Level up your open finance game three times a week. I’m releasing this Free for Everyone until November 1. Get the Bankless program by subscribing below.

Dear Crypto Natives,

I left you hanging when we spoke about the crypto money portfolio a couple weeks ago. We talked about the three crypto bets: money bets, bank bets, and stablecoin bets. But we didn’t answer an underlying question—how much should you allocate to crypto in the first place?

So today I’m going to give you a strategy for answering this question. Ready?

Let’s dive in!

- RSA

P.S. There’s bonus content at the end—a podcast episode you won’t want to miss

THURSDAY THOUGHT

The Typical Portfolio

Most financial advisors will recommend a portfolio allocation that looks something like this:

- 50% in stocks

- 20% in real estate

- 20% in bonds

- 10% in cash

They’ll change the percentages based on your timeline and objectives of course. Also, your risk tolerance: Are you aggressive? More stocks. Are you conservative? More bonds. They might add commodities to the mix. A small number may even be okay with you allocating a couple percentage points on those swing-for-the-fences investments like cryptocurrencies.

Their recommendation is based on modern portfolio theory. And historically this approach has performed well, especially when management fees are minimized. I have no big issues with their advise—though I do wonder if it will perform at historic norms as we approach the next paradigm shift.

But is this the only option when considering crypto allocation?

No.

And I’m not even convinced its our best option.

I want to introduce an alternative: the crypto barbell strategy.

The Crypto Barbell Strategy

Think of the assets in your portfolio as a barbell with weights on each side but skinny in the middle. On one side, you have ultra safe investments, say cash & treasuries. On the other side, you have extremely risky investments, your crypto money. The skinny middle? That’s the semi-risky stuff—like stocks & real-estate—you put next to nothing here.

It looks like this:

Is this aggressive? Is it conservative? Yes. It’s both at the same time. You size each side according to your tolerance & objectives. You could do 70/30 portfolio or 90/10 or 80/20, for example:

- 80% - low-risk / no payoff treasuries & cash equivalents

- 20% - extreme-risk / big payoff crypto money portfolio

You assume the crypto money side either delivers extreme returns or drops to nothing. Because of the way you’ve sized your portfolio, your downside is limited—if crypto crumbles, you have the low-risk assets to fall back on. And you’ve completely avoided the small payoff yet still risky middle ground.

No stocks. No corporate bonds. No real-estate. Just safe assets and crypto.

Nassim Taleb might say an approach like this helps you avoid negative black swans—those rare, earth shaking events that crush the middle—while positioning you to take advantage of a positive black swan—the potential that crypto money takes off and delivers 10x even 100x returns from here.

Sound interesting?

An unconventional strategy

This may seem like an unconventional strategy, but remember we’re dealing with an unconventional asset class. There are few times in history that average retail investors had the potential to invest in an asset with such extreme risk and extreme upside. Bets with asymmetric payoffs have been almost entirely reserved for VCs, private investors, and the already wealthy accredited investors who know best.

But crypto is different.

Crypto money is an asymmetric bet accessible to anyone with an internet connection.

And the outcome is somewhat binary—either we’re right and crypto grows into the trillions or we’re wrong and the entire asset class fades out. Like the early internet, this tech is either changing the world or amounting to nothing.

It’s zero or trillions. No middle ground.

Tweaking the strategy

Once you determine the percentages allocations on each side of the barbell, you can implement this strategy on your existing portfolio and also though paycheck dollar-cost averaging.

On the low-risk side, you invest is the safest possible assets. Treasuries and cash-like options are probably the way to go. If you’re worried that mounting sovereign debt will cause increased inflation, maybe you choose to hold an asset like gold here too.

On the high-risk side, you invest in crypto. I like the crypto money portfolio which is composed of mostly money bets, some bank bets, and stablecoins for daily use.

What about stablecoins as investments? They’re tricky, because they exist in that middle area the barbell strategy seeks to avoid. They have some risk—a stablecoin like DAI is exposed to the systemic risk of ETH. Even a dollar backed USDC has risk exposure to crypto systems. So the best approach to include stablecoins may be to fatten up the middle of your barbell strategy—you do this by allocating some percentage to stablecoins and lending these out for interest.

Something like:

- 80% - low-risk / no payoff treasuries & cash equivalents

- 15% - extreme-risk / big payoff crypto money portfolio

- 5% - medium-risk / low payoff stablecoins which you lend for interest

Of course its up to you to decide the allocations. The stablecoin part is optional. You can tweak this in any way you like.

Wrapping up

The crypto barbell strategy is a way to allocate both your current net worth and your future investments across both crypto and traditional assets. It’s composed of two extremes: on one side you have a large portion of super safe no-payoff assets—on the other side you have high-risk massive upside crypto assets. You skip smaller payoff assets like stocks and bonds entirely.

This unconventional approach fits the unconventional asset we’re dealing with—unlike public stocks, cryptoassets have extreme risk and return profiles. Moon or die.

You can decide whether the crypto barbell strategy works for you.

But I’ll leave you with this: having a large portion of safe assets may help you weather the extreme volatility of crypto. I’m writing this on a week when crypto markets have plunged over 30%—stocks are down too. Having a stash of safe asset gives peace of mind and a clear head on the red weeks allowing you to make better long-term decisions.

And leveling up is all about making better decisions.

Actions

- Ask yourself: should you consider a crypto barbell strategy?

- Model it out—how does this strategy look in your portfolio?

Continue leveling up. $12 per month. 20% off if you subscribe before November 1.

BONUS

I went on the Into the Ether podcast with Eric Conner yesterday. We talked Bankless, money, open finance, Maker, and ETH killers among other topics.

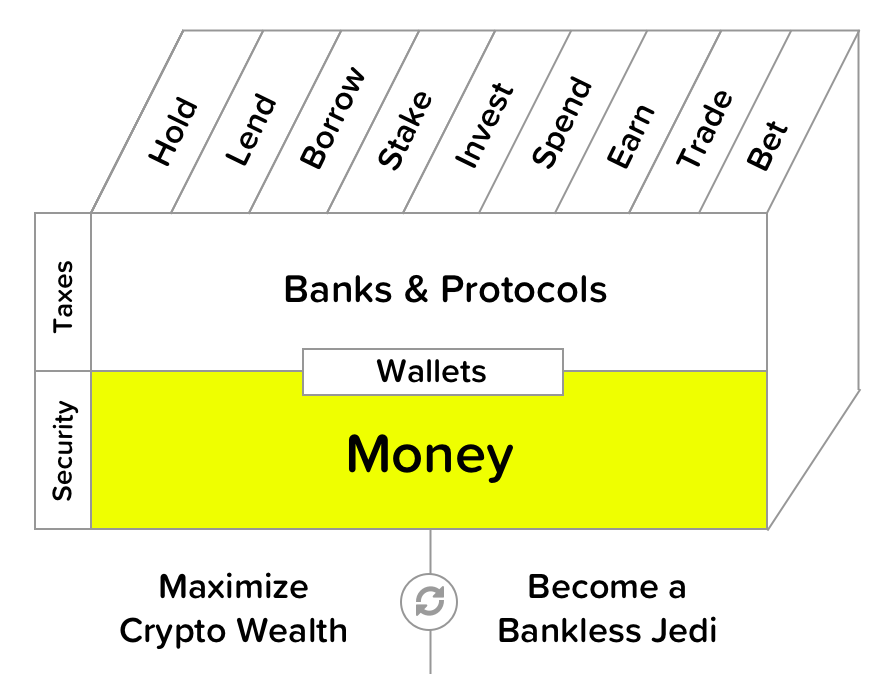

Filling out the skill cube

By learning the crypto barbell strategy you’re leveling money layer of the skill cube. This is the most foundational layer of the Bankless program.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.