Ethereum: The Money-Game Landscape (Preview)

Level up your open finance game 3x per week. You’re on the free version of the program so you’re only getting part of this article. Become a paying subscriber to get full access!

Dear Crypto Natives,

Are all money protocols just economic games competing to capture more ETH? That’s what David Hoffman explores in today’s thought-piece.

David’s written some of the best posts on Ethereum and crypto money. And guess what—he’ll be posting something new every month for Bankless subscribers only starting today. 🔥(Bankless keeps delivering the goods)

New models, new paradigms, and new ways of thinking about these novel crypto money systems—I love it.

But you’re only getting partial access to this article since you’re on the free version of the program. Subscribe to get the full article so you can start leveling up at warp speed with the rest of us!

- RSA

P.S. David hangs out in the Inner Circle with the rest of the Bankless community—join in the discussion there

THURSDAY THOUGHT

Ethereum: The Money-Game Landscape

By Bankless contributor: David Hoffman COO RealT & POV Crypto host

Game theory is a fascinating subject. Like cryptocurrency, its highly inter-disciplinary and tangential to basically everything in the world.

Learning more about game theory, one discovers its parallels to the living of life itself. We are all rational agents, interested in bettering our lives. We all must make decisions about which direction to take, at the cost of all other possible directions. This makes every decision that we make a sort of game.

- “If I buy Apple instead of Google, will my portfolio go up?”

- “Do I throw a fastball, or a curveball?

- “If I date Alice, instead of Sarah, will that make me happier?”

- “What do I want more: pizza, or hamburgers?”

- “Do I become friends with this individual, or is it not worth it?”

- “Do I drink that extra beer, when I have work at 6:00am?”

This are all single match games that we play inside the big game of life.

Life is the cumulative set of many individual games.

Life is about maximizing value. Game theory (or specifically, decision theory) is about the choices that rational agents make in order to achieve that purpose. As you progress through life, you make decisions that are either conscious choices, or unconscious ones, about how to best find value in the world. “If I buy Apple, will it grow in value?” is a choice that is very obviously about how to maximize value. “If I date Sarah, will that work out?” is still about how to maximize value, but in different terms. “Is this too much jam on my PB+J” is also about maximizing value, but less obviously so.

A ‘rational agent’ doesn’t necessarily mean a conscious individual. Yuval Noah Harari in his masterpiece book Sapiens illustrates how all organisms are “survival and reproduction maximizing algorithms”. We are all algorithms that make choices to best optimize for survival and reproduction. When we haven’t eaten enough, our algorithm makes us hungry; if we haven’t drank enough, we become thirsty. If we are lonely, we seek others.

Yuval uses the example of a hungry monkey, hanging from the trees in a jungle. He sees a banana, and wants to eat it, but it’s next to a lion. The monkey must make a choice… a calculation about what decision to make. Is the risk of being eaten by the lion too great? Can he find bananas elsewhere? Maybe the lion just ate, and isn’t interested in more food. How fast can the monkey grab the banana? These decisions are reflected in the emotions of the monkey, and will ultimately determine what choice the monkey chooses. Evolution will determine if they made the right choice or not.

The Game of Life

The Game of Life is played in a three-dimensional space that we call “the universe”. The rules of the game are the laws of physics, and the players of the game are every individual life-form.

The goal of the Game of Life is to capture value. There is only so much value, to go around, so this effort ultimately converges in competition. Animals compete for mates, food, shelter. Humans do the same thing; the dating market, real estate market, stock market… (we don’t compete for food anymore, but we’re also systemically obese). Humans have evolved to compete inside of markets, rather than the Serengeti.

Establishing New Rules for Life

Sometimes people use a strategy for gaining value that comes at the costs of others. Theft, violence, murder are all strategies that one can use to gain an upper-hand in life, at the cost of another. It’s easy to have more value if you just steal it from people who worked had to create it.

But that makes people upset, and so humans have banded together to create these institutions called ‘governments’ that have the power to add new rules, called ‘laws’, to the game of life. Now, in addition to having to follow the laws of physics, you also have to follow the laws of government.

This is the role of Government, distilled: Generate and enforce a new set of rules that allow for fair competition of value.

Life, Liberty and the pursuit of Happiness

Analogue Value

The value that humans are currently competing for is analogue value. Real estate, dollars, gold, shares of companies, lovers, etc are all found with physical forms in the real world.

Since the beginning of time, humans have only played games that are analogue games. Competition for food and mates being the most analogue. Things begin to transition away from ‘analogue’ in the modern world. Companies aren’t digital, but they’re not exactly a tangible either. Tangible fiat money only has value because of this intangible belief-layer on-top of it.

Shared beliefs are the precursors to digital value.

Bitcoin: The First Digital Game

Bitcoin is one big game. Bitcoin is an interlocking set of stakeholders (players) and protocol-established incentives (rules). The scarcity of BTC drives demand, which creates value, which creates hashpower, which creates security, which creates the value-prop, which creates more demand…

It’s also an accumulation game. Who can accumulate more BTC? I wrote about this in an old article: Bitcoin: Prosecutor of the Prisoners Dilemma. In summary, Bitcoin is one big game of reverse Chicken. The last person to buy it loses; the first person to buy it wins.

Bitcoin is the universe’s first digital value. All previous forms of value were analog, real world, tangible forms of value. However, it was a digital form of value with just one game: the Bitcoin game.

Bitcoin = A digital game of accumulation. Bitcoin the most simple version of digital games. Bitcoin says to the world: “There are these digitally scarce things! Go find them!”. Bitcoin’s game started as a proof-of-concept, and turns out a decent number of players want to play Bitcoin’s game.

Are there more digital games that we can build and play?

What if we get bored of “find the Bitcoins!”? Are there more interesting, complex games out there?

Subscribe now to access the rest of this article which includes:

- Developing Ethereum: The Landscape for Infinite Games

- Applications Capture Value

- Ethereum: The Landscape for Value-Capture Games

- Ethereum: The House

- Bitcoin’s Game vs Ethereum’s Game

- Conclusion

Subscribe to the Bankless program. $12 per mo. Includes Inner Circle & Deal Sheet.

Author Blub

David Hoffman is the Chief of Operations at RealT and host at POV Crypto. He writes on open finance and Ethereum topics. Check out his recent talk on how ETH accrues value and this accompanying post. (RSA note: this video one of two 4 x 🔥I’ve ever given—highly recommended)

👉Send Bankless a DAI tip for today’s issue

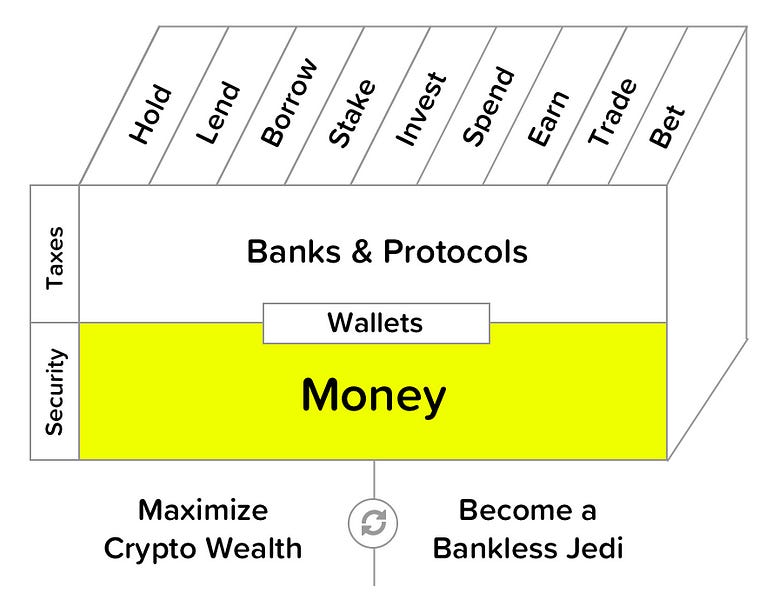

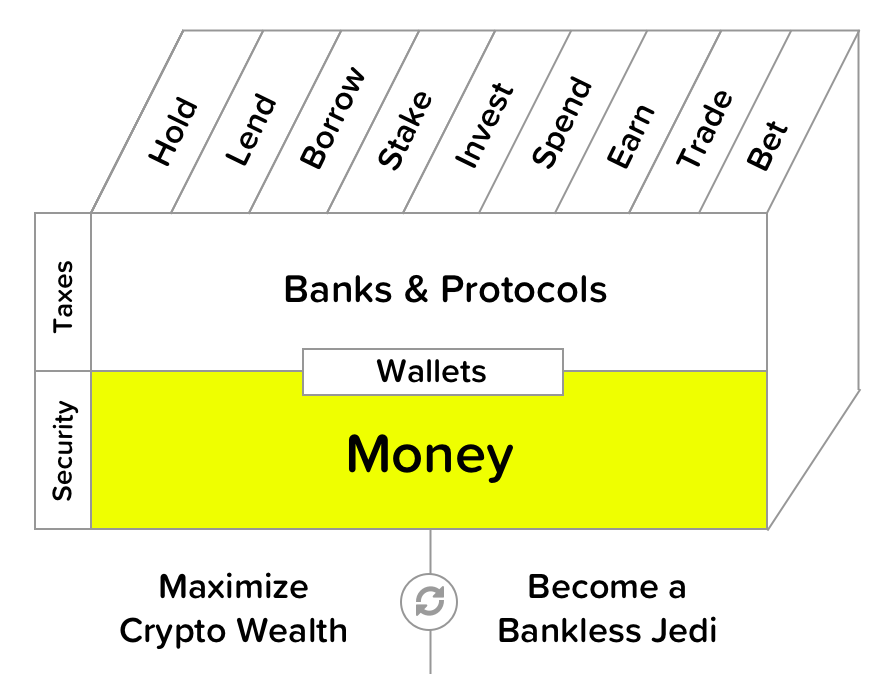

Filling out the skill cube

Ethereum as a landscape for playing economic games that capture Ether—you’re leveling up of Money layer of the skill cube. Everything in crypto is based on this.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. I’ll always disclose when this is the case.