Dear Bankless Nation,

You want to provide liquidity, but you’re worried about impermanent loss.

I get it…impermanent loss is annoying.

In simple terms, impermanent loss is the difference in your portfolio’s performance when providing liquidity to an AMM (like Uniswap or Balancer) versus just holding those assets in your wallet.

For most AMMs, if there’s sustained price divergence between from the time you deposit liquidity and the time you withdraw it, then you’ll underperform a simple buy and hold strategy…you’ll lose money vs holding.

This is a risk for LPs (liquidity providers). Why would anyone want to provide liquidity when they can just hold and do better?

Is there a way to mitigate the risk of impermanent loss?

Fortunately there are some tips and tricks that allow you to mitigate, and even avoid, impermanent loss today.

William digs into a few of them.

- RSA

P.S. Our new show Top Signal premiers tonight at 9pm EST! Grab a beer and watch us try to make you laugh with DeFi Dad, Owocki, and Anthony Sassano (idk if it’ll work). Join us!

📺 Watch SotN #52: PleasrDAO and NFT Bear Market

Jamis Johnson is a founding member and Chief Pleasing Officer of PleasrDAO✨. We bring him on to hear about the state of PleasrDAO, and the NFT bear market!

We livestream State of the Nation every Tuesday at 2pm EST—join us!

Tactic Tuesday

Bankless Writer: William M. Peaster,Bankless contributor and Metaversal writer

How to avoid impermanent loss

Impermanent loss, which entails losing value by providing liquidity to Automated Market Makers (AMMs), is a risk native to DeFi. Understanding how to navigate this phenomenon will help you stay in the green more often than not as a liquidity provider.

This Bankless tactic will outline a handful of different strategies to teach you how to mitigate impermanent loss in the course of your DeFi activities.

- Goal: Learn how to defend against impermanent loss

- Skill: Intermediate

- Effort: Varies depending on the strategies used

- ROI: Loss prevention and safer yields

What is impermanent loss?

The DeFi ecosystem’s decentralized exchanges have pioneered the automated market maker (AMM) model. AMMs center around liquidity pools, which are powered by liquidity providers (LPs) who supply crypto assets into these pools for anyone to trade through.

The main idea? Traders can swap the tokens they want, when they want, and LPs can earn a cut of all the trading fees when it’s used.

Yet for many liquidity pools, it’s far from guaranteed that their LPs will profit from trading fees over a particular span of time. That’s because of what’s called impermanent loss (IL)—a fundamental risk of supplying assets to liquidity pools due to the fundamental nature of how AMMs work and the volatility of cryptocurrencies.

Simply put, AMMs like Uniswap use special algorithms to automatically maintain a given liquidity pool’s ratio balance, e.g. a 50/50 ratio for an ETH/WBTC pool. Continuing this example, fluctuations in the ETH and WBTC prices can lead to rebalancings in which LPs endure acute losses of funds against their original deposits.

This experience is dubbed “impermanent” loss because these losses only become realized, i.e. permanent, if LPs close their positions when they’re in the red. For instance your LP position can fall into IL today and out of it tomorrow courtesy of market volatility, ‘round and ‘round.

Tl;dr—what’s the easiest way to understand IL?

It’s what happens when the value of an LP position declines compared to the value of the constituent tokens external to the pool. In other words, impermanent loss is when you would’ve profited more by simply holding ETH and WBTC in your wallet over being an ETH/WBTC LP on Uniswap.

An example of IL

If you’re still trying to wrap your head around IL, here’s a brief example that will help.

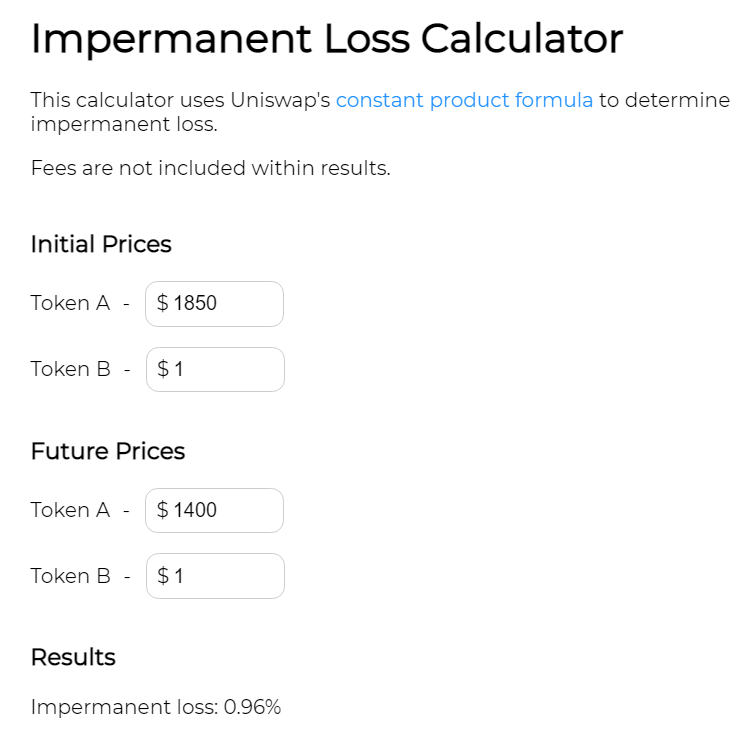

Let’s say you head over to Uniswap and you want to LP in the ETH/USDC pool with $1,000. If we tally the current ETH price as $1,850 and the USDC price as $1, you’d put $500 into both assets for a ratio balance, meaning you’d end up with ~0.27 ETH and ~500 USDC.

Then let’s say over the course of a handful of weeks, the ETH price drops to $1,400. Your LP position rebalancing would leave you with 0.31 ETH and 434.96 USDC at this point, which comes out to an aggregate value of $869.92. However, if you’d simply held your initial 0.27 ETH and 500 USDC to date you’d have $878.38, or ~$8.50 more. So in this particular hypothetical, the LP would’ve faced just under 1% in impermanent loss.

If you’re interested in making your own IL calculations and hypotheticals, consider checking out the Uniswap-centric Impermanent Loss Calculator tool from dailydefi.org.

Strategies to Mitigate Impermanent Loss

Now that we know what IL is, how do we fight it? In many liquidity pools IL is an unavoidable reality, but there are certainly a range of strategies you can use to mitigate or even totally avoid the effects of IL.

Here are the most fundamental of these mitigation strategies.

1. Avoid volatile liquidity pools

Crypto assets like ETH aren’t pegged to the value of an external asset like stablecoins are, so their value fluctuates per market demand.

Take note as liquidity pools centered around volatile assets are the biggest sources of IL risk. And while crypto blue-chips like ETH and WBTC may be volatile, much smaller coins have even higher chances of facing massive intraday price swings, so they’re way riskier in the lens of impermanent loss.

If avoiding impermanent loss is the name of the game for you, one wise move may. be to steer clear of volatile liquidity pools.

2. LP for same-pegged asset liquidity pools

Stablecoins like USDC and DAI are pegged to the value of the U.S. dollar, so these tokens always trade right around the ~$1 mark. Then are other stable assets like sETH and stETH, which are pegged to ETH, and WBTC and renBTC, which are pegged to BTC.

In same-pegged asset liquidity pools (e.g. a USDC/DAI pool) there’s very little volatility between the tokens pairs. This dynamic naturally results in little to no impermanent loss for LPs. Therefore if you’re wanting to earn fees as an LP but you’re not down with facing lots of IL, same-pegged liquidity pools may be a good option.

3. LP for one-sided staking pools

Not all liquidity provider opportunities in DeFi come via two-token liquidity pools. Indeed, other popular sources of revenue for LPs are staking pools, which are often used to guarantee protocol solvency and only accept deposits of a single type of asset. For instance, consider the Stability Pool of the lending dapp Liquity.

Users supply the LUSD stablecoin to the Stability Pool to ensure Liquity’s solvency, and in exchange for doing so these LPs earn a cut of Liquity’s accrued liquidation fees. There’s no IL in such a pool because there is no ratio balancing between two assets!

4. LP for uneven liquidity pools

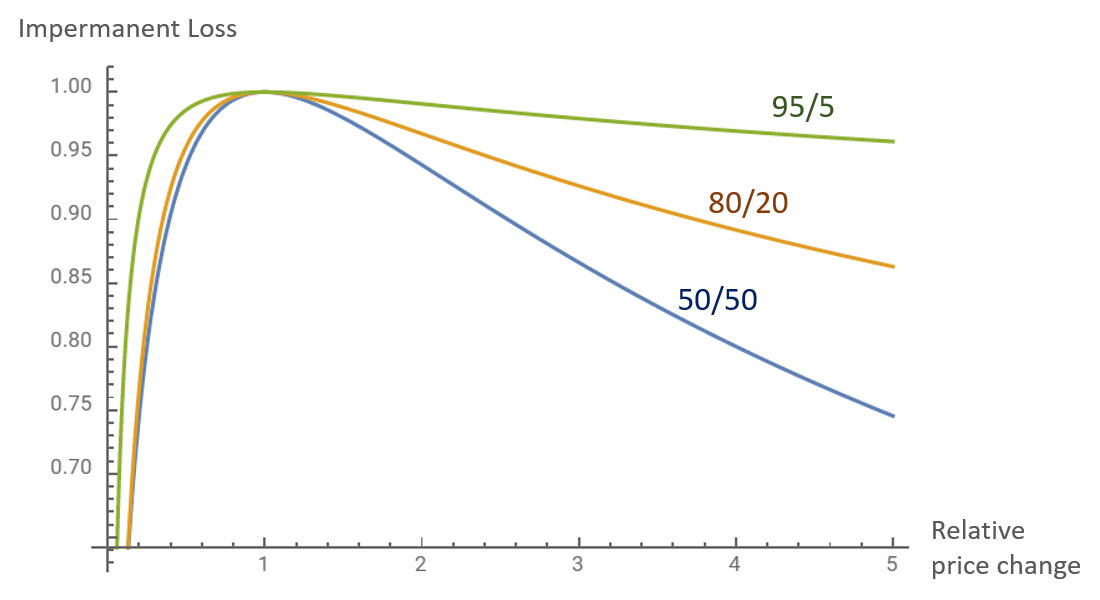

Uneven liquidity pools are pools that employ asset ratios beyond the traditional 50/50 split. Balancer is best known for pioneering these kinds of flexible pools, which notably can have asset ratios like 95/5, 80/20, 60/40, and so forth.

These ratios have implications for IL. For example, consider the case of an 80/20 AAVE/ETH pool. If the price of AAVE climbs against the ETH price, given LPs are mostly exposed to AAVE (80% of the pool), price volatility is less impactful on IL than if they were providing liquidity for a 50/50 AAVE/ETH pool.

So uneven liquidity pools are one avenue for mitigating IL, though it’s all dependent on the performance of the underlying assets of course.

Bankless Resources on Balancer:

5. Participate in liquidity mining programs

These days liquidity mining programs — where protocols distribute governance tokens to their initial liquidity providers — are ubiquitous in DeFi. Why? They give these protocols an easy way to decentralize governance, bootstrap liquidity, and win the hearts of their early users.

However, liquidity mining programs offer another advantage, which is that in many cases their token rewards can make up for any IL that LPs face. Indeed, what’s 5% impermanent loss over the course of two months if you earned 25-100% on your original deposit via token rewards in that span?

In the very least, these rewards can offset IL so as an LP, always keep incentivized liquidity pools in mind.

Zooming out

As AMMs keep rising in popularity, impermanent loss is a phenomenon that more and more people are going to have to contend with. The good news is that there are strategies available to help you do so capably and cautiously.

Looking ahead, the recent launch of Uniswap V3 has put concentrated liquidity — LPing in specific price ranges rather than along an entire price curve — at the forefront of DeFi.

Concentrated liquidity amplifies LPs’ gains and IL, so it’s a new and more potent LP paradigm to deal with. Expect to see many more discussions around managing IL as this concentrated liquidity model continues to gain further adoption!

Action steps

- Provide liquidity to AMMs to experiment and track impermanent loss

- Execute on some of the above strategies to mitigate your potential loss