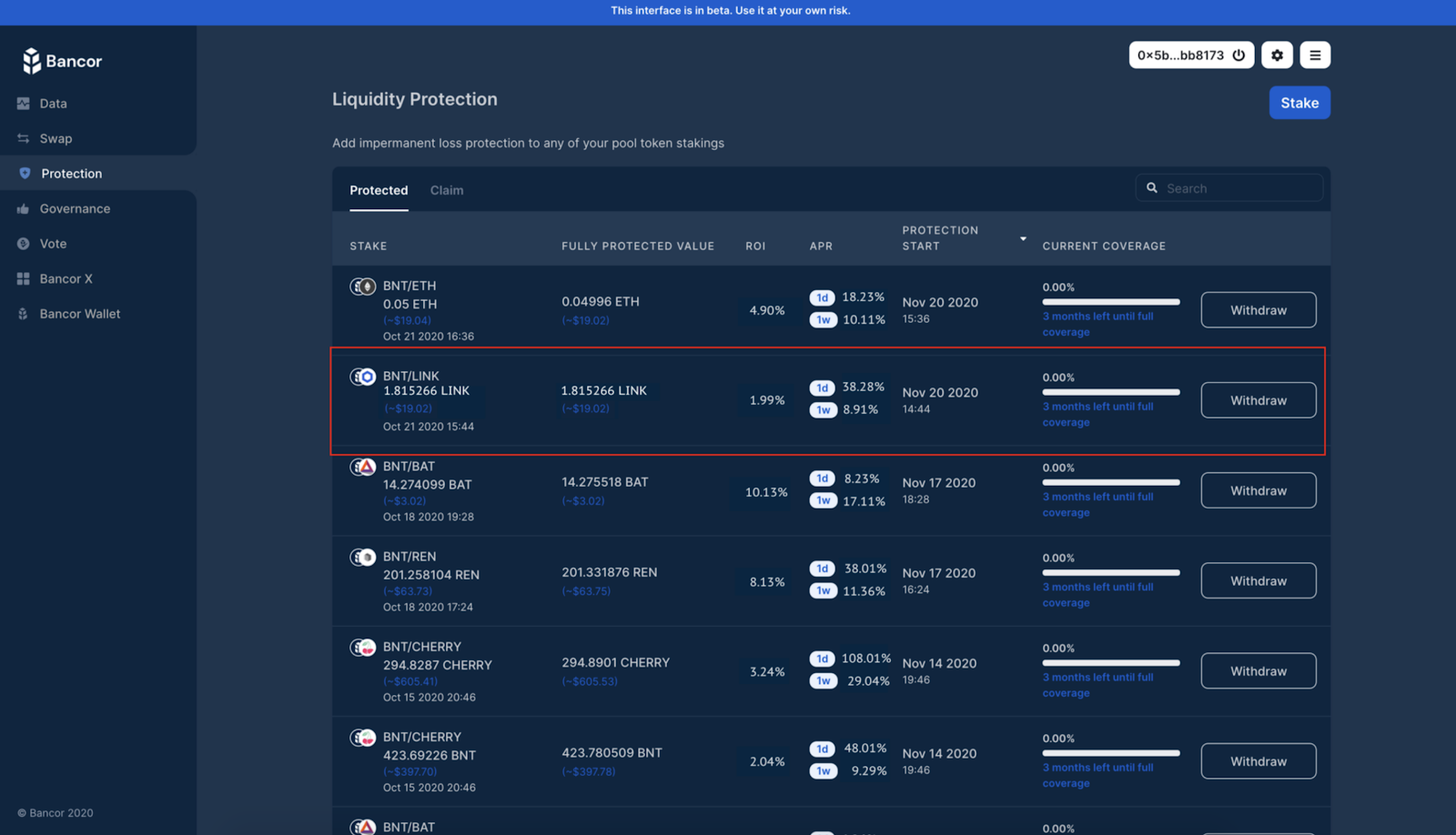

And that’s it! Once the transaction confirms, your protected single-sided liquidity stake should now appear in the Protection screen. If it doesn’t, click refresh!

The ROI indicates your individual returns, while APR indicates the overall pool returns for all LPs based on 1 day and 7 days of activity.

Wrapping up

Bancor’s new AMM solution attempts to eliminate one of the biggest drawbacks with AMMs today—impermanent loss. By introducing an elastic supply token, Bancor can diversify the risk across multiple stakeholders and provide IL insurance to all liquidity providers.

If you’d like to learn more about Bancor v2.1, read up on the write up here!

Have questions? Contact us on Telegram or Discord

Action steps:

Provide liquidity and collect impermanent loss insurance with Bancor

Read up on Bankless resources covering AMMs:

Author Bio

Nate Hindman is Head of Growth at Bancor Protocol. Prior to joining the project in 2018, he was a financial journalist and marketing lead at several mobile Internet startups.

Go Bankless. $12 / mo. Includes archive access, Inner Circle & Deals—(pay w/ crypto)

🙏Thanks to our sponsor

Zerion

Zerion is the easiest way to manage your DeFi portfolio. Explore market trends, invest in 170+ tokens, view returns across wallets and see your full transaction history on one sleek interface. They’re also fully bankless, which means they don’t own your private keys and can’t ever access your funds. I use this app daily! Start exploring DeFi with Zerion on web, iOS or Android. 🔥

- RSA

P.S. Don’t forget to get check out Zerion’s new Uniswap integration. 🦄]

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.