WTF is Olympus DAO??

Dear Bankless Nation,

DeFi is a financial and monetary sandbox.

Anyone in the world has the ability to write code and spin up a new financial product that’s accessible to anyone with an internet connection. New paradigm.

A 14-year old kid in her parents basement can create a global lending and borrowing market or…if they’re extra ambitious, maybe build a new world reserve currency.

Experiments abound.

But a trustless world reserve currency? That’s the holy grail in crypto.

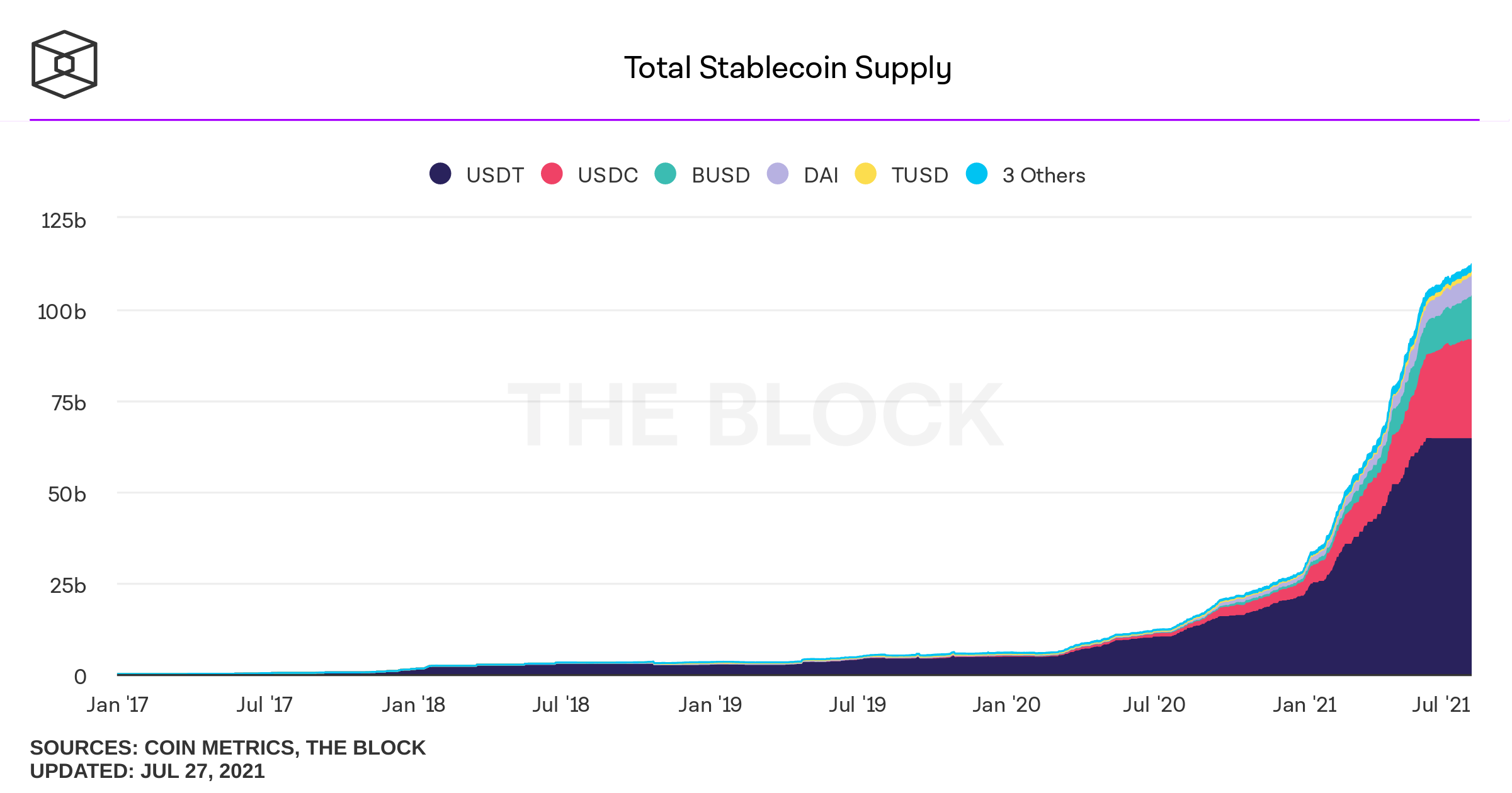

Crypto doesn’t want to rely on central banks, but we do still for quite a bit. I mean, there’s over $100B in dollar-pegged stablecoins circulating crypto right now.

Can we change that?

Olympus is one of the new DAOs on the block looking to create a currency to compete with the dollar. It’s native token, OHM, is a free-floating currency (meaning it’s not pegged to anything) backed by a basket of assets held in its treasury.

The project started 5 months ago, but it’s already poking its way into the top 10 stablecoins by market cap with $525M. Not only do they have a unique approach—they also have a passionate community.

You should know: there are many experiments in the DeFi stablecoin space and most of them will fail. Maybe all of them will fail. But there’s a chance some of them succeed. And for those that do…the prize is massive.

So it’s worth taking a look at Olympus.

Another fascinating monetary experiment powered by Ethereum.

- RSA

WTF is Olympus DAO?

The current state of DeFi is one of deep irony.

Despite being born out of the desire to de-dollarize, DeFi is highly dependent on dollar pegged stablecoins, with $97 billion of USDT, USDC, and DAI in circulation. While these assets are more stable than Bitcoin or Ether, they reintroduce the dependencies and risks of the fiat system we are trying to leave, such as inflation, and centralized, unaccountable monetary policy.

One project that is trying to solve this problem is Olympus DAO. Launched in March 2021, the protocol is aiming to design a non-USD pegged, stable asset.

It’s a project you may have heard of, as it boasts insanely high APYs, and profiles with (3,3) are all over twitter. It also may seem a bit strange as to why the price of a “stablecoin” like OHM has been anything but.

So... what’s the deal?

How does Olympus work?

Are the yields sustainable?

What on Earth is (3,3)?

That’s what this piece will explain and highlight why Olympus is quickly emerging as one of DeFi’s most interesting protocols.

What is Olympus & OHM?

Olympus is a protocol that is responsible for the issuance and management of a fully backed, algorithmic, free-floating stable asset, OHM.

That definition is a mouthful, so let’s break it down piece by piece.

Fully Backed

OHM is fully collateralized, as it’s backed by a treasury of crypto-assets that sit under the purview of the Olympus DAO, which is known as the protocol controlled value (PCV).

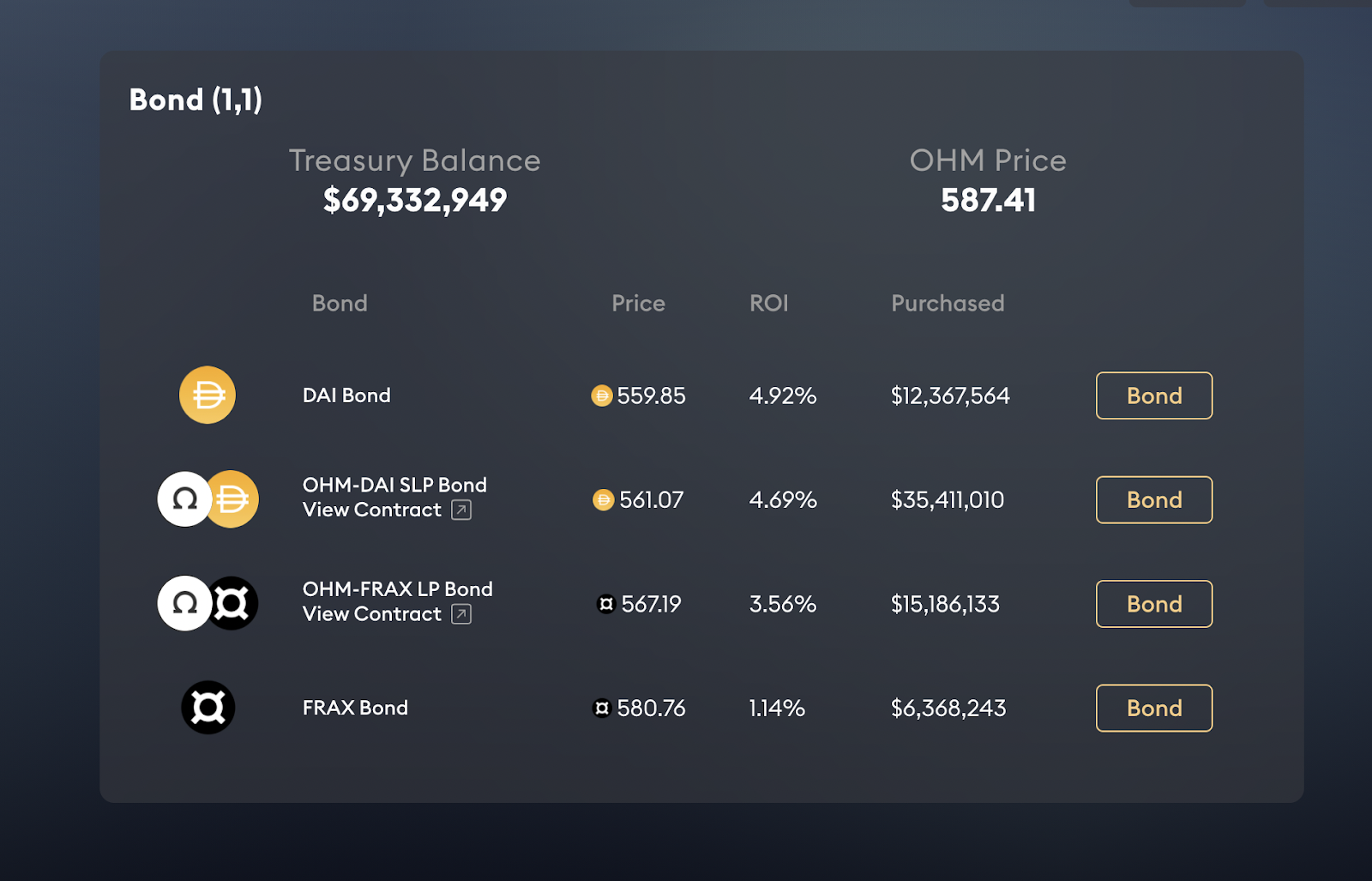

The DAO has decided that each OHM issued has to be backed by $1 in collateral, though this can be changed by a governance vote. Initially, this consisted of just DAI, with every OHM issued having 1 DAI in the treasury as its backing. However, the protocol has since expanded the treasury to include other assets, such as FRAX, another algorithmic stablecoin, as well as OHM-DAI LP tokens from SushiSwap, and OHM-FRAX LP tokens from Uniswap.

There are also active governance proposals to add ETH and BTC to the treasury. This means that now each OHM is now 2x backed from a mixture of these assets, rather than solely DAI.

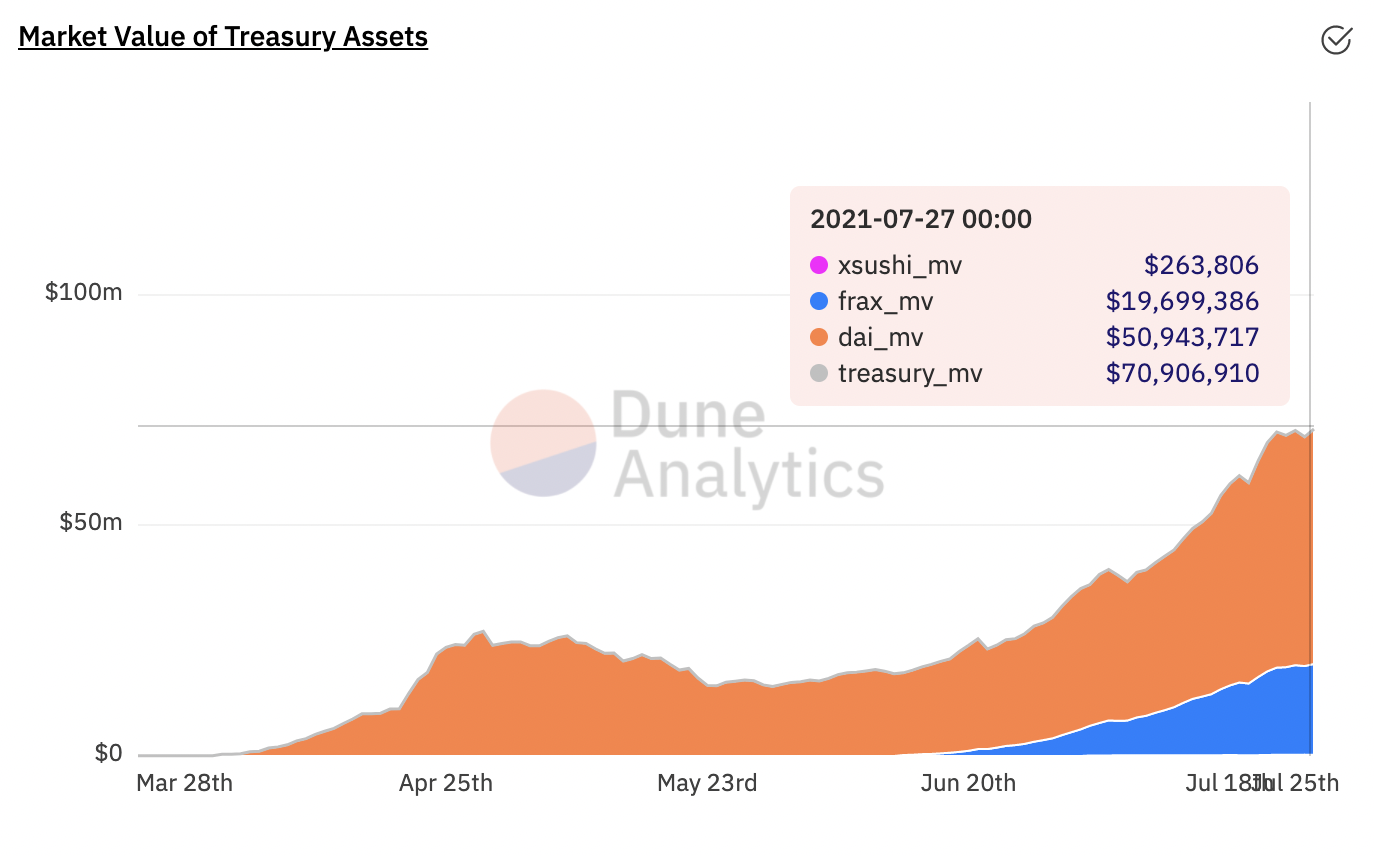

As we can see, the current value of the assets in the treasury sits at over $70 million, with its composition sitting at roughly 71.8% DAI, 27.8% FRAX, and 0.4% SUSHI, the governance token of SushiSwap accumulated from yield farming rewards (more on that later).

While Olympus has been compared to a private bank issuing its own notes, another interesting parallel that comes to mind is the Federal Reserve. As we know, in the fiat system, the Fed holds a variety of different assets, such as the US Treasury Bonds, gold, dollars, and foreign currencies, which they use to help conduct monetary policy.

Olympus manages a similar balance sheet, however the currency which it governs and issues is fully backed by these assets, while of course the USD dollar is not (yeah we said it).

Algorithmic

While Olympus allows the market to largely determine the price of OHM (more on that below), it does utilize the assets in the treasury to help keep the price as close to $1 as possible.

When OHM trades at a premium, as it does now, the protocol will mint OHM and sell it into the open market in order to increase supply and drive down price. The DAO will also intervene should OHM trade at a discount, as if its value falls below $1, the protocol will buyback and burn tokens to decrease the supply, and increase price.

Free-Floating

Although Olympus conducts open market operations, the price of OHM is largely allowed to “float.” This means that rather than having its price pegged to that of another asset, such as USD, the value of OHM is determined by the free market. Because of this, its price in dollar terms can, and has been, volatile, as like any other non-pegged asset, it is subject to the whims of supply and demand.

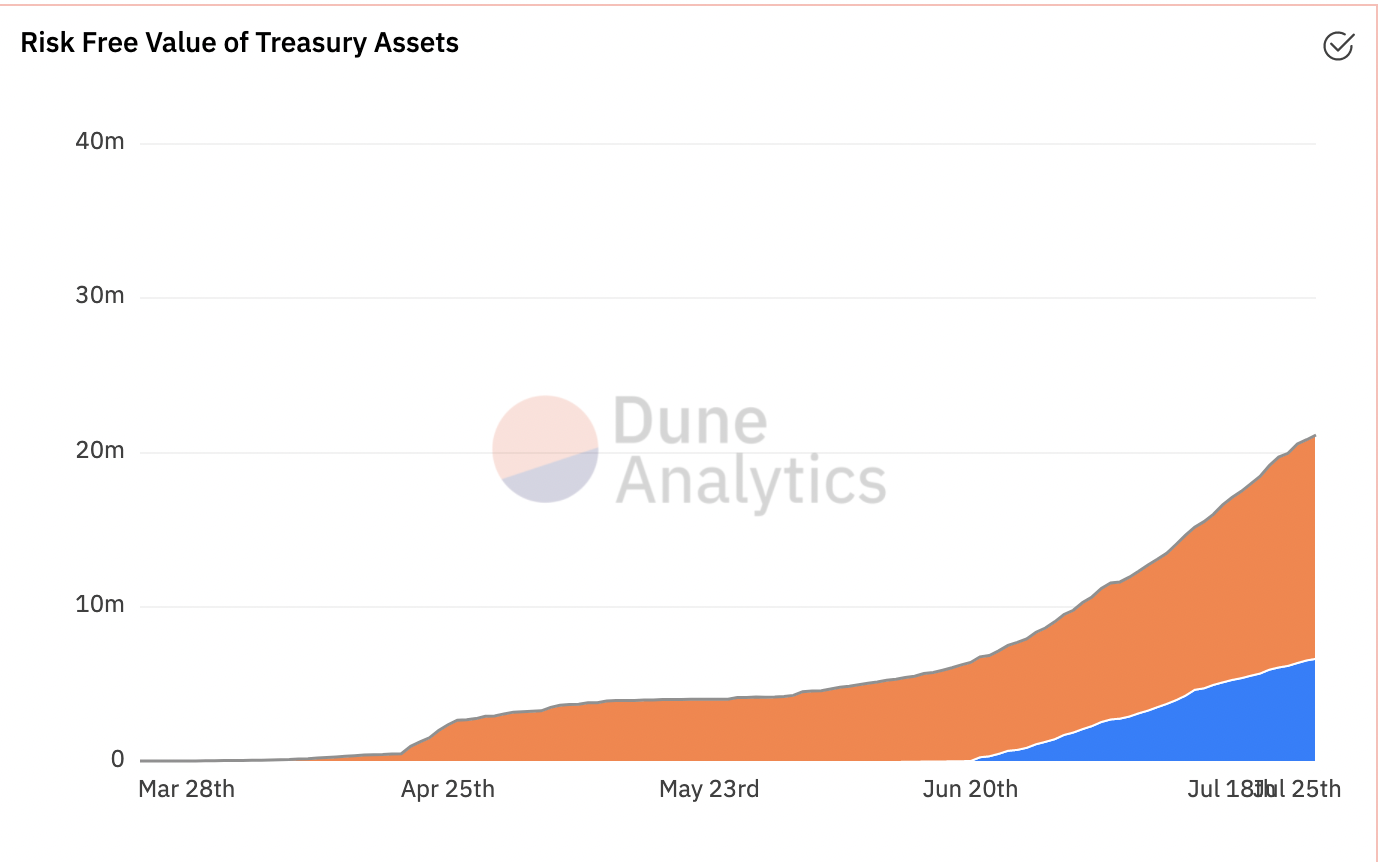

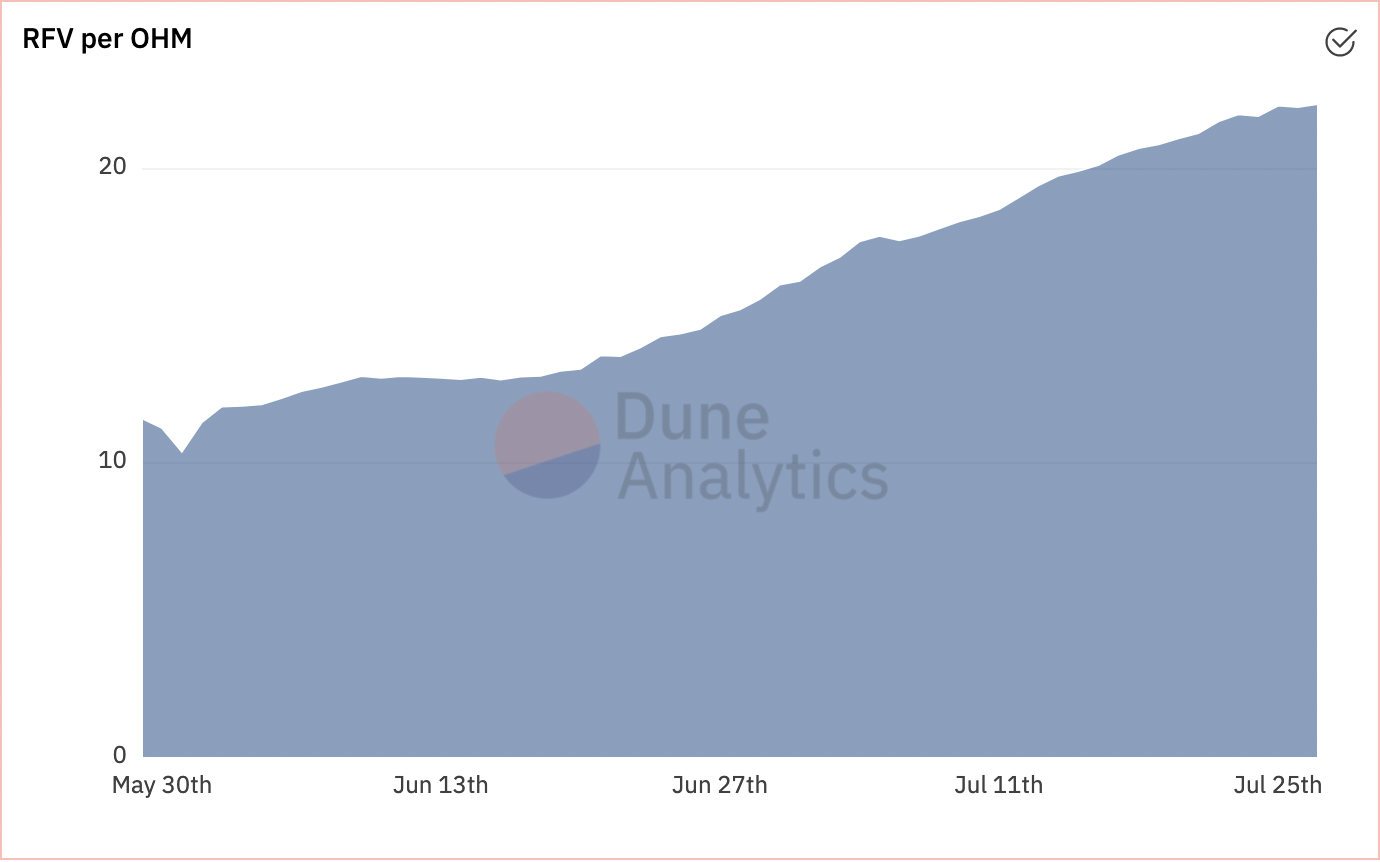

Despite this, OHM is considered to have a “floor price” or “risk free value (RFV)” that is worth the amount of assets backing each token. The current RFV of the protocol treasury is equivalent to the stablecoins, and, to account for risk, a discounted value of the LP tokens in it.

Currently, the RFV of the treasury is $21.1 million, with $14.4 million (68.2%) of DAI, and $6.6 million (31.8%) of FRAX.

As we can see, this means that the 771,985 OHM in circulation are trading at over 22x their RFV.

This means that currently, OHM is trading at a premium to its RFV. This may be due to several different factors, such as demand to stake OHM, and/or the future expectation of earnings distributed to OHM holders from the treasury assets being deployed within DeFi.

In addition, because issuing new OHM only requires $1 worth of collateral, the premium also represents the amount of OHM that can be minted in the future. For instance, based on the RVF and circulating supply metrics listed above, the protocol can increase the current supply of OHM by 21x. Of course, this is subject to change, but means that as the value of the treasury grows, the capacity to issue more OHM will see a commensurate increase.

Monetary Policy Tools

Now that we understand the characteristics of OHM, let’s dive into how it enacts its monetary policy.

Since the protocol is in its infancy, Olympus DAO current objective is to grow the supply of OHM. While it is intended to eventually have a stable value, and may seem counterintuitive, the protocol is not immediately aiming to achieve this. This means that volatility can, and should be expected. Of course, it should also be noted that we have yet to see if the protocol can effectively stabilize the price of OHM.

There are two key mechanisms used by the protocol to carry out its monetary policy objectives: Staking and Bonding.

Staking

Staking is the process through which the protocol issues new OHM.

There are a few reasons as to why OHM holders would want to stake their tokens. For starters, like with other systems, it can allow them to lock in their share of the total token supply, and avoid facing dilution. In addition, the high OHM denominated returns can help offset the price risk that comes with the volatility of the token.

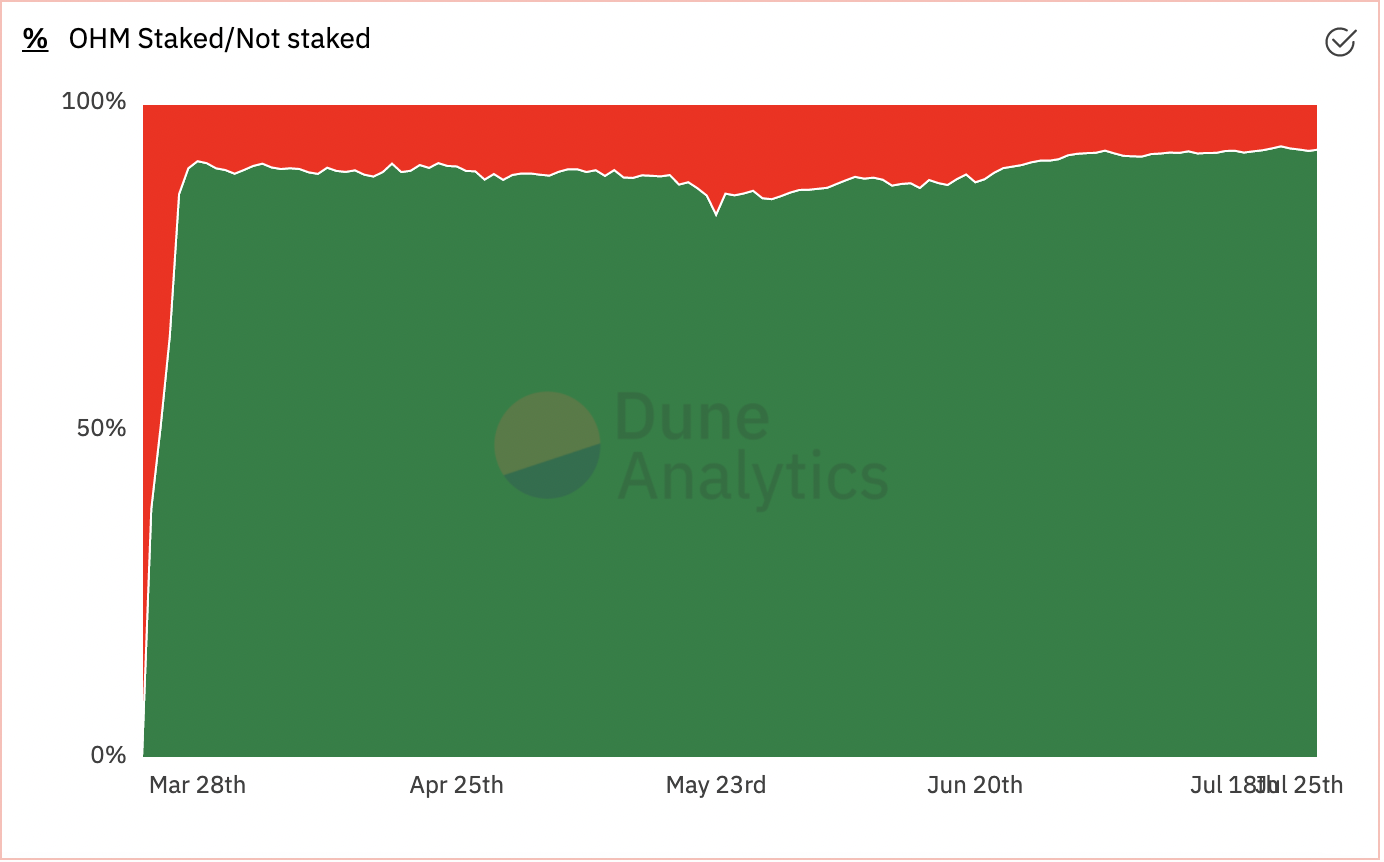

Currently, over 93% of the OHM supply is staked.

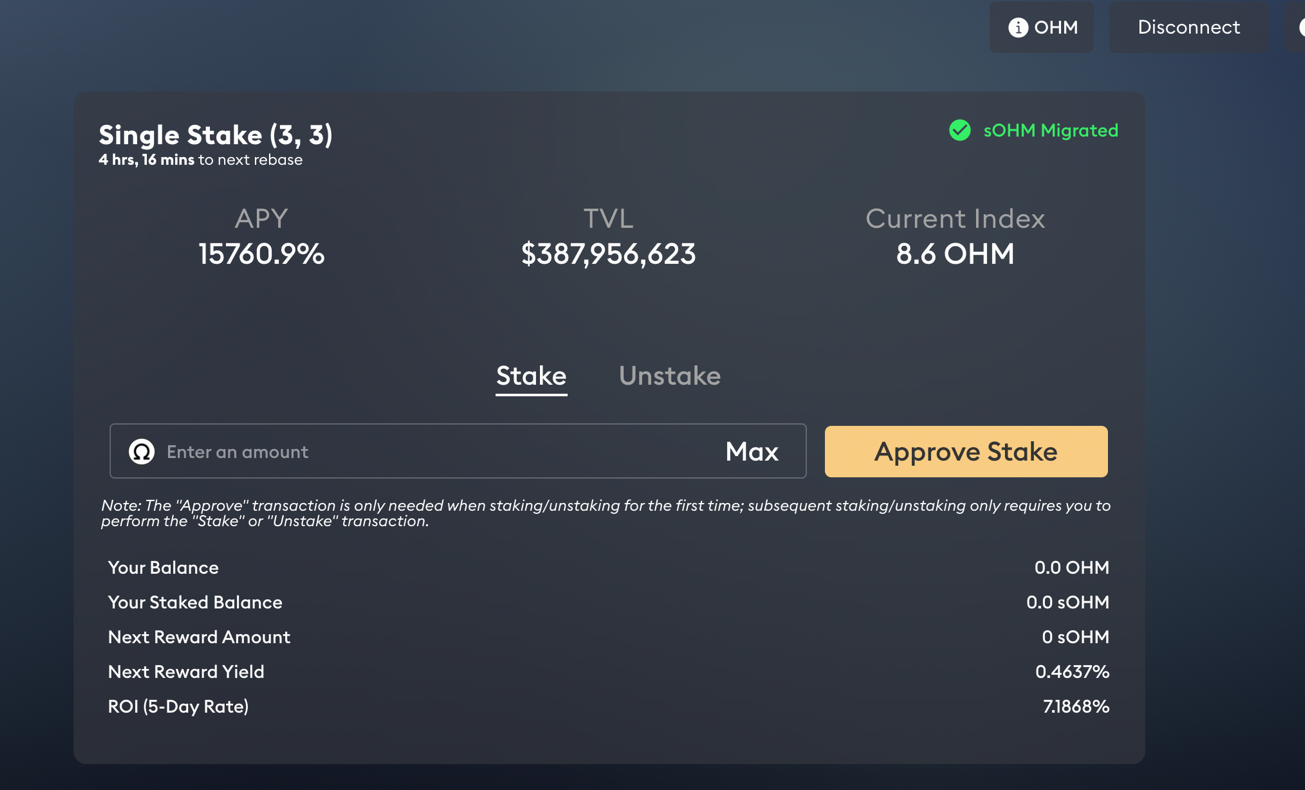

Like any other asset, OHM can be bought on a decentralized exchange, such as Uniswap or SushiSwap. Once staked, holders will receive the new distributions in the form of sOHM, as well as 90% of the yield generated by the assets in the treasury. OHM rewards are paid out every eight hours, with stakers sOHM balance rebasing to account for the new tokens.

This also means that rewards are compounded three times a day, which can help to explain as to why Olympus’ has such high yields.

While the staking APY is currently quoted at 15,760%, the APR is “just” 507%, a figure more in line with some returns that we see in DeFi. Although this yield may seem unsustainable, a June 2021 analysis by Glassnode calculated that OHM would be able to payout a 40,000% APY for 180 days, given the size of the treasury and amount of OHM staked at the time.

How is this the case?

Olympus is able to sustain these yields because of the premium that we discussed earlier. Since each OHM only needs $1 in backing, and each token in circulation currently has more than that in backing, the protocol is able to use these excess assets to issue more tokens. It also means that as the value of the treasury grows, so does the ability to mint OHM and continue to pay out high yields to stakers.

Bonding

Bonding is the process of selling an asset to Olympus in exchange for discounted OHM, that vest over the course of five days. Users have an incentive to bond when the return they would earn from it is greater than that from staking. While the protocol initially only offered bonds for OHM-DAI and OHM-FRAX LP tokens, this has been extended to include pure stablecoin ones.

🧠 To read more about the math behind bond prices, click here

Bonding serves several key functions for Olympus. For starters, it serves as a funnel for the protocol to be able to accumulate more assets, and grow its treasury. In doing so, it is able to grow its RFV, thereby being able to increase the amount of OHM that can be issued, as well as sustain the high yields for stakers.

Beyond helping with growth, bonding plays a key role in that it also helps to indefinitely secure the liquidity of OHM. As we know, capital in DeFi is mercenary, constantly shifting in search of the highest yield. As a result, many protocols have a toxic relationship with their liquidity providers, and are often forced to “pay” them to stick around with token incentives, de-capitalizing themselves in the process.

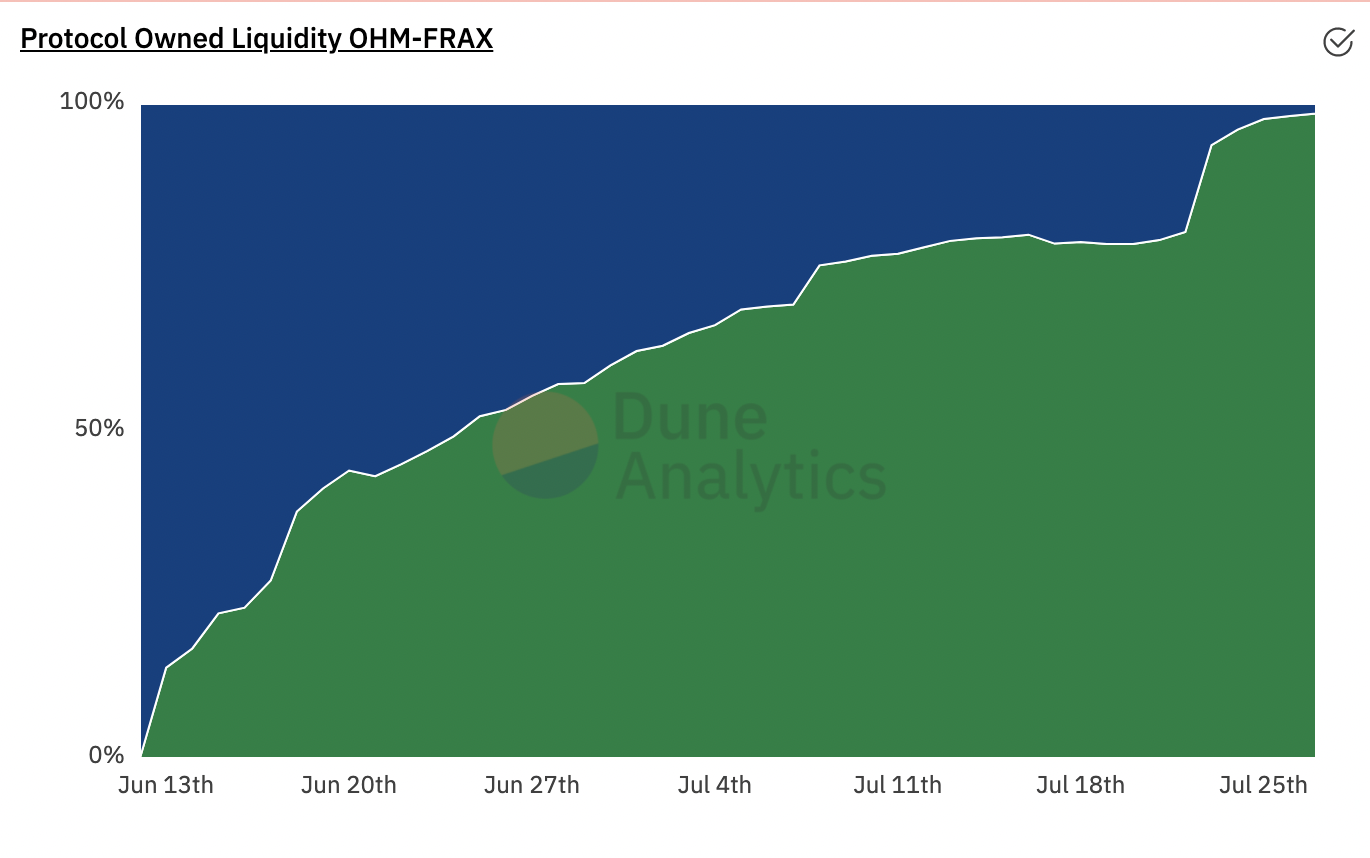

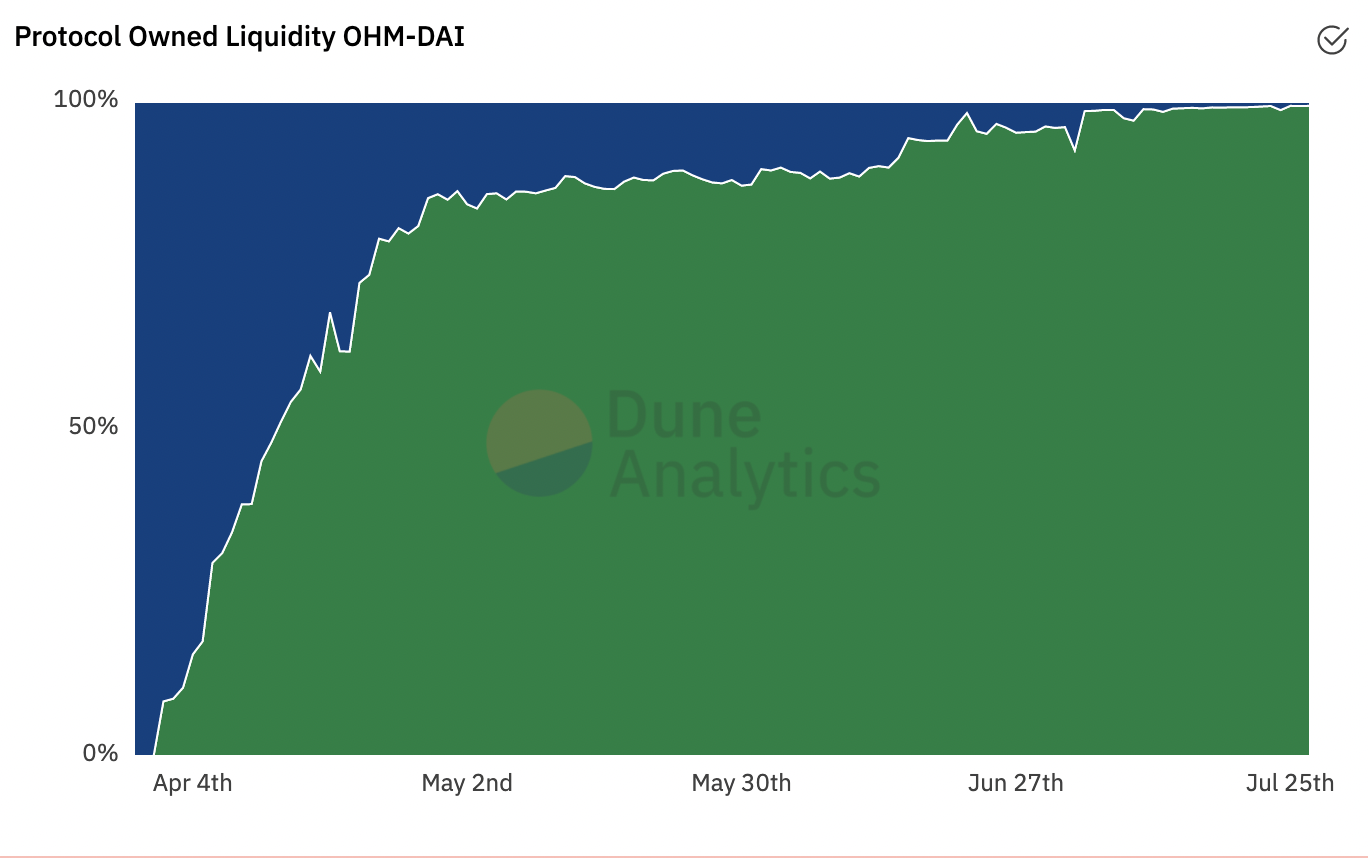

Through LP bonding, Olympus is able to turn this dynamic on its head. That’s because it enables the protocol to own and control its own liquidity, with the LP tokens held by Olympus known as Protocol Owned Liquidity (POL). This means that rather than incentivizing or hoping third-party providers continue to provide liquidity, the protocol can, to quote Thanos, do it itself.

It also means that should the DAO continue to hold the LP tokens, there will be a constant, and growing, floor of liquidity that is available in perpetuity.

Bonding has so far been an effective mechanism for implementing this strategy, as the protocol currently owns 98.5% of the liquidity for the Uniswap V2 OHM-FRAX pair, and 99.5% for the OHM-DAI pair on SushiSwap.

It has also allowed Olympus as a protocol to reap the rewards that come with providing liquidity. For instance, as we referenced earlier, the protocol itself has earned a substantial amount of SUSHI tokens (the OHM-DAI pair is incentivized on SushiSwap) because they own nearly all the liquidity in the pool.

Furthermore, the DAO is able to earn the standard trading fees that come with LPing, which also increases the treasuries assets, and enables them to grow the supply of OHM.

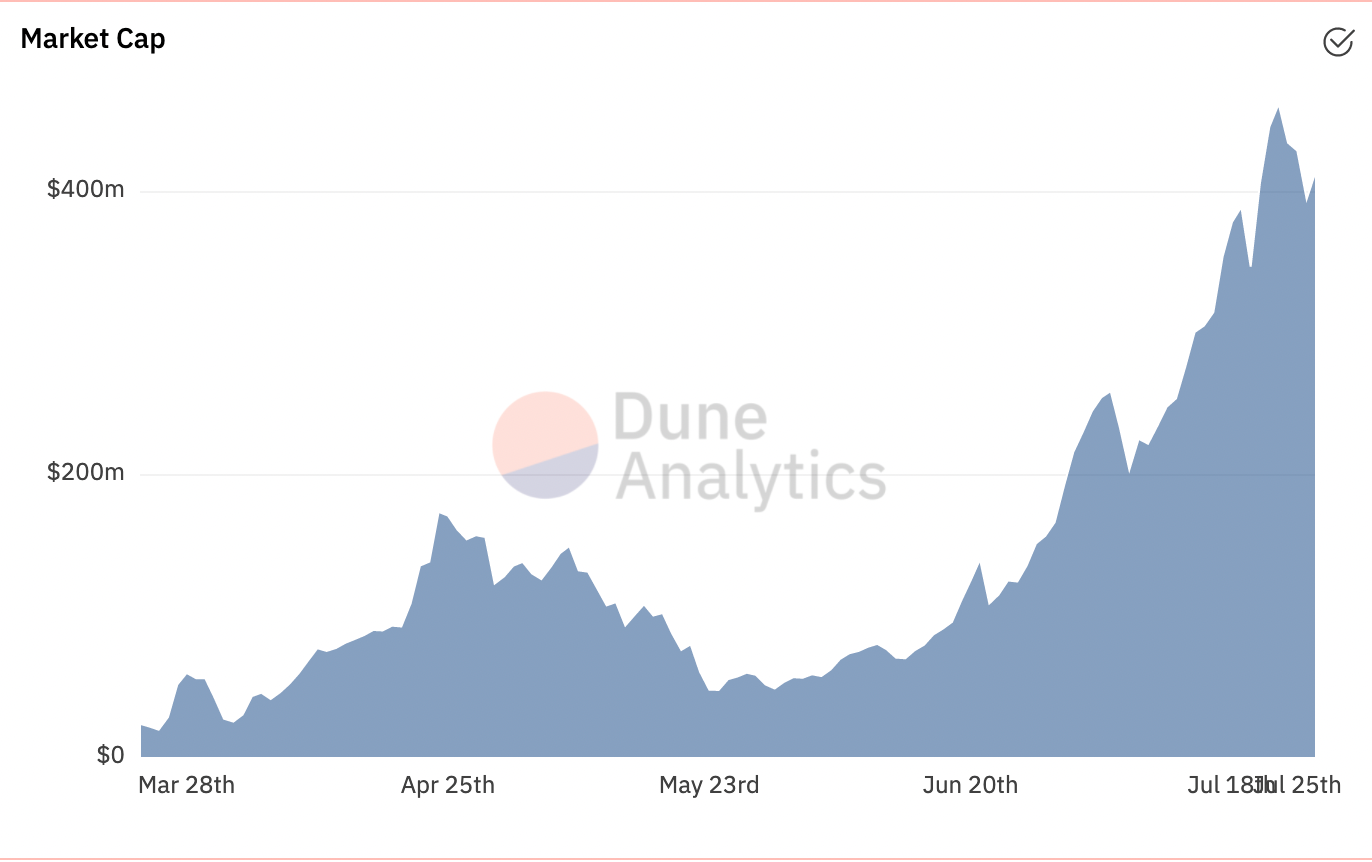

Adoption

Despite the nascency and incredible complexity of the system, Olympus has managed to see incredible growth in the under five months since launch. OHM currently has a market cap of $464 million, which would place it as the 10th largest stablecoin, and rank it fifth among decentralized ones.

In addition, the protocol is beginning to partner with other DeFi projects. Not only is the protocol boasting FRAX and SushiSwap partnerships, Olympus recently helped launch a pool on Rari Capital’s Fuse, a protocol for creating isolated money markets.

The pool accepts deposits of sOHM, DAI, FRAX, USDC, and ETH, allowing OHM holders to increase their capital efficiency and unlock the value of their assets by borrowing against their already yielding tokens. This has quickly become a popular place for OHM holders to park their capital, as it currently holds over $49 million in funds, over 40% of Fuse’s total TVL.

There are other major catalysts for adoption of OHM on the horizon. For instance, there was a recent discussion and vote on the Aave governance forums, which currently has 100% support to list sOHM and allow it to be used as collateral within the protocol.

The Ohmies: A Grassroots Federal Reserve?

Of course, we’d be remiss to have a discussion about Olympus DAO without talking about it’s community, the “Ohmies”.

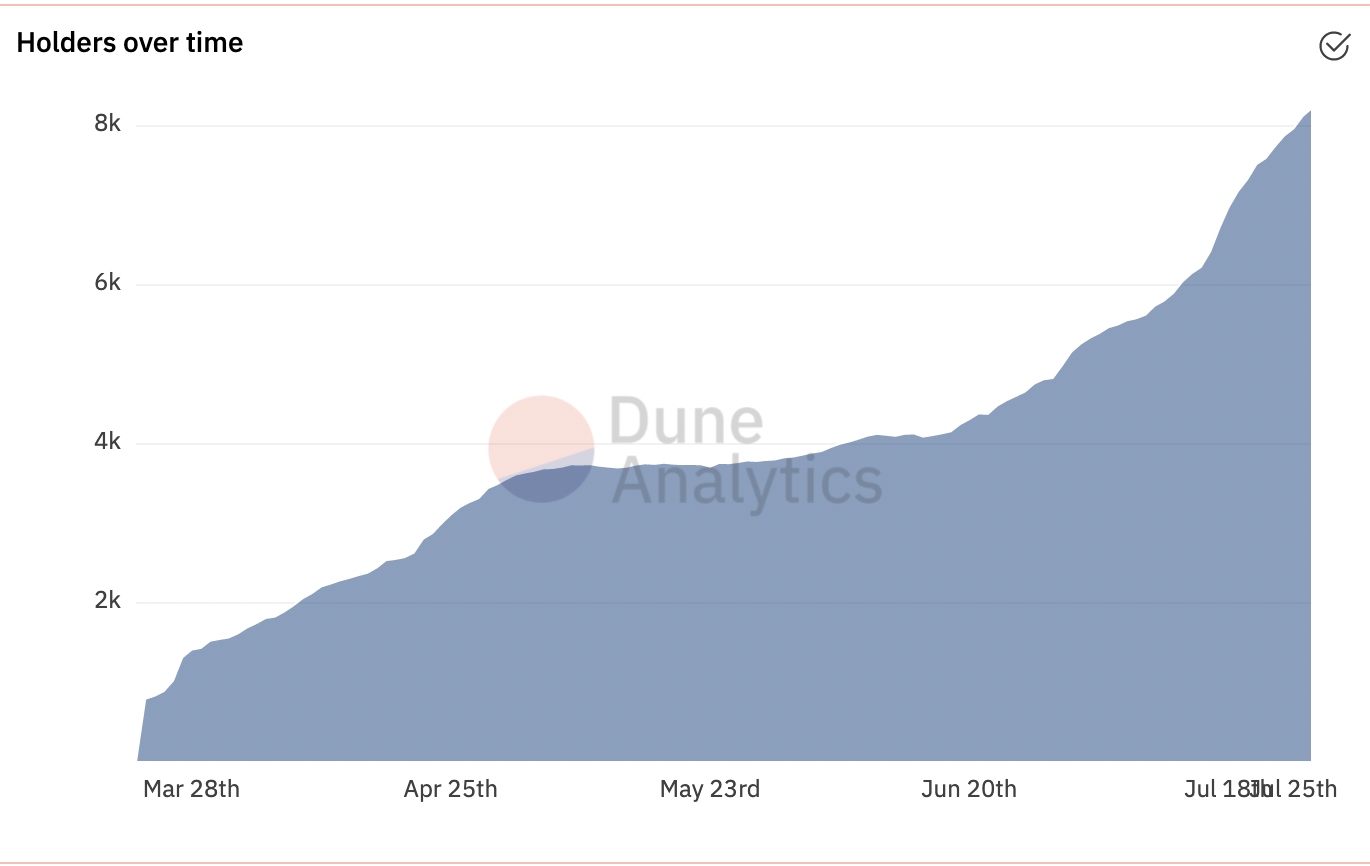

The Ohmies have emerged as one of crypto’s most passionate communities in 2021, as there are now more than 8200 holders of OHM, and 11,000 members in the Olympus discord. On a more intangible level, “Ohmie culture” is beginning to proliferate throughout that of broader crypto, with (3,3) turning into one of the most popular twitter handles suffixes, along with .eth and of course, the 🦇🔊.

Along with an “Initial Discord Offering” that distributed 50,000 OHM to early members of the Olympus Discord server, and terrific community building, there are a few interesting features of the protocol that may be contributing to its continued fervent support.

Game Theory

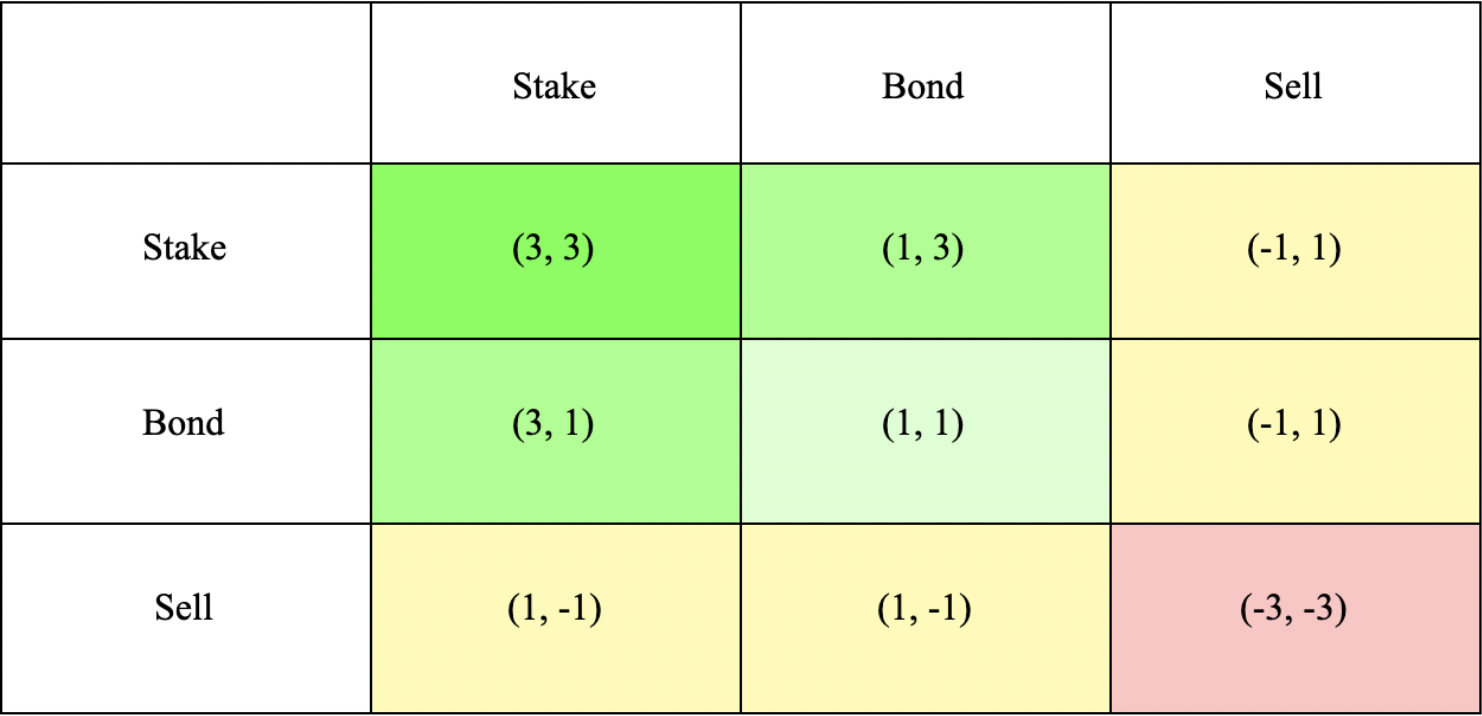

There is interesting game theory behind whether or not a participant will stake OHM, bond, or sell their OHM.

The number pairs pictured above are a way in which the community has been able to illustrate this, and how beneficial or detrimental each action a participant in the system is to themselves and the protocol.

Staking is considered to be the most beneficial action for all Olympus participants. This is because it helps to increase the value of OHM by causing positive buy pressure from the initial purchase of tokens, as well due to the increasing its scarcity as a result of the supply being locked up.

Bonding is also considered to be net-positive, albeit not as much as staking, in that it provides assets for the Olympus treasury, though it does not place direct buy pressure to increase the value of OHM.

Selling OHM is considered a net-negative, in that it puts downward pressure on the price of OHM, with the decline in price possibly encouraging other participants to sell their tokens.

With this in mind, we can see why (3,3) has become a rallying cry of sorts, as it is a way to convey the positive-sum benefits of staking and encourage other participants to do so.

Currency Holder Governance

Another interesting characteristic of Olympus that may contribute to the passion of the Ohmies is that it’s governed directly by OHM holders.

This differentiates it from other stablecoin protocols, such as DAI, FEI, and RAI, and of course, centralized stablecoins like USDC, or USDT, whose monetary policy is determined by holders of a secondary governance token or c-suite management, respectively.

This means that the holders of the actual currency, rather than owners of a secondary governance token, are the ones who determine monetary policy. This is a compelling dynamic, as it encourages active participation from a wider set of stakeholders. In addition, it aligns incentives of all participants in the system and encourages monetary policy decision making to be made through the lens of what is best for the value and stability of OHM.

Lastly, it also minimizes the risk that governance token-holders make changes to the protocol that may help accrue value to the governance token at the expense of the currency under their purview.

For example, while unlikely, there exists a scenario where MKR holders would vote to increase DAI stability fees (i.e. revenue being redirected to them through token burns) during a bear market. This would come at a time when it may not be in the best interest of other stakeholders in the system, as high interest rates during a downturn would help to discourage the usage and adoption of DAI, and would essentially function as a transfer of wealth from DAI holders to MKR holders.

Because OHM holders and Olympus DAO governors are one and the same, this agency problem is no longer present, as any changes to the monetary policy of OHM will lead to a similar same benefit or detriment to all participants in the system.

A Fascinating Monetary Experiment

Olympus DAO is a fascinating project.

The protocol is attempting to tackle a hugely ambitious problem through its unique design and incentive mechanisms. It’s also managed to be hugely successful at attracting rapid growth and a rabid community.

While it’s unclear if it will ultimately succeed in achieving its vision, it is clear that Olympus is a project worth keeping an eye on.

Action steps

- Dive into Olympus DAO