Fork Defense Strategies in DeFi

Level up your open finance game 5x a week. Subscribe to the Bankless program below.

Dear Bankless Nation,

The protocol wars are here.

Uniswap vs. Sushiswap, YFI vs. YFII, Swerve vs. Curve—getting impossible to keep up.

Forks take the code of a parent protocol and redeploy it, sometimes with tweaks. A fork might add a token, target a new market, or change investor allocations. And sometimes a fork is just an attempt to cash out on someone else’s work…

But it turns out liquidity isn’t the moat some thought it would be. Farmers are emotionless, yield-hungry savages who put their capital to work in the highest returning opportunity. No questions asked.

Instead, protocols need to compete for community, for trust, for real-word adoption — for things that actually drive value. And founders have to recognize that their protocol is going to get endlessly forked.

So the question now becomes: how can a protocol defend against a fork?

Ian explores a few strategies today.

- RSA

🙏Sponsor: Zerion – Invest in DeFi from one place. 🚀 (I use this app daily - RSA)

WRITER WEDNESDAY

Guest Writer: Ian Lee, Managing Director at IDEO CoLab Ventures

Fork Defense Strategies in DeFi

Since publishing “Fast Follower Forks in DeFi” a few weeks ago, I’ve talked with many founders and investors about the implications and how to design fork-resistant (or embracing) protocols. More teams are preparing to launch fast follower forks in the coming days—and existing projects that have not yet launched a token are talking to their investors about restructuring their token cap tables to make them more “fair” (and thus more fork-resistant—or at least that’s the hope).

The protocol wars are officially upon us, marking a new era of crypto where competitive positioning and strategy matter as much as composability and collaboration.

As a former consultant with a focus on competitive strategy, I find this fun, familiar, and incredibly fascinating.

But it’s more than just intellectually interesting—competitive strategy is now critical to crypto projects and founders who aspire to build something valuable, defensible, and lasting in our space.

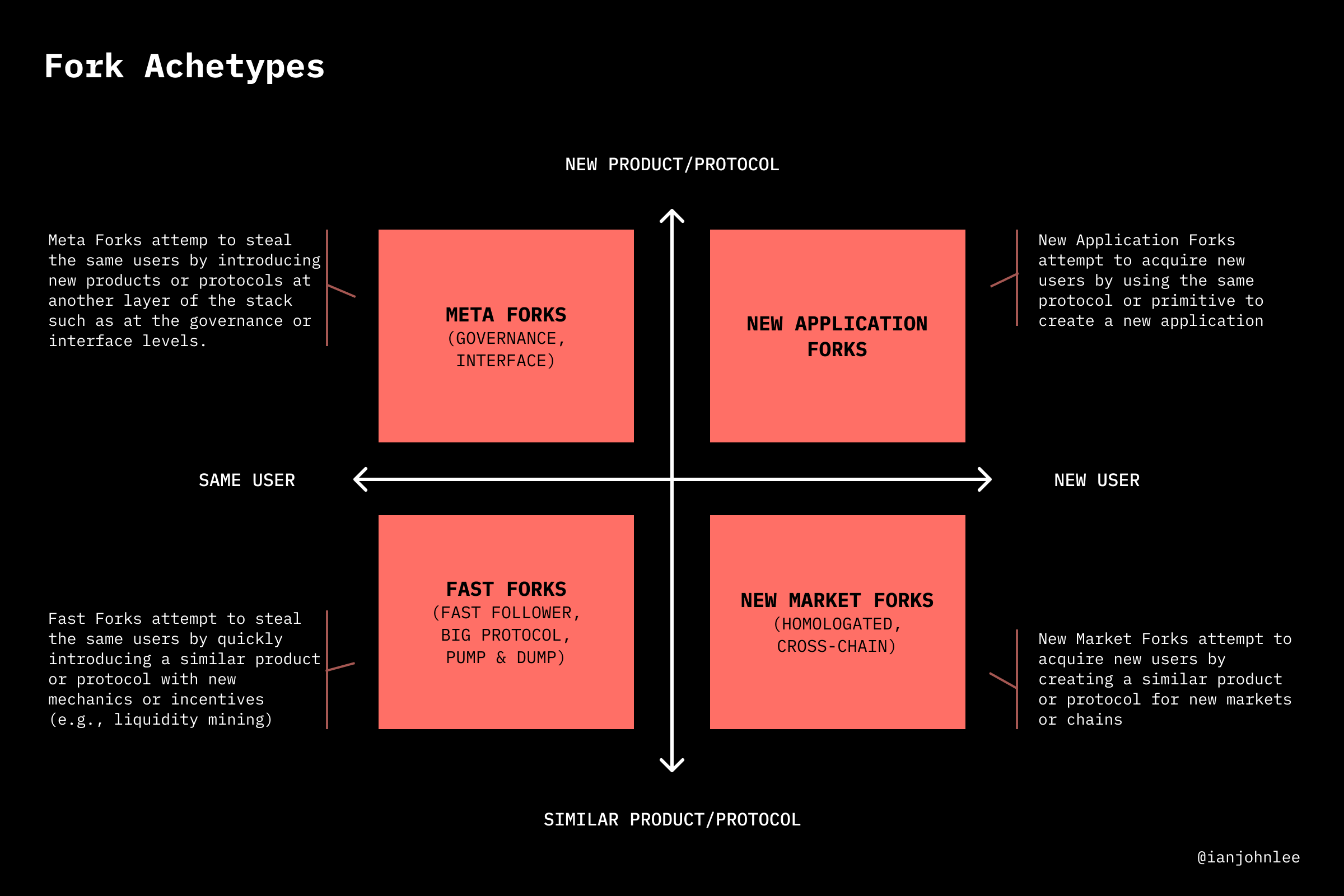

Not All Forks Are the Same

First, you have to realize that not all forks are the same. Each has a different intended outcome, approach, and strategy. Since Sushiswap’s ‘vampire attack’ on Uniswap two weeks ago, we have now seen multiple archetypes of forks—some of which were anticipated, and others which are still new and emerging.

From “Fast Follower Forks in DeFi”:

- Pump & Dump Forks: Forks whose primary purpose is to make a few people a lot of money, get a lot of people REKT, then move on to the next one. There have been many of these lately—particularly forks of YFI, forks of Sushiswap (itself a fork of Uniswap), and forks of YAM.

- Fast Follower Forks: Forks trying to unseat an original protocol or do something a little better—whether token distribution, incentive design, or a key functionality. This is where I would classify ‘vampire attacks’ that try to steal liquidity from an original protocol.Examples include YAM (AMPL), YFII (YFI), Sushiswap (Uniswap), Hotdog (Uniswap), Kimchi (Sushiswap), C.R.E.A.M. (Compound), Swerve (Curve), and many more.

- Homologated Forks: Forks that homologate the protocol, interface, brand, and messaging to a particular geography, region, customer, or segment. These forks try to take advantage of deeper customer understanding and intimacy. For example, YFII (YFI) has translations in Chinese, Japanese, Korean, and Thai to connect with users in those markets.

- Big Protocol Forks: Forks from existing, well established protocols to increase their capabilities and/or offerings to existing users. We haven’t seen these yet—but they’re coming.

New and Emerging Fork Archetypes:

- Governance Forks: Protocols that try to amass governance power in one or multiple networks by introducing a meta governance token. Examples include Unipool (Uniswap), PowerPool Concentrated Voting Power (Compound, Synthetix, Curve, YFI, etc.), and others.

- Interface Forks: Forks of a commonly used interface but with new features, integrations, and experiences that encourage users to switch away from the original. This will include aggregators, dashboards, and wallets. Once getting enough traction, they can then swap out some of the underlying protocols.

- Cross-Chain Forks: Forks that take an existing Ethereum-based DeFi protocol and bring it to a new chain or cross-chain. My bet is that we’ll see many of these on Layer 1s like NEAR, Polkadot, Cosmos, Tezos, and Tron. Some of them may be created by the Layer 1 teams themselves to bootstrap their DeFi ecosystems.

- New Application Forks: Forks that take an existing protocol or primitive to create a new application for a new set of users. Arguably, this type of fork has a very different intent—rather than compete for the same users or markets, it’s creating a new market, use case, and set of users.

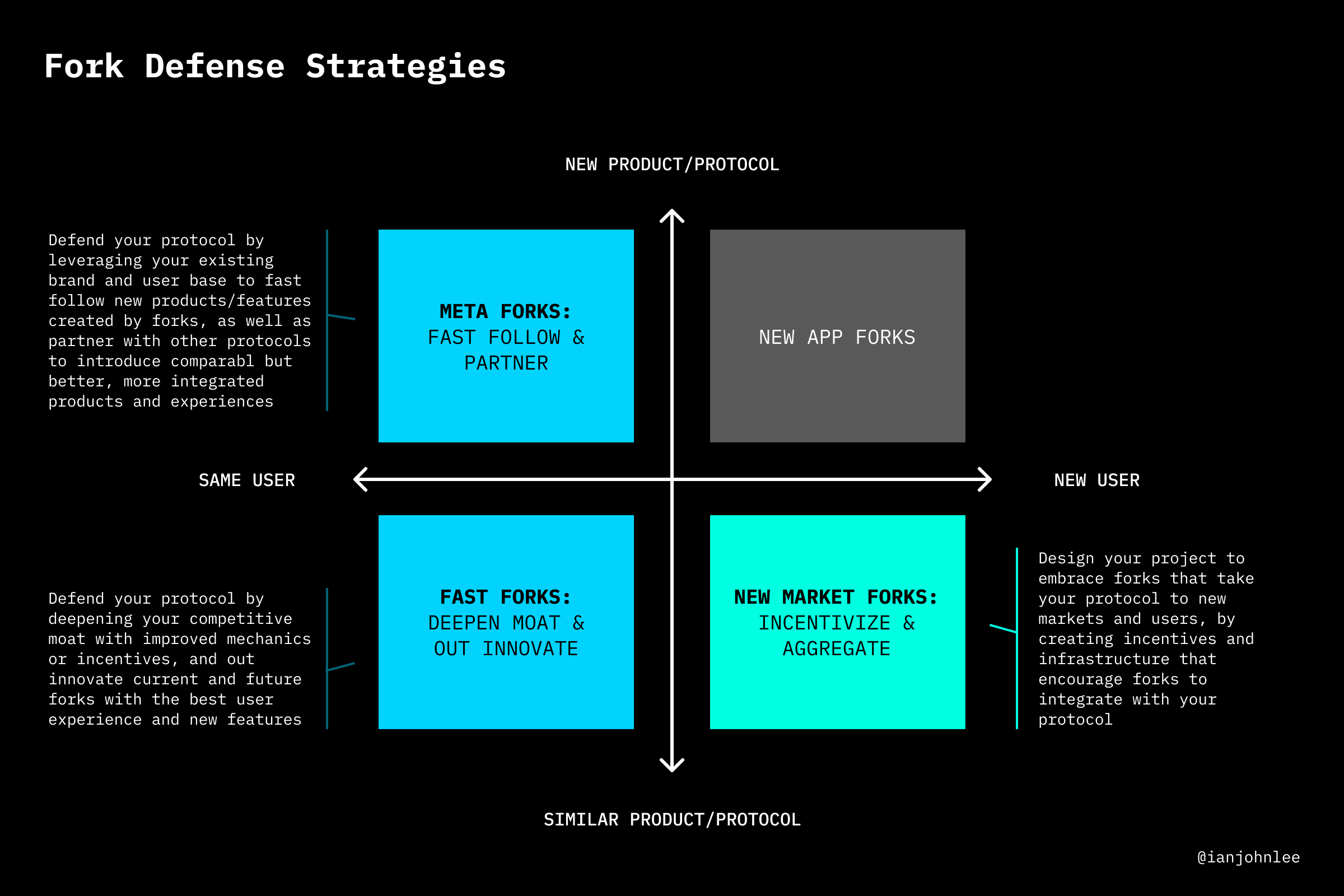

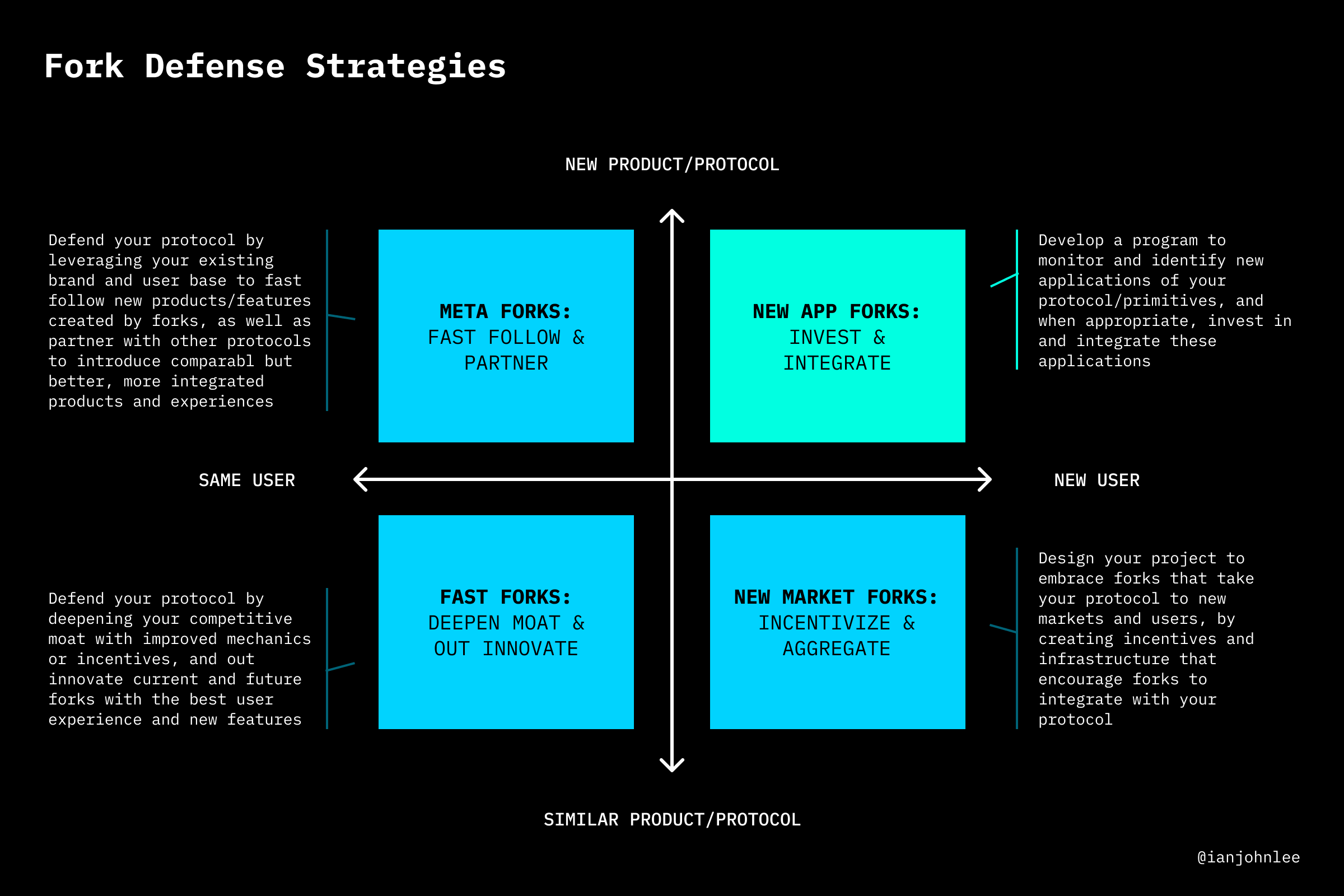

By identifying the different archetypes of fork, teams can better defend against the ones that present the greatest risk to their protocol. For example, some forks target the same users and introduce a similar product/protocol—while others target new users with new products/protocols.

As you might expect, the competitive dynamics and ways to defend against a fork are different depending on the fork archetype. A one-size-fits-all approach to forks won’t work. It’s likely that protocols will need to develop multiple strategies.

Accept That You’ll Be Infinitely Forked

Whether we like it or not, we need to accept that being infinitely forked (by increasingly savvy and advanced teams) is inevitable—it’s the shadow that comes with the light of open source software.

So if we instead assume that forks of all types of a protocol will happen in the future, what can DeFi founders do to make their protocol more defensible and resilient to forks going forward?

Can protocols be designed to turn forks from a zero-sum to positive-sum game that benefits the fork as well as the original protocol?

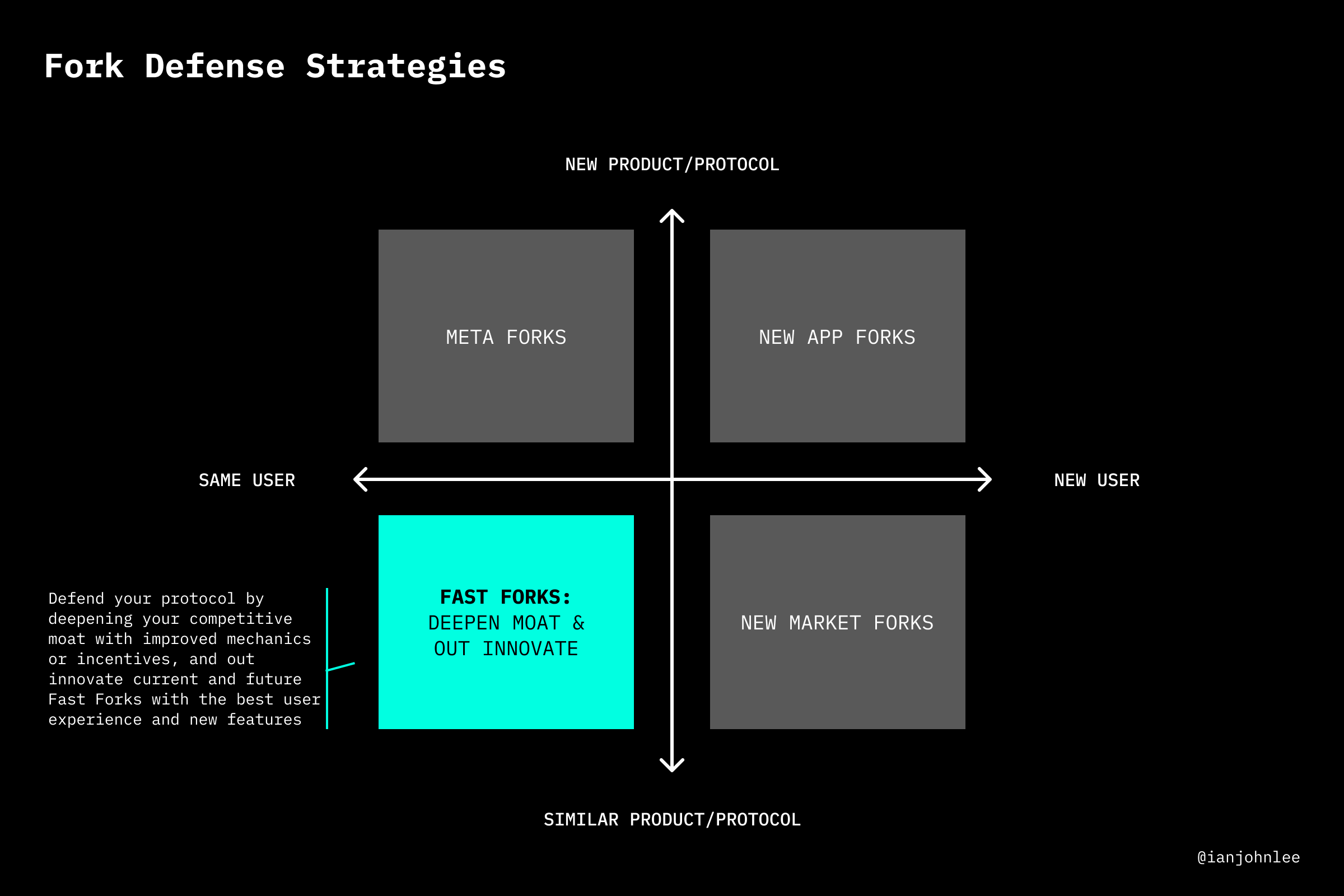

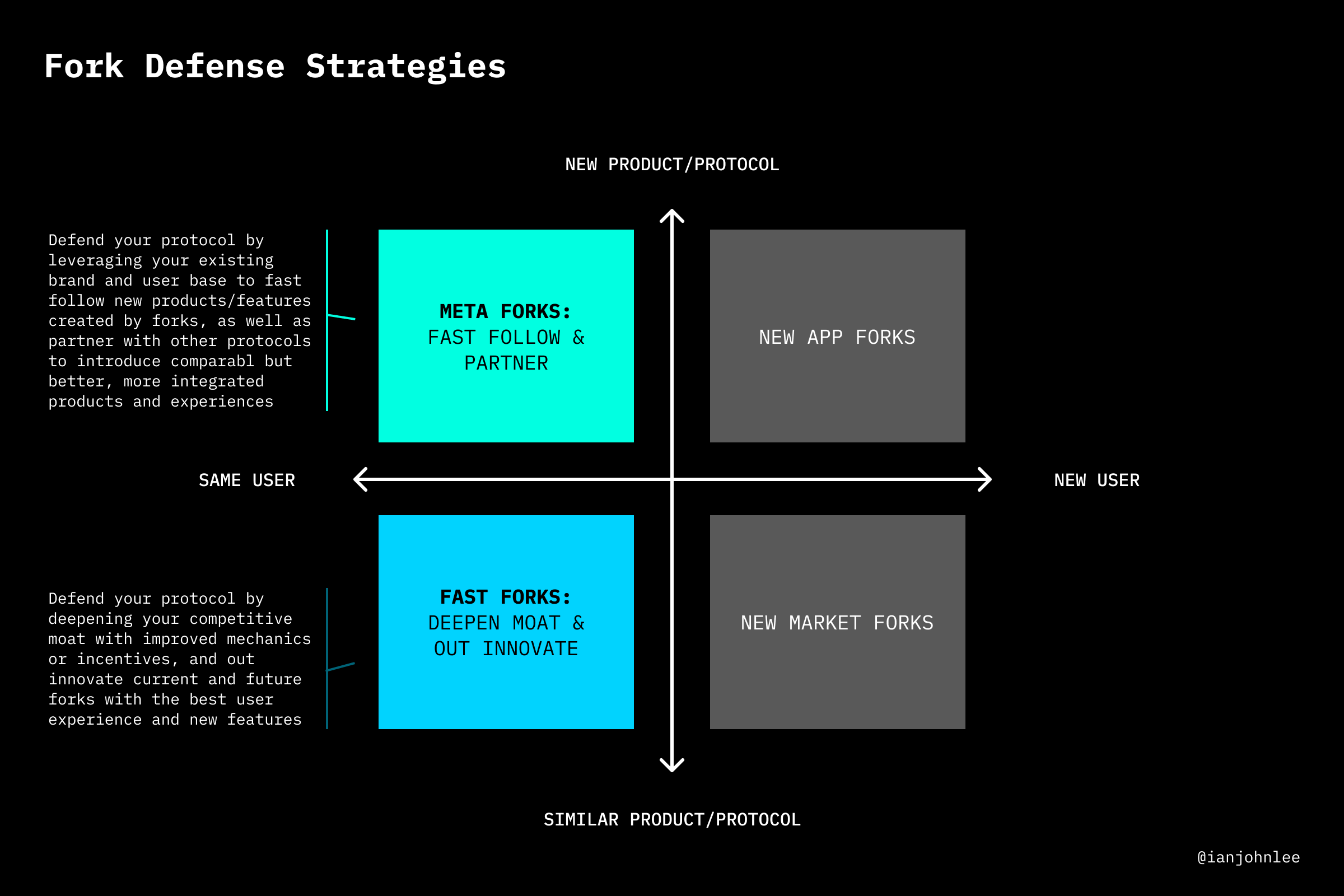

1. Fast Forks: Deepen Moat and Out Innovate

‘Fast Forks’ are the most common type of fork today, in part because they’re relatively easy to execute. Yet the strategies to defend against Fast Forks are not very well understood. As Sushiswap, Swerve, and so many others have shown, liquidity alone is not a moat—liquidity providers will move in an unemotional way from one protocol to the another in search of the highest yields as profit maximalists.

To defend against ‘Fast Forks’ from new and existing teams (e.g., big protocols) alike, protocols should both deepen their moat in ways other than liquidity, as well as organize themselves to continuously out-innovate current and future competition.

Strong economic defenses

Minimize the amount of VC ownership and overhang on your token cap table to maximize distributions to users (to defend against fair launch forks), as well as create more flexibility. Design into your protocol liquidity retention/growth incentives, and potentially consider liquidity migration disincentives or remigration incentives to prevent and/or attack future forks. In 2018, Simon de la Rouviere outlined some designs for this.

User experience (UX)

Design and deliver the best user experience out there—for not only your protocol but also the flows to other protocols it’s integrated with. If you deliver the best experience, you will win and keep users. Build user experiences not available on forks (e.g., token-permissioned chat rooms via Collab.Land), and design the best holistic experience for members of the community—from the core interface, to the communications and forums, to the governance tools and experiences (e.g., via platforms like Boardroom).

Unforkable crypto social networks

Focus on acquiring and locking-in the highest quality, highest lifetime value (LTV) users into your protocol. They could be key opinion leaders in crypto (e.g., crypto founders, crypto investors), trusted institutions (e.g., OTC desks, exchanges), or particular DeFi communities that won’t churn when higher yielding forks come to market. Surface these onchain connections and profiles through things like leaderboards, portable pseudonymous reputation engines (e.g., 3Box), or new social experiences (e.g., token permissioned chat rooms) that allow people to tangibly see and feel the community that has built around your protocol.

Real world adoption and integrations

Get your protocol adopted and integrated with non-crypto businesses and systems. Do the hard work that teams who fork won’t do because it’s too much effort. Onboard trusted institutions with strong reputations as users of your protocol and let the world know about it. This will become particularly important as new institutional and retail players move into DeFi.

DeFi composability and integrations

Get your protocol adopted, integrated, and whitelisted with other top DeFi protocols. Ensure that your assets are composable and used as collateral in other top DeFi projects, building off and adding to other protocols’ positive network effects.

Resources for continuous innovation

Ensure that your protocol has access to enough capital (e.g., treasury, foundation, venture capital) to continue to innovate your protocol faster than future forks. As they say, “innovate or die”—so whether that is through some VC money or a reverse foundation in the case of a fair launch, don’t give 100% of the network to short-term yield farmers, because they won’t be able to help the protocol remain competitive long-term.

Trusted brand, team, and contracts

Build a durable brand that is globally recognized, respected, and trusted. Under strong leadership, cultivate a highly aligned team that is consistent in their communications and principled in their actions. Plan for all scenarios. Get your contracts audited, and communicate more than “Audited by XYZ.” Detail what’s been audited and tests that have been run. Publish parts of the audit report publicly.

2. Meta Forks: Fast Follow and Partner

Meta Forks are interesting because it’s often unclear whether they’re intended to support or attack the underlying protocol—via some form of governance or UI/UX abstraction. In these scenarios, the best thing to do is reach out to the team, assume good, and build a collaborative working relationship with them.

Because who knows—if they are indeed trying to better support your protocol and community, then it’ll be great to work with them as true partners. If the project, however, turns out to be a type of meta fork, here are two strategies to consider employing:

Fast follow the forks

Take from the ‘Fast Fork’ playbook by leveraging your existing brand and user base to fast follow the Meta Fork. Replicate the fork’s new products and features and add them to your existing experience or as a separate project. Concerned about a meta governance token? Create another one on top of it. Concerned about a new fork of your interface? Fast follow and quickly add its features to yours. Let the forks do the R&D to make your product/protocol better.

DeFi co-creation partnerships

Partner with other DeFi protocols to not only fast follow, but also quickly co-create new features, integrations, and experiences across multiple DeFi protocols that are current unavailable with the Meta Fork. By partnering, you’ll be able to do more together than you or the forks can do alone, while attracting and retaining users in the process.

3. New Market Forks: Incentivize and Aggregate

Forks that take your protocol to new markets and users can either be ignored or embraced.

In my view, it’s more powerful and interesting to think about ways in which your protocol can embrace these types of forks, by finding ways to incentivize and ultimately aggregate the homologated or cross-chain fork into your protocol in a way that both benefits the fork as well as your protocol.

Aggregate forks’ tokens

Design mechanisms into your protocol to use forks’ tokens, thereby incentivizing and bringing forks’ liquidity to your own network. For example, combine forks’ tokens with your protocol’s tokens to create an entirely new or rarer asset using token bonding curves.

Collateralize and bootstrap forks

Design mechanisms that incentivize the use of your protocol’s token to help collateralize and bootstrap new forks, thereby enabling forks to benefit and grow from your liquidity (and in the process, increase the use of your protocol’s token). Further incentivize the fork to integrate with your protocol, enabling the fork to access and benefit from your protocol’s network of users, tools, experiences, etc.

Fork integration incentives

Design incentives that reward forks that integrate with your protocol, bringing forks’ networks of users, tools, and experiences to your protocol, and vice versa. Also consider hiring integrations managers to support forks.

Shared infrastructure

Create infrastructure utilized by your protocol and offer it to forks (perhaps in return for integrating) such as shared fiat on/off ramps, wallets, user profiles, social graphs, libraries and documentation, etc.

Ecosystem fund for forks

Set aside tokens via a treasury, foundation, or community managed DAO to support the creation, growth, and integration of forks into your protocol.

4. New Application Forks: Invest and Integrate

Forks that take your protocol or primitives to find new applications and users should be invested in and integrated when appropriate.

To do so, it’s likely that protocols will need to setup an ecosystem or community development fund to pursue these types of investments. For example, many DeFi founders are doing this today through angel investments.

This can be more structured, however, by setting up for the protocol the equivalent of a corporate venture capital arm. Investments into new applications will also help your protocol identify new markets, products, services, and protocols outside of your core areas that may lead to new opportunities for significant growth.

Forks Can Do Things That DeFi Needs

Despite all of the ideas listed above, we’re still in the early stages and have only seen the tip of the iceberg in terms of the forks yet to come as well as the strategies to defend against and embrace them.

However, hopefully these frameworks will help serve as a map for teams to think through the range of possible forks, the potential responses and strategies, and new ways for the crypto ecosystem to turn forks—which today are zero-sum games—into a positive-sum game, by finding novel ways for forks to be additive and embraced, as forks can help rapidly decentralize a protocol and proliferate it to new markets, users, and applications in ways that only forks can.

—

If you’re working on a fork or project exploring fork defense (or embracing) strategies, reach out. I’d love to learn more.

Thank you to the many founders including Kevin Nielsen, Alexander Angel, Blake West, and James Duncan, and our friends at Delphi Digital including Anil Lulla and Medio Demarco, and my colleagues at IDEO for providing early feedback on this post.

Action steps

Recognize different fork archetypes in DeFi & their respective defense strategies

Read Ian’s previous pieces on DeFi & protocol forks

Author Bio

Ian Lee is a Managing Director of IDEO CoLab Ventures, a crypto-focused venture firm backed by IDEO that invests and helps incubate early-stage crypto projects and protocols. Prior to IDEO, Ian was a Director at Citi Ventures, Citigroup's venture capital and venturing arm, where he led Citi's network of R&D Labs, an early-stage R&D fund, and crypto across the enterprise from 2014-2017.

Subscribe to Bankless. $12 per mo. Includes archive access, Inner Circle & Badge.

🙏Thanks to our sponsor

Zerion

Zerion is the easiest way to manage your DeFi portfolio. Explore market trends, invest in 170+ tokens, view returns across wallets and see your full transaction history on one sleek interface. They’re also fully bankless, which means they don’t own your private keys and can’t ever access your funds. I use this app daily! Start exploring DeFi with Zerion on web, iOS or Android. 🔥

- RSA

P.S. Don’t forget to get check out Zerion’s new Uniswap integration. 🦄

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.