How to buy discounted tokens

Dear Bankless Nation,

If you’ve been following Bankless long enough, you’ve heard us mention the mental model of crypto tourists, settlers, and mercenaries.

Mercenaries are the profit maximalists, the yield chasers, and the degen traders. And since the DeFi bull market of 2020, they’ve benefited heavily from each DeFi project’s need for liquid token markets.

In order to bootstrap liquidity, DeFi protocols created liquidity mining programs, incentivizing token holders to provide liquidity to AMMs like Sushiswap, Uniswap, and Balancer and rewarding them with tokens.

The mercenaries loved these programs.

But liquidity mercenaries are expensive and only loyal to the highest bidder. Once the liquidity mining program ends, mercenaries just dump their tokens and move on.

Is there a better way?

One of the major shifts in the newest generation of DeFi projects is protocol-owned liquidity. With systems like Olympus Pro, DeFi protocols can still leverage mercenaries while also keeping ownership of their own liquidity.

This is good for protocols.

And it’s also an opportunity for savvy crypto natives like you.

It provides the opportunity to buy tokens at a discount.

Whether you’re a mercenary, tourist, or settler, William shows you how to buy tokens at a discount with Olympus Pro.

- RSA

P.S. The mostly credible news source in Web3 dropped Edition #1 on Mirror. Only a few left to collect!

Liquidity mining campaigns have become a staple tool in bootstrapping upstart DeFi projects since 2020. The problem? These campaigns only let protocols temporarily “rent” liquidity instead of owning their liquidity.

Cue Olympus Pro, a new alternative to liquidity mining. The bonds-as-a-service mechanism lets DeFi protocols sell discounted bonds so they can come to “own” their liquidity. Accordingly, this tactic will show you how to buy DeFi tokens at a discount using Olympus Pro.

- Goal: Learn how to buy discounted tokens

- Skill: Intermediate

- Effort: 1 hour of research

- ROI: Bond rates up to +20% currently

First, what’s Olympus?

Facilitated by Olympus DAO, Olympus is a decentralized currency protocol. Its native OHM token isn’t pegged to the dollar but instead is backed by the protocol’s treasury of assets.

This model, combined with the project’s mint-or-burn mechanism, makes OHM a free-floating, fully-collateralized, and algorithmic currency the likes of which DeFi hasn’t seen before.

Zooming in, two key activities lie at the heart of the protocol: staking and bonding. We’ll briefly explore both below, but note that it’s bonding that’s particularly important for understanding Olympus Pro later.

💡 Olympus DAO is a complex DeFi 2.0 protocol. I highly recommend you read our WTF is Olympus DAO article if you’re not already familiar with the protocol.

🔨 Olympus staking

Olympus relies on staking to distribute new OHM. Stakers receive sOHM, which allows them to accrue more sOHM from Olympus DAO’s yield-generating treasury. This system is the protocol’s first value accrual approach. (Currently, 88% of all OHM is staked!)

🔁 Olympus bonding

Olympus’s next value accrual strategy is bonding. Bonding allows members to sell LP tokens (or other specified assets, like stablecoins) to Olympus in exchange for discounted OHM.

This practice lets the protocol purchase its own liquidity, hence the phrase protocol-owned liquidity that’s risen to the fore of DeFi lately.

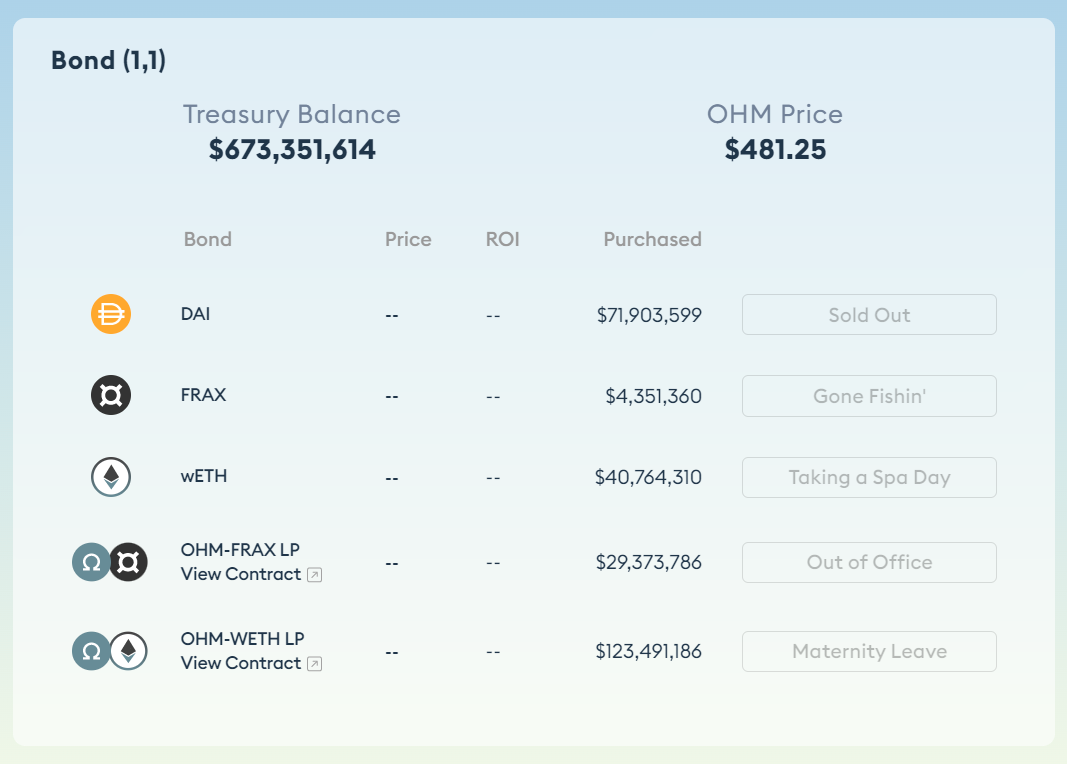

Specifically, the system entails Olympus users buying bonds for discounted OHM tokens that vest linearly for 5 days. The project currently has bonds for DAI, FRAX, WETH, OHM-FRAX LP tokens (Uniswap V2 ), and OHM-WETH LP (Sushi) tokens.

What’s Olympus Pro?

“This is a major shift in the way liquidity mining generally works because instead of renting liquidity with rewards, projects can buy and own liquidity using bonds.” — Olympus DAO

A simple way of understanding Olympus Pro is to understand it as Olympus’s OHM bonding system, but generalized for other token projects to use!

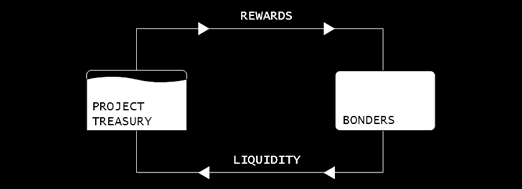

As such, this new service lets DeFi protocols sell bonds as alternatives or complements to liquidity mining programs. The gist? A project puts up a certain sum of its governance tokens for sale at a discount, i.e. bonding. The project then takes the assets it purchases and locks them in its treasury indefinitely.

This bonding opts for permanent liquidity over mercenary liquidity. In doing so, the system aligns incentives between the bond issuer and liquidity providers and lets projects generate additional revenues by becoming LPs themselves.

Buying discounted tokens

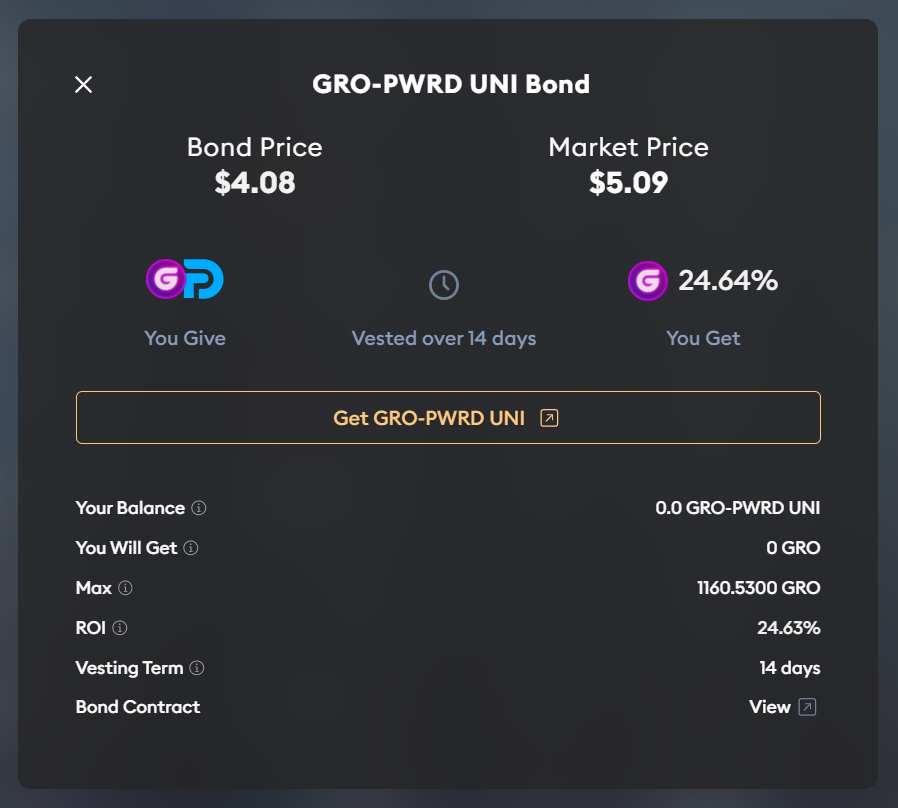

Before proceeding, it’s important to note that the secondary market activity around Olympus Pro bonds makes their discounts generally unpredictable. In the image above, the ROI is the return you could earn if you bonded and claimed your payout after vesting at the current bond rate. Yet that rate can change over time per supply and demand of the bonded token, so keep that in mind!

For example, on Olympus Pro you can presently bond your GRO-PWRD UNI LP tokens to purchase GRO for $4.25 per token, a discount from GRO’s spot price of $5.18 right now.

If this positive bond rate holds over the vesting period, then bonders stand to make a ~22% return. But that rate could go up or down in that span, so the ROI isn’t fixed.

This makes bonding an active and short-term investment strategy, in contrast to passive, long-term staking. If you’re interested in trying this sort of active DeFi strategy out, you can follow the steps below.

Bonding 101

To use Olympus Pro, you’ll first head over to the Bond Marketplace and connect your wallet.

Select your desired bond. Some may be marked “Sold Out” depending on current market conditions; the ones that are available will have a “Bond” button available. Click on one to proceed, and you’ll be taken to an interface that looks like so:

Next, input the amount of tokens you want to supply. If you don’t have any of the required tokens yet, Olympus Pro provides a link on where to get the LP tokens.

Press “Approve Bond Contract” and follow through with the approval transaction if this is your first time buying a bond on Olympus Pro.

Then review the details, like the vesting term, and if everything looks okay press “Bond” and complete the final bonding transaction.

That’s it! You’ll start receiving discounted tokens, e.g. GRO, vested linearly over your designated term, e.g. 14 days.

Claiming 101

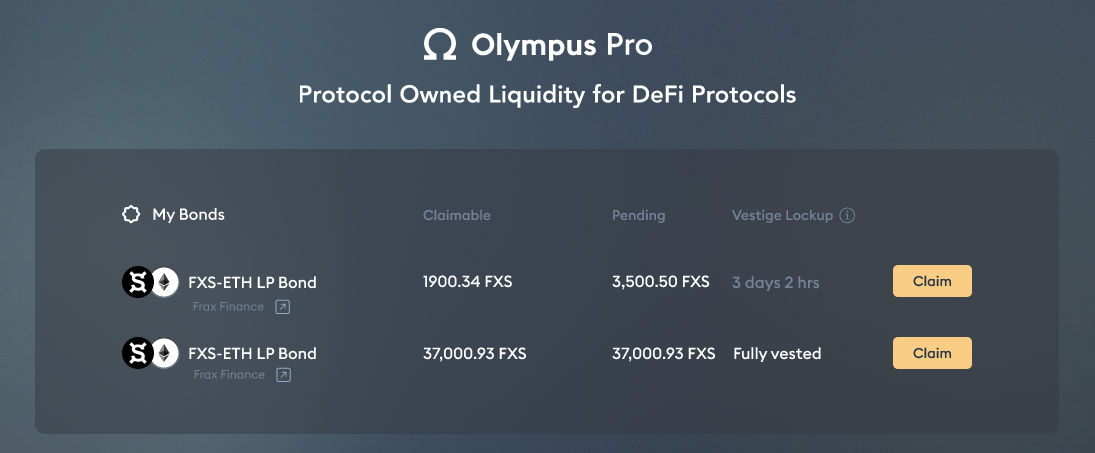

- Once you’ve purchased bonds, the Olympus Pro dashboard will show you a “My Bonds” section where you can find your “Claim” options. For example:

- Press “Claim” on the bond of your choice, at which point you’ll see a claims interface. Note: you can claim available earnings prior to the vesting term being finished, but you’d save on gas costs by doing one claim transaction once your bond is fully vested! Up to you, though.

- Input how many rewards you want to claim, or simply press “Claim All,” and then complete the ensuing transaction with your wallet. Once that’s done you’ll receive the governance tokens you bought for a discount!

Bankless on Olympus

- WTF is Olympus DAO

- The Secret Weapon of DeFi 2.0 | Zeus from Olympus DAO

- DeFi 2.0 Summit | Rari, Olympus, Tokemak, TracerDAO, Alchemix

Conclusion

Protocol-owned liquidity looks poised to play an increasingly pivotal role in the DeFi ecosystem going forward, and Olympus Pro has led and continues to lead the charge in that direction.

At the very least, this bonds-as-a-service system represents an empowering new resource in the liquidity toolbox of protocols, DAOs, and so forth. In contrast to renting, Olympus Pro helps projects own their own liquidity and make it sustainable while offering users the upside of discounted gov tokens.

That’s a win-win, DeFi 2.0 style!

Action steps

- Buy tokens at a discount via Olympus Pro

- Check out our previous tactic How to stake ETH if you missed it