How to use Balancer V2

Dear Bankless Nation,

Last month featured a lot of upgrades in the world of Automated Market Makers (AMMs).

Uniswap, Balancer, and Sushiswap all launched new protocol versions or had major product releases. Competition is heating up.

All of these liquidity protocols are taking their own novel route towards liquidity in DeFi. But all of them are in the same race: capital efficiency.

The teams building these new money robots will continue to upgrade them with every capital efficient weapon they can—it’s ultimately a match of battle bots.

And guess who benefits from this battle to the death? We do! The users!

Higher capital efficiency brings higher yields for liquidity providers and lower slippage for traders. So whether you’re a trader looking to get the best price or an investor looking to earn, these protocols are becoming better and better.

Balancer V2 was one that had a notable launch in May. It’s already garnered a few hundred million in value locked with a lot more on the way—the protocol’s new liquidity mining program is pumping out some serious yields for prospective LPs.

There’s a lot to cover with the AMM space. William covered Uniswap V3 a couple of weeks ago, now Balancer is up at bat.

Let’s learn how to use Balancer…v2.

- RSA

P.S. Ledger’s new update is 🔥🔥🔥. Hardware wallet + Ledger Live combo lets you stake, borrow, lend, and more with security in mind. Try it out.

📺 Watch Episode 50 of State of the Nation!

📺 Watch State of the Nation #50: El Salvador Adopts BTC | Nic Carter

We chat with El Salvador’s self-appointed Bitcoin Ambassador on the recent news. Tune in!

We premiere State of the Nation on Youtube every Tuesday at 2pm EST—join us!

Tactic Tuesday

Bankless Writer: William M. Peaster, Bankless contributor and Metaversal writer

How to use Balancer V2

Balancer recently released V2 of its protocol, which is turning heads courtesy of the substantial improvements over the DEX’s already-popular V1.

Accordingly, this Bankless tactic will show you how to capitalize on these improvements by teaching you how to use Balancer V2 for both crypto trading and investing. Either way, there’s plenty of cash to be made with this upgrade version of Balancer.

- Goal: Learn how to trade and invest on Balancer V2

- Skill: Intermediate

- Effort: Swapping tokens/depositing tokens

- ROI: Variable, but Balancer V2 has many profitable liquidity pools right now

A Primer on Balancer

One of DeFi’s top decentralized exchange projects, Balancer is an automated money market protocol, or AMM, that makes it easy for people to trade crypto assets or invest capital into the new yield pastures that the protocol offers.

Since its inception, one of Balancer’s fundamental contributions to DeFi has been serving as an AMM that supports liquidity pools that can be composed of up to 8 tokens. These multi-token pools, whose weightings can be customized, allow for significant versatility for prospective LPs and have become popular among DeFi power users accordingly.

With Balancer’s total value locked (TVL) currently over $1 billion USD, the protocol is now among DeFi’s largest applications—ranked 13th on DeFi Pulse. But keep your eyes peeled, as this TVL could rise much further in the months and years ahead if users keep flocking to the AMM’s powerful and newly launched V2 system.

What’s new with V2?

Balancer Labs launched Balancer V2 in May 2021 along with a totally redesigned trading and liquidity interface. The new front-end was much sleeker than its predecessor, but let’s be clear: the biggest changes from V1 to V2 were the optimizations made “under the hood.”

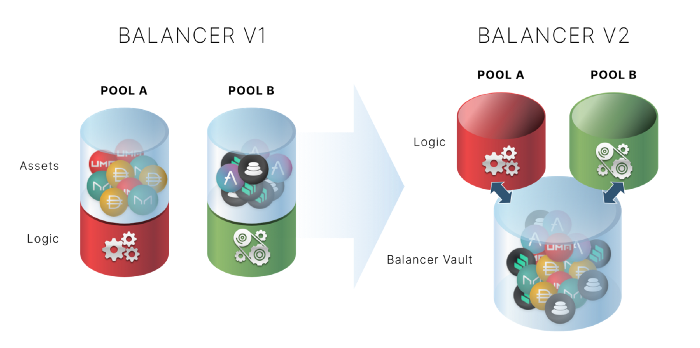

The most fundamental of these changes was a structural one, namely how Balancer handles its vault system.

As depicted in the graphic above, Balancer V1 liquidity pools each maintain their own respective vaults of assets with a particular AMM logic (i.e. the parameters of pool). Balancer V2’s big evolution is that it separates vault management from AMM logic by maintaining a single vault of all the assets deposited into Balancer, around which people can create their own efficient, custom-logic pools in a permissionless manner.

The result?

A new decentralized exchange protocol that’s been tailored for superior efficiency, flexibility, and security.

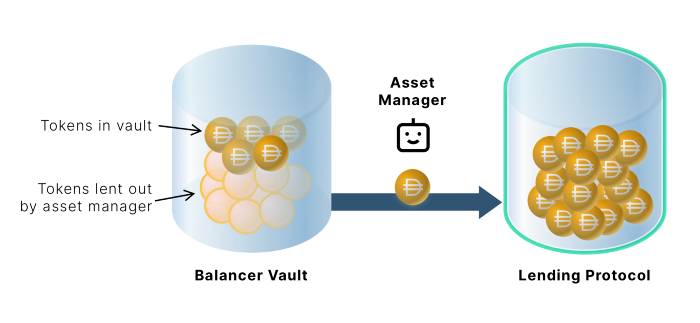

Efficiency: Balancer V2 provides considerable capital and gas efficiency advantages over Balancer V1 due to how the new system facilitates liquidity. On one hand V2’s new internal balances feature helps users to save big time on gas, while the protocol’s new Asset Manager feature allows ideal vault assets to be deposited into partner lending protocols (Aave is the first partner up) in order to earn liquidity providers (LPs) more yield. Lower gas fees, higher yields—that’s the name of the game.

Flexibility: V2 lets people create/use customized liquidity pools, so there’s a little something for everyone. Balancer also teamed up with financial modeling platform Gauntlet to provide a range of dynamic-fee AMM pools in V2, allowing for the pool to price fees according to demand, and providing better yields for LPs over time. Gauntlet accomplishes this by changing pool parameters in real-time per shifting market conditions in order to notch the most optimal trading fees possible.

Security: V2’s new master vault architecture has been audited by a few of the industry’s top blockchain security firms. That’s certainly meaningful in DeFi, where we’ve previously seen more than a few projects launch without any audits completed.

All in all, Balancer V2 is a substantial improvement over it’s original version, and serves as a promising liquidity protocol in an increasingly competitive DEX landscape.

How to use Balancer V2

Balancer V2 equally centers around 1) servicing traders who want to efficiently trade tokens in decentralized fashion, and 2) servicing investors who want to earn yields by supplying liquidity for traders.

If you’re just starting out with Balancer V2, you simply have to decide if you’re interested in trading, investing (by serving as an LP), or both.

Once you’ve done that, you’re ready to start diving in.

Trading on Balancer V2

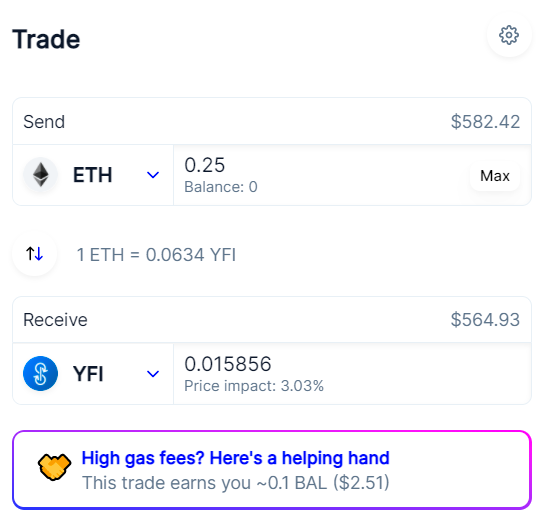

- Head to Balancer’s new trading interface. It’ll look like this:

- Per usual, click on the “Connect Wallet” button in the upper right corner of the page and connect your desired wallet (the currently supported options are MetaMask, WalletConnect, Fortmatic, Torus, Portis, and Coinbase).

- Once you’re connected, you can start trading. Navigate over to the swapping interface in the center of the page and input the token you want to sell, how much of it you want to sell, and then the token you want to buy.

⚖️ Alpha: Balancer has a gas reimbursement program! Trade whitelisted pairs and earn BAL-back for any gas you spend. Try it here.

At this point Balancer will automatically populate the current exchange rate and show you how much BAL (the AMM’s governance token) you’ll earn as part of the project’s ongoing gas rebates program.

- If everything looks good proceed by pressing the “Preview Trade” button. A new prompt will appear confirming the details of your proposed trade. Follow up by pressing the “Confirm Trade” button.

- The proposed transaction will appear in your wallet, where you can stick with the suggested gas fee or set your own. Press “Confirm” in your wallet to complete the trade once and for all.

- That’s all it takes to trade on Balancer V2! And keep in mind that you can claim your accrued BAL gas rebate rewards any time through the new V2 front-end.

Investing on Balancer V2

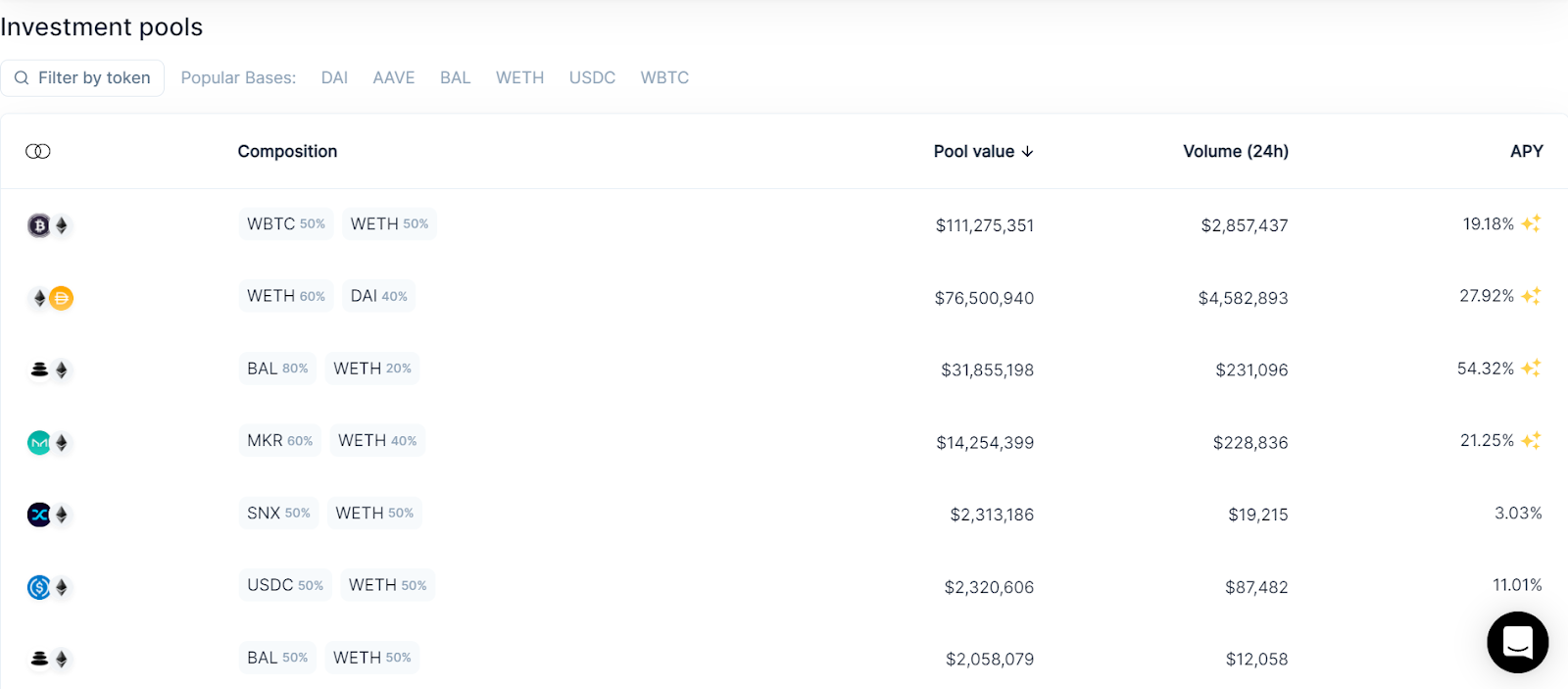

- Head to Balancer’s new investment interface. Scroll down and you’ll see the following dashboard:

In this dashboard you’ll find many different Balancer pools to choose from. Search until you find a pool you’re interested in, and then click on it.

If you’re just looking for the highest yields, use the “APY” column to find the best-performing pools. Pools with ✨ next to their APYs indicates they’re being incentivized with BAL liquidity mining rewards, so here LPs earn trading fees + BAL!

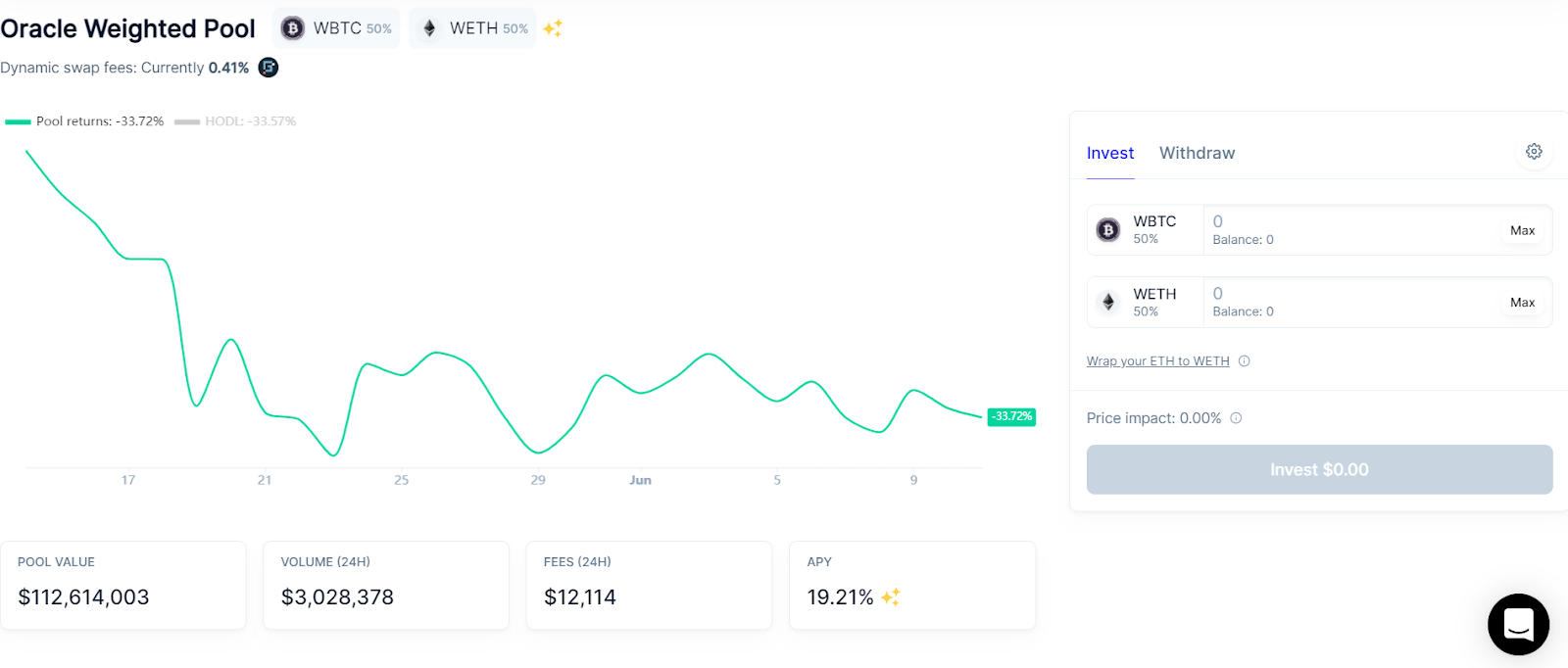

- Once you’ve clicked on your chosen pool, e.g. the Balancer 50/50 WBTC/WETH pool, you’ll be taken to a dedicated deposit interface like this:

Balancer allows for single-sided or varied-weight deposits, so for example in the pool above LPs could deposit 100% WBTC, or 100% WETH, or a 60/40 WBTC-WETH split instead of having to do the equal 50/50 supply ratio that’s traditional for other AMMs like Uniswap.

Just input the amount of tokens you want to invest as liquidity, and then press “Approve” and complete an approval transaction (or two) to give Balancer the greenlight to use your tokens.

- Once these transactions are complete, press “Invest,” and then your wallet will be prompted to complete the supply transaction. Confirm the transaction and after that, boom! You’ll be supplying liquidity to the Balancer vault and will now get paid on a rolling basis (in trading fees + potentially BAL) for this service.

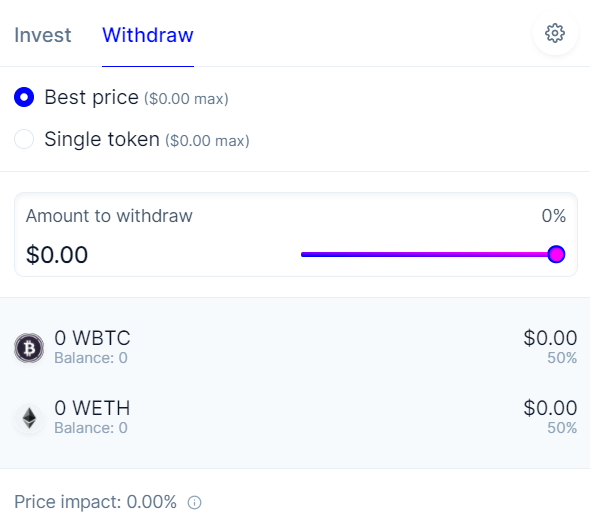

- One last thing: you’ll receive Balancer Pool Tokens (BPT) after you supply liquidity to Balancer. These are just LP tokens that represent your portion of liquidity in a particular Balancer pool. You can use your BPT to withdraw your underlying deposits + interest and rewards any time by using the “Withdraw” hub on your pool’s page.

Bankless Resources on Balancer:

The Big Picture

Balancer V2 is a novel AMM protocol that’s already vaulted into DeFi’s top echelon of decentralized exchanges. The upgrade features a new user-friendly interface and robust design that’s highly competitive in the current DEX landscape.

It’s suited to serve casual investors, professional high-frequency trading outfits, or even DAOs looking to park portions of their treasuries in productive but reasonably safe DeFi opportunities.

Wherever you fit along that spectrum, Balancer V2’s got you covered.

Action steps

⚖️ Check out Balancer V2’s investment pools. Considering your portfolio or desired portfolio, do any pools jump out at you?

Review pool values, 24-hour volume, 24-hour fees, and APYs.