Dear Bankless Nation,

Metagovernance is an up-and-coming topic to level up on.

In short, metagovernance revolves around how DAOs use non-native governance tokens to vote on outcomes in other protocols.

The Curve Wars is a perfect example of this. Protocols want liquidity; Curve provides it.

One of the best ways to build liquidity on Curve is to accumulate veCRV, which provides the ability to vote on where CRV token emissions go.

As a result, other DAOs will accumulate a ton of veCRV to vote on directing the CRV rewards to their own pool.

Taking this a step further, DAOs will even bribe other people with more money to use their veCRV to vote on their pool.

This is what [REDACTED] Cartel—a new metagovernance protocol—is focused on with their product Hidden Hand.

REDACTED aggregates governance bribes across different projects for tokenholders. If you hold the protocol’s vote-escrowed token, you can vote on bribed proposals and Hidden Hand handles the rest.

And you can earn a pretty solid return on it.

Want to earn a governance bribe?

This is how.

- Bankless Team

How to use REDACTED Cartel

REDACTED Cartel is a metagovernance project that seeks to boost token rewards for its users by influencing DeFi governance matters. This Bankless tactic will demonstrate how to use Hidden Hand, REDACTED’s DeFi bribes marketplace.

- Goal: Learn how to use REDACTED’s Hidden Hand market

- Skill: Intermediate

- Effort: 30 minutes

- ROI: Yields from DeFi bribe payments!

Welcome to REDACTED Cartel

REDACTED Cartel — A fork of Olympus DAO — is a metagovernance DAO that launched in December 2021.

Olympus has used its protocol-controlled value (tokens owned by the protocol itself) to position its $OHM token as a reserve currency.

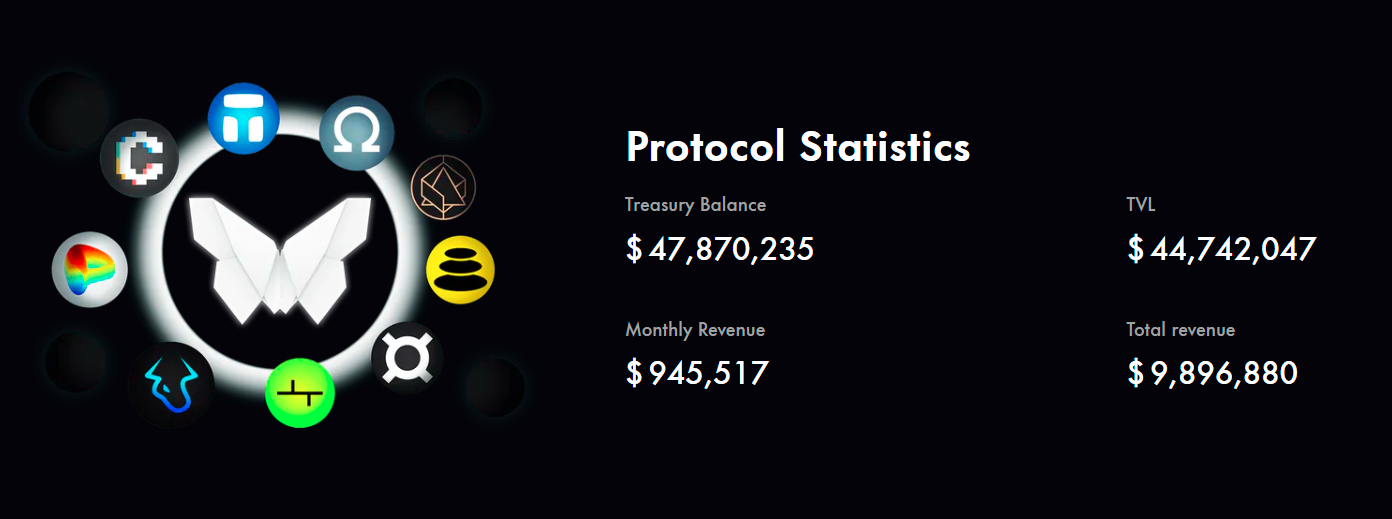

REDACTED uses its PCV token to “create and extract value through the incentivization of governance in DeFi.”

As such, REDACTED is a “metagovernance,” or governing governance, project. It’s designed to amass as much voting power as possible throughout influential DeFi protocols to — amongst other goals — boost rewards for its own users.

For example: The Curve Wars, in which protocols jockey to direct Curve’s $CRV rewards to their desired liquidity pools, have dominated the DeFi landscape since late 2020. Against this backdrop, REDACTED seeks to fill its treasury with tokens that are central to the Curve Wars, like $CRV and Convex Finance’s $CVX, so that the project can influence reward flows for its users.

💥 Catching up on the Curve Wars? See these Bankless resources:

So how does REDACTED actually accrue tokens for its treasury?

The answer to this question depends on which version of the protocol we’re talking about. V1 used a short-term, Olympus-like bonding approach to bootstrap the REDACTED treasury. V2 — amid a phased rollout right now — will pivot the project away from bonding in favor of ongoing revenues from governance bribes.

Understanding REDACTED V1 and V2

REDACTED V1 centers around bonding. This system allows users to provide the protocol with important governance tokens like $CRV and $CVX in exchange for discounted $BTRFLY, which is REDACTED’s rebasing governance token. A “rebase” token is a cryptocurrency that uses an algorithmic system to maintain its price.

The bonded assets became PCV in REDACTED’s treasury, so $BTRFLY can’t be redeemed for this PCV, but the token does offer holders governance exposure to a range of assets in, and a cut of the revenues generated by, the project’s treasury.

Notably, REDACTED V2, which is being rolled out in parts right now, will migrate from bonding and $BTRFLY rebasing altogether.

This is because V2 will instead rely on revenues from REDACTED’s newest offerings, like Hidden Hand and Pirex. In addition, if passed through governance, V2 will introduce new tokenomics with a fixed supply cap of 5M $BTRFLY. A new staking format will also allow holders to stake $BTRFLY into $glBTRFLY (governance-only benefits) or $rlBTFFLY (revenue-only benefits).

REDACTED Products

REDACTED is currently working on three main products: Racket, Pirex, and Hidden Hand.

Racket, which is still in development, aims to “stabilize DeFi governance networks by creating incentives for self-regulating behaviors” once live.

Further along is Pirex, which is due out any day now. Pirex will be the first DeFi platform to let people collateralize their $clCVX (vote-locked $CVX) to earn more from governance bribes, leverage their previously locked tokens, and so forth.

Lastly, there’s REDACTED’s Hidden Hand offering, which was soft launched in April 2022. The Hidden Hand is a veToken marketplace where protocols can bribe token holders to vote in certain ways in important DeFi governance matters.

This is where you can make the money.

How to use Hidden Hand

Hidden Hand is the first of REDACTED’s products to be available to DeFi, so we’ll focus on this platform and explore how you can try it out below.

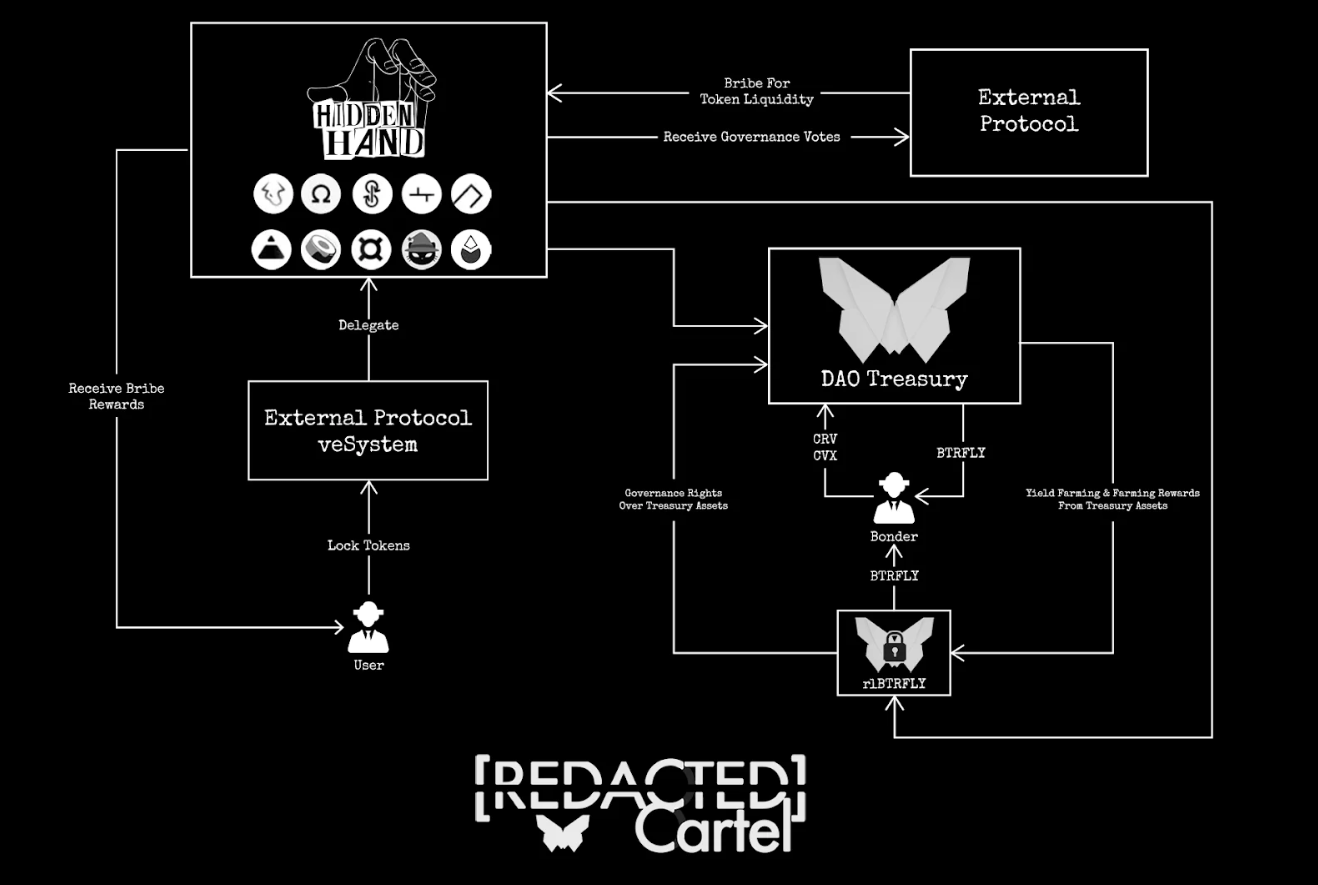

First things first, it’s good to have a bird’s-eye view of how the marketplace works. Toward that end, the REDACTED team have created this insightful visual explainer:

As you can see, there are three main processes that lie at the heart of the Hidden Hand. The first is external DeFi protocols coming to the marketplace to offer token rewards in exchange for voting rights, the second key process comes when veToken holders delegate their tokens in order to receive bribes, and the last process is the earmarking of transaction fees + profits for $rlBTRFLY holders.

REDACTED currently has voting rounds ongoing for DeFi projects Balancer, Frax, and Ribbon. The Balancer bribes are the highest-yielding opportunities at the moment, so I’ll focus on the DEX here.

To recieve bribes on Hidden Hand, we’ll need vote escrowed tokens. In Balancer’s case, that means we’ll need veBAL. You start by heading over to Balancer’s veBAL UI and following these steps:

- Click the “Get B-80BAL-20WETH” button and invest in Balancer’s 80-20 BAL-ETH pool to receive Balancer liquidity provider tokens (BPT).

- Navigate back to the veBAL UI.

- Input how many BPT you want to lock up and how long you want to lock them for. Note that the longest lock-up option, 1 year, will earn you the most veBAL.

- Press “Preview,” complete the approval transaction, and then complete the final lock-up transaction. After this, you’ll be credited with veBAL.

Once you’re ready with your veBAL, head over Hidden Hand’s Balancer page and connect your wallet. Then you could browse through the available bribe markets to find an opportunity that suits you. Once you’ve done so, click on your desired opp’s “Vote” button, at which point you’ll be redirected to Balancer’s external veBAL voting center.

Now, you’d scroll down to your chosen opp’s liquidity pool and press “Vote.” A UI will pop up where you can input how much of your veBAL voting power you want to use, e.g. 100%. Note, this vote will cost gas and your vote allocation will be locked for 10 days.

Voila! Hidden Hand will take care of the rest. At this point, you’d simply wait for the current voting round to end, and then another 1-3 days after that round ends for your bribes to come through.

After the dust has settled, head to the Hidden Hand “Claims” dashboard to accept your reward distributions. Just keep in mind that gas costs might outweigh your earnings, so this is something to watch out for.

Conclusion

Metagovernance is a surging theme in DeFi, and it’s central to REDACTED operations. Over time, the REDACTED community will coordinate via $glBTRFLY in a bid to become a kingmaker in the Curve Wars, the Balancer Wars, and so forth so that the project can offer optimized rewards, new sorts of governance infrastructure, DAO-to-DAO collaborations, and more.

Of course, REDACTED is barely six months old, but the project’s poised to become a DeFi force to be reckoned with if it can continue pulling off its vision.

Yet one can also envision how metagovernance matters may lead to flashpoints in DeFi if these sorts of infrastructure or newer projects are commandeered by more nefarious forces in the future. In the meantime, we’ll have to wait and see how things shape out, but REDACTED is definitely a prime gateway right now to this brave new world of metagovernance.

Action steps

- 🦋 Check out REDACTED Cartel

- 👀 Also check out our previous How to prepare for an Arbitrum airdrop tactic