How to take out a self-repaying loan

Dear Bankless Nation,

We’re only scratching the surface of what’s possible with programmable money.

Right now, DeFi is heavily skeuomorphic. Skeuomorphism happens when the first versions of digital systems closely mimic their analog counterparts—kinda like how early newspaper websites resembled actual physical newspapers.

Applying old models to a new paradigm is how new tech starts.

But what happens when we approach programmable money with a blank slate—when we move beyond the past and ask what’s possible is this new medium?

Alchemix is one of these protocols taking the concept of programmable money to new levels. They’ve exploded onto the DeFi scene too. In two short months, the protocol has accumulated over $1 billion in value locked and $400M in liquidity across its stablecoin pools.

So what is it?

It’s a protocol that allows yield to time travel. You deposit money in, the protocol puts your money into a yield farm, and you get all of the future yield up front in the form of a synthetic dollar loan.

And then you can do what you want with the money—use it for car repairs, pay off a mortgage, or ape into the latest Uniswap gem. (Maybe just buy more ETH)

The crazy part? Your loan auto pays itself back overtime. 🤯

That’s right: you don’t actually have to pay back the loan. 🤯🤯🤯

What dark magic is this???

This the future of finance folks.

Let’s level up on self-paying loans with Alchemix.

If you still have questions bring them to our Alchemix AMA tomorrow at 1:30pm EST.

- RSA

P.S. Need a good way to get your friends into DeFi? Check out the new Dharma app. Go from a U.S. Bank account to Aave in a few taps—it’s 🔥🔥🔥

📺 Full episode of State of the Nation drops later tonight!

Tune in for ultra sound money pt. II w/ Justin Drake featuring a complete excel model for it!

Tactic Tuesday

Guest Writer: Scoopy Trooples, Founder of Alchemix

How to take out self-repaying loans with Alchemix

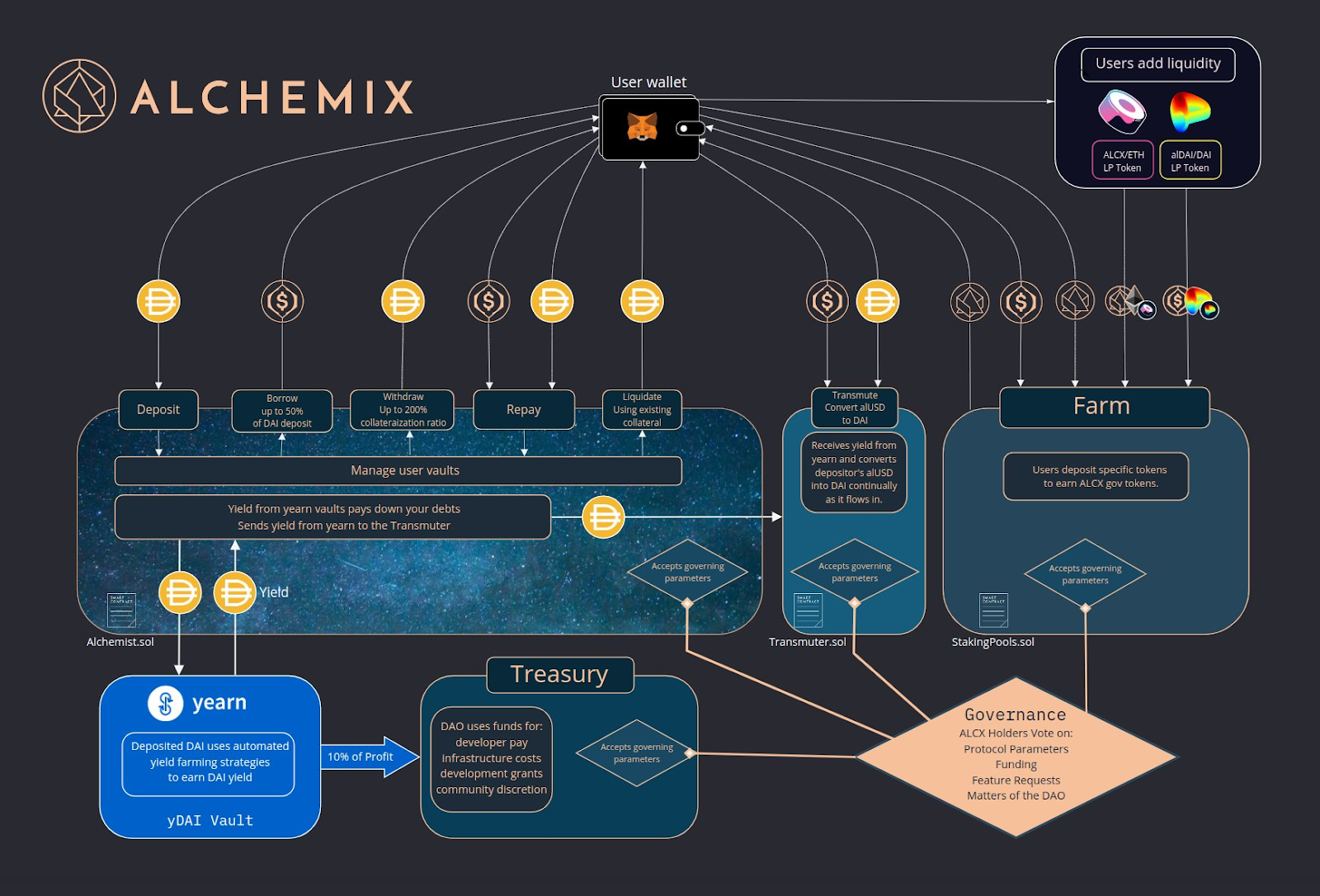

Alchemix is a new DeFi protocol that allows you to take out highly flexible loans that pay themselves off over time. The protocol effectively gives you an advance on your yield farming rewards in the form of a loan in alUSD, the protocol’s native stablecoin, which is then used to pay off the loan at the current variable rate of APY (at the time of writing above 25%).

This tactic will show you how Alchemix works and how you can use it to take out a self-repaying loan—it’s free money!

- Goal: Take out a loan that repays itself

- Skill: Intermediate

- Effort: 15 mins

- ROI: A free loan (sort of!)

📺 To get a quick understanding of how Alchemix works, check out this <1 min video!

WTF is Alchemix?

DeFi offers more efficient, fair and secure parallels to what currently exists in the legacy financial world. While this is invaluable, have you ever wondered what might be possible with infinitely programmable money? Like what if we created a way for yield to time travel?

That’s kinda what Alchemix does. The platform virtually allows you to travel into the future and collect the yield you would earn after staking your assets for a long period of time and redeem those yields in the form of a loan. The truly magical part is that by the time that future becomes ‘the present’ your loan would have paid itself back.

By depositing fund into Alchemix, you’ll be offered a loan of up to half the amount delivered in alUSD with minimal counterparty risk (there’s still smart contract risks though!!). From there, you can immediately convert into stablecoins and spend on whatever you want—whether it’s to self-finance your spending, ape into the latest yield farm, or start earning passively elsewhere.

What makes Alchemix unique?

Using this sorcery you can now take advantage of completely flexible loans that come without any fees or risk of liquidation. You literally cannot lose (unless there’s a smart contract bug). So in a nutshell, Alchemix was created because it offers revolutionary debt that doesn’t weigh heavy on the shoulders of its debtors.

It’s a new world order where debt is no longer a negative thing.

One of the most compelling side-effects Alchemix creates is promoting healthy money management habits for its users. It encourages users to save first then borrow against their collateral in a risk free way. This continuous offer only promotes adding to the users savings (in the form of their Alchemix deposit), since the bigger the deposit, the more free and regenerating debt the system issues out.

What’s exactly happening behind the scenes?

Alchemix allows you to take out an advance on your yield from Yearn’s V2 DAI vaults in the form of a dollar soft-pegged synthetic token, alUSD. This means that alUSD is technically backed by the Yearn vault’s future yield

The protocol allows you to borrow up to half the amount of DAI you deposit. For example, depositing 1000 DAI allows you to borrow up to 500 alUSD. The DAI you deposit is then put to work earning yield in Yearn—to repay your alUSD debt gradually over time.

✍️ Writer’s Note: At current rates, a max loan takes between 1.5 and 2 years to be completely repaid.

What can I do with Alchemix debt?

What you do with your yield advance is up to you!

Many people end up yield farming with it to earn yield on their future yield while their deposits are still earning yield. Yes…you should be confused by that. 🤯

Others will use it like any other normal DeFi loan and use it as leverage (like buying more ETH or speculating on a new Uniswap gem).

But perhaps most interestingly, some anecdotal stories have been showing how it can be used in real life finance. For example, various people have used Alchemix alUSD loans to finance boats, cars, down payments for their homes, hospital bills, college tuition, credit card debt, dapp projects, and managing personal finance.

Jerry’s Car Trouble

Many people ask why take an Alchemix loan. Imagine Jerry.

He has $1,000 saved up. But one day Jerry’s car breaks down and he has to pay $500 to fix it. Rather than forking out half of his savings to pay for the repairs, he uses Alchemix instead.

He deposits his savings of 1,000 DAI and borrows the 500 alUSD and fixes his car. Assuming an interest rate of 25%, in two years, he will have no more alUSD debt and will be able to withdraw his full $1000. If he were to have paid $500 out of pocket and then put the remaining $500 in DeFi, again assuming a 25% interest rate, he could make ~$280 interest in two years.

In the scenario where Jerry used Alchemix, after two years he’d have a fixed car and $1000. If he hadn’t used Alchemix, he’d have $780 and a fixed car.

Using Alchemix resulted in Jerry having $220 more principal than he would have if he paid for his car out of pocket. Taking an Alchemix loan to finance purchases will always result in a better outcome than paying using cash out of pocket (assuming yields stay high).

How does the yield compare to the rest of DeFi?

Thanks to one of Alchemix’s key features, the Transmuter, APYs are significantly higher to those offered by DeFi blue chips like Yearn, Compound or Aave.

The Transmuter is a simple exchange interface where you can convert your freshly borrowed alUSD into Dai at a fixed 1:1 ratio. This offers users an alternative to exchanging using Curve should alUSD fall below its peg to the dollar.

This transmutation from alUSD to Dai isn’t instant however, it takes a little time—that’s the trade off for a guaranteed 1:1 swap rate. All users of Alchemix’s borrowing facility benefit from this however, since Dai held by the Transmuter goes to work repaying everyone's loan that bit quicker.

Currently, there is over 190m DAI in the transmuter and over 140m DAI in the DAI vaults. When added together, it brings the effective principal 330m DAI. We can offer around 30% APY because the DAI held in the transmuter is also earning yield in Yearn, and when this yield gets passed onto our DAI depositors, it boosts the APY earned by DAI deposits from ~13% to around 30%. Pretty cool right?

So now that you have some idea what you can do with Alchemix, let’s get into the how.

📺 If you’d like a guided video tour through the interface then watch this:

How to use Alchemix

Below we’ll run through how to use Alchemix and the steps involved with taking out your first self-repaying loan.

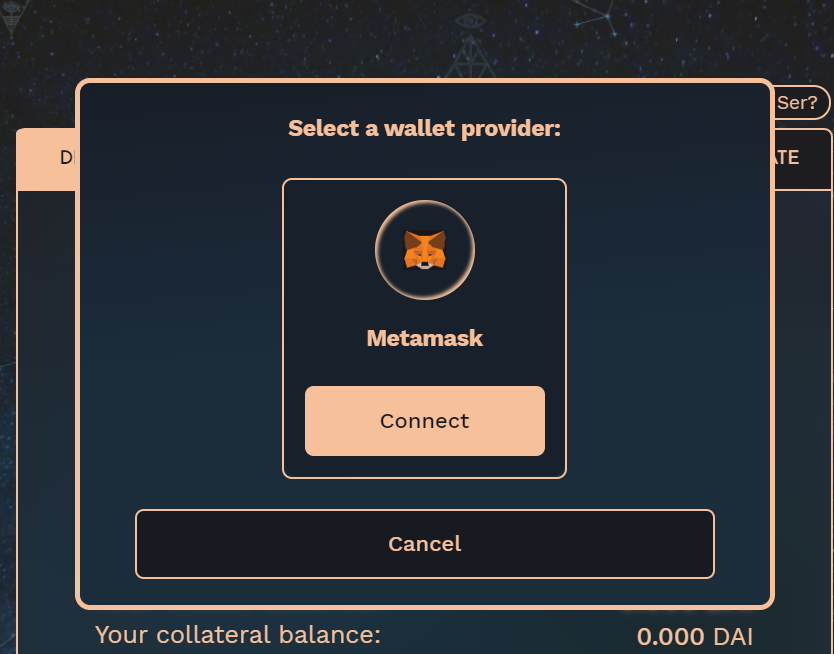

- The first step is to make sure you have a Metamask address with ETH and DAI in it!

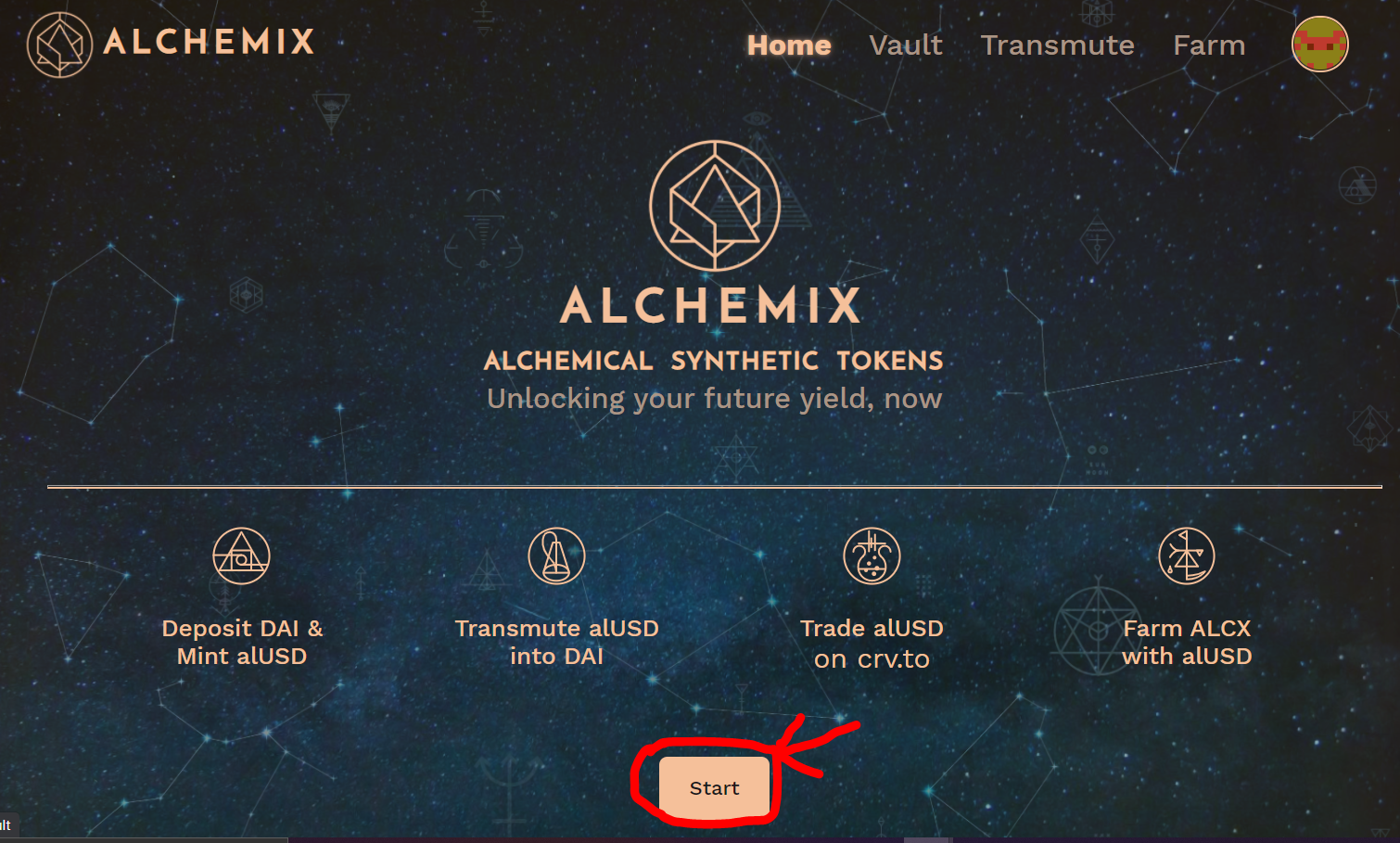

- Go to https://app.alchemix.fi/ and click on the Start button.

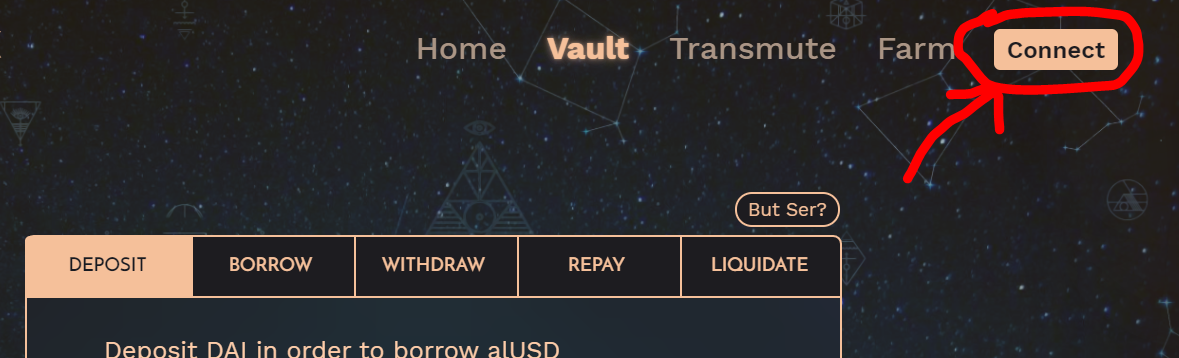

- Now that you are in the vault page, click the connect button on the top right and then sign into your Metamask wallet

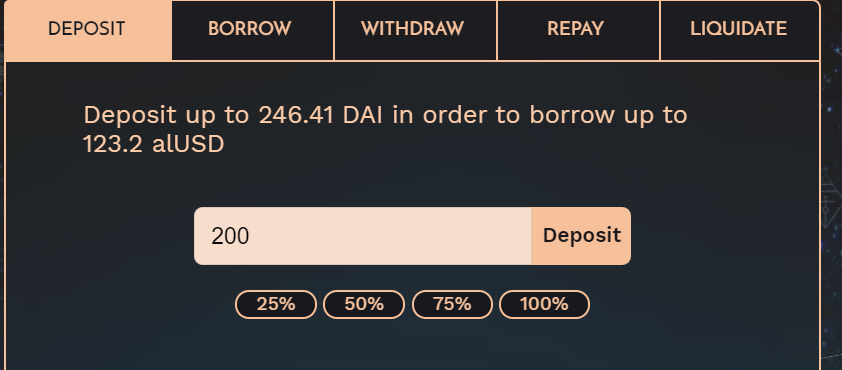

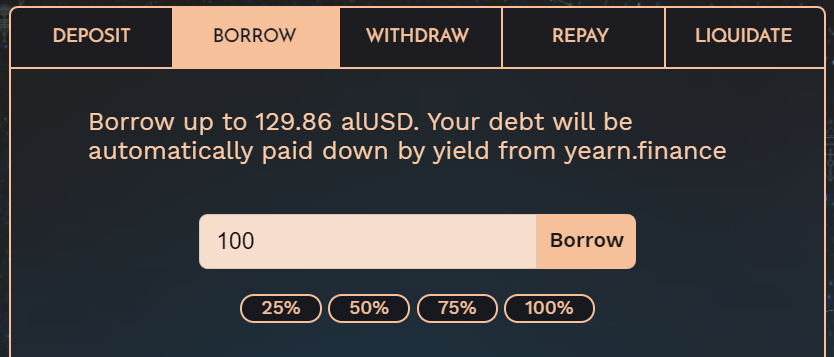

- On the vault page, input the amount of DAI you wish to deposit. Hit the deposit button and confirm the transaction in Metamask. Remember, you can take out a loan for up to 50% of the amount of DAI you deposit!

- Click on the Borrow tab, input the amount you wish to borrow, and confirm the transaction in Metamask.

Great, now at this point a user has alUSD in their wallet. Each time yield is harvested, the user's debt will automatically be paid off. Wait long enough, and the debt will vanish completely.

As your debt gets repaid, you can withdraw more and more DAI, until you can completely withdraw it all when the debt is repaid. Beware though, withdrawing your collateral will result in a longer debt repayment period. If a user wishes to repay early, they can always do so by repaying in alUSD or DAI. The Repay tab uses funds from a user’s wallet to repay their debt, whereas the Liquidate tab uses funds from a user’s DAI collateral to repay their debt.

What can you do with alUSD?

In addition to using your loan how you want, there’s also a few opportunities within the Alchemix ecosystem as well!

Option 1

The first option is staking alUSD in the Alchemix Farm to earn ALCX. Simply stake your minted alUSD into the alUSD pool on the “Farm” page of the app. ALCX rewards will accrue over time and can be claimed anytime.

Option 2

Another popular option is providing liquidity on https://crv.to/pool. After you approve your tokens and add liquidity to crv.to, take the ‘alUSD3CRV’ LP tokens to the Farm page on the app site and stake them there.

Rewards work just like they do in the alUSD pool, with ALCX claimable anytime.

Option 3

So you woke up feeling degenerate? Instead of aping into a Pool2, you can ape a bit more safely.

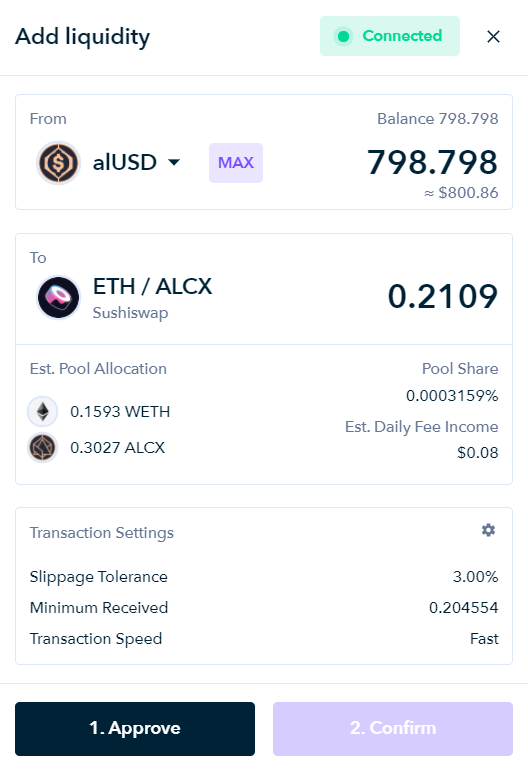

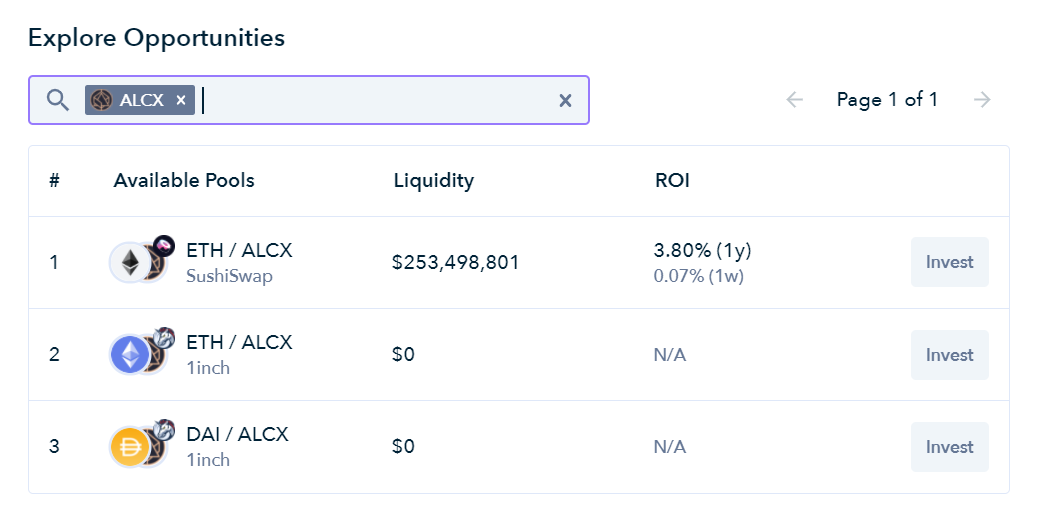

For this strategy, deposit DAI and max mint alUSD in Alchemix. Then go to Zapper.fi and connect your wallet. Navigate to the “Pool” tab and search for ALCX and select the ETH/ALCX pool. You can then take your borrowed alUSD and convert it to Alchemix’s high APY farm tokens, ALCX/ETH SLP, which is currently earning ~280% APY.

And then stake the LP tokens on the farm page:

Pool 2’s typically have a high risk to reward ratio, and if you buy into a pool 2 using Alchemix, your collateral will still be repaying your debt regardless of how well your risky investment goes.

So next time Andre releases his hot new project, ape in using an Alchemix loan…just in case :)

What’s Next

While V1 has been a huge success, Alchemix V2 is on the way! It’ll allow for multiple stablecoin collateral types as well as more flexibility in choosing your sources of yield.

The upgrade will also add alETH and alBTC loans, which will take ETH and different flavors of BTC on Ethereum as collateral. Just imagine taking a self paying ETH loan on your ETH! One of the more interesting parts with V2 is the improvement in composability with other protocols, allowing the Alchemix ecosystem to expand into the larger DeFi ecosystem and open up entirely new use cases and models. There’s also rumors of a Layer 2 launch as well…

Lastly, Alchemix DAO is shaping up for a full launch with various upgrades, including on-chain governance and revenue streams for ALCX holders (it’ll also be on Layer 2!)

The future of programmable money is looking bright. And we’re only getting started.

We can’t wait to hear all the unique ways the Bankless community uses Alchemix!

Action steps

- Take out a self-paying loan with Alchemix

- Get ready for tomorrow’s AMA with Scoopy Trooples. Starts at 1:30pm EST!

Author Bio

Scoopy Trooples is a tech and future enthusiast and the founder of Alchemix, a next generation yield protocol enabling self-repaying loans.